Learning guide for online trading: “What is trading?” – Explained to beginners

Table of Contents

Trading definition and explanation:

“Trading” means “trade” or “to trade”. This means buying and selling certain assets on a public exchange or OTC (over the counter) market. The exchange automatically determines the price of an asset (market) on the basis of the number of contracts (trading volume of buyers and sellers). For online trading, there are different financial products and markets with certain features.”

Note:

Trading is a zero-sum game. There must be always a seller and a buyer to do a transaction.

What is online trading and how exactly does it work? What things do beginners have to keep in mind in order to increase their money in the long run and not lose it? – In this learning guide for online trading 2021, we will show you the step-by-step process of how the stock exchange works. With more than 9 years of experience in the financial markets, more than 300 published Youtube videos of the channel “Trusted Broker Reviews”, we will prepare you for your first investment.

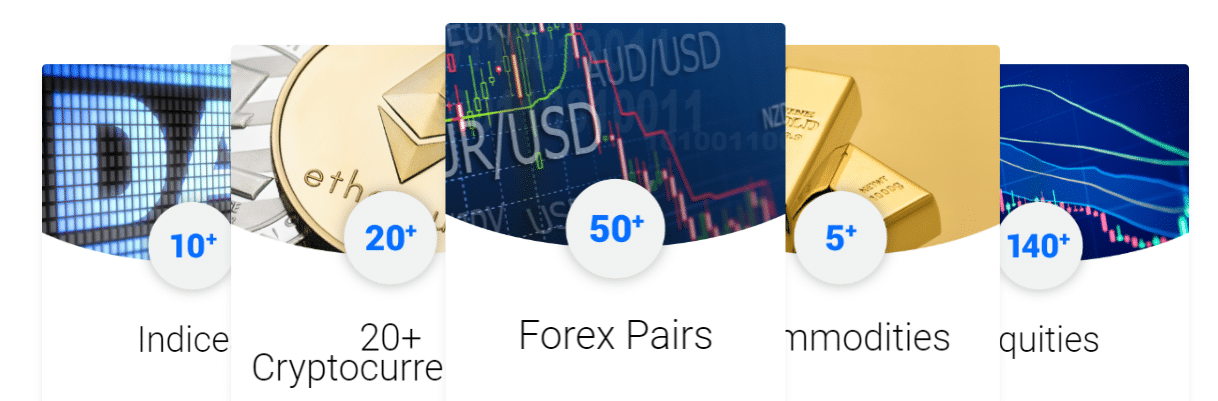

Which markets are available to trade?

There are countless different assets that are for free trading on the world’s stock exchanges. In the following, we would like to give you an overview of the possibilities available for online trading. Different assets have different prerequisites, which is why you should find out more about the market before you trade them.

Many traders specialize in certain markets to improve their earnings. From our trading experience, it is always better to focus on one market segment because you can combine your power and knowledge. Of course, every trader has his choice open and every trader has his own preferences.

The best-known assets to trade:

Forex (currencies):

FX trading (Wikipedia) is very popular with beginners. Currencies are exchanged against each other and represent an exchange rate. The trader can invest in one currency and sell the other at the same time and exchange the currencies back at the end of the trade. The difference in the exchange rate or the value of the currencies remains as profit. The advantage here is that they are the most liquid markets in the world and one can act with small capital and high leverage.

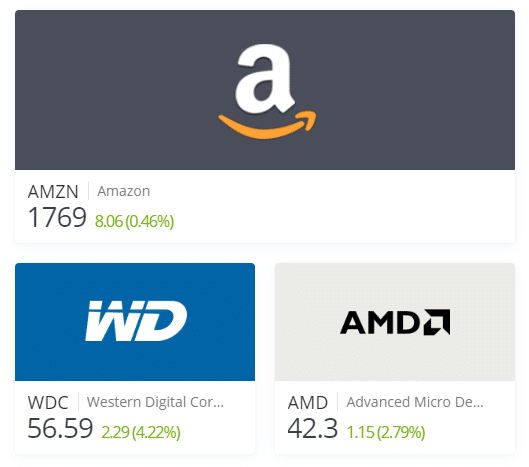

Shares (securities):

With shares, you can participate in a wide variety of companies. Profits can be realized through price differences or dividends of the company. These markets particularly like to react to company and economic data. With various financial products, leverage can also be used or a short sale (speculation on falling prices) can be carried out.

