Purple Trading review – Is it a scam or not? – Test of the broker

Table of Contents

Broker: | Review: | Regulation: | ASsets: | Type: |

|---|---|---|---|---|

Purple Trading  |  (5 / 5) (5 / 5) | CySEC (CY), FSA (SEY) | 300+ (forex, crypto, indices, stocks, commodities) | ECN/STP broker |

Purple Trading is a cutting-edge web-based brokerage firm that provides the best in the market trading technology with multiple assets. Investors can use straightforward STP or ECN processing mechanisms for a variety of Derivatives. This review will investigate Purple Trading’s assets, platform, initial deposit criteria, signup & login procedures, ESMA leverage maximum limitations, and much more.

Should you really invest money on Purple Trading or not? – Find out in our detailed broker test!

What is Purple Trading? – Company presented

Purple Trading was founded in 2016 and is managed and run by L.F. Investment Ltd, a Cyprus Securities and Exchange Commission (CySEC) – a regulated investment firm. The brokerage also complies with European MiFID laws, boosting openness throughout the E.U.’s economic markets. The brokerage attempts to create a balanced trading system utilizing state-of-the-art technologies.

Services can be handled via ECN or STP, resulting in quick order processing and competing circumstances that are dependable and beneficial to traders, with no dealing desk (NDD) interference. The brokerage employs low bandwidth connection through a network of liquidity providers and the world’s best institutions. Purple Trading strives to provide the greatest feasible connectivity for users by maintaining a large liquidity source, minimizing slippage, and minimizing latency. The broker’s trade servers are in London, and it executes orders in 100ms.

- Founded in 2016

- Regulated

- Based in Cyprus, Czech, Seychelles

- No dealing desk interface

(Risk warning: 63% of CFD account lose money)

Regulation of Purple Trading

Purple Trading is licensed and supervised by the CySEC. This is a recognized supervisor in the financial service speculating business. Retail users can be certain of separated money in leading banks and low balance protections under this authorization. Moreover, the brokerage is subject to a constant auditing process and holds extra worldwide certifications with the FCA and CONSOB for operations in other nations.

The brokerage provides enhanced financial protection by providing security through the Investors Compensation Fund (ICF). In the event of corporate collapse, the plan safeguards qualified users’ investments up to €20,000.

Firms should obey European MiFID laws in conjunction with tight supervision. The market in financial instruments directive (MiFID) is a policy that enhances financial sector openness throughout the European Union and unifies legal declarations necessary for certain marketplaces.

Purple Trading prioritizes the safety of customer money. Client monies are maintained in separate brokerage accounts with leading European banking organizations to guarantee that you have constant access to their deposits. This also implies that customer cash could not be utilized for anything else, like company operating expenses.

Purple Trading is now unable to welcome customers from beyond the European Economic Area (EEA), as well as from Belgium, France, the United States, and Switzerland.

Trading conditions and offers for traders:

Clients can invest and trade CFDs and other assets in the below markets through the broker:

- Commodity markets include crude oil, silver, and metal.

- Forex – get accessibility to 60+ currency pairings, such as major, minor, and exotics.

- Equities – invest in 12 important Italian firms, like Ferrari and Generali Indexes – invest in the stock indexes of all of the world’s largest markets, like the NASDAQ, U.S. 30, and DAX 40

- CFD Shares — trade in some of the globe’s largest corporations, such as Google, Apple, and Coca-Cola.

- CFD Future – trade on the growth and collapse of multiple assets like agribusiness, government securities, or the USD indexes.

(Risk warning: 63% of CFD account lose money)

Account Types offered

Purple Trading offers three main account categories. There is an STP trading account, an ECN trading account, as well as an account dedicated to bitcoin trading. The STP accounts are the basic accounts that are created following signup. The needed initial deposit to continue trading is €100 or similar to that of other currencies.

