5 best Forex Brokers & platforms with market execution in comparison

Table of Contents

See the list of the best 5 Forex Brokers with market execution:

Broker: | Review: | MINIMUM DEPOSIT: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | $20 by card | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (138+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

2. Vantage Markets  | $200 | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

3. IC Markets  | $200 | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

4. FxPro  | $100 | FCA, CySEC, FSCA, SCB | 250+ (70+ currency pairs) | + Multi-regulated + User-friendly + Mobile trading + Competitive spreads + Free demo account | Live account from $100(Risk warning: 72.87% of CFD accounts lose money) | |

5. Pepperstone  | $200 | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Trading has slowly been gaining so much popularity nowadays. This doesn’t come as a shock because this profession does not require you to travel to an office to earn a living. After all, who doesn’t want to work from the comforts of their own home?

If you’re looking to utilize the market execution method, you will have to make sure that this is an option with the broker you partnered with. When trading using the market execution method, you generally avoid even during the most volatile market conditions. This means all your orders will be executed or opened as soon as the next market price becomes available.

Although trading is accessible to almost anyone, it is not as simple as clicking on buttons on a screen. It requires a lot of research and knowledge. But before you start learning the dos and don’ts of trading, you have to choose a broker to partner with.

Here are some things that you should factor in when choosing a broker:

- Is the broker regulated?

- Does it have the asset you want to trade?

- Is the platform reliable?

- Can you access the broker and its platform from your country?

- Does it have a free demo account?

Those are just a few things you should keep in mind before you sign up with a broker. This article will help narrow down your choices. Keep reading to learn more about the five best market execution brokers available.

List of the 5 best forex brokers with market execution:

1. Capital.com

Capital.com was founded in 2016 and is a well-known forex broker around the globe. While being relatively new to the trading scene, this organization now has four offices that can be found in Cyprus, Australia, and the United Kingdom.

Capital.com is closely monitored by four regulatory authorities to guarantee that it is safe to use. The ASIC or Australian Securities and Investments Commission, the SCB of Bahamas. The FCA, or Financial Conduct Authority, and CySEC, SCA in the UAE, or the Cyprus Securities and Exchange Commission, are the institutions in question.

Listed below are the advantages of partnering with Capital.com:

- The website has a lot of educational materials that anyone can access.

- The trading fees are low and affordable.

- Opening an account won’t take more than five minutes.

- $20 is the minimum deposit by credit card.

- The demo account is free.

- You can trade on your mobile device via the mobile application.

Now, here are the disadvantages of Capital.com:

- Only IOS mobile devices support Touch and Face ID login.

(Risk warning: 75% of retail CFD accounts lose money)

2. Vantage Markets

Vantage Markets is a forex broker located in Australia that was established in 2009. The company’s headquarters is located in Sydney. However, it has more than 30 offices across the world. Vantage Markets is licensed to operate in over 170 countries, making it extremely accessible to nearly everyone on the planet.

The FCA, or Financial Conduct Authority, as well as the ASIC, or Australian Securities and Investment Commission, regulate this forex broker. Vantage Markets, additionally, protects its clients’ money by keeping their investments separate from one another. On their official page, you may learn more about their privacy policies.

Let’s go over the pros of partnering with Vantage Markets:

- You can practice and check out the platform using a free demo account.

- There are more than 40 forex pairs to trade with this broker.

- You can utilize the forex calendar to stay updated.

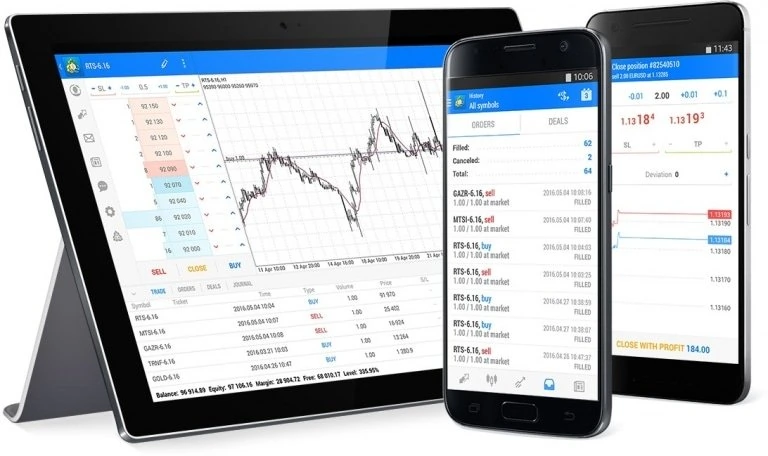

- Trade on the MetaTrader 4 or MetaTrader 5 platform.

