What is Social Trading? – Tutorial and platform review

Table of Contents

Definition and explanation:

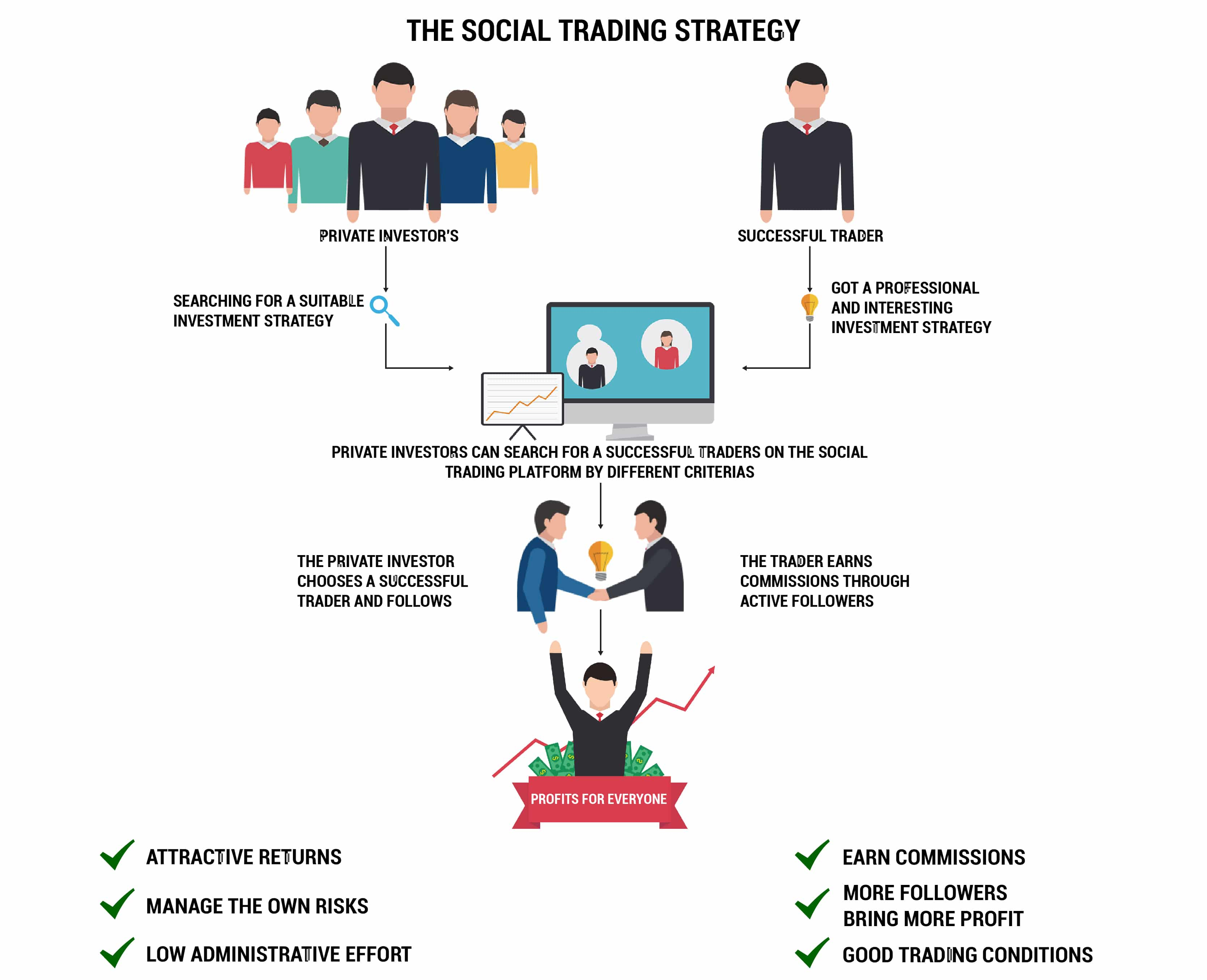

The term Social Trading means that private investors follow or copy the trades of successful and professional investors. Nowadays, it is a very transparent process without a lot of administrative effort. By using Social Trading the trader can earn which is better than most finance products of banks. Intelligent platforms allow the trader to manage the risk and invest the capital by different criteria.

**Please note that instruments restrictions may apply according to region

As you see in the picture above there is always a clear structure for Social Trading. First of all, you have to search for successful traders or investors on the trading platform which offers the copy service. You can use these different criteria (risk, yield, and more). If you found the right trader who fits your expectations you can start to follow him. In the next sections, we will discuss each step in detail and give you the best tips for Social Trading.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Why is Social Trading so popular?

Nowadays, Social Trading (link Wikipedia) is a trend for retail investors. The interest rates are very low and the most fonds performed badly. Social Trading is the solution for retail investors who want to earn money with online trading. Online trading can be difficult and hard to master. You need a lot of experience and knowledge. Professional traders are available on Social Trading platforms.

With just 2 clicks you can follow a successful trader and copy his trades. The trading platform shows you all the information which you need to make investment decisions. For retail investors, it is very easy to sign up and invest in a portfolio. Even trading with small amounts of money is possible.

