SimpleFX review and test – Is it a scam or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.8 / 5) (4.8 / 5) | Not regulated | $0 | 60+ | From 0.01 pips |

SimpleFX is a foreign exchange trading company primarily based online. “Simplicity” is not only the catchword that they abide by and include as part of their name, but also their core principle. They want to make forex easy and accessible for all people. This CFD (contracts for difference) broker has been present for a while, since 2014 and has grown progressively since then. They have increased their services tenfold by providing leveraged trading, of approximately five hundred times more on assets like cryptocurrency, foreign exchange, shares, commodities, etc.

Yet, there is a question that has to be answered for potential traders in this type of company: Are they trustworthy? This review will give you an answer as well as provide all the necessary information about this broker. We have more than nine years of experience in the financial industry and have had undertaken significant tests concerning this provider. Also, you will further learn about its nuts and bolts and a few beneficial trading tips.

An overview about the company SimpleFX

SimpleFX LTD is a brokerage firm that came into existence in 2014. It became operational and worked out of its address in Suite 305, Griffith Corporate Centre, Beachmont, Kingstown VC0100, St. Vincent and the Grenadines. However, it became a registered entity under the Local Operating Unit of the London Stock Exchange on June 24, 2015. It is also known under the designated registrar number 22361 IBC (International Business Companies).

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

It has grown steadily from the start. It now provides valuable services to more than 100k traders in one-hundred sixty countries all over the planet. The company also won a few deserving awards. The most recent one was in March 2019, wherein the Finance World Expo Summit (based in Switzerland) bestowed a prize for the best trading application for mobile phones. It was because of its reliability, ultra-fast updating features, and loading speed. Its app users have increased exponentially since then.

This internet trading platform has made web-based specifications that enable itself to be more user-friendly. Yet if you are a seasoned and savvy online trader, there’s a more advanced platform called the Meta Trader 4 or MT4, catered to your needs.

This online trading company’s goal is to gather as many customers from all over the world as possible and give them their brand of uncomplicated yet insightful trading know-how.

Is it safe to use?

For a truly interested trader looking for a safer means of trading, wanting to know that the broker is not leading you astray is tantamount to success. You want to know that your funds are well taken care of by the broker and given priority.

One of the most important ways to ensure the authenticity of a particular online trading medium is that it is regulated by an official financial entity. It must accomplish the essentials and criteria to gain a license. If it violates any of its rules or there is an occurrence of fraudulent activity, its license will be permanently withdrawn.

While SimpleFX is registered by the IBC and has a register number 22361, and has LEI (Legal Entity Identifier) of 21380042B8QJ87V4HA89, it remains unregulated. However, it is among their list of priorities and will soon be accomplished.

Their motive for lacking currency regulation is because of their dealings with cryptocurrencies. If you observe the current cryptocurrency market, well-known entities like Kraken and Binance are not financially regulated.

However, SimpleFX has security measures to make trading safer:

