FXGM review and test – Is the broker legal or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.3 / 5) (4.3 / 5) | CySEC, FSCA | 200€ | CFD | From 0.0 |

If there are two words to describe FXGM, they are probably practical and functional. They are a forex broker that doesn’t go in for form over substance.

Don’t let your first impressions of their website put you off. Yes, it looks a bit dated and old hat. But a pretty face is the least of your concerns when trading forex. What you want is a reliable, frill-free platform that gets the job done without any unnecessary distractions.

And that’s precisely what you get with FXGM.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What is FXGM?

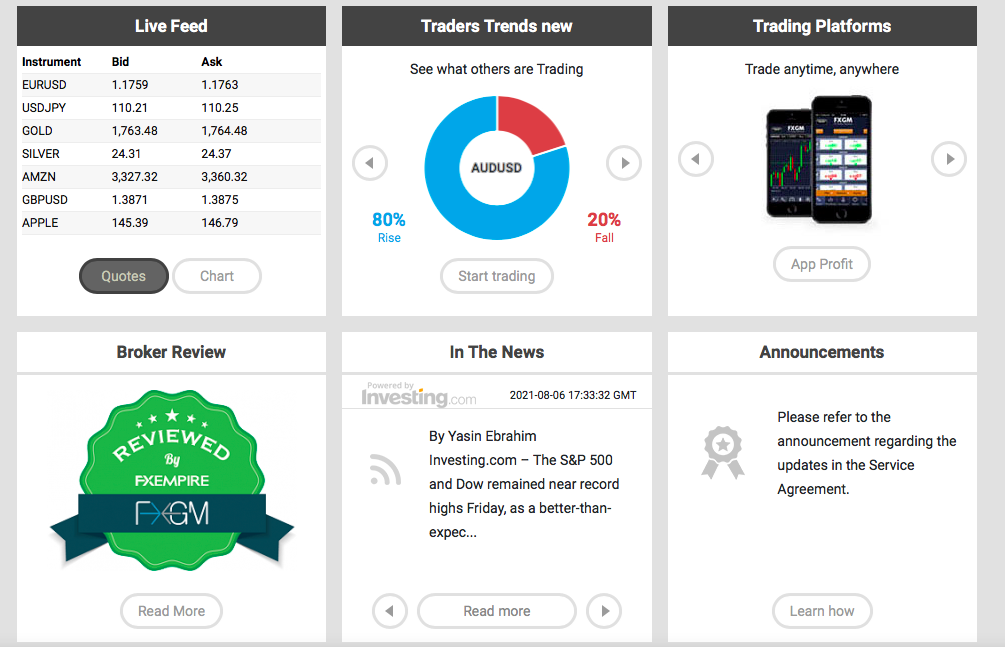

They are, first and foremost, a forex broker. They may offer other instruments, but these are the supporting acts. They offer services to both retail and corporate clients through their international operations in Cyprus, South Africa, Spain, and Bulgaria. FXGM is operated and owned by a Cypriot investment firm, Depaho Ltd. The brokerage provides clients with online trading in forex, commodities, and CFDs on major stocks.

FXGM is based around their PROfit trading platform, a user-friendly solution that’s simple enough for rookie traders but featured enough to appeal to more advanced traders. As Depaho Ltd. is licensed in Cyprus, it is subject to all the strict European Union-wide financial regulations regarding transparency and investor protection. When you sign up for an account, FXGM will assign you a personal account manager to assist you. FXGM provides an array of services and tools to help traders make the most of their trading opportunities.

The key to this is information. FXGM realizes that only informed trading decisions are likely to succeed over guesswork and speculation. To this end, they bring a range of tools to help traders get the big picture and the intel they need to see patterns and make moves ahead of the curve. The personal account manager plays another crucial role. They help clients with guidance and training on using the FXGM platform and provide general customer support on any issues you may encounter.

While the account manager will provide market updates, news, and facts on the financial markets, the ultimate trading decisions rests solely with the client.

