Interactive Brokers review and test for new investors – How good is the broker?

Table of Contents

Considering the amount of credible and trustworthy brokers and forex specialists out there, it’s hard to decide which company deserves to be a part of your trading world. Not to mention the fact that a “good broker” can be subjective. A particular company might be good enough for you, but to some, they may be lacking, or their services just don’t suit them.

To put it simply, you need to weigh the assets and liabilities of a broker before deciding to sign up for their platform. Is this broker dedicated to helping their clients succeed? Do they offer all the assets that you plan to trade? Is it safe to invest your hard-earned cash in them? Will you learn anything new from this broker?

This review contains all the answers to the questions above and much more crucial information that you would need to truly make an informed decision.

What is Interactive Brokers?

Interactive Brokers is a company dedicated to becoming one of the best brokers in the market. It is well known for its competitive speed, price, global assets, and professional trading tools.

Thomas Peterffy founded the company in the year 1978. They’re the biggest broker that has $9 billion in equity capital. With its 43 years of experience on the market, they operate on more than 130 market destinations worldwide. Interactive Brokers Group, along with its partners, performs more than 2,998,000 trades each day.

Their main office can be found in Greenwich, Connecticut. They have over 2,500 employees in all their other offices located in Estonia, Ireland, Singapore, China, Luxembourg, India, Japan, Hungary, Russia, Australia, United Kingdom, Canada, Hong Kong, Switzerland, and the United States of America.

Here is a quick overview of Interactive Brokers:

⭐ Rating: | (5 / 5) |

⚖️ Regulation: | Regulated by multiple platforms |

🏛 Founded: | 1978 in New York, New York, United States |

💻 Trading platforms: | Web platform, mobile applications |

💰 Minimum deposit: | No minimum deposit required! |

💸 Withdrawal limit: | No limit |

⌨️ Demo account: | Free and unlimited |

🕌 Islamic account: | Available |

📊 Assets: | Investment Products, Stocks, ETFs, Options, Futures/FOPs, Event Contracts, Spot Currencies, Cryptocurrencies, US Spot Gold, Bonds, Mutual Funds, Hedge Funds |

💳 Payment methods: | Various payment methods available, including Bank deposits, Credit cards, e-wallets, online banking and more. They are depending on your country of residence |

🧮 Fees: | Low spreads from 0.0 pips |

📞 Support: | 24/7 chat and email |

🌎 Languages: | English, Spanish, Chinese, Japanese |

Is Interactive Brokers regulated?

Interactive Brokers Group is regulated in multiple countries. You will see their branch and which company regulates them in each country below:

Branch: | Regulated by: |

🇺🇸 Interactive Brokers LLC (United States) | New York Stock Exchange (NYSE), Financial Industry Regulatory Authority (FINRA), and Securities Investor Protection Corporation (SIPC) |

🇭🇰 Interactive Brokers LLC (Hong Kong) | Securities and Futures Commission (SFC) |

🇦🇺 Interactive Brokers LLC (Australia) | Australian Securities and Investments Commission (ASIC) AFSL number: 245574, ARBN number: 091191141 |

🇨🇦 Interactive Brokers Canada Inc. | members of Investment Industry Regulatory Organization of Canada and Canadian Investor Protection Fund |

🇬🇧 Interactive Brokers (UK) Limited | Financial Conduct Authority (FCA) Registry Entry Number 208159 |

🇱🇺 Interactive Brokers Luxembourg SARL | Commission de Surveillance du Secteur Financier (CSSF) |

🇮🇪 Interactive Brokers Ireland Limited | Central Bank of Ireland (CBI) |

🇪🇺 Interactive Brokers Central Europe Zrt | Central Bank of Hungary (Magyar Nemzeti Bank) no. H-EN-III-623/2020 |

🇦🇺 Interactive Brokers Australia Pty. Ltd | Australian Securities and Investments Commission (AFSL number 453554) and member of the Australian Financial Complaints Authority (member number 38492) |

🇭🇰 Interactive Brokers Hong Kong Limited | Hong Kong Securities and Futures Commission and member of the Stock Exchange of Hong Kong and Hong Kong Futures Exchange |

🇸🇬 Interactive Brokers Singapore Pte. Ltd | Monetary Authority of Singapore license number: CMS100917 |

Financial Security

Interactive Brokers clients have nothing to worry about when it comes to the safety of their funds. Client money is separated and placed in a custody account or in a special bank. This ensures that if the broker goes bankrupt or goes into liquidation, the client’s assets or funds will be returned to them. It’s important to note that to get your funds back, you must have no borrowed money or stocks, and you have no future positions.

Interactive Brokers also puts in some of their excess money in those segregated or custody accounts to ensure that all their clients will be protected if the company goes bankrupt.

Here are some facts about their security:

SSL: | Yes |

Data protection: | Yes |

2-factor authentication: | Yes |

Regulated payment methods: | Yes, available |

Negative balance protection: | Yes |

Trading conditions and offers of Interactive Brokers

Here is an overview of their trading conditions and offers:

Leverage: | Interactive Brokers can lend up to 85% of the value of your portfolio if you are eligible for portfolio margin (you must have account equity of at least $100000 for that). You might, for instance, borrow $85000 from a $100000 portfolio. |

Execution time | 1 ms (no delays) |

Markets: | 150+ |

Forex: | Yes |

Commodities: | Yes |

Cryptocurrencies: | Yes |

Investment products: | Yes |

Binary options: | No |

Event contracts: | Yes |

Futures: | Yes |

ETFs: | Yes |

Bonds: | Yes |

Mutual funds: | Yes |

Stocks: | Yes |

Hedge funds: | Yes |

Interactive Brokers’ Trading Platform

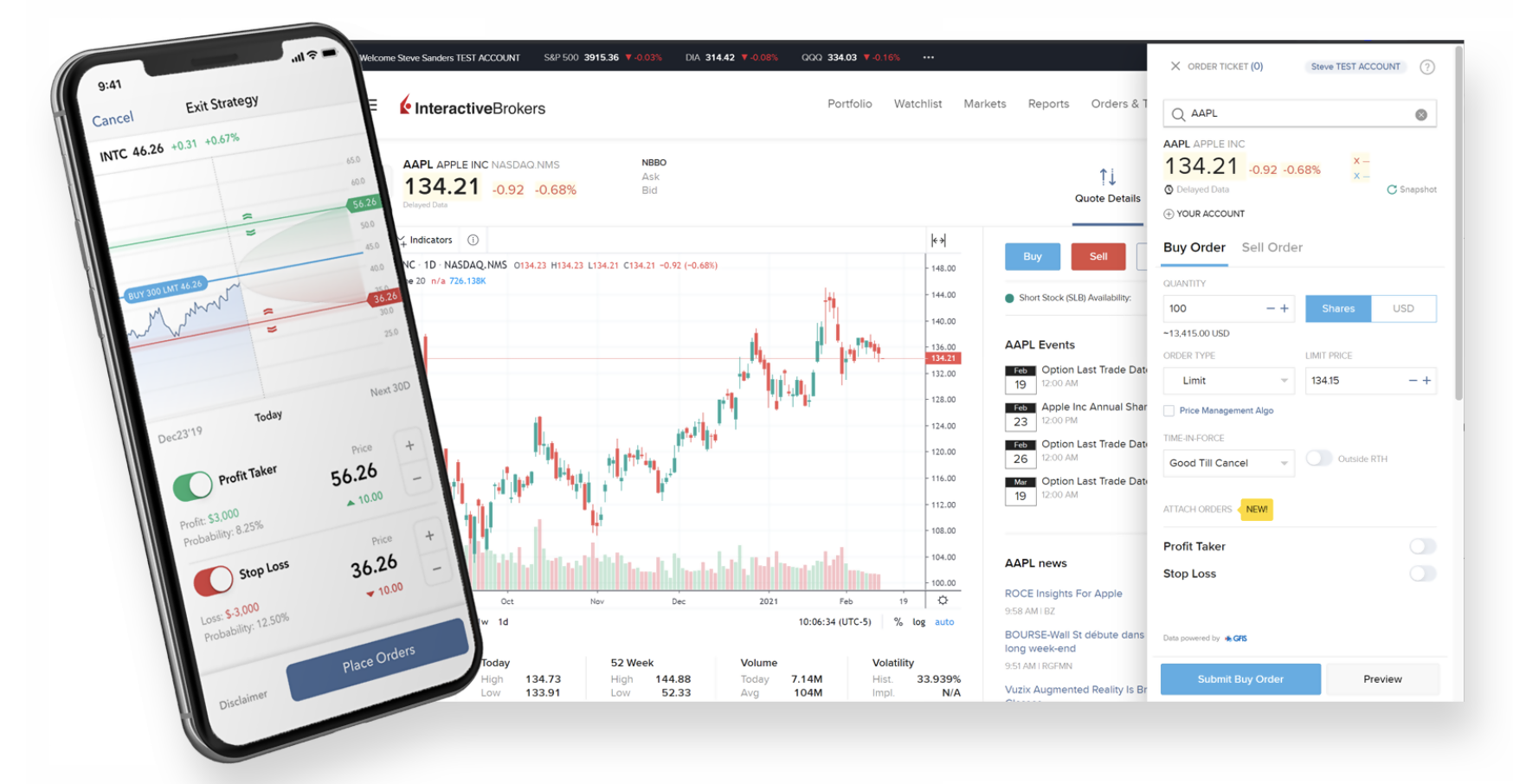

Interactive Brokers has four trading platforms. All their platforms have advanced trading tools that target the needs of all kinds of traders. For options traders, Interactive Brokers have a tool called OptionTrader as well as Probability Lab. These tools make complex options trading simpler to understand and execute.

