5 best Forex Brokers & platforms with welcome bonus in comparison

Table of Contents

See the list of the 5 best Forex Brokers with a welcome bonus:

Broker: | Review: | WELCOME BONUS: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex  | $30 USD | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + Leverage up to 1:2000 + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. FBS  | $70 – $140 USD | CySEC (Cyprus) for EEA countries | 500+ (40+ currency pairs) | + MT4 & MT5 + 24/7 support + Bonus program + Low spreads + Low commissions + Leverage up to 1:3000 + International trading | Live account from $1(Risk warning: Your capital can be at risk) | |

3. XM Forex  | $30 USD | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Cheap trading fees + No hidden costs + Regulated and safe + International trading + 1000+ different assets | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) | |

4. InstaForex  | 100% bonus on the first deposit | FCA, AFSL, FSCA | 200+ (50+ currency pairs) | + Multilingual support + 200+ instruments + User-friendly + Bonus programs + Leverage up to 1:1000 | Live account from $50(Risk warning: Your capital can be at risk) | |

5. Tickmill  | $30 USD | FCA, CySEC, FSCA, SCB | 250+ (91+ currency pairs) | + UK regulation + High customer safety + Excellent support + Low trading fees + Cheap forex broker + Great conditions | Live account from $100(Risk warning: Your capital can be at risk) |

The forex industry is competitive as forex brokers compete to attract more investors to their platforms. They have devised methods to encourage forex traders to choose them, and one is through the welcome bonus.

The welcome bonus is one favorite aspect that forex traders like to search for in a forex broker. They come in different forms, where some are a percentage of the total deposit. Forex brokers state the actual welcome bonus forex traders will get when they open an account on their platform.

What is a welcome bonus?

A welcome bonus is an amount that a forex broker deposits in the cash account of a new forex trader. The welcome bonus is a promotion that forex traders get for opening a trading account with a forex broker and funding it.

The welcome bonus gets offered once, which means only when a new forex trader opens and funds their account. It is why forex traders like to choose a forex broker that offers a high welcome bonus. The welcome bonus sometimes comes with some conditions.

Forex brokers should clearly state the conditions so the forex trader can decide whether to accept it or not. Some conditions are like this; a trader has to reach a certain threshold when funding their account to get the welcome bonus.

It is not always the case since some forex brokers don’t require you to deposit anything to get eligible for a welcome bonus.

How do you apply for a welcome bonus?

1. Register an account

Start by registering a forex trading account with a forex broker you have chosen. The registration process needs personal details like names, email addresses, and home or city addresses. The forex broker may need your phone number and financial history.

2. Verify the registration details

Verify these details by submitting copies of your ID and utility bills you have paid before. Verification is a crucial legal process required by a regulated forex broker.

3. Deposit funds to your Forex broker account

It is the final stage for some brokers, you receive the welcome bonus after successful verification. Others require you to deposit some funds in your new account to get the welcome bonus.

List of the 5 best Forex brokers with a welcome bonus in comparison:

1. RoboForex

Roboforex is a forex broker founded in 2009 and is one of the forex brokers that offer a welcome bonus of $30. It is regulated by Cyprus Securities and Exchange Commission (CySEC) and serves over 170 countries.

Roboforex has access to financial markets such as Cryptocurrency, stocks, indices, ETFs, Energy, metals, and others. It is in Cyprus while its headquarters is in Belize.

Pros and cons of Roboforex:

Pros

- It is regulated by CySEC meaning, it is a secure platform to trade.

- Variety of trading platforms that cater to the needs of forex traders.

- The low minimum deposit for most of its accounts.

- It has six accounts that work for diverse traders.

- Wide range of trading instruments.

- It offers high leverage of 1:1000

Cons

- It isn’t available in many countries.

- High CFDs trading fees.

