INFINOX review and test for investors – How good is the platform?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.3 / 5) (4.3 / 5) | SCB, FSCA, FSC | £1 | 49+ | From 0.2 (ECN account) |

With a combined management team track record stretching back over a century, it’s little surprise that INFINOX is an internationally recognized forex and CFD trader.

Founded in 2009, INFINOX has been steadily expanding and now boasts a presence in more than 15 countries. Despite their shouty all-caps name, INFINOX has been quietly building a worldwide clientele by providing premium client services and competitively pitched trading conditions.

What is INFINOX?

INFINOX is a forex and CFD trader that is regulated and registered in The Bahamas. Their registered office is in Nassau, the Bahamian capital. But they also have the UK based in Lombard Street in the historic heart of the City of London.

Among the assets you can trade with INFINOX are forex, equities, indices, commodities, and futures. And with five different account types, you are sure to find one that’s a perfect fit.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

More than 49 currency pairs can be traded 24/5 on tight spreads using the leverage of up to 300:1. Or go long or short, trading CFD equities on the world’s largest companies and brand names using small margins. Typically, the commission per share on each trade-in, say, Google, Tesla, or Apple, is just $0.02. If you prefer more liquid markets and trading on the news, then INFINOX has you covered with its indices trading. And for traders with a penchant for the tangible, you can trade commodities too.

Meanwhile, back in the day, the trading of futures was once the sole preserve of large institutional traders. That is no longer the case. You can easily trade CFD futures with INFINOX at low margins and without the prohibitive trading cost overhead. All of their trading types have compelling conditions that the discerning trader should take into consideration. Among these headline arguments tipping the balance in favor of INFINOX are:

- Nine platforms – including social trading – mean you can trade wherever you are on any device

- INFINOX is regulated internationally by Tier One regulatory bodies

- They offer multilingual customer support

- They have a reputation for providing premium client services

- They have a solid deposit insurance scheme in place

- And have a decade-long business track record.

Suffice to say, if you are hunting for excellent trading conditions and exceptional customer service, INFINOX is quite definitely in the running.

Regulation and safety of INFINOX

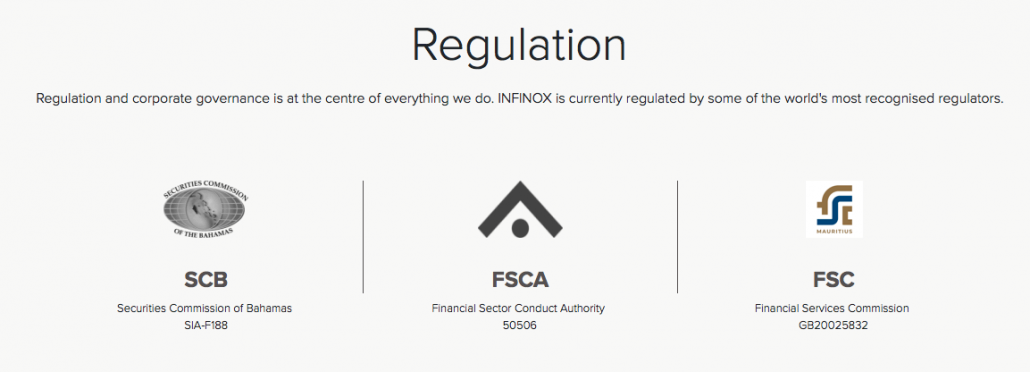

INFINOX is widely regulated in multiple jurisdictions. Among those financial bodies with oversight are:

- The Securities Commission of the Bahamas: INFINOX holds the SCB Registration Number SIA-F188. As such, the broker is authorized to deal, arrange, and manage securities.

- The Financial Conduct Authority: The UK financial regulator has INFINOX registered. Their registration number is 501057.

- The Financial Sector Conduct Authority: INFINOX is registered to trade in South Africa under license number 50506.

- The Financial Services Commission: The Mauritius-based regulator has issued INFINOX with the license number (GB20025832).

Furthermore, INFINOX holds a business license in The Bahamas (10077880) and is a registered company in the UK (11290391).

As part of their best practice commitment, INFINOX holds client funds in a segregated bank account with the Commonwealth Bank of Australia. This bank is globally acknowledged as a trustworthy and reputable financial institution. Meanwhile, INFINOX account holders are also covered by a million-dollar insurance policy. Should INFINOX become insolvent, each claimant will receive up to USD $1 million in compliance with the inevitable terms and conditions and limits of the insurance policy.

