FP Markets broker review – a real test for investors

Table of Contents

REGULATION: | ASSET: | MIN. DEPOSIT: | MIN. SPREAD: | |

|---|---|---|---|---|

(5 / 5) (5 / 5) | ASIC, CySEC, FSCA | 7 classes, 10.000 markets | $100 (AUD or equivalent) | Variable 0.0 pips |

Reputation and credibility in trading vary in the products and services offered and executed by an online broker. FP Markets claims to be one of the most reputable Forex Brokers in the trading industry. How serious is “FP Markets” in supporting and serving its clients? Does this broker really give the most suitable trading products among global markets? Should we give our trust in this broker? Let’s find out together in this review.

What is Fp Markets? – The company presented

FP Markets is a trusted global CFD and Forex broker founded in 2005. The company’s vision was to create a superior forex trading destination where traders could access a full suite of trading products in the global markets. It offers the ability to trade CFDs across forex, equities, indices, commodities, futures, and cryptocurrencies. This broker offers its clients the convenience of being able to trade all these assets from a single account. This is one of the key reasons traders choose FP Markets.

FP Markets believe that focusing on the key ingredients in getting successful trades gives its clients the confidence to choose them as a broker. The company gives special attention to its traders’ needs and has learned that the combination of pricing, execution speed, cutting-edge platforms, product range, customer support, and market analysis can gain not only the trust of its clients but also certainty. As FP Markets is an Australian licensed forex broker, its clients’ interests’ are the top priority. This is the broker’s firm commitment to excellence.

Facts about FP Markets:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2005 |

💻 Trading platforms: | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

💰 Minimum deposit: | $100 AUD or equivalent |

💱 Account currencies: | AUD, USD, EUR, GBP, SGD, CAD, CHF, HKD, JPY, PLN |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Shares, Metals, Commodities, Indices, Bonds, ETFs |

💳 Payment methods: | More than 20 payment options |

🧮 Fees: | Starting at 0.0 pip spread / variable overnight fees |

📞 Support: | 24 / 7 support via live chat, phone, or e-mail |

🌎 Languages: | 20 languages |

Is the FP Markets platform regulated? – Regulation and safety for customers

Regulation is one way to determine if a broker is legit. This is due to the fact that a broker is not able to operate legitimately without passing certain criteria to attain this license. This regulation also serves as your protection from scammers. You must first know if the broker is regulated and what the regulator has given its license for the safety of your investments. FP Markets is regulated and authorized by Australia’s corporate regulator and financial watchdog. This regulator is the Australian Securities and Investment Commission (ASIC), but they also have licenses from European and African regulators.

FP Markets is regulated by:

- Australian Securities and Investment Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

Financial security

The security of money and investment is the main concern of any trader. FP Markets claims to be a global award-winning regulated broker that traders can trust. The company complies with the most stringent regulations for investor protection, which are laid out by its regulator – ASIC. FP Markets commits to adhere to strict capital payout obligations and has a risk management program to ensure its clients’ safety. The firm ensures its clients that the funds are segregated. FP Markets keep the funds of its clients from the firm’s capital.

This is also protected by leading (top-tier) banks, and this broker ensures the safety of its client’s funds. FP Markets have partnered with top financial institutions, like HSBC, JP Morgan, Barclays, and Goldman Sachs, to ensure multi-asset liquidity. These partners of FP Markets ensure the highest levels of interbank liquidity for its clients. Also, the financial accounts are audited by external audit firms to ensure constant compliance with regulations across the operations of the company.

Summary of regulations and financial security:

- Regulated and authorized broker

- Segregated clients funds

- Top-tier liquidity

- Transparent to its traders

- Corporate Governance

- Reliable global broker

- Implements risk-management

What are the pros and cons of FP Markets?

Pros of FP Markets? | Cons of FP Markets |

✔ Huge variety of deposit options | ✘ Only two account types to choose from |

✔ Excellent customer reviews and reputation | ✘ Spreads on uncommon currency pairs are rather high |

✔ Extremely fast processing of withdrawals | |

✔ Huge selection of trading platforms and tradable instruments | |

✔ Great website security with a 2FA authentication method | |

✔ Call-back option for support is available | |

✔ Plenty of free educational material available |

Is the user experience at FP Markets any good?

Usability and reliability is perhaps the most important factor to consider after security and fees, in our opinion. In this section, we take a closer look at some key points to consider, but in short, FP Markets has some of the best and most user-friendly platforms available.

Criteria | Rating |

General Website Design and Setup | ★★★★★ Clean and easy design of the website and very helpful support |

Sign-up Process | ★★★★★ Took us less than two minutes to open a demo account. And fast approval for a live account. |

Usability of trading area | ★★★★★ Highly reputable trading platforms to choose from, and tutorial videos for both platforms for beginners |

Usability of mobile app | ★★★★★ Full account access via app, browser access via the mobile web version |

Review of trading conditions for traders of FP Markets

FP Markets offers its clients the advantage of trading CFDs across forex, equities, indices, commodities, futures, and cryptocurrencies from a single account. This broker promotes fast execution, convenience, and customer satisfaction. We recommend this broker due to its performance.

FP Markets have proven its excellence through its products and services. In fact, the firm has won more than 40 awards, and this includes the title of the ‘Best Value Global Forex Broker.’ Also, FP Markets has won 6 awards as the ‘Number One Most Satisfied Traders’, four of the title as ‘Number One Best Trade Execution,’ and twice as ‘Number One Best Education Material.’ The company claims to be dedicated to serving its customers and valuing not only customer trust but as well as customer satisfaction which we can confirm from our experience and research.