- Two-factor authentication

- Negative balance protection

- No dealing desk

- Fast and secure transfers

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

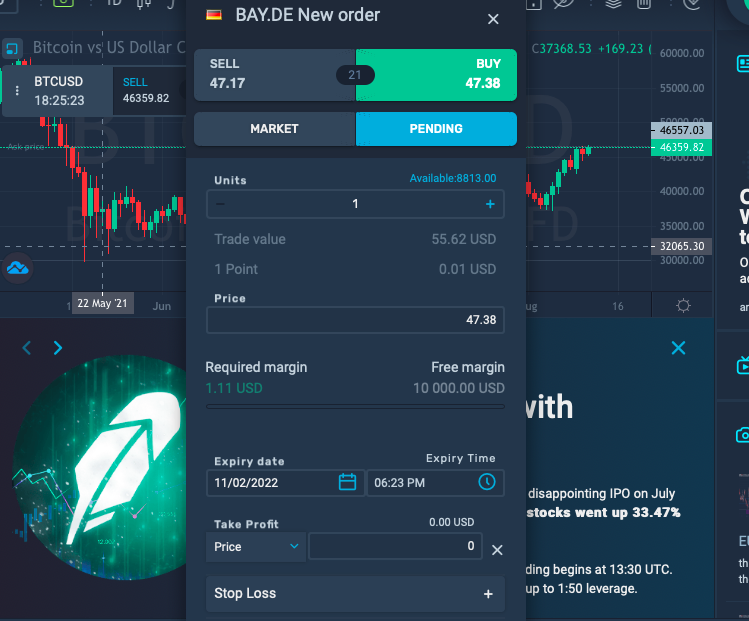

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Withdrawal and deposit feesAs mentioned earlier, there are no deposit fees for any inward payments happening in the SimpleFX platform, which includes web wallets and cryptocurrencies. Yet, upon withdrawing money, withdrawal fees are involved. If you use online payment getaways like Neteller, Skrill, or Fasapay, a one to three percent fee is incurred. Since there are neither withdrawal nor deposit fees in cryptocurrencies, there might be minor network fees that you should not concern yourself too much because it only has the smallest possible quantity.  LeverageWhen you utilize SimpleFX for trading, you are engaging with assets with a minimal margin from the trades you are about to deal with. You will be trading “on the margin,” which means you are transacting with borrowed money. To illustrate this further, if you are trading on a particular platform whose only requirement regarding the margin is to hold it at one percent, this means you have one-hundred times more leverage from your starting amount. Whenever the asset price moves, your position will increase a hundredfold. On the SimpleFX platform, the most leverage you can undertake is over five hundred times more, which entails a 0.5 percent margin. The exact amount is dependent on a few aspects, like the particular asset and its size. If you want to know the leverage amount that you can potentially come across, here are a few significant leverage numbers and margin levels:

These are sensible leverage concerning foreign exchange commodities and assets. Yet, you might find it unsatisfactory that the leverage for cryptocurrencies is sorely lacking. Margin call: Whenever you are utilizing leverage in trading, you are in possible danger from a margin call. It comes in the form of a notification to deposit money to increase your margin to the minimum requirement. In the SimpleFX platform, you are expected to set up a margin with aspects mentioned earlier in the leverage portion. You will get a margin call whenever the leftover margin can become less than fifty percent of the required amount. If you are not able to restore the amount to the minimum requirement, you will be “stopped out,” or you have to exit your trading position. It occurs to take control of the inherent risk from using leverage for trading purposes. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Coverage of assets on SimpleFXAnother distinctive factor that separates SimpleFX from the rest of the trading platforms is its impressive array of markets you can trade-in. Here are some noteworthy assets that you can trade-in:

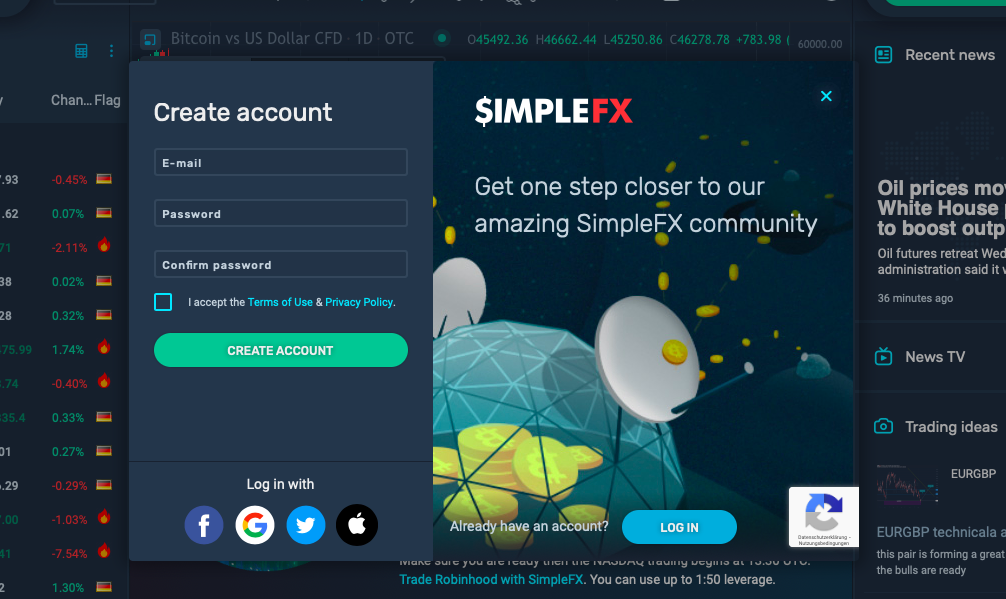

It is an uncommonly wide array and impressive display of assets. Yet regarding commodities, metals, and cryptocurrencies, there is a potential to include more assets. Especially in dealing with cryptocurrencies, they could still add EOS, Stellar, and XLM. Registration – how to open your accountWhen you have made up your mind in choosing SimpleFX as an online broker, you have to make an account in it. This process is comparatively easy and makes you believe in their “simplified” motto and name. You can easily find the “create account” link on the home page, so click on it. A registration form will pop up and put in the necessary details. The most significant piece of information is the email address to which a verification link is sent. Check on your email address if you have gotten the link. Once you find it, click on it and, you will be directed to create a password. Make it as unique as possible, which makes it immune to threats from online hackers. Once it is accepted in the system, then you can begin depositing funds and trade.  VerificationIf the type of funds you are depositing is cryptocurrencies, then verification is in the SimpleFX platform is not necessary. If you are dealing with fiat money, you have to finish the KYC (know your customer). It is a process that financial institutions utilize to identify and verify the identity of a potential customer. They do this to ensure that the claim for the customer is genuine and not made up. Put in all your personal information, like your full name and residence. This way, the verification is complete. “Document” refers to your ID, preferably issued by your government, and also provides address proof. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Verifying these details will take time because this is done with actual people working in SimpleFX. They will physically check on the information provided by the customers. They are usually quick to respond, but you will have to wait one or two days for this to finish. Free demo account for practise tradingIf you intend to use SimpleFX as your online trading platform, it is recommended that you test its services first to make sure everything amenable to your liking. You can first make a demo account, which is not real and does not use real funds. In it, you can try out your trading skills without running the risk of losing your hard-earned money. Once to make one, you will be given 0.4 BTC demonstration Bitcoin for trading. In it, you will duplicate the conditions in trading online to the fullest extent. There is no limit in testing this, so you can take all the time you want. You can also constantly add your funds with no limitations so that your comfort level and confidence in your trading skills and the platform will increase, which will work in your favor in the long run.  Withdrawal and depositingOnce you are confident and have fully developed your trading skills, you will want to add funds to your real account. Cryptocurrency is the first option and most preferred option because it is the fastest option to deposit funds into your account. If you are well-versed in cryptocurrency online procedures, then you will not have a difficult time adding funds. You will have to supply an address where you can deposit it. If you are already knowledgeable about this, then you would not have a problem. But if this is the first, then login first. Click on the accounts and deposits link, select your particular one, and hit the deposit button. The different options will show, so pick Bitcoin. You will be supplied a string address, which also works as a QR code. Once you have sent your cryptocurrency, you will need to wait for the network to confirm the transaction. You can keep tabs on the whole online procedure by utilizing a blockchain explorer. If you do not have any cryptocurrency yet want to have one, you can purchase it on online crypto exchange platforms like Kraken or Bitstamp. Or you can do this on the SimpleFX website itself. There are other ways to deposit to your account. Instead of Bitcoin, you can utilize fiat money, which can be done on either Fasapay, Neteller, and Skrill.  Withdrawing funds is not a complicated process as you might think. It is easy to do this on SimpleFX. Go through the same procedure earlier to deposit, but rather select the withdraw tab. In it, you will have to type in your address offline if you intend to send out Bitcoin. You have to be verified to undertake this procedure. Whenever you intend to withdraw in the future, you can only do this to the same method and account that you have utilized to fund yours. The longevity of the whole process depends on the withdrawal method, which can take a few hours to one whole day. The fastest funds to withdraw (and deposit) are cryptocurrencies. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|