The 5 best CFD trading accounts in comparison

Many people today are becoming more aware of financial matters. You are no doubt one of them. CFD trading is one of many possibilities to make an income online. It doesn’t matter if your goal is to supplement your income with some extra cash or if you plan to fully replace your regular job. CFD trading won’t make you rich overnight, but if you are dedicated, I can tell you from my own experience that it is possible.

Before you start your trading journey, you will need a reliable CFD trading account. In this article, I will reveal my favorite CFD trading accounts and what factors you should consider before signing up with a broker. So before you jump in on trading and creating that CFD trading account, let’s take a look at the top five CFD trading accounts currently in the market.

See the list of the 5 best CFD trading accounts:

CFD Broker: | Review: | CFD trading available: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. XTB | Yes | Starting 0.1 pips | 3,000+ | + More than 3,000 different markets + Very good trading conditions + Direct market access + Bonus Program | Free demo account(Risk warning: 76% of retail CFD accounts lose money) | |

2. Markets.com | Yes | Starting 0.6 pips | 250+ | + Accepts international traders + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: 67% of retail CFD accounts lose money) | |

3 eToro  | Yes | Starting 0.0 Pips | 3,000+ | + A regulated and safe company + Social and copy trading + Innovative and user-friendly platform + Professional support + Minimum deposit from $ 50 | Free demo account61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. **Please note that instruments restrictions may apply according to region | |

4. Vantage Markets | Yes | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: Your capital can be at risk) | |

5. RoboForex | Yes | Starting 0.0 pips | 12,000+ | + High leverage is possible (1:2000) + Start with a small amount of money + Bonus Programm + Low spreads and commission + Professional Support | Free demo account(Risk warning: Your capital might be at risk) |

What is a CFD account?

A contract for differences (CFD) is a financial contract that pays the differences in the settlement price between the open and closing trades. A CFD trading account is a necessity every broker needs in order to access the market as a non-institutional trader.

There are hundreds of brokers you can sign up with and create your CFD trading account, but I highly recommend sticking with a broker company with a good reputation, multiple regulations, and a proven history on the market. Especially as a novice trader, you might find it difficult to differentiate reputable companies from scam offers.

If you are in a hurry, you will find a list of my top CFD trading accounts, which I personally tested and recommend. I will give you more details for each broker, as well as some advantages and disadvantages further below in this article.

See the list of the 5 best brokers that offer CFD trading accounts:

- XTB – Very good trading conditions

- Markets.com – Over 8,200 markets to trade

- eToro – Leverage up to 1:30 for European traders

- Vantage Markets – Reliable support and service

- RoboForex – High leverage is possible (1:2000)

How I tested CFD accounts

Unfortunately, not every article you will find online is written by true trading experts with personal trading experience. As a result, some advice you will read is outdated or just plain false. I started my trading career ten years ago, and it became my main source of income over the past years, therefore I know exactly what a good CFD account should offer.

I can assure you that I personally tested each and every CFD trading account on this list with my own money, and I still use many of the brokers I will introduce to you. At the same time, I am always on the look for new software and tools, to provide you with the most recent information. I listed a couple of the requirements I look for whenever I review a new CFD account below.

Regulation of the broker

The security of your funds is key with any broker and I highly recommend verifying that the company in question holds a valid license from a top regulation authority before you open a CFD account. You can largely avoid falling from scams and stand much better chances should you ever need to pursue legal action against any company by doing so. In short, reputable, regulated brokers are more safe and customer-friendly as they risk losing their license if they disregard your rights. There is no unregulated broker on this list as a matter of fact, but you can always verify if that information is still accurate.

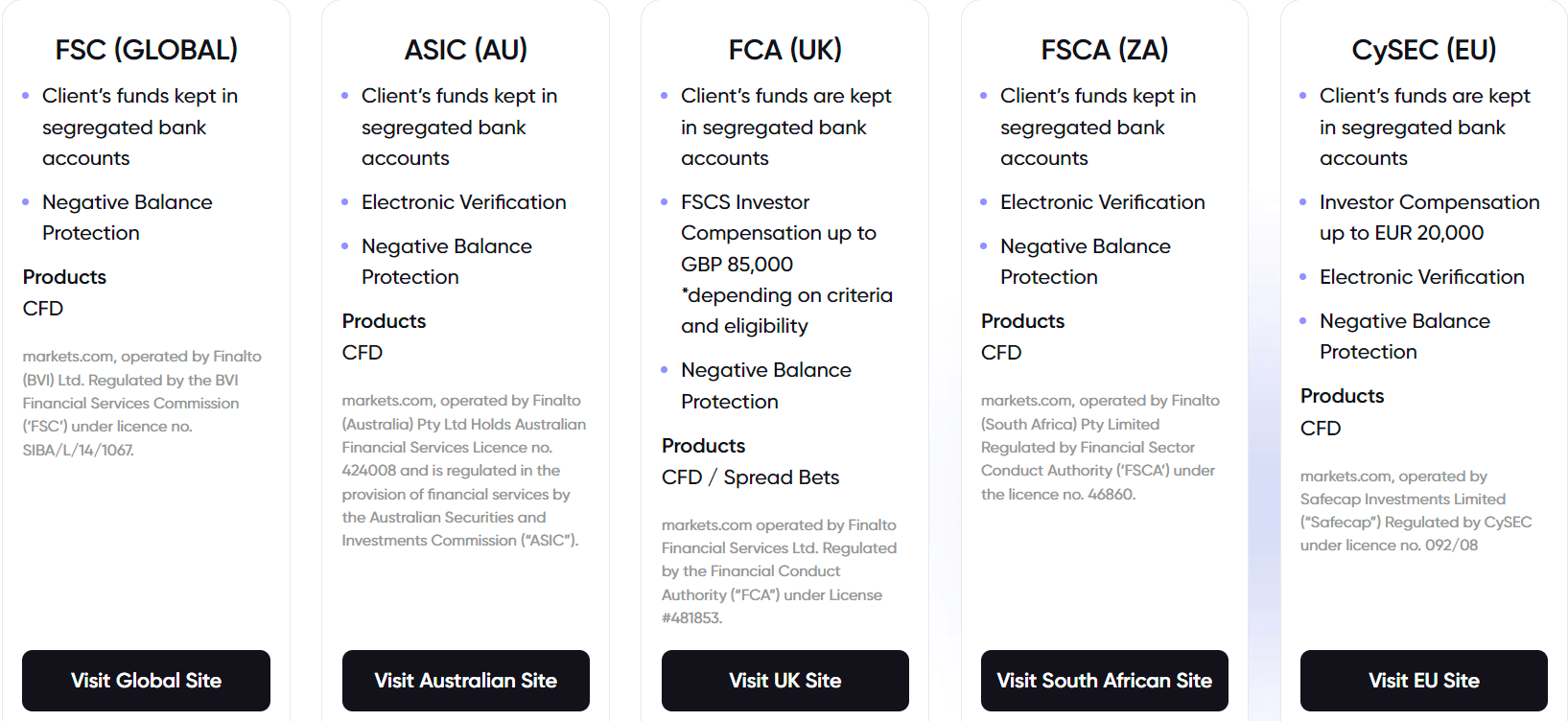

A broker can also have regulations from multiple different regulators, as you can see in the example above, and some brokers will even let you choose under which regulation you would like to open your CFD trading account. Your choice is especially important, as the maximum leverage limit can be different, but each regulator has different requirements to maintain their licenses.

