3 best cTrader brokers in comparison & test for traders

Table of Contents

Earning instant profit is everyone’s dream, and trading is helping in this field to make people’s journey quick. Even though many trading platforms are available in the market, cTrader is ruling.

This platform is emerging as the most reliable platform when we talk about trading. First, if you’re a newbie to this cTrader, you might be interested in exploring what this platform is all about. Is trading on cTrader beneficial for you, or are you curious about the profitability of this trading platform? This cTrader review will allow you to know it and also choose the best brokers.

See the list of the 3 best cTrader brokers:

Ctrader Broker: | Review: | Regulation: | Spreads: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Pepperstone | Regulated by FCA, BaFin, ASIC, DSFA & SCB | From 0.0 pips | # MT4, MT5 and cTrader # High liquidity # Educational resources # Excellent support # Spreads from 0.0 pips # PayPal supported | Live account from $ 200 (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

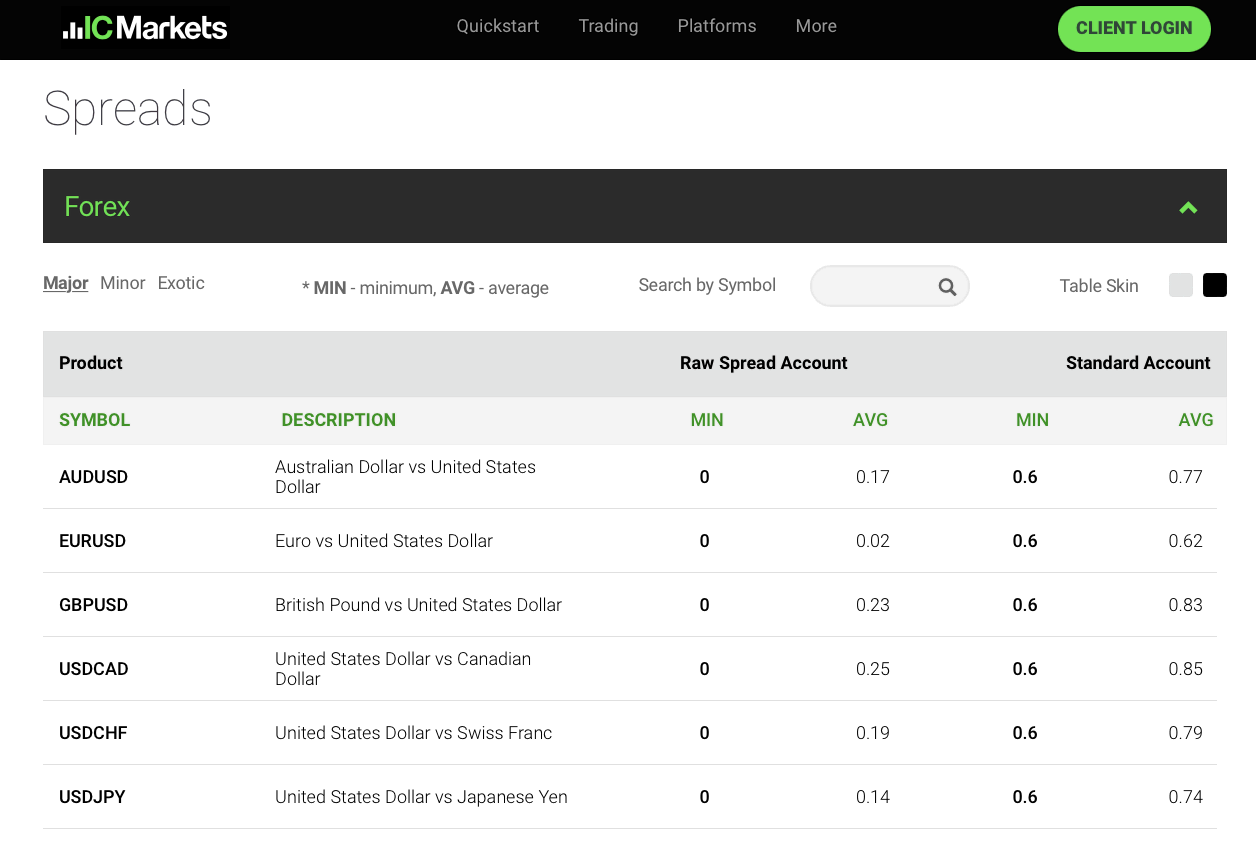

2. IC Markets | Regulated by ASIC, FSA & CySEC | From 0.0 pips | # Fast execution speed # Great customer support # Award-winning broker # cTrader available # Free demo account # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

3. FxPro  | Regulated by FCA, CySEC, FSCA & SCB | From 0.0 pips | # High leverage up to 1:500 # More than 250 markets # cTrader, MT4 & MT5 # Fast execution speed # Spreads from 0.0 pips | Live account from $ 100 (Risk warning: 72.87% of CFD accounts lose money) |

Why choose the best cTrader broker?

Since this platform is springing up quickly, many companies claim to be the best. Therefore, choosing the best cTrader broker is crucial while trading. Although the platform may have a lot of features, could you rely on your broker to serve you the finest quality service?

We know that finding the most reliable cTrader broker could be difficult. Therefore, we have listed the best cTrader brokers to help you with this platform.

List of the 3 best cTrader brokers

We know that a broker would be responsible for more than just guidance. They also manage one money transfer, have all the personal information, hold the trading capital, and other responsibilities.

That’s why it’s crucial to ensure you’re dealing with an authorized cTrader broker that provides excellent customer service, superior performance, and affordable costs.

Although there are an increasing number of cTrader brokers offering trading solutions to traders, there are the top 3 who shine apart from the crowd, and they are:

Here, we have reviewed the top 3 cTrader brokers for you, which can help you to find the required one.