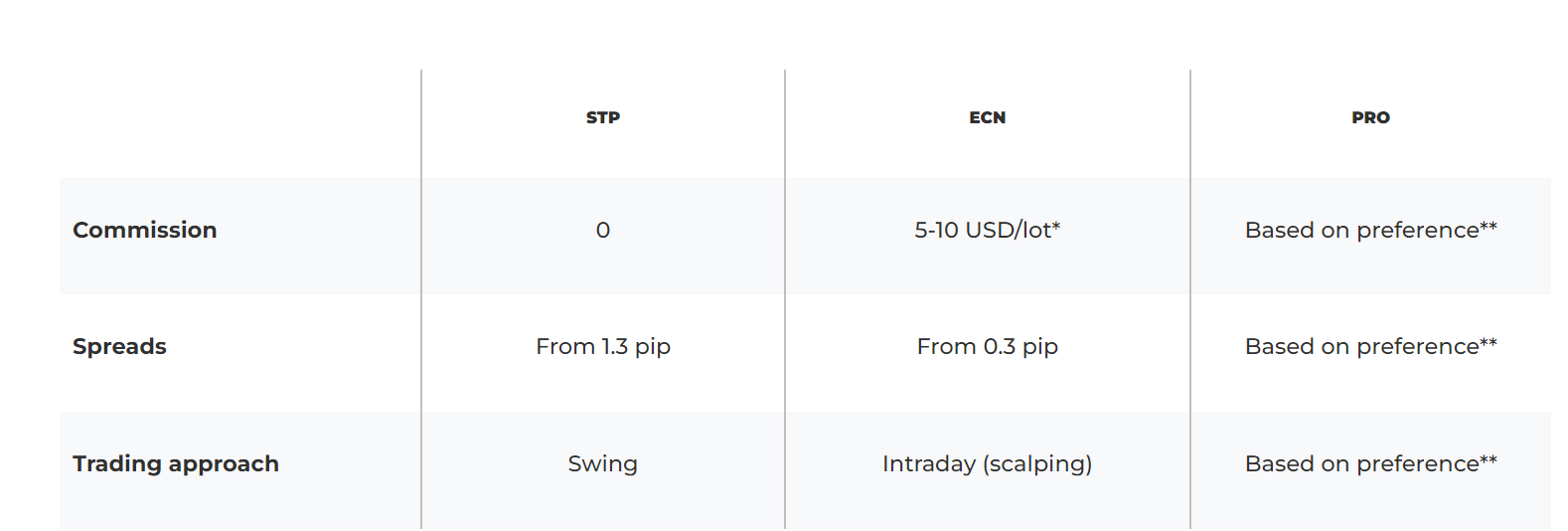

STP Account

The STP accounts are likely to be preferred by people who retain trades for extended durations. It can also be appropriate for investors who desire to pay simply the spreads and no further commissions. The spreads indicate how much you will pay, with executions influenced by market fluctuations and position volumes. Trades are transferred to the money markets for processing, with significant margins starting at 1 pip.

Account ECN

The ECN accounts are designed for intraday and automated trades, as well as for traders who often employ scalping methods. These accounts also provide direct processing in the interbank market, with real-time interbank margins provided by a large variety of liquidity sources. Because there are no spread mark-ups on this type of account, spreads will be lower, yet there is a reasonable fee payable beginning at $5 for each lot based on a user level.

Pro account

Based on the asset being exchanged, the standard leveraging varies from 1:2 to 1:30. Some who qualify as professional customers can enroll for the pro accounts, which provide enhanced leverages of up to 1:400 for specific products and a decrease in existing margin fees, helping you to exchange with more leverages than retail customers due to ESMA constraints.

To register as a pro-customer, you must fulfill two of the three criteria listed below:

- 1) Maintain a portfolio worth more than USD500000, excluding property or cash; and 2) Possess a proven track record of executing big-sized positions at the disposal of the broker.

- 3) Have had a skilled job in the field of derivatives, speculations, or investing. To identify as a pro-customer, you must meet at least 2 of these conditions.

It is crucial to remember that if you qualified for a pro account, your negative balance protections, Investor Compensation Fund, and access to the Financial Ombudsman Services could be eliminated because you are now designated as an expert investor within ESMA regulations.

Cryptocurrency accounts

The Cryptocurrency user account is a specialized account for persons who solely deal with cryptocurrency. This account is readily established from the customer’s Purple Zone. It boasts low margins that originate directly from liquidity providers and a 0.15 percent fee charge.

Demo account

Prior to actually creating a genuine account, a demo account is offered to evaluate the various trading systems and parameters. These are inexpensive and enable you to test your trading techniques with imaginary cash without risks.

(Risk warning: 63% of CFD account lose money)