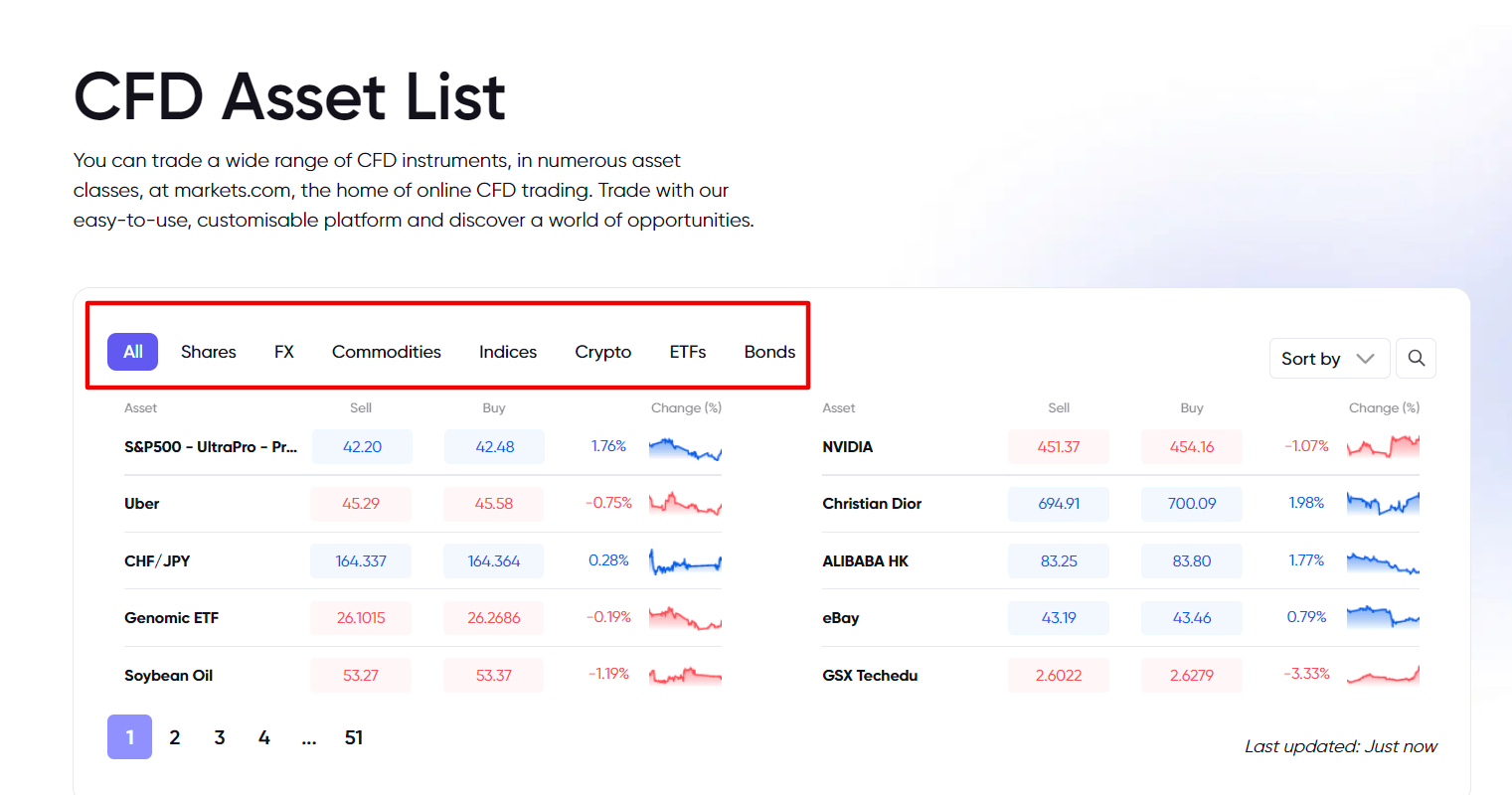

Number of tradable assets via CFD account

Forex and commodities are particularly popular products among CFD traders, but the beauty of CFD trading is the wide range of assets. There are almost no limitations but some brokers and account types offer a greater selection of assets to choose from than others. The size of the broker company is one of the most critical factors, regarding the number of tradable assets in my experience. Large trading companies tend to offer 2,000+ assets among the various categories, while smaller companies often especially in one particular category, such as currencies, stocks, cryptocurrencies, or commodities.

You will have to decide for yourself, which assets you plan to trade and do some research to find the best CFD account fitting all your needs, but in my experience, if you are just starting out it is unlikely that you will trade highly exotic markets anyway.

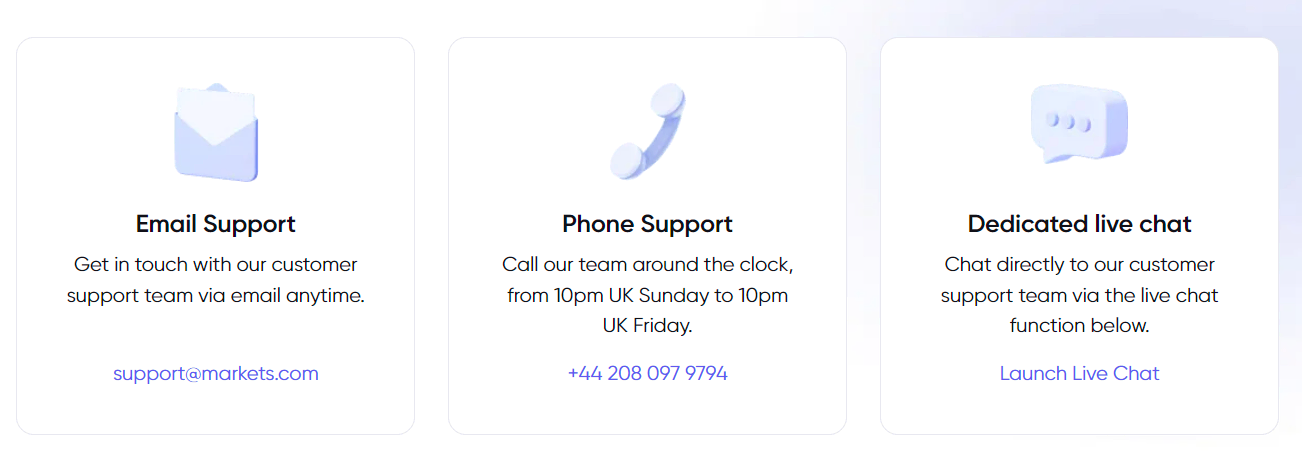

Availability of customer support

This is a critical factor should you ever get stuck with anything. There are differences regarding the channels brokers provide assistance to their clients. Many brokers offer client support via phone or live chat, but others (especially companies with low fees) might require you to contact them via E-mail or contact form. The last option tends to result in longer waiting times for a response, but speed isn’t the only factor when it comes to customer support. The knowledge of the support staff and in how many languages the customer support is offered is also something I test in my reviews. To sum it up, 24/5 Support is pretty much the industry standard, but the best-in-class brokers offer support around the clock on multiple channels and in more than ten languages.

Usability of trading account

I test the usability of the trading account myself and try to put myself in the shoes of a trading beginner. For example, all my tests include how many clicks it takes, to open or close a position for example, how easy it is to navigate, if the platform is optimized for mobile trading and offers a dedicated app, and much more.

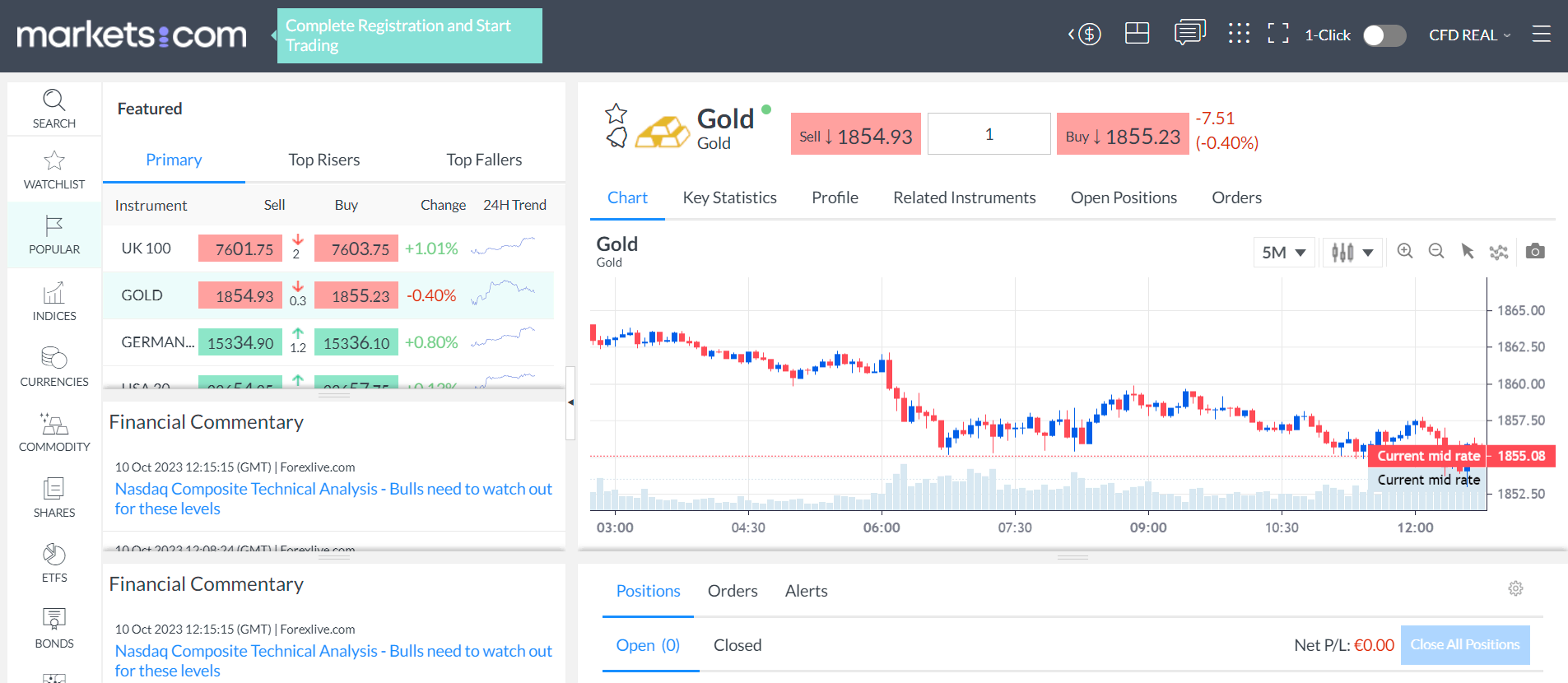

Whether or not the broker supports interaction with external trading software such as MetaTrader is also part of my investigation. And finally, I pay special attention to their in-house trading platform, and the indicators and analysis tools on it. Why? Because the functionalities on MetaTrader are the same as any broker, but with their own platforms, they can truly set themselves apart from the competitors.

