LMFX review and test for new investors

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(3.3 / 5) (3.3 / 5) | No regulation | $50 | 60+ | From 0.0 pips |

Choosing the right broker is one of the most critical decisions a trader or investor must make. With that said, there are a lot of factors that you should consider when choosing which company to invest in. One of the most significant factors that you should look out for is their credibility. Are they trustworthy? Are they regulated or registered businesses? Most importantly, what do you have to gain if you decide to work with them?

LMFX has its fair share of pros and cons. Keep reading to find out if this company has all the factors mentioned above and if they suit your trading needs. In our review below, you will find all the products and services offered by LMFX. You will also find the pros and cons of the company to help you make an informed decision.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Get to know the company

LMFX has been around since the year 2015. This company operates under Global Trade Partners Ltd based in North Macedonia. Their main goal is to establish a global presence with their top-tier trading kits and services. They don’t only cater to big institutions, but they also offer their services to small retail traders.

Is LMFX regulated?

Despite operating as a broker for more than five years, LMFX is not regulated. Very little information is given about their parent company, Global Trade Partners Ltd. However, they are registered as a broker in North Macedonia. Their registration number is 7020600.

Despite being a registered company, the CNMV, or Comisión Nacional del Mercado de Valores, suggest traders to be wary of brokers that this Spanish financial regulator does not regulate. However, this does not mean that LMFX is a scam. This only means that LMFX is not under close monitoring by any financial regulator.

What can I trade with LMFX?

There are five markets available on the LMFX platform. These are forex, indices, commodities, metals and oil, and stocks. Their assets are pretty limited, but they do have the seven major pairs, which is probably good enough for some traders. However, suppose you are looking to trade major indices, specifically the Hang Seng index of Hong Kong, the Shanghai SE Composite index or China, or Nikkei 225 of Japan. In that case, you are better off with a different broker that offers these products. They also lack lumber, cotton, cocoa, wheat, and soybean in their tradable commodities list. For metals offered, they do not have aluminum, nickel, lead, and iron. As much as they offer shares of listed companies from the United States of America and the United Kingdom, these do not include a lot of stocks. This limits the trader’s options and would significantly lower their opportunities in trading more volatile issues. It is worth noting that access to markets such as the Hang Seng index is a big disadvantage.

LMFX does not offer ETFs or exchange-traded funds, either. Trading ETFs gives the capability to invest or trade in a particular sector. Without access to this and a lot of specific stocks, traders do not have greater options to diversify their portfolios. The company doesn’t cater to option traders as well. Without this, there are limited options for hedging your account. This means you have lesser room for mistakes if you want to protect your equity. You won’t be able to trade options contracts that would give you a big payout if you are right.

Forex

LMFX, as the name suggests, specializes in foreign exchange. They have 48 currency pairs to choose from. Among these are seven of the major currency pairs: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD.

Spreads when trading this asset class can reach as low as 0.0 pips when using their Zero account. Non-zero accounts, however, can only reach as low as 0.7 pip. Leverage starts at 1:1 and can go as high as 1:1000. The used margin for trading forex is around 1000 USD depending on which forex pairs you choose. It can go up to 50,000 USD when tradings exotic pairs. It’s important to note that for some pairs, volume limitation applies.

Generally, trading hours start every Monday at 5:00 AM GMT +2 until Friday at 11:59 PM GMT +2. However, some forex pairs don’t follow this timeline. For pairs EURDKK, EURNOK, USDDKK, and USDNOK, trading starts at 4:00 AM to 12:00MN. For USDRUB, the trading session is open from 10:00 AM to 5:55 PM.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) StocksThe great thing about LMFX is that you can trade stocks from both the US and United Kingdom markets. The stocks available are from NYSE (New York Stock Exchange), NASDAQ (Nasdaq Stock Market), and LSE (London Stock Exchange). Since LMFX offers these shares as single stock CMDs, you can trade these either long or short with leverage. Here is a list of all the available stocks on LMFX’s platform. LSE:

NASDAQ:

NYSE:

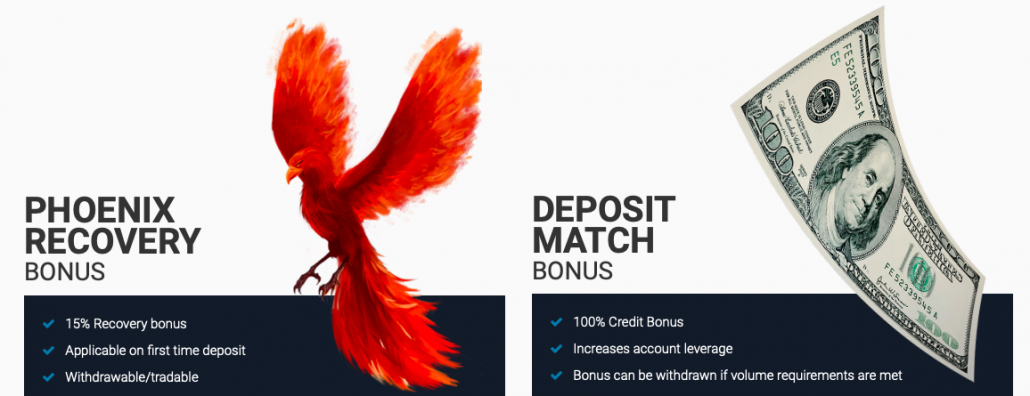

Trading hours for the US-listed stocks is 4:31 PM until 10:55 PM GMT +2 from Monday to Friday. The stocks listed in the London Stock Exchange start at 10:01 AM until 6:25 PM GMT +2 on weekdays. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Trading with LMFXLMFX uses the MetaTrader 4 or MT4 platform for trading. This software is well known because of its simple interface and helpful tools. Trading using the MetaTrader 4 platform gives clients the ability to trade accurately because of how fast their servers are. Aside from this, MT4 also has a lot of other features, such as built-in indicators and the ability to use and produce your EAs. The MT4 software is available on Mac as well as on Apple and Android mobile devices.  AccountsLMFX offers five account types, Premium, Fixed, Zero, Demo, and an Islamic account. Each of these accounts has its own corresponding fees and spreads. Denominations for all accounts are USD and EUR only. Spreads, as well as commissions, vary depending on each account. You don’t have to worry about the exclusivity of the markets they offer because these are all tradeable using any of their account types. Premium AccountsPremium accounts are ideal for regular retail traders as well as newbies. The minimum required deposit is only $50. After your first deposit, the amount necessary goes down to only $25. Premium account holders are allowed up to 100 open trades, and each trade can be as small as 0.01 lot or as big as 60 lots. This type of account’s margin call is 50%, while the stop out is 20%. The maximum leverage that premium account holders can use is 1:1000. Signing up to their Premium account entitles you to your own account manager, and you will have access to all their trading platforms. To register, you will be asked to input your full name, contact number, date of birth, email address, and your desired currency. You will also need to send them a copy of a government-issued ID and a Proof of address.  Fixed AccountsLMFX’s fixed accounts, as the name suggests, is ideal for clients who would rather trade with fixed spreads and no added commission. The minimum required first deposit is $250. After your first deposit, the amount necessary goes down to $50. Fixed account holders can use up to 1:400 leverage.  Zero AccountsThe Zero Account was made with scalpers and high-volume traders in mind. With as low as 0 spreads, they can trade with ease. They won’t have to pay attention to the fluctuating spreads, and would just trade to their heart’s content. However, every transaction would incur $4 per lot. According to their website, commissions are even better when trading more than 1000 lots. For zero account holders, they are entitled to up to 1:250 leverage. The minimum initial deposit is $100. After that, the minimum deposit decreases to $50.  Demo AccountsSigning up for a demo account with LMFX gives you access to MetaTrader 4. This allows you to practice your trading strategy and for you to get used to market conditions without having to spend real cash. Once newbies are comfortable with their performance in their demo accounts, they could confidently move on to trading with real cash and gaining real profits. All features found in live accounts are also available in this account.  Islamic Accounts To acquire an Islamic account, which does not charge fees for swaps and interests, you will need to send LMFX an email. The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

|