Hantec Markets review and test for new investors – Scam or not?

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(4.8 / 5) (4.8 / 5) | FCA, JSC, FSA, FSC, ASIC, CGSE | $1000 | 100+ | From 0.01 lot |

Choosing the right broker to invest in is not a simple task. There are a handful of factors that you should consider when it comes to choosing a company to partner with. You have to make sure that they’re regulated, straightforward, and, most importantly, reliable.

With 30 years of experience, Hantec Markets surely knows its way around the trading scene. You can rest assured that they possess all the important factors mentioned above and more. Below is all the information you need to decide on whether Hantec Markets is the right broker for you.

What is Hantec Markets – Introduction to the broker

This company has been around since the year 1990, making it one of the oldest companies in the financial market scene. It was founded by a group of people in Hong Kong who possess a passion for helping others succeed in their trading journey. Throughout the years, the Hantec Group was known for a wide range of business types. These include real estate, finance, consulting, IT, and even Culture and Art. By the year 2000, the Hantec Group became part of the Main Board of Hong Kong Stock Exchange and built physical offices in the Philippines, France, and Japan.

In the year 2008, the name “Hantec Market” was created in Australia. Two years later, Hantec Markets set up a flagship office in London, United Kingdom. This jumpstarted their goal to grow and reach an even wider audience. To this day, Hantec Markets plans to expand its global presence to provide the best service to anyone who needs it.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Is Hantec Markets regulated?

Since Hantec Markets has grown into a vast company with a huge global presence, they split the company into two divisions: the Eastern Division and the Western Division. Below is a list of countries Hantec Markets operates in and which companies regulate them.

Western Division:

- United Kingdom – FCA or Financial Conduct Authority

- Jordan – JSC or Jordan Securities Commission

- Mauritius – FSC or Financial Service Commissions

Eastern Division:

- Australia – ASIC or Australian Securities and Investments

- Japan – FSA or Financial Services Agency

- Hong Kong – CGSE or Chinese Gold and Silver Exchange

Client Money Protection

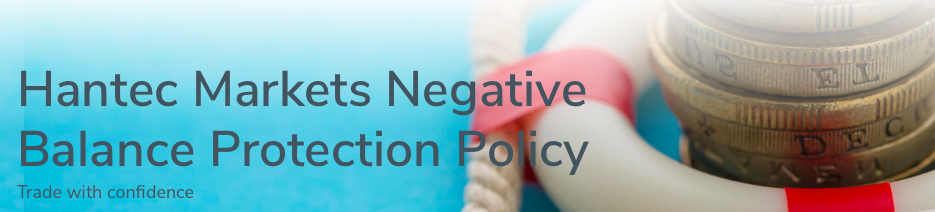

Since Hantec Markets is well known for being very client-centric, all their clients are covered by their Excess Loss Insurance policy. This states that if for any reason, the company goes bankrupt, or they encounter any insolvency event, their clients are insured up to $100,000.

To view the full details, terms, and conditions, as well as the certificate of the policy, you check their website or ask their customer service representatives to explain it to you.

Trading conditions

They charge zero commissions and offer competitive spreads. Aside from the regular demo and live accounts, Hantec Markets also have swap-free accounts. For clients that have multiple accounts, this broker has a Multi-Account Manager (MAM) for their clients.

Fees:

Each market available on Hantec Markets’ platform has its corresponding fees. For CFD markets, the usual trading cost is the spread or commission. For positions that you hold overnight, you will be charged an overnight funding fee or swap charge. This depends on how much you invested and the size of your trade.

What markets are available on Hantec Markets?

Hantec Markets is a broker that offers high-quality trading for all its clients. They offer a lot of assets such as currencies, indices, cryptocurrency, bullion, stocks, and commodities. As a broker that specializes in forex, they aim to give the best service for this particular market. Hantec Markets utilizes the most popular trading platform: MetaTrader 4.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) CommoditiesTo build a diversified portfolio, Hantec Markets offer the service to trade specific hard and soft commodities. Hard commodities include natural gas, oil, and precious metals like zinc, lead, aluminum, and copper. For soft commodities, sugar, wheat, cotton, coffee, and cocoa are available.  Spreads start at 0.5 and can reach up to 100. A leverage ratio of up to 1:500 is available for clients who want to utilize this. The minimum trade size for commodities is one, and the maximum lots per trade are 10 or 100, depending on the commodity being traded. There is no minimum funding required to trade US oil or UK oil. However, minimum funding of 1000 USD, 1000 EUR, or 1000 GBP is required for the other tradable commodities with Hantec Markets. Most importantly, they do not charge commissions to trade these. Below you can find all the available commodities, their corresponding account denominations, and trading hours:

