5 best MetaTrader 5 demo accounts for online investments in comparison – Reviews:

Table of Contents

When it comes to trading platforms, we naturally want an application that features the best tools. We would also want to be able to navigate through it smoothly so we could focus more on our trading strategies.

MetaTrader 5 is the upgraded version of the MetaTrader 4 platform. If you are familiar with the trading industry, you have probably heard of this software. But what exactly makes the MetaTrader 5 better than the MetaTrader 4?

In this review, you will read about the 5 best MetaTrader 5 demo accounts for online investments. You will get to know the brokers one by one, as well as the tradeable products as well as additional features they have to offer on their trading platform.

See here the list of the best MT5 demo accounts:

MetaTrader Broker: | Review | Demo account: | SPREADS & ASSETS: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets  | $ 100,000 Free & Unlimited | From 0.0 pips spread + $ 2 commission per 1 lot trade 800 markets+ | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips # Paypal & crypto payments | Virtual account: (Risk warning: Your capital can be at risk) | |

2. FxPro  | $ 10,000 Free & Unlimited | From 0.0 pips spread + $ 0 commission per 1 lot trade 250 markets+ | # Multilingual 24/5 customer support # 5-star rated customer service # Award-winning broker # Offers training and educational materials # User-friendly interface | Virtual account: (Risk warning: 72.87% of CFD accounts lose money) | |

3. XM  | $ 10,000 Free & Unlimited | From 0.0 pips spread + $ 3.5 commission per 1 lot trade 1,000 markets+ | # 1000+ assets # No hidden fees # Professional support # 3 account types # Regulated and safe | Virtual account: (Risk warning: 75.59% of retail CFD accounts lose) | |

4. Pepperstone | $ 10,000 Free & Unlimited | From 0.0 pips spread + commission from $0 depending on account type 180 markets+ | # Advanced Tools # Transparent trading experience # User-friendly platforms # Free demo account # 24/5 multilingual customer support | Virtual account: (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IC Markets | $ 10,000 Free & Unlimited | From 0.0 pips spread + $ 3 commission per 1 lot trade 2000 markets+ | # Free demo account # Spreads from 0.0 pips # Low commission # Real raw-spread trading # Big liquidity providers | Virtual account: (Risk warning: Your capital can be at risk) |

Who is the best broker for the MT5 demo account? – List:

The list of the 5 best brokers for the MetaTrader 5 demo account includes:

- Vantage Markets – Outstanding trading conditions & offers

- FxPro – One of the best choices for pro traders

- XM – Forex broker operating since 2009

- Pepperstone – Australian-based CFD broker with raw spreads

- IC Markets – Awarded for the best trading app

(Risk warning: Your capital can be at risk)

Does MetaTrader 5 have a demo account?

MetaTrader 5 has a demo account. It provides the best features to its traders. They do not have to fear losing their money as they are given virtual currency to trade.

Good to know!

There are many brokers through which you can sign up for a MetaTrader 5 demo account. For instance, brokers such as Vantage Markets are the best for MT5 traders because of their simple signup process.

So, MetaTrader 5 demo account lets the traders be familiar with the trading functionalities and how to manage the risk rate on a live trading account.

