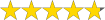

Investing.com review – how good is the platform?

Table of Contents

| Review: | Type: | Markets: | Special: |

|---|---|---|---|

(4.8 / 5) (4.8 / 5) | Financial information platform | Forex, stocks, indices, crypto, and more | News, economic calendar |

Online brokers and other providers in the field of securities trading are springing up like mushrooms these days. After all, investments are an attractive way to make money. In order for the investment to be successful, however, a reputable partner is needed at the side of the trader. But occasionally one still finds black sheep on the market, which it applies to distinguish from safe and respectable offerers. After all, the security of the customer, his data, and his assets is probably the most important concern.

Trading with securities and shares is already fraught with enough risk so that the trader would at least like to know that he is safe with his broker. Is Investing.com one of these safe brokers? And what is Investing.com anyway? These and other questions will be answered in the following report. Investing.com was tested in various areas and the corresponding experiences are shown below.

What is Investing.com? – The platform presented

Investing.com was founded back in 2007. Unlike traditional brokers, Investing.com is a financial portal with more than 250 employees in seven locations around the globe. Investing.com is one of the three most successful financial portals in the world today. The website can boast over 21 million users per month and more than 180 million sessions. According to the worldwide activity and usage, the services are provided in 44 different languages. These include, for example, German, English, Italian, French, and Polish.

The trader can use more than 300,000 financial instruments for free and also has access to useful and professional tools that help him make sensible decisions in securities trading. Investing.com also offers a selection of brokers and several apps.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