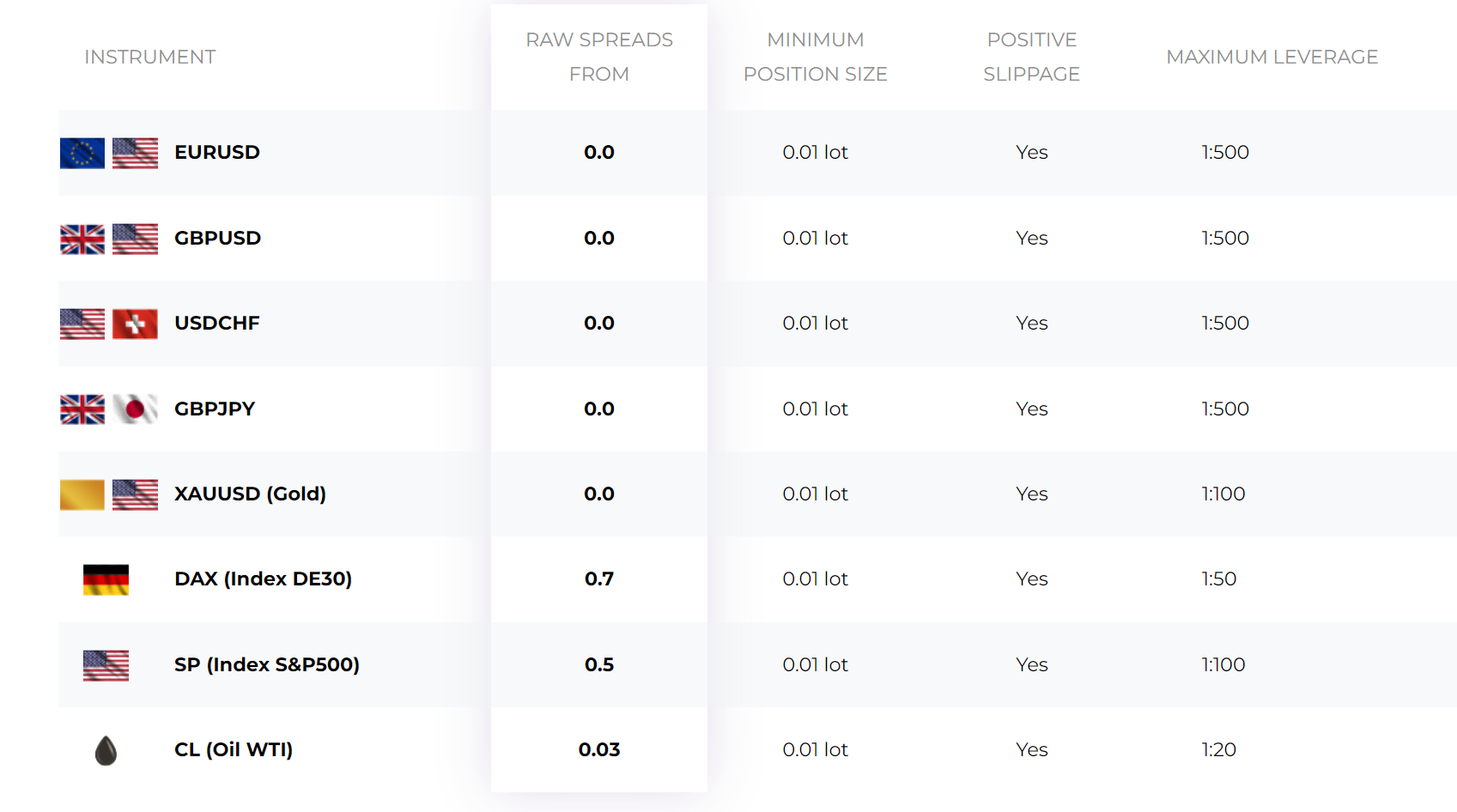

Review of the spreads and conditions

Variable spreads are available across all account categories at Purple Trading. ECN account also carries a commission per lot that differs based on the initial deposit. It might be USD5, USD8, or USD10 per lot while exchanging currency pairings. Equity CFD trading fees are $0.02 per American stock and 0.1 percent of the total transaction base value for other stocks. CFD commissions on contracts are $10 per lot exchanged, and actual share fees are 0.25 percent of the transaction value. Purple Trading does not impose deposit or withdrawal charges and provides a variety of inexpensive funding and payment alternatives (mostly through banks).

It is important to remember that the electronic money methods Skrill and Neteller charge costs for both payments and transfers. The price for inactivity beyond 6 months is 15 €/$ and is levied quarterly. The price for inactivity beyond 6 months is 15 €/$ and is levied quarterly.

When shifting a position till the subsequent day, there are exchange costs and commissions.

Overview about the conditions:

- Spreads from 0.0 pips (variable) – average 0.3 pips on our test

- The commission per 1 lot traded (depending on your account type) is $ 5, $ 8, and $ 10 for forex

- $ 10 commissions on CFDs per 1 lot traded (indices, commodities)

- Commissions on stocks are $ 0.02 per share and 0.1%

- Leverage up to 1:500 (Seychelles regulation), 1:30 for European regulation (1:500 for professional clients)