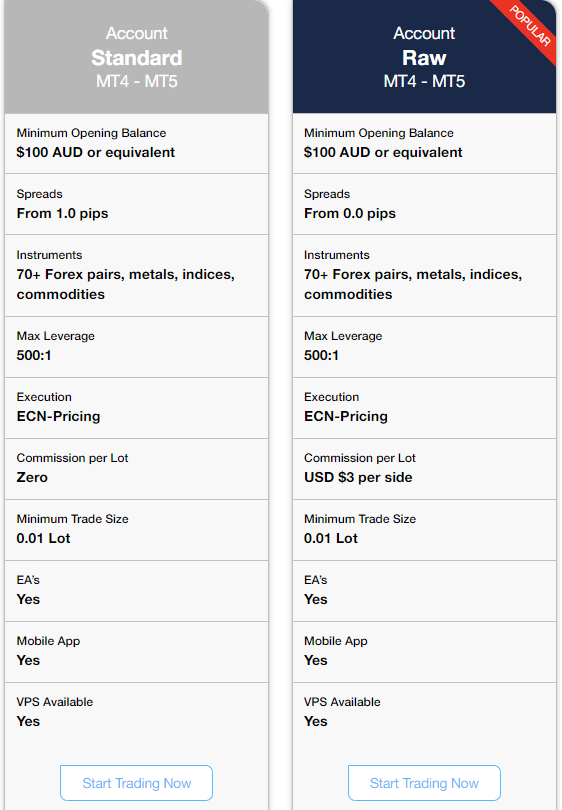

You will be able to select what kind of account type you want to use with this broker. There are five classes of assets that you can choose from to trade, namely: Forex, metals, commodities, indices, and cryptocurrencies. You can choose between the Standard account and the Raw account. There are no commission fees on the Standard account. However, in the Raw account, it depends on what asset you are trading on.

Please see the table below for detailed information:

| ACCOUNT: | STANDARD | RAW |

|---|---|---|

| FOREX: | Variable Spreads (starting 1.0 pips) | Variable RAW Spreads (starting 0.0 pips + commission) |

| METALS: | Variable Spreads (starting 0.16) | Variable RAW Spreads (starting 0.0 + commission) |

| COMMODITIES: | Variable Spreads (starting 0.02) | Variable Spreads (starting 0.02) |

| INDICES: | Variable Spreads (starting 0.2 pips) | Variable Spreads (starting 0.2) |

| CRYPTOCURRENCIES: | Variable Spreads (starting 0.004) | Variable Spreads (starting 0.004) |

For the security of funds, FP Markets assures its clients by segregating the funds from the company’s funds. Also, it is protected by leading (top-tier) banks and ensures multi-asset liquidity. The company offers ultra-low spreads from 0.0 pips and up to 500:1 leverage. Free funding at no cost, and customer support is ready to assist 24/7. If you are new to the trading industry, you can use a Demo Account first, which is also offered by this broker for free. For trading real funds, you can start right away with a minimum deposit of $100 (AUD or equivalent).

Facts about the conditions for traders:

- Fast execution (ECN/DMA execution)

- Competitive spreads (from 0.0 pips)

- Award-winning global broker

- The minimum deposit is $100 AUD (or equivalent)

- Transparent trading experience

- Competitive Platforms (MT4/MT5/IRESS)

- Offers free Demo Account with virtual funds

Test of the FP Markets trading platforms

FP Markets gives options to its clients in choosing what platform to use. The company has partnered with well-known and best platforms in the trading industry. This includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), MetaTrader WebTrader, and cTrader.

Trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- FP MarketsMobile App

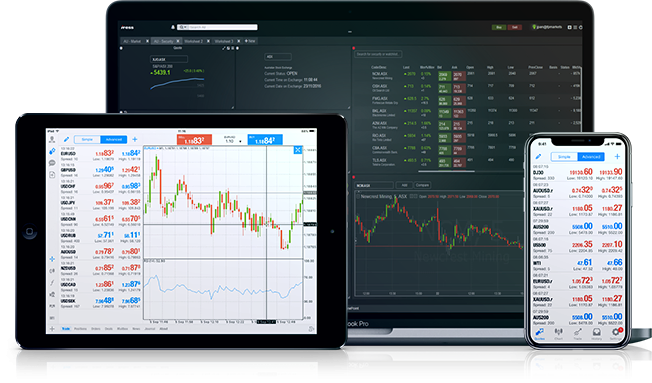

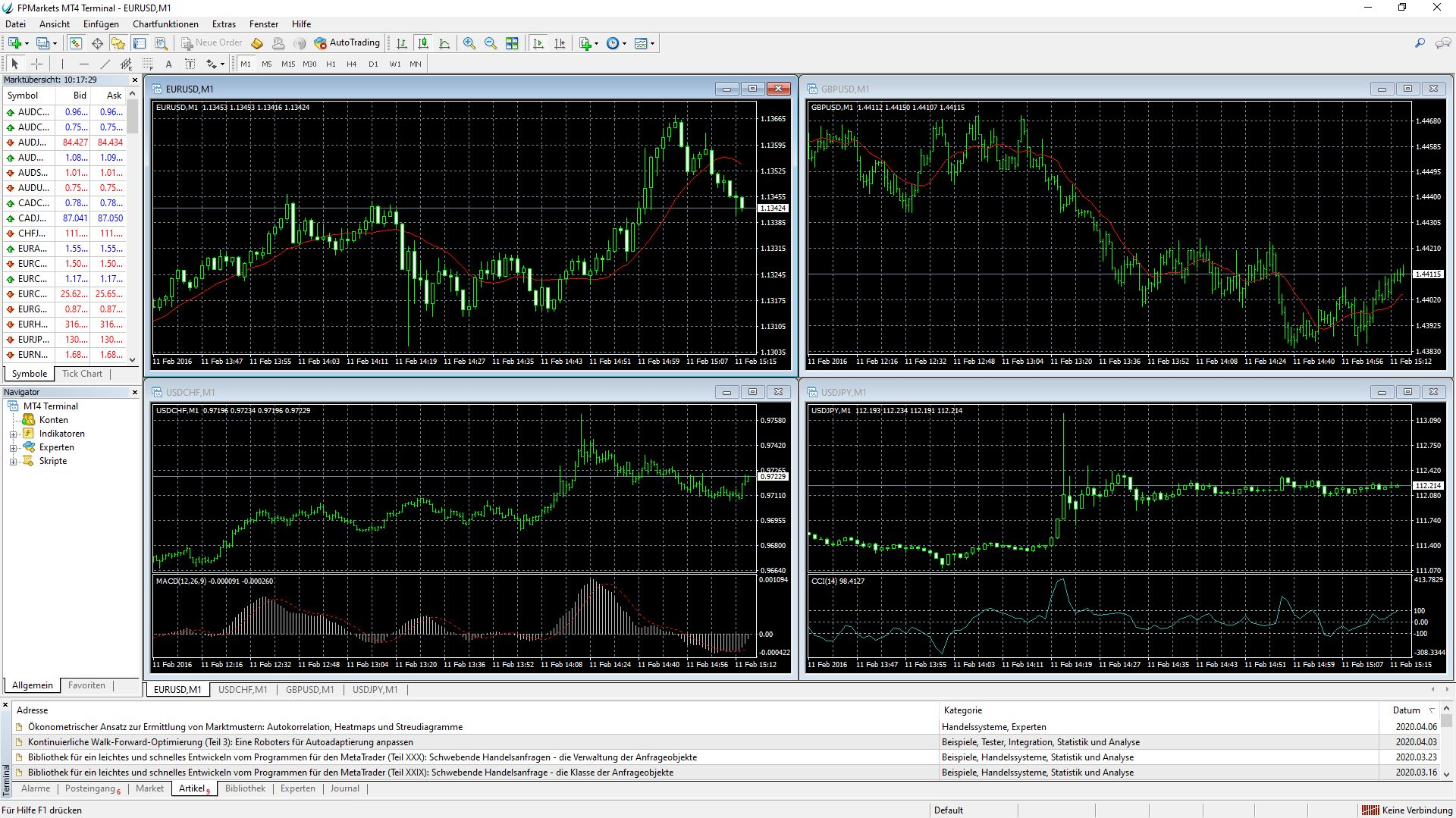

MetaTrader 4 platform and MetaTrader 5 platform

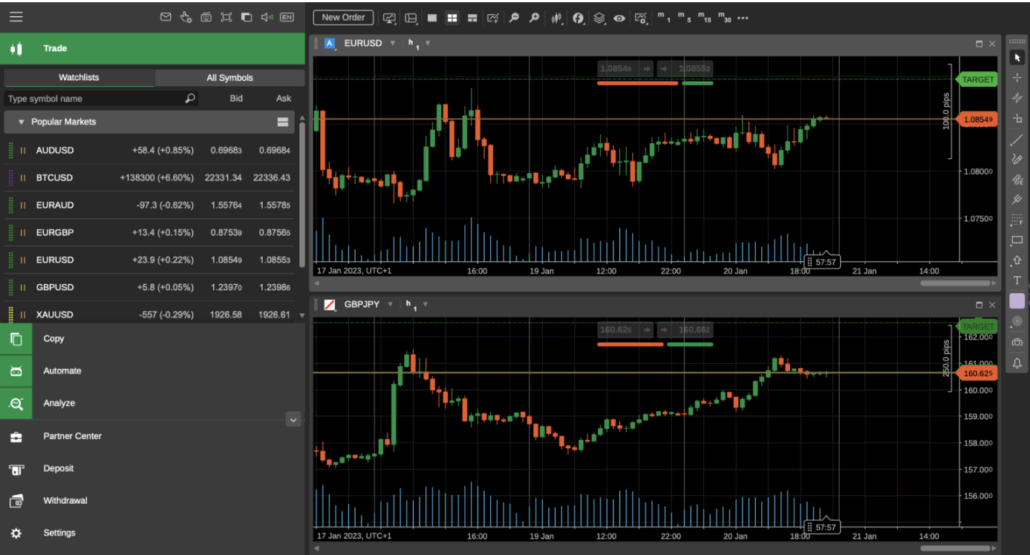

MetaTrader 4 (MT4) is known to be the world’s most popular trading platform. FP Markets has chosen this platform not only for its popularity but as well as for its flexible trading conditions, ultra-tight spreads, and fast execution. MT4 features a customizable interface that includes colors of technical indicators, which makes it easier to read and analyze. Also, one-click trading for traders’ convenience, MarketWatch, and live price streaming on Live and Demo accounts. For secure trading, data are encrypted, and the platform has Expert Advisors (EAs) and customizable alerts. You would also be able to have access to the MetaTrader market and MQL4 community. It has multiple chart abilities and is compatible with iOS, Android, and Mac devices.

On the other hand, MetaTrader 5 (MT5) promotes superior trading. This platform is known to be one of the most technologically advanced trading platforms. The FP Markets MT5 offers modern traders access to a world of opportunity. It features a depth of market display, has six pending order types (including Buy Stop Limit and Sell Stop Limit), is an improved strategy tester for EAs, and has a built-in market of trading apps. It has Time & Sales (exchange data) and trading alerts with e-mail and pushes notifications on mobile devices. Also, hedging and exchange trading are allowed on this platform. You can also transfer funds between accounts using MT5.

