Options vs. Futures trading: What is the difference?

Table of Contents

Futures and Options share a lot of similarities. Both give you unlimited money-making potential, and both are extremely popular amongst retail traders. More notably, the two are derivatives, meaning they derive their price from another asset. Choosing to trade one over the other will make a lot of sense in some circumstances since the way the two instruments operate, and their markets, are very different.

But before you can make that call and decide what financial instrument is more likely to make you a profit, you must have a deep understanding of the two. In addition to giving you a quick refresher about what futures and options trading is, we’ve compared the two for you, so you have an easier time picking between the two.

What is Options trading?

Options are contracts that give an investor the right to buy or sell stock at a stipulated price at a later time. Since you’re not obligated to buy or sell anything, you risk less capital and have an opportunity to make more money.

Options take on two forms:

Call Options:

These options give you the right to buy a stock, bond, commodity, or asset for a set price within a specified period. You must use these when you think the price of an asset is going to rise.

Put Options:

These options give you the right to sell a stock, bond, commodity, or asset for a set price within a specified period. You must use these when you think the price of an asset is going to fall. An expiry time is set when you get your hands on an options contract.

If you get an American-style options contact, you will be able to exercise your option any time before it expires. On the other hand, if you get a European-style option, you will only be able to exercise your option at expiration. While American-style options are a lot more flexible than European ones, they are also more expensive.

To close out the contract, you can either sell your option to another trader before it expires or execute the contract. If you leave the option be and do not renew it, it will expire and not yield you any profit. The premium will go to waste, but you will not lose any more money.

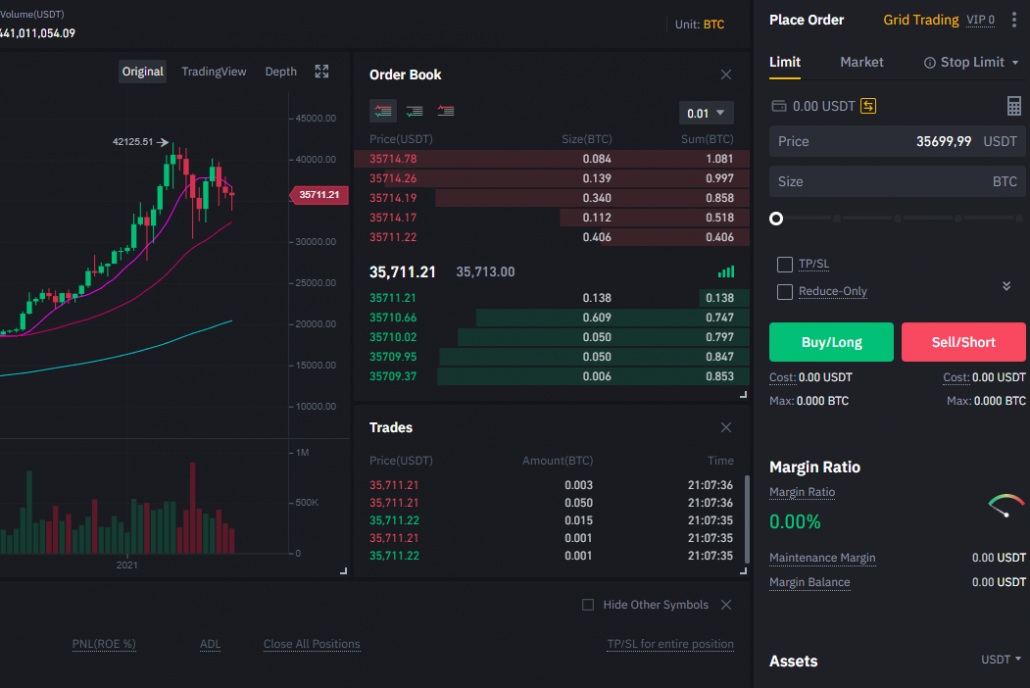

What is Futures trading?