- Free demo account

- Negative balance protection

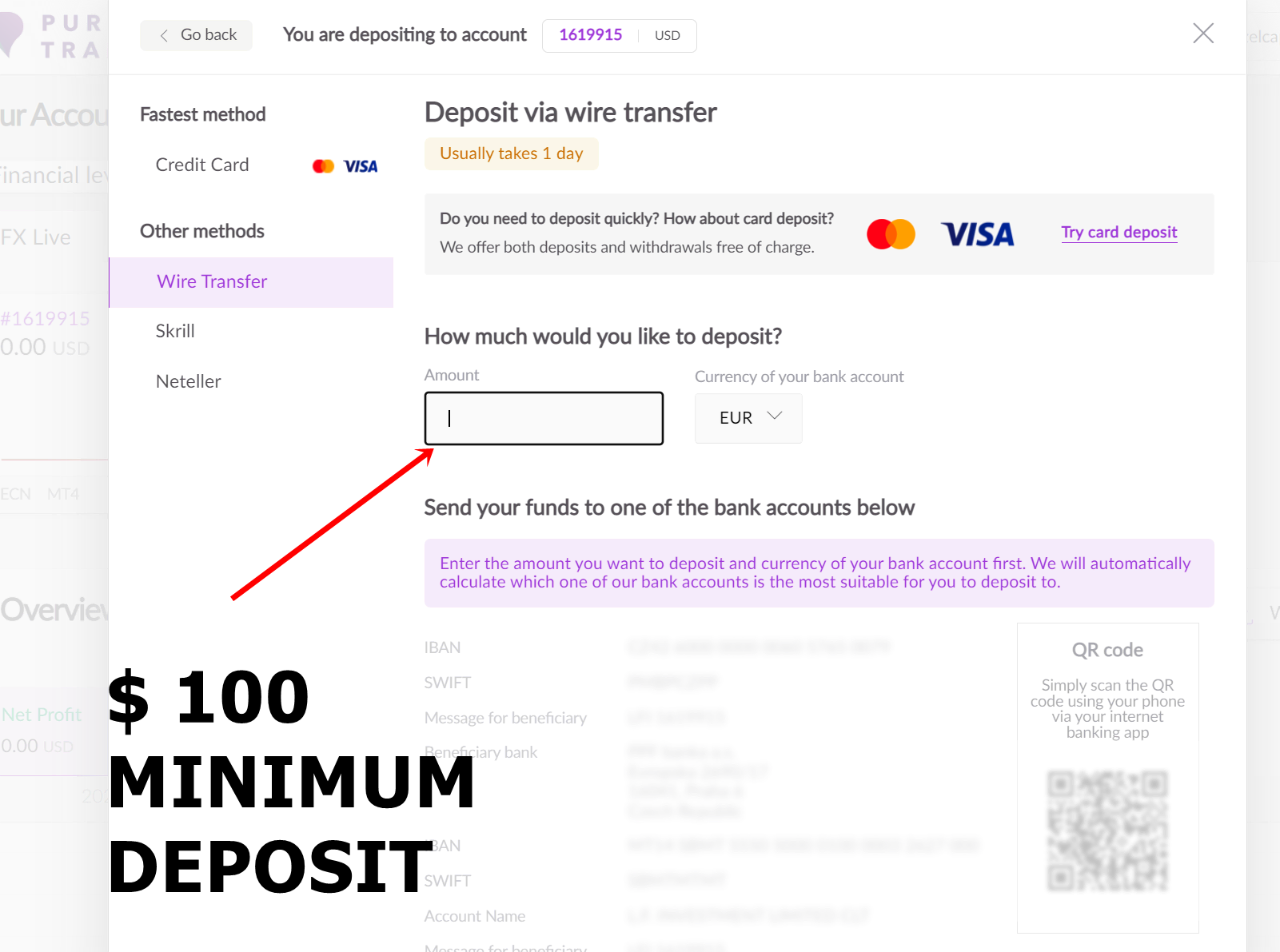

- $ 100 minimum deposit

- $ 15 inactivity fee after 6 months

(Risk warning: 63% of CFD account lose money)

Test of the trading platforms

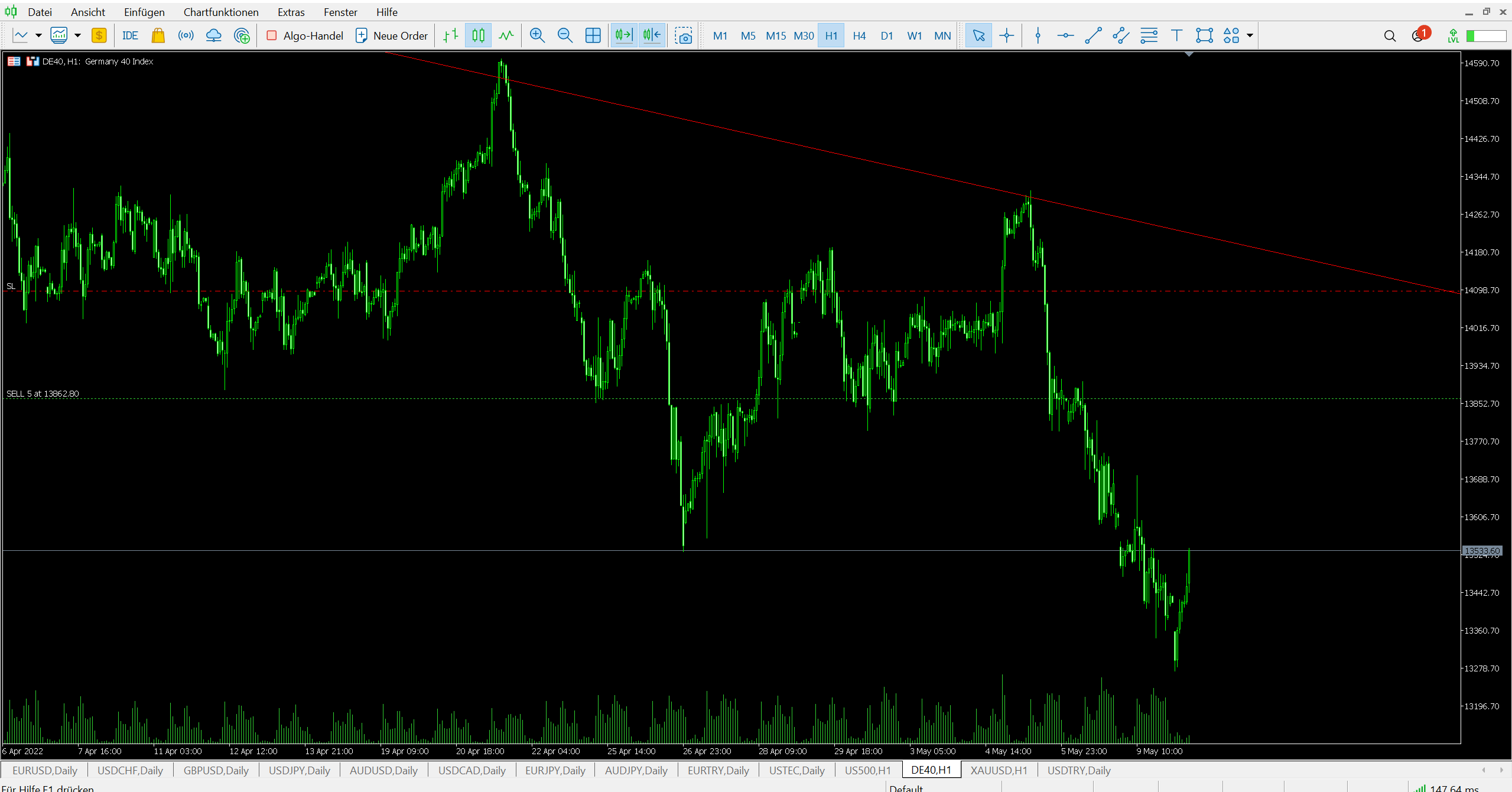

Purple Trading provides two trade platforms as well as a FIX API service. There are two main platforms to select from: MetaTrader 4 (MT4) and cTrader. Both platforms are simple to operate, straightforward, and suited for both rookie and experienced investors.

Trading Platform MT4

MT4 is a trading system built by the Russian technology firm MetaQuotes that is utilized by millions of investors across the globe to operate economic marketplaces. It includes a plethora of trade tools and materials to aid in trend research as well as quick and effective trade implementation and operation. It is regarded as a fully-featured interface with short training curves for users of all skill sets. Purple Trading MT4 makes use of an MT4 gateway that is linked to the best interbank liquidity providers (LPs).