- The account opening process is straightforward and very easy.

- Take advantage of the free e-books, video tutorials, and other educational materials on the website.

- The broker has a mobile application, so you can trade on the go.

Now, here are the cons of Vantage Markets:

- The minimum deposit required is $200. This is relatively higher compared to other brokers.

- To gain full access to the Pro Trader Tools on the platform, the broker requires you to have $1,000 in your wallet.

- One account type (Pro account) requires a minimum deposit of a whopping $20,000.

(Risk warning: Your capital can be at risk)

3. IC Markets

IC Markets is a renowned Australian-based forex broker that was launched in 2007. It has offices all around the world and more than 250 staff members to assist or guide you through the website or platform.

Three well-known regulatory agencies keep a careful eye on the corporation and grant it permission to operate. The CySEC or Cyprus Securities and Exchange Commission, the FSA or Financial Supervisory Authority, and the ASIC or Australian Securities and Investments Commission are the three companies that regulate IC Markets.

You will find a list of the pros of choosing IC Markets as your broker:

- The commission and trading fees are low.

- You can create an account in a matter of minutes.

- This broker does not have a deposit or withdrawal fee.

- An inactivity fee is non-existent.

- You are given the option to trade on either cTrader, MetaTrader 5, or MetaTrader 4 platform.

- If you prefer trading on your phone or tablet, a mobile application is available.

- It features a free-to-use demo or practice account.

- There are a ton of e-books, articles, tutorials, and other educational materials on the website.

Here are the cons of partnering with IC Markets:

- The standard account requires $200 as an initial deposit.

- It takes a while for you to get in touch with the customer support representatives.

- You can not turn on price alerts on the platform.

- Although there are a lot of educational materials, you won’t find any videos.

(Risk Warning: Your capital can be at risk)

4. FxPro

FxPro is a currency trading platform headquartered in the United Kingdom. It was founded in 2006, and in 2017, it was named “Most Trusted Forex Brand” by Global Brands Magazine. FxPro now has more than 1,700,000 customers from over 160 different countries.

The Cyprus Securities and Exchange Commission, the Securities Commission of The Bahamas, the Financial Sector Conduct Authority, and the Financial Conduct Authority all regulate this particular broker.

To give you a better idea of why FxPro is part of this list, here are some of its advantages:

- You can start trading on a live account in a couple of minutes after registering.

- FxPro does not have any hidden withdrawal or deposit fees.

- The commissions and trading fees are affordable.

- $100 is the minimum deposit required to open a live trading account.

- Your charts on the platform are customizable.

- You can enable notifications for any price changes on your trading assets.

- FxPro offers a free trial of its platform via a demo account.

- The educational tab on the website contains a lot of useful articles, e-books, and videos.

(Risk warning: 72.87% of CFD accounts lose money)

Here are some disadvantages you have to take note of, though, before you decide to partner up with this broker:

- An inactivity fee is charged if you don’t use your account for six months.

- FxPro’s customer service is not open 24/7.

- This broker supports only a few minor currencies.

- Educational webinars are not available on the website.

What does market execution mean for forex traders?

When trading using the market execution method, the client only specifies the volume of the trade. The broker will then generate the bid or ask price of that particular asset, and it is the client’s job to either accept or decline the trade.

Some brokers will only allow the client to enter their desired take profit or stop loss levels after the trade has been executed. This means these factors can only be added once the price of the asset is known.

Advantages

Market execution is favored by a lot of traders mainly because this method eliminates the chances of requotes. When using the instant execution method, requotes are a common occurrence. In the event that the asset does not reach the specific price that the trader wants, the broker will send them a message with a requote. The client will then have to decide whether they should or should not push through with the trade.

With market execution, trades are usually fulfilled within a matter of seconds. Sometimes, it’s even instant. This makes it ideal for traders because it lowers the chances of missing out on a perfect trading opportunity.

