What is Slippage? – Definition – Advantages, and disadvantages

Table of Contents

Time and again, one stumbles across the term slippage in stock market lingo. But what does it actually mean? When we talk about slippage, we always refer to a loss or gain on the foreign exchange and stock markets. What a slippage is, how it works, and whether it should be considered positive or negative, we will show you in this article.

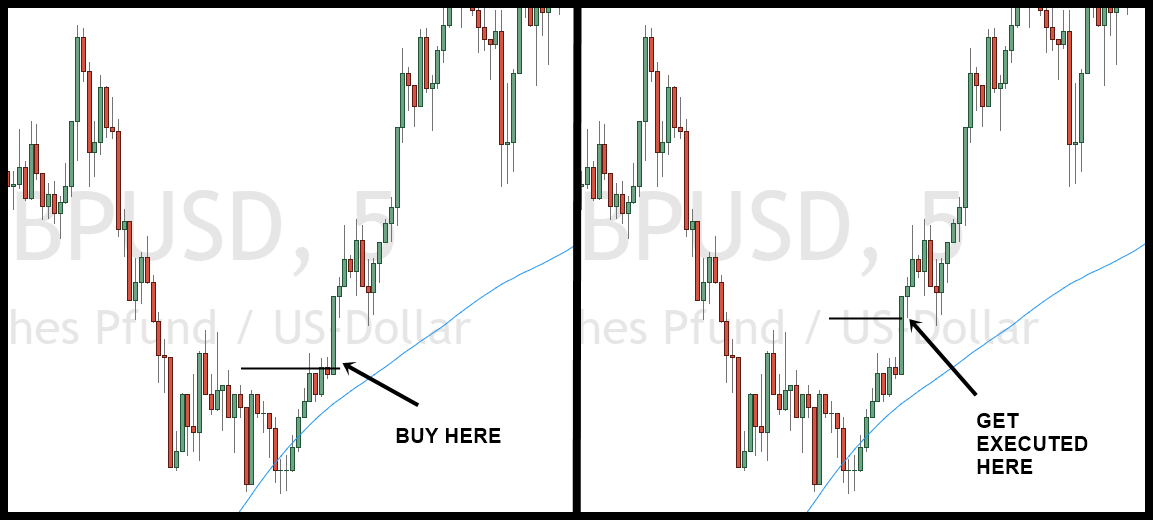

See this example of slippage in trading:

What is a slippage in trading?

So what is a slippage? It can be described as “slipping”. That already sums it up very well. Slippage is an unexpected change of course. The term thus stands for the difference between the price at which the market is to be entered and exited and the execution price of the trade. Thus, slippage is the difference between the expected and actual price of exchange trade.

To understand this better, we would like to show you a practical example:

If you want to invest in online trading, first consider the bid and ask for a currency pair. The currency pair USD/EUR is quoted from 1.00001 USD to 1.00003 USD. If you now make a market buy order, you assume that you will quote it at 1.00001 and execute it at 1.00003. However, since the market and therefore the rate is sliding, you execute it at 1.00013 USD all at once and therefore at a rate increase of 1 pip. In this case, you pay 10 USD more.

In case of slippage, however, you do not necessarily pay more than planned. Depending on the difference, the slippage can be negative or positive. Thus, a distinction is made between positive and negative slippage. While positive slippage has a positive effect on the trader, negative slippage is actually a problem for traders.

With positive slippage, an order is executed at a cheaper price than expected. In the case of negative slippage, however, the order is executed at a higher price, as in our example.

So while positive slippage definitely means cost benefits for traders, negative slippage of the price should be avoided. To make this possible, it is first necessary to understand what causes slippage to occur.

The causes of slippage are explained:

Slippage occurs primarily when a new equilibrium opens up in the market, causing supply and demand to shift. This is often accompanied by volatile markets. As an investor, you are therefore spoilt for choice: you take the risk of investing in volatile markets or you avoid the risk and thus at the same time forego the opportunity to benefit from a positive slippage.