The advantages of Social Trading:

- Copy successful trading strategies

- Trade forex, stocks, CFDs, and ETFs

- Profit from experienced traders

- Fully automated process

- Manage your risk by yourself

- Start trading with a small amount of money

The disadvantages of Social Trading:

- Without knowledge, it will be hard to make a profit

What is the best Social Trading platform?

On the internet, you will find a lot of different offers for Social Trading. Most of the time there is a lack of financial regulation on this platform. On this page, we will present to you the biggest Social Trading Platform in the world “eToro”. It is a leading platform and from our experience better than any other Social Trading platform.

eToro is regulated and licensed by highly trusted authorities like the CySEC, FCA, and ASIC. Your funds are safe with this broker and you can use a huge variety of payment methods to fund the trading account. Practice and testing the platform are possible too by using the free demo account. You can trade stocks, forex, commodities, and ETFs.

The platform is very popular and used by a lot of traders. Traders who want to join Social Trading will find enough offers to copy and follow. Another advantage of the platform is the customization of the Social Trading function which we will show you in the next sections. All in all, we can recommend eToro because of the range of offers and trustworthiness.

The advantages of eToro:

- Regulated and licensed Online Broker

- Leading Social Trading Platform

- Copy automatically other people’s portfolio

- Stocks and CFDs for forex, commodities & more

- Free demo account

- A low minimum deposit of $ 200

- Competitive fees

- Professional support and service in different languages

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

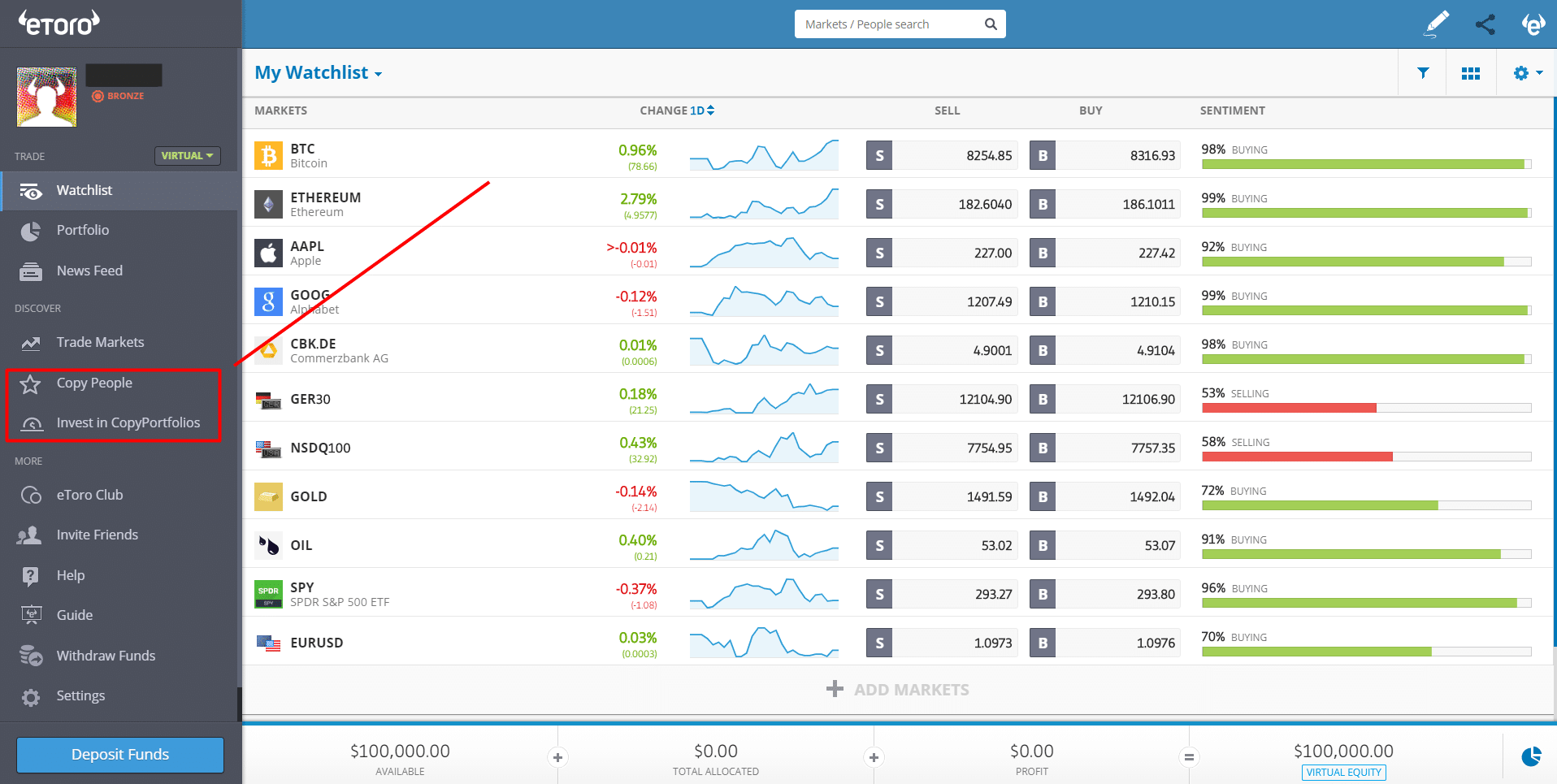

1. Choose “Copy People” or “Invest in CopyPortfolios”

In the picture below you see the eToro trading platform. On the left side, there is a menu where you can choose “Copy People” or “Invest in CopyPortfolios”. The difference between these 2 options is that you can follow real traders or follow a portfolio of markets, top traders, or partners. First of all, we recommend choosing “Copy People” to get an overview of the main functions.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