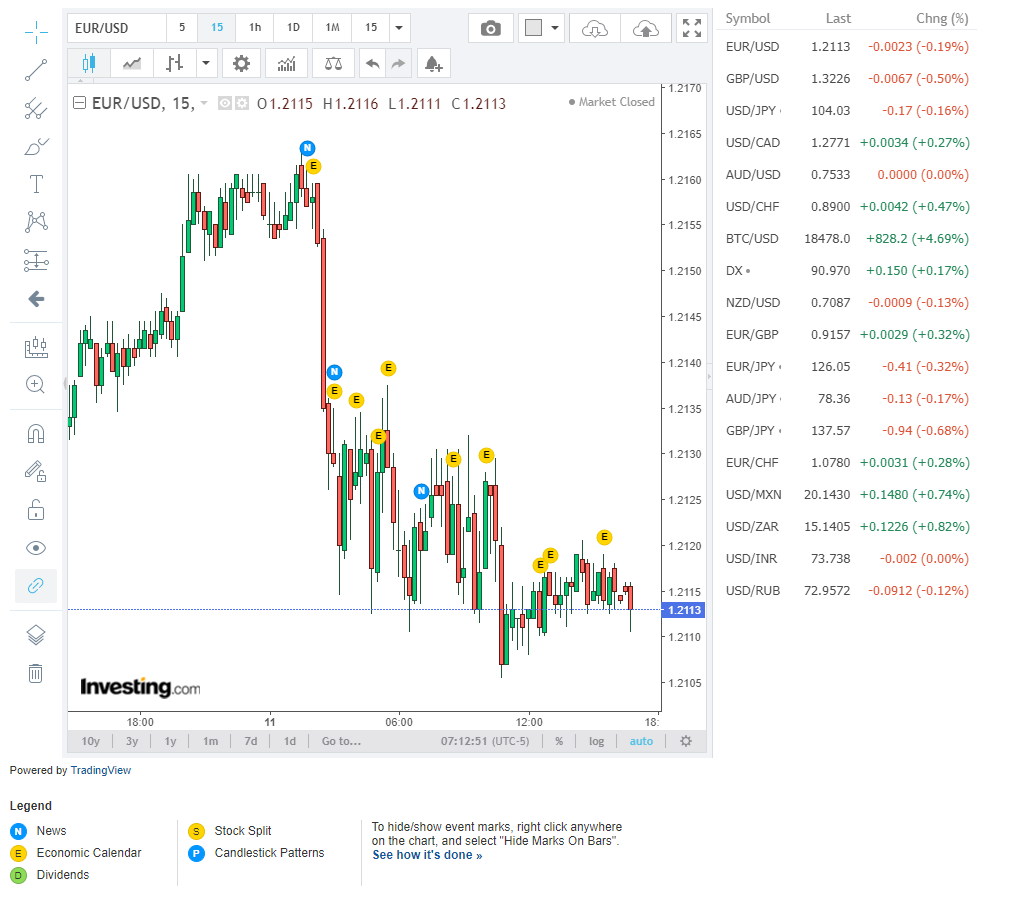

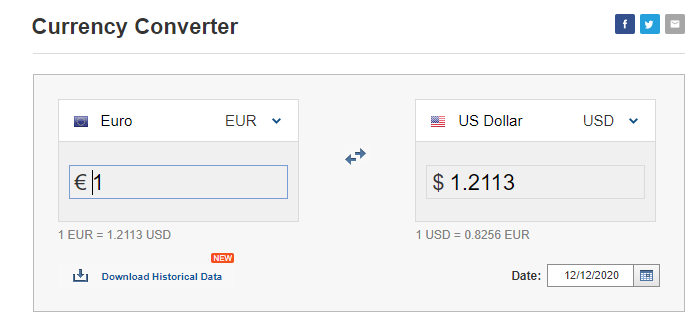

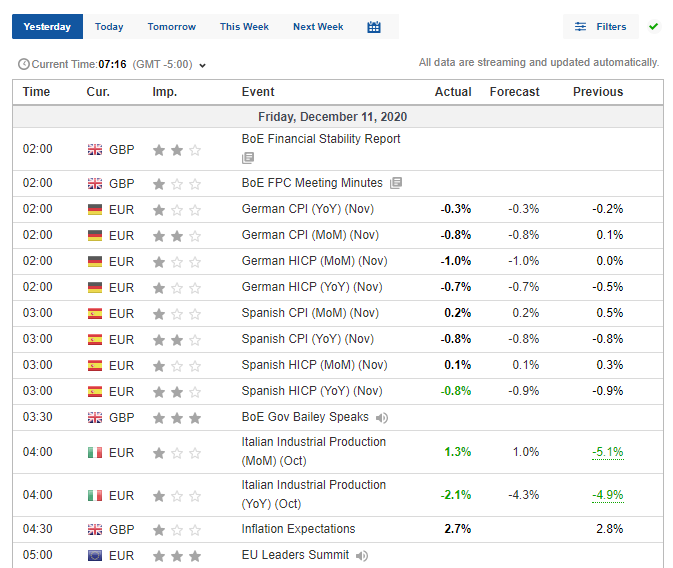

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Overview of Investing.com toolsIn addition to a wide range of products, the tools offered usually play an important role in choosing the right provider. After all, customers also want to benefit fully from useful and professional tools and other features. At Investing.com, the trader has a number of different tools to make use of. Among them are technical tools, investment tools, and more. These have been tested extensively and the following is my Investing.com experience in the tools section. Technical ToolsTechnical tools include pivot points, moving averages, and the candlestick pattern. These will be discussed in more detail here. The pivot point calculation is a trading strategy. It is as simple as it is effective and is even used by traders, banks, and other financial institutions. It can be used to assess the strength and weaknesses of a particular market. Another tool for technical analysis is the moving average. Here, the selected time period for which the average is to be calculated can vary. Depending on the period you choose, the analysis will be short, medium, or long-term. For example, the period can be 10, 40, or even 200 days. Old data may have too great an influence on the average and thus change the result. Therefore, more weight is often placed on more recent data points. In the candlestick pattern, price movements are technically analyzed and then graphically displayed on a so-called candlestick chart. This allows market changes to be predicted if necessary.  Investment ToolsInvesting.com’s investment tools include the Stock Screener, the Fed Rate Monitor, the Currency Calculator, and the Fibonacci Calculator. These tools were also put under the microscope. The Stock Screener displays an overview of all available stocks. The trader can sort according to various criteria – including country, industry, or even stock exchange.  