MetaTrader WebTrader platform – MT4 & MT5

The MetaTrader (MT4 & MT5) WebTrader of FP Markets allows traders to trade in any device from any browser as long as they are connected to the internet. It features a complete suite of trading tools and operations. It requires no download, which eases your trading experience. It has a one-click trading feature, a “depth of market” feature, multiple order types, and execution modes. Also, it displays real-time price quotes and has data synchronization across all platforms. The online support operates 24 hours a day, five days a week. Plus, customer support has multiple language selections.

cTrader

FP Markets cTrader platform is a cutting-edge digital trading platform that provides a full suite of features that enhance trading experiences. Notably, it offers seamless and rapid trade execution thanks to its top-tier technology, which minimizes the risk of slippage and offers traders the most accurate pricing available. It features a user-friendly interface that offers advanced charting capabilities, facilitating technical analysis with precision and ease. Moreover, the platform provides access to a broad range of financial markets, including more than 70 forex pairs, CFDs, indices, commodities, and cryptocurrencies.

With direct access to liquidity providers and no dealing desk intervention, traders can benefit from the truest market prices. Additionally, cTrader supports algorithmic trading and offers robust risk management tools to protect traders’ investments. Its compatibility with multiple devices allows trading on the go, making it a versatile choice for both novice and experienced traders.

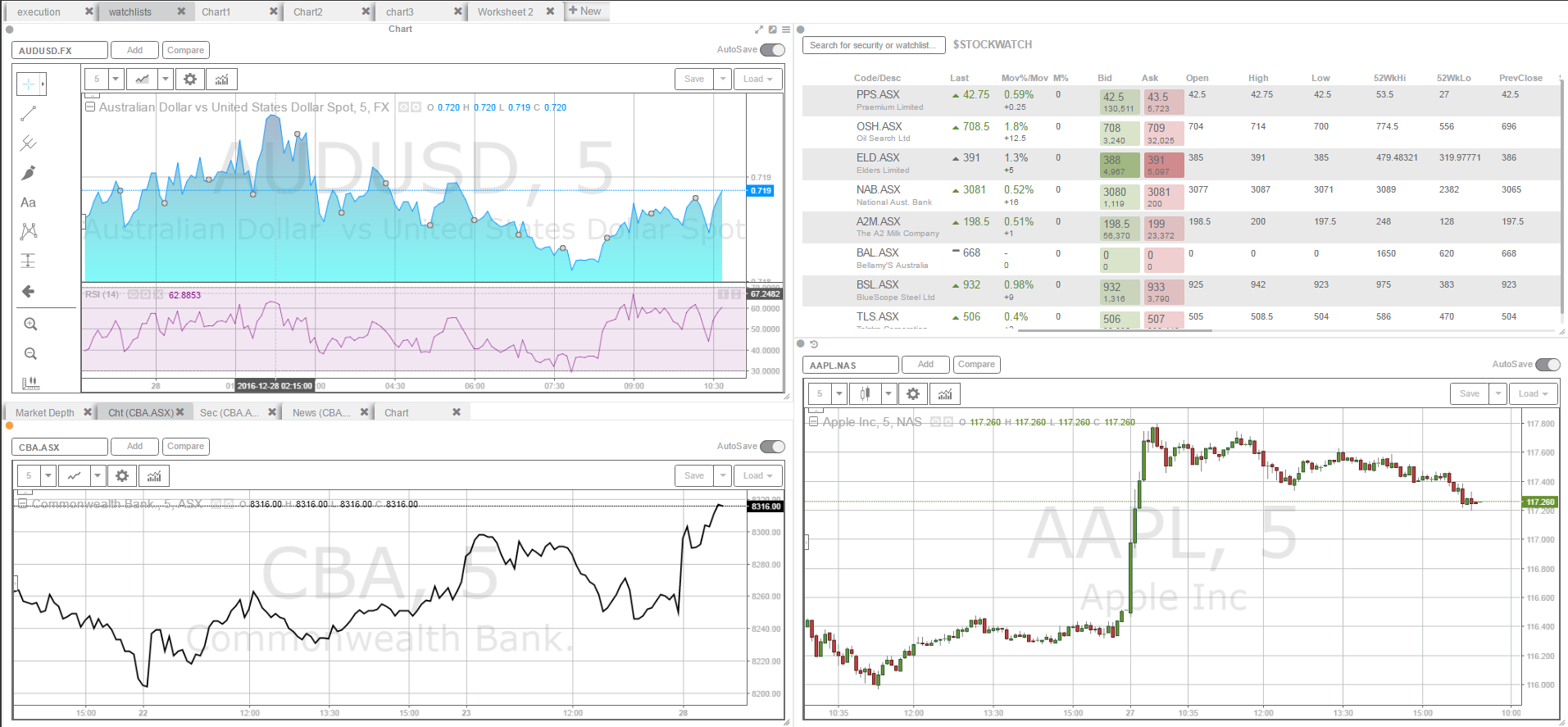

iressTrader Platform

To elevate the trading experience, FP Markets provides its traders with the iressTrader Platform (IRESS). It is a new and improved active comprehensive trader platform with advanced functions. It features automatic data sync between Iress Trader and Iress ViewPoint and is compatible with the latest browser versions. It has module linking, an intuitive interface, improved browser alerts, and can manage multiple portfolios. Also, it highlights real-time price streaming and gives you access to genuine exchange pricing and market depth. Plus, IRESS has enhanced trading tools and better compatibility with a wide range of internet browsers.

This platform is for professional traders and has 59 technical indicators. IRESS requires a minimum deposit of $ 1,000 AUD or equivalent. With this platform, you can access over 10,000 financial instruments. It has auto-open & close positions, advanced tools, and advanced functionality.