Futures are essentially contracts that represent an agreement that two parties – a buyer and a seller – will trade an asset at an agreed-upon price on a stipulated date. The key difference between futures and options is that with an option, you are not obligated to trade anything, but you do have the right to trade. With a futures contract, you are obligated to trade with the other party when the contract expires, whether you’re buying or selling.

A trader can also close out a futures position by buying or selling an identical contract. Future markets involve a lot of leverage. Traders don’t need to pay for the asset they’re buying in full and upfront. Only a percentage of the value of the contract needs to be paid. You can trade securities, commodities, currencies, treasury bonds, and indices with a futures contract. There are two ways of using a futures contract: for speculating and for hedging:

- Speculating: Speculating is when a trader punts on the price of an asset. If you think the price will rise, you can buy a speculative position. If you think the price is going the other direction, buy a short position.

- Hedging: A trade made using futures to limit losses in the event of a price change is called a hedging trade. Let’s suppose a farmer enters a futures contract to sell their coffee. Since the price will remain fixed in the contract, if the price of coffee goes down in the future, it won’t affect the farmer’s business.

Initially, futures contracts were used by farmers and dealers to commit to future trades – hence the name “futures.” The advantage of such deals was that both the dealer and the farmer would remain unaffected by price changes. But now, futures are also used by traders for speculating. These traders have no intention of taking the underlying asset into possession and opt for a cash settlement.

Differences between Options and Futures

At face value, options and futures contracts don’t look much different. However, there are several differences between them, all of which are contrasted below.

Buying a contract: Premiums and Margins

When you enter an options contract, you must pay a fee called a premium. The premium is essentially the price of the contract paid to the seller or the writer of the contract. By convention, an options contract represents a commitment of 100 shares. On the other hand, when you enter a futures contract, you must put down the initial margin of your position. The value of this margin varies from contract to contract and is established by the exchange. It is typically between 3% and 9% of the value of the contract.

Besides paying the margin, a trader must also hold a maintenance margin in their account until the contract is sold or complete. The value of the maintenance margin required is stipulated in every futures contract. Entering a futures contract also entails the mark-to-market process, wherein the margin balance is adjusted from your account daily. The profit or loss from the position is calculated at the end of each trading day and transferred to/withdrawn from the trader’s account balance.

Bear in mind that the margin may drop below the maintenance margin level, in which case a margin call is generated. The trader must wire the required funds into their account, and if they don’t, the position will be liquidated. The remaining payment and the commissions are settled when the futures contract is completed.

Note:

The margin you must pay to enter a futures contract may range in the thousands. In contrast, option premiums typically cost less than a hundred dollars.

Risk and leverage

The only risk involved is the premium. The risk is pre-defined and limited, so you know precisely how much you would lose if things don’t go your way. Selling options contracts, on the other hand, is a lot riskier. The risk to the writer of the option (the seller) is virtually infinite since there is no telling how high the price would go. That being said, the odds of winning trade are much higher when you sell options compared to when you buy them.

The value of a contract is determined by the value of the asset being traded. Regardless of if you’re on the buying or selling end of the contract, there is no telling how much you stand to lose (or gain). Furthermore, since futures use leverage, both parties are at much higher risk. While options contracts also make use of leverage, the risk posed to those holding futures contracts is much higher since the leverage is also much higher.

You can enter a futures position with 10x leverage. This could exponentially boost your profits, but at the same time, you also risk losing a significant chunk of your capital.

Pattern Day Trader Rule

The Financial Industry Regulatory Authority enforces the Pattern Day Trader rule. The rule applies to most securities, including options. If you have less than $25,000 in your trading account, the rule will come into play and limit the number of trades you can make in a day.

If you want to execute more than four trades per day for five consecutive days as day traders do, you will need to add $25,000 to your trading account. The PDT rule does not apply to futures options, since those aren’t regulated by the FINRA.

What is FINRA?

The National Futures Association regulates futures, and it imposes no such restrictions.

Time Decay

As an options contract moves closer to expiration, its value is expected to decline since the chances of the option yielding profits declines steadily.

Futures contracts aren’t affected by time decay because both parties are obligated to transact at the end of the contract period. Regardless of if you enter the trade a day or a year before expiry, you don’t have to factor in time decay and be concerned about it affecting your trade.