1. Pepperstone

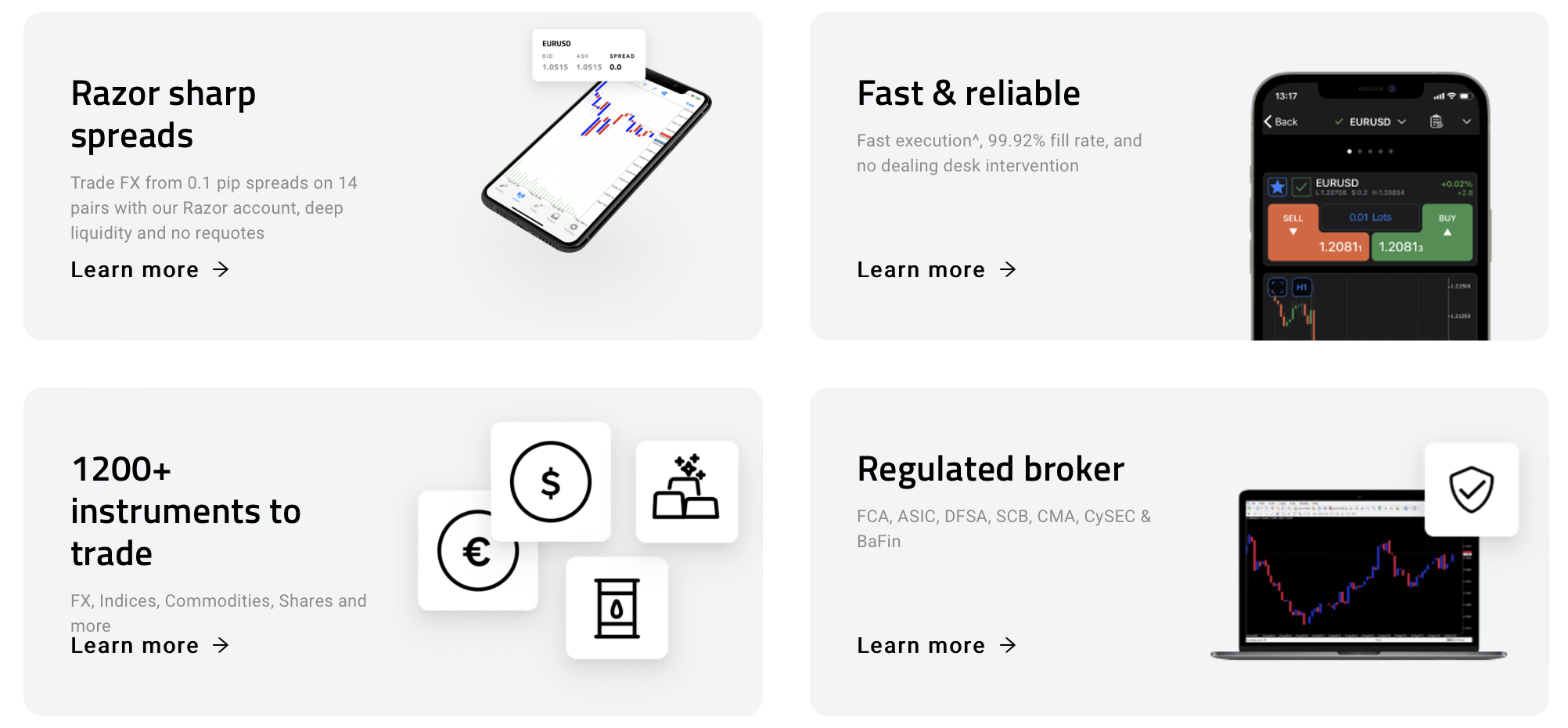

When we talk about the market’s most reliable and trustworthy broker, Pepperstone comes on the top. As per investors, this cTrader broker is the most secure investment platform.

Good to know!