Another advantage is clients are guaranteed that their orders will be executed at the best market price. The broker will be responsible for looking for the best price before the client’s trade is executed. Positive slippage may also occur. This means clients have a higher chance of executing their trades at an even better price.

Disadvantages

Market execution comes with a couple of disadvantages. Although you are guaranteed the best market price, slippage is quite common. This occurs when a stop loss or a market order is opened at a different price. Although it was mentioned above that positive slippage can happen, more often than not, this is negative.

Additionally, during high market volatility, there is a chance that there will be a notable deviation from the set price. Lastly, in some cases depending on the broker, the take profit and stop loss levels can only be set once a trade has been executed.

(Risk warning: 72.87% of CFD accounts lose money)

5. Pepperstone

In 2010, a group of traders in Melbourne, Australia, founded a firm that would revolutionize internet trading. This online broker, now known as Pepperstone, was designed to improve the trading experience of traders all over the world.

Seven regulatory authorities keep a close eye on Pepperstone. The CMA, ASIC, DFSA, BaFin, CySEC, and SCB are among them. This broker has also received several major accolades and has over 300,000 clients from all around the world.

If you choose Pepperstone as your broker, here are some things that you will benefit from:

- Easy account creation process.

- You can rely on customer support, and they reply promptly.

- Pepperstone does not charge an inactivity fee.

- You can withdraw and deposit without having to pay a fee.

- This broker does not have a minimum deposit.

- MetaTrader 4, MetaTrader 5, and cTrader are the platforms you can choose from.

- The three platforms are also available on Pepperstone’s mobile application.

- The demo account is 100% free and can be used by anyone.

- Learn from the free educational materials found on the website.

However, Pepperstone does have some disadvantages. These are:

- Pepperstone charges a high overnight fee.

- Although the customer support system is reliable, they are not available 24/7.

- If you are not from the EU or Australia, you will need to pay a fee when withdrawing from your account.

- You can not enable price alerts.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Deposits

Almost every time you deposit money into your live account, the procedure is the same. You open an account by filling out the registration form, you verify your email address or phone number, and the broker will ask you to top up your account with funds.

But just to be sure, you should double-check that the broker you’ve chosen accepts your preferred deposit method and currency. Let’s have a look at the deposit options offered by each of the five brokers covered in this post.

- Capital.com

In all countries, bank or wire transfers are accessible. Capital.com accepts Maestro, MasterCard, and Visa credit and debit cards for making deposits. The types of online wallets available differ per nation. Sofort, ApplePay, and PayPal are the most popular online wallets.

Deposits made with a credit card will appear in your account immediately. It normally takes 24-48 hours for online wallets to process. Finally, when contributing funds through wire or bank transfer, allow up to three business days for processing.

- Vantage Markets

Vantage Markets is the first company on the list. Deposits can be made through a bank or wire transfer, debit or credit card, or an electronic wallet. It usually takes 2-3 days for a bank or wire transfer to be completed. It merely takes a few minutes or hours to add funds using a card or an online wallet.

You may use your Visa or MasterCard to make a deposit. If you prefer online wallets, you may also deposit via Skrill, Neteller, FasaPay, AstroPay, UnionPay, and JCB. In total, the broker accepts nine different currencies. Major currencies such as EUR, GBP, USD, and others are included. On the other hand, Minor currencies are not supported by the firm. Check out the list of currencies that are available on the website based on your preferred deposit method.

- IC Markets

You can deposit money into your IC Markets trading account using a MasterCard or Visa debit or credit card, wire transfer, or any of the approved e-wallets. Neteller, PayPal, Skrill, FasaPay, UnionPay, Rapidpay, Bpay, Klarna, and Rapidpay are some of the e-wallets available.

The funds are quickly added to your IC Markets account with the majority of these deposit methods. You should see the website’s list of deposit methods for further information. Deposits in the following currencies are accepted: GBP, SGD, EUR, CAD, CHF, HKD, JPY, USD, NZD, and AUD.

- FxPro

Bank transfers, debit or credit cards, and online e-wallets are all supported by FxPro. The processing time for bank transfers is normally one day, and the currencies offered include USD, GBP, JPY, CHF, AUD, PLN, ZAR, and EUR.

If you use your Maestro, MasterCard, Visa debit, or credit card to make a deposit, it will appear in your account within a few minutes. This method accepts the following currencies: EUR, AUD, GBP, CHF, PLN, and JPY.