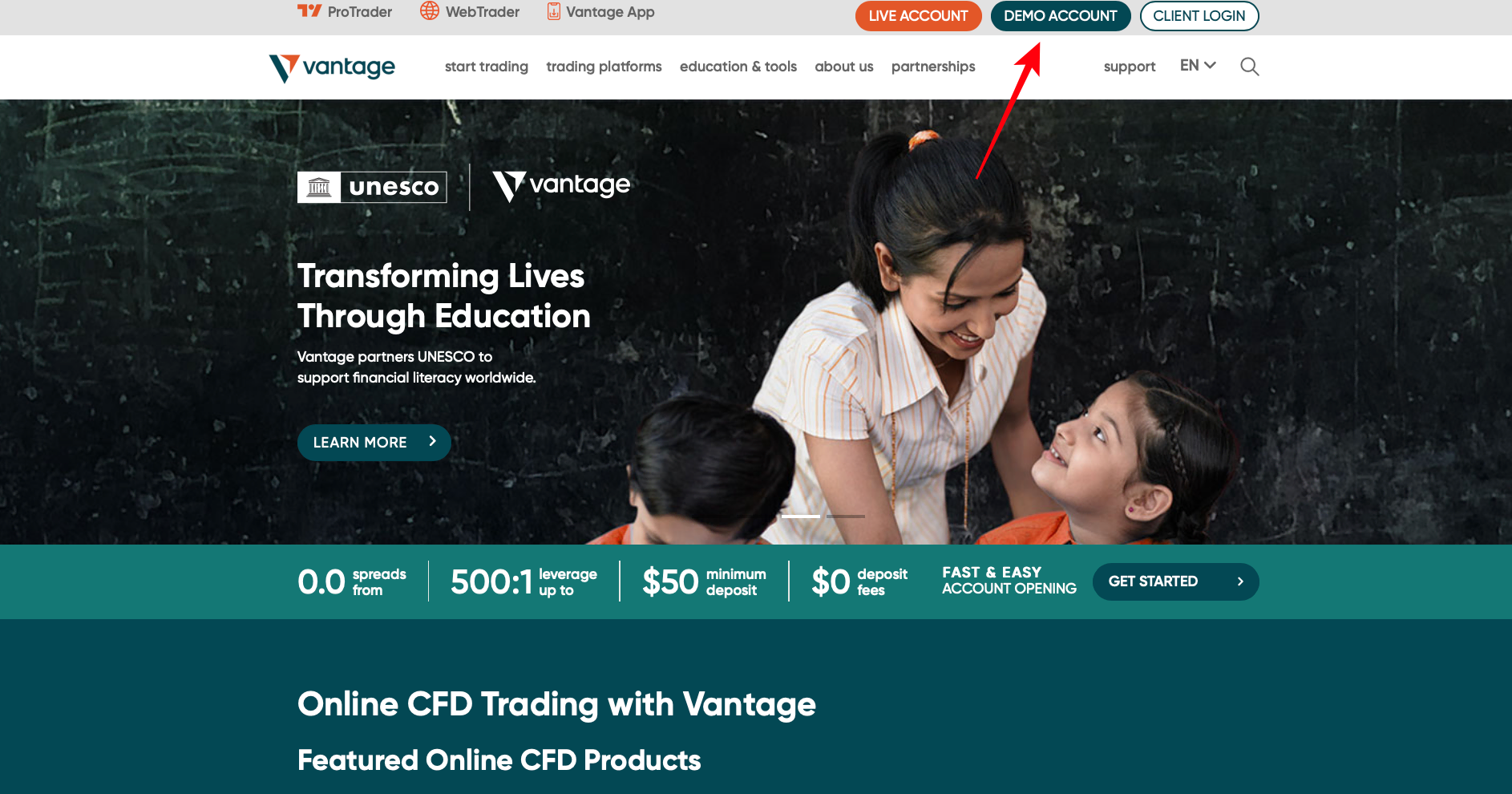

#1: Vantage Markets

Vantage Markets is one of the leading brokers that are offers access to the MetaTrader 5 demo account It is one such platform where you can avail of a stress-free trading experience to enhance your trading experience and capitalize on your market opportunities. This award-winning platform has experience of more than 10 years, and it has been providing uninterrupted services ever since. It has benefitted both the traders as well as the entire trading ecosystem.

This section will further analyze the platform’s various trading tools, instruments, multiple accounts, and other options. And help you make intelligent decisions if you should go ahead with Vantage market brokers.

Let’s elaborate on some of the benefits that Vantage Market can provide:

- The traders can easily make use of TradingView via the Vantage Markets Pro Trader

- The serviceability of the platform is provided 24/7

- More than 500 different instruments are available here on this platform.

- The spreads and fees of Vantage Markets start from 0.0 pips

- The leverage is quite high. It is up to 1:500 available

- There are distinct as well as unique features such as demo account trading, and various other features.

- A unique feature, a Swap-free or Islamic account, is also provided to the customer.

(Risk warning: Your capital can be at risk)

#2: FxPro

FxPro is known to be the number 1 forex broker in the world. With their 15 years of experience, they have the privilege to offer their services to 1.8 million clients from 173 countries. They also boast of having more than 80 international awards for their amazing quality of service.

Based on the fact that FxPro is the number 1 forex broker in the world, one would assume that you can only trade forex with this particular broker. That is not the case. With FxPro’s MetaTrader 5 platform, clients have the option to trade metals, indices, futures, energies, and shares along with foreign exchange.

You can find over 70 forex pairs on their platform, including some major pairs like EUR/CAD, CAD/CHF, EUR/CAD, and some minor pairs like AUD/DKK, AUD/NZD, AUD/PLN, and many more. FxPro also has more than 150 shares from the United States of America, the United Kingdom, France, and Germany. Some of the most popular companies that you can find on their platform are Alibaba, Amazon, Apple, Disney, and Facebook.

You will find a list of all the tradeable metals, indices, and energies on FxPro’s MetaTrader 5 platform below.

Metals:

- Gold

- Platinum

- Silver

Indices:

- AUS200

- ChinaA50

- ChinaHShar

- Euro50

- France120

- France40

- GerTech30

- Germany30

- Germany50

- Holland25

- HongKong50

- Japan225

- Spain35

- Swiss20

- UK100

- UKmid250

- US30

- USNDAQ100

- USSPX500

Energies:

- BRENT

- NAT.GAS

- WTI

Signing up for FxPro’s demo account is very straightforward. All you have to do is input your country of residence, full name, email address, and your chosen password. Once you log into your account with your credentials, you will be given $100,000 in virtual cash.

Using your virtual cash, you can practice trading all the available assets with real-time pricing. You will also be granted full access to all the available tools on their MetaTrader 5 software. You can freely add more virtual funds as well to your platform by simply clicking on the “add funds” button. You can practice trading with FxPro for 180 days after creating a demo account.

FxPro also boasts of its 5-star customer service. You can reach them via email or through their live chat support system on their website. They also have dedicated telephone numbers for the other languages that they support. Below is the list of phone numbers and their corresponding country:

- France – 0805 102 593

- Germany – 08005 888 996

- Russia – 8 800 100 6234

- United Arab Emirates – 8000 180 006

- Spain – 800 600 091

- Poland – 00800 1212 981

- Italy – 800 977 428

- Hungary – 0680 019 024

- Portugal – 800 855 271

- Indonesia – 0212 970 4936

- Vietnam – 12 011 398

- India – 08001 007 547

- Japan – 00531 122 031

- South Korea – 007 984 434 12 82

- Australia – 1800 829 465

- Argentina – 08005 888 304

- Brazil – 08007 611 428

- Mexico – 1877 766 4092

- South Africa – 0800988840

Their customer support representatives are available 24 hours a day from Sunday 11:00 PM to Friday 12:00 MN. FxPro does not accept traders from Iran, the United States of America, Zimbabwe, Canada, New Zealand, Myanmar, and Iraq.

(Risk warning: 72.87% of CFD accounts lose money)

#3: XM

This fairly new broker has been operating since 2009 and now has over 3.5 million clients from 196 countries. Despite not having the same years of experience as well-known brokers, XM still delivers high-quality service to all their clients.

The forex broker XM allows clients to trade 57 of their currency pairs. You will find the seven major pairs here, along with a couple of exotic pairs as well. You can also choose to trade stocks from Canada, Brazil, Russia, Austria, Norway, Finland, Sweden, Portugal, Greece, Italy, Belgium, Switzerland, Spain, Netherlands, Germany, France, the United Kingdom, or the United States of America.

Aside from stocks and forex pairs, they also offer exposure commodities, indices, precious metals, and energies. You will find a complete list of these products below.

Commodities:

- US Cocoa

- US Coffee

- US Corn

- US Cotton No. 2

- High Grade Copper

- US Soybeans

- US Sugar No. 11

- US Wheat

Indices:

- US500Cash

- US30Cash

- US100Cash

- UK100Cash

- SWI20Cash

- SPAIN35Cash

- NETH25Cash

- JP225Cash

- IT40Cash

- HK50Cash

- GER30Cash

- FRA40Cash

- EU50Cash

- AUS200Cash

Precious Metals:

- Gold

- Silver

Energies:

- Brent Crude Oil

- WTI Oil

- Natural Gas

- London Gas Oil

- WTI Oil Mini

Signing up for XM’s demo trading account takes less than two minutes. Just fill-up the form on their website. The form will ask for your complete name, country, and city or town of residence, telephone number, email address, and your preferred language.

You will also get to choose your base currency, account type, leverage, and how much you want to invest virtually. To complete your account, all that is left to do is to type in your chosen password.