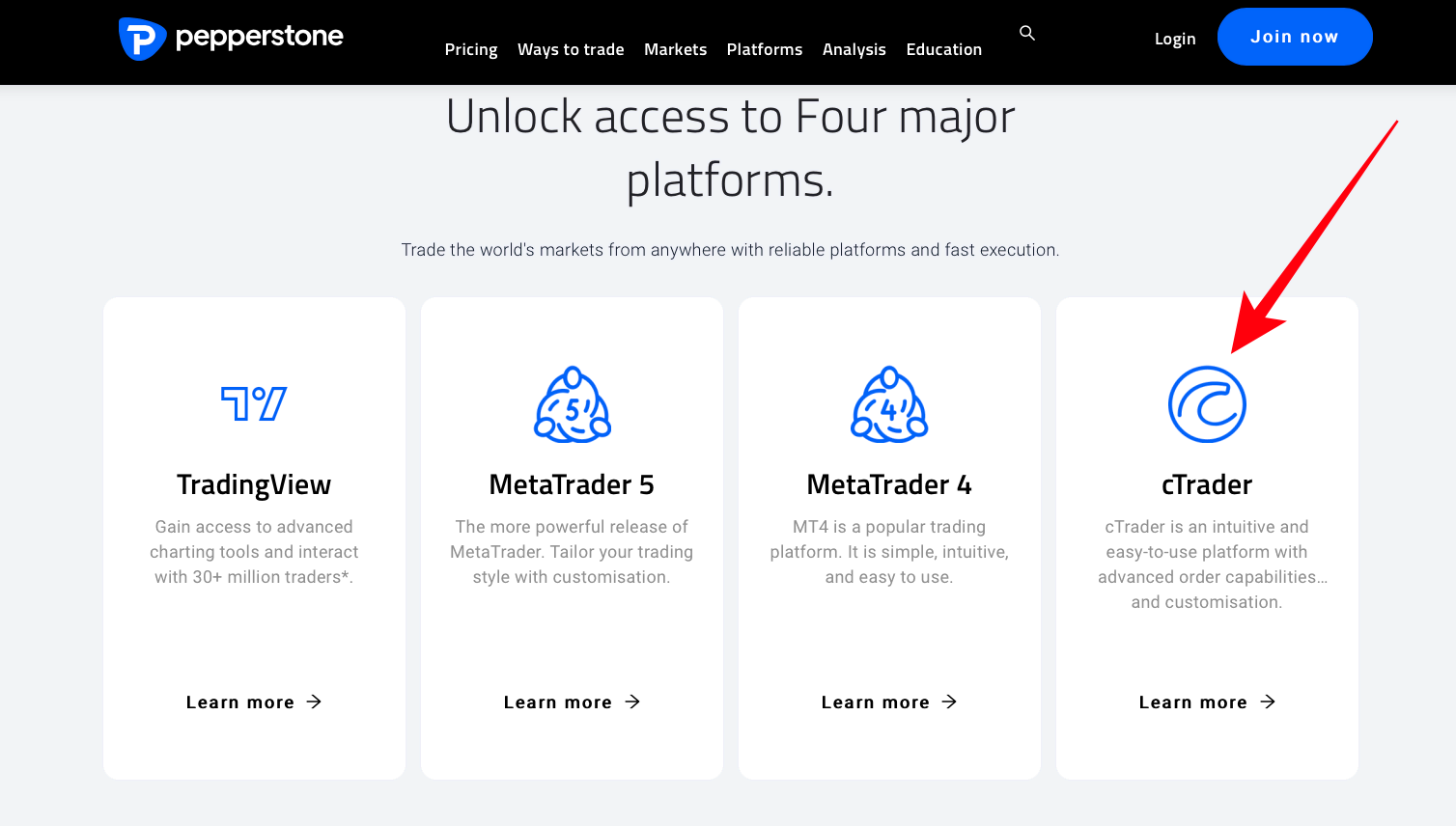

With all this safety, the best thing about Pepperstone is that traders can access the cTrader platform through any mobile, web trader, or desktop device.

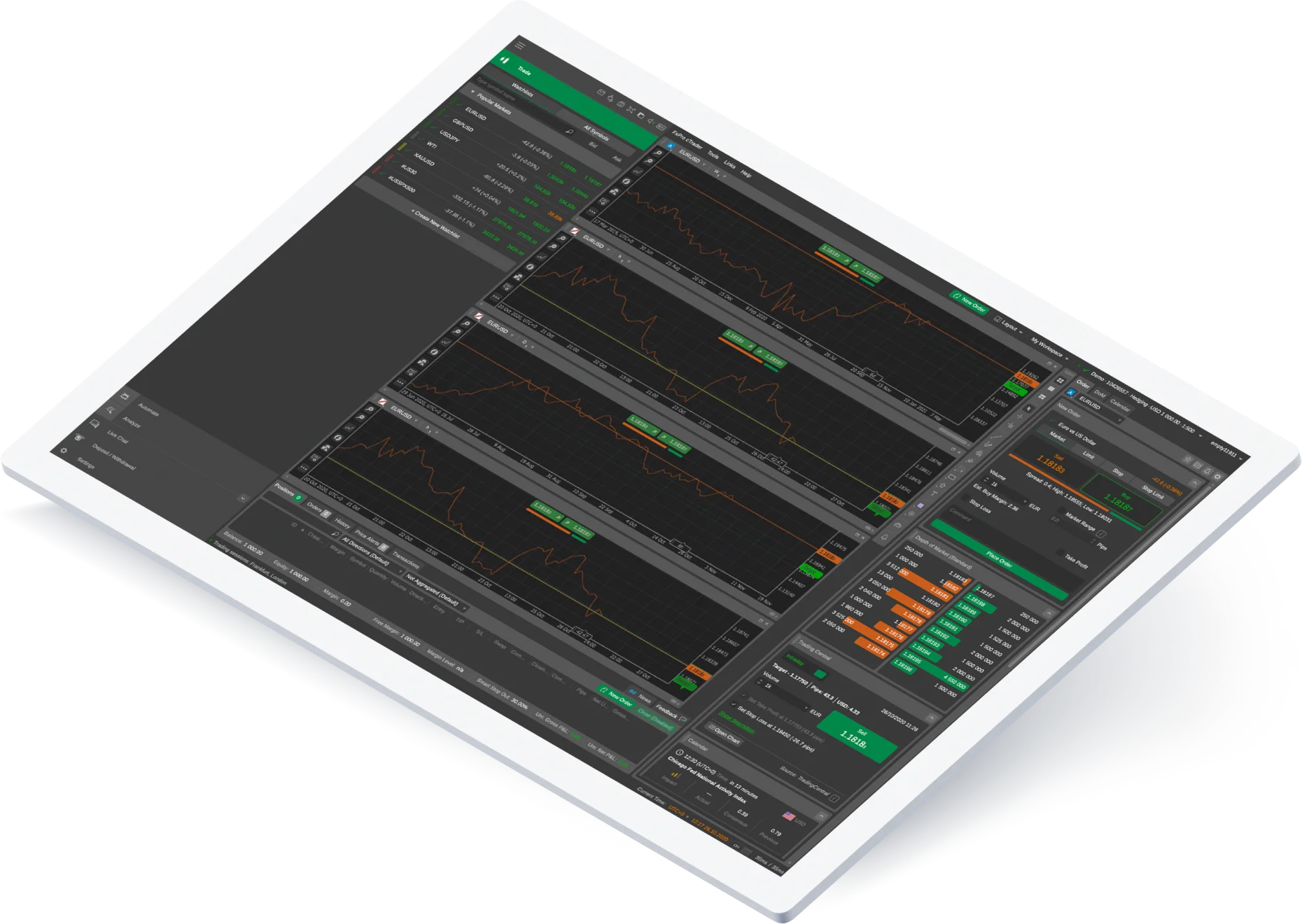

Pepperstone offers the cTrader platform via desktop, mobile, and web. Not only that, but to improve the MetaTrader skills, Pepperstone offers a variety of other platform add-ons.

Good to know!

Being privately held and not running a bank makes Pepperstone a low-risk investment. Also, Pepperstone delivers in-house and third-party analysis and a plethora of training resources for new traders.

Advantages of Pepperstone for traders

By choosing Pepperstone, you can enjoy the following benefits:

- According to the performance parameters, service and support, and brokerage, Pepperstone is regarded as the top forex broker with cTrader in the world.

