5 best-regulated Forex Brokers & platforms in comparison

Table of Contents

See the list of the best-regulated Forex Brokers in comparison:

Broker: | Review: | Regulation level: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | Excellent | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Capital.com | Excellent | FCA (UK), CySEC (CY), ASIC (AU), SCB (BH), SCA (UAE) | 3,000+ (70+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 76% of retail CFD accounts lose money) | |

3. Vantage Markets | Excellent | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

4. XTB | Great | More than 10 | 3000+ (48+ currency pairs) | + Low spreads + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: Your capital can be at risk) | |

5. IG  | Great | FCA (UK), NFA (US), AFSL (AU) | 17000+ (80+ currency pairs) | + Over 17.000+ assets + No hidden fees + Education for traders + Broker since 1974 + Fully regulated | Live account from $0(Risk warning: Your capital can be at risk) |

The forex market is a large market with the trillions worth of volumes in dollars every single day. It also has many forex traders investing millions of dollars. As with other markets, the forex market also attracted scammers who take advantage of new investors.

It has led to many countries trying to find a way to regulate the forex industry from unfair conduct by market participants. Since the forex market is highly liquid, with traders from all over the globe, it is difficult to set up an organization to cover the entire forex market.

What is Forex broker regulation, and how does it work?:

Forex broker regulation happens when a country sets up an organization with the mandate to monitor and manage the operations of forex brokers within the country. It is how forex regulation works, through each country having a regulatory body for forex trading.

Forex regulatory bodies regulate institutions through:

1. Licensing Forex brokers and Forex traders

Forex brokers have to get a trading license from a regulatory body to operate in a country. The license has an agreement that forex brokers have to follow guidelines and rules created to ensure that all forex participants in the forex industry are given fair services without any bias.

2. Ensuring implementation of KYC guidelines

Some forex regulatory organizations have ‘Know Your Client’ (KYC) policies in which traders have to give their details when registering under a forex broker. These policies are under the Anti Money Laundering laws limiting the laundering of illegal money in forex.

3. Reducing risk factors

It limits the amount of leverage that clients can access when trading. High leverage rates can lead to improved profits and also increase losses. Limiting forex leverage ensures clients risk less capital. It also bans the illegal use of certain risky assets, such as CFDs, in the US.

Why is Forex regulation imperative for traders?

Forex regulation is crucial for forex traders since there are various methods that forex brokers use to obtain money illegally from traders. Some include;

Forex broker software scams – forex brokers market their trading software to make it seem to increase the chances of profits. It lures unknowing traders and tricks them into investing huge sums they are unable to withdraw after trading.

Manipulating forex spreads– forex brokers offer wider spreads than other forex brokers. Traders who don’t check how much an asset is worth in the markets can fall for these scams.

Signal selling scams– scammers use it by claiming to be market experts or forex professionals. They make money through selling signals for profitable time to open or close trades for premium subscriptions.

Some even have people that testify how legitimate the signals are and help them make huge profits. Forex regulatory institutions ensure that they monitor forex broker services such that they cannot engage in such malpractices.

They have licenses for forex brokers, and in some countries, even market participants such as forex broker employees and expert traders have to get licensed. It helps to reduce or end cases of getting scammed by a forex broker in that jurisdiction.

Advantages of regulation:

- Ensures fairness for all forex traders and brokers within an area

- Makes it easy to settle forex disputes

- Reduces cases of scams in a region

- Limits the risks of heavy losses when trading

- Increases safety of investor funds

Disadvantages of regulation:

- Some regulations are strict, and there are few forex brokers within the region

- Limited access to trading instruments

- Low leverage rates limit high profits

List of the 5 best-regulated Forex brokers in comparison:

1. Capital.com

It is a forex broker that started its operations in 2016 and has grown to serve over half a million forex traders globally. It has access to 3,000+ financial assets, such as indices, stocks, commodities, cryptocurrencies, and shares.