A volatile market can be caused by different motivations. These are the top three causes:

- Price change due to greater demand from market participants.

- Too large order compared to the market depth

- Conflict of interest of brokers

If we look at the price change that occurs due to larger orders from other market participants, this is a cause that is grounded in economics. If the demand for a product increases, so does the price. The reason for this is classically an excess demand. In order to restore the balance between supply and demand and thus the equilibrium, the price must adjust accordingly.

But it is not only the balance between supply and demand that must be right. Liquidity must also be guaranteed during execution. This is often a problem with brokers, as brokers usually only display the best price, but this does not imply that the order will also be executed at this price. If the liquidity for the order size is not available, a part of the order can be executed at an unexpected and even worse price.

Finally, a conflict of interest can also cause slippage. In this case, brokers would simply implement the execution of the order at a worse rate than would be necessary to increase their own profit margin. Therefore, when trading through a broker, it should always be ensured that the brokers are reputable and offer good trading conditions for forex and stock trading. This way, shrinkage can be avoided.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Slippage and order types (orders):

Slippage can occur when placing a market order. Thus, slippage can occur when a position is opened. However, it would be deceptive to believe that slippage does not occur when a position is closed. Because that can also be the case. To better understand slippage, we will briefly introduce the most important order types:

Order Type: | Description: |

|---|---|

Sell Limit | The aim of a Sell Limit Order is to sell the trading instrument at the current price or a better price. |

Buy Limit | The aim of a buy limit order is that the specified price is below the market price. Thus, traders assume that the price of the trading instrument will first fall and then rise again. |

Sell Stop | The aim of a sell stop order is that the entry price is lower than the current price. Thus, the price is expected to fall. |

Buy Stop | The goal of a buy-stop order is that the entry price is higher than the current price. Thus, the price is expected to rise. |

So if you want to avoid slippage, you should always go for a guaranteed stop-loss order (This is only possible with certain CFD brokers like Plus500) However, this comes at a cost when trading, which is why slippage often occurs with a market order or even a stop order.

You may want to close a market order position at the next best price. Due to an unplanned price change, slippage can occur and it is possible to lose money quickly.

However, losing money in trading due to slippage is also possible with a stop order. For example, with an unlimited stop order, there could be a deviation of the price from the order book and thus from the desired price level.

Slippage can also occur with limited orders if this is placed by means of a buy order. While all other order types would lead to a negative slippage, a slippage during a buy order can lead to a positive slippage.

Fact check on the topic of slippage

So, in summary, slippage occurs in volatile markets that do not have sufficient liquidity. This is usually answered by a demand or supply overhang and thus arises from an imbalance of the market. However, deviations from the desired price can also occur, depending on the order form. In the case of market orders and limit orders, such deviations occur again and again and can lead to you taking a high risk when trading.

Basically, however, a distinction must be made between positive slippage and negative slippage. There are therefore two sides to the coin.

Slippage in trading: This is how you proceed

So what conclusions can you draw from the previous information? Slippage can be positive as well as negative. However, there is always a high risk associated with it. Therefore, a large number of traders want to avoid slippage and thus shrinkage, and this in any trading instruments. While slippage often occurs in the forex and stock markets, it can also occur when trading Forex, CFDs, and other asset classes. Thus, a high level of risk exists in any trading class, and thus also in CFD trading.

Due to the complexity of slippage in trading, this slippage needs to be investigated in every market. Fortunately, there are strategies that you can apply as a trader that can be used for any market. Therefore, below I will show you how to avoid negative slippage while taking advantage of positive slippage.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Avoid negative slippage

First, you should be aware of when negative slippage occurs. This is often when you are a trader using a market order. A simple way to avoid slippage is to choose limit orders instead of market orders. However, this is not possible for every trading strategy or position. For example, if you need to close a position, you cannot avoid choosing a market order. But even here there is an option. For your own risk management, you can alternatively use Stop Loss.