(Risk Warning: Your capital can be at risk)

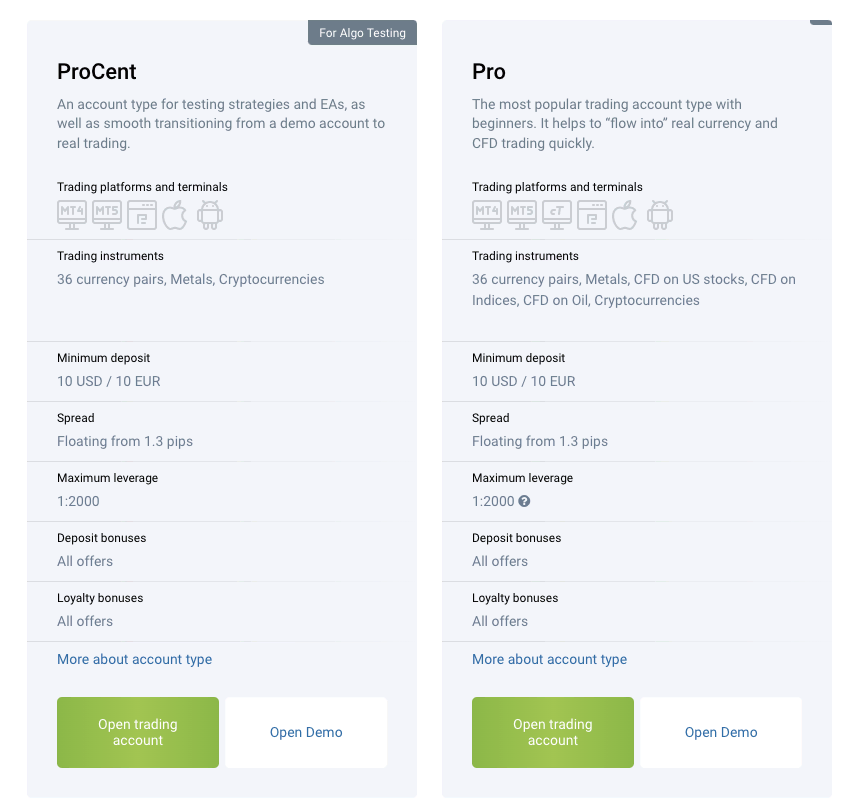

Roboforex account types

It has six types of forex accounts with different features, and forex traders can choose which they prefer. The prime, ECN, R stocks trader, Pro Cent, Pro, and the Demo account. The pro cent account helps to move from the demo account while the pro account is the most popular.

The pro and the Pro-cent accounts have a welcome bonus of $30 when you open an account and deposit at least $10.

Roboforex features

Roboforex uses the Meta Trader 4, Meta Trader 5, R-stocks trader, C-trader trading platforms. They have different trading tools like indicators, charting software, and trading signals. All of them allow traders to choose their trading platforms according to their preferences.

Roboforex has demo accounts created with different trading platforms, such that traders can use to look at the trading platforms. The R stocks trader has an automated strategy builder and is also automated.

It has educational resources such as videos that assist new traders with knowledge on how to trade different financial markets. Other than that, it has fundamental and technical analysis tools. Forex traders can participate in the analysis, learning how to create trading strategies.

Roboforex has a copy-trading account known as CopyFX that has a leverage of up to 1:1000. It gives new traders the chance to copy the strategies of experienced traders. It has a desktop version, a mobile application, and a web-based version with trading features.

Their customer support team is available 24/7, and they respond in minutes. Their Contacts are through emails, live chat, and phone calls, and it is in several languages catering to their diverse clients.

Fees

Roboforex has forex spreads from 1.3 pips for the Pro and Pro Cent accounts. It also has a $15 commission on a 1 million dollar trade size and zero commissions on the ECN and Prime account. It has no deposit, withdrawal fees, and inactivity fees.

The average minimum deposit is $10 for all the accounts except the R stocks trader account, which has $100.

Payment methods

Roboforex accepts Credit/Debit cards, and electronic payments like Yandex, UnionPay, WeChat Pay, Giropay, Payoneer, Astropay, and many others.

(Risk Warning: Your capital can be at risk)

2. FBS

It is a forex broker founded in 2009 and has over 15 million customers worldwide. It is a non-dealing desk broker that offers access to forex, Indices, Cryptocurrency, metals, and energies. FBS is regulated by

- Cyprus Securities and Exchange Commission in Cyprus

- Financial Security Conduct Authority in South Africa

- International Financial Services Commission in Belize

- Australian Securities and Investment commissions in Australia

FBS forex broker is among the forex brokers that have a welcome bonus for new forex traders who register accounts.