Regulation

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission

- Australian Securities and Investment Commission

- SCB of the Bahamas

- SCA in the UAE

Fees

Capital.com has huge diversity when trading with forex spreads from 0.0 pips and has no commissions. It also has an overnight fee when you open positions overnight using leverage.

It follows the ESMA regulations that limit leverage EU clients can access to 1:30. The negative balance protection only covers leverage of 1:30.

Deposits and withdrawals cost nothing to these forex brokers. It accepts various payment methods, such as debit/ credit cards and bank transfers. Traders can also transfer funds using digital wallets such as ApplePay, PayPal, Sofort, Trustly, Multibanko, etc. Inactivity fees may apply after 1 year of inactivity with €/£/$ 10 per month.

(Risk warning: 76% of retail CFD accounts lose money)

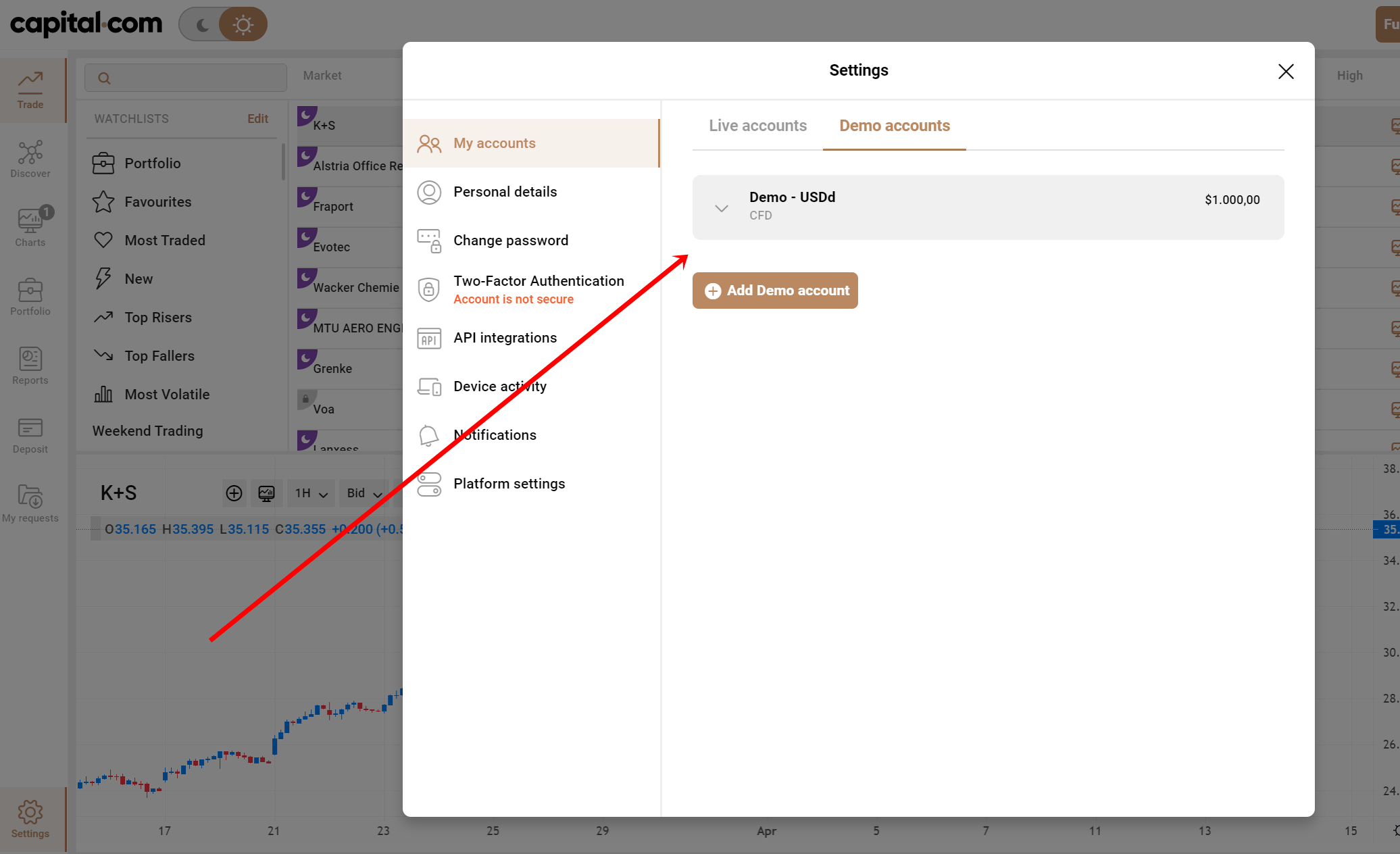

Features of Capital.com

- It has a demo account where new traders can practice trading with virtual funds up to $1,000.

- It has integrated MT4 and the web platform for accessing financial markets.

- Traders can access fast order processing speeds, 85+ inbuilt technical indicators, multiple charts with nine-time frames, one-click trading, and three order types.

- It offers algorithmic trading 24/7 using Expert Advisor and the MQL4 strategy builders from the MT4 trading platform.

- Capital has an efficient trading platform available on mobile through the mobile app, and the desktop version is compatible with windows and MAC.

- Resources and research tools include news and market updates available on the platform through videos and articles from market analysis experts.

- Educational resources include trading lessons, video courses, and tests covering basic to expert-level content for every level of trader.

- It also has the Investmate mobile app designed to offer content via mobile phones wherever traders are.

- Customer support is available 24/7 in 13 languages through SMS, emails, and live chat.

Pros

- Negative balance protection

- Regulation from tier 1 and tier 2 jurisdictions

- Fast order processing rates

- Fast deposits and withdrawals

- Law initial deposits

Cons

