FXPIG review and test – A good ECN broker or not?

- FXPIG review and test – A good ECN broker or not?

- Getting to know FXPIG

- FXPIG trading conditions- What can the broker offer?

- Test of the FXPIG trading platforms

| Review: | Regulation: | Min. deposit: | Assets: | Minimum Spread: |

|---|---|---|---|---|

(4.5 / 5) (4.5 / 5) | VFSC | $200 | 160+ | from 0.01 lot |

When it comes to investing your hard-earned money, make it a habit to trust only the most reputable online brokers. Thanks to FXPIG, finding a versatile and personalized online brokerage is made easy. With its clients at the center of the FXPIG vision, FXPIG has been a reliable trading platform for over 10 years.

For the past 9 years of reviewing online brokers, and we’re here to share all we know about handling financial markets. Get ready to seal the deal as we introduce you to the best trading brokers backed by exceptional investment services. In this article, we’ll dive deep into the trading conditions that FXPIG features, from its vision, platforms, costs, assets, and regulations.

Don’t let your choice of a reliable online broker hold you back. Give your assets the special care they deserve by researching online brokerages that will give you a rewarding trading experience.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Getting to know FXPIG

FXPIG has made a name for itself among institutional and retail investors for its uniquely customizable and interactive trading solutions. Trading as FXPIG, the Prime Intermarket Group Asia Pacific LTD was established in Auckland, New Zealand, in 2010. After about 7 years in the business, FXPIG officially moved to its current address in Vanuatu.

In 2016, FXPIG acquired a license with VFSC, or the Vanuatu Financial Services Commission. In its effort to uphold its company vision and standards, FXPIG has become a member of the Financial Commission in Hong Kong only a year after.

With over 11 years in the financial market, FXPIG has been true to its brand vision of offering transparency and client-centered services. FXPIG simply wanted to create a platform that set its clients up for success. FXPIG is renowned for being a uniquely light-hearted, fun, and interactive online trading platform. We present an STP or Straight Through Processing forex broker that obviously puts clients at the center. Unlike most online brokers that profit from client losses, FXPIG doesn’t go against its clients and never counterparties trades.

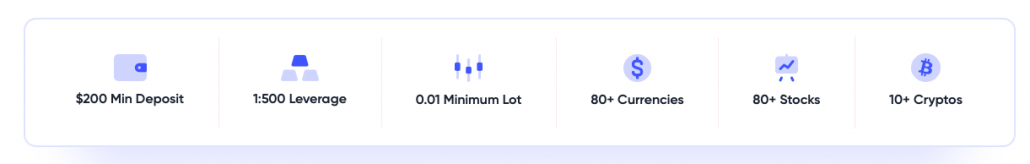

FXPIG provides powerful MTF and cTrader platforms as well as a FIX API solution. Users can open an account with a minimum deposit of 200 USD with leverage up to 1:500. Trade up to 80+ currencies and stocks, as well as more than of the most popular cryptos.

We admire FXPIG for their unparalleled broker transparency, which you can decipher right away from their company website. Clients will find that FXPIG continuously updates their financial statistics on their website every half hour at that! These charts and statistics are based on 24-hour data. Easily find the average execution time and slippage on their website. With FXPIG, every client is in on the secrets of the financial market.

FXPIG ensures that all client trade is directly passed on to aggregated liquidity providers. This means that FXPIG does not create its own market in-house – 100% of client trade gets into the transactional FX marketplace. Clients don’t need to worry about requesting a FIX trade log. Simply ask for help at FXPIG, and they’ll help you understand everything you want to know about your trades. Rest assured that FXPIG responsibly handles its online platform to have compliance audits, accounting, and insurance.

Facts about FXPIG:

- PIG stands for Premier Interchange Gateway

- Prime Intermarket Group Asia Pacific Limited

- Founded in Auckland, New Zealand, in 2010 by Kevin Murcko

- Granted License for dealing in securities given by Vanuatu Minister of Finance and Economic Development

- Licensed under Vanuatu Financial Services Commission Member of Hong Kong Financial Commission in 2017