Pros and cons of FBS:

Pros

- It has high leverage of up to 1:1000.

- It has a variety of account types suitable for various traders.

- A Range of Educational materials for all levels of traders.

- Interactive and engaging customer care team.

- Low commissions on stocks and indexes CFDs.

- Low trading fees

Cons

- Limited trading instruments.

- It is not available in many countries.

Account types

FBS has six account types; Cent, Micro, Standard, Zero, ECN, and the Crypto account. All these accounts got designed for the trading capacity of various forex traders. When you register any of these accounts, a welcome bonus account gets created for accessing the $50.

You don’t have to deposit into the forex broker to get the welcome bonus. With the $50, you can trade two lots and make a profit, which you can withdraw.

(Risk Warning: Your capital can be at risk)

Features of FBS

FBS has a demo account available for the Cent and the standard account. It has the Meta Trader 4 and 5 trading platforms, where traders can get firsthand experience of the FBS platform through the demo account.

FBS also has access to the virtual private server that offers high execution rates.FBS is popularly known for the competitive bonuses it has for its clients.

Apart from the welcome bonus, it also has a level-up bonus. It uses the Meta trader 4 and 5 trading platforms, which have advantages like technical analysis tools, expert advisers, hedging options, VPS, and more.

There is a diverse supply of forex educational resources in FBS. It serves experienced and new traders but focuses on books that support new traders to learn different trading strategies. There are also videos, courses, seminars, and written materials.

FBS provides forex news and analysis reports from market experts, that they give to their traders live as the market changes. FBS has created a mobile platform for forex traders that is one of the leading in the forex industry. They also have a desktop version and the web-based version.

It has copy trader features for new traders to use when they want to learn from expert traders. New traders can use leverage when using the copied trader. Customer support is present 24/7 to help traders reach them through email, live chat, and telephone.

Fees

It has different forex spreads depending on the account you open. It has floating spreads, starting from 0.5 pips, and fixed spreads starting from 0.0 pips. ECN accounts have narrow forex spreads that are competitive in the market.

FBS has commissions charged also different from the account. The Zero spread account has $20 per lot size as commission, while the

ECN account charges $6. It has a 0.05% commission on the crypto account.

It has an inactivity fee of 5 euros for dormant accounts for over one and a half years. It has no deposit and withdrawal fees.

The minimum deposits also start from $1 in the Cent account.

Payment methods

You can deposit to your FBS forex account using credit and debit cards, and electronic wallets like Neteller and Skrill. They accept wire transfers and cryptocurrencies like bitcoin.

(Risk Warning: Your capital can be at risk)

3. XM

It is a forex broker founded in 2009 and has over 1.5 million active forex traders worldwide. It offers a competitive welcome bonus for the new traders. XM forex broker allows access to financial markets such as Stocks, Commodities, Metals, Cryptocurrency, CFDs, and forex.

It is regulated by;

- Cyprus Securities Exchange Commission in Cyprus

- Australian Securities and Investment Commission in Australia

- Financial Conduct Authority in the United Kingdom

- Dubai Financial Services Board in Dubai

Pros and cons of XM broker:

Pros

- It has a library of educational materials.

- It gives access to numerous trading instruments.

- A variety of research tools and reliable trading insight through the Autochartist, videos, and blogs.

- It has a user-friendly platform, making it easy to navigate through.

- Low deposit.

Cons

- It has no investor protection for clients outside the EU.

- It does not have cryptocurrency CFDs.

(Risk warning: 75.59% of retail CFD accounts lose)

Account types

XM broker has six accounts, the micro, standard, XM Zero, XM Ultra-low, and the shares account. Other forex accounts except for the shares and XM zero account have no commission. They have varying minimum deposits where the micro and standard have $5, XM Zero $100, XM Ultra-low $50, and the Shares with $10000.