ETFs:

An ETF can be seen as a basket of several stocks or other assets. They are automated managed funds. They can be traded on public markets. Thus, it is possible for the trader to invest in a large market segment with only one investment.

Commodities:

Almost all commodities are traded on the stock exchanges. Benefit from rising or falling commodity prices. Popular markets are Oil, coffee, soybeans, etc.

Metals:

Gold, for example, is a safe investment for many investors. With trading and the right financial product, you can invest in the gold price, for example, with just a few clicks. Silver, platinum, etc. are also very popular with traders.

Government bonds:

Another very large market is government bonds. Conservative investors buy them to get a certain interest rate. The price of government bonds is also determined by the stock market and you can benefit from rising and falling prices.

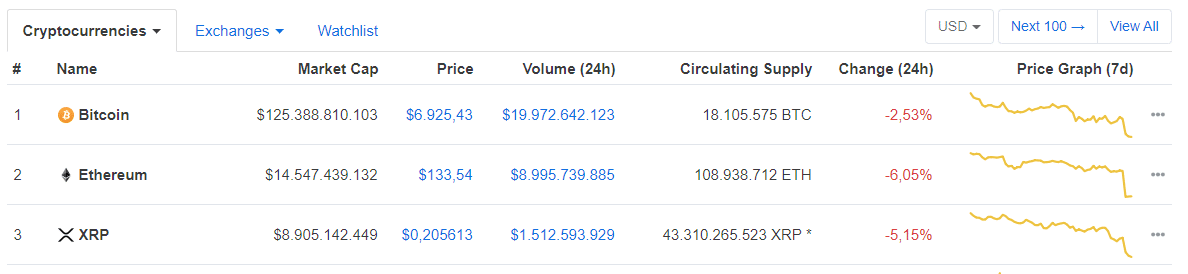

Cryptocurrencies:

Digital currencies are a new market for global investors. The market is characterized by extremely high volatility (fluctuation). High profits or losses can be made here. This new market is developing rapidly and new cryptocurrencies are coming onto the market every day.

Trading in financial products is risky. The higher the risk, the higher the potential profit and loss. You can not earn money on the stock exchange without risk.

The advantages and disadvantages of online trading:

In the following table, we have summarized the advantages and disadvantages. If you want to start trading, you have to decide for yourself. It is an easy and uncomplicated way to earn money, but you need a lot of practice and professional knowledge. It is very risky and at the same time, the chances are very big to make money.

Advantages: | Disadvantages: |

|---|---|

It is possible to earn money with the computer. | You need good and effective knowledge, otherwise you lose. |

You have no physical effort. | You compete against traders in the market who earn millions and have as well a very strong capital. |

Unlimited profits are possible. | You may lose your invested capital. |

How does the price arise on the stock exchange?

Knowledge of the stock market is very important in the investment sector. You should definitely know how the price on the stock market is composed for any asset. This can be used, for example, to derive various trading strategies. In the following picture, we will explain the order book and the pricing building of the markets.

The price is determined by so-called “limit orders” and “market orders” in the order book. The limit orders are placed on the selling prices (Ask) and on the buying prices (Bid). These orders describe that other traders want to buy or sell at a certain price. Only limit orders would not move the market. Limit orders are “placed” in the market and are waiting to be executed. This is done through a market order. A market order is placed manually by the trader through a buy or sell.

This allows you to directly serve the limit orders on the ask or bid. If there are no more limit orders on the ask or bid and further market orders are added, the price must change because supply and demand must match each other.

Limit order

The limit order is only executed at a certain price in the market. Limit orders are passive and waiting for a market order which will consume them. There are only buy and sell limit orders. The trader is choosing a price where he wants to sell or buy. Then the trader is waiting till the market executes the order.

Market order

The market order is directly executed to the best next price. Market orders are aggressive and can change the price very fast. Traders choose the market order to buy or sell directly if they want. A market order has to be executed to the next price and a limit order does not have to be executed.