Liquidity and overnight trading

The US stock market is open from 9:30 in the morning to 4:00 in the noon, which is when options are traded. While many brokerages now facilitate after-hours trading, using it isn’t ideal for traders, since contract liquidity is highest when the market is open. Besides, trading after hours isn’t a good idea since price movements are more erratic, slippage is increased, and the bid-ask price spread is a lot wider.

Futures markets are open for business 24/7, and since the markets are robust and liquid, you don’t have to deal with the issues that trading options entail. Futures are traded in large volumes daily, even on holidays, which means you can enter and exit your positions at any time without hassle. Traders overseas and those who work a 9-5 prefer trading futures over options for this reason.

Profitability

There is no limit to how much money you can make with options and futures. Both contracts can be equally profitable. Knowing this, deciding between the two can seem difficult. If you’re confused between the two, remember that trading futures contracts are a lot riskier than trading options. Future contracts involve a high amount of leverage, and trading them isn’t suitable for inexperienced traders with a low-risk tolerance. An unprecedented swing in the price direction can have a disastrous effect on a trader’s portfolio and even affect their well-being.

Trade futures only if you have a high-risk tolerance, can manage risks appropriately, have consistently been unemotional about trading, and have the capital to back the trade-up if it goes wrong. If you’re new to trading and don’t fit the mold, stick to trading options until you do.

Tax

Futures are subjected to more favorable tax laws than options are, which is good news for swing traders and scalpers. The tax laws are for futures are also much less complex. The US tax code states that futures contracts must be taxed on a 60/40 basis of long- and short-term capital gains rates. The length of the trade is irrelevant.

In other words, 60% of the returns from your trades are taxed at the long-term capital gains tax rate of 15%. The remainder of the returns is taxed at the short-term capital gains tax rate of 35%. Working out the numbers, you will need to pay 23% of your gains from futures trading to the government.

Calculating the tax you need to pay for trading options is a lot more complicated. You must consider the length of the trade, whether you were the writer or a holder in a trade, and if you were working with a put or call. The long-term capital gains rate applies if an options trade is held longer than a year. On the other hand, the short-term capital gains rate applies if a trade is held for less than a year. You must do your due diligence and consult a professional before you begin trading futures or options.

Step-by-step guides on how to trade Futures and Options

Both futures and options are risky contracts, and entering either can destabilize your portfolio. Navigating futures and options trades is challenging and risky. There are several factors you need to consider before you decide which one to pick. Take your risk tolerance into consideration, factor in the liquidity you have, and also when you want to retire.

If you’re worried about trade complexity, you can get your hands on some index-based futures contracts such as the E-mini NASDAQ futures. They are easy to navigate. If you want to trade something that gives you the flexibility to sell any time, you can buy options on high-value stocks, especially tech stocks. Checking out the stocks on S&P 500 and the Dow Jones Industrial Average is also a good idea. A rule of thumb is to take as little risk as possible. Both futures and options are highly risky instruments that can leave you in a bad financial position. However, if you have the capital to cope with high risk and work alongside financial advisors and professional traders, trading both futures and options isn’t a bad idea.

How to trade Futures

Step #1: Understand the risks

Trading futures can be nerve-wracking. But if you understand what you’re in for, you will feel more comfortable taking risks. What you need to remember is that futures are leveraged financial instruments. It means that you will be paying a comparatively small amount up-front to control a much larger amount.

The high leverage can boost your profits astronomically. Notwithstanding, it is a double-edged sword and will also amplify your losses. You stand to lose much more than you initially invested. Planning your trades carefully is a must before you enter a position. Make sure you identify both the profit objective and have an exit plan ready for all possible scenarios.

Step #2: Sign up with a brokerage

Getting started with trading futures is much easier than you’d expect. You can open an account with a broker in a matter of minutes. A futures broker will inquire about your income, trading experience, and net worth. Questions like these help the broker gauge how much capital you can realistically risk.