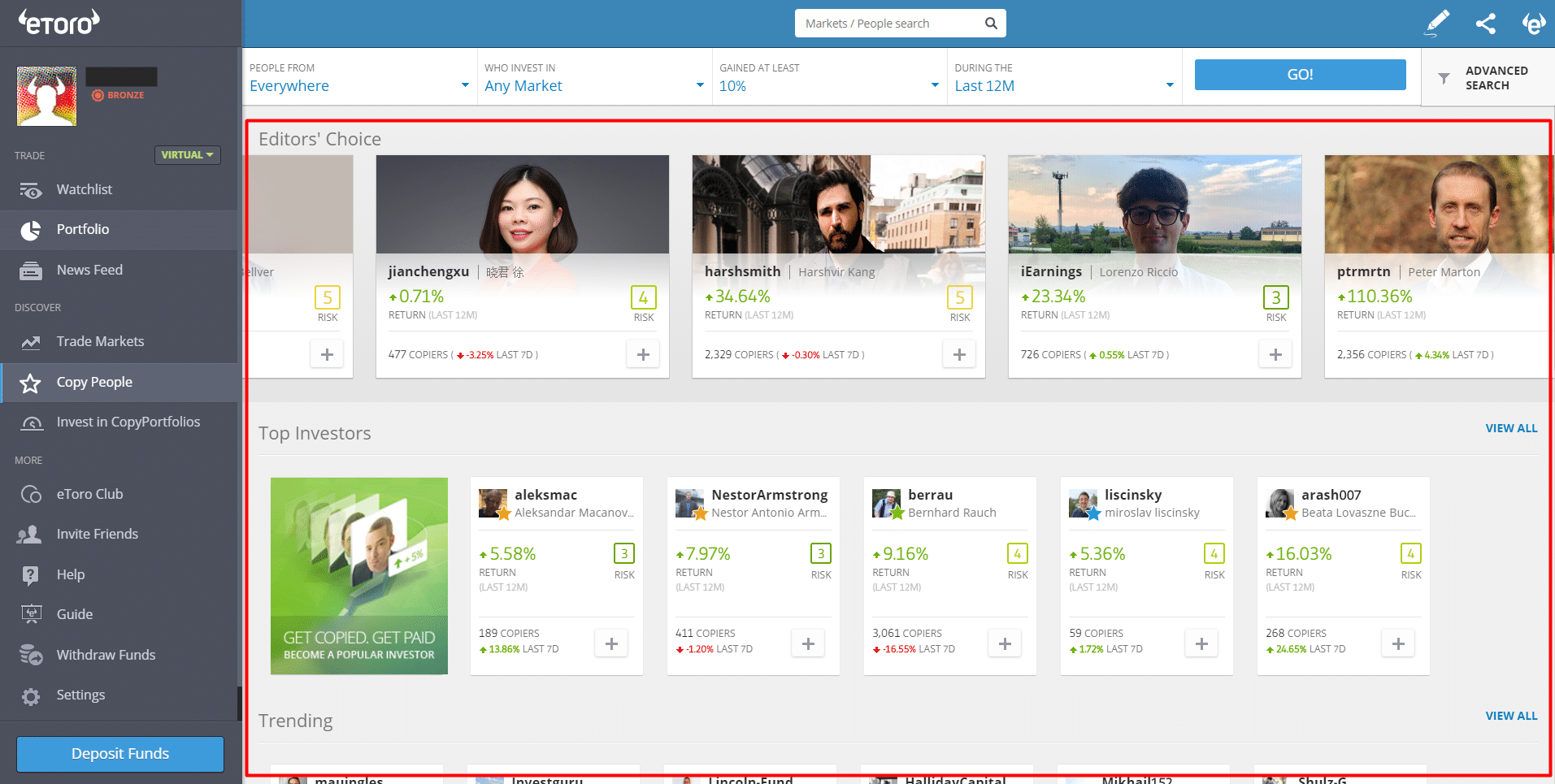

2. Get an overview of the traders and investors

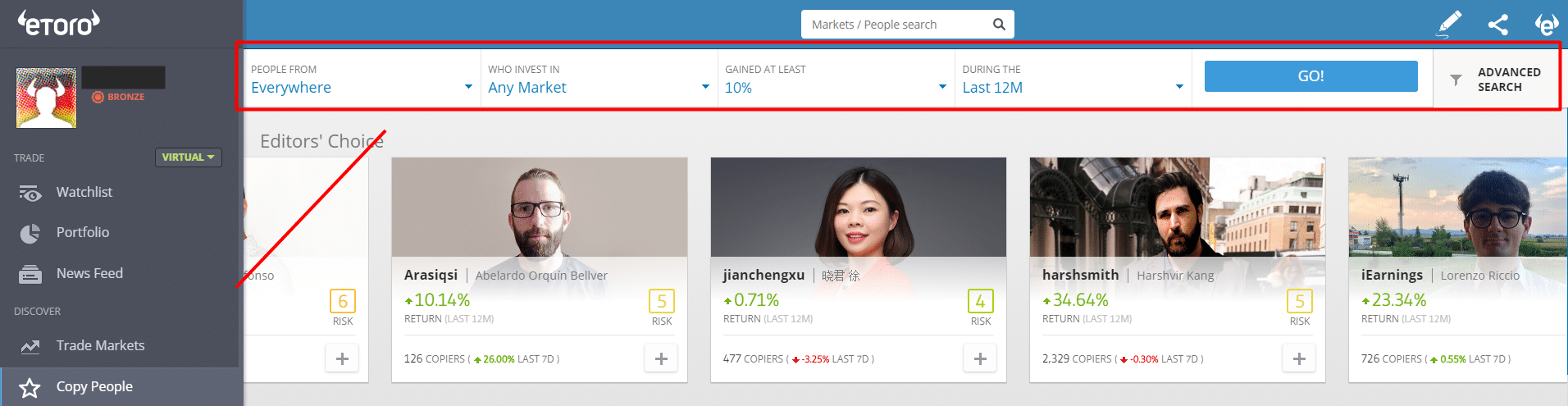

Now you see the Social Trading platform of eToro. We will discuss the details in the following sections. On the top, you see the recommended traders of eToro. If you go with your courser on the pictures there will show up a small description of the trader. Besides, you see the return of investment over the last 12 months and the actual followers of the trader.

eToro is rating the traders by a risk number. The risk number is depending on the maximum drawdown in a certain period. Below that you can find the top and trending investors. This is a nice shortcut to find the most profitable traders at the moment.

3. Search for traders by criteria

You can search for traders by the criteria you want. This is one of the key features of eToro Social Trading. There are different options like trader’s country, markets, profit, and profit time. For more options, you can choose the advanced search.

From our experience, it is easy to find the right trader. Before you start you should learn about the different options and criteria.

Criteria for searching:

- The time period of the profit

- Country

- Return (profit)