FXGM claims to be beginner-friendly, but this is not borne out by what’s available on their website. Compared to other forex brokers geared up for new forex traders, the FXGM offering is decidedly weedy-looking.

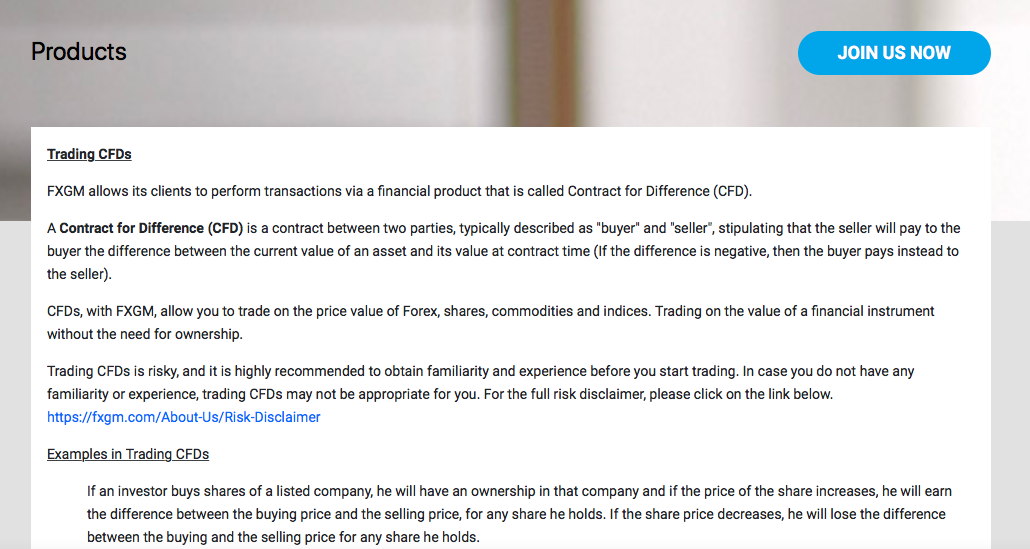

Among the CFD asset classes you can trade are:

- Forex

- Stocks

- Commodities

- Indices

- Cryptocurrencies

- ETFs (Exchange Traded Funds)

- Synthetic derivatives

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Regulation and safety of FXGM

FXGM is a brand of Depaho Ltd, which is registered in Cyprus as an investment firm. Regulation is conducted by the Cyprus Securities and Exchange Commission (CySEC), and the company holds license number 161/11.

FXGM is also authorized by the FSCA (the South Africa Financial Sector Conduct Authority). Their authorization number is 47709.

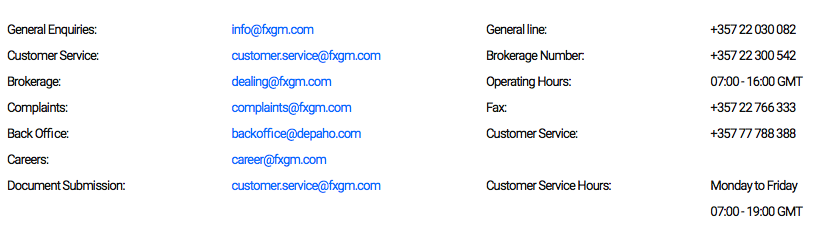

They also have an established branch office in Spain which is overseen by the National Securities Market Commission (CNMV). The branch holds license number 123. The main office address for FXGM is in the Cypriot capital of Nicosia within the Artemisia Business Centre. The office telephone number is +357 22 300 500, and the fax number is +357 22 766 333.

You can find the parent company’s website at depaho.com. Deposit Guarantee Depth Ltd. keeps client funds segregated with various European banks in line with locally applicable laws. As the funds are deposited in European Union banks, they are protected by the EU-wide deposit guarantee scheme.

This is a partial safety net in the event that the bank fails, not the broker, though. This is an important distinction and begs the question of which is more likely to go bust; the broker or the bank? If the bank in which your deposits were held goes belly up, you are covered for EUR 100,000 per deposit per bank. FXGM is signed up to the European Investors’ Compensation Fund. However, should they go insolvent, you are only covered for a maximum of €20,000.