- There are a variety of great interfaces, and extremely affordable FX fees on Pepperstone.

- Pepperstone provides simple and direct market access, allowing customers to concentrate on the challenging effort of managing to trade the markets profitably.

- The user-friendly interface of Pepperstone’s cTrader allows users to set up watchlists, examine charts, execute and track transactions, and maintain track of forthcoming events using the market calendar.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

2. IC Markets

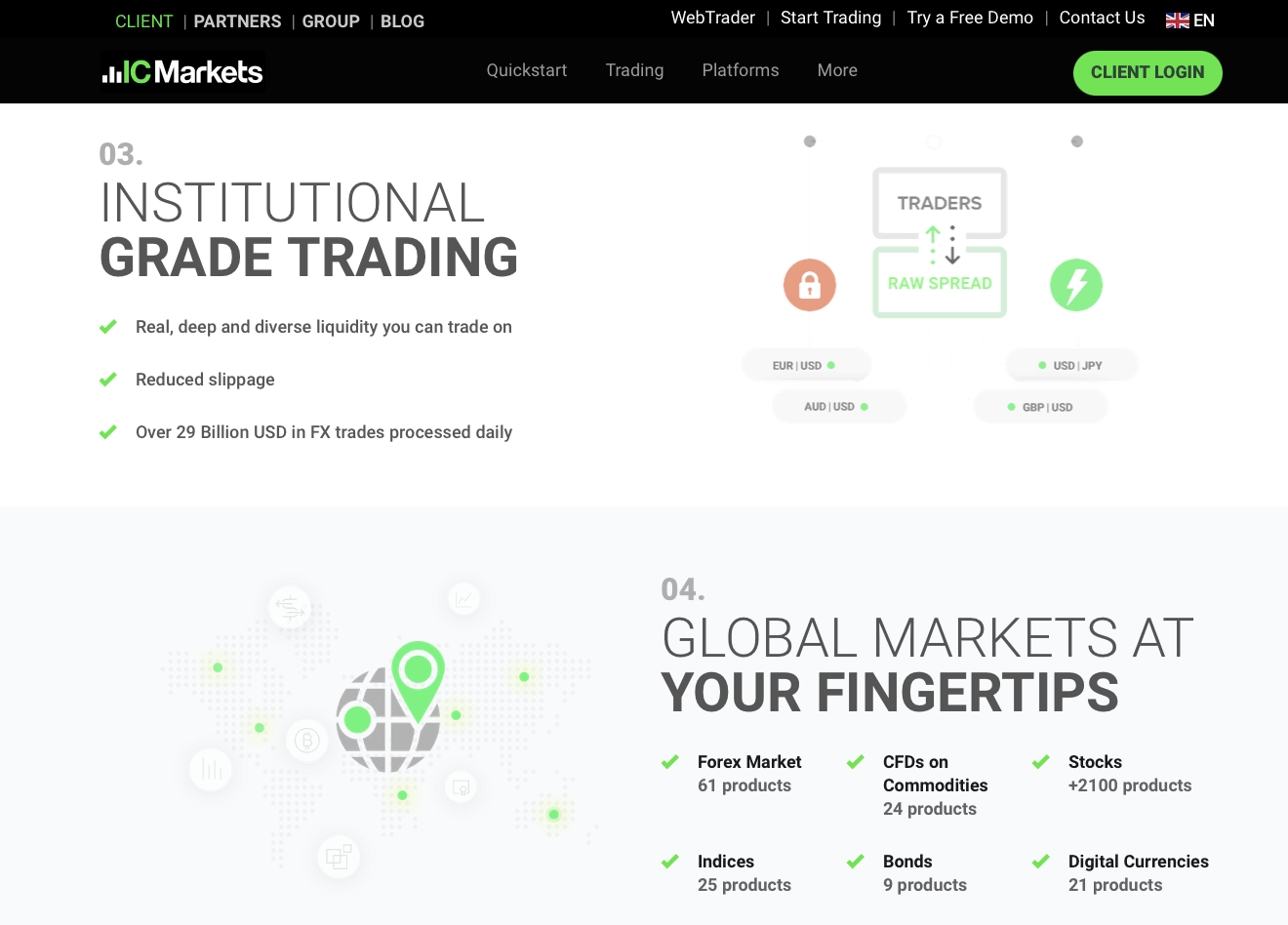

The second trustworthy broker company is IC Markets. Being an Australian CFD broker, it provides market implementation platforms on many trading platforms like cTrader, MT4, and MT5.

Good to know!

The affordable cost and scalable execution of IC Markets make it a great choice for algorithmic traders. However, although it provides a wide variety of third-party plugins and applications, IC Markets’ research and educational offerings fall short of those provided by leaders in the field.