Fee structure of CFD trading accounts

On many trading platforms, you can sign up for a spread-based account or a commission-based account. The main difference is that the broker will add a variable spread depending on the asset type, market condition, and other factors, or you pay a fixed commission per lot. Which model is cheaper depends on your trading strategy, mainly how many positions you open, but I recommend looking for providers that offer both options and will therefore always check the conditions in my reviews.

Besides the structure, the amount of the commissions and fees is just as important. Because spread fees are variable they are a little harder to compare, but a standard commission per spread is between $7-15 per lot. Because the fee structure has a direct impact on your profitability I highly recommend comparing multiple options.

Introduction of the top five CFD trading accounts

Now, that you know what to look for to make an informed decision, let’s take a look at the top five trading accounts and the respective brokers.

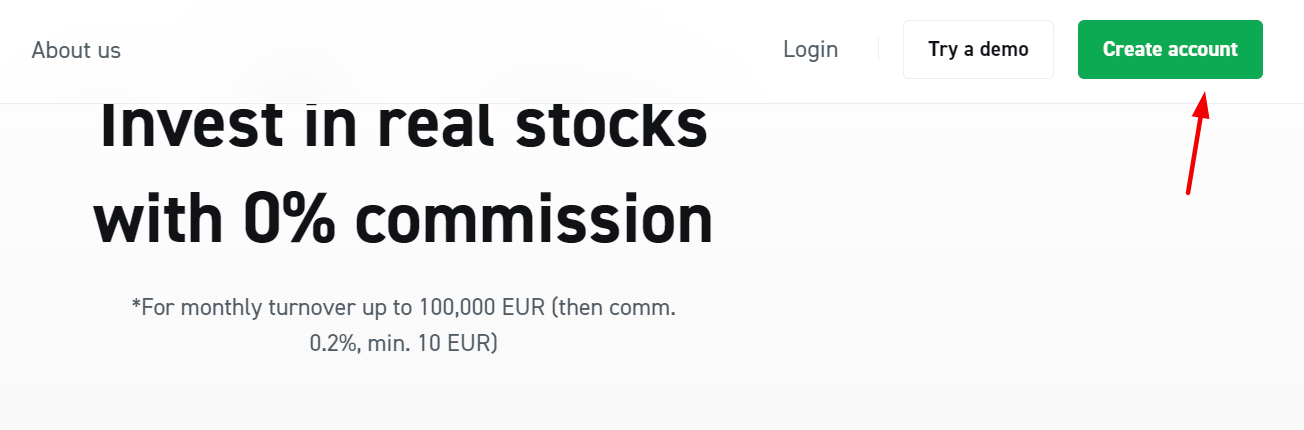

1. XTB – Very good trading conditions

The fact, that XTB is number one on my list is no coincidence. XTB is one of the largest brokers today with a particular strength in CFDs. They started in 2004 in Poland and now have almost 300,000 clients worldwide. They trade more than 5,500 trading instruments and offer excellent trading conditions for CFD traders.

Your investments are safe with XTB since they get regulated in different countries by the authorities. This includes the Financial Conduct Authority, Komisja Nadzoru Finansowego of Poland, and the Cyprus Securities and Exchange Commission. Also, they are watched by the Dubai Financial Services Authority, Belize International Financial Services Commission, and the Comision Nacional del Mercado de Valores of Spain.

One unique advantage of XTB is its simple and easy-to-use trading platform called xStation 5. The design received awards and boasts fast access to various trading assets. You can access it in three ways: the web, mobile app, or desktop app. You can use any of these browsers: Chrome, Opera, Firefox, and Safari. Or use the desktop app for Windows or Mac users. Or use your phone through the app. You can get it free from the App Store or the Google Play store.

If you encounter problems, XTB supports clients on a 24/5 basis via chat, E-Mail, or phone. You can find the chat support feature on the webpage, mobile app, or desktop app. Drop them a note in your language and get answers in real-time. They offer chat services in major language groups, including English, French, Russian, German, Arabic, Thai, Vietnamese, and others.

CFD trading accounts on XTB

It is no coincidence, that I mention XTB first on this list. In my opinion, they are the clear winner and offer the best CFD trading accounts overall. The company has a strong focus on customer satisfaction and offers attractive trading conditions for novice traders and more experienced people alike. In addition, they are the only broker offering you access to the award-winning Station5 platform. The selection of assets is another reason why XTB is my preferred option.

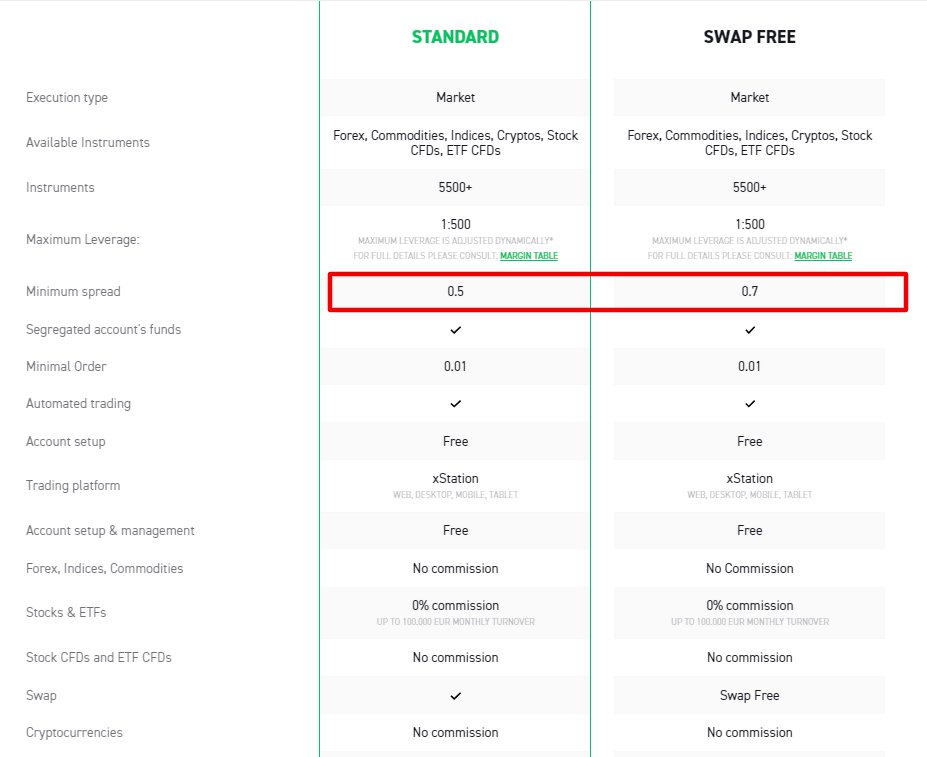

XTB offers you the choice of a standard or a swap-free account. Unfortunately, no commission-based account types are offered, both options are spread-based but start with very low spreads from only 0.5 pips. The swap-free account is designed for Muslim clients, as no overnight swap is allowed for religious reasons. To make up for the missing swap fees, the minimum spread is slightly higher on the swap-free account, starting at 0.7 pips. Apart from that, the conditions for both account types are almost similar with access to 5,500 tradable assets, maximum leverage of 1:500, and minimum order size of 0,01 lots.

advantages of xtb accounts | disadvantages of xtb accounts |

|---|---|

✔ Access to over 5,500 assets globally | ✘ No commision-based account types |

✔ XTB is regulated by top regulators in the world | |

✔ Top-notch training and market analysis resources are provided | |

✔ The Station 5 trading platform works on the web, desktop, and mobile | |

✔ XTB is specialized for CFD trading and has among the best trading conditions | |

✔ Great transparency regarding cost structure and spreads | |

✔ The company offers direct market access to all clients |

(Risk warning: 76% of retail CFD accounts lose money)

2. Markets.com – Over 8,200 markets to trade

Markets.com is an award-winning CFD and FX broker. It bagged the Best Trading Platform recognition for 2020. The company started in 2008 under the wings of the famous firm Finalto (BVI) Limited and the bigger company Playtech. The latter is famous for developing tech in gambling and financial trading.