- Daily and weekly drawdown

- Portfolio size

- Activity

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

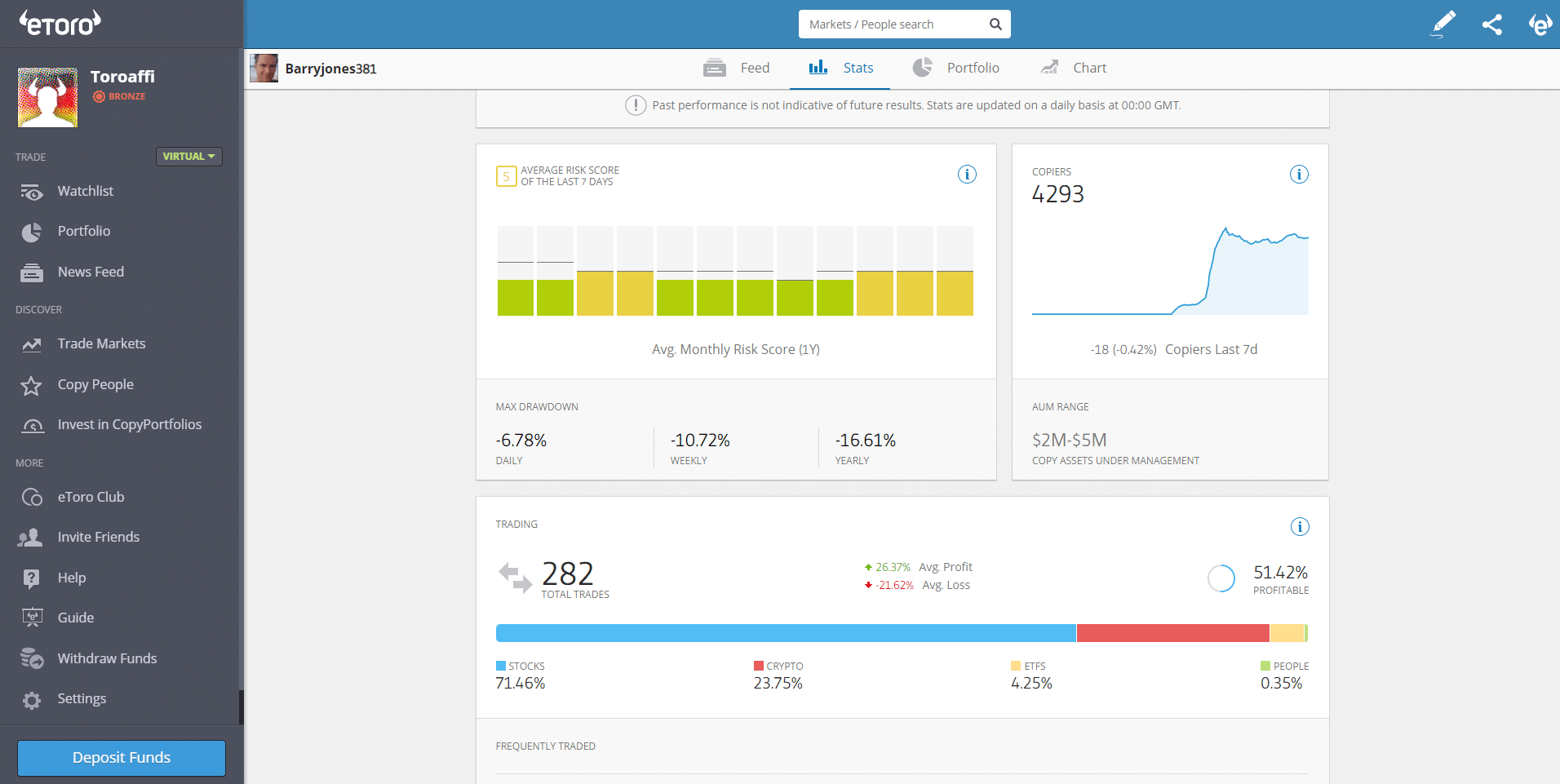

4. Check the stats of the trader

By clicking on the profile of a trader you will see the actual stats of the portfolio and investment strategy. The advantage of the eToro platform is that the stats are shown very transparently and every investor can assess the risk and trading strategy.

The actual traders, profit, and drawdown are shown. Besides, there is the option to see the portfolio and in which markets the trader invest. Furthermore, you can contact other traders by the news feed and see the chart of the portfolio evaluation. In the picture below you see the stats of the trader.

Overall, there are professional graphs that show you information to develop a successful social trading strategy. As an investor, you can decide if it is worth investing in or not. In the following points, we will give you an explanation of the stats.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Performance:

- See the profit of the portfolio

- Some traders are active for more than 1 year

Risk Score:

- Maximal Drawdown

- Average of the risk score

Copiers:

- See how much investors are following the trader

Trading:

- Markets in which the trader invest

- Average loss and profit

- Current trades

- Trades per week

- Holding time of trades

- Profitable weeks

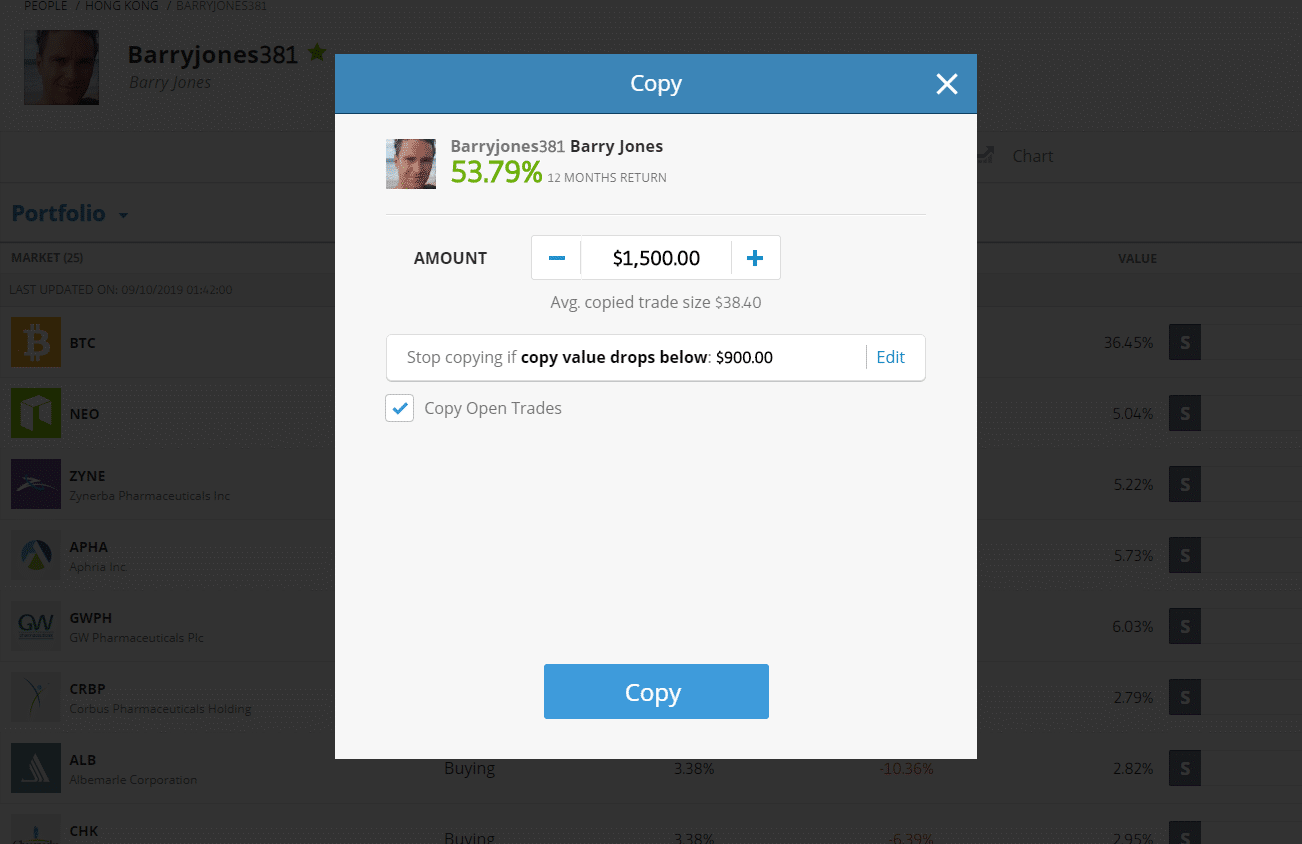

5. Start copy trading

Just click on “Copy” to start investing. You can choose the amount you want to invest in. The minimum investment is $ 200 and can be different from trader to trader because it is depending on the portfolio sometimes. Below that you will see the average copied trade size.

For example, if you invest $ 1,500 into a trader’s portfolio the average copied trade size can be $ 30.40. This is depending on the trading volume. In