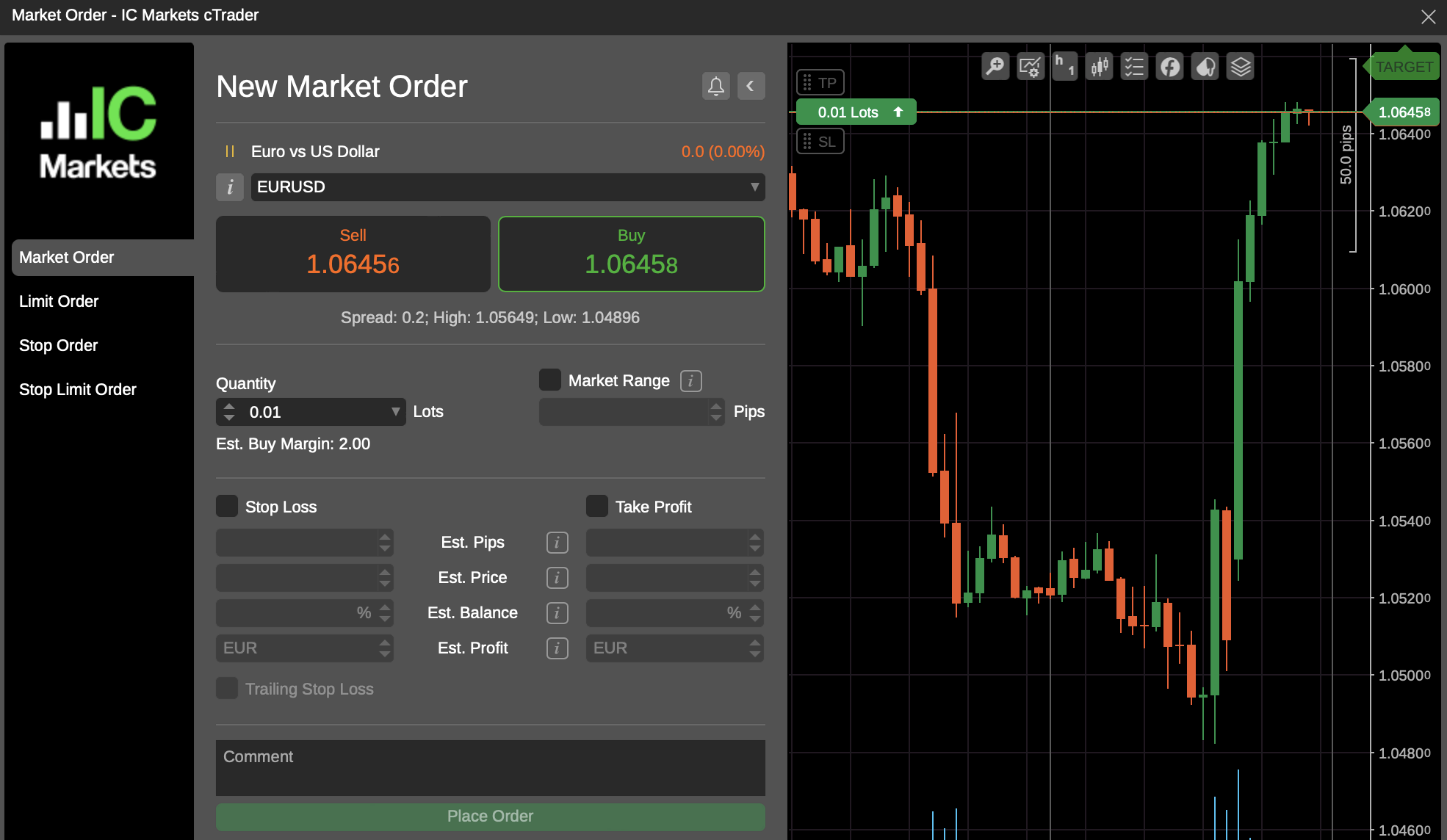

cTrader supports IC Markets’ online trading platform. The software includes a detailed fee report, is multilingual, and is extremely customizable. cTrader provides a fantastic smartphone trading platform for IC Markets. It is simple to use and comes with an appealing look.

Advantages of IC Markets for traders

It also provides special perks to traders who are new in this field:

- A free IC Markets demo account, teaching films on a Vimeo channel, and articles are all available to new traders to assist them in learning everything there is to know regarding trading and IC Markets.

- Charting and trading suggestions are also included in the available research.

- IC Markets provides comprehensive, organized course materials, in-depth, independent market analyses, and webinars hosted by industry professionals.

- With its low fees, ease of use, lack of inactivity service charges, and quick account creation, IC Markets is a fantastic option for new traders.

The True ECN account is the sole account that can get utilized on IC Markets with cTrader.

(Risk warning: Your capital can be at risk)