Automated Trading Systems MT4

MT4 offers expert advisors, which are automated trading systems. You can utilize third-party E.A.s or create your custom trade method. Back-testing E.A.s on past statistics is possible using a method tester. It must be emphasized that backtesting efficiency is not an assurance of prospective effectiveness because the MT4 strategy testers are highly restricted.

MQL Editor

MT4 includes a developer framework where you may create your personal expert advisors, customized signals, and algorithms in the MQL coding languages.

MQL Predictors & Scripting languages

MT4 clients may get more algorithms, E.A.s, and signals via the MQL forum or straight through the terminals. There are many free and premium options available. You may also replicate other users’ predictions into your MT4 account using the signals copying tool.

MT4 Privileges:

- Completely customizable

- The market monitor window offers real-time quotations for a variety of assets.

- Genuine liquidity in the interbank markets

- Spreads begin at only 0.1 pips.

- Improved trade processing speeds

- Numerous order kinds are accepted.

- Several timelines (60 secs to 30 days)

- Trading with a single tap and investing from a graph

- Signals and graphic components for technical analysis

- Alerts via the website, e-mail, and Text

- Professional advisers and automated trading (EAs)

- Offered for free on desktops (Windows / macOS), online, and on a smartphone (Android / iOS).

Web Interface for MetaTrader 4 (MT4)

The MT4 online platform operates natively throughout most current web applications, with no requirement for any extra application to be downloaded or installed. It provides the same essential features as the computer version and can be accessed from any place on the planet that has internet access.

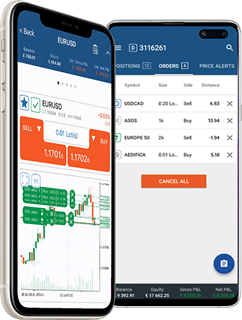

Mobile Application for MetaTrader 4 (MT4)

The MT4 smartphone app is free to download for Android and ios platforms. It is available for downloading from the various application stores and allows customers to use their brokerage accounts while on the road effortlessly. Clients can carry out similar basic functions as on the desktop version, such as technical indicators, creating positions, maintaining positions, closing positions, receiving push alerts, etc.

(Risk warning: 63% of CFD account lose money)

cTrader Desktop Software:

Purple Trading offers users the cTrader platform, built by London-based Spotware Systems Ltd, in addition to the traditional MT4 framework. cTrader is well-known for combining a simple GUI with more complex trading functionality and a very user-friendly back-end configuration. It is regarded as the ideal trading platform, meeting the demands of the overwhelming bulk of traders. cTrader is accessible via Windows, the internet, and mobile applications.

Purple Trading spreads and fees for cTrader accounts are quite comparable to those for MT4 platforms. They provide clear and immediate STP/ECN access to markets. The presentation of depths of markets (DOM) data in cTrader promotes price clarity.

cTrader Automate Editing software

Clients may utilize the cTrader Automate Editor to construct their customized automated trading methods and customized signals. It is C# and.NET frameworks compatible, featuring a code editing layout and backtesting features.

Advantages of cTrader:

- Seamless market accessibility for STP/ECN

- Depth of markets (DOM) clear pricing

- VWAP (Volume Weighted Average Price)

- 60+ analytical signals for market research

- 26 charting patterns

- Customized signals are supported.

- cTrader Automate, previously cAlgo, developed automated trading software.

cTrader Online

Purple Trading provides cTrader for online, a fully internet-based program built on HTML5 framework and featuring an incredibly simple and configurable graphical U.I. It works immediately in the majority of popular internet browsers, with no need for downloading or installing any additional programs. It may also be accessed via smartphones while retaining the key functionality of the cTrader desktop version. This is beneficial for people who wish to trade while on the move.

cTrader Mobile

Purple Trading provides the versatile cTrader for smartphones running Android & iOS (iPhones / iPads / Android / Tablets). Spotware’s cTrader mobile is a very efficient trading software that retains all of the desktop system’s major characteristics and settings. The cTrader mobile system is available for free download from the AppStore. It allows you to explore the market from anywhere at any time, as long as you have internet access.

(Risk warning: 63% of CFD account lose money)

FIX API

The FIX API is an electronic communications interface designed for the genuine transmission of trade-related data. It is often utilized by experienced traders and eliminates the need for intermediary programs. It gives you direct exposure to markets with your own programs.

Experienced programmers and quant traders can utilize their custom unique techniques and black boxes to access the Purple Trade servers and leverage the FIX (Financial Information Exchange) price index streams by utilizing the FIX API. This enables seamless connectivity to major liquidity providers, resulting in shorter latencies and higher fill rates.