Keep in mind that you are only allowed to have five demo accounts and a base currency of either EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, or SGD. Your options for leverage range from 1:1 up to 1:888. The highest amount you can virtually invest is 5,000,000, while the lowest is 1,000.

XM’s support system operates 24/5 GMT. You can reach them by either sending them an email or contacting them via phone support (+501 223-6696). XM also has a built-in live chat system on its website.

XM accepts traders from all countries except Spain, Iran, Portugal, Israel, Canada, and the United States of America.

(Risk warning: 75.59% of retail CFD accounts lose)

#4: Pepperstone

Pepperstone is an Australian-based company that is known as one of the leading CFD and forex brokers. They have been operating since 2010 and are trusted by more than 70,000 clients from all over the world.

With Pepperstone’s MetaTrader 5 platform, clients can practice trading all the types of asset classes that are offered by this particular broker. There are over 150 forex pairs to choose from, including minor, exotic, and the seven major currency pairs.

Stocks are also quite important in the trading scene. Naturally, you would want to practice trading this popular asset class. Pepperstone gives you the opportunity to trade stocks from Australia, the United States of America, Germany, and the United Kingdom. You will find famous companies like Apple, Amazon, Facebook, GameStop, Netflix, and many more popular names on their platform.

You can also trade cryptocurrencies, commodities, and indices with Pepperstone. Here is a list of all the available assets on Pepperstone’s platform:

Cryptocurrencies:

- Bitcoin

- Bitcoin Cash

- Dash

- Ethereum

- Litecoin

- Crypto10

- Crypto20

- Crypto30

Commodities:

- Gold

- Silver

- Platinum

- Palladium

- Crude Oil

- Brent Oil

- Natural Gas

- Cocoa

- Coffee

- Copper

- Cotton

- London Sugar

- Orange Juice

- Soybean

- Sugar

- Wheat

Indices:

- US Wall Street 30 Index

- US 500 Index

- US Tech 100 Index

- US 2000 Index

- US Volatility Index

- Canada 60 Index

- Australian 200 Index

- Japan 225 Index

- Hong Kong 50 Index

- China 50 Index

- Singapore 25 Index

- South Africa 40 Index

- Hong Kong China H-shares Index

- Germany 30 Index

- UK 100 Index

- France 40 Index

- Spain 35 Index

- EU Stocks 50 Index

- Germany Tech 30 Index

- Germany Mid 60 Index

- Netherlands 25 Index

- Norway 25 Index

- Switzerland 20 Index

With so many options to choose from, you can definitely hone your skills and come up with different trading strategies using a demo account before you start trading with real money. Signing up for Pepperstone’s demo account allows you to use all the available tools on their MetaTrader 5 platform for 30 days. You will be given £50,000 in virtual funds that you can use to practice trading all the available asset classes.

If you encounter any problem, Pepperstone’s customer service representatives are available 24/5. You can send them an email with your concern or query or call them on their hotline (+613 9020 0155). This broker’s services are offered to traders from all over the world except for clients from the United States of America, Saudi Arabia, Canada, New Zealand, Brazil, and India.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

#5: IC Markets

IC Markets is a Sydney-based broker that is well known in Australia for its low fees and spreads and high leverage. This broker has been operating since 2007 and has won multiple awards, including Best Overall Broker of 2020 and Best Trading App of 2020.

IC Markets is famous for their forex products, but they also offer different assets. There are more than 61 currency pairs, including the major and minor pairs. With more than 730 global stocks, IC Markets offers a lot of exposure to this type of asset class.

You will find a list of tradeable cryptocurrencies, indices, and commodities on IC Market’s platform below:

Cryptocurrency:

- Bitcoin

- Ethereum

- Dash

- Litecoin

- Bitcoin Cash

- Ripple

- EOS

- Emercoin

- NameCoin

- PeerCoin

Indices:

- Australia S&P ASX 200 Index

- Canada 60 Index

- Hong Kong China H-shares Index

- FTSE China A50 Index

- Germany 30 Index

- Spain 35 Index

- France 40 Index

- Hong Kong 50 Index

- Italy 40 Index

- Japan 225 Index

- Germany Mid 60 Index

- Netherlands 25 Index

- Norway 25 Index

- South Africa 40 Index

- Sweden 30

- EU Stocks 50 Index

- Switzerland 20 Index

- Germany Tech 30 Index

- UK 100 Index

- US Small Cap 2000 Index

- US Wall Street 30 Index

- US SPX 500 Index

- US Tech 100 Index

Commodities:

- Brent Crude Oil Futures

- Cocoa

- Coffee

- Corn

- Orange Juice

- Soybean

- Sugar

- Wheat

- West Texas Intermediate – Crude Oil Futures

- Brent Crude Oil Spot vs United States Dollar

- Natural Gas Spot vs United States Dollar

- WTI Crude Oil Spot vs United States Dollar

Good to know!

IC Markets offers a free demo account for their clients to practice within real-time. Signing up requires you to input your country of residence, full name, email address, and contact number. It’s important to note that your demo account will expire after 30 days of inactivity.

This broker’s help center covers a wide range of topics regarding their services offered, how to open accounts, and many more. But if you prefer to get in touch with their customer service, you can contact them via email, telephone (+248 467 19 76), or built-in live chat system on their website. Their customer service representatives are available 24/7.

Keep in mind that traders from the United States of America, Liberia, Togo, Niger, Cuba, Cote D’Ivoire, Ghana, Iran, Iraq, Zimbabwe, and Canada are not eligible to sign up with IC Markets.