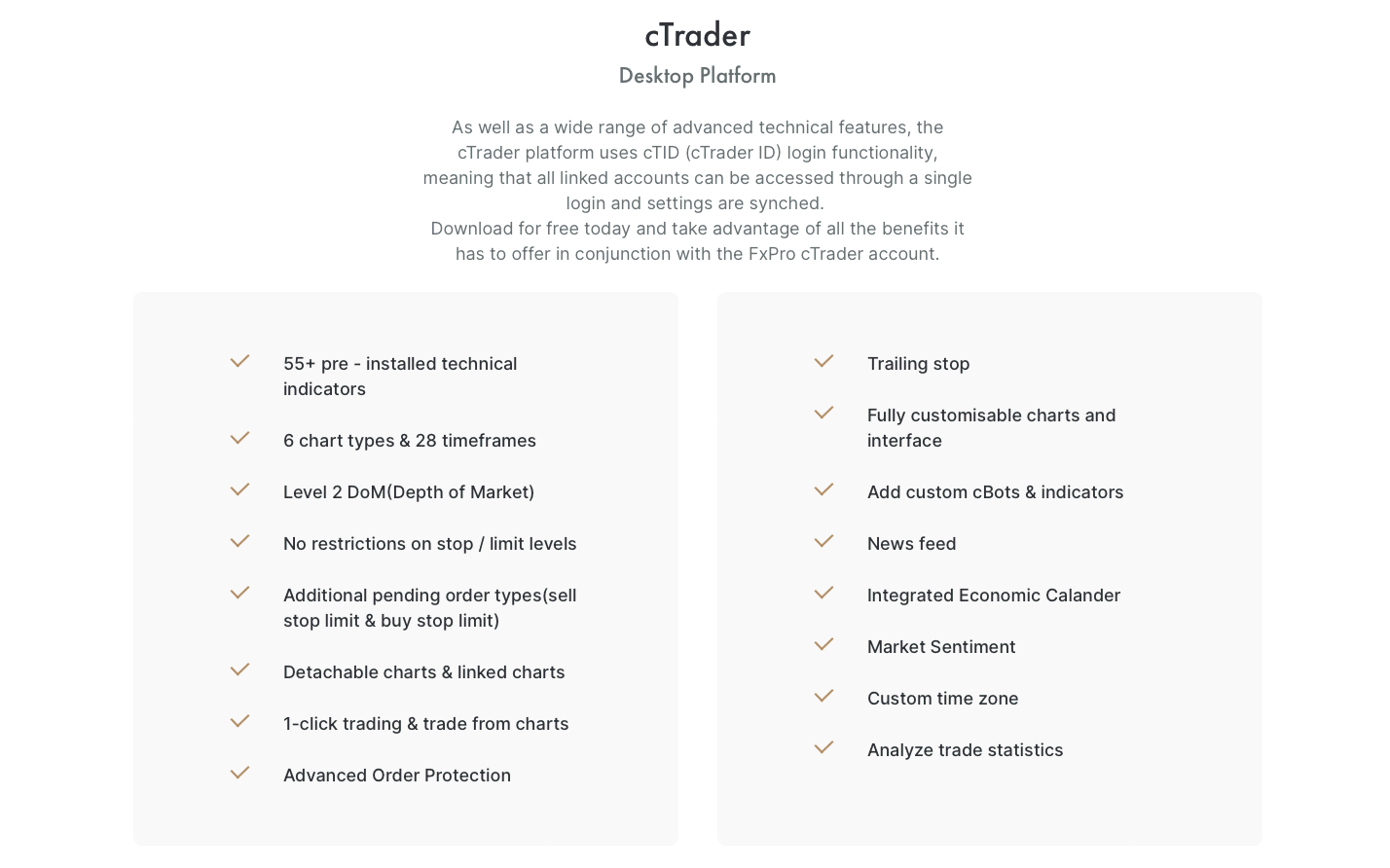

3. FxPro

Like Pepperstone and IC Markets, it is not an Australian broker. Instead, FxPro is a digital trading broker and a UK-based company.

Forex traders at FxPro have a choice of numerous award-winning trading platforms that are accessible in desktop, web, and smartphone versions.

Good to know!

The non-trading costs and fees at FxPro are moderate. There’s also no registration fee, and FxPro rarely imposes a transaction fee.

Therefore, you may be charged if you transfer your money to Skrill or Neteller without completing a transaction or repay PayPal over six months following the initial investment.

Advantages of FxPro for traders

There is a variety of perks of using this broker for cTrader:

- FXPro offers to trade in shares, commodities, and indexes.

- FxPro’s cTrader account does not provide requotes and will accept incomplete fulfills for trades with insufficient financing.

- FxPro also provides a variety of technical assessment indicators for cTrader users.

- The cTrader platform from FxPro makes it simple for traders to create and cancel orders.

- The broker offers acceptance for eight distinct base world currencies, which benefits the worldwide traders of cTrader.

- It offers three top forex platforms, including MT4.

- They offer low deposit thresholds and simple funding techniques.

FxPro cTrader’s accessibility to Trading Central is one of its best features. It provides you with exposure to everyday technical analysis-based forex trade ideas. These concepts can be an excellent beginning point for rookie traders.

(Risk warning: 72.87% of CFD accounts lose money)

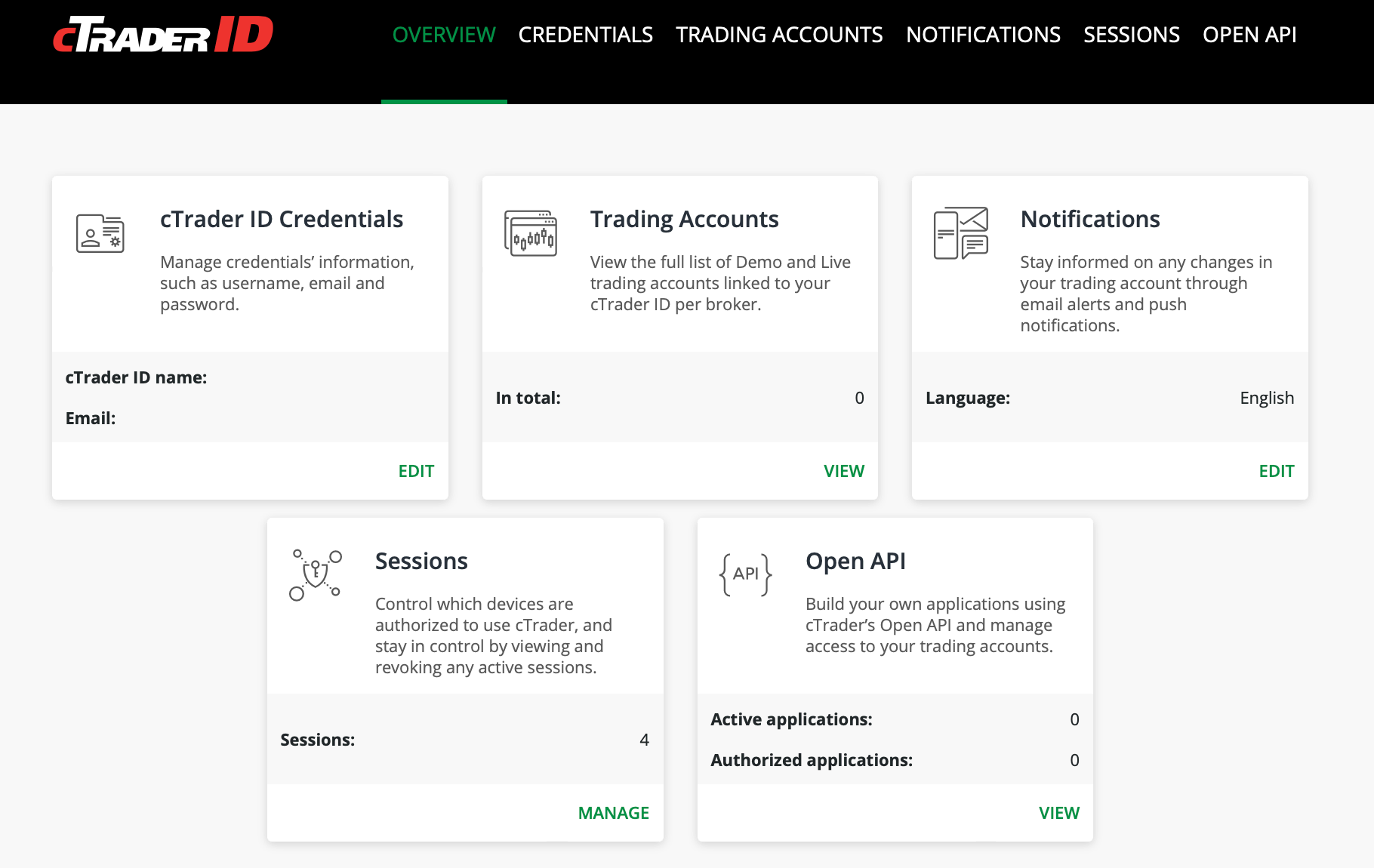

How to connect a broker with cTrader?