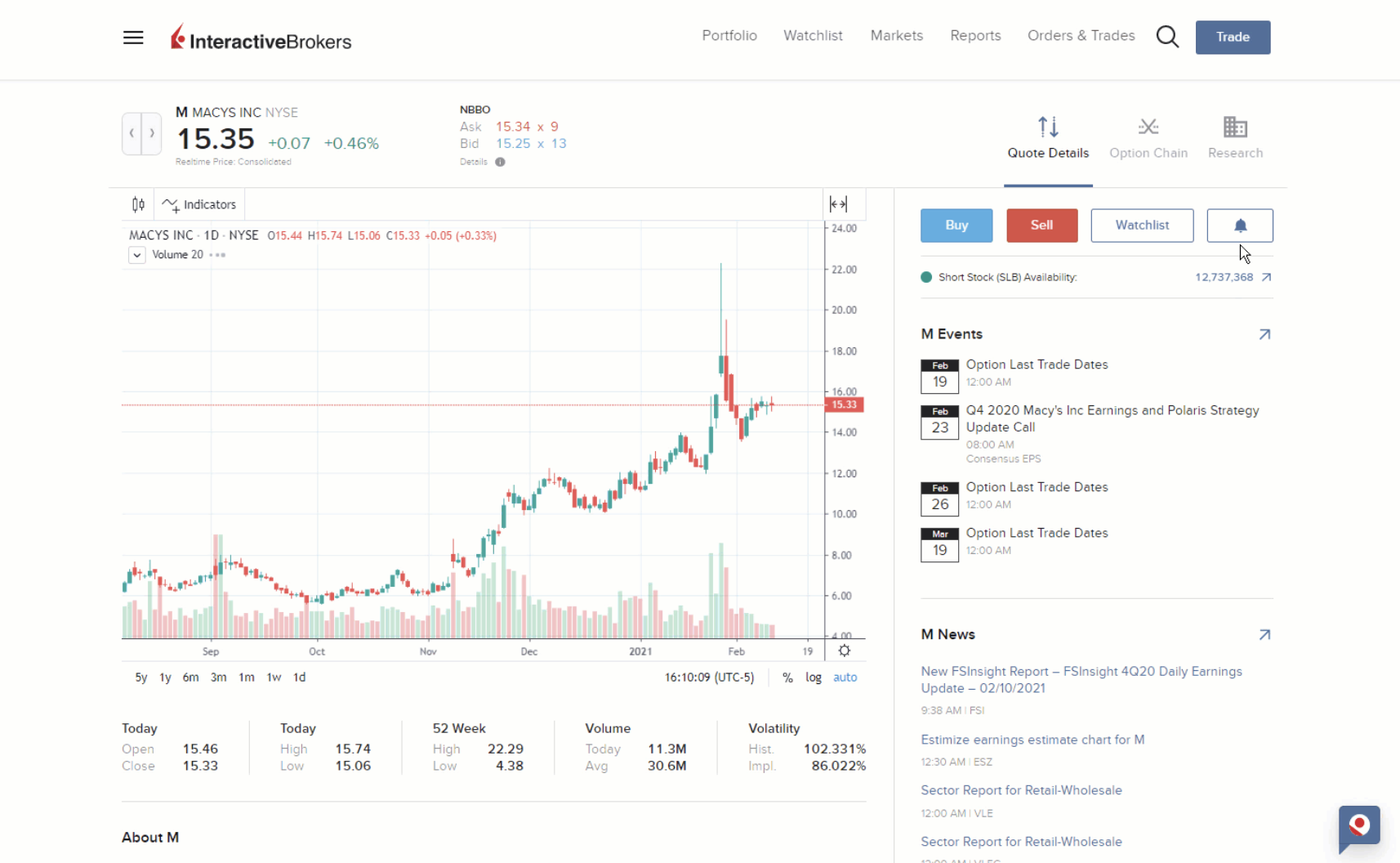

Client Portal

Interactive Brokers Client Portal platform requires no download and can be accessed via your browser on any device. In this platform, you will have all the necessary tools you need to manage and keep an eye on your account. Its simple interface allows traders to quickly understand and utilize all the available tools on the platform.

This platform features a slide-out trade ticket that helps you view, execute, and manage all your orders. You can also easily access any vital information regarding your account. Examples of these are your buying power, liquidation value, and more.

With the Client Portal, you will have the ability to easily customize your charts. You will be able to add essential to advanced technical analysis tools like EMA, SMA, Bollinger Bands, and volume bars. These are only a few of the tools that you can add to your chart.

Staying updated on market news or news related to a specific asset is vital to traders as well. Interactive Brokers features a live news stream that will instantly notify you when something important comes up.

Event calendars can also be accessed through the Client Portal. Here you will find important market events like monetary policy changes, fed meetings, non-farm payroll updates, jobless claims, and many more.

Tracking your portfolio’s performance requires so little effort. Their built-in analytics will judge your trades based on the rate of return, risk, and profitability.

The client Portal has also recently added an IBot feature. This tool helps you navigate your way around the Client Portal and access trading tools, features, information, and account data. Simply type in your question, and IBot will give you the answer.

You can also input commands like “Buy 100 more shares” or “Show me next week’s economic events,” and IBot will take care of the rest.

Interactive Brokers Trader Workstation

Their central trading platform is the Trader Workstation or TWS. This is available on any desktop computer, but you will need to download the software.

With the Trader Workstation’s customizable interface, you can access all the necessary data like charts, research, or live quoting, all in one screen. Simple and multi-leg orders can be made and tracked easily. If you trade more than one asset class, TWS allows you to view multiple products side by side with their multiple asset display.

Given that Interactive Brokers is the best in their field, they have more than 100 order types such as block orders, iceberg orders, GTC, trailing stops, limit orders, and many more. You can set and customize this depending on your trading strategy.

The analysis given by third-party subscriptions like Dow Jones, Reuters, Zacks, and Morningstar can also be access through this all-in-one trading platform.

With Interactive Brokers Trader Workstation’s real-time monitoring feature, you will see an overview of your current funds in a single account window. Here, you will find the funds available, account balances, portfolio data, and margin. This is customizable to your needs.

You can also set up your watchlist, alerts, and trades easily. This would give you an edge in planning out the future actions of your account. The Trader Workstation also has a built-in tool to help in portfolio margining. You will be able to determine the margin requirements for your desired trade.

Interactive Brokers give importance to risk management. With Interactive Brokers IB risk navigator together with options analytics, you would be able to determine your risk exposure between all of the asset classes offered. With this, you can easily modify your portfolio to suit your desired risk and maximum drawdown.