(Risk warning: Your capital can be at risk)

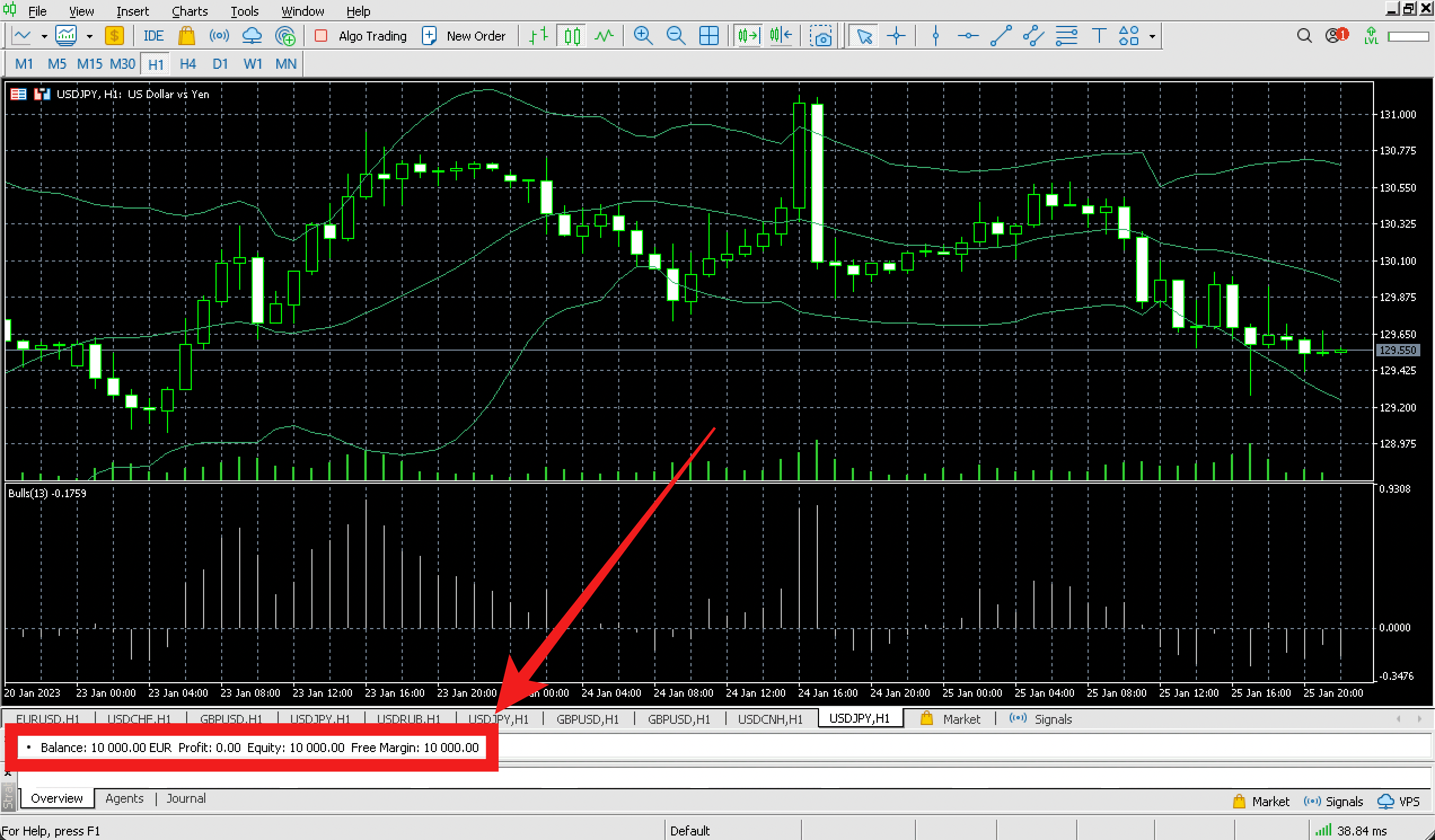

What is a MetaTrader 5 demo account?

The MetaTrader 5 demo account is a demo account that uses one of the most sophisticated trading platforms available. With MT5 demo accounts, you don’t need to risk even a single dollar to practice trading different asset classes with your preferred broker.

Trading conditions differ depending on the broker you choose to make a demo account with. Usually, you’ll be given 1,000,000 dollars of virtual cash on your portfolio with access to most of the broker’s features. Important features you’ll most likely be having access to are their charts, trading guides, asset analysis as well as the ability to simulate actual trading with the use of leverage and margin.

Keep in mind that some brokers would only allow you to use their demo accounts for a set period of time, while others don’t have a set time limit. Some brokers even allow you to modify the amount of virtual cash in your account.