Your money invested through Markets.com is protected by the FSC or Financial Services Commission. This company adheres to strict standards of regulation wherever its offices are in the world, including CySEC in Europe, FCA in the UK, and ASIC in Australia.

Markets.com offers many financial instruments. You can choose from 67 major and minor currency pairs. Or participate in the trading of the shares of almost 2,000 blue-chip companies on the earth. Also, you can opt to trade in 28 different commodities and 40 indices of stocks.

One of my favorite things about markets.com is its in-house trading platform. It is accessible through web browsers of standard PCs and laptops. It has a lot of features to get you started on market trading. You can get trader insights and advice from experts in the trading world. All the programs and tools are inside the system, so accessing them is as easy as 1-2-3.

You will be able to tell how people feel about the assets and movements in the system. You can also access MarketsX using the mobile phone app. This will allow you to trade assets wherever you are and at whatever timezone you are. Downloading the app is accessible through the Apple or Google Play stores.

There is also a great customer service team ready to assist. You have the option to contact them 24 hours a day and 5 days per week and get the answer to your trading problems. You can find them through the “contact us” section on the webpage or the mobile app. You can also choose to call them (for UK customers) or chat with the agent live. There is also a huge knowledge database in English, Arabic, and Spanish. This is where you get satisfying answers to common questions from clients all over the world.

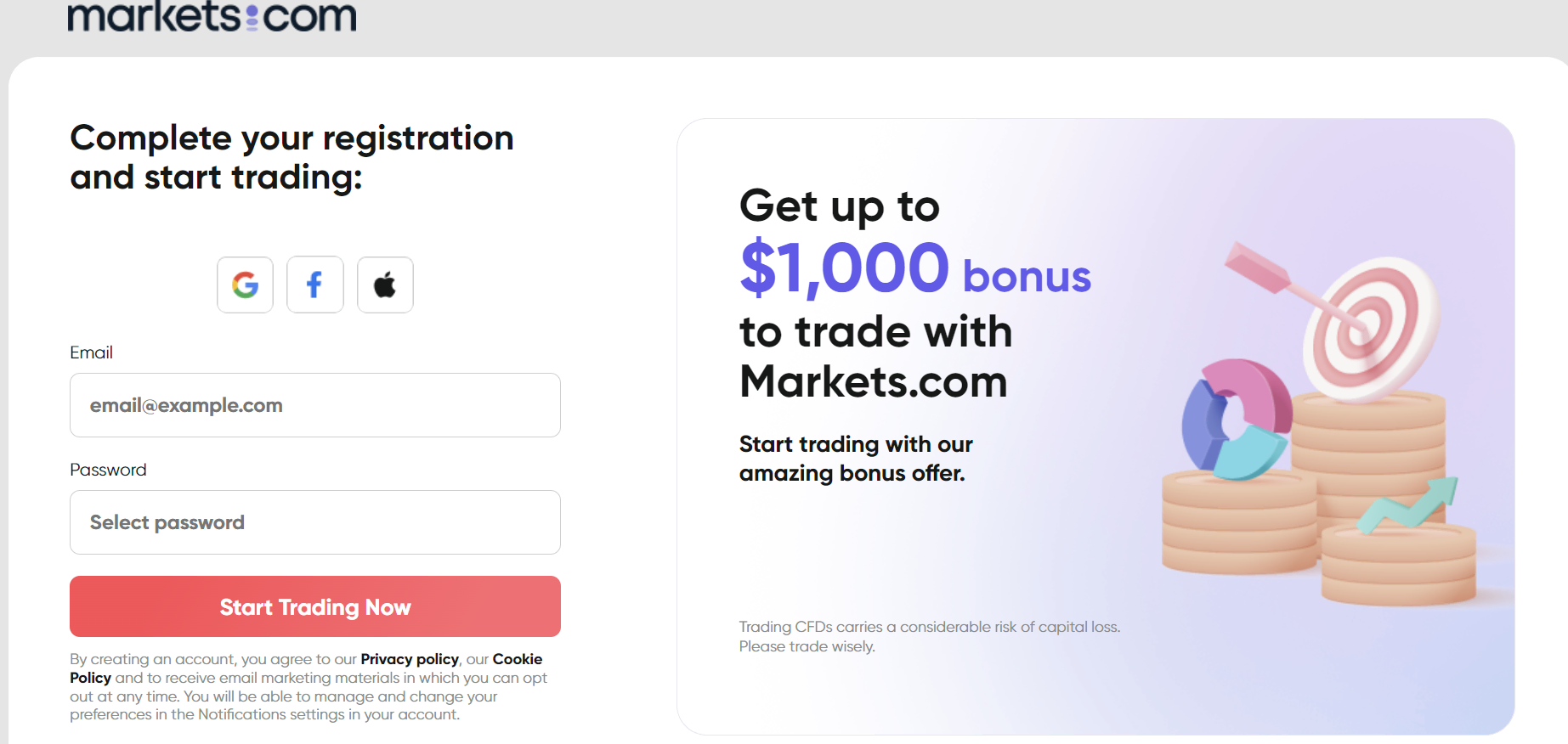

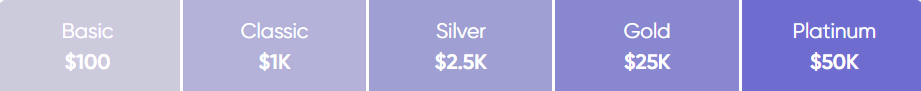

CFD trading accounts on markets.com

CFD trading account opening is easy with Markets.com. You can create a test account and start trading various instruments. You will cut the risk of losing money with this demo account. Once you are ready to open a real-live account, the minimum deposit is only $100. You can use Skrill, Neteller, or PayPal. Visa, Mastercard, and bank transfers are also accepted so that you can get started with CFD trading.

Markets.com offers only one spread-based account type with different account levels. Just as with XTB, there are no commission-based accounts with this broker. Depending on the account level and the deposit amount, you will benefit from different advantages such as priority handling of withdrawal requests, personalized customer support, and other things.

Personally, I would recommend markets.com trading accounts, especially for trading novices because the trading software is easier to understand than trading tools such as MetaTrader for example, but it still gives you access to ä sufficient number of analysis tools and indicators.

Advantages of markets.com accounts | Disadvantages of markets.com accounts |

|---|---|

✔ Among the most beginner-friendly trading platforms that work on the web and mobile app | ✘ No RAW spread accounts are available |

✔ High security due to regulations in all the markets they operate in | ✘ Account opening is a bit confusing, as it isn’t very clear if you open a live account or a demo account |

✔ Diverse payment methods to choose from | |

✔ Great for forex traders, the platform offers 67 currency pairs | |

✔Multiple channel support is available 24/5 | |

✔ Easy access to some of the best educational resources on the market | |

✔ Full integration of the MarketsX trading platform across devices | |

✔ One-click trading option available for all account levels |

(Risk warning: 67% of retail CFD accounts lose money)

3. Etoro – Leverage up to 1:30 for European traders

**Please note that instruments restrictions may apply according to region

Etoro is the number one trading platform today, with more than 10 million traders and investors from 140 countries in the world. They are very popular even with non-traders because they are active on Facebook, Twitter, Linked In, and other social media channels.

Rest assured that your investments are safe with Etoro since they are regulated by several authorities. It includes the Financial Crimes Enforcement Network (FinCEN) in the US. In the UK, the Financial Conduct Authority (FCA) regulates Etoro. In Australia, the company is controlled by the Australian Securities and Investments Commission (ASIC). And in Europe by the Cyprus Securities and Exchange Commission (CySec).

You don’t have to worry if you are new to trading with Etoro’s trading platform. It is not complex and is very receptive. You can buy and sell over 2,000 financial assets like commodities, currency pairs, ETFs, and indices. You will notice that top-tier companies such as Apple, Tesla, Alphabet (Google), Facebook, and Amazon are in their roster of trading partners.

