Trading Central review and experience – how good is the platform?

Table of Contents

| Rating: | Highlight: | Markets: | Offer: |

|---|---|---|---|

(5 / 5) (5 / 5) | Broker analysis platform | 85+ | Web, App |

The trading business is fast-moving and risky at the same time. Those who are not trading on the stock market as institutional investors or professional traders often cannot react as quickly to price fluctuations as other investors. In order for private investors who do not find much time for trading to be able to react quickly without spending a lot of time trading, there are automated tools that do analysis for you.

One provider of such a tool is Trading Central. The company is a leader in the field of technical strategies and assists traders in making investment decisions. How you can make better trading decisions with Trading Central, you will learn in the following Trading Central test.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

About Trading Central – introduction

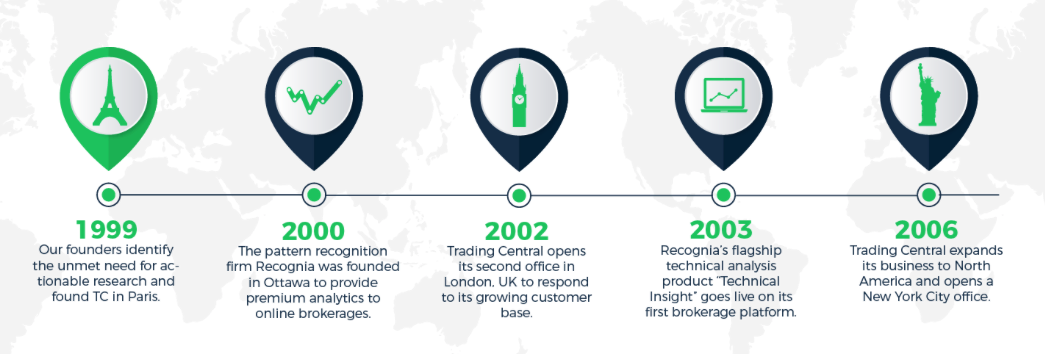

This emerging fintech company was founded in 1999 in the French capital, Paris. Even then, the company’s goal was to analyze the needs of traders and create solutions for them. It all started with the foundation of Alain Pellier and Romain Gandon. Today, Alain Pellier is CEO & Co-Founder of Trading Central, while Romain Gandon acts in the position of Managing Director. Both have many years of professional experience in international business.

As early as 2000, Trading Central expanded its own segment and founded the company Recognia in Ottawa, which deals with pattern recognition. Following this, Trading Central expanded in 2002 and opened its first office in London. In 2003, the excitement continued. The company Recognia launched for the first time a technical analysis product called “Technical Insight”. Success was not long in coming. In 2009, Trading Central expanded to North America and opened its first office in New York. Thus, already the starting years were an exciting ride.

In the following years, the company expanded more and more and Recognia released more and more products for trading. Most recently, Trading Central opened a development house in Bucharest in 2019 to ensure around-the-clock technical support and technical growth.

In summary, the history of Trading Central can thus, be described as follows:

- Established in 1999

- The founding of the pattern recognition company Recognia in 2000

- The first expansion in 2003

- Expansion of the company to North America in 2009

- Opening of a development house in Bucharest in 2019

The company history describes in the best way what services Trading Central stands for. Thus, Trading Central stands for pattern recognition and the provision of algorithms in the form of pattern recognition software, which serves to support trading on the stock exchange. The provision of technical analyses and trading knowledge is carried out directly by well-known online brokers, such as

- Admiral Markets

- AvaTrade

- GKFX

- InteractiveBrokers

- FxPro

- Swissquote

- and many more

Technical tools, as well as complex instruments, are provided to investors for trading at the respective brokers. Trading Central’s product portfolio includes the following offerings:

- Technical Analysis

- Fundamental Analysis

- News and Intelligence

The instruments and analyses can be used for several asset classes. Trading Central is thus a B2B company and does not sell its own services directly to the investor, but to the online broker through which clients can trade.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

