Fullerton Markets review and test – Is it a scam broker or not?

Table of Contents

Fullerton Markets live by its core values: “Passion, Excellence, Commitment, and Sustainability.” They take pride in being an unassailable force of nature, determined to be the best online trading platform in the entire cyberspace.

So far, they seemed to have achieved it, as you will read below. Their highest goal is to continuously build their company brand as the top-level Asian foreign exchange brokerage company. Continually being a profitable enterpriser and innovator, thus making a positive influence on the financial community. We have over nine years of experience and made exhaustive scrutiny of the platform and the services it offers. Once you have entirely read this review, it will invariably help you to decide whether you are going to use it or not.

Is it a scam broker or not? – Lets find out in our review.

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.2 / 5) (4.2 / 5) | Previously regulated by FMA. Currently unregulated | $0 | 22 | Can go as low as 0.1 pips |

What is Fullerton Markets? – The company presented

Its full company name is Fullerton Markets International Limited or FMIL. It is an international foreign exchange broker, which was previously established in 2015 in New Zealand and now has its base of operations in Saint Vincent and the Grenadines. It is currently the fastest-growing online brokerage company in Asia.

The current CEO or Chief Executive Officer is Mario Singh, who is based in Singapore. He gave the company worldwide acclaim and credibility since he frequently appeared over forty times as a finance expert in international media outlets like Bloomberg and CNBC, which has over 350 million audiences in the entire world. He has also been brought in by a couple of the largest banks worldwide as a corporate consultant to speak to their clients about financial topics.

He is also an accomplished author with four acclaimed books titled: “Unlocking the World’s Largest Financial Secret,” “17 Proven Currency Trading Strategies,” “The Magical Rules of Three,” and “Secret Conversations with Trading Tycoons.” All of these books are highly recommended by global leaders. Fullerton Markets is similar to other trading platforms, wherein they provide full access to the financial markets of the world. What sets the platform apart is that its transactions can be carried out with no requite. You, as a client, will acquire the most beneficial price when buying or selling.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

The company has excellent partnerships with liquidity providers, who are at the top in their fields and offer highly competitive prices. It has garnered liquidity for the top banks and ECNs (Electronic Communication Networks) of the planet like Citibank, Credit Suisse, Deutsche Bank, Hotspot, FXSpotStream, JP Morgan, and Barclays.

Here is its company information:

- Registered address- 1st Floor, First St. Vincent Bank Ltd Building, James Street, PO Box 1574, Kingstown, VC 0100, St. Vincent and the Grenadines

- Telephone number- +442038088261

- Email- [email protected]

Customer support is available 24/5 through the chat service and online contact form.

Core values of the company

The Fullerton Markets team has passion. They are searching for new ways to challenge themselves to reach progress through innovation. They are committed to enriching their clients by giving them great opportunities to educate themselves and flourish in the fast-paced world of online trading.

Excellence is their trademark. They had partnered with some of the largest banks and supplied each one with tier-one liquidity. They ensured that their potential traders would benefit from accessing the most outstanding financial markets on the planet and provide a streamlined experience in trading in their online platform.

They commit to providing strong safety measures with Fullerton Shield that enables triple-level protection for the clients’ funds. They also offer Negative Balance Protection, which guarantees that their customers’ trading accounts will never get negative balances. They have cultivated an atmosphere of trust, wherein every trader is protected and has the opportunity to be wealthy.

Finally, they take pride in their sustainability, and their long-term goal is to make sure that each customer can be successful in the trading markets. Then will invariably make the right decisions. These aspects will be beneficial in the future. And will aid in the clients’ being productive and expert traders.

Is Fullerton Markets regulated?

Fullerton Markets was previously regulated by New Zealand-based FMA or Financial Markets Authority. However, in 2018, the company all its Fullerton Markets Limited business entities in New Zealand to a new company based in St. Vincent and the Grenadines, with a new name: Fullerton Markets International Limited.

Even though the brand new company is incorporated and registered as an offshore entity in St. Vincent and the Grenadines, it is not regulated. Most seasoned traders prefer regulated brokers due to the protection it provides, but Fullerton Markets has security measures in place, like the Fullerton Shield (as mentioned in another segment above), which has a triple layer of protection. Its features include Professional Indemnity, Independent Custodian Protection, and Crime Insurance. Full information will be explained in another segment below.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Fullerton Markets trading platforms presented:In trading, the trading platform is crucial. If you trade with Fullerton Markets, you can use several trading platforms at once. In addition to the well-known platforms MetaTrader 4 and MetaTrader 5, you can also trade social trading with CopyPip as well as with MirrorTrader and analyze the markets. We will take a closer look at the trading platforms and the suitable account models in the following. At Fullerton Markets, you can tailor your own trading with the selection of different options.  MetaTrader 5 (MT5)MT5 is a familiar tool by experienced traders in the entire world and is mostly utilized by online brokerage companies on their sites. It is famous for its easy navigational interface and many essential features, like advanced charting capabilities and one-click trading. It, in turn, makes trading an uncomplicated and enjoyable chore. There are over fifty graphical objects and custom indicators, which can be analyzed technically. Nine timeframes grant detailed and careful price analysis, extending from one minute to one whole month. It is also the preferred trading tool for newcomers. Thus, enabling them the capability to learn quickly without much confusion. It is also practicable for the more advanced traders, whose tools apply to their needs.  Here is the list of its key features:

By the way: You can download MT5 after you have opened a Fullerton Markets trading account and logged in to Fullerton Suite, the client terminal. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) MT5 or MetaTrader 5Online traders can also utilize another trading tool besides the MT4, which is the MT5. It is regarded as a more improved version than the former, which provides more advanced features. Traders who are not used to it will be happy to learn that it has quicker processing times, can take advantage of many tools for technical analysis, and innovative pending orders. It will enable them to reach a higher level of trading, never before reached by MT4.  Even though MT4 is widely utilized by most online brokerage firms, it operates on less sophisticated software. It will be discontinued eventually. So if you are technologically savvy and intend to take up online trading, you must adapt and learn about MT4 because it will be the preferred trading tool in the hereafter. Here is a list of its best features:

Which is right for you? The answer to this question is: it will be dependent on your trading processes and your personal preferences. You only have to note each of the platform’s main strengths: MT4 is widely accessible and works well for currency trading, and MT5 provides flexible trading procedures of different assets. CopyPipIt’s Fullerton Market’s social trading platform that enables the clients to select from a wide array of more than three hundred signal providers. You are also able to supply your trading signals that others can copy. IB or Introducing Brokers that work for Fullerton Markets can also become signal providers by using CopyPip. It can also automatically arrange their end-of-the-month profit sharing.  Here are CopyPip’s best features:

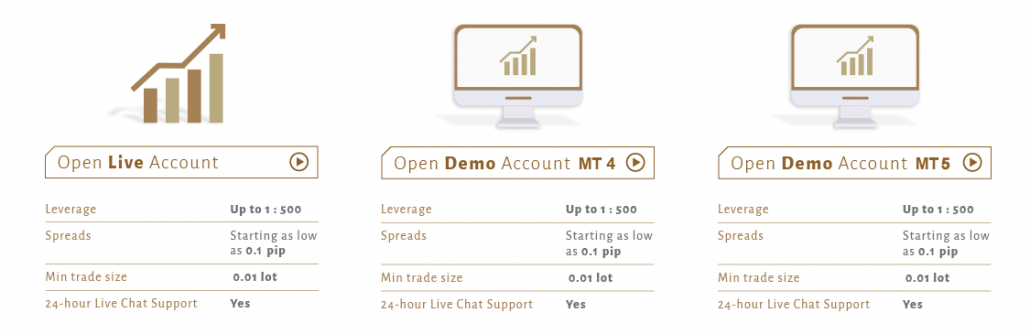

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Mirror TradingFullerton Markets have collaborated with Tradency, which is a pioneering financial technology provider. Its functions are similar to CopyPip, wherein you can copy trading procedures into your account. There are no assurances if these trades will be successful or not. You also need to understand that, when doing online trading, substantial risks might be involved. The way Mirror Trading works is that Tradency servers monitor the strategy developers’ signals to buy and sell. When traders use it, they can look, analyze, and assess the signals sent by expert traders and adapt the signals into their accounts. Global strategy developers will share their best practices and knowledge with Mirror Trader users. The Tradency platform will record all buy and sell signals from the strategy developers. This information will help the users in deciding which signal strategy to adapt in their accounts. Fullerton Markets Types of AccountsThere is only one live account in the Fullerton Markets platform (the other one is the demo account, which will be discussed in another segment). As mentioned, the minimum deposit is one hundred US dollars, and 0.01 lots are the minimum trade size.  This account type offers total accessibility to all the great trading features of the platform like copy trading service, downloadable MT5 tool, and market analysis.

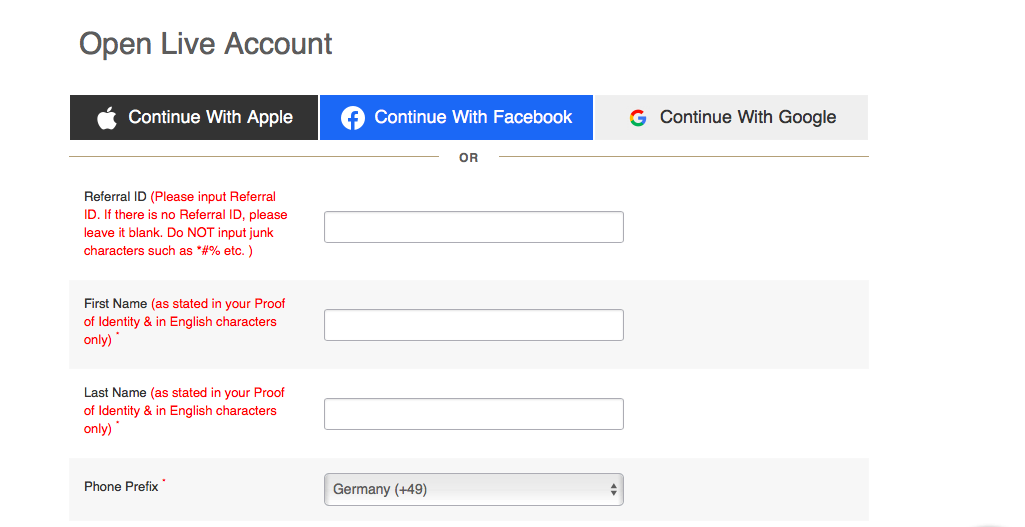

You can access it directly on the MT4 tool and has a virtual balance of 10k dollars. You can alter the deposit sum in the platform. If you will not be using this account within thirty days, it will automatically expire. How to open an trading accountIt is easy to create an online trading account. There is an “Open Account” tab in the upper right corner of the page. Once you click it, you will be directed to a web form wherein you will need to input your details, including your email, which it will ask you to verify.  You will also need to upload proof of identification and address, like a driver’s license and a utility bill. Once your information will be verified by the accounts team, then you can start trading. Be sure to add funds to your account first. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|