If you plan to start out with stock CFDs or copy trading, you should definitely sign up with eToro. The company is way ahead of its competitors in those two niches in my experience. Additionally, eToro offers a leverage of up to 1:30 for European traders.

CFD trading accounts on eToro

The Etoro’s trading platform is a gem, as it has everything you need to get started with trading. You can use it on your favorite web browser or straight from your mobile device. Changing devices is hassle-free, so never fear when you need to go out of your home or office. You can access it from your mobile phone, tablet, or laptop through the app. Get it for free from the AppStore or the Google Play store.

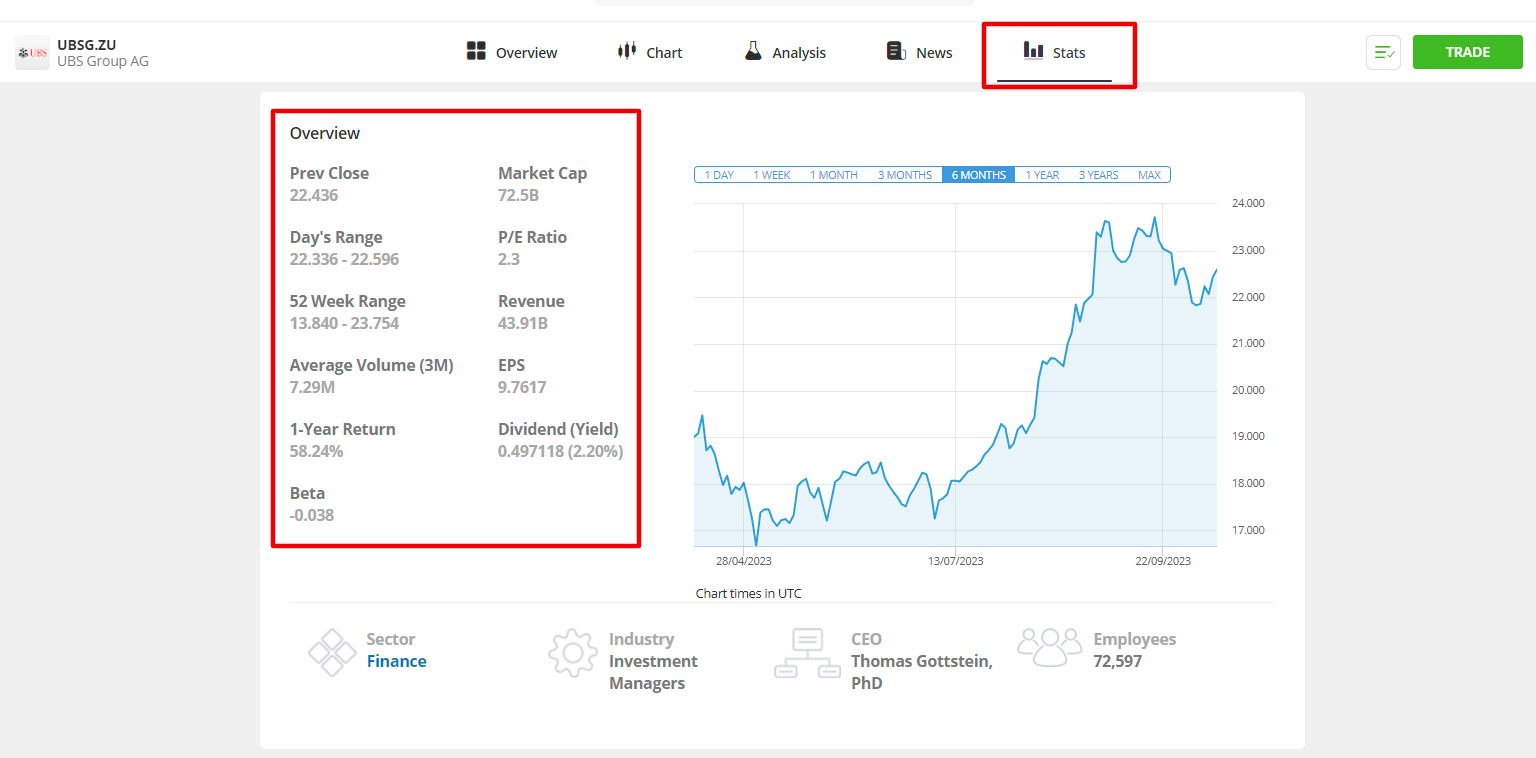

eToro offers no integration with other trading platforms, but the web trader is very beginner-friendly. Once you choose the asset you would like to trade gathering the relevant information you need to make your trading decisions is a walk in the park. For instance, if you click in the stats section, eToro will give you background information for each asset in one click, just as in the sample with the UBS stock below.

In terms of trading accounts, eToro offers you four types of trading accounts:

- Personal retail account: With this account, you can trade all the assets the company offers, copy other traders, and invest in Smart Portfolios. The level of leverage you can use is limited to 1:30 for European clients, but account holders have the highest level of consumer protection.

- Professional account: This account type is only available if you meet certain criteria, you must have a proven track record of experience with CFD trading. If you qualify, you will benefit from higher leverage than on the retail account.

- Corporate account: Corporate accounts are for legal entities only. It allows you to trade with capital, that belongs to your business.

- Islamic account: Just like most other broker companies, eToro offers a specific account type with no swap fees for Muslim clients.

There are no commission-based account types available on eToro, but the company is very transparent about its costs. I really like the fact that eToro charges no management fees and 0% commissions on stocks. Aside from that, the costs and spreads tend to be slightly higher than with some other brokers, but the other benefits make up for it in my mind, so opening a CFD trading account with eToro is still a very good choice.

advantages of etoro trading account | disadvantages of etoro trading account |

|---|---|

✔ Trading accounts offer a good selection of payment and withdrawal methods | ✘ Trading accounts lack integration with external trading software |

✔ The processing speed for withdrawal requests is very good | ✘ Spreads on the default account tend to be slightly higher than usual |

✔ eToro has one of the best trading apps | |

✔ The company is established and has over 10 million clients based in 140 countries | |

✔ Unique CopyTrader feature which helps new traders succeed | |

✔ Certified by the most reputable regulators | |

✔ Excellent rating on Trustpilot with more than 19,000 reviews | |

✔ Account insurance for up to $1,000,000 included |

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

4. Vantage Markets – Reliable support and service

Vantage Markets is a well-known company from Australia that also serves international customers. The company has existed since 2009 and knows exactly how to respond to the wishes of its customers. The broker is mainly based in Level 29, 31 Market Street, Sydney NSW 2000, Australia, and accepts traders from almost every country. But they also got business addresses in the Cayman Islands and Vanuatu.

Overall, Vantage Markets offers a very high level of security. The broker is regulated by the Australian regulator ASIC, the Cayman Islands Monetary Authority CIMA, and is audited by KPMG (auditing firm).

Every quarter, the security and administration of client funds are reviewed, and corresponding financial reports are published. For Vantage Markets, the safety of client funds is essential. Therefore, there is also additional protection by liability insurance of 20 million USD.

Vantage Markets has more than 180 different tradable assets. These include forex (currencies), indices (Dax, SP500, etc.), commodities, precious metals, energies, and cryptocurrencies. The selection here is extensive, and every trader should find his matching asset to trade. The broker is constantly striving to expand the offer and to implement new markets.

CFD trading accounts on Vantage Markets

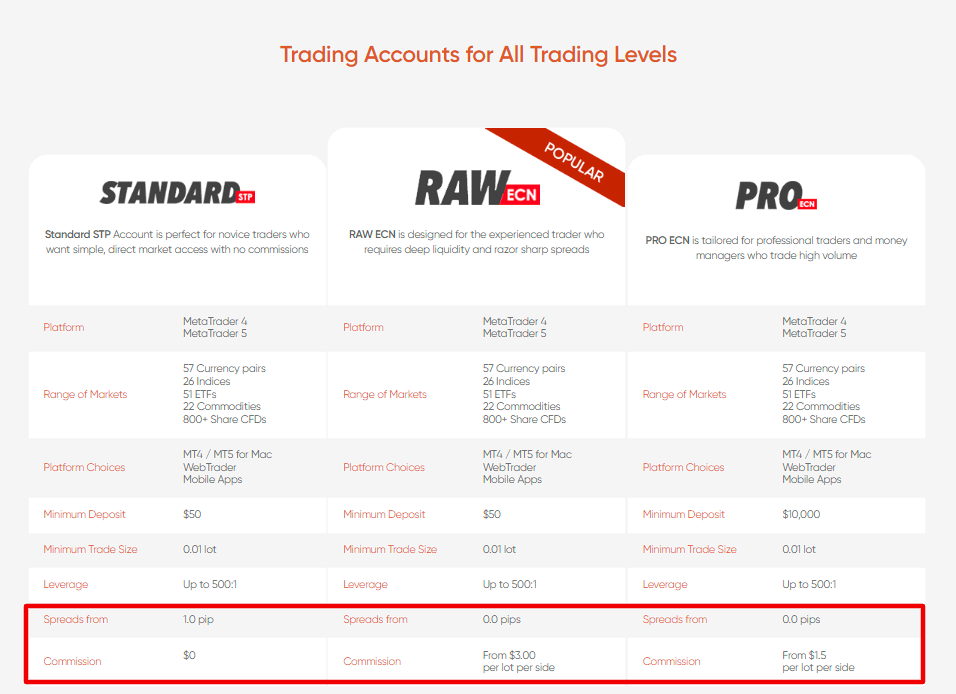

Vantage Markets offers three different account models (STP, RAW ECN, and PRO ECN). The leverage can be up to 1:500 high for all accounts, and the spreads start depending on the account model from 1.4 pips or 0.0 pips. The commission per trade from 1 lot is either $ 3 or $ 2 high. Therefore, Vantage Markets is among the cheapest forex brokers.