Ensuring that the brokerage provides access to the markets you’re interested in is critical. Also, since there is no industry standard as far as commissions and fee structures go, check out a handful of brokerages even after you think you’ve found the right one. There are several reputable brokerages in the industry, but each one offers different sets of services. While some provide excellent research tools, they may not provide you with a quote and a chart. Some may offer charts but not help you with research.

Many brokerages give traders access to demo accounts, which are accounts that come loaded with false virtual currency. You can use this account to practice strategies and make trades in the market without risking real capital in your trading account. If you haven’t traded futures before, we recommend spending some time using the demo account and getting a grip over strategies before using any capital. Even seasoned traders make use of these accounts to try out new strategies.

Not every brokerage offers a demo account. You must do your due diligence and only sign up with a brokerage that meets your needs.

Step #3: Pick the right market to trade in

Always start trading futures in markets with assets, industries, or sectors you know a lot about. If you’ve been trading metals for a long time, trading gold futures may be the right way to go. Start with your comfort zone, and slowly and carefully venture out to another market you think will serve you well.

Aim to focus on two markets at the most, since this will allow you to focus your attention optimally. After you pick a futures market, begin working on forming an opinion about its price movement. Study relevant news stores, do some technical analysis and treat it like you would treat an equity trade. When you think you have a good idea of which direction the asset’s price is heading, sift through futures contracts, identify them by size and duration, and find one that suits the circumstances.

Step #4: Execute and manage the trade

After you settle on a futures contract, create an entry and exit plan. Also, calculate the initial margin requirement, so you know how much you need in your account to go through with the trade. When all is set and done, establish the position by submitting an execution order. Don’t forget to plot out your exit strategy using a stop order or a bracket order, or another protective order.

While a protective order will help manage risk, you must remain diligent and be ready to re-evaluate your exit plan if the market begins moving against you.

How to trade Options

Step #1: Sign up with a brokerage

Options trading is discernibly not as simple as equity trading, since there are more moving parts. You must brush up on your options trading lingo before heading online and finding the right broker. Options brokerages will need to know more about you before they can allow you to trade options. You will be screened, and the brokerage will assess your trading experience, background, net worth, and more.

After the brokerage gauges the risk you can take and your financial preparedness, the details will be documented in a trading agreement. It is only after screening and documentation that your request to use a platform to trade be accepted or rejected.

You can expect that the brokerage will ask you to provide:

- Details of your trading experience: It helps the firm gauge your investing knowledge. You must also provide them with specifics like how many trades you make a year and the typical size of your trades.

- Financial information: You must calculate your liquid net worth and account for the investments you can sell for cash quickly. The brokerage will also need to know your net worth and employment information.

- Investment objectives: The brokerage will inquire if you want to trade full-time, for growing your money, to preserve your capital, or only for speculation.

- Options types: The brokerage will ask you whether you intend to trade calls, puts, or spreads. If you choose to be a seller or writer, you will be obligated to surrender the stock if the buyer exercises the option. You must inform the broker if you protect your trade with underlying stock, i.e., make covered trades or trade unprotected or “naked.”

After collecting your answers, the brokerage will assign you a trading level based on the highest level of risk you can take.

The screening process should never be one-sided. If you’re interested in doing business with a broker, ensure that you ask them all the questions you want. If the broker does not offer the research tools, guidance, and support you need to make money, the brokerage isn’t worth signing up with.

Note:

If you’re new to options trading, you must be especially careful, since the brokerage you use can make or break your chances for success.

Step #2: Choose Options to buy or sell

Here’s a quick refresher about the terminology you need to know:

- A call option is an instrument that gives a trader the power to buy shares at a pre-determined price. However, the trader may choose not to buy the stock at all.

- A put option is an instrument that gives a trader the power to sell shares at a pre-determined price. However, the trader may choose not to sell the stock at all.

If you’re expecting the price of an asset to go up, you can either buy a call option or sell a put option to make a profit. On the other hand, if you’re expecting the price of an asset to fall, you can either buy a put option or sell a call option to make a profit.

