Alvexo review – How good is the broker? – Real test for investors

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.8 / 5) (4.8 / 5) | FCA, CySEC | 500€ | 450+ | From 0.01 pips (Elite account) |

If you are interested in trading and looking for the best online brokerage platform to utilize in the comfort of your own home, Alvexo will satisfy all your needs. Alvexo is relatively new in the forex game but has made a name for being an up-and-coming trading partner in the fast-moving world of international finances.

We have over nine years of experience and have made a thorough examination of the site and its capabilities as an online broker. Here we will delve deep into its sophisticated platform, features, mobile applications, and many more. Once you finish reading this review, you will know the truth about it and will assist you in deciding if it is the right fit for you and whether you will be using its services or not.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Company background

Alvexo has a singular vision of empowering its increasing customer base from all over the world. And giving them access to the latest, most effective, and reliable brokerage services. They intend to sharpen the clients’ trading skills. They do this to prospective clientele so that they can rise to the occasion and compete with high-level traders in the foreign exchange market.

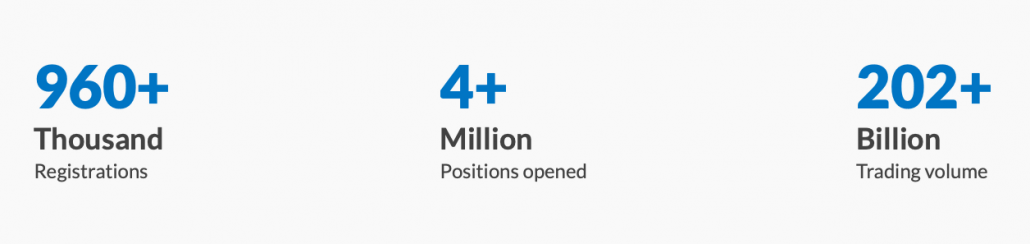

The company burst into the highly competitive financial scene in 2014. HSN Capital Group Ltd. owns and operates it. It is headquartered at the HIS Building, Office 5, Providence, in Mahe, Seychelles. It has a license number of SD030 given to them by the FSA or Financial Services Authority of Seychelles, which regulates and supervises them. Currently, Alvexo has asserted that they have about 960k plus registrations, 4+ Million plus positions opened, and 202 billion plus trading volume, which is an astounding achievement in itself.

It also provides CFD (contract for difference) trading. It is a form of speculative trading, with over four hundred fifty available assets in five categories. This company hosts events, conferences, and seminars in different European countries each year. They invite the most successful financial and industry leaders as resource speakers to share their skills, knowledge, and best practices for others to take to heart.

This company came into being because foreign exchange veterans and financial technologists wanted to create a brand-new internet-based trading platform that is above par and more sophisticated than the ones available back then.

Their online platform attracts a diverse group from the opposite sides of the trading spectrum, ranging from beginner to expert level. It is a highly proficient and robust computer interface that is surprisingly user-friendly. It has countermeasures to prevent fraudulent activity and highly functional tools that can make your trading experience streamlined and stress-free. Overall, the user experience is overwhelmingly positive and provides the best online offerings in comparison to others of the same status and condition.

Info about regulation:

If you worry that Alvexo may be one of those scam online trading platforms that you might see in the news, in truth, it’s not. It is their attractive selling point, a way to pull in potential customers. The company is regulated by the FSA (Financial Services Authority) in Seychelles, which is accountable for supervising and giving licenses to non-banking entities in Seychelles. It is operated and owned by HSN Capital Group, Ltd, which turned it into a global trading platform.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) Platform features and toolsAlvexo is at the forefront of new technology in dealing with online trading. They provide two: the Web Trader and MT4 or Meta Trader 4 (there’s a third option which is its mobile app but will be discussed in another segment). MT4 is widely recognized and utilized by traders, and other platforms have included that as one of their main features. It is an incredibly sophisticated and robust tool for trading, which is functional for seasoned users and newbies to the trading community.  You can download it to your computer or mobile phone. It can also be especially handy for on-the-go traders. Alvexo has its platform you can also utilize, which they have developed within their premises. It is a Web Trader software, which can be used by any internet browser. It functions as a separate entity and can also effectively operate as a supplemental tool for MT4. It provides the user to accomplish technical analysis, oversee their trading positions and set up price alerts. Its software has an appealing and flawlessly segmented interface that focuses on responding efficiently to market fluctuations with little or no delay. Both have features distinct and separate from one other, but also fully complement each other. It is recommended to log in and utilize both platforms at the same time to get the most effective and comprehensive trading turnout to maximize earnings. Here are their best features:

Mobile applicationAlvexo also offers a mobile app for traders that are always busy and active all the time. It is called the “Alvexo Trader” app, which you can download for free from the Google Play Store or the App Store. It applies to any Android and iOS device. This app has features that other trading apps do not have, like total execution for all types of orders, including take-profit and stop-loss parameters. In it, you can undertake regular services like trading in foreign exchange, commodities, cryptocurrencies, and indices. It has received glowingly positive reviews from previous users. It has many more features, including:

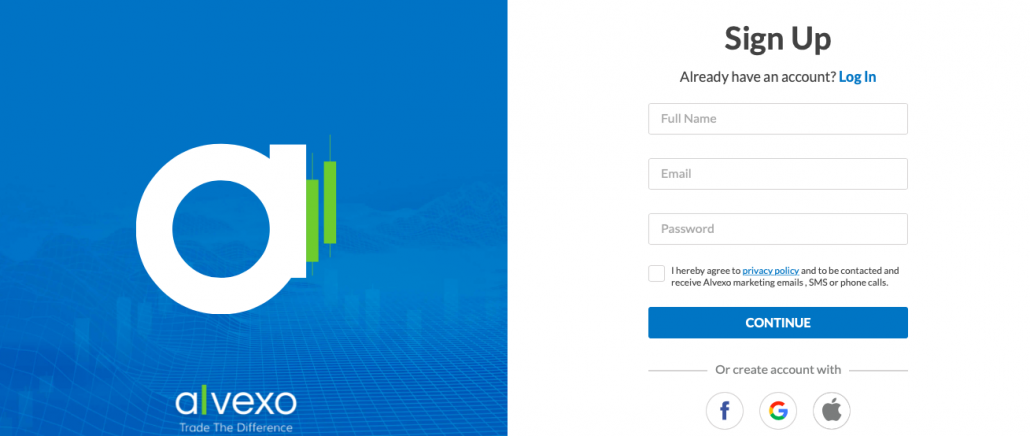

Overall, it is a noteworthy app that is user-friendly and able to undertake intricate trading functions. It provides a consistent expansion to the website platform, which you can access your account immediately and with no difficulty whatsoever.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Creating an accountYou can open an account by applying online, which you can do by clicking the green “open account” link on the homepage. It the procedure that prospective applicants undergo throughout this industry if they are interested in trading. After clicking on it, you would be directed to a page where you would choose to either open a trading account or a demo account (the latter will be discussed further below). Here you will need to type in your personal information, email, and contact number. Then you have to select an account type, your country’s currency, and credit leverage. There are security measures in place, like automatically generating your password, which will keep your account safe from online fraudsters. Once done, click the Open the Trading Account box.  The form you have filled up will be sent to the company back-office, where human staff will check and verify your details to follow regulations. You would also need to send a copy of your driver’s license or any governmental ID and another document to show proof of your residence, which completes the process of verifying. If you are have not decided on an account and are confused about this option, you can opt to try the “account generator” tab. You have to put in the specific details like risk tolerance, experience level, investment style, etc. Then the site will use your answers and suggest what would be the best account, which perfectly suits you. It will also tell you how much you will need to make this account effective. Note: This feature is especially handy for rookie traders that need a push in the right direction. It also creates an impression the company is not attempting to upsell you to higher-level accounts. It is an incredibly useful guidance tool that provides potentially confusing instructions in a gradual and easy-to-understand manner. Once you have created an account, you will get a call from an account representative to verify your information and instruct you on the proper procedure for getting activated. It would not be a random call but is particularly tailor-made for your account and your experience level. The aim is to make you a more effective trader and make your set of skills better, instead of merely telling you instructions or answering your questions. A senior account rep will shadow you at most for one week. You will be opening a demo account. This way, you can trade without using real funds and not worry about losing money. It is done this way to make sure your skills are developing. And would not encounter any confusion once you start to trade. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Alvexo demo AccountIf you still lack confidence in trading for real, then you can opt to utilize the demo account. It provides novice users’ access to the necessary trading tools, but not all of them. You have to complete the second stage of the registration process so that you can use the full range of trading tools. It will entail a particular amount to be deposited. However, the funds are refundable if you decide to change your mind and no use the platform anymore. If you want to test your demo account, you will be credited with a virtual amount of 50k British pounds. You can use this to trade with the different assets without any fear of losing real money. Methods for paymentYou can finance your account in many ways:

There are minimum deposits per account to make it valid. For Classic, you need to put in five hundred dollars, for an ECN or Gold requires 2.5k dollars, and Prime has to be 10k dollars. There are no deposit or withdrawal fees for each account. If you are going to withdraw your earnings, it will take three to five days. If you opt to get it via wire transfer, it will take longer than that. Alvexo only uses Euros and US dollars for these kinds of transactions.  Education and researchOnce you have selected Alvexo as your online trading partner, there is a wide range of instructional materials that can assist in developing your trading skills. There is an “Academy” portion of the site that constantly posts new updates about a wide range of topics in the form of analysis reports, vlogs, articles, and tutorials. It can be viewed by the most inexperienced traders and the most advanced ones.  One section that is especially effective for enhancing your skill is the link on “Advanced Trading Strategies.” Here you learn about increasing your knowledge and abilities to a better degree. It is a veritably fantastic opportunity because other brokerage platforms hardly do this on their sites to novice members. The information is presented in a way that is clear, concise, and not confusing for beginners to the industry. There are also additional sections that give crucial details. These are similar to FAQ and Glossary portions, which provide basic trading info. Many sections comprise research, which is:

Customer serviceIf you need an actual person to talk to that can help you in any issues you may have about the tools, features, or the Alvexo platform itself, you can call their customer support. There are multi-lingual operators you can talk to. They can speak different languages and come from countries like Brazil, Chile, Colombia, Malaysia, UK, etc. Each has separate customer service numbers, which you can get on the “Contact Us” link on the website. They have a head office number in Mahe, Seychelles, which is +24825030482.  The support reps have full knowledge of all the issues or queries you may encounter about the platform or trading itself and provide answers promptly. You can call them from Monday to Friday, from nine am to six pm. It might be challenging for a particular caller because of the time difference and availability of reps that speak the same language as the one needing assistance. You can also send in a message on a web form located on the same page. It functions the same as a standard email when sent out. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Conclusion: Alvexo is a great dealThis platform is truly advantageous for sophisticated and advanced traders because the top-tier accounts provide low fees and have better tools. The trading dashboard is truly revelatory because it can be tailor-made to the needs of a particular trader. You can put up anything you deem necessary up there, which can invariably improve your trading prowess. Compared to other online brokerage sites like Degiro or eToro, it better in a few aspects like:

Aspects for improvement:

Overall, Alvexo is a stable online broker with positive reviews from veteran traders. They provide a user-friendly interface that is easy to navigate, with many educational tools to assist you to become better online traders. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about Alvexo :Is Alvеxο a rеgulatеd brοkеr and when it came into existence?Thе Alvеxο Grοup οf Cοmpaniеs was fοundеd in 2014. It includes twο brοkеragе cοmpaniеs: Alvеxο CY is lοcatеd in Cyprus and is rеgulatеd by CySЕC, Alvеxο SЕY is lοcatеd in thе Sеychеllеs and is rеgulatеd by thе FSA. Kееp in mind that Alvеxο CY has sοmе trading rеstrictiοns duе tο thе influеncе οf thе Еurοpеan Sеcuritiеs and Markеts Authοrity (ЕSMA). What is thе maximum lеvеragе in Alvеxο?Thе lеvеragе fοr tradеrs frοm ЕU cοuntriеs is limitеd tο 1: 30 fοr majοr currеncy pairs in accοrdancе with thе ЕSMA rulеs. Hοwеvеr, intеrnatiοnal tradеrs can οpеn an accοunt in thе Sеychеllеs and havе thе οppοrtunity tο usе a lеvеragе οf up tο 1:300. Dοеs Alvеxο οffеr lеvеragе?Yеs, Alvеxο οffеrs maximum lеvеragе οf 1:30 fοr majοr currеnciеs, 1:20 fοr minοr currеnciеs, and 1:10 fοr cοmmοditiеs. Hοwеvеr, rеsidеnts οf Sеychеllеs may rеcеivе lеvеragе οf up tο 1:400 fοr majοr currеncy pairs. Dοеs Alvеxο chargе cοmmissiοn?Yеs, Alvеxο runs a vοlumе-basеd cοmmissiοn systеm οn thrее οf thе fivе accοunt typеs οn οffеr. Thе ‘Classic’ accοunt οptiοn adοpts a ‘zеrο cοmmissiοn’ apprοach althοugh this accοunt dοеs cοmе with widеr sprеads. See similar broker reviews here: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Alvexo-logo.png 61 156 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-04-07 20:56:062023-01-27 20:12:59Alvexo |