Deposits made with UnionPay, Neteller, or Skrill are normally processed instantly, and the currencies supported include JPY, CHF, GBP, EUR, USD, and PLN.

- Pepperstone

Pepperstone only offers four deposit methods. Visa debit or credit card, MasterCard debit or credit card, bank transfer, or PayPal are the options available. The money you deposit should appear in your Pepperstone account right away. However, you should allow at least three business days if you utilize the bank transfer option.

Perpperstone’s platform has nine different base currencies to choose from. NZD, JPY, HKD, GBP, CHF, EUR, SGD, USD, and AUD are the supported currencies. There are no deposit or conversion fees with this broker.

Withdrawals

The deposit methods mentioned above also double as withdrawal methods. There may be a withdrawal charge, depending on the broker. Furthermore, processing time might range from a few hours to a few business days, depending on the method you choose.

All of the information is available on each broker’s website. If you have any issues with the withdrawal procedure, simply write them an email or call their customer service specialists for assistance. You may rest easy knowing that your money is safe and secure.

Conclusion – Make sure to test the broker you choose

Before you sign up with any forex broker in the market, you have to make sure that they are the right one for you. The information provided above should be enough for you to make an informed decision, but it wouldn’t hurt to check out other brokers or visit their websites to get more important details.

Reading articles and user reviews should also give you a rough idea of how well the broker performs. However, not all reviews can be trusted. There are a lot of fake and o reviews out there to trick oblivious traders into signing up. This is why it’s very important for you to look into each of the brokers before anything else.

Testing out the platform should also be one of the steps you should go through before creating a live account with a particular broker. All five of the brokers in this article provide a free demo account to anyone. Take advantage of that and test the limits of each of their platforms.

Although market execution has its pros and a lot of well-seasoned traders favor this method, it is worth looking into the other available methods. Market execution gives you more options and almost always guarantees that your trades are executed at the best price. But keep in mind that although the broker is in charge of executing the trade, you still have some work to do.

In general, before you set up a trade, make sure to study the market thoroughly. Don’t just rely on the broker to do everything for you. Study up and learn everything that you need to know. Trading comes with a lot of risks. You can minimize your losses if you keep yourself up to date on the latest news and familiarize yourself with the market’s movement.

FAQs– The most asked questions about Forex Brokers with market execution :

How does market execution work?

Market execution is the fastest way to open a trade. Your chosen broker will receive information on the prices of the assets from liquidity providers. With the price information, the broker will then decide which is the best price depending on the client’s volume.

Once the broker has determined the best price, they will execute the trade for the client. However, slippage may occur. Slippage can either be positive or negative. The broker can execute the trade at the next best price if the price changes instead of avoiding losses.

Why do traders use market execution?

Most traders prefer market executions because it minimizes the chances of their trades being requoted and rejected. This means they don’t need to spend as much time checking their messages to see if the broker sent them a requote.

Requotes are sent to clients by the broker when their desired asset does not reach the specific price that they set. This doesn’t happen with market execution because clients only need to set the volume. The client agrees to execute the trade at the current price by doing so.

Does market execution instantly open up a trade?

Yes, this method immediately opens or executes a trade for you. Traders use this method to guarantee that their trade will be executed. However, the execution price is not guaranteed. Make sure to do a little bit of research before you set up to open a trade. It is also a good idea to keep a close watch on the charts or your platform to see if there have been any changes.

What is Market Execution?

Trading financial instruments are trending these days. It has been observed that previously it was only large banks and institutions that had the ability to trade the markets. But with the advancement and improvement in technology along with the innovation and implementation of high-leverage trading accounts, retail traders have benefitted from the opportunity. They have gained total access to the trade market. It can further be emphasized that the traders prefer market executions simply because is that it decreases the chances of the trade being requoted or rejected at the same time. This effectively saves their time from checking the messages sent by the broker that has been asked to requote. This certainly is not the case with market execution because the traders need not set the volume.

What is Instant Execution?

If you are interested to know what exactly instant execution is all about, it can be said that whenever an order is processed with the help of the broker’s price feed, the exact process is termed instant execution. Instant execution is frequently provided by market-maker brokers. In such instances, requotes are very common. This implies that if the trader is unable to get hold of the desired price level at the time of trade execution, then the broker can requote the freshly available price levels that are available.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)