- Limited research materials

(Risk warning: 76% of retail CFD accounts lose money)

2. Vantage Markets

It is a forex broker serving 500,000 forex traders since its launch in 2009. Forex traders using this platform have access to trading instruments such as metals, forex, CFDs, shares, indices, and commodities.

Regulation

- Cayman Islands Monetary Authority

- Vanuatu Financial Services Commission

- Australian Securities and Investments Commission

Account types at Vantage Markets

Vantage offers three trading accounts, including the Standard STP account, which has a minimum deposit of $200. It offers forex spreads from 1.4 pips and has no commissions. It is suitable for new traders as it has low trading costs.

The Raw ECN account for more advanced traders has a $500 initial deposit. It also has commissions of $6 per round turn.

The Pro ECN account is a trading account for professionals that trade volumes or corporate traders and has an initial deposit of $20,000. It has forex spreads from 0.0 pips and commissions of $ 4 per round turn.

(Risk warning: Your capital can be at risk)

Trading costs

Vantage Markets has no inactivity fee, account maintenance, or hidden charges. Traders who keep positions open using leverage overnight will have rollover costs according to the size of the position.

Deposits and withdrawals are free using credit/debit cards, wire transfers, and e-wallets such as Skrill, UnionPay, Neteller, and other methods.

Features of Vantage Markets

- It has a demo account that traders use to test the Vantage markets trading platform.

- It uses the MT4 and MT5 trading platforms.

- The MT4 offers fast execution speeds, one-click trading, a Depth of market price quotes, 50+ technical indicators, and several charts with nine-time frames.

- MT5 also offers trading tools such as hedging and scalping options, fast order procession speeds, four order execution types, access to 173 financial markets, and advanced trading charts with 21-time frames.

- Muslim traders get to register their Islamic or swap-free accounts compatible with the MT5 and MT4 trading platforms.

- Automated trading is present thanks to the MQL4/ MQL5 programming languages and the Expert Advisors to build a trading robot.