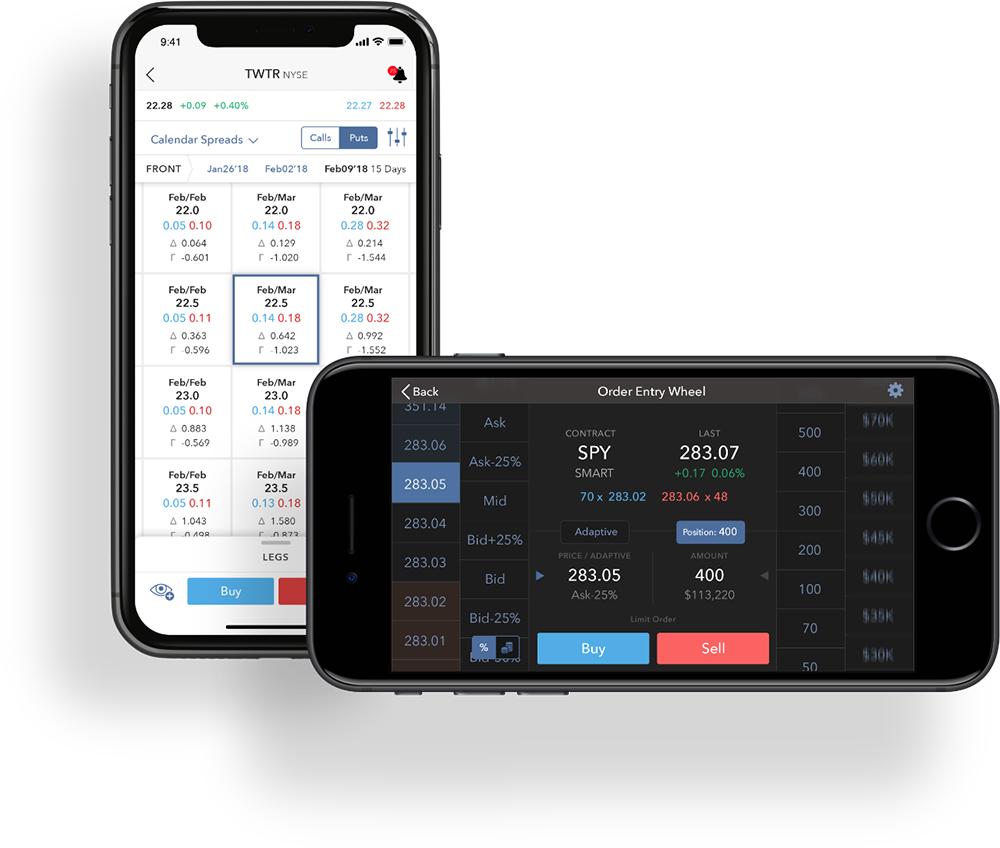

IBKR Mobile

IBKR Mobile can be downloaded on both iOS and Android devices so you can manage and trade on the go. This is also available on the Amazon Store, Baidu, and 360Zhushou.

All of the assets available on Interactive Brokers can be traded using this platform. However, the tools available are pretty basic compared to the Trading Workstation. Some of the features not included in this application are advanced orders and algorithms, backtesting, options analysis, and many more.

IBKR APIs

Interactive Brokers gives you the option to create your own trading application using APIs. This allows you to automate, customize, and streamline the whole trading process. These APIs could be as simple as Excel APIs or industry-grade APIs. You can even create your own commercial trading software.

With IB SmartRouting, your software will always get the best prices and execution times for the assets offered by Interactive Brokers.

Learn to trade with Interactive Brokers

Interactive Brokers has so many free educational materials to choose from. You can sign up for their trading academy to learn new things or expand your knowledge on the trading scene. They have daily webinars that help you understand current market trends or topics. They even have quizzes that you can take to test your knowledge of trading.

You can access their trading glossary to familiarize yourself with all the critical trading or market terms. You will find more information on each of their programs on the education tab of their website.

Available assets on Interactive Brokers

They have various assets to choose from. Here, we have listed all the assets you can trade on IB.

Stocks & ETFs

Interactive Brokers offers a wide range of stocks from the United States, Europe, and the Asia Pacific region. Within these 33 countries, there are over 135 markets that you can trade on. Some of the more important stock exchanges that they offer are the likes of the New York Stock Exchange (NYSE), Chicago Stock Exchange (CHX), Nasdaq Composite Index (NASDAQ), London Stock Exchange (LSE), and Australian Stock Exchange (ASX).

Since stocks are their primary product, you can rest assured that you will find most, if not all, of the widely traded stocks. They offer commissions for as low as zero. They also allow Fractional Trading. This means that you won’t need to buy one whole share of a stock to own it. Instead, you can invest any amount in your company of choice.

Traders can also take advantage of their Stock Yield Enhancement Program. With this program, clients can lend their shares to other traders to short. In turn, Interactive Brokers gives the lender 50% of the fees and interest that the borrower will pay for.

The eligible clients for this program should have an account under IB LLC (including Japanese and Indian clients), IB Canada, IB Hong Kong, IB Singapore, and IB UK. Aside from this, the account holder should have equity that is worth more than 50,000 USD. It is important to note that stocks held on margin are not allowed to be loaned out.

For more information about the Stock Yield Enhancement Program, visit their website or contact their customer service.

On the other hand, investing in ETFs provides exposure to a specific subsector or industry. Aside from ETF options, Interactive Brokers also provide short ETFs and leveraged ETFs from 28 exchanges in 14 countries. Needless to say, ETFs have lower costs, can be traded in the short term, and can give results faster compared to mutual funds.

With IBKR, you’re only charged a fee of as low as $0.005 per US share. They also have partnered with some companies to give rebates to their clients who invest in particular ETFs. You will find more information about this on their website.

Options

For clients that would want to trade options for income or to hedge risk, Interactive Brokers has a lot of asset classes that are available as options. Given how options work, they can also be used in demanding and volatile market conditions. Options via Interactive Brokers are for stock options and ETF options.

The commission for trading options starts from 0.15 USD and can reach up to 0.65 per option contract. You will have the option to incur a lower fee depending on your account type and plan and the frequency of your trades.

Interactive Brokers clients also gain access to their Probability Lab and analytics. Both of these and more features will allow the client to find profitable strategies and ideas to better manage their trades.

Given that options trading is a different ball game, Interactive Brokers also has a built-in option calculator on their website. Aside from this, their proprietary trading tool will assist you in building up your portfolio with your desired hedges and speculative trades in place.

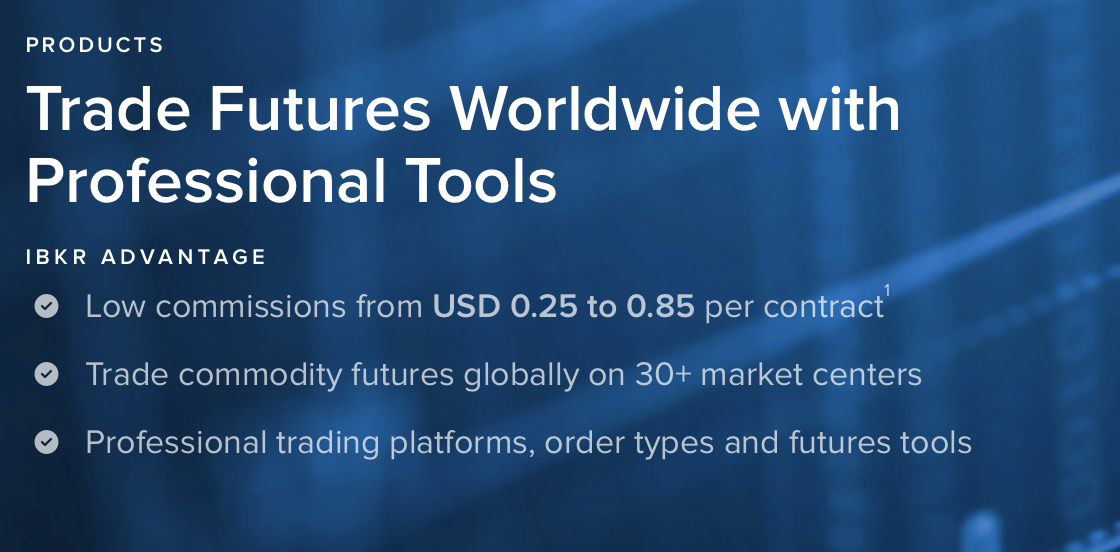

Futures/FOPs

Futures trading with interactive brokers gives you one of the lowest commission rates in the world. According to their website, they offer over 35 financial markets across different continents. The list of their offered options contracts can be found below.

- Agricultural – Grains, Livestock, and others

- Fixed Income

- Currencies

- Interest Rates

- Soft Commodities like sugar, cocoa, coffee, and others

- Hard Commodities like oil and metals

- Equity Indices

- Narrow-based Indices

- Volatility Indices

- Singe-Stock Futures

Spot Currencies

With Interactive Brokers, you can trade 23 different trading currencies. Within these, you can find the most important tradeable currencies, which include USD, CAD, EUR, AUD, GBP, and many more.

This broker gives clients real-time access to currency quotes provided by 17 of the world’s largest forex dealing banks. This gives the advantage of low commission and spreads. Since IBKR operates with an ECN-like market structure, this provides market liquidity and transparency that provides customers with more confidence to trade with them. They also have a large-size order facility that caters to large volume transactions in the market to minimize market impact.

