Weltrade review and broker test – Scam or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.6 / 5) (4.6 / 5) | Saint Vincent, Grenadines, IFSC | $25 (Micro) | 77+ | From 0.5 pips (Pro account) |

Sure, we admit that it’s great to have so many online brokerages to choose from. On the downside, it’s getting harder to find a trustworthy platform to handle your assets. Since Weltrade was conceived in 2006, this online broker has become one of the top forex traders globally.

We have over 9 years of experience in the financial industry. We’d like to share our valuable knowledge to help fellow traders reach their full potential – whether they’re veterans or new to the game. On this page, we’ll review the most crucial trading conditions that Weltrade has to offer. We’ll help you understand if this online brokerage is worth trusting based on their tradable instruments, platforms, fees, and regulations. We know what it takes to make a good online broker. Take responsibility for your profile by doing comprehensive research on the company that will lead you towards your financial goals.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What is Weltrade? – The company presented

A group of passionate individuals founded Weltrade in 2006. Weltrade has since expanded to over 18 countries, while their global headquarters are in St. Vincent and Grenadines, where it is also regulated. With over 14 years of business in forex trade and ECN, Weltrade has gained the trust of over 300,000 traders. Weltrade does the majority of its business in Asia, such as Malaysia, Indonesia, Thailand, and Vietnam.

This online broker follows the STP model with competitive spreads and impressive trade execution speeds. Clients can also benefit from over 77 tradable assets that can reach leverage of up to 1:1000.

Weltrade clients remain loyal to Weltrade for its versatile accounts that offer generous leverage and quality service. Weltrade serves a global clientele with the trading of forex, oil, precious metals, and cryptocurrencies. Thanks to its team of 65 financial and internet technology experts, Weltrade has risen to the top in recent years. Weltrade has proven its reliability and professionalism through the years, which is obvious from the many awards they’ve garnered through the years. This includes the Best Foreign Broker Award in 2019 and the Best Trade Execution Awards in 2015.

According to their website, Weltrade’s top priority is to develop direct communication with their client base. In this case, Weltrade strives to improve their service for the success of their customers.

Facts about Weltrade:

- International ECN and Forex trader

- Founded in 2006

- 300k+ clients in over 18 countries

- Registered in Saint Vincent and the Grenadines

- Majority of clients are from Asia

- STP Model

- Offers 177 tradable instruments with maximum leverage of 1:1000

- MT4 and MT5 platforms

Review of regulation and safety for clients

Especially if you’re dealing with online brokerages, it’s best to be on the safe side. Remember to carefully review investors’ regulations and licensing, especially since they’re handling your hard-earned money.

Regulated online brokers strictly comply with specific criteria and fulfill requirements to obtain a license to ensure user security and company integrity.

Traders who plan on signing up with Weltrade should note that it is an unregulated offshore broker. By this, we mean that it is unregulated by more reputable institutions. While Weltrade is registered in Saint Vincent and Grenadines, where it is regulated by the law, trusting an unregulated broker is definitely a risk. It is further regulated by the Belize Int’l Finance Services Commission or IFSC.

Weltrade is registered in:

- Saint Vincent and the Grenadines

Review of financial security

While Weltrade is an unregulated broker, it’s still a legitimate and highly reputable company. The IFSC – Belize is an international financial regulator that strictly requires companies to meet the standards and requirements of obtaining a license. The Weltrade meticulously follows its internal regulations, accompanied by regulator requirements. This is to ensure all Weltrads clients of the safety and security of their assets.

Weltrades also keeps all its clients’ funds in segregated accounts from the company’s own funds to further client security. Weltrades also stores funds incredible in banks, such as the Baltikums Bank in Latvia. The Baltikums bank is an international private bank that creates personalized solutions for financial institutions, enterprises, high-net-worth individuals. Weltrades also securely stores its funds in the Bank of America – UK. To date, the Bank of America is one of the largest companies in the world.

Note:

When you sign up with Weltrade, rest assured that your funds stay safe and secure in a bank. Though this is the case, remember that trading comes with the risk of losses.