Note

There must always be a buyer and a seller at the stock exchange. Otherwise, the business won’t work. If a party is missing, a new price must be found.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Which financial products should you start trading with?

In addition to the various markets and assets, there are also various financial instruments that can be used. These differ in the possibilities and the risk. The operation is also different. In the following section, we will give you an overview of the different financial instruments offered by most brokers:

Forex (ECN):

As a trader, you have direct access to the interbank market via a broker. Your order will be placed by various liquidity providers or other traders. High leverage is possible and the fees are very low. There is a lot of confusion because Forex (currencies) can also be traded via CFD (difference contract), options, or futures (forward contract). Trade on rising and falling prices.

CFD (Contracts for Difference):

This is off-exchange trading with the broker. The broker can hedge if necessary. The difference contract can be mapped to all markets. You do not trade the market directly but only the contract. The asset forms the basis of the contract. Here a lever can be used and trading is possible with small as well as large capital. Trade on rising and falling prices.

Future contracts (for experienced traders):

Transparent trading on the public exchange. You can view the orders transparently via software. High leverage is also used here and the required capital is very high. Not necessarily suitable for a beginner. Forward contracts are used by the economy to secure a certain price in the past for anything. At the expiration of the futures contract, this thing must be delivered or bought. Trade on rising and falling rates.

Options (for experienced traders): They are another complex financial instrument. The trader secures the right to buy or sell an option at a certain price. The option does not have to be exercised. It is important to read several books about this financial instrument.

Stocks and ETFs

Stocks and ETFs are traded directly on the stock exchange. Only a few are available via OTC (over-the-counter) markets. Stocks and ETFs can be traded via real value or leverage. Most traders use CFDs for trading stocks with leverage. Stocks/ETFs are always listed on a specific exchange of the origin country of the company. For trading stocks and ETFs, you will need an online broker with access to different stock exchanges. These assets are suitable for long-term investing and also earning dividends.

Options

Options are like futures derivatives and traded mostly with leverage. There are different types of options depending on the broker you choose. For example, Binary Options are like betting on rising or falling prices in determined expiration time. If you are right you will earn a high yield of up to 90%+.

American and European Options give you the right to buy or sell an asset at a determined price and time. The exercise date is always in the future.

Summary:

Forex and CFD trading is best suited for most beginners and advanced traders because the financial instruments are not too complex. It is very easy to invest in rising or falling markets in just a few clicks. Leverage can be used and the fees are very low.

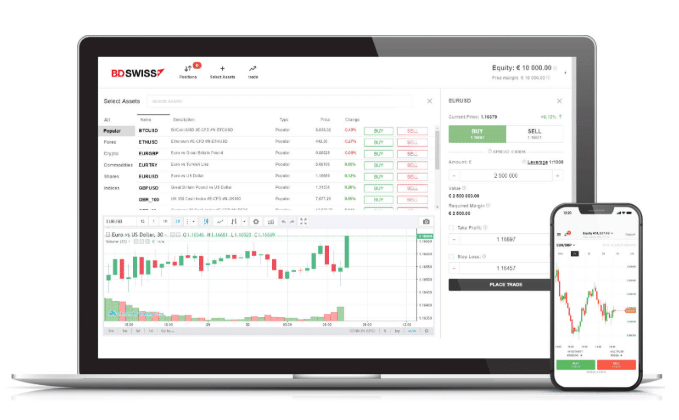

Which trading software and broker is the best?

On the Internet, there are far too many offers from brokers and software manufacturers for the trading sector. From our experience, the offer is already too large, so that it is very difficult for a beginner to choose the best software and the best broker. With more than 10 years of experience with different brokers, we have tested many providers and published many reviews on this page.

The broker usually also provides the software (trading platform). Most of the time even several different trading platforms are offered. There are also apps for the smartphone to start mobile trading. This means that trading does not always have to take place statically in front of the PC, but you can check and change the portfolio at any time with Internet access.

In the following section, we would like to introduce you to our test winners. You will also learn which criteria you should pay attention to when selecting your broker.

