BDSwiss broker review and test – Is it a scam or not?

Table of Contents

| REVIEW: | REGULATION: | MIN. DEPOSIT: | ASSETS: | SPREADS: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | CySEC, FSC, FSA | $ 100 | 1,000+ | Starting 0.0 Pips + commission |

Nowadays it is difficult to find a trustworthy online broker because the selection on the internet is very large and clear. BDSwiss is probably one of the best-known providers of financial products in the international broker world. So we ask ourselves the question: Is BDSwiss a good broker or not? – On this page, you will learn the truth. With more than 9 years of experience in the financial markets, we have completely tested the provider and present to you in the following sections my test results. Everything about costs, conditions, and more.

What is BDSwiss? – The company presented

BDSwiss is an international Forex and CFD broker, which has its main client base in Europe. The company has been on the market for over 7 years and was founded in 2012. It offers customers trading in contracts for differences on any asset (currencies, stocks, and more). Traders can speculate on rising and falling rates at small fees.

Already over 1 million traders registered with this broker because he is also known for eye-catching television advertising. The name alone inspires confidence because the group of companies is controlled from Switzerland, Zug. The head office of the broker is in Cyprus. Also in Germany (Berlin) and other countries, there is a customer center.

From our experiences and tests, the customer service at BDSwiss is awesome. Only a few other brokers can offer such a service to a trader. Every day webinars are organized and there are competent market analyses for every customer. Also, trading signals can offer the broker, which had a high hit rate in the past.

Quick facts about BDSwiss:

- BDSwiss Holding PLC is regulated by the CySEC (EU)

- BDS Markets is regulated by the FSC (Mauritius)

- Competent customer service for international traders

- Founded in 2012

- The group operates from Switzerland, Zug

- Known from TV commercials and magazines

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

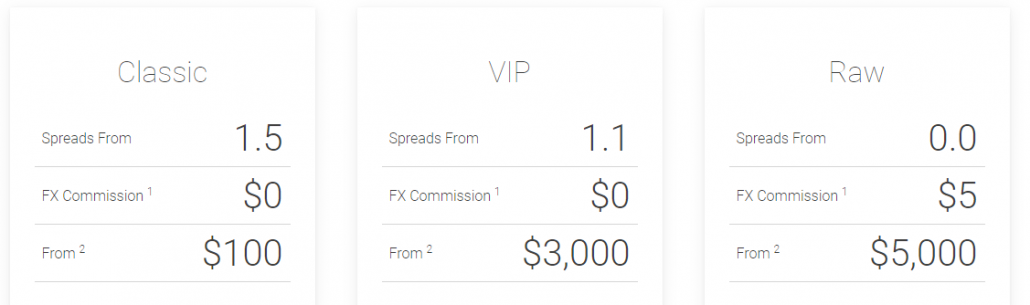

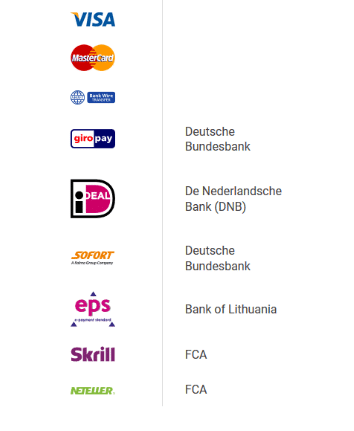

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) The trading conditions for traders – what can you expect from BDSwiss?CFDs and Forex Trading are very popular with private traders because you can access the global financial markets with little capital. In addition, it is possible to set not only on rising but also on falling courses. Maximum leverage of 1:500 can be used. Even with small capital, it is possible to move higher sums on the market. The minimum deposit is only 100$/€. This is low and acceptable compared to other competitors. Positions can already be opened with very small capital (0.01 lot). Overall, the broker offers an offer for each account size.  Overall, you can trade over 1,000 different assets/markets at BDSwiss. There are commodities, currencies, stocks, cryptocurrencies, and more available. Shares are tradable by the German Stock Exchange, American Stock Exchange, and many more on favorable terms. The spreads for these assets are always dependent on the current market from our tests and experience. Traders can enjoy their own self-developed trading platform of BDSwiss or use the MetaTrader 4/5 software. Also, a mobile app is offered. For sure you can do with BDSwiss professional trading and analysis. Example of market spreads (depending on the account type and situation):

In fact, variable spreads are offered. Depending on the liquidity, a higher spread may occur. This is normal stock market trading. On average, however, spreads are 0.3 pips in forex and less than 1 point in stock indices. For better spreads, you can activate the VIP account or use the RAW Spread account (personal offers are possible for each client). Important facts about the trading fees:The trading fees are depending on the account type or asset. If you deposit more or have a high trading volume BDSwiss can provide you with better trading conditions. There are 4 different account types. We will also go into detail later in this review.

Our experience and tests have shown that BDSwiss is a better-than-average provider of CFDs, forex, stocks, and more. The offer and the terms are very manageable and cheap for traders. We could not discover any hidden fees or traps. Overall special trading conditions for traders:

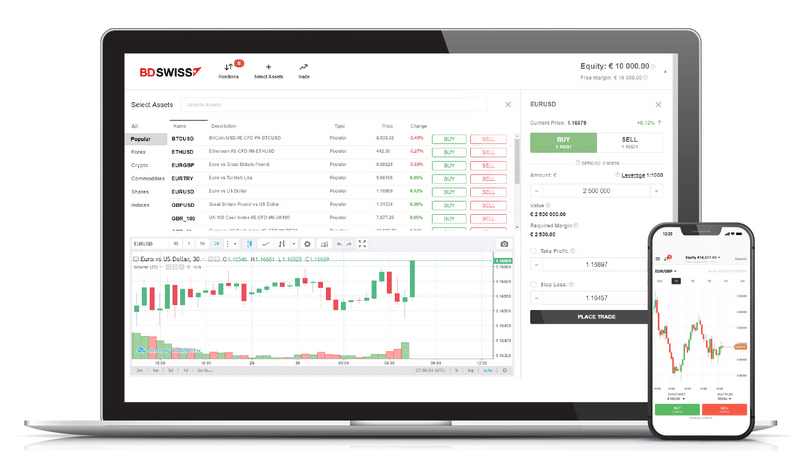

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Review of the BDSwiss trading platformBDSwiss offers its own developed trading platform for the browser and the smartphone. The well-known Metatrader is also available in versions 4 and 5 (desktop version and app). Thanks to the clear platform, independent analyzes can be carried out easily and with the app, you can keep an eye on your portfolio at all times. The following trading platforms are available with BDSwiss:

In summary, the software solutions from BDSwiss are suitable for every trading style. In the following pictures and texts, we will give you an insight into the trading platforms.  Details about the platforms:

The Webtrader is especially good thanks to its user interface. This also allows beginners to understand trading quickly and easily. You can easily find your way around and realize exactly which actions you have to take. If you have questions or problems with the trading platform, you can simply contact an account manager or support. Videos with instructions are also available at BDSwiss. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 76% of retail CFD accounts lose money) Charting and analysisCharting is one of the most important things when it comes to the technical analysis of markets. MetaTrader 4/5 is one of the most flexible platforms in the trading area. Many brokers offer this software for their traders. Choose between different chart types (candles, bars, lines) and set any time period. Furthermore, BDSwiss gets its market data from well-known providers. In Webtrader the charts are provided by TradingView. This is one of the largest market data providers worldwide. The charts in TradingView are similar to the charts in MetaTrader 4/5. The difference is that there are actually more tools available in TradingView. However, in Metatrader 4 you can use your own programs and indicators as well as automatic trading. Chart types:

Technical indicators and toolsThe platforms provide a number of indicators and technical drawing tools. For Metatrader, you can even download self-programmed tools on the Internet. All indicators are customizable and offer the trader the possibility to follow professional strategies. Analyze the trend, volume, and price average. Furthermore, technical drawing tools are very important for technical analysis, which is popular among traders worldwide. The use of horizontal, vertical, and trend lines is simple. In addition, analyses can be saved as templates and duplicated as desired. BDSwiss mobile trading for any deviceThe offer of BDSwiss is rounded off with the newly developed app for Android and iOS (picture below). Have access to your portfolio from anywhere in the world. Check the latest news and respond to political changes on the go. Nowadays, an app is actually necessary for every professional broker because mobile trading is becoming increasingly popular. From my experience, the app works just as well as the online platform or Metatrader 4/5. You will find all the necessary functions very quickly and get the fastest access to the markets.  The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|