In addition, the user can add further criteria to be searched for. For example, by certain key figures, prices, turnover, dividends, or technical indicators. Furthermore, additional favorites can be defined. With the Fed Rate Monitor tool, it is possible for the trader to calculate the probability of an upcoming Fed rate hike. The calculations of the Fed Rate Monitor are based on the Fed funds futures prices for 30 days. These prices indicate how likely the market thinks a change in the US key interest rates is. The currency converter, as found on numerous websites, gives the current exchange rate between two currencies. At Investing.com, the user can not only calculate the current rate but also download historical data and view overviews.  The Fibonacci calculator allows the trader to calculate the future development of a rate based on extreme points in the chart. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Investing.com Economic Calendar – The Most Important ToolInvesting.com is probably so often used for its economic calendar. This is one of the most important tools for the Forex and CFD trader. In the calendar, the daily economic news is published with all the related data. For example, thanks to Investing.com’s economic calendar you can watch the GDP or the publication of unemployment figures. The publication of the data has a direct impact on stock market prices. Therefore, it is essential for a trader to keep an eye on the economic calendar.  The stars or “bulls” indicate the strength of the event. Releases with only one star almost never have an impact on current prices. An event with 3 stars, on the other hand, can change the markets several percent. It is recommended to close all positions before a strong event if your market is affected. In addition to technical and investment tools, Investing.com also offers other interesting and useful tools. These include, for example, various calendars such as the economic calendar, the dividend calendar, the splits calendar, and the IPO calendar. Thus, the user is always informed in advance about upcoming dates, events, or stock exchange holidays.  With the Forex correlation calculator of Investing.com, you can track the exchange rate for a certain period. The currency pair, as well as the time frame and the number of periods, can be specified individually. The time frame can be determined as follows:

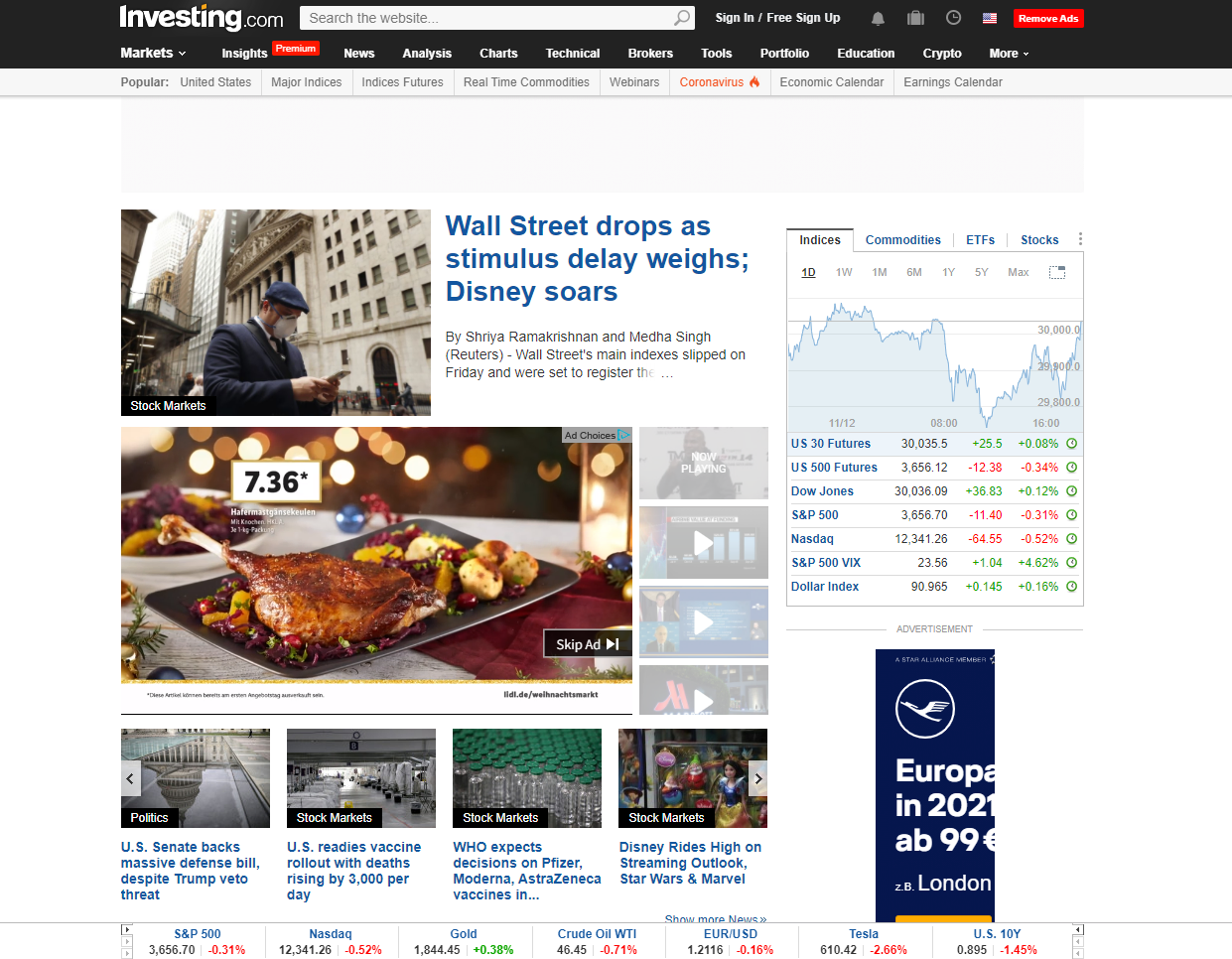

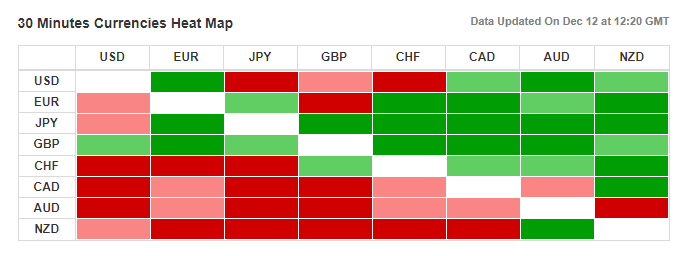

The number of periods can be between 10 and 300. With the exchange rate profit calculator, as the name suggests, the user can calculate his exchange rate profit. For this purpose, the user only needs to specify the currency pair, the account currency, the transaction size, the opening and closing price, as well as the action, i.e. whether to buy or sell. The Margin Calculator, Forward Rate Calculator, Forex Volatility Calculator, and Mortgage Calculator can be used to calculate margins, forward rates, volatility, and mortgages in a similar way. In the heat map, the current value of a particular currency pair is displayed in a graph with specific colors. For example, currency pairs in dark green are above the last bar high and currency pairs in dark red are below the last bar low. The Investing.com PortfolioWith the Investing.com Portfolio, the user is able to control his financial instruments and keep an eye on his portfolio positions as well as the performance of the portfolio. In doing so, he can follow several watchlists and access them via PC or phone as well as via tablet or smartphone. In addition, securities such as stocks, funds, indices, currencies, and commodities can be added to the portfolio. All that is required is a free registration via Facebook, Google, or e-mail address. Introduction of the Investing.com platform:In addition to the wide range of numerous markets, news, and tools offered by Investing.com, which have already been presented, the company also provides its users with various charts and analysis options. In the next sections, the experience report not only covers the charting and analysis section but also takes a closer look at the brokers recommended by Investing.com, as well as the customer service and support. In addition, the company also offers some training opportunities, which were also tested. Charts and analysesInvesting.com convinces with a large variety of different charts, including live charts and charts on various securities. The user can use these charts for his analysis at Investing.com:

In addition, there are also interactive charts on forex, futures, indices, as well as stocks, and the customer also has the option to view several forex or indices charts simultaneously. In the analysis section, the trader has access to opinions and analyses on the market overview but also on topics such as Forex, cryptocurrencies, stock markets, commodities as well as bonds. It is also possible to select according to popularity, recommendations, or even comics.  Brokers at Investing.comUnder the “Broker” tab, numerous online brokers are listed and described. By clicking on it, a profile of the respective broker appears with all important information, such as the valid regulation, deposit and withdrawal methods, and trading platforms. Traders can even search specifically for the market they want to trade. For example, Forex brokers, stockbrokers, or CFD brokers are displayed separately. If one selects a certain area for trading, an overview of various brokers is first given. Here, not only the broker as well as the corresponding regulation but also the respective spreads of EUR/USD and the necessary minimum investment. If the user selects a broker, a detailed profile of the online provider is displayed, through which the trader can get more detailed information about the company. Broker Overview Investing.comAccording to Investing.com, the top 5 Forex brokers include the following:

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|

(5 / 5)

(5 / 5)