Step #3: Speculate price movement

Regardless of what option you buy, you must remember that it only retains its value if the contract is closed “in the money.” For call options, it means that the current price should be higher than the strike price for you to make money. In contrast, if you have a put option, the current price should be lower than the strike price.

Before you spend any money and buy a stock, ensure that its strike price reflects where you want it to go.

Let’s say you believe that the price of an asset currently trading for $100 will rise to $110 in a week. You can buy a call option with a strike price of less than $110, and if the price does rise above the strike price, your option will be “in the money.” You may not find a call option selling for the price you want. However, as long as you make sure that the price is no higher than $110 minus the option price, your trade will remain profitable.

By the same token, if you believe that the price of an asset trading at $100 is going to fall to $80, you can buy a put option. Make sure that the strike price is above $80. If the price of the asset does fall to $80, your option will be “in the money.” You may not find a put option selling for the price you want. However, as long as you make sure that the price is no lower than $80 plus the option price, your trade will remain profitable. Bear in mind that you cannot type in a strike price. Every options’ brokerage will give you access to an “options quote”, which comprises a range of strike prices. The strike price is calculated separately for each stock.

However, the increments in the strike price remain constant. For example, the increments between strike prices maybe $1, $2.50, $5, and so on.

Step #4: Work out the Option time frame

Before you enter a position, you must work out the expiration period of the contract. The expiration period indicates the last day you can exercise an option before it is rendered valueless. Just like you cannot type in a strike price, you also cannot type in an expiry date for your options contract. You will need to pick from the limited number of options your broker provides you from the options quote.

One of the most important things for you to remember is that there are two styles of options – American-style and European-style. American-style contracts are more expensive than their European counterparts, but give traders the flexibility to exercise the option at any time before expiration. While European options are cheaper to get your hands on, you can only exercise your option on the day of expiry. For this reason, European options are considered a lot riskier, and most traders prefer trading American-style options.

The expiration of an option can range from days to years. However, as mentioned earlier, options are affected by time decay, and the longer the expiry, the higher the risk of the contract not yielding a profit. Long-term traders can still take their chances with monthly and yearly options contracts. Time decay is a factor, but the longer expiry period gives the asset plenty of time to move.

There is also the possibility of retaining some time value even though it is trading below the strike price. If you see that the trade has gone against you, but there’s a lot of time left for the contract to expire, you can still sell the option and make as much as the time value is worth. However, options that expire in a day and week tend to be the riskiest, and if you haven’t traded options before, steer clear of them.

Conclusion: Is trading Futures or Options right for you?

Is trading futures right for you? Or is options trading far better for your portfolio? The answer to those questions isn’t straightforward, but the number one thing you need to consider is your risk tolerance. While you don’t necessarily have to pick between the two and can trade both, if you’re starting your trading journey, trading options is the right thing to do since you don’t risk much capital.

After you master options trading and understand the ins and outs, dabbling with futures contracts and taking slightly bigger risks is the way to go. Demo accounts can be extremely helpful in getting comfortable with trading futures.

FAQ – The most asked questions about Options Vs Futures :

What is the difference: Options Vs Futures?

Futures are contracts that give authority to the keeper with the right to purchase or sell a specific commodity at a chosen price on a speculated date in the future. Whereas on the other hand, people who hold options have the right to purchase or sell an underlying asset at a given price on a given date in the future, but they are not obligated to do so. This is the specific distinction between futures and options.

Which is better: Options Vs Futures?

Futures tend to have a greater margin, seem easy to value and understand, and are usually more liquid than options. Due to these reasons, they seem to have the edge over options. But at times, they may become more complex to comprehend than the underlying assets that are being tracked by them. Futures come with a lot more risks than options, so you must be careful while trading in them.

Which will bring you more profit: Options Vs Futures?

Both options and futures do not have a limit on the money-making part and bring great profits. But if you cannot seem to choose, you should always keep in mind that trading futures contracts are always involving more risks since a high amount of leverage is involved. Therefore beginners must not trade in futures contracts and must prefer staying with options.

See our similar blog posts:

Last Updated on January 27, 2023 by Arkady Müller

unsplash.com/frankbusch

unsplash.com/frankbusch