Why you should use a MetaTrader 5 demo account

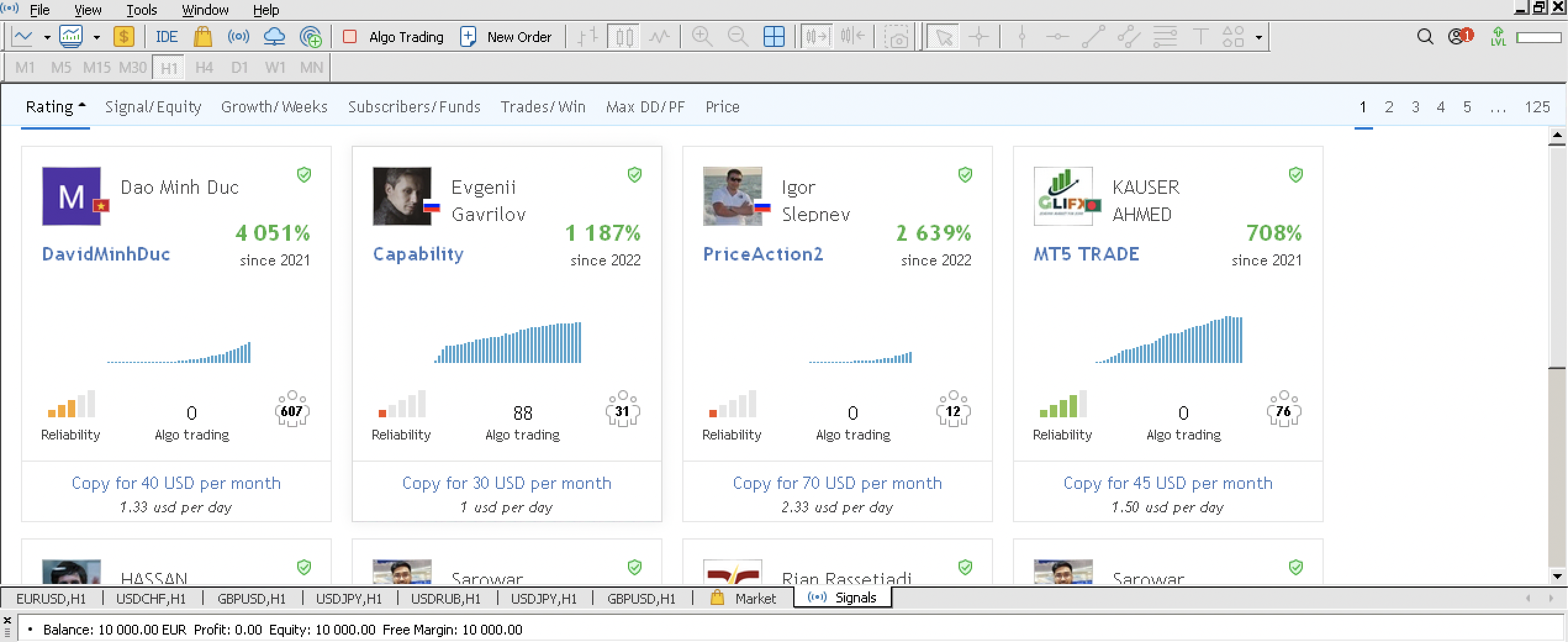

Having a demo account at your disposal enables you to experiment using the trading platform to your heart’s content. This is beneficial for all traders, from beginners to advanced users. You can explore what your broker can offer and even know the basics of trading. Learning how to set your trades from scratch involves you analyzing the spreads and the risk you’re going to incur on every trade. Without the risk of losing money, you can try out different strategies that involve different indicators or perhaps a combination of multiple indicators to suit your trading style.

An important feature found in demo accounts is their realistic trading conditions. Demo accounts use leverage and margin like live accounts. It is a common mistake to blow up your account when using these tools irresponsibly, but demo accounts allow you to know what amount of added risk you’re able to take on a regular trade. Practicing this on a risk-free account will greatly increase your chances of surviving different market conditions.

Sometimes, brokers also offer a trading contest for demo accounts in which they award the top-performing demo account based on percentage gain. This is a good way to test your skill and strategy against all other traders using the same broker.

Metatrader 5 also is the latest and best version of its kind. You’re guaranteed to have the best service with the most popular trading software.

(Risk warning: Your capital can be at risk)

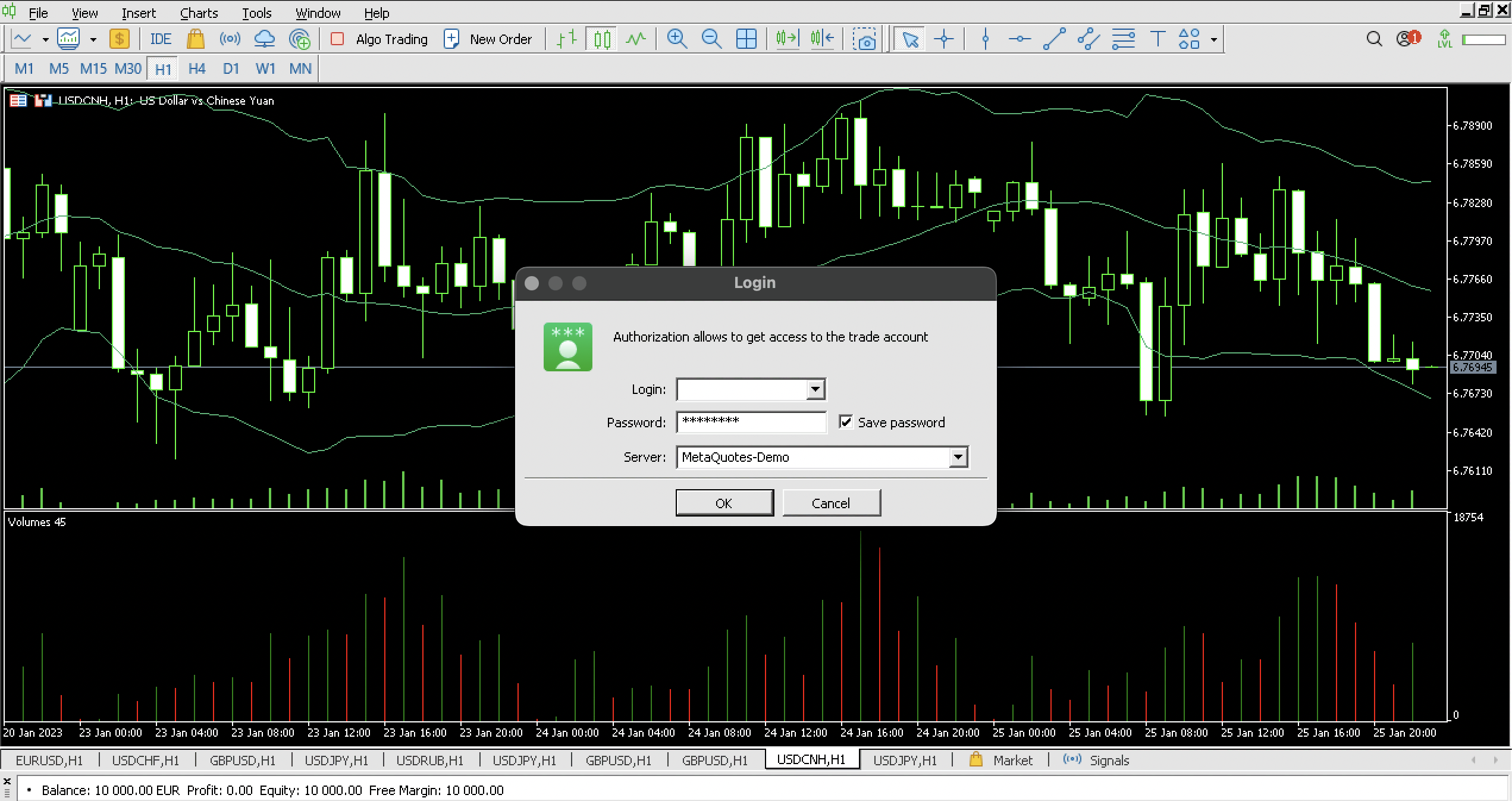

How to open a MetaTrader 5 demo account?