addition, you can check the option “Stop copying if copy value drops below:”. This is an automatic risk limit but you can manage the positions later too. Also, there is the option to copy open trades. By checking this option you copy the open trades whether it is in profit or loss.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

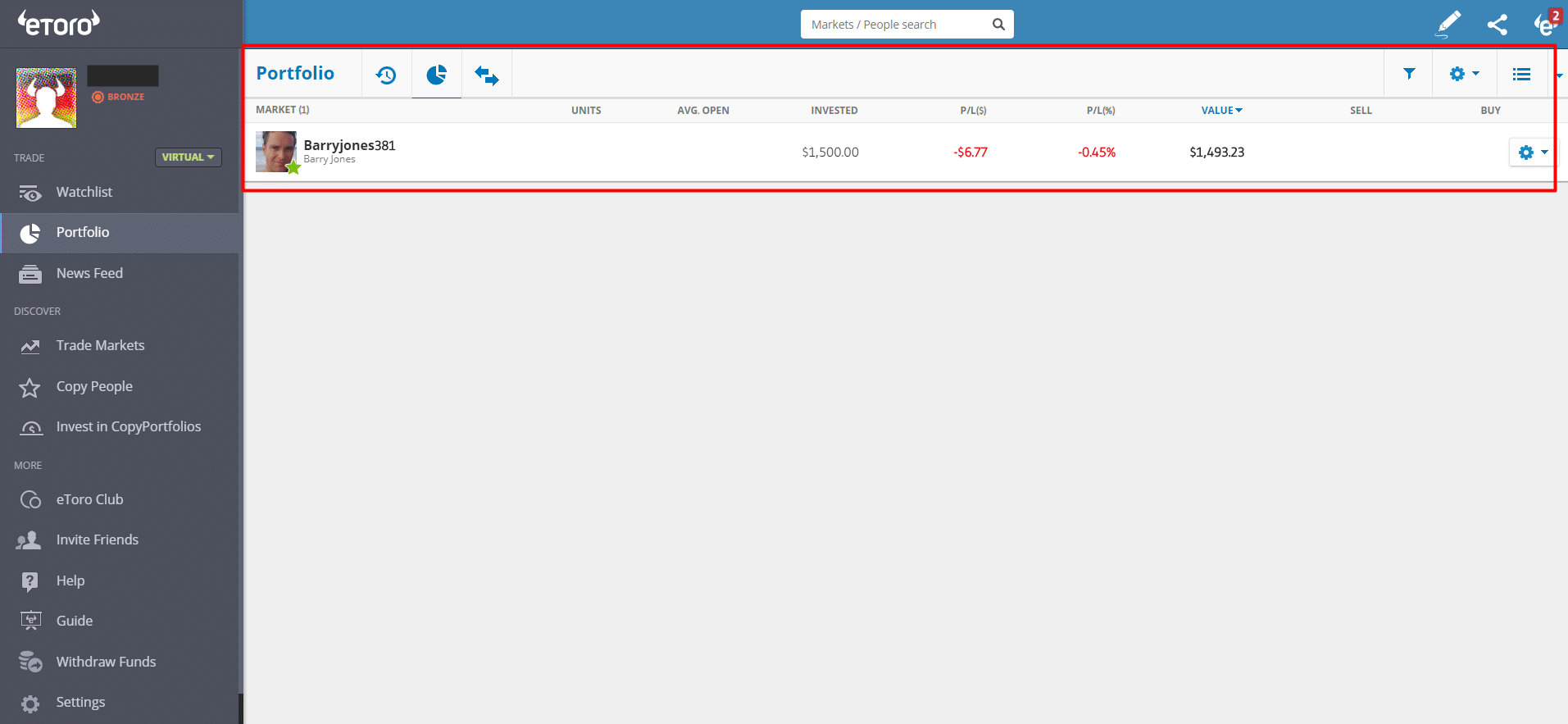

6. Manage your portfolio

You can manage your portfolio at any time or add funds to social trading. In the picture below you see the portfolio menu where are all opened positions are listed. Investing by Social Trading is like opening a trading position on the markets.