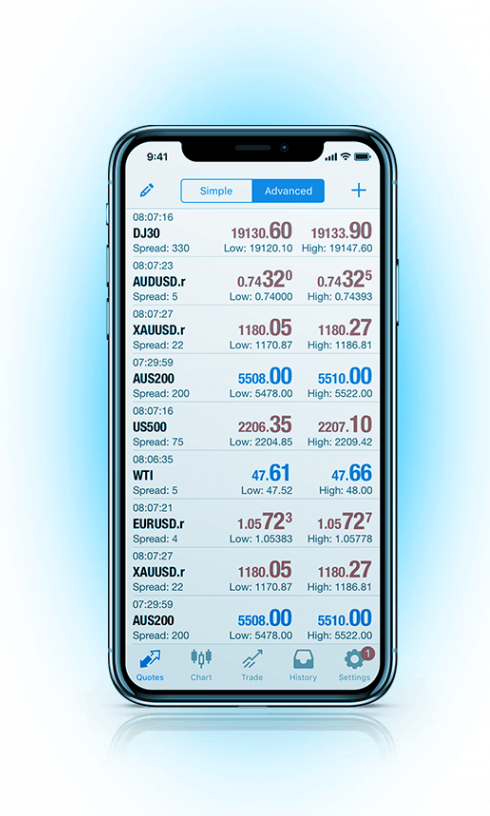

Mobile Trading (App) is possible with FP Markets

MetaTrader 4 (MT4), MetaTrader 5 (MT5), and iressTrader (IRESS) platforms are available on mobile. Mobile trading enables traders to trade anywhere they are and anytime they want when connected to the internet. This is one of the significant products in the trading industry that traders seek not just for convenience but also to be ankle to track their trades without any hustle. This Mobile Trading App is available on all kinds of platforms FP Markets is offering. This is free to download in Google Play for Android and in AppStore for iOS.

This mobile app embodies the same features and functionality of each platform. It has live dynamic pricing and access to real-time financial news, and you can track portfolios and holdings. Also, it has advanced order management and enhanced charting. It has a host of technical indicators, multiple timeframes, display currency market depth, and multiple pending order types, including Buy Stop Limit and Sell Stop Limit. Plus, it has a multi-chart display, multiple inbuilt indicators, and graphical objects. It is easy and fasts to download. FP Markets Mobile App has a user-friendly interface that features trade levels with volumes on a chart and real-time quotes 24/5. You can customize your forex trading layouts, and it highlights one-click trading in the palm of your hand.

Features of FP Markets Mobile Trading App:

- Available in all FP Markets Platforms (MT4, MT5, IRESS)

- Convenient and user-friendly

- Trade via your Android/iOS device

- Real-time quotes 24/5

- One-click trading feature

- Customize your Forex trading layouts

- Interactive and advanced charts

- The ability to view your full Forex trading history

- Offline modes are available with charts and symbol prices

- Display currency Market-Depth

- Multiple pending orders types, including Buy Stop Limit and Sell Stop Limit

- Multiple inbuilt indicators and graphical objects

- Multiple timeframes and multi-chart Display

- Hedging allowed (MT5)

Professional charting and analysis are available

Two most important things you need to know before trading is charting and analysis. This is significant in getting successful trades due to the fact that charting enables you to read and understand how the market moves. The volatility of the markets lets you determine whether to buy or to sell. With the right use of technical analysis, together with the knowledge of charting, you will be able to have good trading results. Charting keeps you track of the historical prices in the markets. This makes total sense because Technical Analysis is a method of analyzing the markets and predicting price movements. With the use of historical prices, you can determine or predict whether the price value will go up or down.

FP Markets has a section on its website where you can read updated articles about Technical Analysis and Fundamental Analysis of the markets. The company puts effort into these articles to update its traders. This makes it easier for traders to know what’s going on in the market value. Both technical and fundamental analysis is very important in trading. However, both also have advantages and disadvantages. Fundamental analysis helps you understand the market’s movement (upward or downward). The good part is that when combined with technical analysis, this can lead you to long-term trends, which is a good edge on your part as a trader.

FP Markets has interactive and advanced charts. The company has well-developed technical indicators that you will find helpful in trading. There is a feature on the platforms of FP Markets where you can select colors in order for you to read and analyze easier the movements of the markets.

FP Markets support professional charting:

- Indicators

- Drawing tools

- Fully customizable chart

- Multi-charting

- The broker offers training for technical analysis

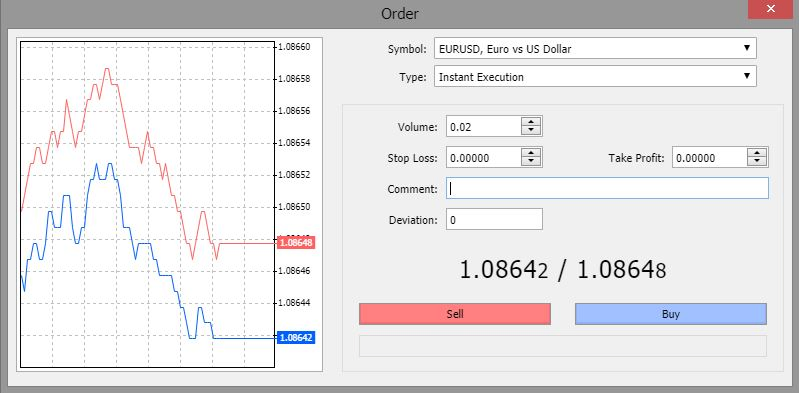

FP Markets trading tutorial: How to trade

In trading, you need to make decisions and analyses. In order to get good trading results, you must first know how trading works. With this said, you should know which market you want to analyze and trade on. Also, bear in mind that the movements of the markets are a big part one must know in order to have successful trades. It is easier to decide whether to buy or sell once you already understand the volatility of the markets. For example, if you think that the market value is going to fall, then choose to sell instead of buy. But, if you think that the price is going to increase in value, choose to buy instead of sell.