XM broker has a welcome bonus of $30 if you open a forex account on its trading platform. It also has a welcome deposit, if you register and verify your account, you don’t have to deposit anything.

XM features

XM has ensured the safety of its users through its two-step verification account login. The broker has an easy-to-use platform

with clear instructions and directions available in many languages. IT works with the Meta Trader 4 and 5 trading platforms.

The MT4 and 5 allow over 100 financial markets and 55 currencies to trade. Traders can also register for the demo account, where they trade assets using virtual money, and the MT4 and 5 platforms are integrated to give traders a realistic feel.

It has different charting tools with more than 30 technical indicators to use. The education offered at XM consists of videos, seminars, and tutorials with lessons covering various topics. These educational materials come in 19 distinct languages.

It offers live training lessons for XM users that are available online and offline. These features are in the website, mobile application, and desktop version. The desktop has notifications for traders to keep track of the financial markets.

XM has the MQL5, an automated service that allows traders to copy trades and get trading signals. The MQL5 gives traders the chance to be ahead of the market with its fast execution rates.

Their customer care team is present for 24/7 days in 25 languages. XM users can contact them from their phone numbers, live chat, and email.

XM Fees

XM forex spreads are lower than those of most forex brokers. It charges 0.8 pips per lot on the standard accounts for the EUR/USD, cheaper than other forex brokers.

It charges no commissions on its platform, as they earn through forex spreads. It also has low overnight fees and an inactivity fee of $5 every month after a year of no activity on a trading account.

Payment methods

XM users deposit into their accounts through credit cards, Bank transfers, if they are available in your regions. It accepts digital wallets like Skrill, Neteller, Moneybookers, and others.

(Risk warning: 75.59% of retail CFD accounts lose)

4. InstaForex

InstaForex is a trading broker founded in 2007 and has grown to have over 7 million users globally. It has the welcome bonus feature for newly registered forex traders. It has access to many financial instruments like forex, commodities, cryptocurrencies, derivatives, stocks, and CFDs.

Pros and Cons of InstaForex:

Pros

- It has no initial deposit.

- It offers diverse languages on its platform.

- It has a wide range of educational resources.

- It has a variety of bonuses like the welcome bonus.

- It offers a low commission for trading CFDs and stocks

- High leverage ratios.

Cons

- Limited access to financial markets.

(Risk Warning: Your capital can be at risk)

Account types

InstaForex has six trading accounts to cater to diverse forex clients. It has the Standard, ECN, Eurica, ECN pro, and the scalping account. Eureka and the standard account is for new traders and has no minimum deposit.

When you open an account on InstaForex, you get a 30% added to the total deposit that you have made. What you require to do is to;

- Register for a forex account.

- Deposit funds to your account.

- Fill in an application for the 30% bonus.

- Get the bonus into your trading account.

InstaForex features

InstaForex has educational features such as videos tutorials, Courses, and articles to help new traders learn fast. These educational materials get collected from research and target retail traders with fundamental knowledge about financial markets.

Their research gets done by a team of more than 30 analysts, which they present to Instaforex users as analysis. Research is based on feedback through comments, and the team works on the content traders’ requests.

It has a free demo account for traders who want to look at the InstaForex platform functionality or practice trading. It also has high leverage of up to 1:1000 that forex traders like to utilize. Furthermore, it integrated the Meta Trader 4 and 5, Insta-tick, the web trader trading platform.

It is available on mobile, desktop, and web-based platforms. Their customer support is present to answer any questions traders have through email, phone, and live chats. They are also active on social media like Facebook, Telegram, and WhatsApp.

Fees

Instaforex makes its profits through forex spreads, but their forex spreads are competitive. The ECN, scalping, and ECN pro accounts have narrow forex spreads ranging from 0.8 pips per standard lot.

Instaforex is slightly different from other forex brokers because 1 standard lot equals 10,000 units of base currency instead of 100,000 units. The commissions are high for InstaForex users, but the forex spreads are low for the accounts with high commissions.

It has a low minimum deposit in most accounts and charges an inactivity fee of $10 after a year of inactivity. It has no deposit and withdrawal fee, and the overnight fee is according to the position size.