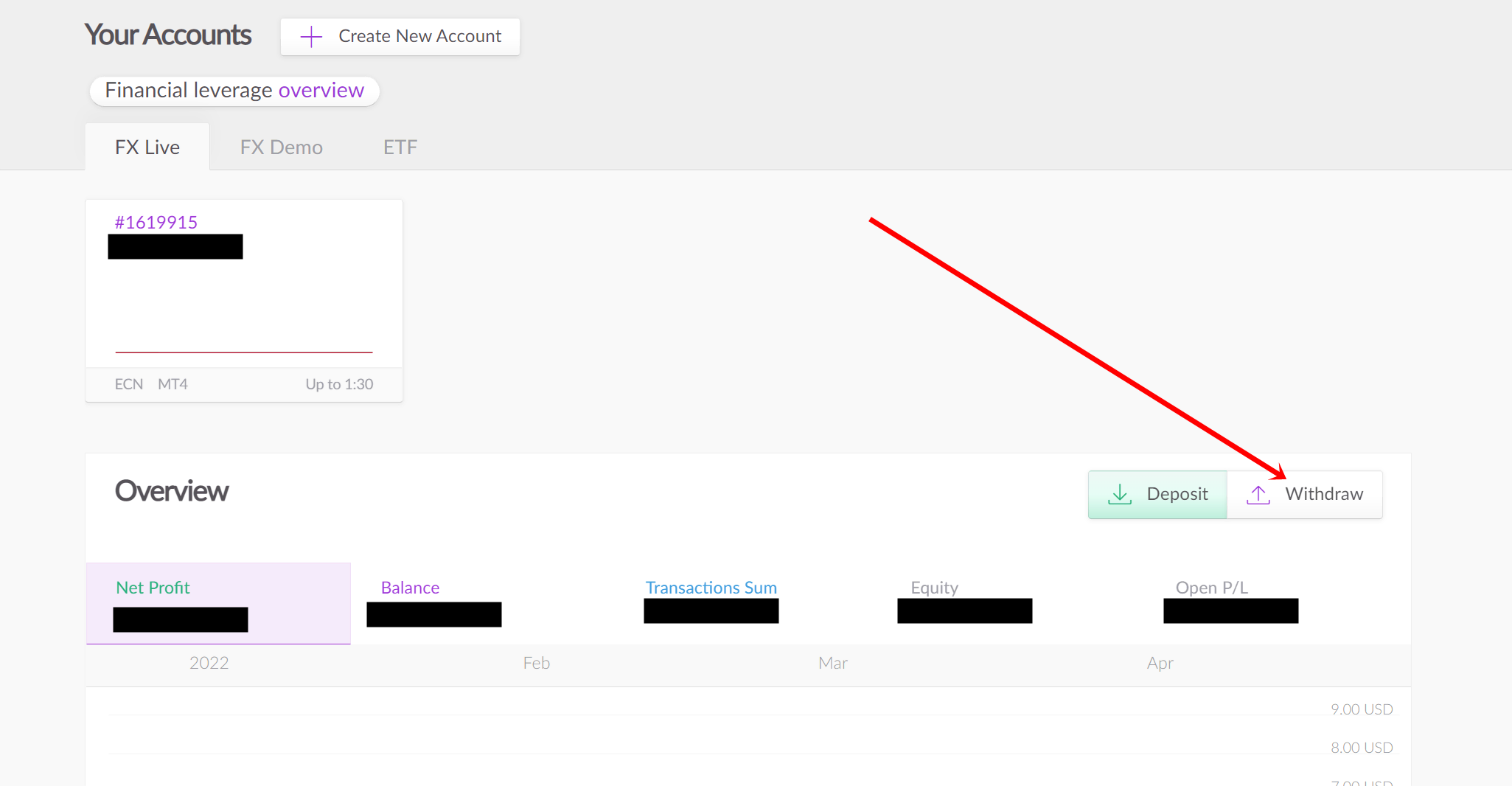

What is the Purple Zone?

Purple Zone is Purple Trading’s customer back-end portal, where you can perform anything from creating new accounts to account overviews, transfers, payments, and a unified multi-trader. It is accessible in several dialects, is smartphone compliant, and offers rapid automated deposits.

(Risk warning: 63% of CFD account lose money)

How to trade with Purple Trading?

To begin trading using Purple Trading, you must first signup on the firm’s website and establish an account and register for a member’s area. Complete the procedures below to accomplish this:

- Visit the Purple Trading homepage and select the Open Account option.

- Type your initial name, surname, e-mail address, nationality, and mobile number in the application form.

- Choose your account’s default currency.

- Enter your e-mail address and password to access the member’s area.

- Select Account type

- Make the Initial Deposit

- Select your desired sell or buy order in accordance with your prediction

- Select the currency pairing

- Enter the desired amount for the trade

- Execute the trade

- Wait for the trade to expire to make a profit

The following are the features of the member’s area:

- Create more accounts.

- Deposit money from your personal accounts.

- Make a withdrawal application.

- Produce statistics on the firm’s deducted commissions.

- Activate and deactivate professional trading tactics.

- Examine all open or closed positions and also the success of the method adopted.

- Monitor the performance of ETF holdings.

How to open your free trading account?

Purple Trading does not have a free trading account; all the account types offered by Purple Trading do require a certain amount of initial deposit. However, clients can open a free demo account and test their trading skills.

(Risk warning: 63% of CFD account lose money)