Interactive Brokers also permit the use of leverage when trading spot currency. This is not available to all clients and would further need additional permissions from IBKR. However, interactive brokers allow all accounts to convert between currencies without the use of leverage.

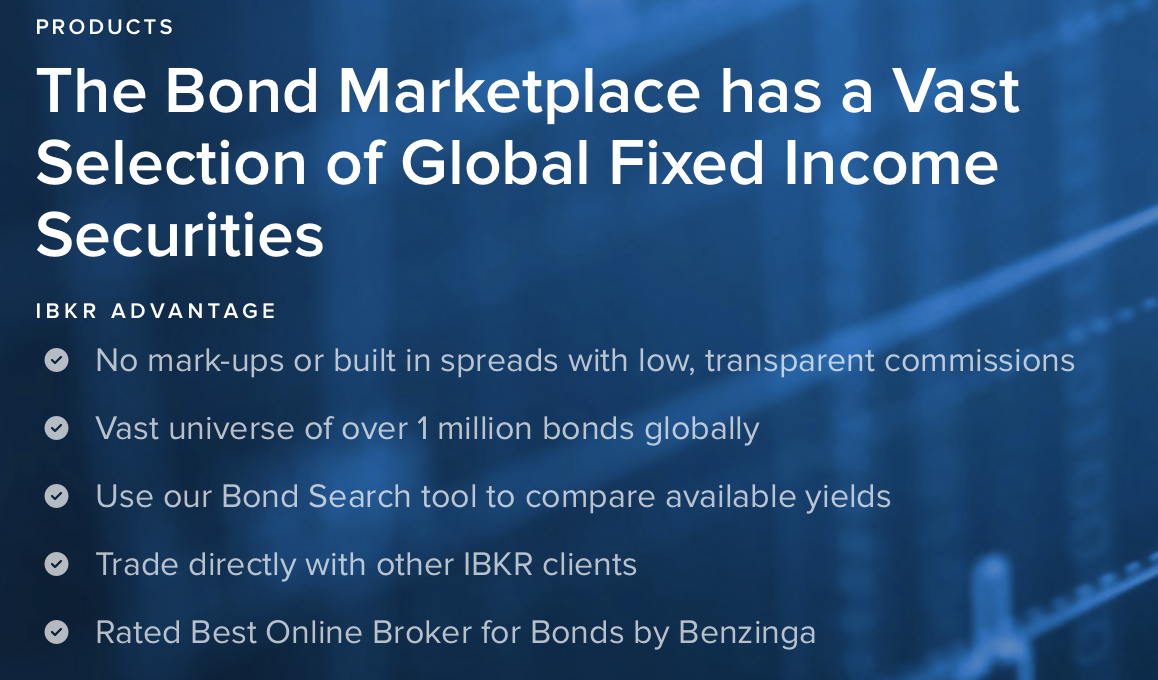

Bonds

As the best online broker for bonds, Interactive Brokers gives you the advantage to trade and passively invest in bonds. Using their bond search tool, you can filter out your ideal bond from a list of more than a million based on the type of bond, industry, yield, and maturity date.

The bonds they offer include US treasuries, US certificate of deposits, Global Corporate Bonds, US Muni Bonds, and non-US sovereign bonds. They also have another filter that sorts out the best bond with the best risk versus return.

For corporate bonds, the minimum charge per order is $1, and they also charge 2.5 to 10 basis points.

Since orders through IBKR utilize SmartRouting, you’re guaranteed to get the best prices from liquidity providers. Your orders will go through bond market centers that include NYSE bonds, Bloomberg ALLQ, Euronext, and many more.

You can even submit a request for quotes on bonds that have no existing quotes or for those that could probably have better prices. With Interactive Brokers Trading Workstation, you can easily compare bonds from one another.

Mutual Funds

As the best-rated mutual funds online broker, they take pride in having more than 40,000 different funds available for their clients, of which more than 8,000 funds are transaction fee-free. Both clients and non-clients alike can use Interactive Broker’s Mutual Fund Search Tool to filter mutual funds by country or region, fund family, and by commission charge.

Some of the popular mutual funds that IBKR offers include those offered by Fidelity, BlackRock, Invesco, and Allianz.

Hedge Funds

Interactive Brokers has more than 60 hedge funds for their clients to invest in. These hedge funds are a passive way to earn money as they are essentially your fund managers. You can choose your ideal hedge fund depending on your investment strategy. Some of these strategies may depend on the investment time frame or the market capitalization of your desired investments.

Some hedge funds even specialize in a certain industry. Once you have made an account with IBKR, you can take a look at the track record of each hedge fund, their total assets under management, as well as their minimum required investment.

Hedge funds are ideal for traders who have higher risk tolerance. Investing in this fund requires a lot of research and patience.

Keep in mind that you will need to go through a certain process to be able to invest in hedge funds offered by Interactive Brokers. You will need to either contact the fund management company or put in a request for them to contact you.

It’s also important to note that the minimum investment and withdrawal amount for hedge fund investments is 25,000 USD. However, if your fund balance is lower than that, you can withdraw the full amount.

Account types available on Interactive Brokers

Signing up to Interactive Brokers is relatively straightforward. You can choose from the different types of individual and institution accounts. You simply create a username and password, confirm your email, and fill up the application that the company will give you.

For individual accounts, you will need to provide your contact information, tax and income residency information, information on trading objectives and experience, and your bank account information. For institution accounts, they will ask for your bank information, legal documents that prove your company exists, the authorized person’s contact information, and your organization’s tax and contact information.

However, choosing the right individual or institution accounts can be a bit tricky. There are so many options with different services and perks. It’s important to note that Interactive Brokers does not require a minimum deposit to open any account type.

Demo Account

If you’re not familiar with Interactive Broker’s platform, you could practice and familiarize yourself by signing up for a free demo account. You simply need to register using your email address, and you will gain access to all their platforms with virtual equity worth $1,000,000.

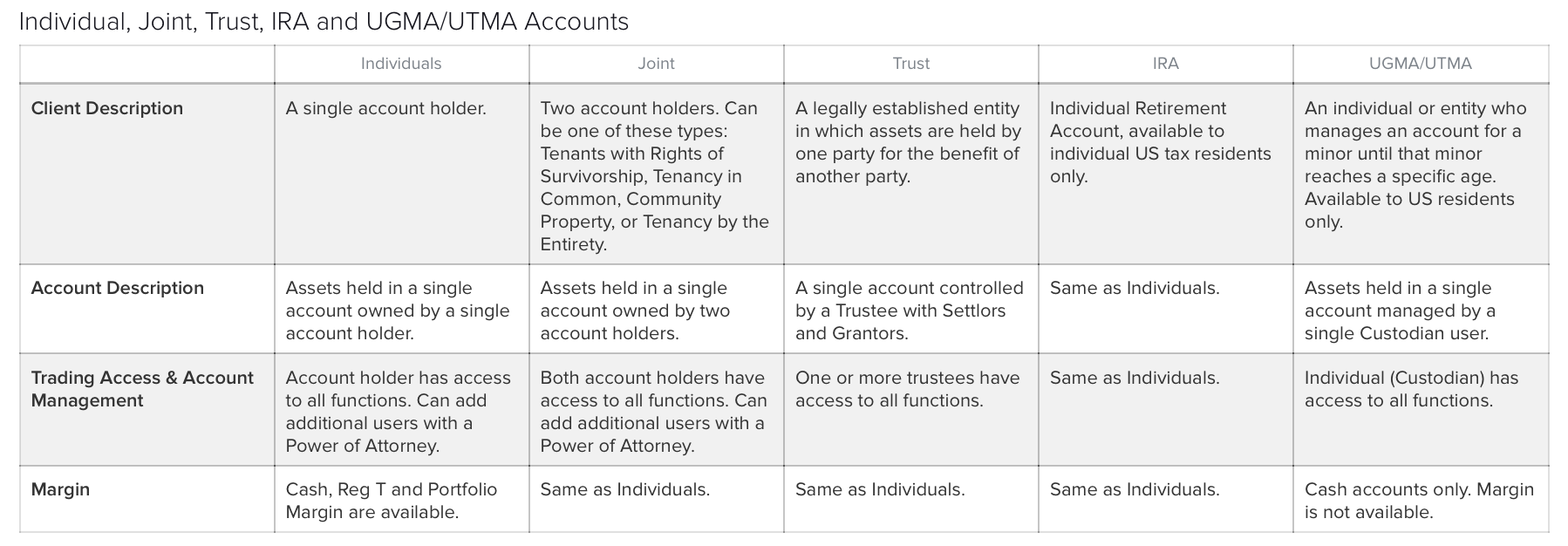

Individual, Joint, IRA, and Trust Accounts

These four account types almost have the same functions and access. The main difference between these four accounts is the type of clients that own them. Individual and Joint accounts are pretty self-explanatory. IRA accounts are specifically for US tax residents. On the other hand, trust accounts are created by a grantor or settlor and managed by a trustee for someone else’s benefit.