Payment platforms

InstaForex accepts credit/debit cards, bank transfer methods, digital wallets like Skrill, Neteller, Sort, and many more. Users can also deposit bitcoin through crypto-wallets.

(Risk Warning: Your capital can be at risk)

5. Tickmill

Tickmill is a forex broker founded in 2014 and is among the forex brokers that offer a $30 welcome bonus to new traders. Tickmill offers CFDs, Cryptocurrencies, stocks, indices, and metals. It is regulated by the;

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission in Cyprus

- Financial Services Authority in Seychelles

- Financial Sector Conduct Authority in South Africa

Pros and Cons of Tickmill:

Pros

- It is a highly regulated forex broker with many regulatory institutions.

- It has low forex spreads.

- It has negative balance protection for its clients.

Cons

- Limited forex trading instruments.

- Customer support is only available 24/5.

(Risk warning: 70% of retail CFD accounts lose)

Account types on Tickmill

Tick mill has three account types, pro, classic, and VIP accounts. The Pro account and the VIP have tight spreads, while the classic has high forex spreads. Tickmill has a welcome bonus of $30 for opening any of these accounts.

They require you to ;

- Register for a trading account on Tickmill.

- Complete the verification process.

- Fill in the request for a welcome bonus.

Tickmill features

Tickmill partners with Meta trader 4 and 5 trading platforms, that allow traders to access premium charting software, over 30 indicators, and other tools. It provides research tools like the advanced trading tool kit present on the trading platforms.

Tickmill users can get information about the market through data analyzed by their market experts and presented on their website. They also have the Autochartist tool to add to the signals and information provided to forex traders.

It has a demo account and copies trading feature to allow forex traders to copy strategies from forex experts. Tickmill is available on the website and has a desktop version. Its mobile application got developed for account management only.

It has an average amount of educational resources, some e-books, and videos on its trading platform. It also has YouTube videos carried out as webinars for forex trading. Their customer support is fast and assists within 24 hours.

They can get contacted through email, phone calls, and live chat.

Fees

Tickmill has an average forex spread of 0.7 pips for the EUR/USD and has a commission of $2 per lot size for the pro accounts. The VIP accounts have a commission of $1 per standard lot and low spreads of up to 0.3 pips.

It has a fee for deposit and withdrawal of funds and charges no inactivity fees for dormant accounts.

Payment platforms

The payment is through bank transfers, debit, or credit cards. It accepts electronic wallets such as Neteller, Skrill, Paysafecard, Sorfort, Webmoney, and other payment platforms.

(Risk warning: 70% of retail CFD accounts lose)

FAQ – The most asked questions about Forex Brokers with welcome bonus :

How many times can I apply for a welcome bonus?

You can only apply once for a welcome bonus. It is a promotion offered to new forex brokers with new accounts.

Why am I not able to withdraw my welcome bonus?

You cannot withdraw because the welcome bonus is used as credit for trading. Once you make profits using the welcome bonus, you can withdraw your profits.

Is it a must deposit to get a welcome bonus?

Not all forex brokers require a deposit, others only require users to open an account on their platform and apply for the welcome bonus.

Which is the best forex broker with a welcome bonus?

Many forex brokers offer traders a welcome bonus. A forex broker with a welcome bonus makes his trading platform lucrative for a trader. If a trader is looking for the best forex broker with a welcome bonus, he can sign up with one of the following five forex brokers.

RoboForex

FBS

XM

InstaForex

TickMill

How can I sign up with a forex broker with a welcome bonus?

A trader can sign up with a forex broker with a welcome bonus within simple steps. First, a trader must visit the platform’s website or download the mobile application. Then, a trader can easily see the ‘signup’ option. Clicking on this option will allow traders to enter their details to make a trading account. They can enjoy trading once they submit this information and the broker verifies it.

How does a trader claim bonus with a forex broker with a welcome bonus?

A forex broker with a welcome bonus will allow traders to use it as and when they sign up for the trading account. The broker will credit it to your account, and you can use this bonus and your deposit to make the trade. However, a trader cannot withdraw the welcome bonus. It is available only for trading.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)