- STP forex broker

- 200 USD minimum deposit with 1:500 leverage

- cTrader, MT4, FIX API, Web & Mobile platforms

- Minimum lot size: 0.01, spread starts at 0 pips

- Commission: from 5 USD

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

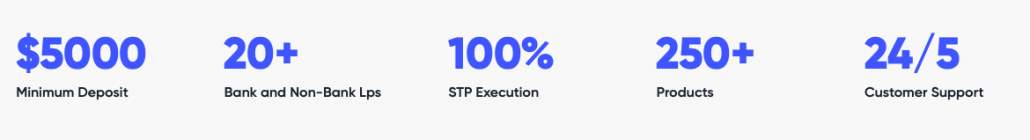

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) FXPIG trading conditions- What can the broker offer?FXPIG provides its clients from nearly 100 countries with enough chances to grow their assets and profiles. Find a true STP broker with FXPIG. The broker provides Institutional Straight Through Processing aggregated from more than twenty banks and non-bank LPs. This is to assure clients of the highest quality trading operations with no delays and zero restrictions. FXPIG’s offers a wide selection of currency pairs, indices, commodities, and share CFDs to clients in Australia, Canada, China, Germany, and Russia. Clients can trade over 80+ stocks, 80+ forex pairs, 10+ cryptocurrencies, 12 index CFDs, and precious metals with zero restrictions through MT4, cTrader, or FIX API platforms. Clients can trade across multiple markets with up to 1:500 leverage. FXPIG ensures that all its clients are up-to-date on the latest market research and strategies thanks to its comprehensive Education page brimming with articles, videos, and blogs on the financial market. Novice and veteran investors can also access a Market Analysis page to keep ahead of the game. FXPig also offers reliable access to professional financial advice with their customer service support through call, live chat, and email 24/5. FXPig aims to create transparent and client-centered trading conditions that reflect true market conditions. This is to ensure that all clients are set up for success. Also, FXPIG has gained both local and worldwide recognition for its distinctive and unique approach to the financial market. To this day, FXPIG remains one of the most respected and highly-rated online trading platforms. Moreover, clients are given access to FXPIG’s award-winning liquidity through its reliable platforms. Account TypesFXPIG offers versatile and customizable solutions for all types of investors. Opening an account with FXPIG means you get an account that is well-suited to your profile and financial needs.  Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Price FeedsFXPIG offers three price feeds to choose from via its MT4, cTRrader, and FIX API platforms:

The difference between the SPA and MPA feeds is in the liquidity aggregation pool. The SPA feed takes its liquidity from both bank and non-bank market makers, making it a great option for clients looking for fast operations, consistent pricing, heightened tick values, and tighter spreads at 0.3 pips. SPA feeds also protect against double-tapping. It also has no dealing desk and 0 margin hedge trading. Traders can open a standard account at a minimum of 200 USD.  MPA feeds take liquidity from ECNs and non-bank market makers. FXPIG Premiere accounts are a hybrid of Multiple Trading Facilities and the Electronics Communication Network. According to FXPIG, this provides clients with an opportunity to take advantage of multilateral matching and multiple aggregations in ECN simultaneously. Clients who get Premier accounts get direct access to the forex market to have direct trades. MPA spreads increase access to the liquidity pool, and it also off increased trader anonymity.  A customized account provides venue-specific liquidity and access to alternative pools that are built on non-bank flow. FXPIG currently offers all these options through their live accounts with the option to go for Raw + Commission or All-in: Standard, Premiere, and Pro. The first two are available on all platforms, while the Pro account is only available on MT4 and cTrader. All options provide access to over 250 tradable products with 100% STP execution and no restrictions. All accounts also feature spreads from 0.1 and maximum leverage of 500:1. All FXPIG clients have direct access to a Portal that provides full information on deposits, withdrawals, commissions, profits and losses, and other statistics. Clients can also request custom statements from FXPIG, with the option to view these online or in downloadable PDF documents. To further transparency, FXPIG also tracks the Master Account through a tracking website. Clients who wish to keep their track record hidden can easily detach their accounts from this option. The accounts in detail:

Fees and costsFXPIG allows deposits through a variety of methods: Bank Transfer, Uphold, Skrill, Neteller, and Debit/Credit Card. Each deposit method warrants a deposit fee and a minimum deposit of 500 USD. Almost all payment options offer instant processing and are allocated to the Master Account eWallet. Withdrawals are also available through several trusted methods: Bank Transfer, Uphold, Skrill, Neteller, EURO SEPA, Worldwide SWIFT, and Debit/Credit Card at varying fees. Clients can also choose to get their own PIGcard that offers the benefit of low-cost and instant withdrawals from their eWallet. All withdrawal methods are available 24/7. Review of Spreads and Commissions FXPIG makes sure to offer competitive spreads. This online broker truly strives to make their platform user-friendly, as can be seen on their real-time spread monitor. Most of the spreads were able to stay low from 0.3 to 3 pips. This ensures that all trading costs will remain low. Commissions on FXPIG will depend on the type of account and platform. 25 per million commission is applied with the MT4 platform, while it goes up to 30 per million on cTrader. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) LeverageFXPIG determines leverage depending on the current account balance, not the account type. Leverages can go up to 1:500 in some cases, but the stop-out level will reach 100% compared to the normal 50%. Account balance:

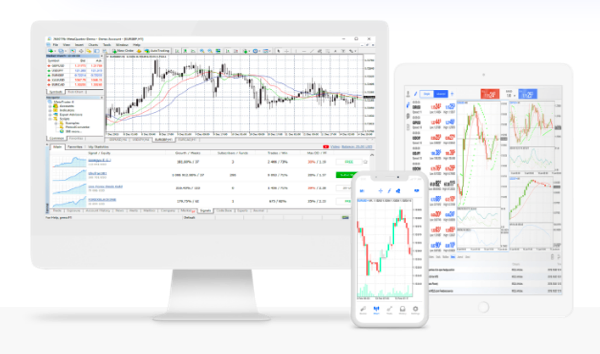

Test of the FXPIG trading platformsFXPIG features three trading platforms: MetaTrader4, cTrader WebTrader, and FIX API. Choose between these three trading platforms to cater to your specific financial needs and preferences. The first two options are available on iOS and Android for additional versatility. MetaTrader 4MT4 is arguably one of the most reputable trading platforms in the forex industry. Millions of traders worldwide depend on MT4 for its fast execution, user-friendly interface, and wide selection of trading tools. The MT4 is definitely the complete package, and FXPIG claims to have made the platform even better.  cTrader WebTraderWhile newer than MT4, cTrader is undoubtedly the more advanced platform. It’s considered to be one of the best trading platforms globally. This web-based platform is suitable for both new and professional traders – clients are provided full STP access to four pricing feeds. Dealing desk isn’t possible with cTrader. This altogether levels off the playing field with traders.  The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|