Eligible claimants must be a customer of the Insured and have submitted, within 12 months of the insolvency event, a claim to the Insolvency Practitioner and an Investor Compensation Form to the Insured. You can download a PDF document of the Lloyds policy details on the INFINOX About Us page.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

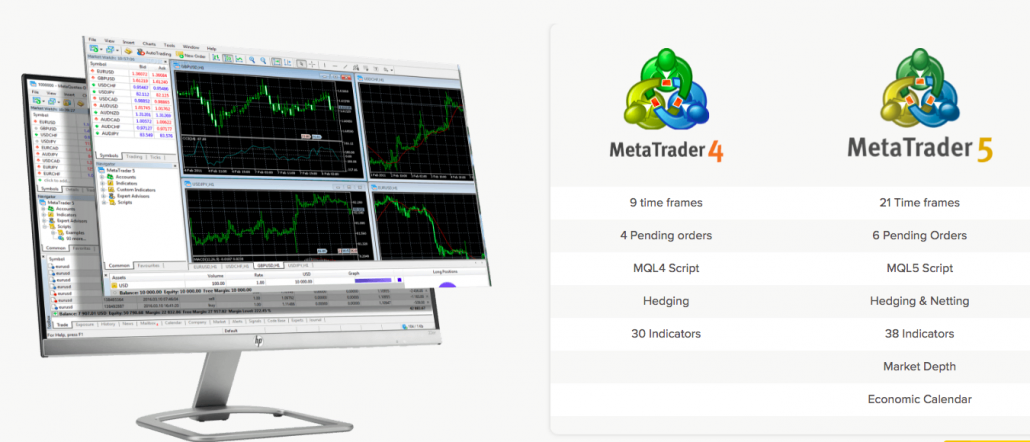

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) MetaTrader 4 and 5INFINOX offers both MetaTrader flavors enabling traders to use this iconic platform to trade forex, gold, indices, commodities, equities, ETFs, and more. Plus, you have all the tools and charts at your fingertips to exploit every market opportunity that arises. MetaTrader 4 and MetaTrader 5, alternatively known as MT4 and MT5, are two of the most popular and widely used trading platforms. They combine advanced trading tools that are packaged together into a surprisingly user-friendly interface. Their foundations are the powerful programming languages MQL4 and MQL5. Since its first release, MetaTrader has become the de facto automatic trading standard.  However, it is essential to know that there are differences between the two; MT5 is not merely an MT4 upgrade, for instance. MT5 is a different beast altogether, though it does share a lot of the same DNA. The primary divergence is that MetaTrader 4 was custom-built and renowned for forex trading. MT5, meanwhile, also enables users to trade indices, metals, oil, and equities. To muddy the waters, though, you can trade indices, metals, and oil on INFINOX’s MT4 platform. So unless you desperately need equities in your portfolio, the platform decision boils down to personal preference between the straightforward MT4 platform and the more advanced and agile MT5. Both are customizable by the user, so they can have the exact view they want for their trading and are easy to use. A big part of their appeal is the analytical tools, with MT4 offering up to nine time-frames and MT5 21 time-frames. The decision on which variety of MetaTrader to opt for comes down to your trading objectives. If you solely want to trade forex, then chances are you will be happy enough with MT4. It offers six pending orders, hedging, and 30 built-in technical indicators. Along with advanced analysis tools, traders can easily read trends and then determine their entry and exit points thanks to advanced ordering. If you want more flexibility and more trading options, then MetaTrader 5 will be the better option. It contains the same features as its older sibling but offers more assets to trade. Consequently, MT5 is more feature-packed, having 21-time frames, six types of pending orders, and editable scripts. Arguably, MT5 is more efficient and easier to use than MT4. Other distinguishing features are MT5’s netting ability, its 38 integrated tech indicators, and market depth and economic calendar intel. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Mobile tradingMT4 and MT5 are both available as mobile apps for Android and iOS phones and tablets. The apps are downloadable from Google Play and Apple’s App Store. Both apps are intuitive and easy to use, have most of the same features, and offer one-tap trading. You can also use Webtrader to log into your account from any device with a stable internet connection.  IX Social TradingThis is INFINOX’s shiny new social trading app giving access to all the financial trading markets, including stocks and crypto. The app offers beginners the opportunity to mirror successful traders via auto-copying. And for seasoned traders to earn money by sharing their winning strategies with their followers. The app is downloadable from Google Play and the App Store. How to tradeIf you are a forex or trading newbie, you are well-advised to do your homework first. The worst possible outcome is guaranteed by diving straight into live trading without a firm grasp of the markets and how to trade successfully. Unlike most others, INFINOX, disappointingly, does not offer traders much in the way of educational or training resources. And those they do have been well hidden and relatively lightweight. This shortage clearly signals that INFINOX is not the best place for rookie traders to begin their forex journey. But no matter which asset type you plan to trade, it’s essential to understand the market fundamentals and how to trade effectively. You will also need to be up to speed on how to navigate your way around the trading platform in addition.  Ask anyone involved in CFD trading, and they will all tell you the same thing: the best way to lose money is not to do your homework first. And as forex and other financial markets are so fluid and dynamic, you never quit learning. However, you can give yourself the best headstart possible by taking an online course on trading. Consume every piece of content you can and study hard until your only shortcoming is lack of experience. Of course, the quality of what is available online varies wildly. So keep a close eye on who is offering a course. If it’s get-rich-quick style, walk away and find something better. A rich vein of learning materials is available on many broker websites. Just not INFINOX, unfortunately. What they do have isn’t comprehensive or detailed enough to make a big difference. Most of the best broker and forex trading sites do not even require you to open an account to access most of their online training assets. However, to gain access to webinars and so on, you may have to register first. How to open an accountINFINOX offers a range of account types, including individual, joint, and corporate accounts. They are either straight-through processing (STP), or electronic communication network (ECN) based.But INFINOX loses marks for offering little hard information about their accounts without first signing up. There’s no visual way to compare them or what they offer.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) The account types are:

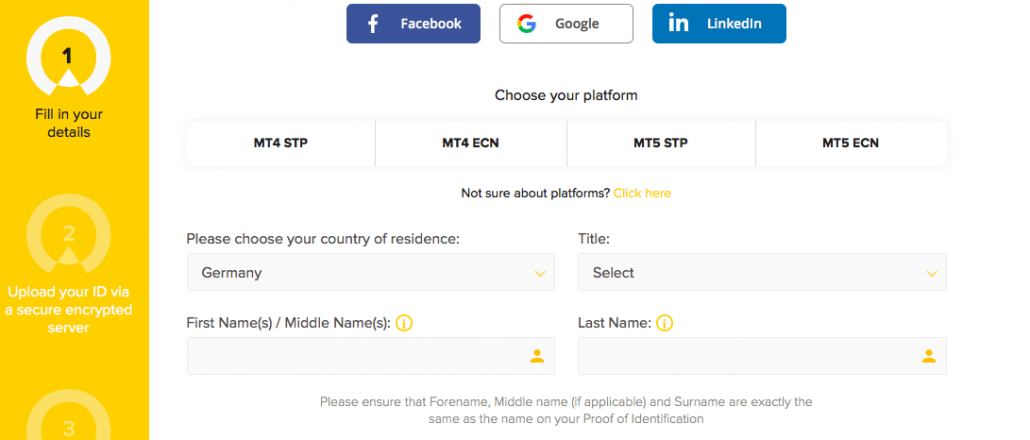

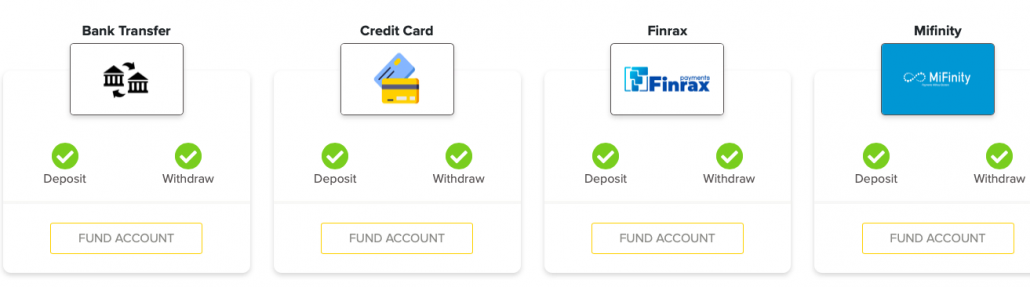

To open an account, click or tap the Sign-Up button on the INFINOX home page. Then choose your account type and complete the online form. Alternatively, you can opt to open your account using a Facebook, Google, or LinkedIn account. The second step is to upload your ID documents for verification. As INFINOX is a regulated broker, it is legally required to comply with all the requirements of KYC (Know Your Customer). This regulation is mainly to prevent money laundering and other illegal activity.  To fully comply with these regulations, INFINOX needs to have sight of identity documents. How these documents are handled and stored is subject to strict rules. To verify you are who you claim to be, INFINOX – like every other regulated brokerage firm – needs a copy of your valid passport, driver’s license, or government-issued national ID card. These documents must not have expired. You will also need to send a recent proof of address dated within the last three months. This could be, for instance, a statement from your bank or a utility bill. Once your documents have been verified, INFINOX will send you all your account details, and you can start trading. In common with other brokers, INFINOX will not transfer money to a third-party account. Occasionally, they may also ask for further account information to verify a withdrawal. Sensitive data and privacy are taken seriously by INFINOX. They won’t share your personal data with third parties for marketing purposes. However, they may use your personal details to verify your identity and prevent fraud. Demo accountINFINOX offers demo accounts you can access via the prominent green Demo button on the home page’s top menu. Signing up is risk-free. No deposit is required, and you don’t need to produce documents to verify your identity. On the demo sign-up page, you first select which platform you want to test drive. The choice is either the straight-through processing or electronic communication network versions of MT4 and MT5. You can then complete the process using your email address and completing the text fields.  Alternatively, you can opt to sign up using your Facebook Messenger or Telegram accounts. When you select your preferred instant messaging platform, you then follow the on-screen instructions to open the demo account. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Is there negative balance protection?Yes, INFINOX has negative balance protection in place for all its retail customers. This means you cannot lose any more than your account balance even when using leverage of up to 500:1. Negative balance protection stops your losses before you end up owing money on a losing trade. If you are trading a rapidly moving or volatile market such as forex, then negative balance protection is a safety net of sorts. In the worst-case scenario, you end up with an account balance of zero. Not great, admittedly, but far preferable to what might otherwise be the case. Deposit and withdrawalsDropping a deposit or taking out your profits is a streamlined process and faster than you may expect. There are multiple ways to send a deposit. And to get going with INFINOX, you only need a pound or the equivalent of £1 in your chosen base currency.  Topping up your account can be done via the following methods:

INFINOX does not accept cheques, cash, PayPal, American Express, or Diners cards. Deposited funds, as noted earlier, are held in a segregated bank account. This means that your funds held by INFINOX cannot be used for other purposes and can only be paid out to you. To withdraw funds from your INFINOX account, go into My Account and tap Withdraw Funds. There’s then an online form to complete so INFINOX can process your withdrawal. In addition to bank transfers, it’s also possible to have funds returned to your credit or debit card if you have deposited from the card in the past 12 months. You can open a live trading account in GBP, USD, EUR, or AUD. To avoid foreign exchange conversion fees, open the account in whichever currency you expect to use for deposits and withdrawals. You can change the currency of your account, but you will need to open a fresh account. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Support and serviceINFINOX is easy to get hold of for customer support. There are several ways they can be reached:

Special offersAs it operates out of the heavily regulated UK, INFINOX cannot offer any special offers or discounts as you may see elsewhere. There’s no deposit bonus, loyalty schemes, or anything of that ilk. That said, INFINOX is not completely miserly as it offers an interesting selection of free tools to give you a competitive edge. Not least of which is Autochartist, the world-leading charting software that makes implementing technical tools much less of a headache and more effective. What Autochartist does is scan the market for emerging patterns. Autochartist then gives you a heads-up on which way the price is likely to move when it finds a pattern. It’s then up to the individual trader on whether to take action on this intel or not. The software plugs into all the various iterations of MetaTrader 4 and 5, so it’s easy to deploy and use. It’s user-friendly, too, identifies a sizable range of patterns, and comes with an integrated risk calculator. Conclusion of the review: INFINOX is a trusted brokerINFINOX is not suitable for beginners unless they wish to stick with copy trading using the platform’s IX Social mobile app. Novice traders are not well served, even with the option of opening a demo account. There are no shortcuts, do-overs, or substitutes for experience. As INFINOX makes only a minimal attempt to provide beginners with comprehensive educational or training resources, there are far better places to learn to trade. INFINOX, then, is squarely aimed at experienced and advanced traders who need the minimum of hand-holding. This broker is not a scam. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) FAQ – The most asked questions about INFINOX :How do you trade on INFINOX?Trading in INFINOX is a very simple procedure. Firstly, register yourself by applying online. This includes registration and verification. Next, make your first deposit and fund your account to start placing orders, and that’s it; your INFINOX account is trading ready. Is INFINOX a ECN broker?Infinox is setting its standards high day by day through competitive pricing. Start trading your CFDs using any type of account, be it STP or ECN account type. With either of them, you will get cutting-edge execution, deep liquidity, and a complete range of platforms and tools. How do I link INFINOX to MT4?Start with signing up for the Infinox trading account. Next, select the CFD trading platform you want to choose (STP or ECN); after finishing the account registration form, download MetaTrader 4 for the device you are using- desktop or mobile. Now login to MT4, and you are all set to trade through Infinox servers. How do I withdraw money from INFINOX?To withdraw money from Infinox to your bank account, first register your bank account information in the “bank Account” tab. After filling up all the other necessary details, click on the “Money Out” tab and complete your request for withdrawal via bank wire. Learn more about brokers: A broker lends trader’s shares for short-selling – Risks and Benefits How to withdraw money on Pocket Option – Withdrawal tutorial Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/INFINOX-Logo.png 70 240 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-03-22 19:35:372023-01-27 20:02:32Infinox |