But not only the order type can help to avoid negative slippage. The timing of trading is also crucial. Thus, it makes sense for your own risk management if you do not hold open positions when market changes occur.

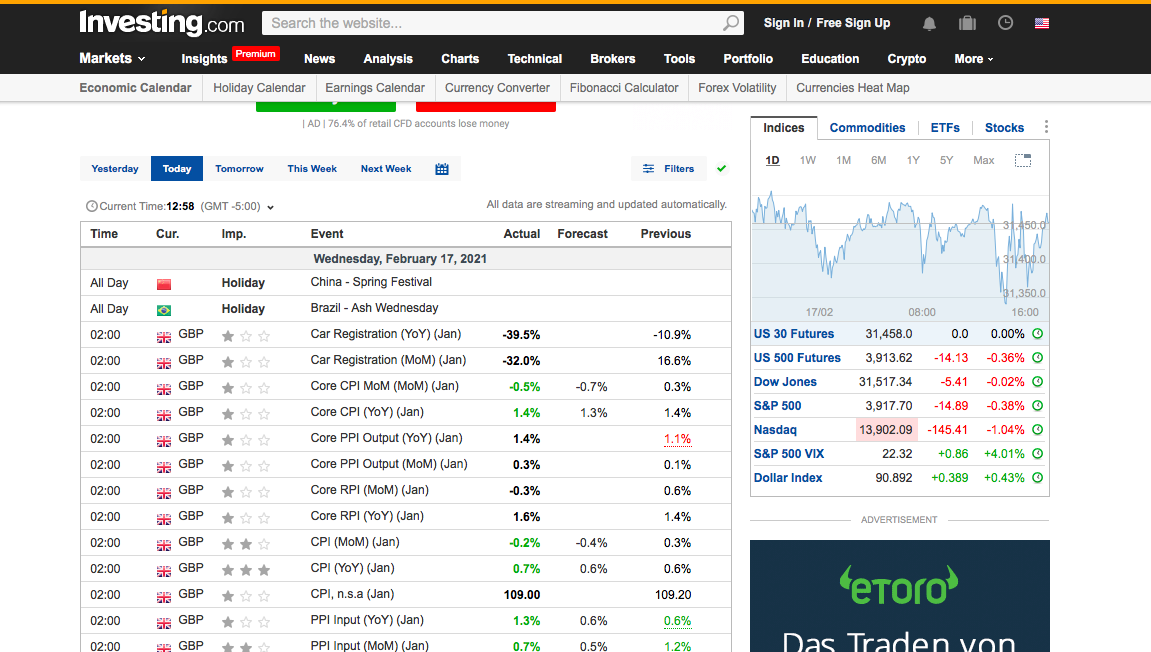

As mentioned earlier: slippage occurs, especially in volatile markets. Thus, if it is foreseeable that news may follow in the market, you should close all open positions. But how can you tell? At your broker of choice or also on financial portals you can refer to economic calendars. These show you when important days are coming up for your market. On these days, when events are planned, you should be especially careful with opening orders.

So we summarize: Negative slippage can be avoided by good risk management with regard to current economic news as well as by the choice of order work.

Positive Slippage: How you can use it

Now, in the first step, you know how to avoid slippage. However, that doesn’t always have to be the goal. Slippage from the price can also give traders advantages, after all. In this case, you should take a closer look at how you can use slippage to your advantage.

Slippage can be used particularly well with an entry order. The prerequisite is that the current price is above the limit price. In general, limit orders are particularly helpful to use slippage in your own favor. How does it work?

With a limit order, you can set the maximum price for your desired execution. If this occurs in this case, a lower execution also occurs at the same time. This way you can buy at a lower price and benefit from the slippage of the price.

