4 best Forex brokers for cryptocurrency trading in comparison

Table of Contents

The list of the 4 best Forex brokers for crypto trading:

Broker: | Review: | CRYPTOCURRENCIES: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | 14+ | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Capital.com  | 250+ | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (138+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

3. XTB  | 10+ | More than 10 | 3000+ (48+ currency pairs) | + Low spreads + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: 72% of retail CFD accounts lose money) | |

4. XM Forex  | 7+ | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Cheap trading fees + No hidden costs + Regulated and safe + International trading + 1000+ assets | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) |

For Forex traders looking to start investing or trading in cryptocurrencies, there are some crucial things they have to consider. One is a good forex broker that supports a range of crypto markets.

Investors have different choices of cryptocurrencies they prefer to trade. The best forex broker for cryptocurrency trading should have a trading license/registration and low trading fees. The forex broker for cryptocurrency should also be transparent and have liquidity.

What is cryptocurrency?

It is a digital currency created and maintained through cryptography technology, such that it is impossible to replicate or forge. They are available online through a cryptocurrency network of computers known as nodes. The transactional information is stored through a system known as blockchain technology.

Blockchain technology is a network of data blocks that store transactional data to allow investors to trace back the history of the cryptocurrency. The cryptocurrency gets secured through verification of each transaction traders make by the nodes.

Cryptocurrency is appealing to many investors since it is not influenced by microeconomic factors. It is also free from third-party intermediaries like banks, which means traders can send and accept cryptocurrency directly from the seller to the buyer.

It makes cryptocurrency free from some factors that affect fiat currencies, like inflation. It means that cryptocurrency keeps increasing in value with time.

How do you trade cryptocurrency?

- Identify a cryptocurrency and know how it works

There are many cryptocurrencies and cryptocurrency CFDs, and some are still emerging. If you want to start trading cryptocurrency, look at those in the market for a long time. While looking at the cryptocurrency options, identify those accepted in your location.

- Choose a forex broker

Choose a forex broker that offers the cryptocurrency you want. A good forex broker for cryptocurrency should have low trading fees, and trading tools should be per the market standards. Check its regulation and safety precautions it has taken to secure investor funds.

Other crucial factors are if payment methods work in your location, the deposit limits, and the initial requirement. They should also have quality research resources and education materials covering cryptocurrency markets.

- Fund your account

If you find a good forex broker register a trading account and fund it. There are different payment methods according to the location you are from. Most forex brokers accept bank wire, although you can also use digital wallets available in your area.

- Get a crypto wallet or offline cold wallet

It is for traders who feel secure storing their cryptocurrencies on a crypto wallet rather than their online broker. There are some cases of traders who have lost their private keys to hackers, or they did not store them correctly.

Crypto traders use crypto wallets or ledgers to avoid losing their private keys. But, traders can also store them on their online forex broker if it is regulated and has credibility from many forex traders.

- Create a trading strategy

There are several strategies that traders can use to approach the cryptocurrency markets. The forex broker educational materials assist and other resources available on the internet. If your forex broker has a copy trading feature, you can learn from other expert crypto traders.

- Practice your trading strategy

Practice on the demo account to predict how the market moves. Most forex brokers for cryptocurrencies have a free demo account. It allows you to understand the market and how effective the trading strategy is.

- Start trading

If you have done enough practice, you are confident to start trading in the live account. It is crucial to note that the demo and real account have differences in the results. It is why you should start trading using small trading accounts before risking more capital.

Which cryptocurrencies are available on most forex brokers?

There are 10,000+ cryptocurrencies that forex traders can access. Here is a list of some of the most traded cryptocurrencies;

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Chainlink (LINK)

- Cardano (ADA)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Zcash (ZEC)

- Stellar (XLM)

- Cardano( ADA)

- Binance Coin (BNB)

- XRP

- Polkadot (DOT)

List of the 5 best forex brokers for cryptocurrency trading:

1. RoboForex

It is a forex broker founded in 2009 that has over 3.5 million forex traders from 170 countries.

Regulation

Roboforex has regulations from the International Financial Services Commission of Belize.

Financial markets

Its users have access to a wide range of trading instruments from 12000 markets. Some include indices, stocks, ETFs, forex, metals, and commodities.

Roboforex also offers access to 26 cryptocurrency instruments, including;

- Cardano

- Bitcoin

- Dogecoin

- Ethereum

- Polkadot

- Chainlink

- Litecoin

- Solana

- Cosmos

(Risk Warning: Your capital can be at risk)

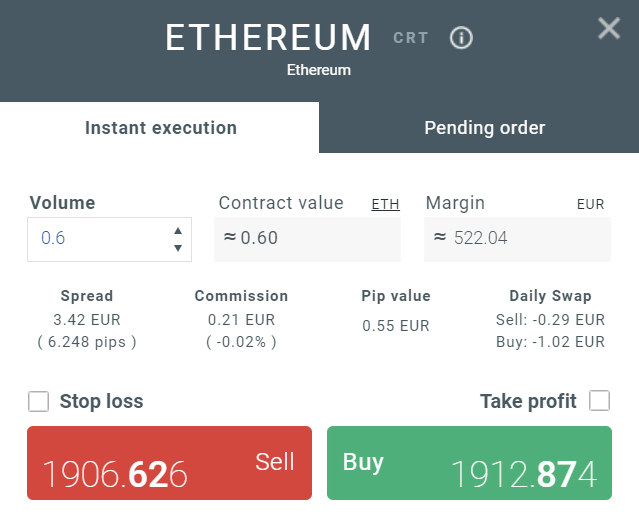

Fees

Roboforex has low forex spreads, which vary with the type of trading account. The Pro and Pro-Cent accounts have forex spreads starting from 1.3 pips with no commissions. The Prime, ECN, and R stocks traders start from 0.0 pips and fixed commissions.

An inactivity fee of $10 gets charged monthly on a dormant account for over a year. It also has overnight fees, depending on the size of the open position overnight. Deposits and withdrawals are free and can get done through bank transfers, credit/debit cards, and electronic wallets.

Traders can access leverage of up to 1:50 for cryptocurrencies, and other markets have forex leverage of up to 1:2000. The leverage limits vary with the type of trading account at RoboForex.

Features

- A demo account for traders to trade cryptocurrencies risk-free using virtual funds.

- It has numerous trading platforms such as the MT4, MT5, c Trader, and the R stocks trader.

- C trader has 54 technical indicators, 9 charts with 14 time-frames, level 2 pricing, C trader Automated trader, and fast execution rates.

- MT4 and 5 also have trading features such as 50 trading indicators, algorithmic trading with MQL4, MQL5, and the Expert Advisor.

- Clients at RoboForex have access to fundamental analysis, signals, and trading insights from the research experts.

- Social/copy trading features for new and advanced traders to use.

- The web-based version of the trading platform is available on mobile apps, websites, and desktops. ‘

- Educational resources through videos, articles, and the economic calendar help traders prepare for trading.

- Customer support is available 24/7 in 11 languages through chats, emails, and phone calls.

Pros of Roboforex

- Advanced trading tools

- Numerous trading platforms and trading accounts

- Fast transactions

- A wide variety of Cryptocurrency markets

- Low minimum deposits

- Low forex spreads

Cons

- It is not available in many forex-trading countries.

(Risk Warning: Your capital can be at risk)

2. Capital.com

It is a forex broker founded in 2016 and has over one million forex traders using its trading platform.

Regulation

- Australian Securities and Exchange Commission

- Cyprus Securities and Exchange Commission

- Financial Conduct Authority in the United Kingdom

- SCB (Bahamas)

- SCA in the UAE

Trading instruments

Capital.com offers access to more than 3,000 financial markets, including Indices, commodities, shares, and forex. It also has access to cryptocurrencies and their CFDs, such as;

- Bitcoin

- Litecoin

- Ethereum

- Dogecoin

- Shiba Inu

- Cardano

- Stellar Lumens

- MANA

- CRO Coin

- Tron

(Risk warning: 75% of retail CFD accounts lose money)

Fees

Capital.com has tight forex spreads starting from 0.6 pips and has no commissions on cryptocurrencies (other fees can apply). To open an account at Capital.com is $20. Cryptocurrency leverage on Capital.com goes up to 1:2.

Withdrawals and deposits are free, but there is an overnight fee. It varies according to the open position using leverage. Payment methods that Capital.com accepts are bank transfers, credit/debit cards, and digital wallets.

Features

- The demo account has $1,000 in virtual funds that traders use to practice strategies.

- It uses the MT4 and its proprietary platform web-trader for accessing different financial markets.

- Some Trading tools are like advanced MT4 charts with 9 time-frames, 75 technical indicators, and risk management tools such as stop-loss and take-profits.

- It also has fast execution rates, Expert Adviser, and MQL4 automated trading features available 24 hours for trading.

- Capital.com has a mobile app, desktop, and web-based version so traders can access their trades wherever they are with different gadgets.

- The research team offers insights, analysis, weekly news, trading articles, and the economic calendar.

- It has educational content covering various financial markets accessed through videos, articles, webinars, and courses.

- The Invest app has educational materials covering major trading topics and various courses from basics to advanced levels.

- A responsive customer team is available 24/7 in eight languages through emails, phone calls, live chat, and social media platforms like Twitter and Telegram.

Pros of Capital.com

- Low trading fees

- Zero commissions on many financial markets

- User-friendly trading platform with AI integration

- Low initial deposit

- Responsive customer support

Cons

- Limited trading instruments

- MT5 is not available

(Risk Warning: Your capital can be at risk)

4. XTB

It is a secure, publicly traded forex broker founded in 2002 that offers cryptocurrency trading. It has 30 offices in eleven countries, serving over 400,000 forex traders.

Regulation

- International Financial Services Commission in Belize

- Polish Securities and Exchange Commission

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission

Financial markets

Traders at XTB can access more than 4000 trading instruments ranging from forex, stocks CFDs, commodities, ETF CFDs, and cryptocurrency.

XTB has 14 types of cryptocurrency markets. Some mainly traded are:

- Bitcoin Cash

- Chainlink

- Dogecoin

- Ethereum

- Litecoin

- Bitcoin

- Cardano

- Binance Coin

- Polkadot

- Stellar Lumen

- Tezos

- Eos

- Uniswap

Trading fees

XTB offers low trading fees, with the Standard account offer spreads starting from 0.5 pips, while the Pro account has spreads starting from 0.1 pips. The Standard trading account has no commissions, but the Pro account has $3.50 per lot.

XTB has the highest forex leverage set at 1:500. Stakeholders at XTB change with time. It has no minimum deposits for opening a standard account on its platform.

There is also an inactivity fee of $10 for inactive accounts of over 12 months. The deposits and withdrawals are free and can get done through bank transfers, credit/debit cards, and electronic wallets such as Skrill and PayPal.

(Risk warning: 72% of retail CFD accounts lose money)

Features

- With a demo account, forex traders can test out its trading features and the cryptocurrencies offered.

- It has a proprietary trading platform, X station 5, that works, and the X station Mobile.

- It offers professional charts, 30 advanced drawing tools, a stock screener, 50+ technical indicators, and an advanced trading calculator.

- Traders can compare more than one market chart and compare the market prices through its advanced multi-charting software.

- Its clients can access risk management tools like stop loss, take profit, and EU clients have the benefit of Negative Balance Protection.

- It offers technical and fundamental resources via daily financial news, economic calendar, regular articles, and analysis videos.

- The Powerful Stock screener allows traders to search for news and information about an asset to make effective trading decisions.

- It is available on a mobile platform, a desktop, and a website version for traders to access their trades from wherever they are.

- Educational resources cover all content from beginner level to topics for advanced traders.

- Traders can access educational content such as video courses, articles, and live webinars. They can also get mentorship from account managers about various trading instruments.

- Customer support is available in 16 languages 24/5 via phone calls, emails, and live chats.

Pros of XTB

- It has been in the market for a long time and has established trust among traders

- It has regulations from tier 1 and 2 jurisdictions

- It has quality trading tools

- Low trading fees

- Industry-standard educational and research materials

- No initial deposit

- Fast deposit and withdrawals

- It has a fast account registration process

Cons

- Has no MT4 and MT5 trading platforms

- Has limited trading instruments

(Risk warning: 72% of retail CFD accounts lose money)

5. XM

It is a forex broker serving more than 1.5 million traders in 190 countries since its launch in 2009. It offers various trading instruments like cryptocurrency CFDs.

Regulation

- Cyprus Securities and Exchange Commission

- International Financial Services Commission in Belize

- Australian Securities and Investment Commission

Financial markets

XM forex traders have access to 1000+ trading instruments from forex, Indices CFDs, Commodities CFDs, Stocks CFDs, Metal CFDs, Commodities CFDs and Energy CFDs.

It also offers Cryptocurrencies on CFDs, some of which are:

- Bitcoin Cash

- Bitcoin

- Litecoin

- Ethereum

- XRP

Trading fees

XM has low trading fees starting with the Micro, and the standard account has forex spreads from 1.0 pips and is commission-free. The XM ultra-low account has a forex spread starting from 0.6 pips and is commission-free. The shares account has forex spreads depending on the assets with commissions.

The leverage charged depends on the type of account, but the maximum forex leverage at XM is 1:888. Cryptocurrencies have a forex leverage of 1:250 and get traded 24/7. It has an inactivity fee of $5 charged on an inactive account and a one-time maintenance fee of $15 after one year of inactivity.

There is an overnight fee for open positions overnight, depending on the size you open. It has free deposits and withdrawals done through various payment platforms. Forex traders can deposit and withdraw their funds through; credit/debit cards, bank wires, and electronic wallets.

(Risk warning: 75.59% of retail CFD accounts lose)

Features of XM

- It has a demo account with $100,000 in virtual currency that forex traders use to test different financial markets, including Cryptocurrencies.

- It has four trading accounts, each having varying trading conditions Micro, Standard, XM ultra-low, and XM shares.

- The initial for the three trading accounts is $3, except for the Shares account, which is $10,000.

- It uses three trading platforms, the web trader, Meta Trader 4, and Meta trader 5.

- The MT4 has three charts with 9-time frames, 50 technical indicators, and the Expert Advisor.

- Traders can access XMs MT4 multi-terminal, allowing traders to monitor several accounts.

- MT5 has more trading tools, charts, hedging options, market news, and trading history.

- It has automated trading with an Auto-chartist and Expert Advisor via MQL4 and MQL5.

- The web trader platform is available on desktop and website versions. MT4 and MT5 are available for mobile trading desktop and website trading platforms.

- Research materials like several technical tools, trading signals, and an economic calendar are available on the trading platforms.

- New and advanced traders can find comprehensive educational content through articles, video courses, and daily webinars.

- Customer support is available 24/5 in 23 languages through live chat, phone calls, or emails.

Pros of XM

- Quality trading tools

- Negative account protection

- Low forex spreads

- The low initial deposit of $ 5

- Fast execution rates from MT4 and MT5 trading platforms

- Numerous bonus offers

- Comprehensive research tools

- Fast and free deposits and withdrawals

Cons

- Limited trading instruments

- Wide spreads on the standard account.

(Risk warning: 75.59% of retail CFD accounts lose)

Conclusion – You can trade cryptocurrencies at many of the most popular brokers

Cryptocurrency is a trading instrument that came to the market later on after many other assets. It started as a speculation, and many forex traders and expert financial analysts were skeptical. The first and most popular cryptocurrency is bitcoin.

Many years later, people have embraced cryptocurrency trading and created other cryptocurrencies. There is a lot of hype on cryptocurrencies, more so Bitcoin which attracted a lot of financial investors. It is why many forex brokers offer crypto trading, Crypto CFDs and ETFs.

Forex traders should be careful when choosing a forex broker for cryptocurrency trading. It is also imperative that crypto traders choose wisely the type of cryptocurrency they want to trade.

FAQs – The most asked questions about Forex Brokers for cryptocurrency:

Is it legal to trade in cryptocurrency?

Is it legal to trade in cryptocurrency?

Can you short-sell cryptocurrency?

Can you short-sell cryptocurrency?

Is cryptocurrency trading risky?

Is cryptocurrency trading risky?

Do you need to trade cryptocurrency through a broker?

No, you do not have to trade cryptocurrency through a broker. You can trade Bitcoin via a cryptocurrency exchange that offers Bitcoin trading.

What should I look for when choosing a cryptocurrency broker/platform?

The credentials of your intended cryptocurrency broker/platform should represent a high level of competence and operate in compliance with current regulatory measures as stipulated for financial service providers. A good cryptocurrency broker has state-of-the-art security systems in place. You should also be able to access your cryptocurrency broker/platform 24/7 via mobile app and desktop.

What does a cryptocurrency broker do?

A cryptocurrency broker acts as an intermediary between the different cryptocurrency markets with the aim of facilitating the buying and selling of cryptocurrencies.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5)