You can use the cTrader analytical tools and complete your trades as quickly as possible by connecting your broker and cTrader accounts.

Switching between applications to perform the deal is optional after copying it. Traders can do everything through its app.

Following are the steps to connect a broker with cTrader:

- Enter your login information which generally includes email and password. If you don’t have a cTrader trading account, you can register for it and then connect with the broker.

- Once the logging is done, select the menu icon and search for the “connect broker option.”

- After scrolling, you will find the “connect your broker” link underneath the “trading” section. Tap it and take another step towards the linking of broker and cTrader.

- You will find various options on the trading platform; choose cTrader. After that, your account will be automatically logged out.

- Again, log in with the information.

- You will find the option of “approve access.” Just press the option.

- And that’s how you connected the broker with cTrader.

So, following these simple steps will allow you to the trader on cTrader software through your broker. This trading platform offers only the best to traders. It is time that a trader gets the best out of trading on cTrader.

Good to know!

These three brokers make the trading experience of traders trading on cTrader better than anyone else. With their great customer support, these brokers ensure that nothing comes in the way of profit earning for traders. These brokers are all that a trader needs to connect with cTrader.

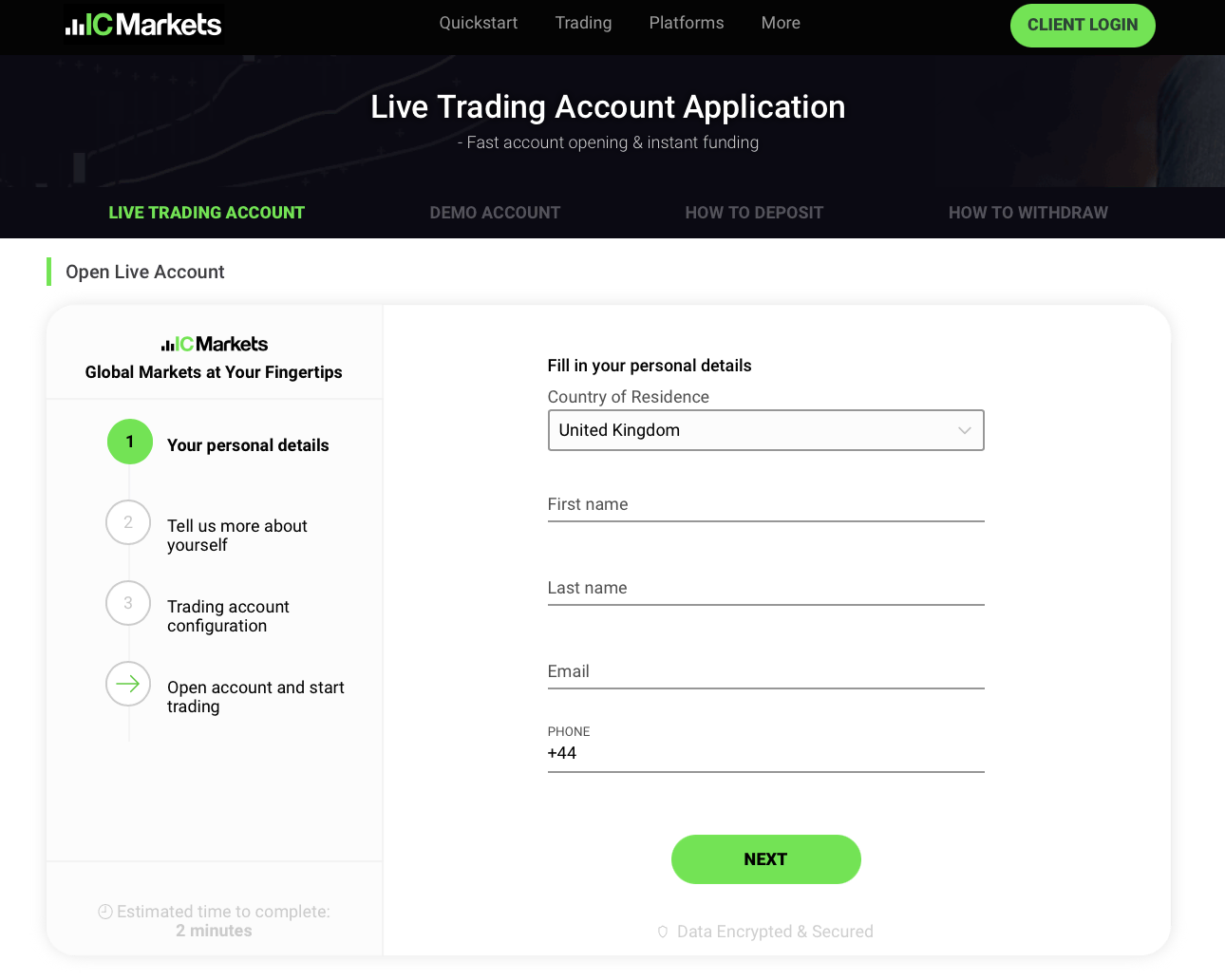

Sign up for a trading account

Signing up for a trading account is a trader’s most intelligent choice. Moreover, it can lead to various perks in the future if they choose the right broker.

This step is essential in trading. Numerous investing opportunities become available after opening a trading account. Traders can open it in simple steps such as these.