As you can see, Vantage Markets is the first broker, that offers spread-based and commission-based account types. I would generally recommend Raw ECN accounts with no spreads to more experienced traders. However, if your trading strategy involves a lot of trades (with a scalping trading strategy for example) you might be better off, with such an account to begin with.

advantages of vantage markets cfd trading account | disadvantages of vantage markets cfd trading account |

|---|---|

✔ Offers a selection of spread-based and commission-based account types | ✘ Customer support is available in English only |

✔ Outstanding trading conditions for forex trading | ✘ The withdrawal process took several days in my test |

✔ The friendly customer support is knowledgeable and quick | |

✔ Vantage Markets is a broker with generally low trading fees | |

✔ You can connect your trading account to MetaTrader 4/5 | |

✔ Transparent fee structure and no hidden fees | |

✔ Many settings in an account are adjustable to own preferences | |

✔ Leverage of up to 1:500, which is one of the highest in the industry |

5. RoboForex – High leverage is possible (1:2000)

RoboForex is a world-renowned trading company with almost one million clients in 169 territories. You can trade with greater confidence here since the company won several industry awards, including Most Trusted Broker in 2020. Sports fans will be happy that it supports athletes such as Starikovich-Heskes at the Dakar Race 2017 and Muay Thai fighter Andrei Kulebin.

You can be sure that RoboForex is legitimate since it is regulated by the International Financial Services Commission. The Company is also part of the Financial Commission, which resolves disputes and awards claims relating to brokerage.

As a client of RoboForex, you can choose from seven financial assets: Forex, stocks, indices, ETFs, soft commodities, energies, and metals. This company trades in more assets than other brokers giving their clients more flexibility. For Forex traders, you can select from the 40 currency pairings available. Trading is also done at blazing speeds, with one transaction happening as fast as a fraction of a second.

For people interested in stocks, RoboForex has over 12,000 assets, including Siemens, Amazon, and Facebook. You can also choose from the more than 1,000 ETFs, metal and energy, or soft commodities like coffee, wheat, or sugar. Their 24/7 live support in 11 languages, including Thai, Ukrainian, Taiwanese, Vietnamese, and Malay is another great reason to give the company a try.

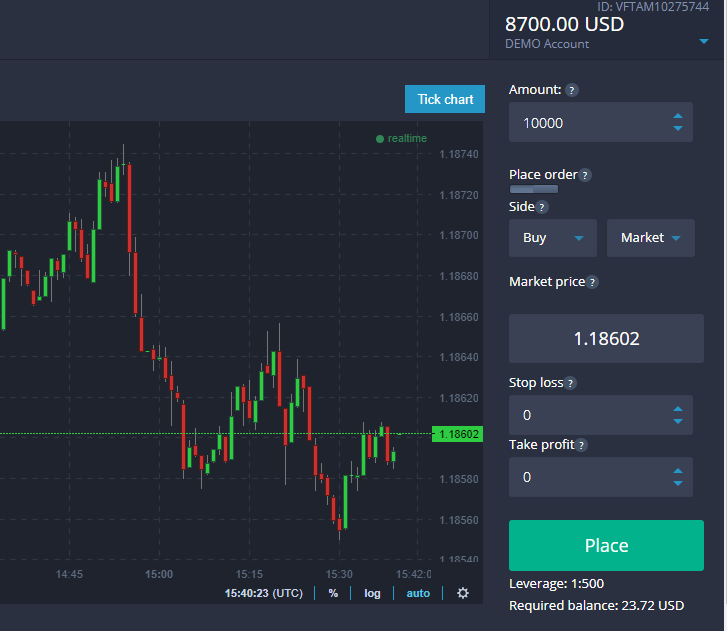

With RoboForex, you have added flexibility to choose the trading platform that is best for you. Select MetaTrader 4 and 5 if you want to enjoy the same features used by millions of traders today. Both have web-based and mobile app versions. If you are an experienced Forex trader, the cTrader is your best choice. You can also choose RTrader if you are a web browser user or RWebTrader if you have an MT4 account. You can access these through the app or the web browser.