Criteria for a good broker:

- Regulation and licensing by a public financial supervisory authority

- Free demo account (virtual money)

- Low minimum deposit

- Stable trading platform and fast execution

- Favorable and transparent fee model

- Fast support for customers

Use a demo account (virtual money) as a beginner

A demo account is an account with virtual credit. It is “play money” which simulates real trading. Beginners can try out the broker and also test different strategies. In general, we recommend every beginner to practice with the demo account until you feel safe investing real money. The demo account is one of the most important tools for a prospective profitable trader. Nowadays, you can create this trial account for free at any broker. For starting with real money the minimum deposits are very low from our experience.

Online trading broker selection and recommendations

In the table below, you can see our current top online brokers, all of which have been tested with real money. These providers are the best in their field worldwide and stand out due to their strong features in contrast to their competitors. Further comparisons can also be found under “Forex Brokers” and “CFD Brokers”. Create a free demo account and start your trading trip:

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Order execution: How does online trading work?

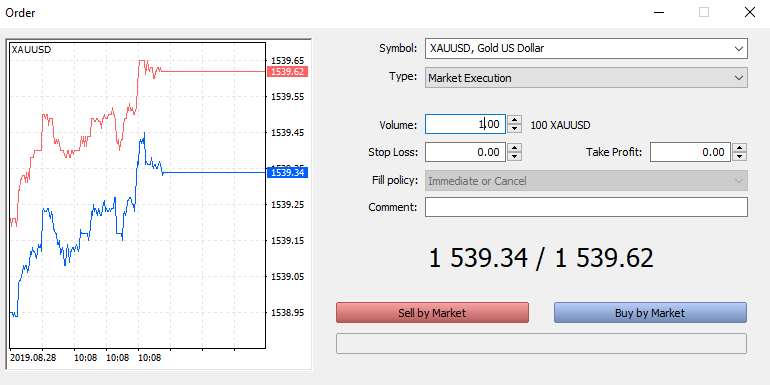

Today’s trading platforms are designed very clearly and you can buy or sell a certain value on the stock exchange with just a few clicks. In the following picture, we will explain step by step how an order execution works. The order can vary according to the preferences of the trader.

Order execution in the Online Trading Platform MetaTrader 5

- Select any market. An analysis should be carried out beforehand so that you have a suitable plan for your investment.

- The volume describes the size of the traded position. This can have different characteristics depending on the market. For this purpose, the broker provides information on the position sizes.

- Stop Loss: This is an automatic loss limit. Set the price at which you absolutely want to end the position in the loss. The stop loss can also be set at will after the trade has been opened.

- Take Profit: Similar to stop loss, Take profit is also an automatic limit. This time, however, it works the other way round in the case of a win. Take profit automatically.

- The order type describes the market execution. As mentioned before, there are market orders and limit orders. Adapt the type of order to your strategy.

- Buy or sell the market with a click.

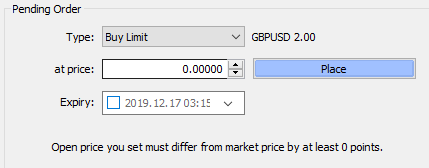

Types of orders for trading

Traders can use different order types for online trading. Depending on the strategy, one of these types is selected. Invest in rising or falling prices. The following points will give you an overview:

Buy:

- Market Buy: Direct purchase at market price

- Buy Limit: Wait for the market to trade a certain price (below the current price)

- Buy Stop: Wait until the market trades a certain price (above the current price)

Sell:

- Market Sell: Direct sale at market price

- Sell Limit: Wait until the market trades a certain price (above the current price)

- Sell Stop: Wait until the market trades a certain price (below the current price)

What trading fees can I expect in Online Trading?

In trading, there are different fees and cost models for the client of a broker. In summary, it can be said that fees have become extremely low due to the digital age. Nevertheless, you should look for a cheap broker, because the fees can be very high during the year.

Account maintenance fees:

Very few brokers still charge an account maintenance fee. In my experience, an account maintenance fee can occur after a longer period of inactivity.

Spread:

This is the difference between the bid price and the asking price. This may vary depending on the market situation or may be imposed by the broker. You will always see it transparent on the trading platform.