First, you need to select the asset you wish to analyze. Next, analyze the asset and determine a forecast of the price movement. Then, open the order mask on the platform. After, customize your position and choose the order volume. Lastly, decide whether to buy or sell.

Step-by-step tutorial:

- Select the asset you wish to analyze

- Analyze the asset and determine a forecast of the price movement

- Open order mask in the platform

- Customize your position

- Choose the order volume

- Decide whether to buy or sell

Free FP Markets demo account

Before trading real money, we highly recommend getting a Demo Account first for unintentional trades. In trading, you have to be aware as a trader that there is a high risk of losing your money, especially if you don’t know and understand how trading works. Good thing FP Markets offers a free Demo Account to its traders, and this account comes with virtual funds. In this account, you will be able to practice your trading skills and strategies 100% risk-free.

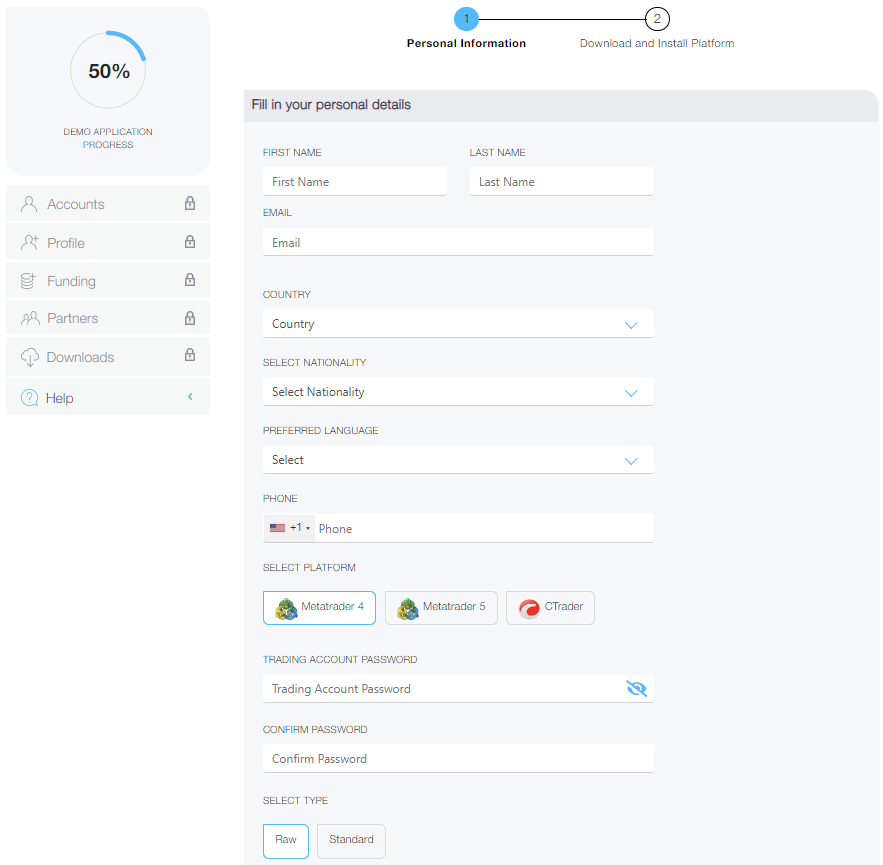

How to open your account

Opening an account with FP Markets is fast and easy. All you need to do is to fill up the Trading Application Form on the official website of FP Markets. This form only takes 3 minutes to complete. First, enter your personal details (First and Last Name, Country, Phone, and Email). Then is for you to share more about yourself, like address, employment status, and date of birth. Afterward, you can choose what type of platform you wish to use (MT4/MT5), account type (Standard/ECN Raw), and base currency. Lastly, it will ask you to answer some questions, and then once you are done, you can start trading.

Account types of FP Markets

FP Markets gives its traders the power to select a trading platform with a pricing model that suits the trader’s trading style and skill. The company offers a product range across all account types.

Forex Account has two types with FP Markets, namely: Forex MT4/MT5 Account Standard and MT4/MT5 Raw. These accounts vary in spreads, wherein Standard is from 1.0 pips, while Raw is from 0.0 pips. The minimum deposit is the same, amounting to $100 or equivalent. Also, the maximum leverage is 1:500. However, the commission in Standard is zero (ASX), while Raw is $3 (USD).