- Vantage markets are available on mobile and desktop gadgets through its mobile app and desktop version, complimenting the website platform.

- Research signals, trading ideas, and news from trading experts are available on the platform articles, videos, and the economic calendar.

- Traders can also get trading signals from Trading Central, which scans and filters signals according to client preference.

- Educational content at Vantage markets includes blogs covering information from basic to advanced levels.

- Customer support is ready 24/7 to assist traders through emails, live chat, and phone calls.

Pros

- Fast account opening process

- Low trading costs

- Fast order processing speed

- Fast withdrawals and deposits

- Zero commissions

Cons

- High initial deposit on the Pro ECN account

- Limited educational materials

- Limited trading instruments

(Risk warning: Your capital can be at risk)

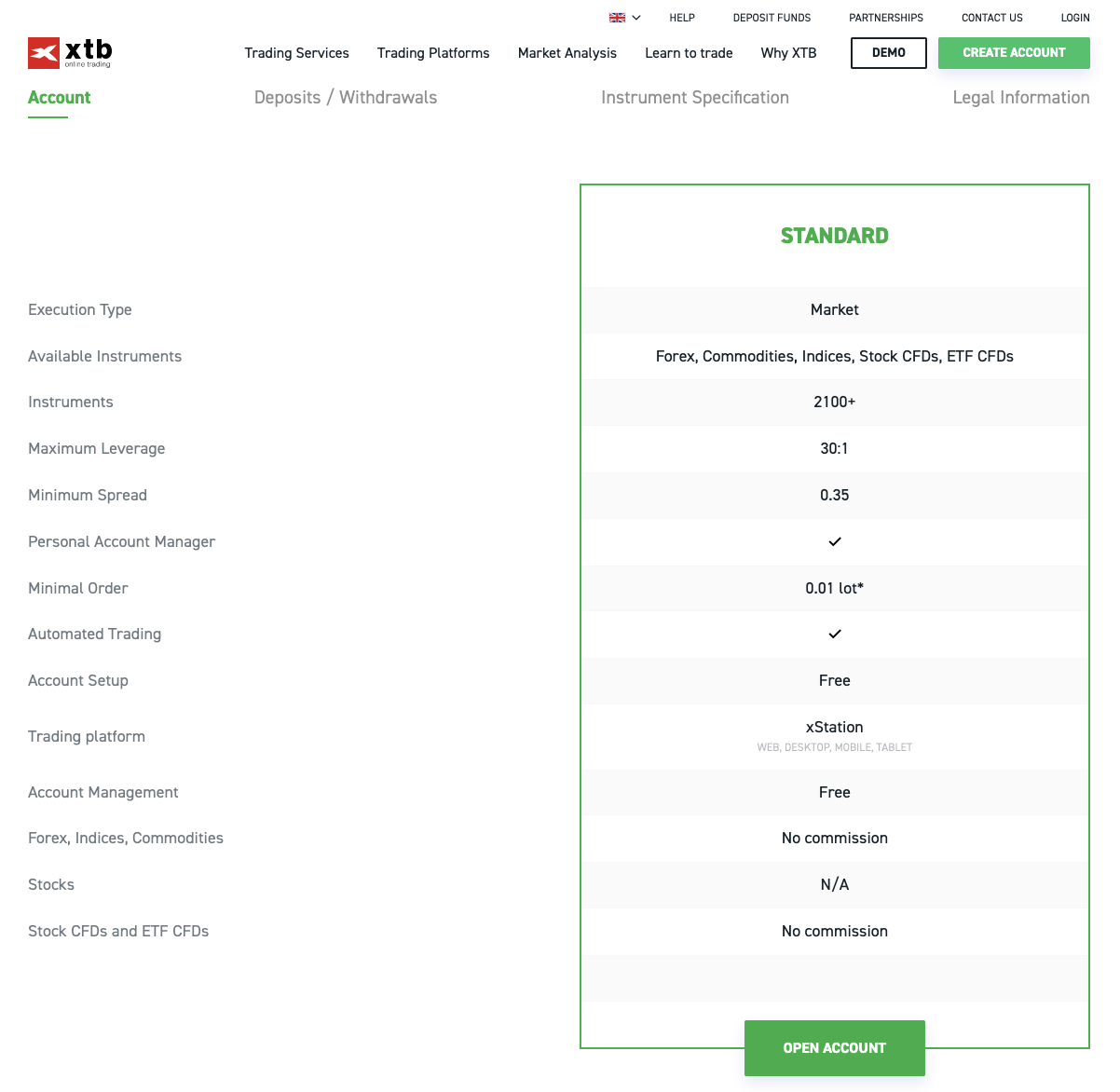

3. XTB

It is a broker that started its operations in 2002 and has grown to serve thousands of forex traders for the last two decades. It offers access to 4000 trading instruments ranging from forex, stocks, CFDs, commodities, cryptocurrencies, and ETFs.

Regulation

- International Financial Services Commission in Belize

- Cyprus Securities and Exchange Commission

- Polish Securities and Exchange Commission in Poland

- Financial Conduct Authority in the United Kingdom

(Risk warning: 76% of retail CFD accounts lose money)

Account types

XTB offers two trading accounts, the Pro and Standard accounts. The Standard account has no minimum deposit with forex spreads from 0.5 pips and has no commissions. Forex traders can start with this trading account before moving to the pro account.

The Pro account has professional trading features with minimum forex spreads from 0.1 pips and commissions of $7 per round lot.

Trading costs

It has a high leverage rate of 1:500 and has overnight charges depending on the size of the open position overnight. An inactivity charge of $10 is due every month after twelve months of inactivity on the trading account.

Deposits and withdrawals are free using bank transfers, credit/debit cards, and digital wallets like Skrill and Neteller.

Features

- It has a free demo account with $100,000 virtual currency for risk-free trading limited to 30 days.