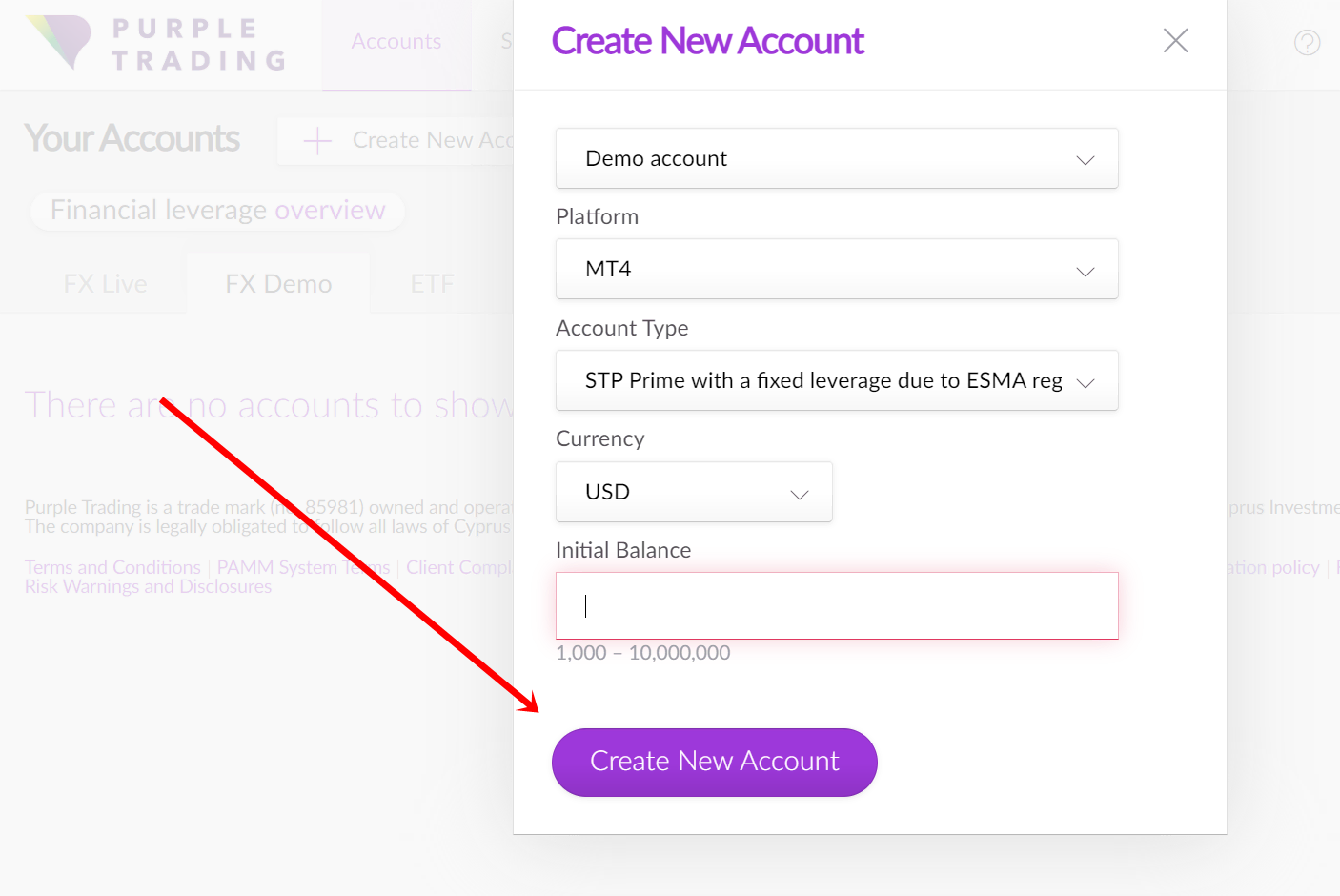

The following are the steps to open a free demo trading account:

- Visit the Purple Trading webpage and click on the Demo tab

- Provide your first name, surname, and country of residence

- Provide the E-mail ID and mobile number

- Click on the Tick button to acknowledge the terms and conditions

- Click on Continue

- Select the desired Trading platform (MT4 or cTrader)

- Input the Demo account password

- Select the desired currency and initial virtual deposit amount

- Select the Demo account type (ECN prime or STP prime)

- Select the Financial leverage

- And finally, click on “Create Demo Account.”

(Risk warning: 63% of CFD account lose money)

Affiliate scheme at Purple Trading (introducing brokerage)

An Introducing Broker (IB) acts as a go-between for those who want to trade or trade with the Money market and Purple Trading. The I.B. is compensated for introducing new users to the firm.

A strategy Provider is a professional trader who earns commission from clients who follow his technique. The Provider can be paid in three ways: managing fees, a share of the clients’ profit, or a portion of the deposits.

All associates are given accessibility to the Spark system, which allows them to monitor customer activities like the volume of lots transacted, all deposits and payments made, plus charges paid to the brokerage.

Deposits (minimum deposit) on Purple Trading

For ECN and STP account options, the initial deposit is $0 for some wire transfers and USD20/EUR20/PLN 80 for other modes. Purple Trading does not impose any fees for payment options; however, third-party fees may apply. To perform withdrawals and deposits, users must check in to their personal profiles.

Payment methods available include:

- Local Bank Money Transfers in PLN – no cost, completion period of 1-2 working days, initial deposit PLN 80, max deposit PLN 25,000

- Credit and debit card – no fees, quick processing, an initial deposit of EUR20, the maximum amount of EUR15,000

- Skrill and Neteller – 2% charge, execution period of a few mins, an initial deposit of EUR20, the maximum amount of EUR5,000

- Foreign Bank Money Transfers in PLN – 0.5 percent cost (up to EUR100), execution period of 3-5 days, no minimum or maximum deposit

- Local bank transfers in CZK or SEPA in € – no cost, execution period of 1-2 working days, no set limit deposit

- Foreign Currencies through Foreign Bank Wire Transfers – 0.5 percent charge (up to EUR100), the processing period of 3-5 days, no threshold deposit.

Currencies converting fees can also occur if accounts are funded in separate currencies. Bank money transfers are only permitted in €, $, £, PLN, and CZK.

(Risk warning: 63% of CFD account lose money)

Withdrawals: How to withdraw money

Withdrawals should be executed in the same manner as deposits. Withdrawals include charges that vary depending on the payment method. The firm promises that withdrawal orders will be completed within one working day.

