5 best Forex brokers & platforms with exchange execution in comparison

Table of Contents

See the list of the 5 best Forex brokers with exchange execution:

Broker: | Review: | Exchange execution: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | Yes | FCA (UK), CySEC (CY), ASIC (AU), SCB (BH), SCA (UAE) | 3,000+ (70+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

2. Vantage Markets  | Yes | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

3. IC Markets  | Yes | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

4. Pepperstone  | Yes | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. FxPro  | Yes | FCA, CySEC, FSCA, SCB | 250+ (70+ currency pairs) | + Multi-regulated + User-friendly + Mobile trading + Competitive spreads + Free demo account | Live account from $100(Risk warning: 72.87% of CFD accounts lose money) |

Nowadays, it seems like everyone wants to jump on the online trading bandwagon. Some people think it’s more convenient since you can do it from the comfort of your own home. Others think it’s an easy way to earn money. But let’s get one thing straight, forex trading is not easy.

It may look like traders simply look at lines on a chart on their computer screen and click on random buttons. Trading actually takes a lot of skill if you want to do it efficiently. You need to set aside many hours to study trading strategies, familiarize yourself with the market’s movement, and hone your trading skills in a simulated environment.

A lot of well-seasoned traders have been in this line of work for years. Truthfully, they wouldn’t go as far as saying that they have mastered the profession. This is because the market can be hard to predict. But before you try to get to their level, you have to find a broker that suits your trading needs.

Simply looking for a broker to partner with is not a simple task. You can’t just pick the first broker you see and fill out the signup sheet right away.

Ask yourself these questions before you invest your time, money, and energy in a specific broker:

- Is the broker regulated?

- Are my funds and identity safe with this broker?

- Does it have the asset that I want to trade?

- Is the customer service reliable?

- Does the trading platform have all the tools that I need?

- Are the fees or commissions reasonable?

These are just some of the things that you have to keep an eye out for when you’re choosing a forex broker. Most importantly, if you have a preferred execution method, you must check which method the broker offers. To help you narrow down your list of potential companies, here are 5 of the best exchange execution forex brokers.

List of the 5 best forex brokers with exchange execution in comparison:

1. Capital.com

Capital.com, which was launched in 2016, is a well-known forex broker all over the world. While this firm is still relatively new to the trade arena, it presently has four offices in the United Kingdom, Australia, The Bahamas, and Cyprus.

Four regulatory organizations continuously regulate Capital.com to ensure its safety and credibility. The institutions in question are the Cyprus Securities and Exchange Commission or CySEC, the Financial Conduct Authority or FCA, the Australian Securities and Investments Commission or ASIC, the SCB of the Bahamas, the SCA in the UAE.

Check out the advantages of Capital.com below:

- You only need a $20 minimum deposit (by credit card) to open a live account with Capital.com

- In less than five minutes, you can start trading on a live account.

- Use the free demo account to try out the capabilities of the platform.

- Capital.com’s platform is available as an application on mobile devices.

- Learn new things with all the materials found in the educational tab on the website.

- Commissions and trading fees don’t cost a fortune.

Listed below are the disadvantages of Capital.com:

- There are only 4 available currencies: PLN, EUR, USD, and GBP.

- Price alerts can not be enabled on the desktop platform.

- The workspace, as well as the charts, can barely be customized.

- Face ID and Touch login are only supported by IOS devices.

(Risk warning: 75% of retail CFD accounts lose money)

2. Vantage Markets

Vantage Markets is an Australian forex broker that was founded in 2009. The headquarters of the corporation are in Sydney. It does, however, have more than 30 offices across the world. Vantage Markets is licensed in over 170 countries, making it incredibly accessible to almost everyone on the earth.

This forex broker is regulated by the ASIC or Australian Securities and Investment Commission and FCA, or Financial Conduct Authority. Vantage Markets also safeguards its clients’ funds by keeping funds in a segregated account. This is to ensure that only you can touch your funds. You can read more about their privacy policy and terms and conditions on the main website.

Below you will see a list of the benefits you get when you choose to work with Vantage Markets:

- The account opening procedure is simple and straightforward.