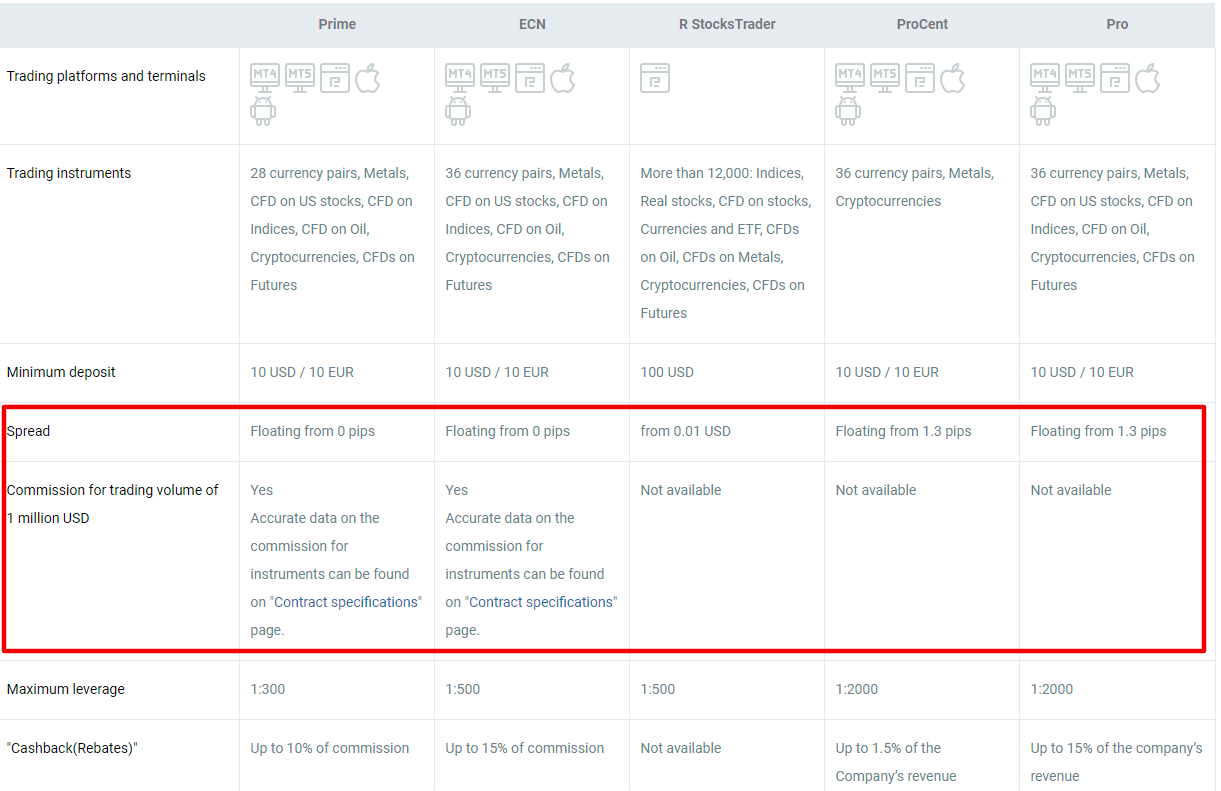

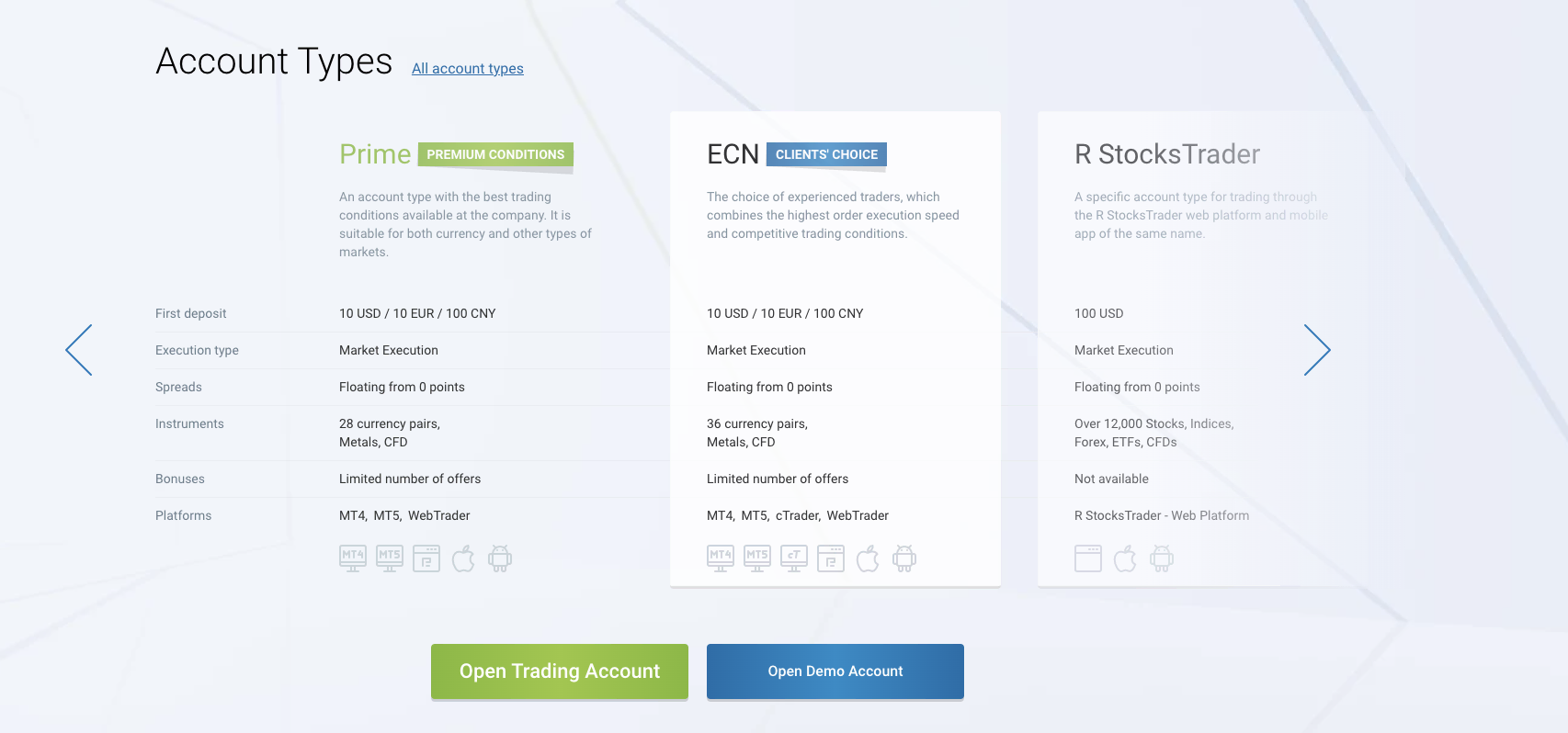

CFD trading accounts on RoboForex

To start trading with RoboForex, register in the member’s area. Choose from various different account types based on your experience in trading. Pro and ProCent are the most preferred, and you only need USD 10 to get started. If you are an experienced trader, I recommend the RTrader account with a $100 initial deposit. Funding comes easy by using bank transfers, e-payments, credit cards, and cash vouchers.

advantages of roboforex cfd accounts | disadvantages of roboforex cfd accounts |

|---|---|

✔ RoboForex has an award-winning trading platform and a very good reputation in the industry | ✘ Relatively high swap fees compared to other brokers |

✔ The broker offers the highest leverage, up to 1:2000 is possible | ✘ The withdrawal process may take up to 10 days, depending on the withdrawal method |

✔ An overwhelming selection of 12,000+ tradable assets is available | |

✔ Great selection of different account types for every need | |

✔ Live customer support is available 24/7 | |

✔ Integration with MetaTrader is included with all account types | |

✔ Minimum deposit is only $10 for most account types | |

✔ The company is an active member of the Trade Commission |

(Risk warning: Your capital can be at risk)

What is CFD trading?

A contract for differences (CFD) is a financial contract that pays the differences in the settlement price between the open and closing trades. A CFD trading account is a specialized type of brokerage account that allows account holders to trade contracts for difference (CFDs) online using their broker’s trading platform.

CFDs are nothing else than a type of leveraged trading in which you as a trader may control a large position with a very little capital outlay. If your broker provides you with a leverage ratio of 1:10, you may trade a $10,000 position with only $1,000.

You may trade a broad variety of assets including stocks, commodities, and currencies using CFD trading, increasing your portfolio’s diversification. By trading CFDs, you don’t have to worry about the fees and dangers connected with actually owning the underlying asset. You as a trader can participate in cross-border market and asset trading using CFDs.

Risks of a CFD trader account

CFD trading has several advantages, but it also has some disadvantages, such as the fact that it is risky because of the use of leverage. If the deal doesn’t go your way, you might potentially lose more money than you initially put in (if you are not covered by a negative balance protection). However, nowadays this protection is very common and most brokers offer it to their clients. If you are a beginner, I definitely recommend looking out for it. Still, even with that risk eliminated it is very easy to lose your entire account balance in a matter of minutes without proper risk management. As an additional risk, overnight costs might eat into your profits if you hold a CFD transaction overnight. But, if you can accurately anticipate market shifts, then you will have a fantastic potential to profit.

As you can see CFD trading isn’t for everyone and I always recommend evaluating if you understand how CFDs work and if you can take the risk of losing your money, which is not an uncommon outcome, especially for new traders. Not investing more money than you can afford to lose worst case is a critical ground rule I always recommend following.

CFD trading account types explained

Most brokers offer their clients access to the most popular type of CFD account: the basic account. Leverage often ranges from 1:50 to 1:500 and here, you can choose from a few assets with average spreads. Both novice and experienced traders can benefit from the simple interface of the basic account.

More experienced traders who want greater leverage and access to premium trading tools and features often like to open a Premium CFD account, which is offered by many brokers. Leverage of up to 1:500 or 1:1000+ is available here for those who wish to place these types of trades. These premium account types also often give you access to even tighter spreads. Some brokers even offer their clients the option of opening a premium account with higher leverage and lower margin.

(Risk warning: Your capital can be at risk)

How to sign up for a CFD account?

Now I am going to show you step-by-step how you can sign up with a CFD account with the XTB as an example. The entire process is very straightforward and should only take a couple of minutes. The steps are the same with most brokers, only the order and the design of the platform are slightly different.