- It has incorporated its proprietary trading platform, the X station 5, and the X station mobile, offering competitive trading tools.

- This trading platform offers fast execution speeds, access to over 4000 trading instruments, risk management tools such as the stop loss, advanced trading charts, and the stocks screener.

- It has an Islamic account that follows Sharia laws and offers the same trading conditions as other regular accounts. The only difference is it has no rollover costs.

- Automated trading is available using the X station 5 trading platform from the Pro and Standard accounts.

- It has the X station mobile trading platform for traders to check the trading status, and the X station 5, is compatible with any OS and browser for desktops and laptops.

- Educational trading materials on XTB include informative articles and the trading academy with categories of learning courses from fundamental to premium levels.

- Research tools include the price table, market news which has market analysis articles, and the economic calendar.

- Customer support works 24/5 in 16 languages to serve traders through phone calls, live chats, and email.

Pros

- A fast account registration process

- Comprehensive educational resources

- No initial deposit

- Low trading fees

- Multiple regulations

Cons

- MT5 and MT4 are not supported

- Customer support is available 24/5

(Risk warning: 76% of retail CFD accounts lose money)

5. IG

It is a forex broker that started its operations in 1974 and is currently serving forex traders from 17 countries globally. It offers access to a wide variety of trading instruments, including forex, commodities, indices, shares, futures, and cryptocurrency.

Regulation

- Financial Conduct Authority

- Australian Securities and Investment Commission

- Commodity and Futures Trading Commission in the US

- Swiss Financial Market Supervisory Authority

- Japanese Financial Services Authority

- Monetary Authority of Singapore

Account types

IG has several types of trading accounts Trading, Professional, exchange, Turbo 24, limited risk, options trading, and share dealing accounts. Trading accounts depend on the location of the trader, and the financial instruments traders can access.

Forex traders often register the trading account with a minimum deposit of $300, and forex spreads from 0.6 pips, and an average commission of 0.5%.