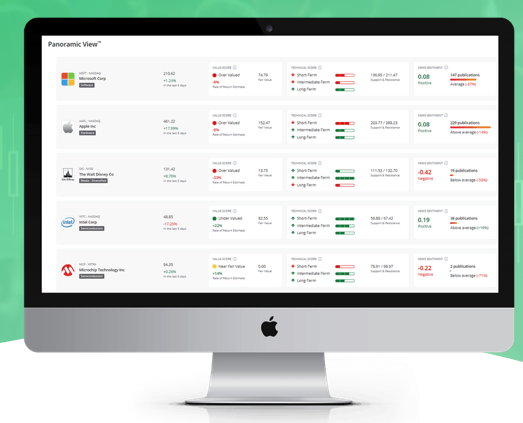

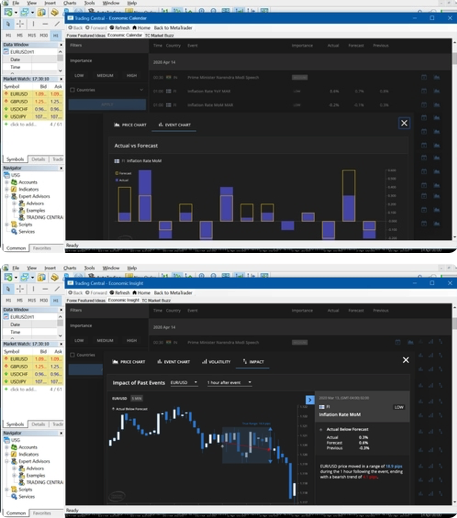

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) Panoramic ViewThis financial tool gives investors the opportunity to get information at a glance and make quick decisions accordingly. The overview in the form of a huge dashboard displays fundamental, technical as well as news analysis and allows you to expand your research by means of a complete panoramic overview of complex instruments, the market, and trading instruments. The special feature of the program is that investors can individualize the display. One’s own portfolio and own financial instruments and asset classes can be added to the panorama at any time.  Meta Trader 4 and Meta Trader 5MetaTrader is the leading trading platform in trading all over the world. Trading with MetaTrader is therefore possible with almost every online broker and traders’ experiences prove how promising the platform is. Therefore, it is not surprising that TC has also tried to cooperate with MetaTrader and it has worked. In this course, TC provides several, complex instruments in the form of plug-ins at Meta Trader. Tip: The Meta Trader offers from Trading Capital are subject to a fee. However, you should not take the risk of losing your money directly. Therefore, try out the programs first. Trading Capital provides a demo version of the offers for this purpose. In this, you can test the functions before opening a premium account. Alpha GenerationAlpha Generation provides indicators that offer new trading opportunities. To achieve this, there are a total of three functions in the program. First, there is the analyst view. In the form of a chart, orientation aids are displayed there in the form of the fluctuating price level of actively traded instruments. In addition, the analysis is based on adaptive candlestick charts, which are intended to improve decision-making for traders. Recommendations for entering and exiting a trading instrument are also presented in the form of indicators and signal lines. The Chart Program is thus very comprehensive and provides recommendations for traders in the form of chart displays. Forex Featured IdeasThose who trade foreign exchange and are active in Forex trading can rely on the Forex Featured Ideas tool. The program offers multi-factor trading ideas, real-time trading analysis in the form of live charts, customizable filters for individualizing content, and a user-friendly overall look. TC Economic InsightFor monitoring and tracking markets and economic events, TC Economic Insight is useful. FX charts are linked to economic events and forecasts as well as historical performances of the market are available. Traders can also set transparent Stop-Lass & Take-Profit profiles. Finally, there is the possibility to analyze markets by means of a volatility analysis.  TC Market BuzzFor traders, current market developments are important in order to be able to react quickly to fluctuations or, at best, anticipate them. However, observing the market in real-time is almost impossible. In order to make use of all the news from social posts, news, and blogs as an individual trader, TC Market Buzz serves. With this tool, customers receive a personalized news desk, a market overview in the form of a sentiment section, a topic list with the most discussed topics, and price charts. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Crowd InvestOften the emotionality and lack of rationality in trading are viewed negatively. The Crowd Invest tool transforms this negative thought into positive and innovative output. The idea behind Crowd Invest is that social media, forums, blogs, and other websites are filtered for personal opinions about a certain investment. In this way, a trend can be identified. Opinions are evaluated based on the feelings expressed with language, subjectivity as well as the strength of the argument. NewsletterA free offer from Trading Central is newsletters. The special feature of these is that they can be set up individually. Readers of the newsletter can therefore set what content they are interested in. But also the frequency of sending can be set individually. Contents of the newsletter are:

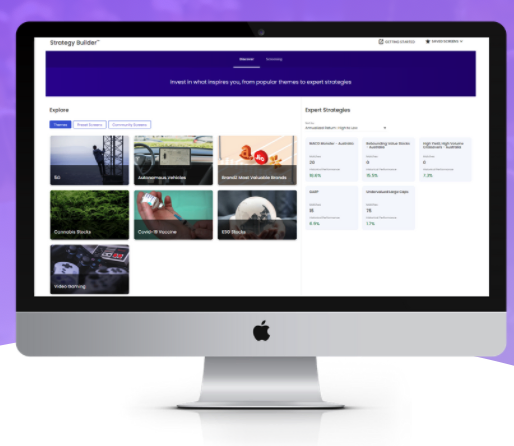

Analyst ViewsThe analysis tool is available in 32 languages and offers insights on over 8000 instruments. It is the only financial market research tool in the world that combines senior analysis expertise with automated algorithms. Clear trends, charts, and scenarios are presented in this tool. The tool also provides forecasts for future developments. Economic CalendarAn economic calendar is a classic tool that almost every online broker offers. It displays real-time economic data and identifies events where fluctuations in the market may occur based on upcoming events. Events in over 38 countries are recorded in the Trading Capital Economic Calendar. Technical InsightsThe technical Insights platform has already won awards for its excellent analytical performance. The technical analysis offered by the trader provides valuable information, interactive charts, allows staying up to date. Above all, it helps not to lose money, because also the own risk management can be managed via the platform. Especially for beginners, the tool is very interesting, because it significantly simplifies trading. Information and references to important contents of the chart are provided. Strategy BuilderAnother tool that is perfect for beginners is the Strategy Builder. Every trader needs an investment strategy, but this is not so easy to set up. To find the right investment strategy for yourself, this tool is helpful. So the own strategy can be designed and tested playfully. Learning effects and experiences can be collected in the tutorial, which shows what should be paid attention to when creating an investment strategy.  Value AnalyzerValue investing metrics can be displayed with this tool. This allows taking emotions out of trading. More rationality and a cool head can be kept this way. Thanks to a simple traffic light display in the colors red, yellow, and green, it is also possible to see whether an investment in a trading instrument is worthwhile at the current time or not. Web TVThe last tool is Web TV. Reporters report live from the New York Stock Exchange on market developments and comment on current financial events. The content can be consumed both in the form of a video and via an RSS reader. This allows for quick information intake via both voice and text.  Fees and costs for private investorsSince Trading Capital is a provider of trading tools for platforms such as MetaTrader and brokers, the trader himself, initially has no fees or costs. Free offers from TC can also be used at any time. Experience shows, however, that costs for the offers of Trading Capital can occur. Provided that the trading tools, which are used in the premium area of the respective trading platform, costs are incurred. Thus, some offers can only be used for a fee or subscription. However, the price varies from broker to broker and from trading tool to trading tool. However, users should be prepared for costs. However, Trading Capital acts very transparently, which is why hidden costs are non-existent. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Trading Central app for investorsTrading Capital’s solutions for online brokers are also available as an app. The app called “Investing App” offers a user-friendly interface, AI analytics, and the expertise of experienced analysts. Trading Capital’s core solutions are thus also available in the form of an app for investors. The app can also be used to view technical, fundamental, economic, and sentiment analyses, which scan the market and act as indicators of price trends. The popular “Strategy Builder” tool is also available in the app. However, some investors will be sad to learn that this app is not freely available either. Thus, this app can also only be used via a broker. The app itself, however, is well thought out, works on all mobile devices and offers a good mix between news, indicators, and trading tools that makes trading easier.  Customer service and supportAlthough Trading Central’s services and offers are primarily aimed at brokers, private investors can of course also get in touch with the company. For example, questions arise regarding cooperating trading platforms with which the offers can be used. Therefore, it is worth taking a closer look at Trading Central’s customer support. However, the contact options on the website are very limited. Unfortunately, there is no possibility to use a live chat. Writing an email is also not possible. Instead, the contact form can be used. Moreover, customer support is available in several languages. However, telephone and postal accessibility are very good. Thus, interested parties can call various offices and receive advice. All contact options per office are listed in the table:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Training opportunities at Trading CentralTrading Central’s service also includes making its own trading experience available to investors in the Learning Center. This way, traders can understand how stock market trading works. By means of blog articles, the authors explain the most important content around trading. How-to instructions, as well as news in trading and basic knowledge, are provided in the Learning Center. The focus is strongly on individual trading tools. Thus, there is a suitable knowledge article for almost every product of Trading Capital. This is aimed at both brokers and investors. Brokers can understand why the tool might be useful for their own clients, while investors can familiarize themselves with the tool itself.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) FAQ – The most asked questions about Trading Central :What is Trading Central?Trading Central is an online brokerage platform where one can invest and learn different technical strategies that will help make a well-informed trading decision. This is a fintech company based in Paris, France. It was established in 1999 and has been one of the best platforms for learning patterns. What are the different offerings of Trading Central?Trading Central allows traders and investors to run different trade market analyses and gain more intelligence and information about the market. It will enable traders and investors to run technical and fundamental studies through which they can know the price action movements, the breakthrough points, and so on. Apart from this, they can also learn more about current trading market news. What makes Trading Central different from other online brokerage platforms?One of the many reasons Trading Central is different from other online brokerage platforms is that it allows you to run different kinds of analysis on the trade markets and know the details about the price action movements, the current trade trends, and many other such attributes. Who should use the Trading Central platform?There is no hard and fast rule about the usage of the Trading Central platform. However, if you are new to trading analysis, start with functional and analytical methods on the Trading Central platform and then move to news and technical analysis. Read more about trading tools: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-01-15 11:43:512023-01-27 19:49:25Trading Central |