Advantages and disadvantages of slippage at a glance

That slippage in most cases has a negative impact on your own trading is well known. It is virtually a race against time that traders often lose. You could not reach your set stop in time and so your own order is quoted at a worse price and therefore a higher price. As a result, it is easy to lose money quickly and you still take a high risk at the same time.

In this case, you can protect yourself with a guaranteed stop. Besides the negative side of slippage, traders can also profit from it. If your placed order develops at a better price, you can make profits and even exceed the desired price.

Avoid slippage: these are the criteria

It is more common for traders to want to avoid slippage. Losing money is not fun and so many want to avoid taking the high risk. To make this possible, it is first necessary to take a close look at the market you are trading. It should not be volatile and liquidity should be guaranteed so that you can trade at the next best price.

But other factors also play a big role when it comes to avoiding the slide in prices. We will now take a closer look at these.

Eyes on the choice of broker

When trading, the broker’s choice is always crucial to take the maximum returns from trading. Each online broker differs by a diverse offer, the regulation and security provision for trades, as well as the trading conditions of the providers.

However, when it comes to the issue of slippage, you should pay particular attention to the trading conditions when choosing a broker. While many brokers do not favor slippage, others do. The reason for this is a conflict of interest between the exchange and the broker – especially if a broker acts as a market maker. In the end, a broker is also a company that makes a profit.

If brokers do not agree with your commission on a position, they can artificially increase the slippage by not executing the order at the next best price or the desired price. Instead, traders have to pay more in order for the broker to make a higher profit. In trading parlance, we would say that brokers are artificially lengthening the “spread”.

Use a good and reputable broker with high liquidity. The best choice is an ECN broker with fast execution. For trading without slippage, we can recommend Capital.com. This company works with large liquidity providers that guarantee fast order routing.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

The cost factor of slippage is not inconsiderable

Slippage can quickly cost a trader a lot of money. If the order is not executed at the desired rate, losses can occur and they lose money trading. In volatile markets, these differences can be particularly high. So it is quickly no longer a few euros, but a large amount of money. To avoid this cost loss, you should also avoid trading in volatile markets.

It also makes sense to make sure that the liquidity of the market is guaranteed. However, if you want to take a risk when trading and bet on a price development that works in your favor, at least your own risk management should be right. You should therefore take into account the slippage of the price. By means of backtesting, you can avoid high losses.

Conclusion: The meaning of slippage in trading

Slippage refers to an unexpected change in a price and this can occur on any market and also with any provider. Basically, this unexpected price change does not have to be bad for you as a trader. You can profit from it as well as lose a lot of money.

You cannot really avoid the slide. However, your own risk management can be geared towards avoiding it. This can be done by calculating the risk, looking at the markets, and choosing your own broker. Also, the order type has an impact on how an unexpected price change affects your own portfolio.

In general, there is only one way to protect yourself: With a guaranteed stop order, which, however, again comes with a cost. Whether you want to take the risk or be on the safe side, you have to weigh up according to your own risk affinity.

FAQ – The most asked questions about Slippage :

What does slippage mean in cryptocurrency?

People refer to slippage as the difference observed between the actual price of a trade and the price at which the trade was expected to take place. Another term that people often use is called slippage percentage, which refers to the movement between the price for a specific asset. Trade prices often go through a lot of movement because cryptocurrency is volatile, and it depends on factors like trade activity and volume.

Do people lose money during slippage?

During slippage, people can lose as well as gain money. The risk of losing money during slippage can be reduced if you trade during the peak hours of the market and markets that are less volatile. A negative slippage results in a loss for an investor, while a positive slippage gets a price better than expected.

What are the ways to reduce slippage?

Slippage is often predicted by traders by calculating the difference in amount between the amount that was predicted for the trade to take place and the actual amount in which the trade has taken place. They also calculate slippage through a different method, which is taking the difference between the highest price bid on that trade and the lowest price that was asked.

See more trading articles:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!