- You can use the website’s free e-books, video lessons, and other instructional tools for free.

- You have the option to trade on the move with the broker’s mobile app.

- The platforms available are the MetaTrader 4 and MetaTrader 5.

- The website and platform feature a forex calendar.

- Trade any of the 40 forex pairs available on the platform.

- A free demo account is available if you want to test out the platform or hone your trading skills.

Now here is a list of the disadvantages that Vantage Markets bring:

- The broker requires at least $200 as a minimum deposit so you can open a live account.

- A particular account type known as the Pro account can only be opened if you deposit $20,000 into your account.

- You will need to have a balance of $1,000 in your account to use the Pro Trader Tools available on the trading platform.

(Risk warning: Your capital can be at risk)

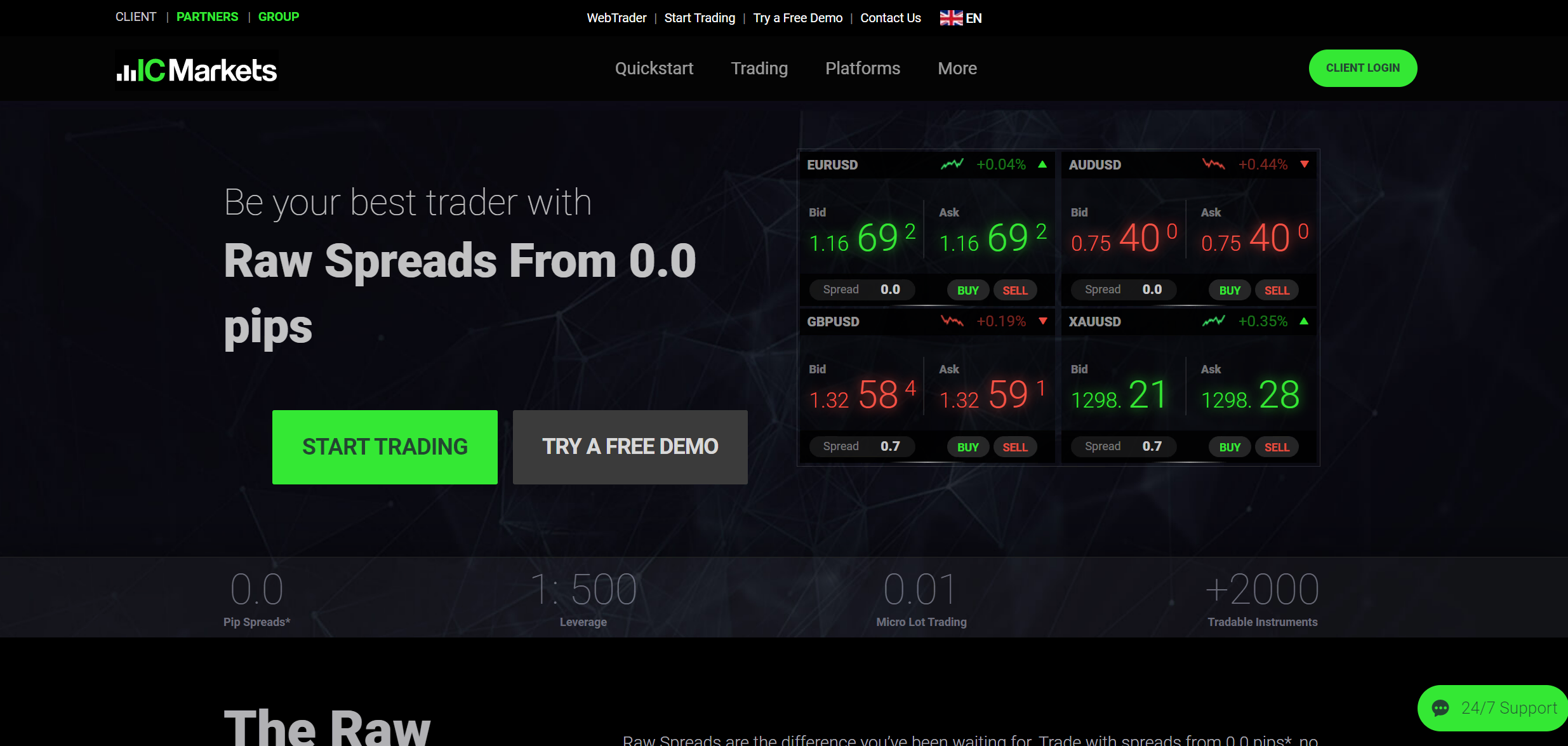

3. IC Markets

IC Markets was created in 2007 by a group of professionals in Sydney, Australia. Through the years, they have expanded their reach to the European region, and the company has a number of offices located around the world.

This specific forex broker is regulated by the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the Financial Supervisory Authority. These companies ensure that IC Markets is safe and reliable.

Check out some of the advantages of IC Markets:

- The trading fees and commissions are low.

- IC Markets does not charge a withdrawal or deposit fee.

- If your account is inactive for six months, you will not be charged an inactivity fee.

- You only need a few minutes to create an account.

- MetaTrader 5, MetaTrader 4, and cTrader are the available trading platforms.

- All three trading platforms are available on this broker’s mobile application.

- Make use of the free educational tools and materials on the website.

- Practice trading for free on IC Market’s demo account.

Now, here are the disadvantages of IC Markets:

- You need $200 to open a live trading account.

- There is no option to turn on notifications for price alerts on the desktop trading platform.

- Customer support representatives take a while to respond.

- There are no recordings or videos on the educational tab on the website.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was established in 2010 by a team of financial experts in Melbourne, Australia. They formed Pepperstone in hopes of revolutionizing forex trading online. In 2016, this broker expanded its offices to London, Dallas, Melbourne, and Bangkok.