- The first stage is picking the right broker to open the account. We reviewed the top ones earlier. Choose a cTrader broker who matches your budget and required services.

- Now, you can open up the mobile application or website of the broker you have finalized. Go to the “signup” button.

- Click on the button and fill in the information the page asks to open your trading account.

- After providing, all the proofs and data, click on the “submit” option, and in this way, you complete your signup process.

And that’s how you opened your trading account.

(Risk warning: Your capital can be at risk)

How to trade on cTrader with a broker?

The main step of starting trading is knowing how to execute a trade without wasting time. Here we have explained the steps that a trader must follow to trade with the broker:

- Pick a trade broker company that provides traders with superior trading services. Traders can consider Pepperstone, IC Markets, FxPro, FIBO Group, and Fondex to get the best result.

- Once a trader chooses that, sign up on their web page or mobile application.

- Now, traders must create a demo or live trading account to resume the process. One must submit the deposit amount, account type, and account currency in the demo account creation.

- Once a trader is done with creating a demo account with the broker company, the broker will provide several cTrader trading platform options. Pick up the one which suited s per your needs.

- And finally, you begin trading with cTrader.

So, it takes only a few seconds for a trader to use cTrader. To gain it, he should ensure he conducts the best research possible. Trading needs extensive study from traders. A month or longer may occasionally pass during the investigation phase of a trade.

A trader that consistently wins their cTrader trades puts a lot of work into doing so.

cTrader key facts

Here are some cTrader key facts that explain why trading on it is the smartest choice for any broker.

Deep information about the market

The fundamental reason why people choose cTrader is that it offers them an opportunity to dig deeper into the market. cTrader has several trading tools for technical analysis that help traders inspect the trends and the price level of any underlying asset.

Customized indicators

Traders who use the cTrader trading platform have the greatest benefit of being able to customize their research. Although traders can use one of the many trading indicators available on cTrader, they can customize them according to their needs.

Chart trading

The best feature and key fact about cTrader are that it allows chart trading for traders. Traders can access a lot of charts on cTrader.

Layouts

While using cTrader, traders can choose a layout that fits their trading needs.

Underlying assets

The most significant advantage to traders using cTrader is that it allows them to access not only a few but many underlying assets. So, researching the asset you want to trade becomes simple for any trader. As a result, they can conduct better technical analysis and place their trades to earn more profit.

In addition to this, another key fact about cTrader is that it offers ease and convenience to traders. Since traders can make the best trading analysis, they can fetch immense wealth.

cTrader allows traders to enjoy trading because it is a quick trading platform. This platform is all that a trader needs to enjoy trading and get a custom trading experience. They can always make cTrader work to fulfill their trading requirements.

Fees and costs

The charges for copying could be determined by the strategy provider based on how much they value their strategy. It also depends on how much they believe the other traders would be prepared to spend for it.

Legally, a provider can declare zero into all fees for whichever live or demo strategies he wants to offer, ensuring that no one would be paid and the strategy offered is free.

The management fee, volume fee, etc., can all be established by a trader after becoming a strategy provider.

Management fee

Every trader who takes help from a strategy provider for trading needs to pay management fees to the strategy provider regularly.

Also. the strategy provider could change the management charge as a yearly percentage of the follower’s wealth. However, this proportion can be at most 10% of the investor’s equity.

Performance fee

The margin of the overall profitability produced by a technique of the copy trading account is known as the performance fee (P). This fee can be at most 30%.

When an investor duplicates several approaches, the performance fee evaluation is applied separately to each specific account.The fee is also assessed when a follower withdraws money or stops using the strategy.

Volume fee

An investor’s price for every million copies of a volume is the volume fee. Each position is multiplied by the side-by-side calculation.

The volume fee is only charged when the Provider joins in trading. Also, it is not charged when the Provider manages its balance.

Available assets to trade

Traders can access a lot of underlying assets on cTrader. When you connect your broker with this trading software, it offers you added advantages. There are hundreds of underlying assets whose technical analysis cTrader supports.

Here is a list of several underlying assets offered by the top cTrader providers:

Pepperstone

Pepperstone offers a variety of benefits to its traders. The greatest advantage of trading with this broker is that the traders can access more than thousands of assets. In addition, it offers more than 1200 underlying instruments.

The following are the assets that Pepperstone offers:

- Stocks

- Cryptocurrencies.

- Commodities

- Currencies

- Indices

IC Markets

IC Markets helps their traders to access the global market with the following asset:

- Futures

- Forex

- Stocks

- CFDs on Commodities CFD

- Cryptocurrency

- Stocks

- Bonds

FxPro

Along with offering premium access to the financial markets through its sophisticated execution strategy, FxPro also has tens of thousands of instruments which include six asset classes:

- Forex

- Metals

- Cryptocurrency

- Energy

- Stocks

- Indices

Conclusion – Choose one of the best cTrader brokers!

Hence, choosing the best cTrader broker for trading is the best way to gain maximum gain quickly. It is the safest and easily learning trading platform. Many brokers are available, so doing brief research is always a smarter idea.

You can go for Pepperstone, IC Markets, and FxPro to make the most from cTrader.

(Risk warning: Your capital can be at risk)

Frequently asked questions about cTrader:

What is cTrader?

cTrader is a platform with various tools to make trading easy. Also, it has a huge range of order management options. It is also considered the quickest platform for trade implementation.

Why should you go for cTrader?

There are many reasons.

cTrader’s software is incredibly portable.

It is a valuable and quick platform.

Indicators abound in cTrader and let you alter the graphical user interface to accommodate different trading and analytical approaches.

Because it charges the brokers, there is no clash between the trader and the cTrader brokerage firm.

Is cTrader appropriate for newbies?

Although many experienced traders utilize cTrader, rookie traders could also gain from this. The chart analyses feature in cTrader is very helpful for beginners. In contrast to most trading systems, the sellers for cTrader’s third-party indicators offer thorough information to assist traders in making the most of them.

What is a cTrader broker?

A cTrader broker is a broker that offers you an opportunity to connect with trading software.

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)