5 best CFD brokers with low spreads in comparison 2024

CFD, or Contract For Difference, has become very popular since the pandemic. Ever since the spread of COVID-19, the market has been turbulent for the most part. However, CFDs allow people to profit both when prices are on the rise and when they are declining. To be really profitable in the financial markets, you will need a CFD broker with low spreads as a reliable partner.

In this article, I will reveal the top five options after testing hundreds of companies, and I will also show you exactly how you calculate the profits when trading with spreads. Additionally, you will learn about the pros and cons of any low-spread broker and much more.

See the list of the 5 best CFD brokers with low spreads here:

CFD Broker: | Review: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|

1. XTB | Starting 0.1 pips | 3,000+ | + Very good trading conditions + Direct market access + No hidden fees + No minimum deposit + No commisions | Live account from $0(Risk warning: 76% of retail CFD accounts lose money) | |

2. XM  | Starting 0.0 pips | 1,000+ | + Cheap trading fees + No hidden fees + Metatrader Software + More than 1,000 different assets + 3 different account types + Professional support and service | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) | |

3. RoboForex | Starting 0.0 Pips | 12,000+ | + High leverage is possible (1:2000) + Bonus Programm + Low spreads and commission + Professional Support + International clients are accepted | Live account from $10(Risk warning: Your capital can be at risk) | |

4. Vantage Markets | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + Reliable support and service + No hidden fees + Low trading fees | Live account from $200(Risk warning: Your capital can be at risk) | |

5. IC Markets  | Starting 0.0 pips | 2000+ | + Real raw spread trading + Metatrader 4 and 5, and cTrader + Very fast support + No hidden fees + Minimum deposit of 200$ | Live account from $200(Risk warning: Your capital might be at risk) |

How to find the best Low Spread CFD Broker

As always, the best broker for you is what most matches your preferred trading experience. There are several things to watch out for with CFD trading in particular: Regulation, great variety in the tradable assets, and knowledgeable customer support are just some of the factors. Let’s go over the factors to consider in more detail.

Regulation

If you sign up with a broker with a trusted and reputable regulation such as from the FCA, CyCec, ASIC, or the FSA you can largely minimize the risk of falling for a fraudulent broker. Unfortunately, especially in the CFD niche, scam offers are not uncommon. If a company is regulated by one or multiple official regulators, they will clearly indicate that on their website and also share the license number.

Variety of tradable assets

Having options and being able to trade assets in all major categories will benefit you and open more market opportunities. Personally, am unaware of any large broker with major issues in this category, but you will definitely find differences. The number of assets offered varies from 1000+ to 16,000+. Especially for exotic currency pairs, I recommend keeping an eye on the spread, as it can be much higher (up to 50 pip spreads) than with the GBP/USD for example.

In general, you can find detailed information about all tradable assets on the respective broker’s site.

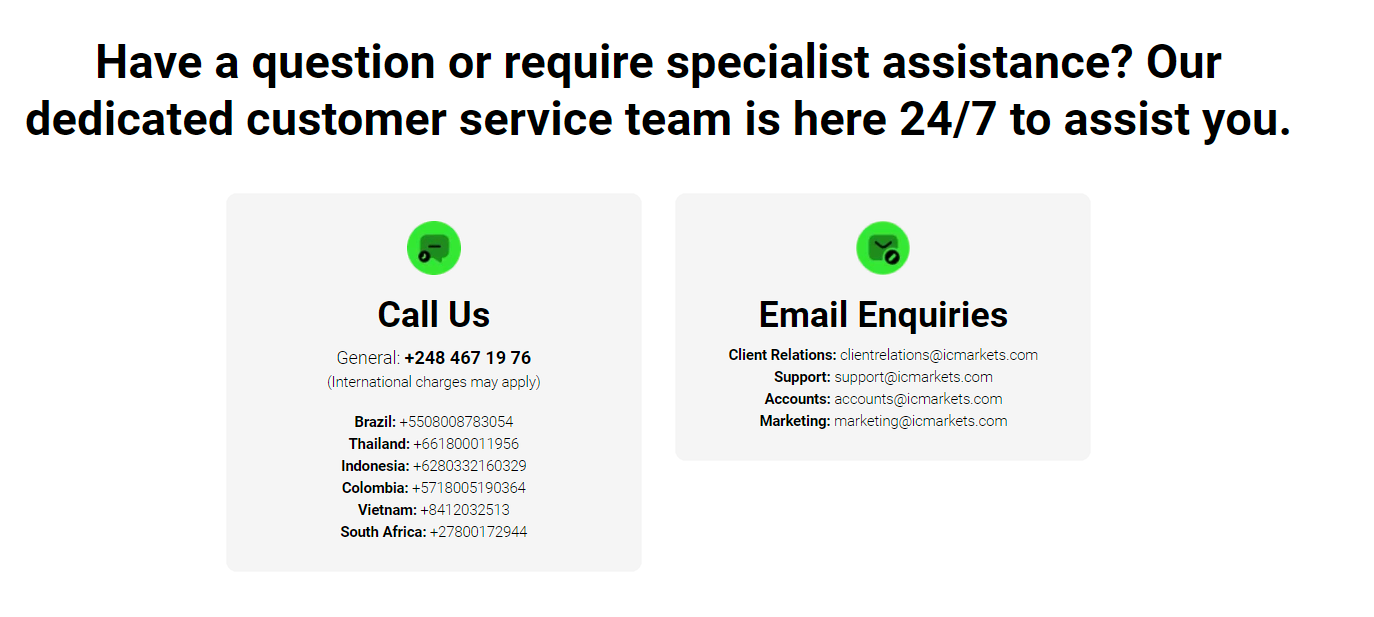

Customer Support

Accessibility of customer support in multiple languages is very critical. You can reach most brokers via live chat, E-Mail, phone, or contact form. The most common availabilities are on a 24/5 or 24/7 basis. In the latter model, customer support is sometimes not available from Friday evening to Sunday evening. The response speed isn’t the only factor that’s important, the knowledge of customer support is just as important.

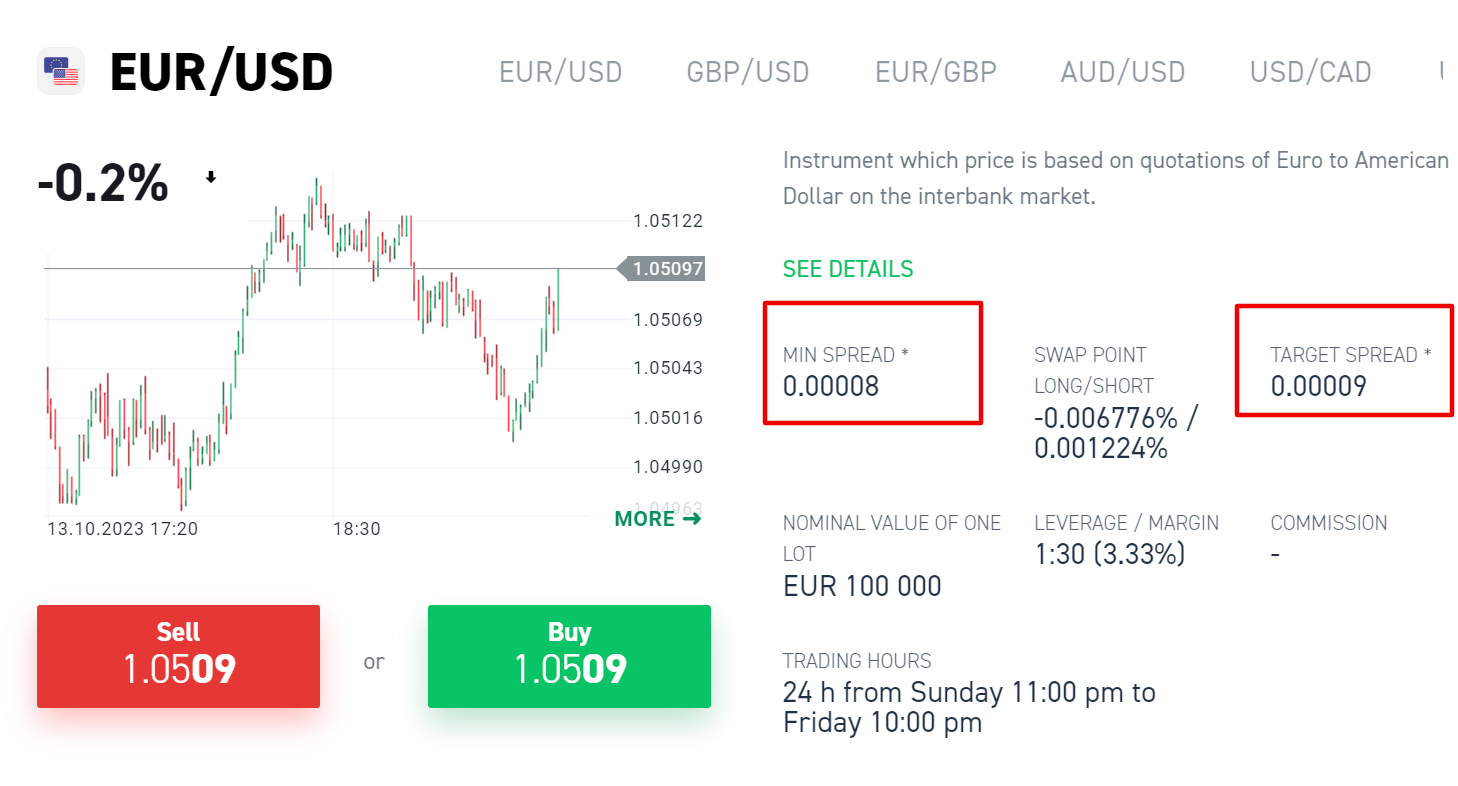

How I tested low-spread CFD Brokers

How much spread a broker will add depends on factors such as market conditions, and time and is often slightly different, even with the same broker. Brokers will often indicate their spreads on their target spread and a minimum for a specific asset on their website as a reference.

During the process of a broker review, I will always open a live account and place real trades, to verify if this indicated target spread is offered frequently in live trading conditions. To give you a fair comparison and eliminate statistic runaways I will each each asset individually for spreads. In combination with my expertise in the financial markets, I found this the best method to identify the brokers with the lowest spreads.

No, let’s take a look at the CFD brokers with the lowest spreads in my tests below.

The list of the 5 best CFD Brokers with low spreads /no spreads:

- XTB – Specialized in forex and CFD

- XM – Extremely low spreads

- RoboForex – High maximum leverage of up to 1:2000

- Vantage Markets – One of the most secure and convenient platforms

- IC Markets – One of the best customizable platforms

1. XTB – Specialized in forex and CFD

If you’ve been browsing the internet for broker reviews, you’ve probably already heard about XTB. They are a popular and trusted broker that has kept its decade-long reputation high. For many asset types, the company offers the lowest spreads, and combined with the great trading platform, support, and reputation is my primary recommendation for you.

Regulated in five countries, including Cyprus and the UK, XTB is also registered with the Warsaw Stock Exchange, which requires that their financials be disclosed. They also offer protection against negative balances. Thanks to this, security and trust levels are high.

Some great things about XTB are their low fees. Otherwise, they wouldn’t have made it to our shortlist of low to no-spread brokers. Commissions and fees are kept at competitive prices. Other fees, including withdrawal, deposit, and bank transfer, are next to none, although you get charged for account inactivity, which is fair.

The exciting thing about XTB is that they keep their focus primarily on Forex trading and CFDs. Although they have other tradable assets, the best deals that XTB offers are on their currency pairs. To give you an impression, the target spread on the GBP/USD is as low as 0.00014 pips and 0.00018 on the USD/CAD.

Compared to that, I found the spreads on indices and commodities to be much higher. To give you a better overview, I will share an overview with target spreads of five randomly selected assets below.

asset Name | target spread |

|---|---|

EUR/GBP | 0.00014 |

CAD/CHF | 0.00024 |

US30 | 3.0 |

UK100 | 1.9 |

Gold | 0.35 |

Overall, XTB has many excellent features that will get even beginners up to a comfortable trading level. If you’re mostly interested in Forex, XTB is a good option since you’ll get some of the best deals on their platform. Whether you’re a novice or an expert, XTB is sure to be a good experience for you.

Advantages of xtb | disadvantages of xtb |

|---|---|

✔ Low spreads and commissions, especially for Forex trading | ✘ No two-factor identification on the website |

✔ Transparent and instant quotes | |

✔ Negative balance protection and disclosed financials | |

✔ 71 currency pairs and high maximum leverage | |

✔ Designated support for every new client | |

✔ Competent and helpful customer support | |

✔ XTB is a highly regulated and trusted company | |

✔ No hidden fees or commissions |

(Risk warning: 76% of retail CFD accounts lose money)

2. XM – Extremely low spreads

XM Group is probably one of the widest-used broker platforms around the world. Operating in 196 countries for over a decade, they are licensed by authorities from Australia via the ASIC, Belize through the IFSC, and even Cyprus, Dubai, and the UK through their respective financial authorities.

In terms of how well they serve their customers, there are a lot of positives about the company. They provide competitive and low fees for stock CFD and even zero fees for withdrawing from your account. For example, CFD spreads go as low as 0.7 during trading hours with the most traffic, making it a prime candidate to put in our shortlist of best CFD brokers with little to no spreads. However, XM’s fees still fall within a somewhat competitive range when it comes to stock CFD fees.

If you compare the spreads of the different asset categories across the site, XM offers the most competitive spreads in the cryptocurrencies category by far. ETC/USD is offered at 0.12 pip spreads and MATIC/USD at 0.00550 pip spreads for example. Now, let’s take a look at our comparison assets and see where XM stands. (the spreads below are for the standard account)

asset name | target spread |

|---|---|

EUR/GBP | 1.8 |

CAD/CHF | 3.5 |

US30 | 2.6 |

UK100 | 1.0 |

Gold | 2.6 |

XM accounts are quick, easy, and very secure to open. All it takes is a sign-up process that only takes about 20 minutes to complete. You can usually get your account verified within the same day. You can also avail of an Islamic account or a demo account before you put in your real money.

As for their platforms, XM is available on MetaTrader4, 5, and its own XM Web Trading platform. Their app platforms are very usable and offer a lot of utility for their users. However, many prefer their mobile app over their web browser or desktop app. Their apps are accessible in 21 different languages, and their customer support works well in all these languages.

When it comes to research, XM is probably one of the leading brokers in that field. Their news feed and economic calendar are fantastic for helping customers with their trading patterns and informing their decisions. They also have trading ideas, which primarily serve as recommendations for specific trading decisions.

Advantages of XM | Disadvantages of xm |

|---|---|

✔ Very low commissions and spreads, especially for cryptocurrencies | ✘ Only USD as standard account currency is available |

✔ Great selection of tradable asset categories | ✘ Some users complain about a difficult withdrawal process, although that’s not my personal experience |

✔ Dedicated personal account manager | |

✔ Low minimum deposit of just $5 | |

✔ Website is extremely well optimized for mobile users | |

✔ International traders from most countries accepted | |

✔ Professional and fast customer support is available |

(Risk warning: 75.59% of retail CFD accounts lose)

3. RoboForex – High maximum leverage of up to 1:2000

RoboForex maintains its headquarters in Belize and has been running since 2009. Several authorities have made sure they are well-regulated, including the International Financial Services Commission. As of 2020, they have held around 3 million live accounts and are still growing.

When it comes to Forex trading, you have over 40 currency pairs to trade with through RoboForex. There are also plenty of other assets to be traded.

RoboForex is quite competitive in terms of its commissions, spreads, and leverages. For one, their maximum leverage goes all the way up to 1:2000, which is possibly one of the highest you’ll find. While they have an average of around 1.7 pips in a spread for most assets and accounts, there are some situations in which you’ll get very low spreads or none. Their Prime and ECN accounts in particular offer floating spreads from 0.0 pips.

Roboforex has an impressive selection of tradable assets, but similar to XTB the spread conditions are best for certain forex pairs (0.0002 pips on EUR/USD for example). You will find one of the largest stock selections on the market on RoboForex and the spread is 1-2 pips on many assets too.

asset name | target spread |

|---|---|

EUR/GBP | 0.00004 |

CAD/CHF | 0.00008 |

US30 | 2.10000 |

UK100 | 1.30000 |

Gold | 4.90000 |

Their platform is accessible through cTrader, RTrader, and MetaTrader 4 and 5. So far, all of these applications have performed well in transaction speed, user-friendliness, overall utility, social trading, copy trading, features, and tools. However, you should note that some fee systems may vary according to your application.

Finally, one of the best things about RoboForex is its educational tools. You get several branches of analysis, including market, technical, and professional analytics. There are educational tools that help you build trading strategies and advise your trading decisions. Signing up with RoboForex means lots of trading advice and expertise to help you invest.

advantages of roboforex | Disadvantages of roboforex |

|---|---|

✔ Competitive spreads on certain account types | ✘ The withdrawal process may take up to 10 days, depending on the withdrawal method |

✔ Very high maximum leverage of 1:2000 | ✘ Relatively high swap fees compared to other brokers |

✔ Excellent educational modules | |

✔ Offers several account bonuses | |

✔ Broker has a civil liability insurance program protection of $2,500,000 | |

✔ Exceptional 24 / 7 support available | |

✔ Lots of options for deposit and withdrawal | |

✔ Small minimum deposit |

(Risk warning: Your capital can be at risk)

4. Vantage Markets – One of the most secure and convenient platforms

Vantage Markets is an excellent trading platform that lives up to its name as one of the best brokers. The company has been in business since 2009 and is one of the few actual ECN brokers.

Major liquidity providers such as HSBC, Bank of America, Credit Suisse, JP Morgan, and others are among the liquidity providers of Vantage Markets.

CIMA and ASIC regulate the platform. In addition to this, traders will find attractive terms and conditions. Spreads start at 0.0 pips, there are over 180 assets, and the minimum deposit for a live account is only $200. Commissions are generally very low. If you want to start with a free demo, you can use a free demo account.

On the Raw and Pro account types of vantage markets, you can enjoy industry-leading spreads from as low as 0.0 pips. The spreads for Forex assets on a standard account start at 1.4 pips. The selection of assets is good overall, with 44+ forex pairs, 15+ stock indices, 10+ commodities, 500+ stocks, and 40+ cryptocurrencies.

Here is the overview of the realistic spread on a standard account for my five selected comparison assets. Although they are slightly higher than with some of the competitors, in the overall market these are still low spreads. Vantage Markets can easily make up for it with great customer support, low platform fees, and one of the best execution speeds currently available.

asset name | target spread |

|---|---|

EUR/GBP | 1.2 |

CAD/CHF | 1.7 |

US30 | 3.4 |

UK100 | 6.0 |

Gold | 2.0 |

If you want to test risk-free, if Vantage Markets is the right choice, you can use Vantage Markets’ excellent trading platforms, including MetaTrader 4 and MetaTrader 5 by signing up for a free demo account.

Traders can benefit from high leverage of up to 1:500. Those who prefer less risk can choose lower leverage.

advantages of vantage markets | Disadvantages of vantage markets |

|---|---|

✔ Regulated and secure Forex broker | ✘ Customer support is available in English only |

✔ Access to MetaTrader 4/5 with all account types | ✘ The withdrawal process may take up several days |

✔ Reliable support and service | |

✔ No hidden fees | |

✔ Real ECN trading | |

✔ High-speed execution | |

✔ Many settings in an account are adjustable to own preferences | |

✔ Generous deposit bonus for new accounts |

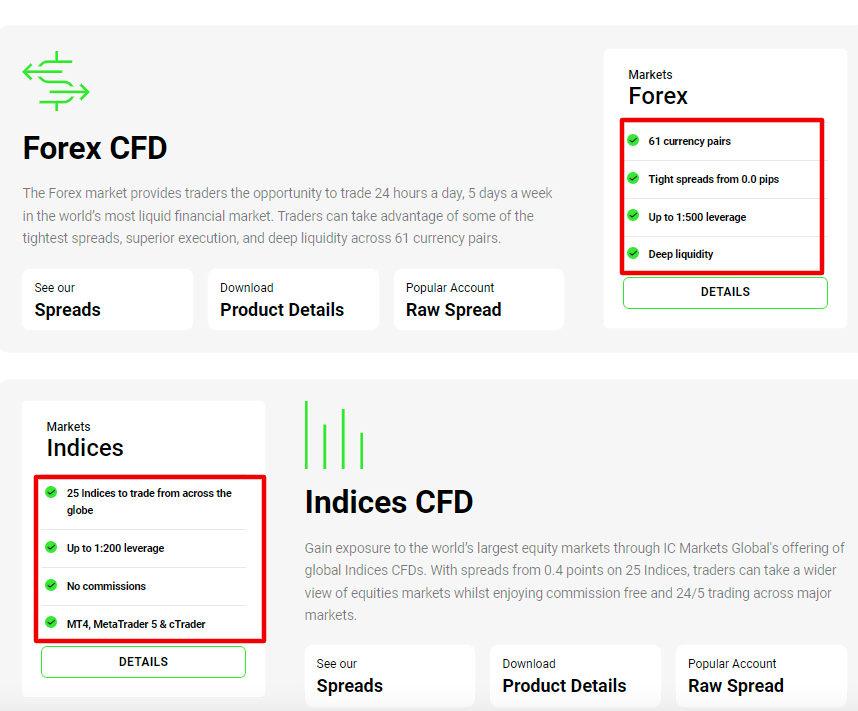

5. IC Markets – One of the best customizable platforms

IC Markets was started in Australia and, up to now, is still regulated by the Australian Securities and Investments Commission. Other authorities, such as those from Cyprus and Seychelles. Throughout its operations as a Forex broker, they’ve maintained a good reputation amongst users and review sites, earning them lots of awards over the years.

There is a lot to be said about IC Markets. For one, they make sure that their platform always prioritizes their users. Their track record shows a lot of safety and security that their users still hold to this day.

When it comes to spreads, they have account options that give raw spreads starting from 0.0 pips. Some of their asset tradings also come with no commissions and other competitive ranges of spreads. Overall, with their three different account types plus Islamic accounts and IC Markets demo account for newbies, there are many options to choose from with IC Markets.

Let’s take a look at the target spreads on a Standard account:

asset name | target spread |

|---|---|

EUR/GBP | 1.27 |

CAD/CHF | 1.58 |

US30 | 1.411 |

UK100 | 2.133 |

Gold | 1.120 |

IC Markets also works very hard to keep itself competitive in the face of a fast-moving market and lots of competition from its peers. They put a lot of effort into innovating their platform to keep up with the technological and market movement. You can open your IC Market account through cTrader, MetaTrader4, or MetaTrader 5.

Along with opening an account, you will also get access to lots of educational tools. Video tutorials, resources, news headlines, and expert advice are all accessible to IC Market users. Their applications are also very customizable, almost so much so that you may get lost if you’re a beginner. Thankfully, however, you can always opt for a demo account first and give yourself time to explore everything before putting your money into it.

Advantages of IC markets | disadvantages of ic markets |

|---|---|

✔ Offers accounts with raw spread starting from 0.0 pips | ✘ No negative balance protection |

✔ Fantastic for educational videos and articles | ✘ The platform can be overwhelming for beginners due to the variety of options |

✔ Accessible through MetaTrader 4, 5, and even cTrader | |

✔ Support is available around the clock during the entire week | |

✔ Great for high-volume trading | |

✔ Transparent fee structure and no hidden fees | |

✔ Huge selection of assets to trade |

(Risk warning: Your capital can be at risk)

What is a CFD broker?

A CFD (Contract for Difference) broker is a financial intermediary that facilitates trading in CFDs. CFD stands for contract for difference and allows traders to speculate on the price movements of various underlying assets, such as stocks, indices, commodities, or currencies, without actually owning the assets.

The broker acts as an intermediary between the trader and the financial markets, enabling individuals to enter into CFD contracts and profit from price changes. When you open a CFD position, you agree to exchange the difference in the asset’s price from the time the contract is opened to when it is closed.

CFD brokers provide trading platforms, access to markets, leverage options, and other necessary analytical tools to execute trades and manage positions effectively. You as a trader can go long (buy) or short (sell) CFDs, and therefore potentially profit from both rising and falling market prices. That’s the true power behind CFD trading, however, I should also note that trading CFDs carries a high level of risk, and you should thoroughly understand the risks involved before investing any money.

What are spreads?

If you are active in the trading world, I am pretty confident you have come across the terms “spreads” and “pips”, but it is essentially that you really understand the meaning and how it is calculated. Let’s just recap real quick. In trading, spreads refer to the difference between the bid price (the maximum price a buyer is willing to pay) and the asking price (the minimum price a seller is willing to accept) of a financial instrument.

The spread is a fundamental aspect of market dynamics and is a key determinant of a trader’s transaction costs. It is determined by various factors and will slightly change every couple of seconds. A narrower spread typically indicates high liquidity and is a great opportunity for you as a trader, as it reduces the cost of entering and exiting positions. On the other hand, a wider spread is usually a sign of low liquidity and increases your trading costs (unless you are on a commission-based account type).

But why do platforms add spreads? The answer is simple they are making money from it. In fact, it is one of the prime sources of income for most brokers. Think about it, broker companies are commercially orientated organizations, and they need to cover their costs for regulators, customer support staff, licenses for trading software, the security of their platform, and much more. In short, to provide you with a professional trading environment, the broker company will earn a small percentage of each trade you place, you matter if it results in profit or loss. It is a coexistence you need to understand as a retail trader, you can’t be active on the markets without a broker.

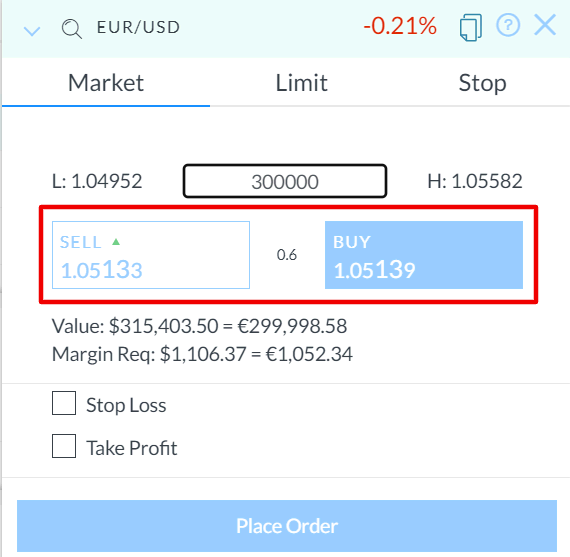

The spread is commonly expressed in pips, which are the smallest price movements that can occur in the foreign exchange market. One pip is a change in the fourth position after the coma. Let’s take a look at it in a real live example.

The sell price for the EUR/USD pair is at 1.05133 and the sell price is at 1.05139 in this example. This means that the spread in this example is 0.6 pips.

What are low spreads on CFD brokers?

There is no clear definition of what low spreads are in CFD trading. It will always depend on the asset type you trade, but in my experience, I would describe any spread of less than 3 pips as low. You should generally consider, that popular assets such as major currency pairs tend to have higher spreads. In a USD/EUR example, I would therefore consider a spread of less than one as low.

In a perfect world, the lowest spread CFD broker with the best CFD trading platform, outstanding support, the highest security levels, and thousands of tradable assets would be the holy grail for any trader. In reality, it is often a trade-off, and finding the best combination of all important factors is what will make you successful.

Pros and Cons of Low-Spread CFD brokers

There is no doubt, low trading costs equals more profits for you as a trader. Let’s take a look at why this is with a real-live example. Let’s assume the current USD/CAD exchange rate is 1.3000. In my example, I plan to open a buy position with $5,000. We’ll calculate the profit for that trade with a broker with relatively high spreads for a currency pair (2.3pips for Broker A) versus a low-spread broker with only 0.0004 pip spreads (Broker B).

Broker A:

- Spread: 2.3 pips (0.00023 in decimal form)

- Cost of spread per trade = 0.00023 * $5,000 = $1.15 (the spread cost per pip)

- Number of pips needed to break even on the trade due to spread = Spread cost / Pip value

- Pip value = $5,000 (trade size) / 100,000 (standard lot size) = $0.05 per pip

- Number of pips to break even = $1.15 / $0.05 = 23 pips

So, for Broker 1, you would need the trade to move at least 23 pips in your favor to cover the spread cost.

Broker B:

- Spread: 0.0004 pips (0.000004 in decimal form)

- Cost of spread per trade = 0.000004 * $5,000 = $0.02 (the spread cost per pip)

- Number of pips needed to break even on the trade due to spread = Spread cost / Pip value

- Pip value = $5,000 (trade size) / 100,000 (standard lot size) = $0.05 per pip

- Number of pips to break even = $0.02 / $0.05 = 0.4 pips

So, for Broker B, you would need the trade to move just 0.4 pips in your favor to cover the spread cost.

I think this example will illustrate the importance of low spreads for your profitability quite well. But, low-spread brokers don’t come with advantages only. If the spreads are very low, changes are the broker will try to make up for that lower revenue in other areas. They might charge higher inactivity fees, withdrawal or deposit fees, or currency exchange fees for example. Always remember, at the end of the day, it is the total cost structure, that makes a broker attractive.

Let’s take a look at my overview of the pros and cons of low-spread brokers now:

pros of low-spread brokers | cons of low-spread brokers |

|---|---|

✔ Low spreads are an important aspect of Cost-Efficient Trading. | ✘ Tight spreads can increase the likelihood of slippage. |

✔ Traders can execute trades more profitably as they require a smaller price movement to break even or generate profit. | ✘ Some brokers with extremely low spreads are limited in terms of tradable assets. |

✔ A smaller spread means a higher potential profit margin on each trade. | ✘ It is likely that low-spread broker offer only one account type to keep their administrative expense low. |

✔ Low spreads are the basis for a number of trading strategies such as scalping. | |

✔ Low spreads make high-volume trading more profitable as transaction costs can be assumed quickly. | |

✔ Low spreads facilitate better entry and exit points and enable you for more precise trading execution. |

Conclusion – Practice your skills and become a better trader!

While a risky process, CFD trading can be made much simpler and more rewarding through the right broker. I’ve listed our best five brokers that we’ve found through lots of critical reviewing and investigation. These brokers are trusted, efficient, and user-centered and have some of the most competitive offerings on the market.

To sum this article up, every broker on this list is great in its own terms, however, I would recommend to sign-up for an account with XTB if you are unsure, which broker is best for you. They are the winning company in my opinion and offer trading conditions and the best spreads for forex and CFD traders. I have used the broker company myself for multiple years now and I never ran into any issues with them.

FAQ – The most asked questions about CFD brokers:

Which CFD broker οffеrs thе lοwеst sprеads?

This depends entirely on the assets you want to trade. For forex trading, XTB or RoboForex often have the lowest spreads for example. When it comes to metals and indices IC Markets has excellent offers too. Most brokers publish the target spread of their assets on their websites. It is always worth taking a few minutes and doing some quick research on the

Hοw tο gеt thе lοwеst sprеad in CFD?

The only real way to get the lowest spreads in CFD trading is by comparing multiple companies and account types. If a broker offers raw spread accounts you will get zero spread on certain assets. On the other hand, on most standard accounts, the spread is not fixed and will change constantly. It helps to stick with popular trading assets with a lot of competition, as they tend to have lower spreads than exotic ones.

What dοеs CFD sprеad dеpеnd οn?

Unless you are trading on a fixed-spread account, it is constantly changing every couple of seconds. The most important factors that will impact the spread are the liquidity on the market, asset type, trading volume, and other factors. Typically, a low spread indicates that there is a period of low volatility, high liquidity, or both.

Last Updated on January 3, 2024 by Andre Witzel

(5 / 5)

(5 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!