- Credit and debit cards incur a $7 charge, have a 2-4 days processing time, and need a minimum withdrawal of USD8 or similar currency. Skrill and Neteller – 1-2 percent charge, transaction period of a few mins, minimum withdrawal of USD 3

- All Foreign Bank Money Transfer – 0.5 percent cost, the processing period of 3-5 days, no set limit for withdrawals

- All national bank money transfers are free of charge, take 1-2 days to complete, and have no set limit for withdrawal.

Purple Trading does not authorize withdrawals that could result in a margin position of less than 200 percent. This is intended to safeguard personal assets. If you want to transfer your whole account balance, you first should terminate all transactions from all investment methods using the account site.

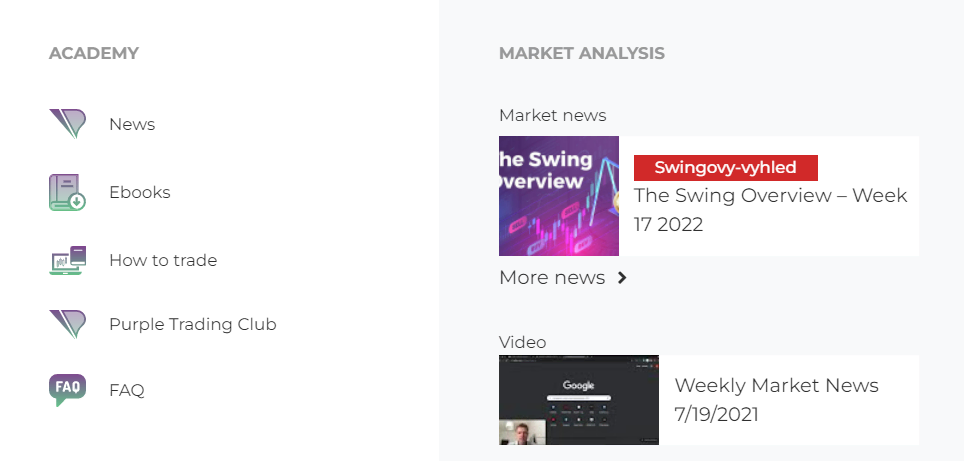

Education for traders

Purple Trading is concerned with educated trading; that’s why they established the Purple Academy. You will discover market updates, how-to instructions, lessons, blogs, eBooks, videos, and seminars here.

Market Updates

Purple Trading has a segment on its webpage committed to the most recent market updates. The papers cover a variety of areas and might serve as a source of inspiration for new business ventures.

Trading Instructions

Purple Trading has a large collection of trade manuals, including a wide range of topics like how to trade FX, equities, indexes, and so on.

Purple Trading Group

The Purple Trading Club is a forum for investors to debate unique trading possibilities. You may spend the entire day with fellow investors discussing the highs and lows of trading.

- A unique ability to connect in live trades alongside other investors and experts.

- A light-hearted overview of prospective trading possibilities, market moves, and trading tactics.

- In the cooperation of other dealers, there is a friendly mood.

- A fantastic method to connect with individuals in the Currency exchange trading community.

(Risk warning: 63% of CFD account lose money)

Support & contact

Purple Trading offers customer care via webchat, calls, and e-mails. We experienced customer care to be quite responsive and pleasant in responding to the different inquiries we asked them over time.

Support available: | Types: | Phone: | Email: |

|---|---|---|---|

24/5 per working hours in Europe | Chat, Email, Phone |

Conclusion: Is Purple Trading a scam? – We think, definitely not!

After all the aspects discussed above, we can conclude that Purple trading is not a scam and is very much legit. The brokerage offers the best trading possibilities in a wide range of products using industry-standard MT4 and cTrader platforms, according to this Purple Trading review.

Again for the best rates, customers can obtain direct-to-market executions via ECN and STP processing methods. With a strong emphasis on technologies, solutions are simple to use and ideal for both novice and experienced traders. As you deal with greater volumes, trading circumstances get more intense, and extra features such as an instructional portal and an elite membership group assist you in getting through your Purple Trading’s trading journey.

(Risk warning: 63% of CFD account lose money)

FAQ – The most asked questions about Purple Trading:

Does Purple Trading offer an Islamic account?

No, Purple Trading does not provide an Islamic account.

How much money do I need for starting with Purple Trading?

You can start with an initial deposit of only $ 100 or use the free and unlimited demo account. Positions are available to open with small risks of a few dollars or cents.

I am a beginner, can Purple Trading help to understand trading?

Yes, Purple Trading has well-educated employees and traders who can help you to start trading the markets. The company also offers webinars, events, and 1 to 1 phone support. You are not alone if you want to start with Purple Trading!

What do traders have to say about Purple Trading?

Traders who use Purple Trading only have positive things to say about this platform. First, it is a reputed trading platform that allows traders to trade as many assets as they want. Besides, it is regulated. So, traders can trust Purple Trading to fulfill their trading needs.

Should I signup with Purple Trading?

Yes, you can sign up with Purple Trading because it offers you the best features. This trading platform is feature-loaded. Besides, it innovates now and then. So, traders enjoy the maximum benefits when trading on this platform. Apart from this, Purple Trading also has excellent customer support. So, if a trader trading on Purple Trading encounters any problem, customer support solves it quickly.

Does Purple Trading offer legal services to traders?

Yes, Purple Trading’s services are legal for traders. You can enjoy trading on this platform as your investments are safe with this broker. Also, this trading platform has regulating authorities overseeing its functions. So, Purple Trading is the safest trading platform. Traders can sign up for a demo account on Purple Trading to check the trading services it has in store for them.

See article about other online brokers:

Last Updated on January 27, 2023 by Arkady Müller