Margin is available for these four accounts as well as regular cash accounts.

UTMA and UGMA Accounts

For the benefit of minors, the Uniform Transfers to Minors Act (UTMA) and Uniform Gifts to Minors Act (UGMA) were established. These allow you to transfer financial assets without the need for legal titles. A custodian user manages these accounts until the minor reaches a specific age.

It is important to note that this is only available for US residents. Aside from that, only cash accounts and non-margin accounts are available for this.

Friends and Family Account

To manage less than 16 clients without the need for legal registration, a Friends and Family Account is needed. Interactive Brokers will give you a master account that is linked to your individual personal account to collect fees and allocate your trades.

While your clients do not have access to manual trading, they do, however, have access to account management functions. For this type of account, margin is also available, and each of your client’s accounts is individually margined.

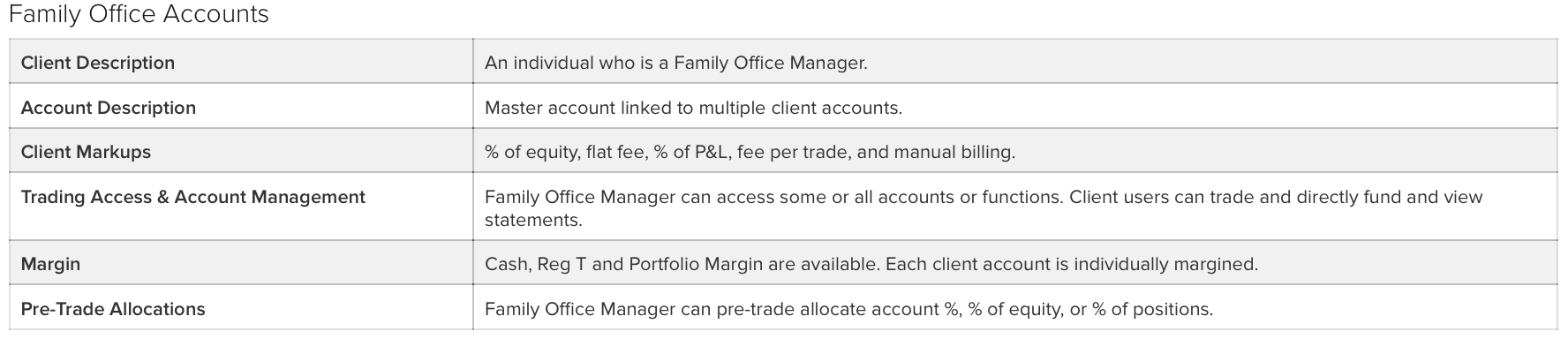

Family Office Account

Needless to say, this is for family office managers. These managers offer their services of managing funds to one or more high-net-worth individuals. Similar to the Friends and Family account, they are also given a master account, but this is linked to multiple client accounts.

These managers have the ability to freely allocate account percentage, percentage of positions, and percentage of equity pre-trade. Margin is available for this account, but it is individually set per client account.

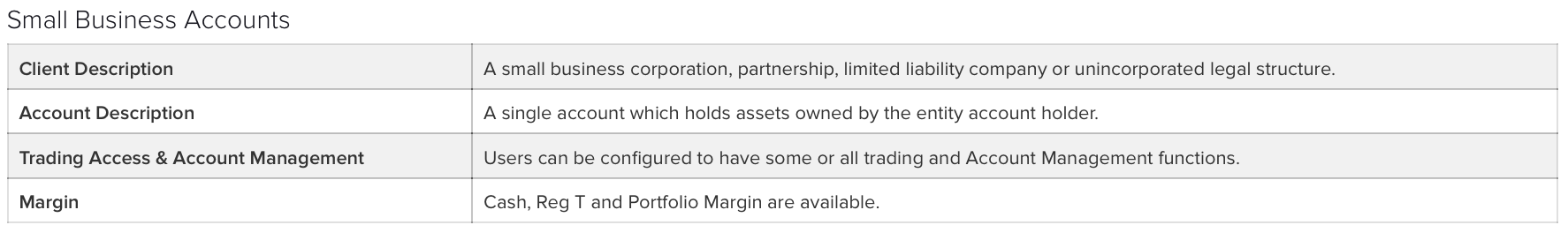

Small Business Account

In this account, which is made specifically for small businesses and partnerships, clients can customize their account management functions. Only a single account is given to the client to manage all of their assets and funds. Margin is also available for this account.

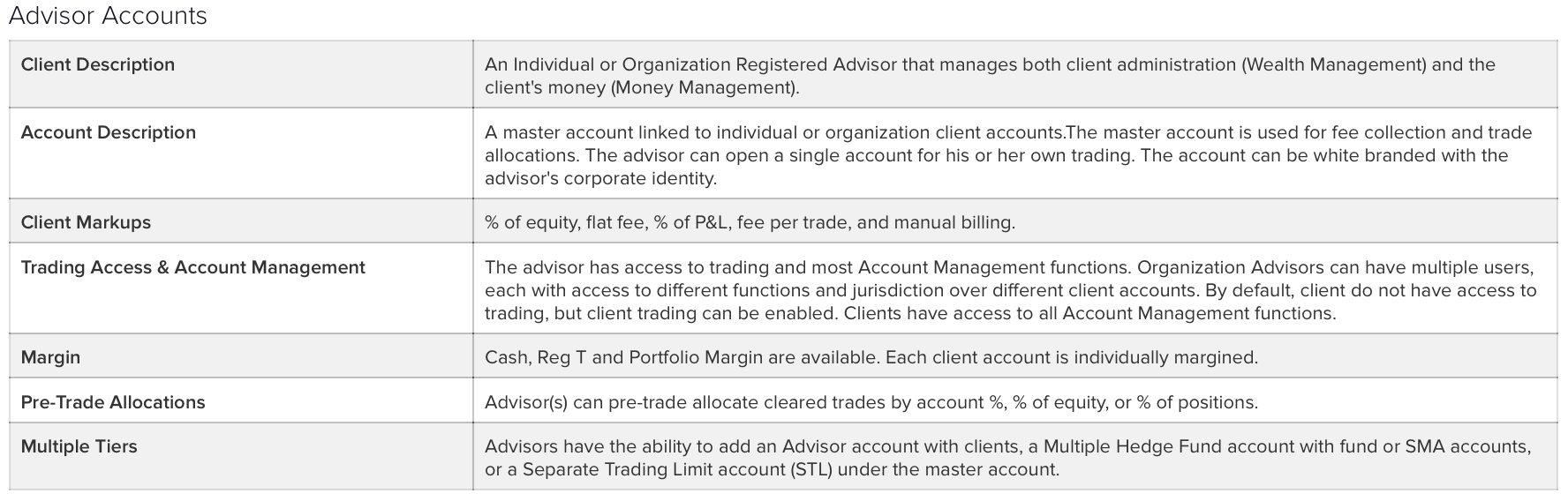

Advisor Account

Whether operating individually or acting for an organization, a registered advisor can use this account to manage both clients and their money. The account holder has the ability to trade and use most account management functions.

Under this master account, these advisors could add other advisors, hedge fund accounts, or STL accounts. Just like the Family Office Account, a margin is available, but each client is individually margined.