There are a few steps to open a MetaTrader 5 demo account

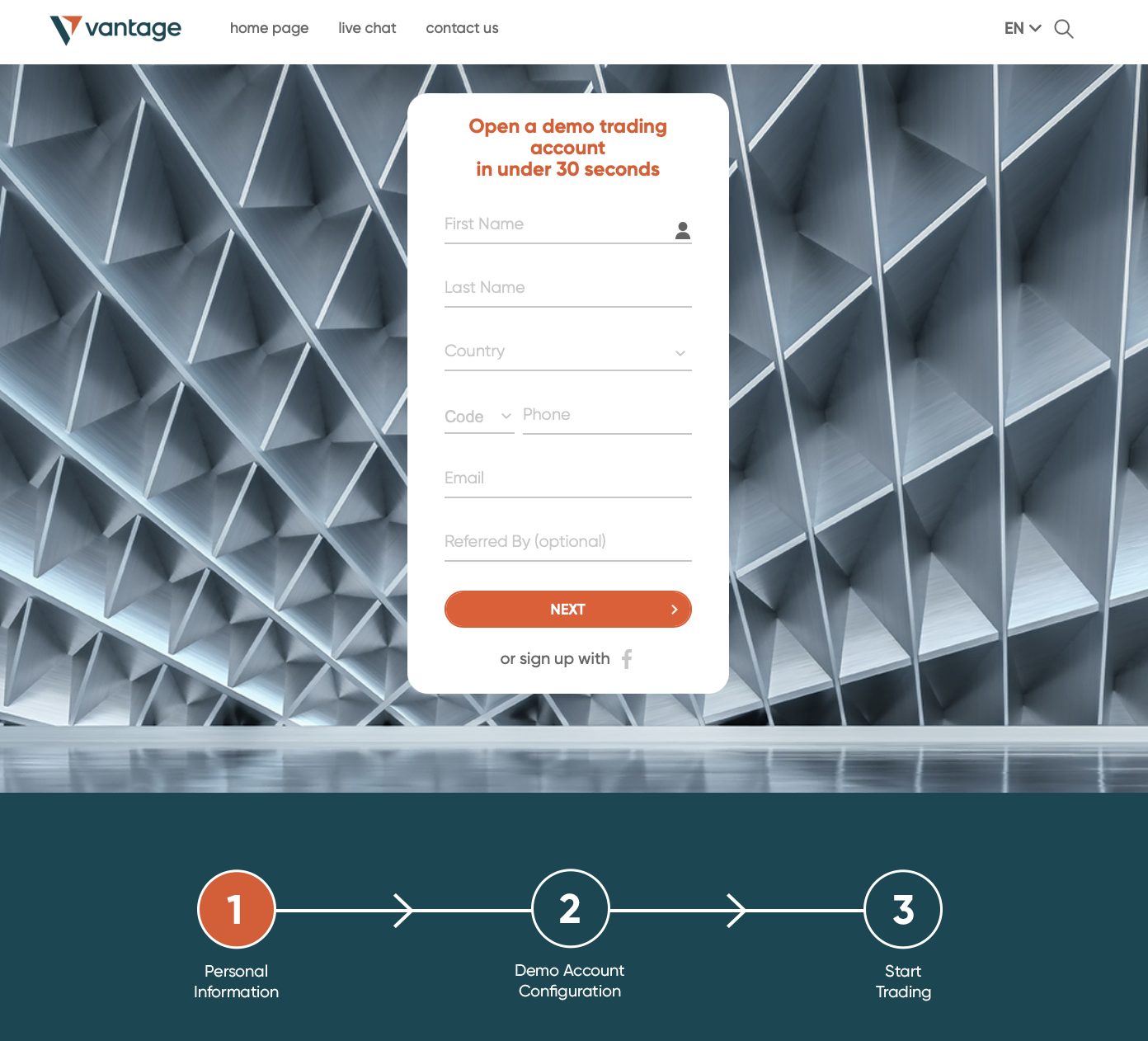

1. Find a broker

You cannot log into your MetaTrader 5 demo account without a broker, so finding a regulated MT5 broker is very important. Choose the broker carefully.

The broker should be lawfully regulated, just like Vantage Markets. It offers a trusted trading environment allowing clients to achieve their goals.

2. Sign up

Once you find a regulated broker, you can sign up for your MT5 demo account. Click on the sign-up option to begin the procedure.

To sign up for MT5 demo trading, fill in your basic personal information like name, phone number, and anything the broker demands.

(Risk warning: Your capital can be at risk)

3. Submit the information

After filling in all details, you can submit the information to begin trading in your MetaTrader 5 demo account.

The brokers allow traders to sign up for MetaTrader 5 demo accounts instantly. So, as soon as a trader signs up, he can start demo trading.

4. Get instant access to your MetaTrader 5 demo account!

A trader can get a MetaTrader 5 demo account by following the simple steps above. These steps will ensure that a trader connects with a broker successfully to use a demo account.

How to add funds to a MetaTrader 5 demo account?

You do not need to fund your MetaTrader 5 demo account because your broker provides you with virtual currency to trade. If you are out of funds, you can ask the broker to refill the virtual currency to continue trading.

Good to know!

The greatest benefit of using the MetaTrader 5 demo account is that you can use it for free. Most brokers will charge nothing from traders for the first 30 days when they opt for demo testing. However, later, a trader might need to pay.

As mentioned, traders need not add funds to their MT5 demo account. The selected broker provides you with virtual funds. You can begin trading with virtual currency. Once the given money finishes, you can ask the broker to top up the currency.

Good to know!

The MetaTrader 5 demo account benefits traders because they can improvise their trading knowledge with this platform. Besides, they don’t need to worry about losing profits.