Commission:

A fixed trading fee for opening and closing a position.

Swap (interest):

Often a trader trades in leveraged derivatives. The leverage must be financed, only a small margin is necessary. Therefore, interest can accrue overnight

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How to earn money with trading: Fast profits or not?

Many beginners want to make fast money with trading. Is that even possible or not? – Trading on the stock exchange always involves a risk. Without risk, you will not earn money. In most cases, the higher the risk, the greater the profit. Unlimited profits are possible. So you can get rich by trading on the stock exchange.

Trading leverage explained:

Most financial products are backed by leverage. In many cases, even leverage is necessary to earn money effectively. You can trade more money on the stock market than you actually own. It is, so to speak, a loan that the broker grants you. All you have to do is deposit a margin with the broker. This is called margin trading.

The leverage multiplies your position. With a security line of, for example, 1000$, you can trade exactly 100,000$ on the stock exchange with leverage of 1:100. The position size, therefore, fluctuates with the value of 100,000$. The profit/loss is then debited from your account.

Summary:

As a trader today, you can participate in the financial markets with any size of capital. Opening positions is possible from just a few cents of risk. High leverage can also result in a high profit or loss.

- Trading is possible from a very small amount of capital

- Unlimited winnings are possible

- The lever can be used to the advantage

- Trading fees have become extremely low as a result of electronic trading

Debts through trading? – The Risk

When trading on the stock exchange, you can lose more money than you have paid into the broker account. This is called a margin call and such an incident can be caused by very extreme market situations. For example, if there is no liquidity, you cannot close your position at the desired price.

All recommended providers on this page do not demand an obligation to make additional contributions anymore but stop you before forcibly. New securities and account protection have abolished the obligation to make additional contributions.

The leverage increases the possible position size and can thereby increase your risk!

The different types of online trading are explained:

In linguistic usage, one uses several different terms for the types of trade. Most traders are universal and adapt to the market, so the boundaries of the types of trade often blur. Roughly speaking, trading types can be divided into short-term and long-term investing. Every trader should find out for himself what he likes best.

Scalping:

Scalping the market. Very short-term trading with a trade duration of usually a few minutes to seconds. Fast profits and losses are the order of the day. High leverage is used. The trader needs a lot of attention and skill. Read more under “Scalping”.

Day trading:

This refers to daily trading. The trader only opens positions from the start of the opening to the end. Trades are not held overnight and are closed in the evening. Here, too, the trader moves in the short-term range. Read more under “Daytrading”.

Swing Trading:

The longer holding of positions is called swing trading. Here, trades are held for several days to weeks. The Swing Trader always moves in large time units and has more time to react. Read more under “Swing Trading”.

We recommend it to a beginner to try out every direction of trading so that he can make his own experiences. Some coaches swear by their own tactics. In most cases, this tactic is not 100% transferable. Make your own experiences on the market.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Correct analyses and strategies lead to success in online trading

Successful traders possess profitable trading strategies for daily trading. In general, a distinction is made between fundamental analysis and technical analysis. Both analyses have their advantages. In my experience, an interaction between these two analyses produces the best result.

Fundamental analysis:

Economic news or indicators are included in the analysis. Economic data has an impact on short-term or long-term market movements. A trader should always be aware of the latest news from his traded market. For example, business news or data can generate very strong price jumps.