Manage your portfolio with the following options:

- Add Funds

- Remove Funds

- Pause Copy

- Set Copy Stop Loss

- Stop Copying

- Write New Post

- View Chart

- Customize

Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

7. Social Trading is not difficult

In the step-by-step tutorial, we showed you how easy it is to start social trading. From our experience eToro is the best platform for copy trading because it is a regulated and safe platform. You see transparent the stats and history of the traders and also their open positions. You can not make it more transparent than this. Our recommendation is to start with the free demo account first and test the platform. If you feel comfortable you can do your first investment.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

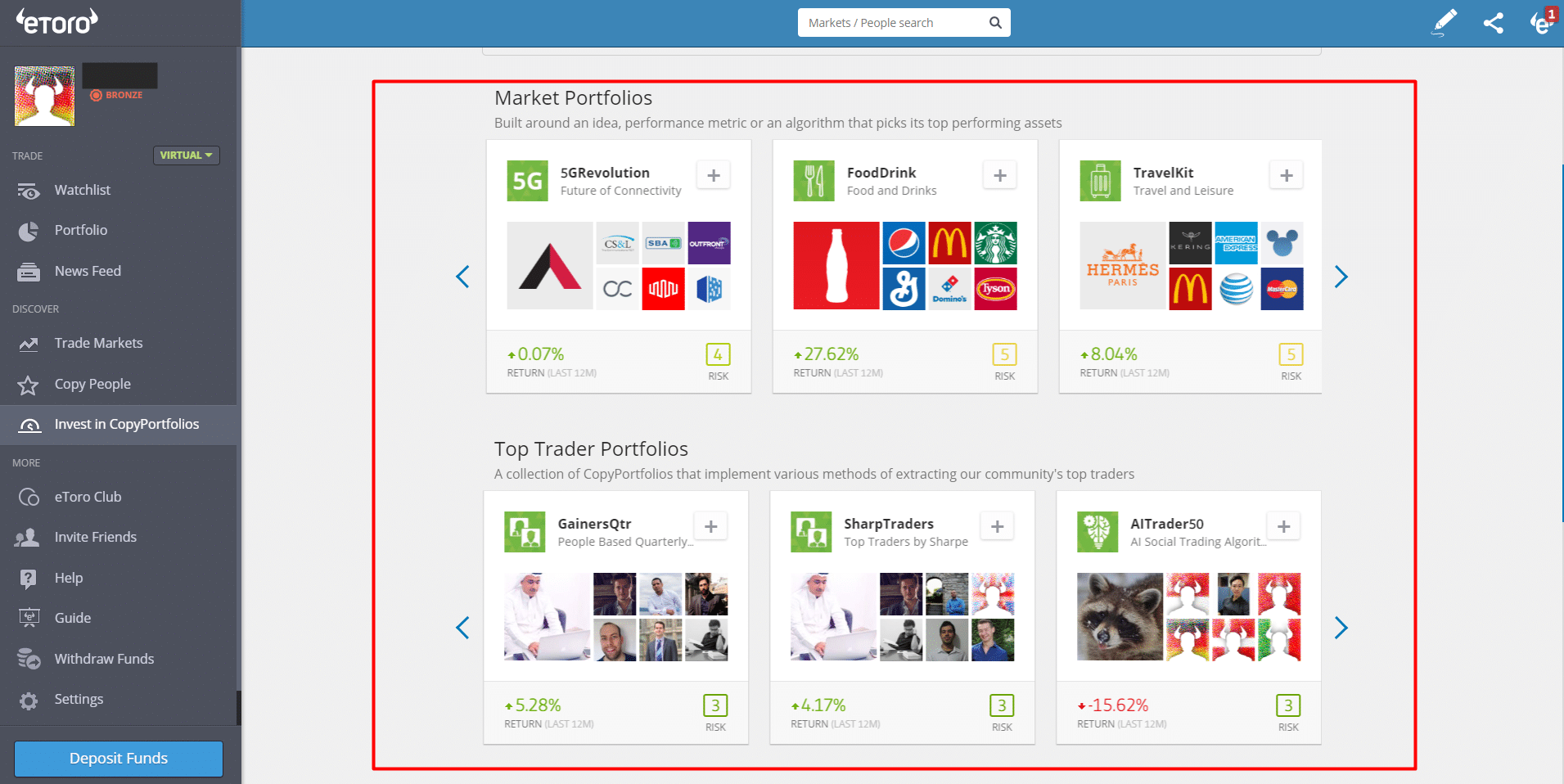

CopyPortfolios are an interesting option for Social Trading

Next to the “Copy People” option, you will find the CopyPortfolios in the trading platform. This can be a good alternative to following other traders. CopyPortfolios are Trader Portfolios or Market Portfolios. The Trader Portfolios comprise the best performing traders in one asset and the Market Portfolios bundles together different markets like stocks, commodities, and ETFs.