Advantages and Disadvantages of a MetaTrader 5 demo account

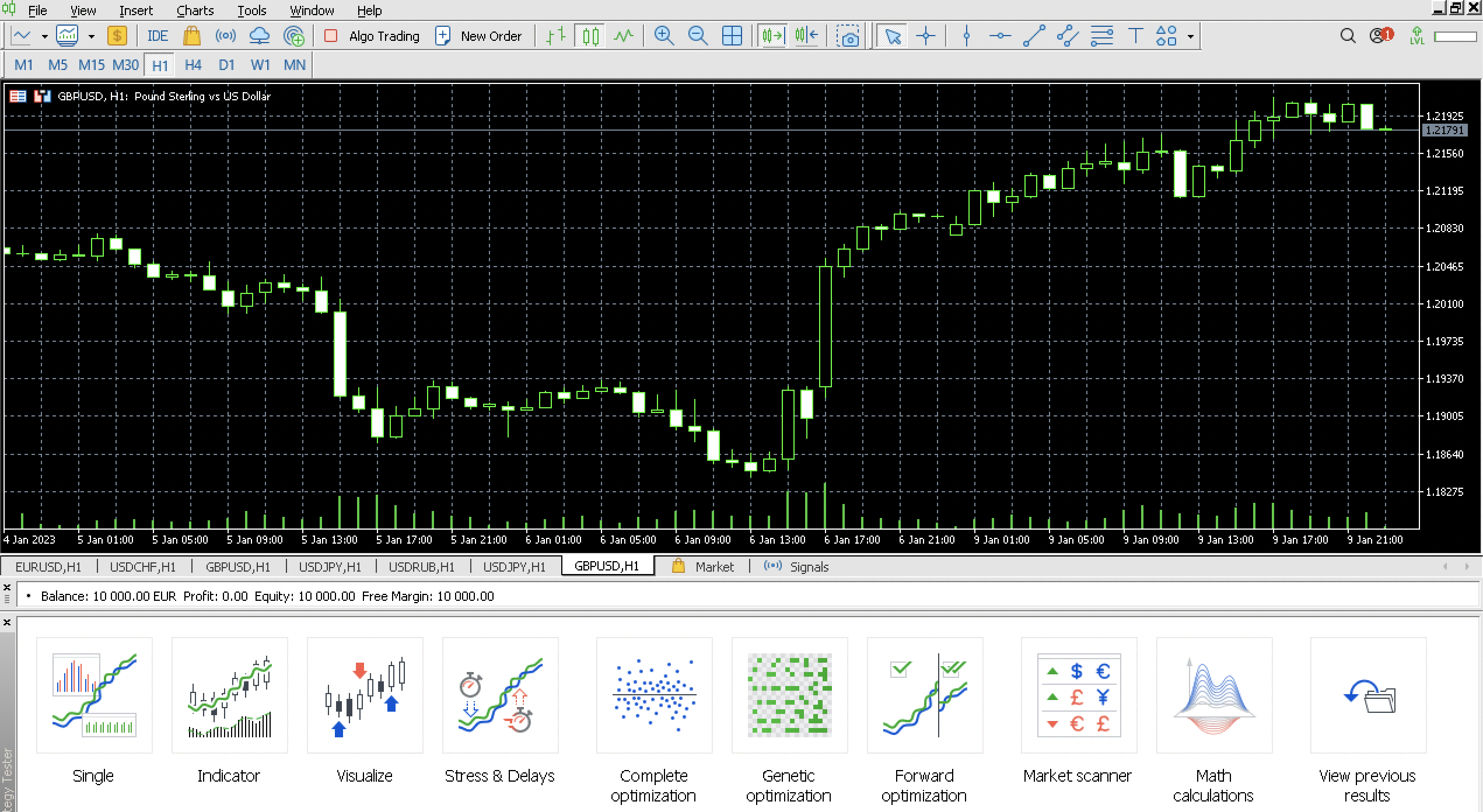

As the most popular trading application, MetaTrader 5 offers a trading experience like no other. With tons of indicators and a customizable interface, you can set up your trading screen to suit your every need. As a MetaTrader product, one could easily adjust themselves if they choose another broker since most brokers use this trading platform. Even if you once used the predecessor of the MT5, the MetaTrader 4, there are only a few differences that set them apart, but MetaTrader 5 really brings out the best of every trader with those added features.

In terms of customizable timeframes for charts, MT5 comes out on top. They have an extra 21 different timeframes compared to MT4, which only has 9. Overall, they also boast 11 types of minute charts, seven hourly charts, and 365 Daily, Weekly, and Yearly timeframes.

Between both versions, MT5 has more options when it comes to pending orders. The MT4 only has four pending order types, which are the buy stop, buy limit, sell stop, and sell limit. The MT5, on the other hand, has two more which are the buy stop limit and sell stop limit. These enable you to customize your trades to another level such that you get to put your orders more precisely without having to look at the market more often.

In terms of technical analysis and charts, the upgraded version features more technical indicators, analytical objects, and an unlimited number of charts.

The MetaTrader 5 utilizes the MQL5 programming language that is integrated into the platform. This programming language, as well as the MQL4 that the MT4 uses, is designed to help you create and use trading bots to automate your trading.

Good to know!

Though the MQL5 has more complex commands, it is still easier to use. You can even alter the scripts that other people have already made. The MQL5 is also better in terms of efficiency. Trading operations using this programming language can be done with just one function, whereas the past version would require multiple functions just for one trading operation.

Both MetaTrader versions mentioned allow the use of Hedging, but for MT5, a request must be made first for the client to be allowed to use this strategy. Other features that MT5 has that MT4 doesn’t include netting, market depth, economic calendar, and fund transfer between accounts.

With all of these features available, it is no doubt that MT5 offers more advantages compared to its predecessor, but some may opt to use MT4 because it is simpler to use or maybe because they’re used to the older version.

- Helps build basic trading knowledge

If you are a new trader, you need to practice it first to know whether it will suit you. MetaTrader 5 demo account is risk-free, and it eases things. It will give a sense of whether your personality is suited for trading and risk returns.

- Helps examine the broker’s trading state

When selecting the right broker, some of the prime elements to consider are trading state of the broker. The MetaTrader 5 demo account is a great platform to check whether you are comfortable investing money.

MetaTrader 5 demo account not only permits you to examine the trading state but also offers you to understand how different brokers work.

- Risk-free mistakes

A MetaTrader 5 demo account allows you to practice before entering the real account. If a trader makes mistakes, there will be no repercussions, and the trader can learn from his mistakes.

- Risk management in an imitated environment

When you start trading in MetaTrader 5 demo account, you are provided with risk management techniques. With time, you will start considering the risk management techniques which will benefit you in real account.

In MetaTrader 5 demo account, you will practice managing risk with virtual currency, which will help you when trading in a real account.