CryptocurrenciesAs a regulated broker, Hantec Markets gives you the peace of mind to trade cryptocurrency safely and securely with them. The available cryptocurrencies are Bitcoin (BTCUSD), Bitcoin Cash (BCHUSD), Ripple (XRPUSD), Ethereum (ETHUSD), and Litecoin (LTCUSD). With zero minimum deposit, you can buy your own cryptos with a minimum trade size of 0.01 lot, while the maximum lots per trade is five. The margin requirement is 20% of the contract value.  Since they offer cryptocurrency trades as CFDs, clients can either long or short the desired asset depending on their outlook on the cryptocurrency’s future. Trading hours for this market using Hantec Markets follows the same time as forex trading. This means if the forex trading market is closed, you can’t trade your cryptos using their platform. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) What platform does Hantec Markets use?Those who trade with Hantec Markets can use the world-famous MetaTrader 4 trading platform. With this trading platform, you have the best entry into the global markets and on top of that, you can use a variety of analytical tools for your own trading. We will now introduce you to the variance of the MetaTrader platform. MetaTrader 4With MetaTrader 4, or MT4, clients get the experience of world-class execution speeds. This is available for all three accounts offered by Hantec Markets. Because of their fast execution speeds, this gives clients the chance to trade accurately.  With Hantec Markets, you will be trading on a global scale with a lot of asset classes to choose from. Spreads are really tight for the benefit of the clients. Their user-friendly platform makes planning and executing trades much easier compared to other platforms. There are also tons of free indicators and tools that you can utilize in managing your trades. In case you’re not familiar with the platform, Hantec Markets also offers a tutorial on how to use MetaTrader 4 and all the available tools. MetaTrader 4 is available for Windows and Mac. MT4 has its own mobile application for Android and iOS users if you prefer working on a tablet or your mobile phone. Learn to trade with Hantec MarketsHantec Markets welcomes new, intermediate, and experienced traders to their Learning Hub. Depending on how you classify yourself (new, intermediate, or experienced), you will find all the necessary information that you need to start trading. They also give their clients access to webinars, glossaries, and other downloadable content that will help you understand the market and adapt or improve your trading strategy. If you can’t seem to find the answer to your question, their customer service representative is readily available to answer all your technical queries. The three types of accounts available on Hantec MarketsWith Hantec Markets, you can choose to practice on their platform by signing up for their demo account, or if you want to get started right away, you can sign up for their live account. Unlike other brokers, Hantec Markets have a third account type. This is their Swap Free account. Demo AccountSigning up for a demo account will only take five minutes. You will be asked to input your full name, email address, country of residence, and contact number. You are also given the opportunity to select your ideal leverage. The available options are from 1:50 up to 1:500. After confirming your email address, you will be given access to the MetaTrader 4 platform. You will be given a virtual balance of £10,000, which you can use to practice trading in real-time. You will also have access to daily and weekly reports, as well as videos provided by their research team.  It’s important to note that after signing up, you will only be able to access their platform for 30 days. This should be enough for you to test out different trading strategies without the risk of losing your hard-earned cash. Live Account ($1000 minimum deposit)Clients have two options when signing up for a live account. You can either choose to register for an individual or corporate account. Opening either a corporate or individual account only takes three steps. First, you will have to register by providing the necessary information on their website. Next, you will be asked to submit a government-issued ID and proof of address for them to approve your account. Lastly, you will have to add funds to your wallet via wire transfer or online payment methods. You’ll be able to start your trading journey with Hantec Markets once you finish all the steps mentioned above. Swap-Free AccountSwap-free accounts are exclusive for Hantec Markets’ Islamic clients. As the name suggests, no swap charges are incurred on this type of account when trading the following: AUDUSD, GBPUSD, EURUSD, USDJPY, EURCAD, USDCHF, EURGBP, GBPCAD, EURCHF, NZDUSD, EURJPY, AUDNZD, GBPJPY, USDCAD, CADJPY, GBPCHF, CADCHF, XAUUSD, and XAGUSD.  To apply for their swap-free account, you will have to contact them via their website. They will assist you with your application and provide all the information you need to start trading with them. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|