- Economic calendar

- News or news

- The earnings calendar for shares

- Political decisions

- Economic indicators

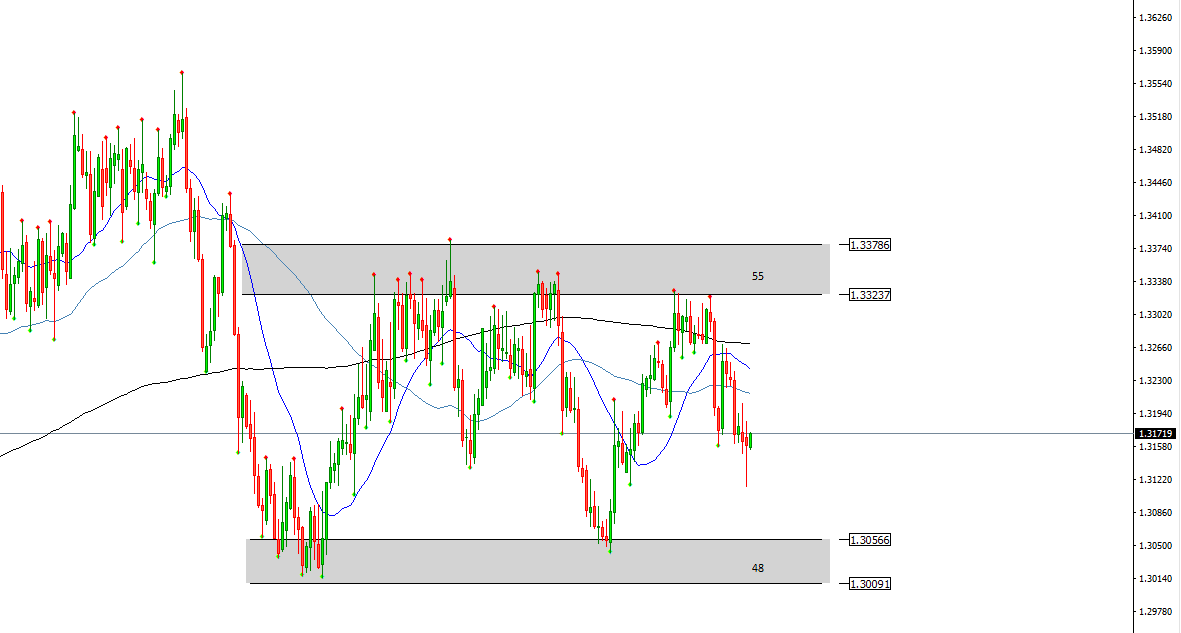

Technical analysis:

The majority of traders rely on Technical Analysis and using the Candlestick Analysis. This includes an understanding of the candlestick chart and various indicators. Some strategies are based only on indicators. Drawing tools and indicators are used in technical analysis. The past of the chart is analyzed and the trader forecasts the future development of the chart. There are many different trading strategies in this area.

- Using the Candlestick Analysis

- Use of indicators and drawing tools

- Combinable trading strategies

Conclusion: Learning to trade online is possible

On this page, we have shown you what online trading is and how it works. In just a few steps you have learned the basics for successful trading on the financial markets. Now it’s up to you whether you want to continue learning and start trading.

Information is very important for every trader. That’s why we created this website. In addition, many brokers also offer training and very good support, so that you can easily call your broker if you have any questions about trading.

Earning money on the financial markets is nowadays possible for anyone who has an internet connection and is willing to take risks.

Summary of the learned knowledge:

- Trading is the buying and selling of security on the stock exchange.

- There are very many different markets

- There are various financial instruments for these markets

- The price is determined by supply and demand

- The choice of a good broker is absolutely necessary

- Opening a position is not a problem

- Trading fees are very low

- Wealth through trading is possible

Note: For more information about Online Trading you can read our 10 best Trading Tips & Tricks.

With the right professional knowledge, you can earn constant money in the financial markets.

Trusted Broker Reviews

Experienced traders since 2013Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – The most asked questions about Online Trading:

Is it possible to learn trading in one month?

You must be attentive and prepared to study diligently. It requires a minimum of 6 months to comprehend swing trading and at minimum 1 year to master intraday trading. Avoid being intimidated by the time investment; it’s a talent that will pay you for the entire duration of your life.

Is it possible for me to learn day trading on my own?

Several day traders learn to trade on their own. They study through free tools and some trade materials you purchase or obtain from the libraries. This is a low-cost and interesting approach to learning. However, given the numerous available resources, you may be unsure where and how to begin.

Is trading a viable professional path?

Trading can be an actual professional career, and numerous people are looking for equity market careers. In addition, there isn’t a particular age requirement to start investing in stocks; both children and grownups can do so.

Is it tough to comprehend how to trade?

Even experienced investors admit that trading is so tough in the long run that many tackle it “1 day at a time” or one trade at a time. Instead, it is simpler to create commitment by investing in minor objectives initially, then working for bigger goals.

Read our other articles about online trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)