ETFinance broker review and test – Good choice or not?

Table of Contents

| REVIEW: | REGULATION: | ASSETS: | MIN. DEPOSIT: | MIN. SPREAD: |

|---|---|---|---|---|

(3.8 / 5) (3.8 / 5) | CySEC | 750+ | $250 | Variable 0.03 points |

As traders, we seek a broker that brings out the best of us and our full potential in the trading industry. ETFinance claims to be a broker that provides tools and products a trader needs in order to reach his full financial potential. How serious is ETFinance with their clients? Is this broker legit and worth the risk? Let’s find out together in this review.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

What is ETFinance? – The company presented

ETFinance was founded in 2018 with an aim to help ambitious people around the world to be able to trade at the best of their potential. This broker believes that the world is an ever-changing financial world, and people should realize their financial potential. The company offers its investors a unique trading experience that they can be able to build their own financial future. This is through the focus of providing their clients with all the tools and knowledge needed in the world of trading.

ETFinance offers a firm foundation and cutting-edge platform that will surely bring out the best in each and every trader. This broker aims to become the choice of aspiring individuals as a go-to platform that they can use to place their investment capital efficiently and intelligently. ETFinance enables its clients to choose from a number of assets to trade on. This includes forex, stocks, indices, commodities, crypto pairs, currency pairs, and ETFs. Also, the firm has an official partnership with Real Madrid Basketball Club.

Facts about ETFinance:

- Founded 2018

- Global broker

- Offers a competitive and cutting-edge platform

- Markets include forex, stocks, indices, commodities, crypto pairs, currency pairs, and ETFs

- More than 750 assets

- Award-winning broker

- Secure

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Financial securityEach and every trader seek a trustworthy broker that will secure their investments and funds. ETFinance provides ancillary services to its clients. This includes safekeeping and administration of financial instruments (including custodianship and related services), granting credits or loans to one or more financial instruments (where the firm granting the credit or loan is involved in the transaction), and foreign exchange services where these are connected to the provision of investment services. Also, ETFinance is a member of the Investor Compensation Fund for Customers of Cyprus Investment Firms and works with regulated payment service providers, such as Wirecard, Trustly, and “Isignthis” to ensure safety of its client’s funds. Summary of regulation and financial security:

Review of trading conditions for tradersETFinance claims to be the broker that brings out the full financial potential of its traders. Enhancing the trading skills and capabilities of its clients is the goal of this broker. ETFinance claims to provide tools and products a trader needs in order to reach his full financial potential. This broker empowers its traders by giving them the freedom to trade anytime, anywhere, through its competitive, user-friendly, and powerful platforms. It offers its clients a reception and transmission of orders in relation to one or more financial instruments. Also, it offers the execution of orders on behalf of clients. ETFinance offers its traders the ability to choose from over 750 assets. You can trade CFDs assets, like forex, stocks, indices, commodities, crypto pairs, currency pairs, and ETFs. ETFinance promotes fast execution of trades and convenience through its platforms. The platform offered by ETFinance is well developed. The platform (WebTrader, MetaTrader, Mobile App) will be further discussed later on in this review.  As a regulated broker that puts customer safety first, the broker keeps the account of its clients secure with its enhanced cyber-security and cutting-edge encryption of all data shared between the user and the server. ETFinance follows the strictest principles provided by the regulators and takes additional measures to make sure that its platform, and our traders, are protected at all times. The following markets are available at ETFinance:

ETFinace offers low spreads, 0 commissions, and maximum leverage of 1:500. ETFinance offers low spreads from 0.03 points and had won several global awards de to its products and services. It provides its clients with advanced tools and fast trading execution. This broker offers a free demo account that you can use to practice in order for you to enhance and develop your trading skills and strategies. This demo account comes with free virtual funds that you can use without risking real money. Facts about the conditions for traders:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Test of the ETFinance trading platformsETFinance claims to have competitive platforms with useful tools that keep traders on track and on edge. These platforms are user-friendly, simple, yet powerful that will suit any type of trader. Trading Platforms:

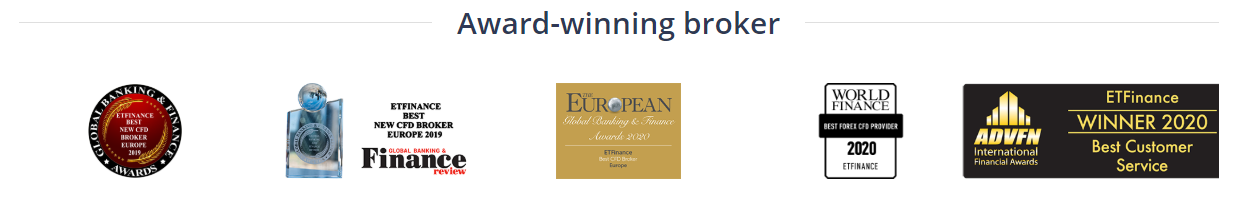

WebTrader PlatformWebTrader is the type of platform that is convenient and doesn’t require download. It is a user-friendly platform with useful tools and vital information that will keep traders at the forefront of market awareness. The WebTrader Platform of ETFinance offers an optimal trading experience that takes financial trading to the next level for both beginners and professionals. It gives traders round-the-clock access to the global arenas through any device using only an internet connection and a web browser. Its exceptional interface enables traders to monitor different assets and trends. It can perform fundamental analysis and make an informed decision that helps fulfill a profitable potential. It is simple, yet competitive. You can view real-time prices conveniently, check your list of tradable assets without ease, analyze graphs and charts professionally, and execute trades with a one-click function.  MetaTrader 4 (MT4) PlatformThe MetaTrader 4 (MT4) Platform is the most popular platform in the trading industry and it is also available when trading with ETFinance. It is an award-winning trading platform that is favored by both beginner and professional traders. It has a lot of helpful tools and great features that give you the edge to have good trading results. It is available on both web- and on mobile-platform. It is a user-friendly, uncomplicated, and powerful platform that millions of traders are using worldwide on a daily basis. With this platform, you are able to access all of ETFinance’s assets and opportunities, alongside advanced analysis tools and instruments that give traders control over the markets. It has an exceptional interface that enables traders to monitor different assets and trends. It is secure and promotes fast trading execution.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Mobile Trading (App) PlatformETFinance gives its traders the ability to trade anywhere and anytime as long as connected to the internet through its Mobile Trading (App) Platform. This platform offers convenience and is easy to use. It has good indicators, is designed for quick action, and brings all the global markets to the palm of the traders’ hand. The ETFinanceapp allows traders to manage their position in real-time alongside their daily activities. It provides the same capabilities as the web platform. It has a responsive interface and one-tap actions for fast and efficient trading. Also, the app keeps traders up to date with the latest market trends by providing market reports, updates, and analyses straight to their mobile devices. This app is free and available to download in GooglePlay (for Android) and AppStore (for iOS). Professional charting and analysis is possibleCharting with the right use of technical analysis can give you better trading results. This makes total sense because charting enables you to keep track of historical prices in the markets and technical analysis helps you determine what next steps you need to take. Charting is an illustration of the volatility of the markets. Through charting, traders can easily understand the movement of the market, whether it’s going upward or downward. Technical analysis, on the other hand, is a method of analyzing the markets and predicting price movements.  Combined together, you would have an edge in making good trading decisions. ETFinance has good technical indicators and helpful tools. The charting capability of its platform is remarkable. The company offers good assistance and has helpful analysis, that can gain you important statistics that you’d definitely find helpful to make a more informed decision. It has trading cubes and visual trends that can speed up your trades and keep track of the latest market trends. This has visual presentations that encompass all the critical information you need to see and highlight valuable data points. We can say that the charting capability of ETFinance is good and well-thought. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) ETFinance trading tutorial: How to tradeIn trading, the first step is to decide what asset you would like to trade. However, before doing so, one must know how trading works and how to execute a trade in order to get good results. Basically, analyzing the markets and making decisions are the most important things a trader should be prepared about. Once you understand and know the volatility of the markets, it is easier to decide what step next you need to take – whether to buy or sell. For example, if you think that the market value is going to fall, then choose to sell. But, if you think that the price is going to increase in value, choose to buy. First, select the asset you wish to analyze. Once you’ve chosen the asset, analyze the asset. Next, determine a forecast of the price movement. After that, open the order mask on the platform. Once done, go ahead and customize your position. Then choose the order volume you prefer. Last, decide whether to buy or sell.  Step by step tutorial:

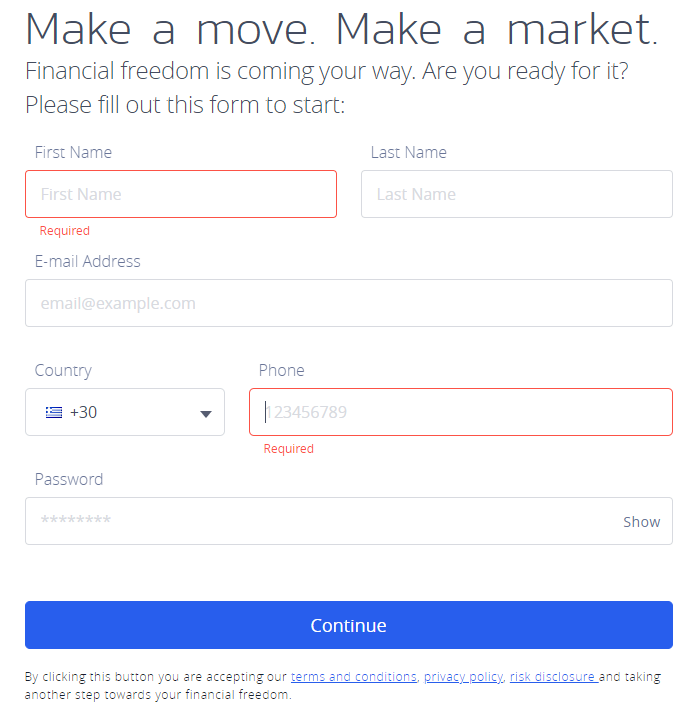

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Free ETFinance demo accountETFinance offers its customer a free Demo Account that comes with virtual funds. This demo account can be used without risking real money or investment. We highly recommend everyone, especially the newbies in trading, to first get a demo account before going live. Trading requires a high risk to your investments, and if you don’t understand how trading works, this may result in a huge loss of money. We recommend practicing your trading strategy and enhancing your trading skills before going live. How to open your accountIt is not hard to create an account with ETFinance. First, fill out the basic information needed that including your first and last name, phone number, email address, and you need to create a password to secure the account. Then, there are some questions you need to answer in order to proceed in confirming the registration of your account. Once you’ve finished answering these questions, it will direct you to the demo account right away. If you plan to go on live-trading, you can easily switch the platform into a live account and can fund your account right away. The minimum deposit requirement is €250.  The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|