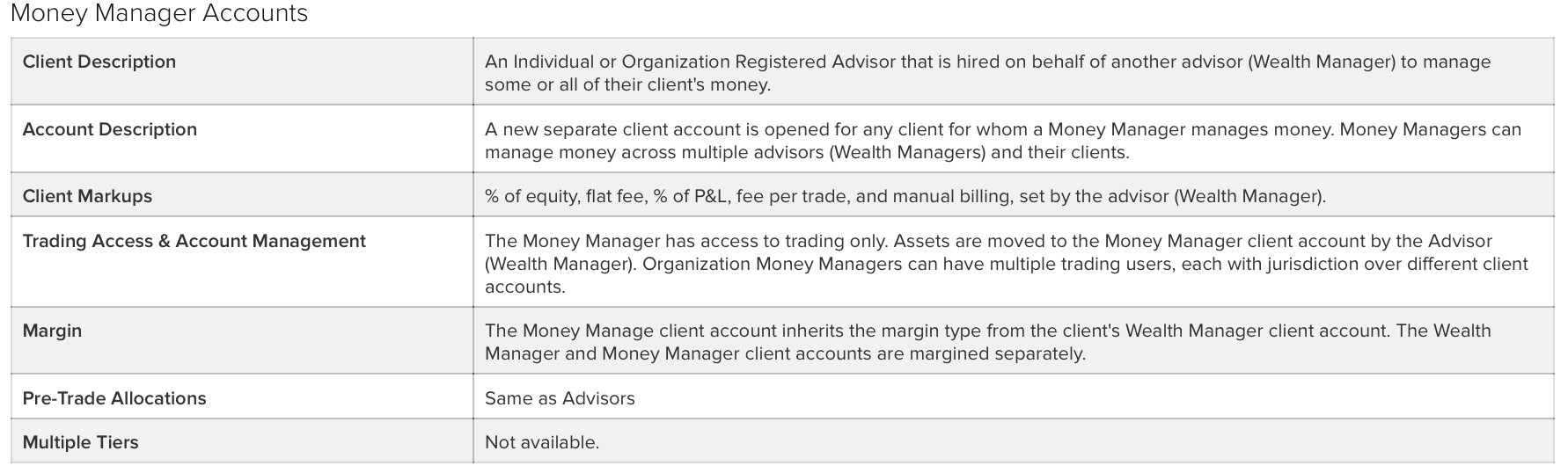

Money Manager Account

Registered advisors, whether individual or organizational, can be hired and managed under multiple advisors. This particular account only has access to trading. Clients with this account type cannot handle other accounts since advisor accounts can only do this action.

Both Money Manager accounts and Advisor Accounts can do pre-trade allocations for account percentage, percentage of positions, and percentage of equity.

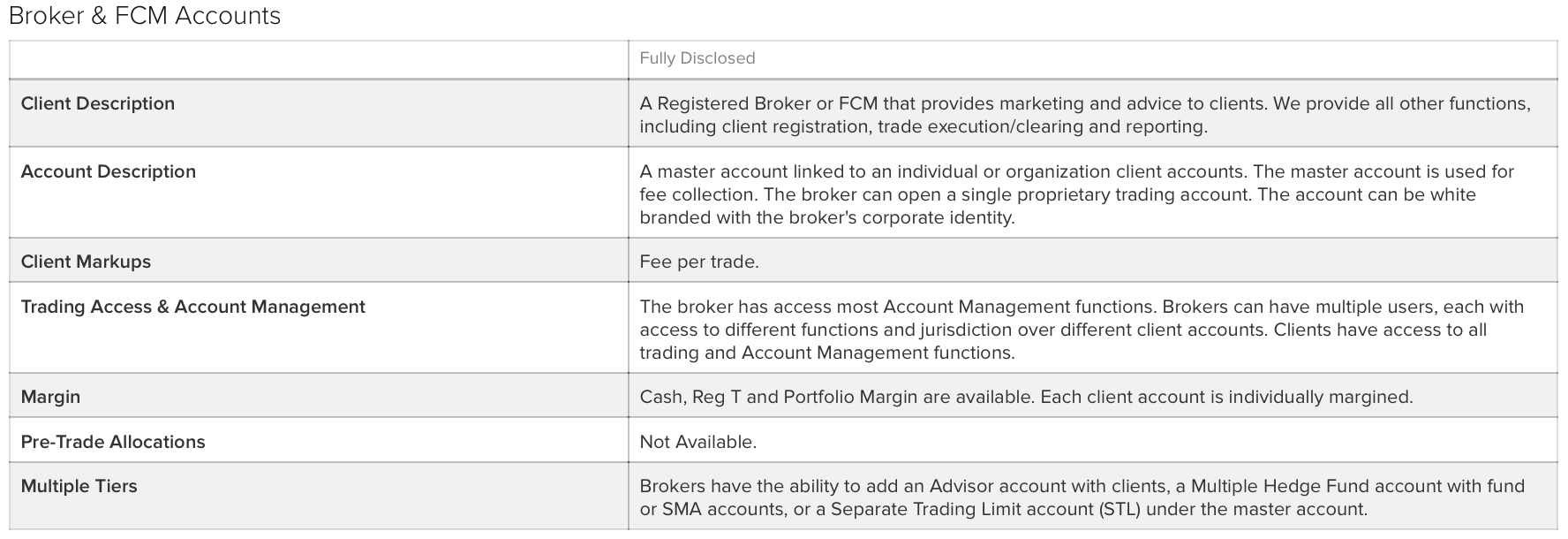

Broker and FCM Account

Brokers and Futures Commission Merchants can open this account type to easily manage their respective clients. With this account, they are given the ability to market their service, and they are given multiple functions for their business to grow.

These functions include client registration, giving financial advice, and account holders are given occasional reports. A master account for fee collection will be provided to oversee individual and organization client accounts.

The Broker and FCM accounts have the most access to account management functions, and this also includes trading. Margin is also available and is managed individually per client. The brokers also have the option to add hedge fund accounts, advisor accounts, and STL accounts under them.

This account type is segregated from the fully disclosed broker and the omnibus broker. To get more information on the differences between these two, refer to their website.

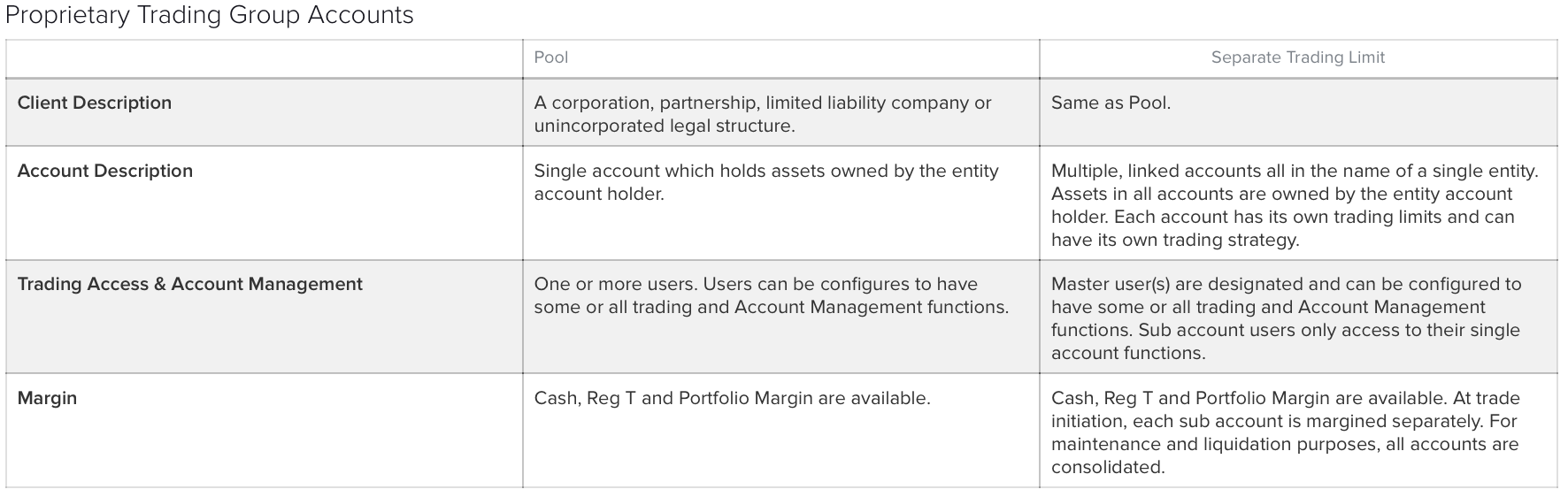

Proprietary Trading Group Account

Single or multiple linked accounts can be used to manage this type of account that is built for corporations, limited liability companies, or partnerships. This account type has two sub-types: Pool account and Separate Trading Limit account.

These two differ in the number of main accounts and in their power to manage different roles under this account. For both of these subtypes, margin is available.

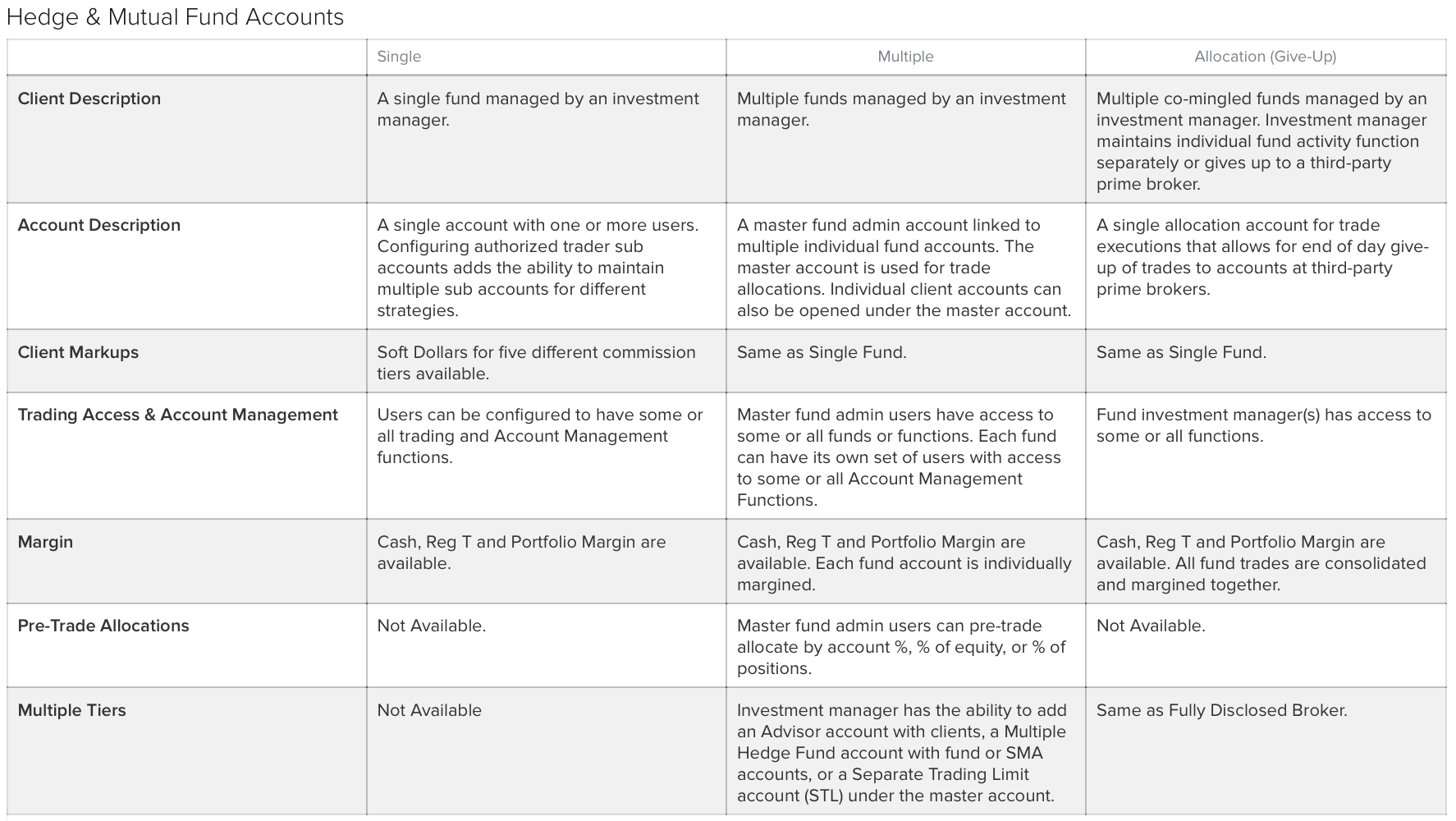

Hedge and Mutual Fund Account

As the name suggests, this account type is specifically for hedge and mutual fund managers.

There are three sub-types under this account. These are Single, Multiple, and Allocation accounts. These three differ in the number of funds managed, the number of accounts linked, and the ability to set pre-trade allocations.

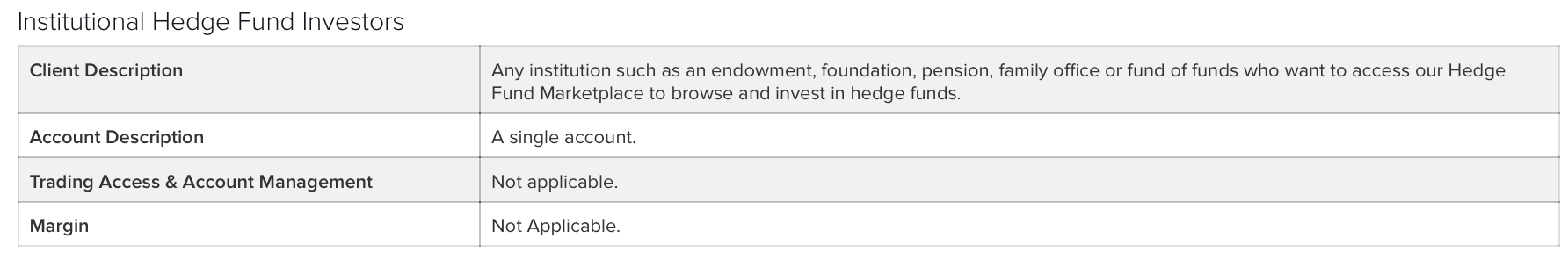

Institutional Hedge Fund Investors

For any institution that would want access to the hedge fund marketplace of Interactive Brokers, this account is recommended for you. The institution can be any of the following: pension, family office, foundation, or fund of funds.

Account Plans of Interactive Brokers

Interactive Brokers offers two account plans: IBKR LITE and IBKR PRO. Retail investors are encouraged to use IBKR LITE because it offers commission-free trading for US-listed stocks and ETFs. There is no required minimum balance or maintaining fee to avail or continue to enjoy this account plan and its perks.

IBKR PRO, on the other hand, is ideal for institutional clients. This is because of their tiered pricing on every product that IBKR offers. Aside from this, they pay smaller interest for margin loans, and they have access to IBKR Web Trader and IBKR APIs. There is no minimum required balance. However, each account is charged a maintenance fee of up to $10.

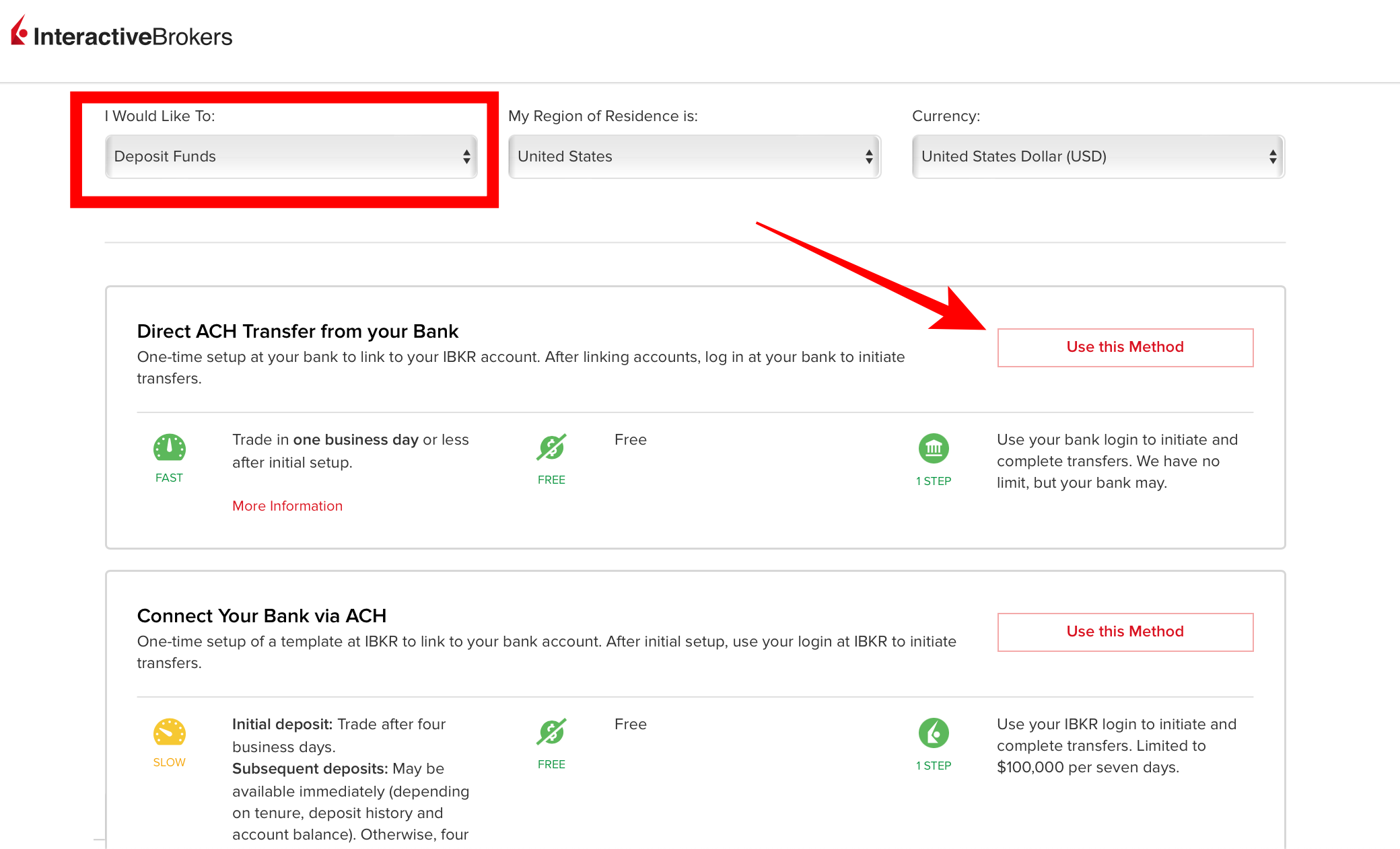

Adding and withdrawing funds from your Interactive Brokers Account

Interactive Brokers clients have a lot of options when it comes to adding funds to their accounts. Below you will find the different methods along with all the necessary information you will need to fund your account without any delays or problems.

To get all the details on the different methods, you can simply visit their website.

Wire Transfer

For bank wire transfer, you will need to contact your bank of choice to process your deposit. Usually, the amount you deposited will reflect on your Interactive Brokers account after one to four business days. For banks outside of the United States, it might take a little longer.

To withdraw your funds, you will need to take note of the cut-off times for all the currencies. You can find this information on IBKR’s website.

US Automated Clearing House or ACH

This method allows you to automatically add funds to your IBKR account using your bank’s ABA number and bank account number. Deposit requests made before 12:00 PM ET will be addressed, and the funds will be credited to your account on the same day. For requests made after 12:00 PM ET, they will be handled on the next business day, and the funds will reflect on your account after four business days.

Keep in mind that the deposit limit is $100,000. This limit will refresh after seven business days. This is also available only for US currency deposits from US banks that permit ACH deposits.

To withdraw funds, you will need to send a request and wait for it to be approved. You can withdraw up to 5,000,000 USD

Checks

For depositing funds using checks, you will need to follow specific instructions. You will need to write your account number on the check, print out the deposit form, fill it up, and mail it to IBKR. The process depends on how fast the mail arrives. Typically, IBKR would deposit your funds on the same day they receive your check.

Only Bank, Bill Payment, and Personal checks are permitted for USD checks. You can find a list of check types that Interactive Brokers doesn’t accept on their website. For HKD checks, you can only deposit using personal checks. For CAD checks, Spousal RRSP, RRSP, and TFSA transfer cheques from non-ATON members are accepted.

Online Bill Payment

This is either an electronic or checks fund transfer made on online payment services provided by your chosen financial institution. You will need to add Interactive Brokers on your list of payee list for US checks. However, for electronic fund transfer, your bank will provide a list of merchants, and you will need to select IBKR.

Your funds will instantly be credited to your account after you have made a deposit.

BPAY

This particular bill payment service is used by traders located in Australia. To deposit funds using this method, you will need to file a request to deposit using BPAY, and IBKR will give you a Customer Reference Number and Biller Code. Take note of these because for your bank to deposit your funds, you will need to provide your Customer Reference Number and your Biller Code.

The time period for this depends on your bank, but it’s usually one to four business days.

Direct deposit

This is one of the most convenient ways to add funds to your Interactive Brokers account. You can deposit pension, paycheck, or other recurring payments into your account. All you have to do is provide your ABA number and account number to your government agency or employer.

Remember that this process might take a couple of payment cycles before your funds reflect on your account. For IRA accounts, this method is not available.

IBKR Mobile Check Deposit

This method allows US clients to add funds to their accounts by simply sending a picture of their checks drawn on a US bank. You will need to install the IBKR Mobile application and use the IB Key Two Factor Authentication for maximum security.

Once your deposit has been approved, the amount will reflect on your account within six business days.

Canadian Bill Payment

This is an electronic fund transfer that’s available for deposits with CAD currency for clients of IB Canada. You will need to fill up a deposit notification, hand over the bill payment to your bank, and wait for them to approve this. If you submit your bill payment before 6:00 PM EST, you will receive the funds within three business days.

Canadian Electronic Funds Transfer

This method is available for deposits with CAD or USD currency from any bank in Canada that permits ETF transactions. The deposit limit for this is $100,000 or the CAD equivalent to that amount. Your deposited funds will be transferred to your IBKR account within seven business days.

The withdrawal limit for this method is 5,000,000 USD or the equivalent of it.

Direct Rollover

Direct Rollover is only available for US-based IRA accounts. This allows you to transfer any amount from an existing retirement plan or 401K into a Direct Rollover Account. You will need to submit all the necessary information regarding your retirement plan. Once you sign the document with this information, send it to IBKR and wait for them to complete the process.

Trustee-to-Trustee

Just like the Direct Rollover method, this is only available for US IRA accounts. The funds are directly transferred from the custodian/trustee to the custodian/trustee. To complete the process, you will be given a form that you need to print and fill out. Once you complete the form, send it to IBKR and wait for your funds to reflect on your account.

Late Rollover

Again, this is only available for US IRA accounts. This is similar to the Direct Rollover process. The only difference is you will need to be eligible to use this method.

Employee/Employer SEP Contribution

This simply allows both employers and employees to deposit funds into their accounts. US IRA account holders can utilize this. The methods for adding funds are limited to check, ACH, or wire transfer.

Employers can deposit up to $54,000 while employees have a limit of $5,500.

Customer service and support of Interactive Brokers

You can contact IBKR via email, phone, or mail. They also have a built-in chat room where a live representative will assist you.

Here is an overview of the support of Interactive Brokers:

Supported languages: | More than 4 |

Live-Chat | 24/7 |

Email: | |

Phone support: | U.S. dial: +1 (888) 919-0022 Outside the U.S. dial: +1 (312) 542-6890 |

Accepted and forbidden countries

Interactive Brokers offers their services to a lot of countries worldwide. Some examples are Australia, Bangladesh, Belgium, Costa Rica, Croatia, Cyprus, Egypt, Fiji, France, Haiti, Korea, Philippines, Qatar, United Kingdom, United States of America, Zambia, and many more. A complete list of all the accepted countries can be found on their website.

Advantages and disadvantages of Interactive Brokers

Interactive Brokers, compared to other brokers, barely charge any fees or commissions. If anything, their fees are extremely low. Their trading platform is also better than most since they have so many valuable tools and features that can’t be found on other applications or software.

The only disadvantage is their website. The amount of information can be very intimidating to newbie traders. There’s so many tabs, and it’s pretty tricky to navigate.

Conclusion – Interactive Brokers is trustworthy and a good choice for traders

All the awards that Interactive Brokers have won are truly well deserved. This broker has proven to be very innovative, trustworthy, and valuable to any type of trader.

With Interactive Brokers you have a first class broker offering 24/7 support. The trading conditions are excellent.  (5 / 5)

(5 / 5)

Trusted Broker Reviews

Experienced and professional traders since 2013FAQ – The most asked questions about Interactive Brokers:

Can I purchase Bitcoin from Interactive Brokers?

Interactive Brokers is a brokerage firm that operates on a multinational level and lets you trade in many underlying assets. They allow you to exchange 4 cryptos, including BTC and Ether. The clients also have access to crypto trading 24/7 through an app created by Paxos Trust Company.

How to convert currency in mobile on Interactive Brokers?

To convert currency on an Android mobile, open the IBKR Mobile app on your phone and select Convert Currency in the Trade section located in the More menu. Then press on Currency I Have and select the currency you have in holding. Next, you need to select Currency I Want and pick the currency to which you want your funds converted. Then, enter the amount that you wish to convert in the Currency I Have section, or enter the amount which you want to convert in the Currency I Want section, and finally, click on convert after previewing.

How many day trades are allowed by Interactive Brokers?

If you can bring the deposited amount in your Interactive Brokers trading account to 25000 US dollars, then you get the benefit of having unlimited day trades.

Last Updated on February 27, 2023 by Arkady Müller