It is similar to a fond or banking product of retail banks but with eToro, you will have more control over your investments. See the picture below for CopyPortfolios.

Market Portfolios

Market Portfolios are created by the top-performing assets which are picked by the algorithm. There are many options for you to invest in. One Market Portfolio covers a specific area in the financial markets. For example, the Portfolio invests in forex and sells short bank stocks. Like in the Social Trading function you can see transparent the stats of the portfolio.

From our experience, Market Portfolios are a good way to generate investment ideas or invest in a whole area that performs very well in the financial markets. The Market Portfolios can contain stocks, commodities, ETFs, and currencies.

Popular Market Portfolios:

- 5GRevolution (Future of Connectivity)

- FoodDrink (Food and Drinks)

- TravelKit (Travel and Leisure)

- DroneTech (Drone Technology)

Top Trader Portfolios

Top Trader Portfolios contain the best traders which you can copy. If you do not know which trader you should follow it is maybe the right option for you. In the Top Trader Portfolio, you will see a mix of portfolios of different traders. It is a good way to spread the risk over many investments. In addition, you will see the risk of the portfolios and the traded assets.

Before you invest, you should check the stats of the portfolio and do deeper research into the markets. To start trading a CopyPortfolio, you will need more money than by following only one trader.

Popular Trader Portfolios:

- GainersQTr

- SharpTraders

- AlTrader50

- ActiveTraders

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Is Social Trading a scam or not?

If you want to start Social Trading the safety and seriousness of the trading platform are very important. On the internet, you will find a lot of offers for copy trading and social trading but you should have a deeper look at the offer. To exclude a scam or fraud you should look for an official finance regulation and license of the platform.

eToro is a high and multi-regulated broker for Social Trading and the company show trustworthiness through different achievements and awards. What we can not recommend is to use a Social Trading platform without financial knowledge. As a trader, you need to know that you can not make a profit without the risk. Social Trading is very risky because the past results of the traders do not guarantee profits in the future.

Criteria for a serious Social Trading platform:

- Regulated and licensed trading platform

- Financial security of customer funds

- Transparent trading conditions

- No hidden fees

- The broker has to be popular and used by many traders

- Information and stats about traders

Tipps and tricks:

Be aware of the risk of your investment. It can happen that you lose your whole investment amount if the trader does wrong investment decisions in a row. For getting a better result in Social Trading we recommend investing in more than one trader. If you invest in different traders who made a good profit in the past you can limit your risk of losing the whole investment.

Demo Account:

Another important feature of the platform is the demo account for beginners. On eToro you can switch with one click between the virtual portfolio (demo account) and the real portfolio. The balance of the demo account is 100,000$. It is virtual money and you can trade without risk by simulating real money trading.

Especially for beginners or new users of the platform this virtual account is useful. You can test the features and functions of the Social Trading platform for free.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Conclusion: Social Trading is a legit investment opportunity

On this page, we showed you how Social Trading works. All in all, it is a good investment opportunity for investors who want to rely on professional and successful traders. The investor decides in which portfolio he wants to invest and how high is the risk.

It is important to choose a reliable and serious Social Trading platform. That is why we can recommend eToro. The online broker is multi-regulated and used by millions of traders. eToro allows you to invest in 1,500 different markets (stocks, currencies, ETFs, and more). Based in Europe the company acts internationally.

Keep in mind that Social Trading is risky like any other trading style. We recommend starting with a free demo account. In addition, the minimum deposit of the platform is only 200$. Nowadays, it is possible that any type of trade can use Social Trading with a secure platform.

Facts of Social Trading:

- Attractive returns

- Manage their own risks

- Low administrative effort

- Choose a regulated platform like eToro

Social Trading is like a revolution against conservative investment strategies. It can bring you a lot of advantages over most market participants

Trusted Broker Reviews

Experienced traders since 201376% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

FAQs – The most asked questions about Social Trading:

What are the benefits of social trading?

Social trading operates by following experienced traders, those who execute insightful trading judgments and through experience and smart approaches. A platform offering social trading makes this simple by allowing you to join top professionals and watch all of their trading activities.

Does social trading cost money?

The top platforms don’t charge you anything to mimic other experts. Nonetheless, there are minimal restrictions in regard to the investment amount. A social trading system, for instance, can let you mimic other investors for free if you invest at least 200USD in your brokerage account.

Is it feasible to make a living through copy trading?

In the past few years, copy or social trading has emerged as one of the most prominent techniques to make passive money in the financial sector. Novices can possibly make as much as experts by using specific platforms and tools that enable them to emulate seasoned traders.

What is the difference between copy and social trading?

Social trading allows you to observe other investors’ holdings and trading decisions, whereas copy trading implies that your accounts will replicate their moves. You purchase if they purchase. You sell when you see them sell. Copy trading is a type of social trading in which clients can mimic the actions of other skilled investors.

eToro is a multi-asset platform which offers both investing in stocks, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Last Updated on January 3, 2024 by Andre Witzel