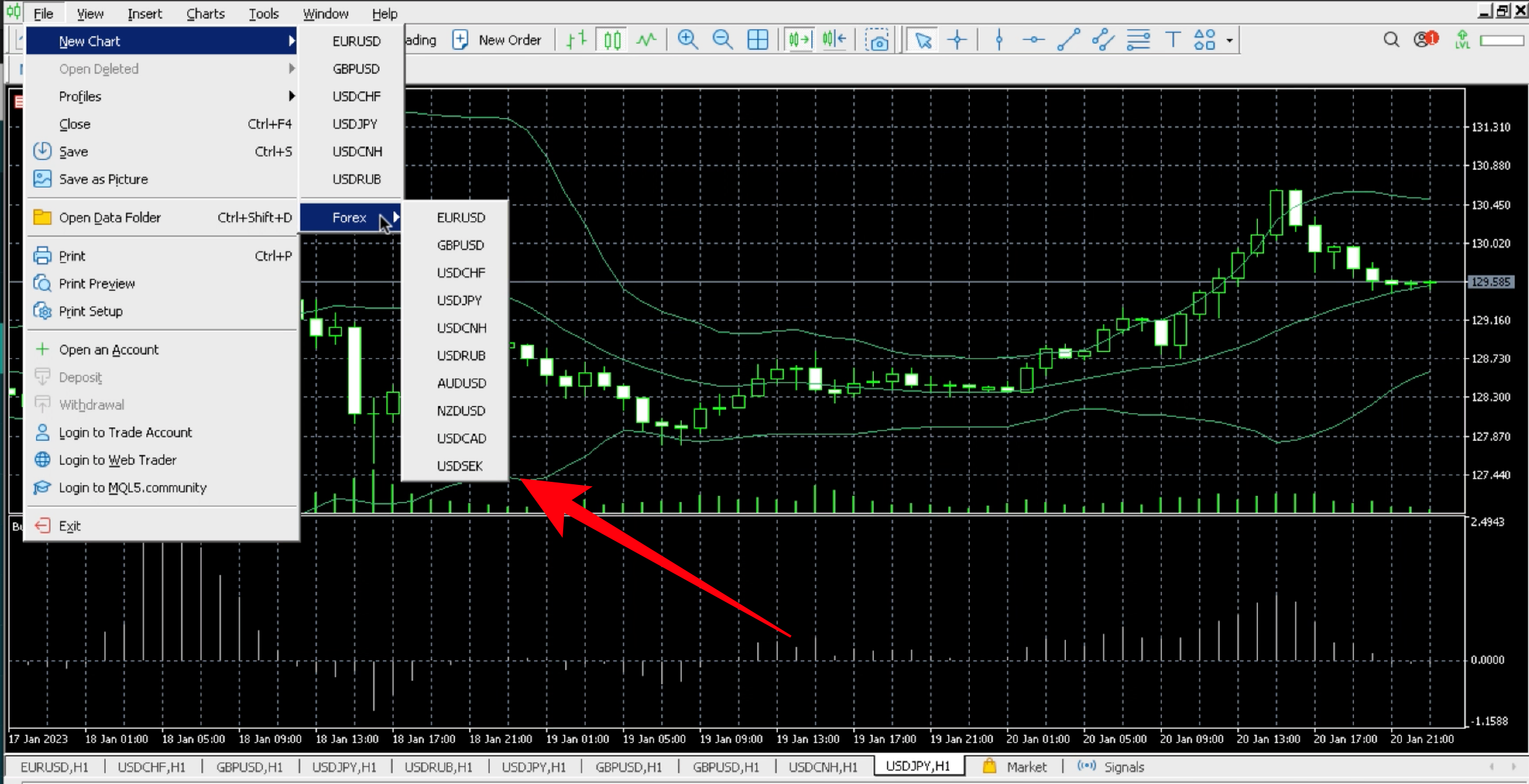

How to trade with MetaTrader 5

After logging in using your username and password in the MT5 platform, you’ll be directed to the main screen, where you’ll be spending most of your trading time.

The MetaTrader 5 home screen consists of four important parts, all of which are customizable for efficiency and ease of use. These four parts are the market watch panel, navigator panel, trading panel, and chart panel.

The market watch panel will act as your watchlist as you add each stock that you plan to trade in the future. The navigator panel gives you access to your account details, trading bots, indicator list, and many more.

Your trading panel will show all active and pending trades you have as well as the history of trades that have been executed using your account. You’ll see your assets and their corresponding volume, price, exposure, and profits or losses.

Market alerts and signals will also be shown together with a calendar of important market events. There are many more features found in this part of the MT5, so be sure to explore them all.

Lastly, you’ll be given access to built-in charts that can be put together side-by-side. These are fully customizable and are very easy to use with the indicators available.

To start trading using your demo account, ensure that you have the right margin or leverage for the account, as this allows you to be sure you aren’t betting too much on a particular asset. You then choose an asset to trade or invest in by looking at the company’s fundamentals and corresponding chart to measure the risk you’re going to have as well as the potential gain for this particular trade.

Once you have chosen an asset, you then choose the number of lots you would want to trade as well as the price you want to buy or sell at. MT5 calculates the amount you spend per trade, and you can double-check this amount with your desired risk. With the MetaTrader 5, you are also given a simpler way to trade using their one-click trading tool that is available within the charts you’re looking at.

Once you have set your trade, you will be notified if your order has been filled, and it would reflect on your portfolio. If you choose to cancel your order, you can simply click the x button located on the right-hand portion of your trade tab.

Tips and Tricks

The main benefit of having a demo account has a risk-free experience to experiment on anything. This is the best way to learn, considering that trading profitably comes from learning from your mistakes. Since these mistakes would just mean losing virtual cash, you get a lot of knowledge from doing wrong things while retaining a lot of important information to profit.

If you’re having difficulty entering your trades or customizing your MT5 to be efficient, you can simply watch Youtube tutorials. Since the MetaTrader platform is widely used, you can easily find your answer there or on forums hosted by the platform itself. There is also a community that contains tons of information on building and reconstructing trading bots.

Aside from using your demo account to practice, you can even aim higher by participating in a contest hosted by your broker. Awards are given to the top demo accounts but keep in mind that not all brokers and exchanges offer this promo.

With all the different indicators available, you can try a combination of a few to suit your trading style. With the variety of timeframes available, by the time you’ve finished practicing, you should decide if you’ll trade intraday, swing, or long-term.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about the MetaTrader 5 demo account:

How can I open a Metatrader5 demo account?

You can open a Metatrader5 demo account with any trusted and reputed Forex brokers, such as Quotex, Pocket Option, and IQ Option. When you visit their website, you can find a simple-to-fill-in registration form. You can enter your first name, last name, and email address. You select a password with alphanumeric and special characters as specified by your Forex broker. Then, you choose the MT5 trading platform from the available options and submit the form to the broker online.

How long can I use my Metatrader5 demo account?

You can use your Metatrader5 demo account for up to 90 days. After that, you cannot access your demo account, so ensure you use it periodically to make the most of it. MT5 demo accounts do not expire with some Forex brokers, such as Trusted Broker Reviews, but they have the right to lock them after 90 days.

Can I retrieve the password of my Metatrader5 demo account?

Yes, you can retrieve the password with the help of the support team of your Forex broker. They will reset the password of your Metatrader5 demo account if necessary. Firstly, they will ask if you opened your MT5 demo account through their trading platform. If so, they will email you your account number and password. Thus, you can retrieve your MT5 demo account password.

Last Updated on February 14, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)