Since Pepperstone has a wide global reach, it is regulated by the FCA, CMA, CySEC, BaFIN, DFSA, SCB, and ASIC. It is also known as one of the largest forex brokers in the world. The company holds multiple prestigious awards, including Best Trading Platform, Best Australian Broker, and many more.

Take a look at the advantages of this particular broker:

- Pepperstone does not require a minimum deposit.

- The customer support representatives are easy to contact.

- Pepperstone does not charge an inactivity, deposit, or withdrawal fee.

- An account can be created within minutes.

- Choose to trade on either the cTrader, MetaTrader 4, or MetaTrader 5 platform.

- A mobile application is available from the Apple Store and Google Play Store.

- Try out the platform for free with Pepperstone’s demo account.

Here are some disadvantages to take note of:

- Pepperstone charges an overnight or rollover fee that varies depending on your trade.

- Customer support is only available 24/5.

- Clients outside of Australia or the EU will be charged a withdrawal fee.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. FxPro

FxPro is an online forex brokerage created in 2006. It is owned by FxPro Group limited, a well-known broker based in Cyprus. To date, it caters to over 1,700,000 traders located in more than 165 countries. This broker has won numerous awards, including “Most Trusted Forex Brand”.

Overall, four regulatory agencies oversee FxPro‘s operations. These four companies are the Cyprus Securities and Exchange Commission, the Financial Conduct Authority, the Securities Commission of The Bahamas, and the Financial Sector Conduct Authority.

Take note of all the advantages that FxPro has to offer:

- Keep track of the market’s movement with the real-time market news feature.

- A free demo account is available.

- Enjoy low commissions and trading fees.

- To open an account, you only need a couple of minutes.

- The charts and workspace are customizable to suit your preference.

- You can opt to get notifications or price alerts on the trading platform.

- You only need to deposit at least $100 to create a live trading account.

- Learn how to trade with the help of all the educational materials featured on FxPro’s website.

- You can deposit and withdraw your funds without having to pay a fee.

Keep in mind that FxPro does has some disadvantages as well:

- If your account remains inactive for six months, you will be charged an inactivity fee.

- You can only contact FxPro’s customer service representatives 24/5.

- Although this broker accepts the major currencies, it only supports a handful of minor currencies.

(Risk warning: 72.87% of CFD accounts lose money)

What is the exchange execution of forex brokers?