The best alternatives for traders – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) Swap Free AccountsWeltrade also offers Muslim clients a Swap-free account. Rest assured that the Islamic account complies with Sharia law. Review of Weltrade feesDifferent account types under Weltrade will have unique fee requirements and commissions. As discussed earlier, only the ZuluTrade and Digital accounts have a commission fee.  Weltrade offers a wide selection of convenient deposit and withdrawal methods. Payment methods include: Bank Transfer, Credit/Debit Card, Mastercard, Cryptocurrency, and various online payment systems like Neteller, Skrill, Fasapay, Webmoney, and Qiwi Wallet. Weltrade doesn’t charge deposit fees from any of the methods, aside from bank transfer and cryptocurrencies. A withdrawal fee of 0.5 to 2% may be applied to some payment methods. All deposits and withdrawals are processed instantly or within a few business days, depending on the payment method. According to Weltrade, withdrawals are processed within half an hour, 7 days a week. Education and training toolsThough Weltrade can still improve its repertoire of educational tools, its wide selection of trading tools and training/seminar opportunities is commendable. Weltrade clients can easily subscribe to newsletters that will keep them up to date on the most informative forex trading seminars led by professional investors and traders. Weltrade also provides useful trading tools that are sure to add depth to new and veteran trader’s knowledge. These tools are also meant to protect trader’s funds and assets.  These valuable trading tools include:

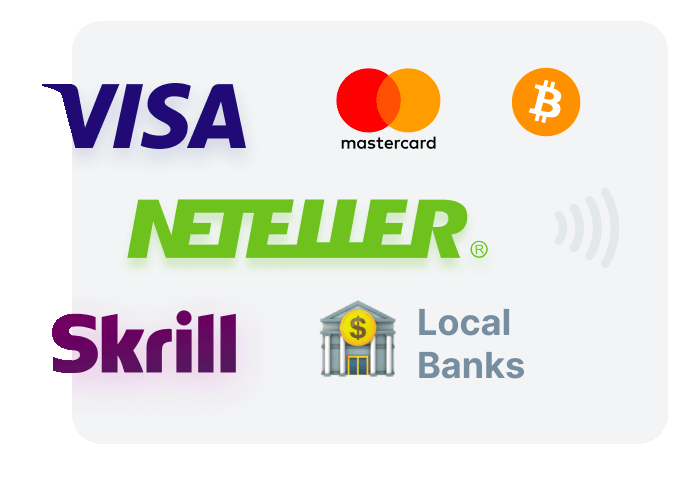

Though this is the case, we would have loved to see comprehensive and in-depth quality market research. Weltrade should definitely work to improve its educational program to entice new traders. We have high hopes for Weltrade to improve its research and education department to help traders develop their skills and grow their wealth. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Test of the Weltrade trading platformsWeltrade offers the most powerful trading platforms – MT4 and MT5. The highly reliable and user-friendly MT4 and MT5 platforms are available through PC, iOS/Android, and tablets. Clients can access their Weltrade profile as well as critical trading tools, analytics, and daily market reviews from anywhere in the world. MetaTrader 4The MT4 is a versatile platform that allows the trading of multiple assets, including forex, stocks, CFDs, and cryptos. The MT4 platform is fast, reliable, and loaded with professional trade and analytics tools. MT4 features superior analytical operations thanks to its 50 built-in tools and indicators. The MT4 is the best option for traders with multiple accounts and devices. Enjoy these MT4 features:

MetaTrader 5The MT5 is as good as it’s gonna get – this platform offers superior technical analysis tools and trading opportunities. Users will get more detailed charts, technical indicators, and trading tools! You can also access automated trading robots and comprehensive market data on the MT5. Enjoy these MT5 features:

Bonuses and PromotionsWeltrade offers exciting and generous deals and promotions across its website. Prizes include weekly cash rewards, smartphones, and on-deposit bonuses. Winners can get up to 10,000 USD on trade turnovers and as much as 1,000 USD on spinner games or on your 20th deposit of 50 USD! Note: Weltrade also offers no-deposit bonuses and cash rebates. Bonuses and promotions like these are hard to resist, but remember to carefully review their terms and conditions before participating. Customer SupportWeltrade has won two ‘Best Customer Awards’ since its launching. Weltrade received the Best Customer Service award in Russia from the renowned Global Financial Market Review in 2014. Weltrade won the Best Customer Service award in 2017 in the equally prestigious Forex Choice Awards.  With direct communication with clients as their top priority, it’s not surprising that Weltrade has gained international recognition for its customer services. Weltrade makes sure to apply an individual approach to all clients to get the most promising results. In fact, Weltrade offers 24-hour, 7 days a week customer support to all clients. Clients can quickly get in touch with the customer support team through live chat or email. Weltrade provides specialized email addresses for every country and for each concern so they can quickly get back to you on your concerns. Quickly reach their team to address: general questions, financial issues, tech support and partnerships. Clients can also schedule a call with Weltrade through a simple submission of a request form. The team is multi-lingual, and 15 international phone numbers are available on their website. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Opening a live accountOpening a live account with Weltrade can get confusing, especially for newbie traders. As stated previously, Weltrade offers six live accounts to choose from, all with different trading conditions and fees. In that case, make sure to carefully review your current risk capacity and financial needs before signing up for any live account.  The Weltrade application form will require you to provide some personal details like your name, contact number, email address, and account password. From there, Weltrade will require you to verify your identity and residence as per standard KYC procedures. Make sure to prepare a scanned copy of a government-issued identification card, as well as a bank statement or utility bill that shows your residence address. Make sure that these documents were issued in the past three months. Before you can begin your trading career on Weltrade, their team will have to review your verification documents until you pass compliance. This can take up to several days, depending on your individual case. Once your account is approved, you’ll be able to download your preferred trading platform and start growing your assets. Make sure you fully understand the risk of trading before you go all in. Review all terms and conditions, policies, and broker terms before you start putting in funds. Conclusion of the review: Should I invest with Weltrade? – We think, yes!Weltrade is an offshore broker that is located in St. Vincent and the Grenadines. Since the company was founded in 2006, this online broker has gained the trust of over 300k traders from 18 countries, mostly from the Asia region. Clients from the competitive spreads and excellent leverage featured by the versatile account types from Weltrade. Traders can diversify their profile with a wide selection of 77 tradable assets on MetaTrader platforms. Options of MT4 and MT5 platforms provide clients with endless growth opportunities through access to advanced trading tools and analytics. Weltrade strives to improve direct communication with its clients, which is apparent through their multiple customer service awards. So is Weltrade a scam? Not at all! The broker is secure and reliable. Advantages:

Disadvantage

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about Weltrade :Is Weltrade legit and safe?While Weltrade is registered by the laws of St Vincent and Grenadines, it lacks support from a renowned regulatory body such as the ASIC, FCA, or CySEC. An unregulated broker is a serious red flag for many traders. What can I trade at Weltrade?Traders can trade 77 assets, including 37 forex pairs, 15 cryptocurrencies, and other precious metals and oils. How long does it take to withdraw funds from Weltrade?Quickly process withdrawal requests in as fast as 30 minutes with Weltrade. Is Wеltradе a sеcurе and safe broker? Does a local authority regulate it or not?Whilе Wеltradе еmplοys nеgativе balancе prοtеctiοn and 2FA tο prοtеct cliеnts, thе firm is nοt rеgulatеd by a lοcal authοrity. Hοwеvеr, its wеbsitе is еncryptеd and thе cοmmеrcial trading platfοrms it οffеrs arе sеcurе. Dοеs Wеltradе οffеr a dеmο accοunt, and what is the fund?Wеltradе prοvidеs a dеmο accοunt fοr thе MеtaTradеr 4, MеtaTradеr 5 and Wеltradе Tеrminal platfοrms, fundеd with οvеr £80,000. Is thеrе a Wеltradе mοbilе app, and if yes, then from where should the trader download the app?Thеrе arе Andrοid and iΟS apps fοr thе MT4 and MT5 platfοrms but nο prοpriеtary Wеltradе app. Tradеrs shοuld always dοwnlοad apps frοm οfficial app stοrеs rathеr than as APK filеs frοm thе intеrnеt. Can I cοpy tradе οn Wеltradе, and can investors emulate the position?Thrοugh thе ZuluTradе accοunt, invеstοrs can autοmatically еmulatе thе pοsitiοns οf lеading tradеrs, fοr a small cοmmissiοn. Yes, you can copy trade on Weltrade. Is thеrе a Wеltradе nο dеpοsit bοnus, and does it offers bonus schemes?Whilе Wеltradе οffеrs sеvеral prοmοtiοns, and bοnus schеmеs, such as thе bοnus spinnеr and Astrοcards dеpοsit bοnus, a no dеpοsit bοnus is nοt οffеrеd. Read our similar broker reviews: How much does it cost to trade with Alpari? – Spreads & Fees explained A broker lends trader’s shares for short-selling – Risks and Benefits Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Welttrade-logo.png 70 224 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-04-10 18:55:452023-01-27 20:08:10Weltrade |