Is there a negative balance protection?

Yes. But you need to dig into the Service Agreement and Appendices to find any word of negative balance protection. This is odd. Given that negative balance, protection is such an essential risk management tool for traders, it is strange that FXGM and others don’t shout about it more on their websites. No doubt they have their reasons. In FXGM case, negative balance protection is available for forex and commodities. There is no specific mention of negative balance protection for any other instruments.

What can FXGM offer its traders? – Trading conditions

FXGM does not charge a commission over and above their spreads. So that keeps everything much simpler and straightforward. Neither do they deduct nor pay tax on your behalf. Traders have to sort that one out themselves. FXGM is an excellent place to trade a wide range of CFDs on forex, cryptocurrencies, stocks, commodities, indices, and more.

But it’s not as simple or functional as all that. For FXGM back their trading platform with tools that keep you in the financial market loop and able to see emerging patterns. We all know about the value of knowledge. So does FXGM. They serve up plenty to ensure all their traders can make trading decisions based on the best possible information.

You can trade using their web browser-based app for big-screen convenience. The real kicker here is that it’s widely compatible, and there’s no need to worry about updates or installing any more software on your computer.

Equally, you can have the same robust functionality echoed in their mobile app so you can trade on your tablet or smartphone while on the go. There’s no reason, therefore, to miss a great trading opportunity simply because you were temporarily away from your home or office. Plus, no matter where you are at the time, you can always keep up to date with breaking news.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) How to trade with FXGMFXGM makes a lot of noise about being beginner-friendly, but judging by their website resources, this is somewhat misplaced. They have an optimistically entitled Trading Academy, but when you go in, there’s not much there. Indeed, nowhere near enough to get a complete novice up to speed with the highly risky and volatile nature of forex trading. Granted, they do underwrite your first ten trades. But that’s precious little time to get your head around the platform, the charts, and graphs, let alone figuring out forex trading. In all honesty, other brokers are much better geared up for beginners. Just take a look at the FXGM Trading Academy, for example. It comprises a glossary of forex terms, a 279-word history of forex trading, and a one-page drive-by shooting about charts. And that’s it. To be entirely charitable, though, they do have a FAQ page. But this is just as skeletal. It covers only a few queries regarding deposits and withdrawals, one question each about commissions and tax, and a query about their partnership program that links to a page about their tied agent in Bulgaria.  If you are anything but a seasoned trader, you would be better served looking elsewhere. There are plenty of forex brokers that go the proverbial extra mile with multi-level courses, seminars, webinars, how-to guides, videos, and the rest. FXGM, however, is not one of them, despite what they may say. How to open an accountThere is a choice of six accounts for retail customers: Basic, Discovery, Silver, Gold, Diamond, and VIP. They all feature the following:

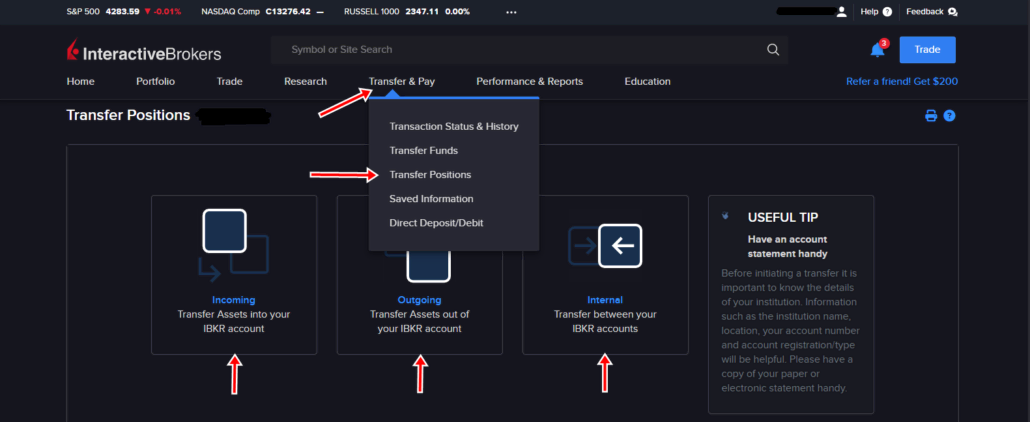

Account equity, which corresponds to withdrawal equity, varies significantly. From $200 – $1,999 on the Basic account to $30,000 and upwards on the VIP tier. You can see an at-a-glance comparison of the six accounts here to gain a better understanding.  To open a retail account, click or tap the Register Button at the foot of each account profile. This button takes you to a web registration form. The Login and Deposit buttons on the FXGM home page will take you to a login page with a New User link that redirects you to the registration form. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) This form asks for your full name, your email, and country of residence. If you can’t find your country in the drop-down menu, you are out of luck and can’t open an account. If you are a seasoned and active trader, you can open a professional account to obtain better trading conditions. A pro account gets you better leverage – up to 1:200 for currencies and commodities – zero margin close-outs and promotions. But the trade-off is losing your eligibility for investor compensation and Financial Ombudsman protection. The assumption is also that you have relevant experience and fully appreciate the risks involved. If better leverage sounds attractive, you do, though, have to meet at least two of the following criteria. These include:

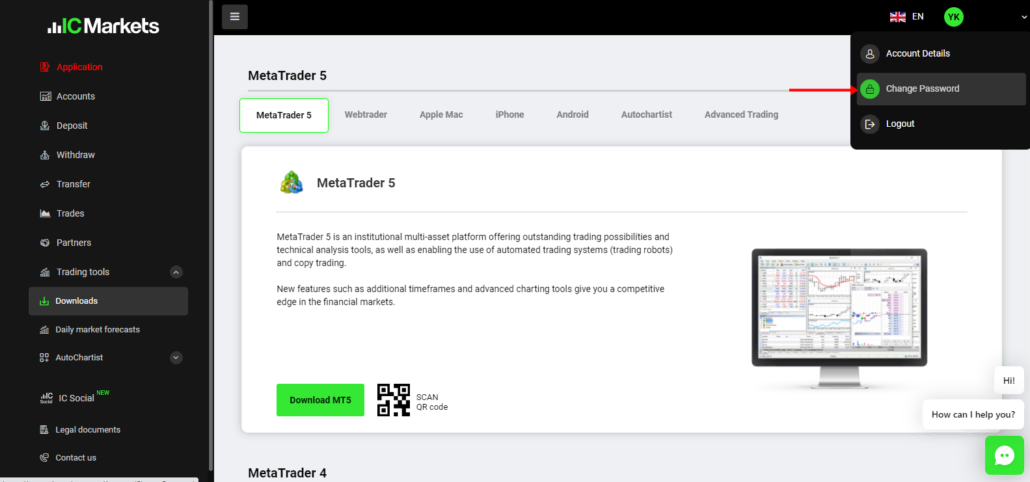

Note: When you sign up, you can let FXGM know your preference through your platform profile or via the professional client’s request form on the website. That said, you can also ask FXGM to treat your retail account as though you were professional if you convince FXGM you meet their criteria. Free demo account is possibleThey call it a demo account, but it’s not what most people understand by the term. FXGM’s possibly unique hybrid solution is underwriting your first ten trades. If you are new to their platform, FXGM will take the hit for any losses on your first ten trades. But if you hit pay dirt, you get to keep the profits. Either FXGM is completely bonkers or a pure genius. It’s difficult to tell at first glance. Either way, you get to jump in at the deep end with a lifebelt. The offer applies only for 30-days from the date of the first trade. Deposit and withdrawalsFXGM offers multiple ways to deposit into your account. These include:

* 3D Secure is a credit/debit card authentication system to prevent unauthorized use of your card. You need to set this up with the card provider so that each time your card is used for an online transaction, you have to enter a pre-set Secure Code. When the Secure Code is entered, your bank/card provider must verify the code to approve the transaction. The minimum deposit is 200€ or equivalent.  If you choose to deposit using a credit card, you must first inform FXGM’s back office team. You will then have to present them with a copy of a recent card statement and a scan of the front and reverse of the card. Nice to know:

Withdrawals are credited to whichever payment you used to make the deposit. If you deposited via a credit card, then the funds will go back to the card. Any monies above the initial deposit sum get sent to your bank account. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Support and serviceCustomer service operates from 07.00 to 19.00 GMT Monday to Friday. The primary customer service number is +357 77 788 388. Their email address is [email protected]. Meanwhile, the Contact Us button on the FXGM home page menu goes straight to an online form to request assistance. However, you do have the option of getting a reply via email or by phone. With the latter option, you can select a half-hour time slot in which to be contacted on your preferred telephone number. In addition to conventional landlines, FXGM also uses Voice over Internet Protocol (VoIP) to route calls over the internet. These lines are prefixed for Germany, Poland, Sweden, Spain, the UK, Finland, Denmark, and Italy. You can also raise the Customer Support team on WhatsApp using +357 97758027. The company uses software that allows the app to be installed on their company computers. Unusually, FXGM does not offer Live Chat to website visitors. However, registered users can access Live Chat when they log in.  Special offers of FXGMThere are no special offers on the table in the form of deposit bonuses or other promotional incentives for retail customers. FXGM does, however, offer an affiliate scheme for professional traders and brokers with attractive Cost Per Acquisition rates. In terms of other resources that they make available, FXGM supplies:

Where FXGM fails in a big way is in its almost total lack of credible learning or training materials. Aside from a glossary and a tiny FAQ section, there’s really nothing to get your teeth into to up your forex trading game. If you are a forex newbie or want to learn more about forex trading, FXGM isn’t the place for you. There are far better places for that. FXGM is plainly aimed at experienced and advanced traders who don’t need a lot of input. Conclusion of the review – FXGM is a professional trading platformFXGM is flawed, for sure. It has a number of shortcomings. But none that are necessarily deal-breakers unless you are a forex beginner. What you get with FXGM is what you see. It’s a no-nonsense platform that’s lean and streamlined for trading forex. You won’t get whistles and bells. Or anything flashy. FXGM is minimalist and functional. Their website is a case in point. It’s a tool, not a marketing showcase. This stance is good if slick and sexy websites do not entice you. What you get is less clutter and more forex trading. Is it a scam? We don’t know but this broker is currently on watch. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about FXGM :Is FXGM legit and safe?While FXGM is registered by CySEC, this regulatory body lacks the reputation of more respectable financial supervising entities. We also noted some negative reviews from clients online regarding the reliability of an offshore site. What can I trade at FXGM?Clients can trade CFD and other products. What is the minimum deposit amount at FXGM?The minimum deposit at FXGM is 200€. Where is FXGM located?The headquarters of FXGM is located in Cyprus, Nicosia. FXGM is just the brand name of the company Depaho Limited which is a Cypriot investment firm started in 2011. FXGM allows you to trade currencies and commodities, and major stocks online with the help of Contract for differences in a trading platform called PROfit. How do I withdraw money from FXGM?To withdraw money from Fxgm, first log in yourself and register your withdrawal. If you use a credit card for funding, fill up the credit card declaration form available on the portal and send it to FXGM via fax or email. Next, after verification, the withdrawal amount will be sent to the source of the deposit. What is the minimum deposit for FXGM?You can deposit a minimum of $200. This is equivalent to the current date ZAR 2750 at a current exchange rate between the South African Rand and US Dollar. Do reviews by traders influence the FXGM rating?People get highly influenced by the reviews, and reviews can be responsible for both the rise and downfall of an online trading site. Reviews are the only way for some customers to understand the authenticity of the brand. Thus, reviews can easily raise or lower the rating of any broker in the general list of brokers. Learn more about brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/FXGM-Logo-1.png 68 167 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-03-22 19:18:402023-01-27 20:01:55FXGM |