Forex brokers that offer exchange execution provide clients with direct access to interbank current exchange rates. This implies that a user may trade directly with interbank rates, and the broker has no potential conflicts of interest with consumers.

When using the exchange execution method, trades are redirected to an outer trading system. Typically, orders or trades are opened at the market’s current price. Clients will have to set the symbol, volume, trade stop loss level, and take profit level.

Advantages:

The advantage of partnering with a forex broker that offers exchange execution is you get to directly interact with the current market prices. Exchange execution brokers are also known as NDD or No Dealing Desk. This means these brokers only provide STP or Straight-Through Processing execution of forex market trades.

With NDD brokers, you will be going through a number of liquidity providers who are responsible for providing you with a competitive bid and ask prices. This is a good thing because you get wider or narrower spreads. But keep in mind that this depends on the currency you are trading and the broker you are partnered with.

Disadvantages:

One significant disadvantage of this is the cost. Since you get direct access to the exact spread available, which gives you wider spreads, the cost to trade a particular currency or currency pair is higher than normal.

Additionally, a lot of No Dealing Desk brokers charge exchange fees. They either charge you directly or in the form of a commission that you will need to shoulder. Exchange Execution is not ideal for traders who are just starting out or inexperienced clients.

Deposits

Once you decide on a broker and finish filling out the application form, you will be asked to deposit funds to your account. It’s fairly easy to do this since all the aforementioned brokers support various deposit methods.

Keep in mind that some brokers charge a deposit fee while others do not. So make sure to read the terms and conditions thoroughly to avoid any confusion. Let’s go over the deposit methods supported by each one of the brokers featured in this article.

- Vantage Markets

Vantage Markets gives you the option to top up using wire or bank transfer, MasterCard or Visa debit or credit card, or electronic wallets. It’s important to note that if you deposit funds via wire or bank transfer, the process will take at least 2-to 3 business days. However, when using your debit or credit card or an online wallet, it typically takes a couple of minutes. Sometimes, the amount will even reflect on your account immediately.

The online wallets supported by Vantage Markets are UnionPay, FasaPay, JCB, Neteller, AstroPay, and Skrill. This broker accommodates deposits made with any of the nine major currencies. Unfortunately, they do not support any of the minor or exotic currencies. Lastly, keep in mind that the minimum deposit for this particular broker is $200.

- Capital.com

Similar to Vantage Markets, Capital.com supports bank or wire transfers, Visa, Maestro, or MasterCard debit or credit cards, and various online wallets. You can use some of the most well-known e-wallets like PayPal, ApplePay, and Sofort.

You can rest assured that the amount you deposited via debit or credit card will instantly reflect on your account. The same goes for online wallets, but you should give it at least 24-48 hours. And as for deposits made via wire or bank transfer, this usually takes three business days.

- IC Markets

IC Markets supports deposits made via bank or wire transfer, MasterCard or Visa debit or credit card, and e-wallets. The only difference is the e-wallets available are Klarna, Bpay, Rapidpay, FasaPay, Skrill, Neteller, UnionPay, and PayPal.

The funds that you deposit will reflect on your account instantly or within a couple of minutes. But keep in mind that this depends on the operations of the bank, card, or e-wallet you are using. If it’s taking too long, you can always contact their customer service.

The currencies supported by Capital.com are GBP, EUR, SGD, CAD, HKD, CHF, USD, JPY, AUD, and NZD.

- Pepperstone

This specific online forex broker accepts deposits made via MasterCard or Visa debit, or credit cards. Bank and wire transfers are also available, and it takes up to three business days to process. If you prefer using online wallets, PayPal is accepted by this broker, and the funds will be credited to your account instantly.

Only nine of the major currencies are accepted by this broker. These currencies are NZD, HKD, GBP, JPY, AUD, SGD, USD, CHF, and EUR.

- FxPro

Deposits made through Maestro, Visa, and MasterCard debit or credit cards usually take a few minutes to process. This deposit method accepts JPY, AUD, PLN, EUR, USD, CHF, and GBP. If you add funds using a bank or wire transfer, this takes at least a day, and it only supports USD, GBP, CHF, PLN, JPY, AUD, EUR, and ZAR.