(Risk warning: 75% of retail CFD accounts lose money)

Trading costs

It has an inactivity fee of $18 after 24 months without any trading activity after contacting the forex trader through email. Rollover fees are applied on open positions overnight using leverage. Deposits and withdrawals are free using bank transfers, credit/debit cards, and e-wallets such as Skrill.

Features

- A free demo account for traders to test the IG trading platform with $20,000 in virtual funds at their disposal.

- It has its proprietary IG trading platform but has integrated MT4, Pro real-time, and API trading.

- The IG platform offers a user-friendly interface, risk management tools like guaranteed stop loss, automated trading, market alerts, and options for the currency you can use on the platform.

- The mt4 trading platform has fast order processing rates, one-click trading, three order types, multi-charting tools, technical indicators, and advanced charts.

- API trading platform is a custom-made trading platform that a trader can build using its tools, ‘depth of market‘, and historical data.

- The pro-real-time platform also has 100+ technical indicators, automated trading tools, and advanced charts with many time frames.

- It offers access to over 17000 financial markets for traders.

- Its platform is available as a mobile app and has a desktop version for laptops and desktops and a website version.

- Research resources include the economic calendar, news, and analysis from IG experts that publish trading articles on current trends from various financial markets.

- New traders can access learning resources covering trading strategies, risk management, trading psychology, and other topics.

- It also has a mobile application with trading courses, webinars, and articles that traders can access through their phones.

- Customer support is available 24/5 through live chat, emails, and phone calls.

Pros

- A fast account registration process

- Variety of trading accounts

- Extensive educational content

- Low trading costs

- Wide range of financial markets

- Quality trading tools

Cons

- Customer support is only available 24/5

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion – Choosing a regulated broker is the safest way to make a fortune in trading

Forex traders should help make the forex industry safer by trading with a registered forex broker. Forex registration is imperative and has more benefits since it lessens the possibility of losing funds.

Traders should be careful when deciding which forex broker. It is safer to choose a forex broker with multiple registrations and one that has operated for a long time.

FAQ – The most asked questions about Forex broker regulation :

How do I know if my Forex broker is regulated?

Forex brokers that are regulated list the regulatory organizations on their website platforms. Forex traders can search on their website for regulations and license numbers on the About Us page.

How can I verify a Forex broker regulation?

You can verify if a forex broker is regulated by visiting the regulatory website, for example, the FCA website. It has a search window that lets you know if the forex broker has a license from the FCA.

How can I ensure my Forex broker is reliable?

Before registering a trading account under a forex broker, conduct a background check. Many online trading forums exist where traders share information and inquire more about your forex broker on these forums.

Another method is opening a mini or micro-trading account to test out features and withdrawals and risk less capital.

Do I require a regulated forex broker?

To enjoy trading without hassles, you need to search for a regulated forex broker. They will assist you with any difficulties in account creation, buying, or selling orders from forex.

The main duty of the forex broker is to carry out your orders, either internally by serving as your principal in the transaction or externally by acting as your agent by transmitting your orders to another market.

But ensure that you verify your broker validates and regulated license prior.

How do I choose a regulated forex broker?

You should check the regulated forex broker based on the following guidelines.

First, confirm that your broker has the appropriate licensing and regulations. Your deposit’s security is given high consideration at all times.

After that, evaluate the account options, trading platforms, resources, and economic research the regulated forex broker offers.

Finally, conduct thorough evaluations of forex brokers to assess pricing and product offerings and determine which factors are most important to your forex trading and investment needs.

How can I verify if my forex broker is regulated?

To prevent forex fraud, confirming that your forex broker is reputable and fully regulated is critical. Use the checklist described below to find out if your forex broker is properly regulated.

Look up the license number

Verify regulatory status

Worldwide accessibility

Verification

Last Updated on September 30, 2024 by Andre Witzel

(5 / 5)

(5 / 5)