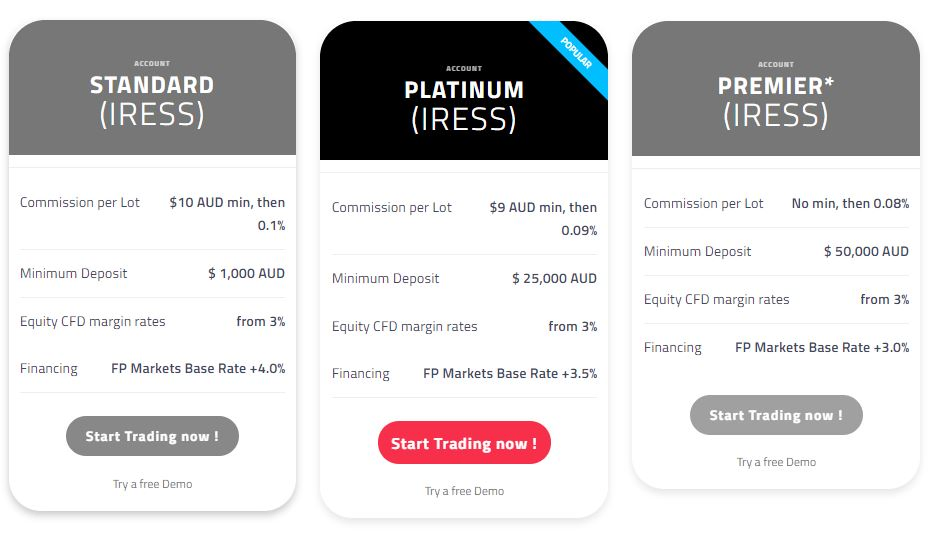

On the other hand, FP Markets also offer IRESS accounts. There are 3 IRESS accounts, namely: IRESS Account Standard, IRESS Account Platinum, and IRESS Account Premier. All of these accounts have the same equity CFD margin rates which are 3%. The minimum deposit of IRESS accounts is naturally higher than a forex account. The Standard (IRESS) minimum deposit is $ 1,000 AUD or equivalent, while the Platinum (IRESS) is $ 25,000 AUD, and the Premier (IRESS) is $ 50,000 AUD. The commission per lot also varies with these accounts. Standard (IRESS) has a $10 AUD minimum (then 0.1%), Platinum (IRESS) has a $9 AUD minimum (then 0.09%), and Premier has no minimum (but then 0.08%).

Account Types:

Forex:

- Standard (MT4/MT5) – minimum deposit $100 AUD

- Raw (MT4/MT5) – minimum deposit $100 AUD

IRESS:

- Standard (iressTrader) – minimum deposit $1,000 AUD

- Platinum (iressTrader) – minimum deposit $25,000 AUD

- Premier (iressTrader) – minimum deposit $50,000 AUD

Reviews of deposit and withdrawal

Flexibility is one of the advantages of FP Markets in terms of payment service. It offers more than ten flexible funding options in 10 different base currencies. These payment methods vary in what type of account (either MT4, MT5, or IRESS) you’ll be placing your funds in. Also, the processing time of the deposit varies on the type of your account and the payment method you choose to use.

Payment Methods that can be used:

- VISA/MasterCard

- Asia Banks

- STICPAY

- FasaPay

- Perfect Money

- pagssmile

- Skrill

- Neteller

- FasaPay

- Bank Transfer / Bank Wire (Domestic and International)

- Apple Pay

- Google Pay

- Broker to broker

The majority of these payment methods do not charge any fees, especially for MT4 and MT5 accounts. However, IRESS accounts usually charge a small percentage of the fee for processing your deposit. It also makes sense due to the fact that IRESS accounts require a large amount of deposit compared to MT4 and MT5 accounts. As has been mentioned above, this still depends on what type of payment channel you choose to use. The major part of these payment channels do not charge for MT4, MT5, and IRESS accounts, accept PayPal, Skrill, Neteller, Bank Wire (International), broker to broker, and in some cases Credit/Debit Cards.

Please see the table below for further details:

| PAYMENT METHOD: | MIN. DEPOSIT: | DURATION: | FEES: | CURRENCY: |

|---|---|---|---|---|

| CREDIT/DEBIT CARDS | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 Business day (IRESS) | -No fees (MT4/MT5) -Domestic (AUD): 1.6% / International: 3.18% (IRESS) | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD |

| BANK WIRE (DOMESTIC) | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | 1 business day | No fees | AUD |

| BANK WIRE (INTERNATIONAL) | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | 1 business day from when the funds are received | $12.50 AUD | Other than AUD |

| PAYPAL | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | -No fees (MT4/MT5) -2% fee (IRESS) | AUD, CAD, EUR, GBP, HKD, JPY, SGD, USD |

| STICPAY | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | No fees | JPY, EUR, GPB, USD, HKD, TWD, KRW, SGD |

| NETELLER | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | 4% (IRESS) | AUD, CAD, CHF, EUR, GBP, JPY, PLN,SGD, USD |

| SKRILL | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | 4% (IRESS) | USD |

| PERFECT MONEY | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | No fees | USD |

| PAGSSMILE | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT 4/MT5) 1 business day (IRESS) | No fees | BRL, CLP, COP, PEN, MXN, USD |

| FASAPAY | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | No fees | USD, IDR |

| APPLE PAY | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | No fees | AUD, CAD, CHF, EUR, BP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED |

| gOOGLE PAY | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | -Instant funding (MT4/MT5) -1 business day (IRESS) | No fees | AUD, CAD, CHF, EUR, BP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED |

| BROKER TO BROKER | $100 AUD (MT4/MT5) | $1000 AUD (IRESS) | 1 business day | -No fees (Domestic) -$25 AUD (International) | Not mentioned |

Is negative balance protection included with FP Markets accounts?

Yes, for additional peace of mind, FP Markets provides negative balance protection for its clients. This means you can never lose more than your account balance. Especially broker novices tend to underestimate how quickly markets move in certain situations, but with negative balance protection, you are safe in this regard.

Fees and costs for FP Markets traders

Fees and costs vary with FP Markets, whether you choose a Forex Account (Standard Account/Raw Account) or IRESS Account. For Forex traders, a Standard account requires a minimum deposit is $100 (AUD or equivalent). With this account, spreads are offered from 1.0 pip with no commission. For the Raw account, the minimum deposit is also $100 (AUD or equivalent). However, spreads are offered from no minimum but a fee of $3.50 AUD per lot per trade.

FP Markets is a low-cost broker. They offer low spreads and commissions.