Lastly, you can top up your online forex trading account via UnionPay, Neteller, or Skrill. The available currencies are CHF, JPY, USD, PLN, EUR, and USD.

Withdrawals

Once you decide to withdraw your funds, you can use the same method you utilized to deposit money into your live trading account. This makes the process faster and more convenient. You can easily fill-out a withdrawal request form from the trading platform. Keep in mind that some important information like your address, phone number, and full name might be required to withdraw your funds. This is for security purposes.

Each broker supports the exact same methods for their withdrawal process. Make sure to read the terms and conditions to see if the broker has a withdrawal fee. In case it takes a while for your funds to be withdrawn, simply contact the broker’s customer service via chat, email, or telephone, and they will assist you.

Conclusion – Choose your broker wisely

When looking for a reputable and reliable forex broker with exchange execution, you really need to pay attention to detail. Reading articles, user reviews, and even blog posts about those forex brokers are all well and good. You get the essential information you need to know the company. But it’s not enough.

Always take advantage of online forex brokers’ free demo accounts. Not only will you be able to try out the platform to see if it suits you, but you can also practice trading or create new trading strategies without having to spend at all.

These demo accounts come with virtual funds that you can use on a simulated market. Try out all the trading tools. Check if you can customize your charts or workspace. Hone your trading skills on these demo accounts before you jump into the real thing.

It’s also very important to familiarize yourself with the commission fees that each of these brokers charges. As previously mentioned, exchange execution costs more than your typical trade. So make sure that you have enough capital before you utilize this method.

Ideally, the forex broker you choose should have a customer support service available around the clock. The forex market is open 24/7, and you need all the help you can get when you’re out there trading.

You can tell that a broker is truly reliable when their customer support representatives reply promptly. An added bonus will be if the service comes in multiple languages. However, you can’t simply rely on the helpdesk of the broker. You need to do your own research and learn about the dos and don’ts of online forex trading.

Trading is, and always will be, very risky. It’s important for you to understand this before you decide to invest your hard-earned cash in this asset. It’s not as simple as clicking buttons on a screen and looking at lines on a chart. This profession takes a lot of skill, patience, discipline, and knowledge.

FAQs – The most asked questions about Forex brokers with exchange execution :

What is exchange execution?

Trade actions are sent to an external trading system in the exchange execution mode. The operations are carried out at current market pricing. Exchange execution forex brokers directly connect clients to current interbank prices. This means that a user may make a direct trade with interbank rates and that the broker has no possible conflicts of interest with clients.

Is using exchange execution brokers risky?

Regardless of what type of broker or method you use, trading will always be risky. But some people would say that exchange execution poses more risk than trading regularly. Although clients get first dibs on the asset, the commission rates are often higher, which makes it very risky.

To minimize risk, make sure you know what you are doing. Discipline yourself and know when to stop. Also, don’t put in all your hard-earned cash on this profession regardless of what people say. Many swear by these brokers and say they became overnight millionaires because of online trading. But the truth is, these are more likely bait reviews to entice users to sign up.

Why do Exchange Execution Forex Brokers need to be regulated?

It has been observed that the regulated Exchange Execution Forex broker often reduces the risk. These regulations safeguard the interest of the consumers. On the other hand, when the regulations are less, it causes faulty services and financial harm. Exchange Execution Forex brokers are regulated to stop fraud.

What are the Exchange Execution Forex Broker’s Funding and Withdrawal Methods?

Whenever you are dealing with Exchange Execution Forex Brokers, it is necessary that you look for easy and convenient funding and withdrawal facilities. These accentuate the process and make the trading process, as well as the trading experience of the trader as well as the broker, smoother and easy to go.

What is the simplest meaning of exchange execution?

Often, it is observed that the trade actions are transferred to an external trading system. The entire process is executed at the current market pricing. The clients of exchange execution forex brokers are directly linked to the existing interbank prices. This simply implies that the trader can directly trade with the interbank rates, and the broker has no liability or is responsible for charging interest from the traders.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.8 / 5)

(4.8 / 5) (4.9 / 5)

(4.9 / 5)