1) Choose account type

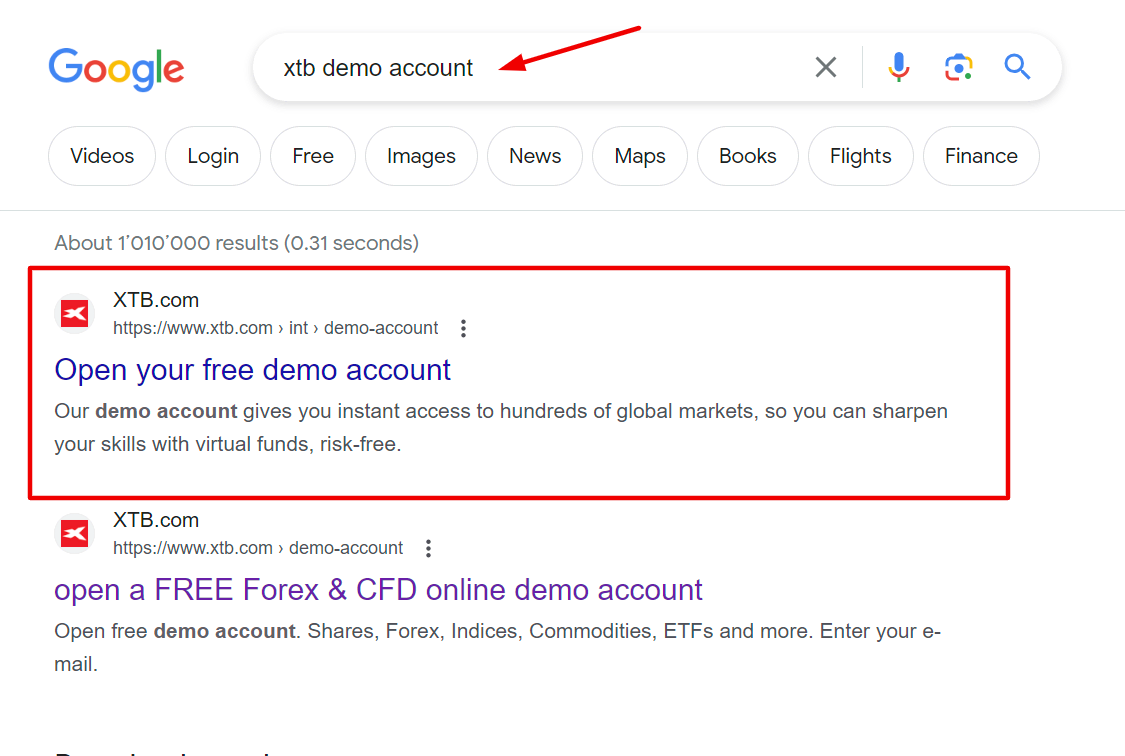

The first thing you need to decide when you sign up with a new broker is the account type. Are you planning to open a demo account or a real-live account and if there are multiple account types available, which one fits your needs best? For the purpose of this tutorial, I will sign up for a live account. Should you have no relevant trading experience I highly recommend to familiarize yourself with the platform and test your strategies on a demo account.

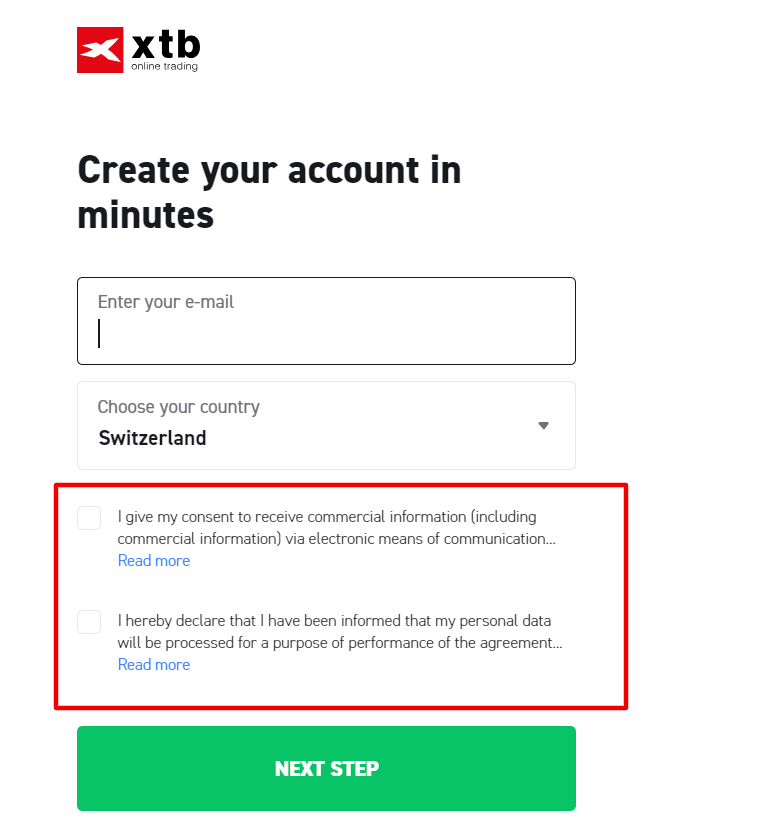

2) Enter E-mail and country of residence

After that first step, you will need to enter your E-mail address and country of residence with any broker. Also, read the “key information documents” which contain information about how CFDs work and about the platform. You will also need to choose a secure account password in this step.

3) Enter your personal details and upload identification documents

Brokers are legally required to verify your identification and ask for your past knowledge and experience in the financial markets. It is very important to answer those questions truthfully and leave no questions unanswered to avoid any delays in the activation of your account. In this next step, you will need to enter your personal information and answer a questionnaire, but it should only take a couple of minutes. Don’t forget to enter middle names in the form, as this is the most common mistake in my experience. Once you are done with this step, very often you will need to upload copies of your passport or ID, as well as a recent bank statement to verify your address.

4) Wait for the approval of your account

Once you submit the required documents, the broker will manually review your application, but it shouldn’t take longer than 12-48 hours. I recommend checking your inbox regularly as the broker will reach out to you if they require additional information. In the meantime, you can test and improve your trading strategies on a demo account. You will be notified, once your account gets approved, and you are ready to place your first trades after that.

Can you open a CFD trading account from any country in the world?

From my experience, you can open a CFD trading account in many countries, but there are definitely some restrictions. Due to restrictions by the Securities and Exchange Commission on over-the-counter financial instruments residents or citizens from the United States are not accepted by most CFD brokers for example.

Additionally, each broker has the right to further limit the registrations. The overview below should only reflect my personal experience and could not be complete. But if you are a resident of the counties below, chances are that some brokers will not allow you to open a CFD account with them.

India | Indonesia | Pakistan |

Syria | Iraq | Iran |

United States | Australia | Albania |

Belize | Belgium | New Zealand |

Japan | South Korea | Hongkong |

Mauritius | Israel | Turkey |

Venezuela | Ethiopia | Uganda |

Yemen | Afghanistan | Libya |

Can you test a CFD account for free?

Yes, the vast majority of broker companies offer demo accounts where you can test their accounts for free. I highly recommend to take advantage of this offer. Demo accounts aren’t just great to test if CFD trading is for you, but they also enable you to backtest the broker’s platform, and your trading strategy and help you to practice in real-world market conditions.

The sign-up process for a demo account is generally very easy, but there are small variations from broker to broker. In most cases, you will find a button to sign up for a demo account in just a few clicks. If you struggle to find such a button, a quick Google search can also help.

Always stick to the broker’s official site to avoid scams. You should also never pay or insert any kind of payment information when signing up for a demo account. Some companies limit the usage of the demo account and limit it to a month for example, but the initial sign-up is always free.

Conclusion – Use one of the 5 best CFD trading accounts!

After reviewing the top 5 CFD trading accounts in the market, are you now ready to jump in? Choosing your trading partner is very important at this stage. You see, all these companies are reputable and have outstanding credentials. Each one of them has good things to offer.

But you need to assess yourself first before opening your trading account. Are you new to trading, or have you been doing this for some time? Do you have the skills and discipline to succeed in this investment? This assessment will help you when looking for the best trading partner.

But what is my personal favorite CFD trading account? If you ask me, XTB is the best CFD trading company at the moment and the one I currently use. Their unique trading platform and attractive trading conditions for both beginners and more experienced traders set them apart from the competition. I should also mention that I never had any issues with them regarding deposits and withdrawals.

(Risk warning: Your capital can be at risk)

But again, to conclude this article, sign up with the trading company that is best for your current trading knowledge and skills. And also, check if your pick can trade from your country. You want to avoid going back to square one because your choice is not allowed in your country.

What is a CFD trading account?

A CFD (Contract for Difference) trading account is a financial account that allows individuals to trade CFDs, which are derivative financial instruments based on the price movements of underlying assets such as stocks, commodities, currencies, or indices. In a CFD trade, the trader doesn’t actually own the underlying asset but speculates on its price movements.

Are there educational resources available to help me understand CFD trading better?

Yes, many broker companies offer educational material in the form of blog posts, videos, FAQ sites, or webinars. A good CFD broker has no financial interest in the outcome of your trades and will therefore support you to their best availability. In many access, you can asses this information without even opening an account with that particular broker.

What is the best CFD trading account for beginners?

There is no universal answer to that question, as the answer depends on your strategy, the assets you plan to trade, your risk tolerance, and other factors. Personally, I would say XTB has one of the most beginner-friendly trading platforms and offers a good amount of support and educational material.

What kind of personal information do I have to disclose when opening a CFD account?

In most cases, you will have to upload a copy of your passport or ID as well as a copy of a recent bank statement or utility bill. Regulated brokers are legally required to verify this kind of information as an anti-money laundering precaution. In addition, you will have to disclose your knowledge and past experience in the financial markets as well as an income statement.

Is it possible to lose more money than originally invested with a CFD account?

Yes, it is technically possible if your broker doesn’t offer a negative balance protection. However, in my experience most brokers have it included for their retail clients. Still, even with this protection, you can still lose your account funds very quickly without proper risk management. Broker companies still have the right to automatically close positions, if your account liquidity drops below the required minimum levels.

Last Updated on January 3, 2024 by Andre Witzel

(5 / 5)

(5 / 5)