For CFD traders, there are three account types offered by FP Markets. The Standard IRESS Account has a minimum deposit requirement of $1,000 AUD or equivalent. There is a fee of $10 AUD per month for minimum brokerage. Overnight financing is at RBA plus 4%. If a trader generates at least a $150 AUD commission in a month, then the $55 GST fee per month is waived. Also, there is a monthly GST fee of $22 AUD that is waived for ASX data whenever the trader generates at least $50 AUD of commission in a month.

For the second IRESS account, the Platinum IRESS Account minimum deposit is $25,000 AUD or equivalent. The brokerage fee is $9 AUD per month. Overnight financing is at RBA plus 3.5%. If a trader generates at least a $150 AUD commission in a month, then the $55 GST fee per month is waived. Also, there is a monthly GST fee of $22 AUD that is waived for ASX data whenever the trader generates at least $50 AUD of commission in a month.

Lastly, the Premier IRESS Account requires a $50,000 AUD or equivalent minimum deposit. The brokerage fee is 0.08% of the trade size, with no minimum flat fee. Overnight financing is at RBA plus 3%, and the GST fee of $55 per month is waived unconditionally.

Facts about fees and costs:

- The minimum deposit is $100 AUD or equivalent – Forex Account (Standard and Raw)

- The minimum deposit for the IRESS account: Standard – $1,000 AUD or equivalent / Platinum – $25,000 AUD or equivalent / Premier – $50,000 AUD or equivalent

- No fees on commission

- The brokerage fee depends on what type of account

- “FP Markets” earns money through an additional spread and commission

How does FP Markets make money from you?

Like most reputable brokers, spreads or commissions are added to every trade (depending on the account type and trading instrument), meaning FP Markets earns a small amount for every trade you make. Additionally, there are overnight fees (also known as swap rates) for open positions. The amount is calculated based on various factors, such as order size, trading instrument, and other factors. On a positive note, we have to mention FP Markets is very transparent about these costs, and as a low-cost broker, the expenses are reasonable, considering the amount of support the broker provides.

Support and service of FP Markets

FP Markets gives its best to support and serve its clients. The company’s support and service operate 24 hours a day and seven days a week. You can reach their support through phone, email, and live chat. The support agents of the firm are very professional, helpful, and responsive.

FP Markets also offers callbacks. If you wish to be called back by a support agent of FP Markets, you need to fill up the form on their official website. This form will ask you for your personal details, like first and last name, email address, and phone number.

Also, FP Markets offers its traders free educational materials. This includes Trading Glossary that will help you understand trading terms, FAQ Section, Support Hub that tackles more about trading and analysis, Newsletter, and Free eBooks for trading.

In addition, the company offers several educational videos that you will surely find helpful. These videos include the introduction of the platform FP Markets is offering – the famous MetaTrader 4 (MT4). You can definitely get a glimpse of how to install it, navigate, use the market watch, trade terminal, and place different order types.

We recommend this broker due to its reliability and good support to its clients.

Facts about the support:

- 24/7 customer support

- Phone support (Offers as well as call-backs)

- Email support

- Live chat

- Trading Glossary

- Economic calendar

- FAQs

- Support hub

- Free educational materials

- Offers free video tutorials

- Free Trading eBooks

- Newsletter

I am still looking for my perfect broker – What are the best alternatives?

In this segment, we will take a closer look at potential alternative brokers before we conclude the article. Each broker has its strength and weakness, but it is crucial for you to find a provider which fits your needs and you feel comfortable with.

Capital.com

Capital.com is, in our opinion, one of the best brokers for beginners, thanks to a huge educational section, a beginner-friendly platform, and great dedicated support. The minimum trading amount on capital.com are slightly higher, but on the other hand, they have more than 3,000 assets to choose from. Learn more about capital.com and dedicated yourself to which broker is better for you.

RoboForex

If you are looking for an overwhelming selection of more than 12,000 assets and very lucrative leverage, look no further. RoboForex is a great alternative for you in this scenario, especially if you already have some trading knowledge. The company is headquartered in Belize, has more than 900,000 customers from around the world, and is definitely an alternative we can recommend. Read our full review here.

XTB

XTB is one of the leading brokers in the industry and is great for new traders and more experienced people alike. What we particularly like about XTB is their designated and award-winning support for each client. Also, the broker can score with very competitive spread fees and is one of the best choices if the security of your funds is a major concern for you.

Conclusion of the review: Is FP Markets legit? – We think: Yes

“FP Markets” proves its legitimacy in its reputation and credibility through its products and services. We can say that this broker is worth our trust and gives its best to support its clients to be successful in the trading industry. The firm offers markets to trade that include CFDs across forex, equities, indices, commodities, futures, and cryptocurrencies. It is regulated and authorized by ASIC and secures the funds of its clients by segregating customers’ funds in top-tier banks.

FP Markets offers assistance through the many choices a trader can have when trading with this company. There are several account types and great options of platforms to choose from that are being offered by this broker. It is regulated, and we can definitely say that FP Markets is not a scam. We can say that traders that choose FP Markets as their brokers have so many advantages to look forward to.

Advantages:

- The minimum deposit is only $100 AUD (or equivalent)

- Free demo account

- Markets include CFDs across forex, equities, indices, commodities, futures, and cryptocurrencies

- Regulated by ASIC

- Segregates customer’s funds in top-tier banks

- Offers transparent trading experience

- 24/7 customer support

- Offers free educational materials

- Hedging is allowed

- Competitive platforms (MT4, MT5, cTrader, IRESS)

- Ultra-low spreads from 0,0 pips

- Secure and reliable

From our experience, FP Markets is a reliable Forex Broker. The company offers transparent trading by ECN/DMA access. The conditions are perfect for beginners and advanced traders.

Trusted Broker Reviews

Professional traders since 2013See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty