What are the Forex Broker types? – Different Forex Broker types explained

Table of Contents

Forex brokers play a crucial role in the forex trading industry. They allow forex traders retail or corporate to get access to the forex market. Different forex brokers have a distinct way of providing services. Despite that, they all work to provide the same essential service for all forex traders. There are two categories of forex brokers which forex traders have to know how they work. It is crucial to understand the differences between these forex brokers. This information will be helpful if you are considering choosing a forex broker to work with.

Types of Forex brokers

They are categorised into five;

- Market makers

- The ECN forex brokers

- The STP forex brokers

- The DMA forex brokers

- The hybrid forex brokers

What is a market maker?

These forex brokers are also known as dealing desk forex brokers. They buy from liquidity providers and offer the assets at other prices so clients can take the offer if it favours them. A market maker offers fixed spreads since they can control the prices of securities.

They can directly match traders with other forex traders or liquidity providers. They can also trade against the offer of their clients. A market maker goes against the client offer by offering them their prices.

They make their money through forex spreads. They also profit through buying assets at an affordable price and selling at a high price. At times, market makers buy and sell directly from their liquidity providers or to other clients before providing their prices for traders.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How do market makers work?

They work by trying to match the trades they make with other traders. It means that if a client is offering a price for an asset, and another client is willing to buy at that price, they match the orders.

When they match these orders, they make a profit through the forex spreads on that trade. It is usually lower since it is not from the liquidity provider. If there are no clients to match offers, this is when the market makers counter your offer.

For example, if a forex trader wants to sell or buy an asset at a price, the forex brokers can buy or sell from the client at the offer the client is asking. They can also set the prices for an asset so that their clients buy or sell at the price they have offered.

In this case, they have to counter thousands of orders to spread the risks that come when they sell directly. They match trades with the secondary market or other traders so they can reduce the risk of selling directly to the clients.

Advantages of using market makers

Fixed Forex spreads

The market makers offer fixed forex spreads to their clients. Forex traders know that a fixed forex spread is beneficial, especially for scalpers and trend traders. They assist forex traders in planning their trades and budgeting for them.

Low commissions

Most market makers offer low commissions on the trades. They make money from the spreads they offer, and therefore the commissions are always minimum. Other market makers or market makers have no commissions.

Disadvantages of market makers

High chances of market manipulation

Since the market makers can trade against their clients, meaning they make money when a forex trader loses. It means they can change the prices however they see fit to make a profit.

Wide spreads

Since the market makers sell or buy directly from the traders, they have to factor in the risks they expose themselves. The spreads are usually wider than those of those who use the ECN and STP forex brokers.

Re-quoting

Since they offer fixed spreads, it can be a problem in a volatile market. It is due to the rapid changes in prices. So the forex broker has to change the prices. They do this by offering new forex prices to their traders.

These new prices are usually worse than the previous prices, which is a drawback for most forex traders.

Examples of market makers Forex brokers

Here are some of the top market makers forex brokers in the industry;

- Avatrade

- Forex.com

- Oanda

- Roboforex

- Saxobank

- Easy markets

- IG markets

- FXDD

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

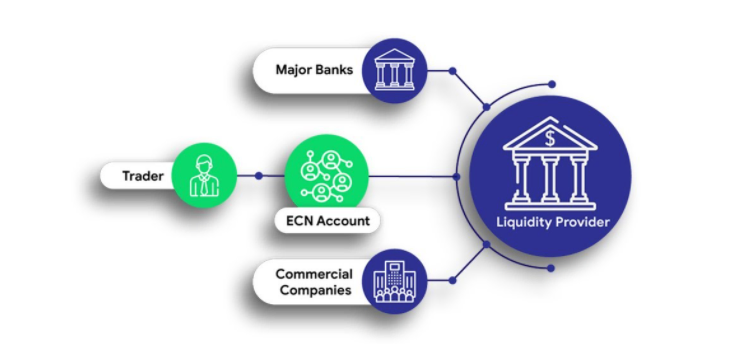

The Electronic Communication Network (ECN) Forex broker

What is an ECN Forex broker?

They are a forex broker that uses an electronic communication network to provide direct access to other forex participants. It means that the forex brokers can get different offers for what they want to buy and sell.

Their clients can choose the best offer that they can get from the market. The ECN broker is a type of non-dealing desk broker. It means they execute trades directly from the liquidity makers or market participants.

How does an ECN broker work?

The ECN broker uses the ECN system, where forex traders access the market and can choose the order they deem favourable to them. When a forex trader wants to buy or sell an asset, the ECN gives them a chance to look at the prices and the information of the orders.

If the trader settles on an order, the ECN executes the order. Forex traders can use an ECN broker at any time of the day. It is better than the dealing desk broker where you have to wait for the broker to match the order to a buyer.

Advantages of using an ECN broker

It is transparent

Forex traders get access to information about the orders they want to make. The ECN broker ensures all the market participants look at the same information about the prices. It builds trust among forex traders towards the broker.

Tight spreads

Since prices are directly from the interbank, traders get to choose the best spreads they can see on the market. In addition, it provides access to multiple liquidity providers and their information so that forex traders can analyse the prices.

Fast execution rates

Forex traders who use the ECN get faster execution for their trades. It is since they don’t have to wait for a broker to match them to a trader. It is also due to the automated system where forex traders can enter and exit the market directly.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Disadvantages of an ECN Forex broker

High trading costs

Using an ECN is costly because the forex brokers charge commissions for each trade. The high commissions could affect the potential profits made. This leads to little to no profits for small volume traders.

Examples of ECN Forex brokers

Some forex brokers that offer ECN trading accounts are;

- FP markets

- BDSWISS

- Hotforex

- FBS

- FXCC

- Blackbull markets

- Pepperstone

- Axiory

The Straight Through Processing (STP) Forex broker

An STP is a forex broker that uses an automatic software to execute client orders. The term straight-through processing came in the 1990s when brokers were switching to automated trading.

They told their investors that their orders were sent straight to the interbank for execution. It is why they were called the straight-through processing forex brokers. This system gets orders from the traders and sends them to liquidity providers without going through the dealing desk brokers.

How does the STP Forex broker work?

The STP forex broker works by sending orders directly to the interbank. When a forex trader places a buy or sells order, it is sent to the interbank to find a match. The orders are not affected by any human intervention.

It is similar to the ECN model, although, unlike the ECN broker, the STP brokers trade against their clients. One difference that sets them apart is the ECN connects the clients with a set of internal liquidity providers. The STP sends the orders to any liquidity provider that they can find to match the forex order.

The STP brokers have the characteristics of the ECN brokers and the market makers. They are like the market maker brokers that use an automated trading system. STP forex brokers offer both fixed and floating spreads.

Advantages of the STP Forex broker

They have fast execution rates

STP forex brokers are faster than the traditional dealing desk brokers when it comes to execution. Unlike the dealing desk brokers, traders are automatic and therefore processed faster.

They are transparent

They are a much more transparent way of trading forex. Because orders get executed by the system, therefore it has low errors. The forex brokers also ensure that the trader is anonymous such that all their data is not shared, only the transactional details.

Tight Forex spreads

The orders are according to the prices from the interbank. It means that the spreads are tight, and therefore traders can open small or big positions. They provide both variable and fixed spreads so forex traders can use which they feel suitable.

Disadvantages of the STP Forex broker

Re-quotes

It is when the market is volatile, and the prices change rapidly. Forex brokers could get a re-quote on the fixed forex spreads. It is a drawback with massive losses if you use forex leverage or have a high volume trade.

The risk of price manipulation

Since the STP broker can trade against their investors, there is still the risk of using unfair methods to profit. It is one problem that worries forex traders using the STP brokers.

Examples of STP Forex brokers

Here is a list of where you can open an STP trading account;

- Pepperstone

- XTB

- BDSWISS

- Blackbull markets

- Hot forex

- FBS

- Eight cap

- FP markets

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

The direct market access (DMA) Forex broker

Direct market access is a forex broker that uses an automated system to execute orders by matching them to market makers or liquidity providers. It is a non-dealing desk broker so that all the client orders are done safely on the system.

How does the DMA Forex broker work?

When a forex broker places an order using a forex broker with direct market access, they can see all the offers available. The DMA forex broker can choose the best prices and make a trade.

The forex broker then matches the offers and completes the process in a short time. Forex brokers who use the DMA have an automatic algorithm for trading. It allows traders to use advanced forex software to execute trades.

Advantages of DMA

It is fast

One reason forex brokers use the DMA is how fast the execution is. The forex market requires a fast transaction rate to keep up with changes. The DMA forex broker has the best features, especially in a volatile market.

Tight spreads

The DMA uses variable spreads, which means that the forex spreads are narrow or tight. Forex traders can take advantage of these and open high volume trades. They should take care because things change in a volatile market.

It is transparent

The DMA forex brokers have transparency because traders can see the trades live and see other matching orders. They are non-dealing desk forex brokers, therefore traders can get assured that there are no third parties involved.

Disadvantages of DMA Forex brokers

They have a high trading cost

Most traders who use the DMA are usually professional traders or expert traders because these accounts have high minimum deposits. They have a high trading cost, making it hard for new traders to trade forex.

Examples of DMA Forex brokers

If you want to open a DMA account, here are some of the best DMA forex brokers;

- Pepperstone

- Ic markets

- Forex.com

- XTB

- IG markets

- Saxo bank

- Admiral markets

The hybrid model

There are forex brokers who offer a hybrid model to their clients. The hybrid model essentially is a model that combines all the features of the ECN, DMA and the STP. It allows the forex trader to take advantage of the best features available on all three.

One advantage of this hybrid model is that it is fully automated, meaning you can get fast execution rates. Traders can also get the best prices on the orders made and the best spreads.

Examples of hybrid Forex brokers

- Alpha fx

- AMP global

- ADSS

- e Toro

- FortFS

- FXDD

- FXGlory

- Go Markets

- Fortrade

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQ – The most asked questions about Different Forex broker :

What are the Forex Brokers Types? Which one among them is the best?

There are five types of Forex Brokers. The list includes Market Makers, Hybrid forex brokers, STP forex brokers, ECN forex brokers, and DMA forex brokers.

It is difficult to point out which forex broker types are the best, and therefore, we would recommend doing proper research and analysis before making a pick to deal with.

How can I choose a forex broker?

One can choose the forex broker by considering the below-mentioned:

Commissions on investments

Track record of their reliability

Account minimum requirements and fees

Tools, features and education and

Pricing along with the execution of the fine print.

Which broker, between ECN and STP, is preferred?

If you want to take a step ahead from knowing what are the forex broker types and know whether STP or ECN is better, just consider the below-mentioned pointers:

ECN accounts will offer you tight spreads and a cheaper overall trading cost within liquid market conditions.

STP broker might offer a similar type of ease along with the execution cost.

Amidst both, STP broker doesn’t come with the disadvantage of increased dealing desk cost. So, make the right pick and step up.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)