Complete guide to using automated Futures Trading system software

Table of Contents

Futures trading is one of the most profitable types of trading. If you have some experience trading in volatile markets and know how to manage risk correctly, there are no bounds to the amount of money you can make trading futures contracts. However, things do get complicated even for the most experienced traders. Futures contracts can be traded in a vast number of markets, and monitoring all of them for for-profit opportunities is simply not possible for one trader.

While you could tackle this issue by testing out all commodities and sticking to the handful that you find the best results in, if you don’t reside in the same time zone as the market you like, you will miss out on many opportunities. Deciding to leave positions open overnight is one of the riskiest decisions you could take, so that isn’t an option. Thankfully, there is a reliable solution to this: automated futures trading systems.

But what exactly are these systems? How do they work? And how should you go about picking one? In this post, we give you the lowdown on automated trading systems and help you understand how they work. We’ve also reviewed some of the best automated trading systems to make finding the right one easier.

What are automated Trading Systems?

Automated trading systems enable traders to make trades on auto-pilot by programming the system with trading rules to match their trading style. These systems are sometimes referred to as day trading robots and Expert Advisors (EAs). You can teach the system to enter and exit trades just like you do. You can also feed in some money management rules to ensure you don’t lose too much capital. While you may think the use of these systems isn’t common, behemoths like JP Morgan report that algorithms drive 80% of trades taking place on its platform.

One of the main characteristics of EAs that attracts traders to them is that these robots enable traders to remove the emotion from the trades they make. A position is automatically opened when pre-set criteria are met. Rules for entering and exiting positions can be programmed using simple indicators like the moving average crossover. Traders can also embed complex strategies into the system; however, this usually requires the trader to understand the programming language the robot works on.

Note:

To use an automated trading system, you will need to use EA software linked with a direct access broker. You will also need to abide by the rules specific to the platform.

How do automated Trading Systems work?

Most automated trading systems come with a setup wizard that enables you to feed in your strategy by selecting common technical indicators and bind rules to them. When the conditions you set are met, the system will open or close positions automatically. Furthermore, you can also program the type of order you want to open when the trade is triggered. But you could always use the program’s default order type in all your trades when you’re starting out.

Programming custom indicators into these trading systems are also possible. However, to make custom indicators, you will likely need to work with a programmer unless you have the required programming knowledge. While making custom indicators requires a lot more effort than using the available indicators, custom indicators give you a greater degree of control over the system and subsequently over your trades. Making custom indicators can be rewarding for this reason. Bear in mind, though, just like everything else in the trading world, there is no perfect investment strategy, and you will lose trades even if you put a lot of effort into making a custom indicator. After you’ve fed in the rules you want the system to follow, the system will monitor hundreds of markets and find new profit opportunities every second.

By the way:

Depending on the rules you’ve set, when the system enters a trade, the stop loss, trailing stop, and profit target will be generated automatically.

Advantages and disadvantages of automated Trading Systems

There is a laundry list of advantages of using automated trading systems to trade futures contracts. Some of the biggest advantages it offers include:

Removes Emotion from Trading

Fear and greed are emotions that every trader must overcome throughout their career. However, since trading robots execute trades automatically when specific market conditions are met, there is no emotion involved in the trading decision. The best traders understand that having the discipline to stick to the strategy is the only way to make money trading. Automatic trading systems enable inconsistent traders to stick to the plan.

Furthermore, these systems also help traders with tendencies to overtrade.

Allows Backtesting

The only reliable way to understand if a trading strategy is viable is to check if it has worked before. EAs allow you to apply the trading rules you’ve set to historical market data to see whether your strategy will work. If you see that the strategy hasn’t worked well before, you can fine-tune the idea or ditch it entirely rather than risking real capital in the live market.

Automated trading systems also calculate an “expectancy” figure, showing you the average amount you can expect to make with a strategy based on how well it’s worked in the past.

Avoids Simple Errors

Since trades are executed automatically, there is no scope for the trader to buy 100 contracts and accidentally sell only 10. It’s common for traders to make errors like this in high-pressure situations where the price is very volatile, and the position needs to be closed.

Improves Order Speed

This is perhaps one of the biggest advantages of using automated trading systems. These systems can generate orders as soon as the set criteria are met. You also will not have to worry about setting up protective stop losses and profit targets when you use these systems since those are generated automatically when the order is placed.

Note:

Future markets move quickly, and opening or closing a trade a few seconds later than you should have often led to a massive difference in the trade outcome.

Diversifies trading

While futures markets are diverse in and of themselves, traders who want to engage in different markets often have to maintain multiple trading accounts. Switching back and forth between these accounts can get taxing. With an automated trading system, you can trade multiple accounts and strategies at the same time. This spreads the risk over the instruments you’re trading and allows you to hedge against risky positions.

While using automatic trading systems boasts many advantages, it does come with some disadvantages that you need to watch out for.

Risk of System Failure

In theory, automatic trading systems are simple to use. You set up some rules, and the system follows those rules and places trades accordingly. While it sounds sophisticated, it too has its flaws. Depending on the platform you use, the order the computer places may reside on the computer and not the server. If the internet connection is interrupted for any reason, then the order may not be sent to the market.

In some cases, the trader could mistake the “theoretical” trades that the system generates with the order entry component of the system. If you plan on using automated trading systems, you can expect a learning curve, and we recommend that you start with trading small amounts till you get used to using the system.

Supervision is required

As great as the idea of trading when you sleep sounds, you will need to monitor the system when you’re using it. There is always a chance that the system may fail. Your computer might crash, or the internet connection may stop working. Also, the system may encounter an error and begin placing errant orders, making you lose money.

Furthermore, monitoring the system is a necessity because you want to make sure that it is making the right kinds of trades at all times. If the market begins going against your strategy, you will be able to create one that takes advantage of current market conditions if you keep monitoring the trading system.

Risk of Over-Optimization

This issue is not specific to traders that use automated trading systems. Any trader that uses backtesting techniques can create a strategy that looks amazing on paper, but backfires in live markets. Traders, especially inexperienced ones, sometimes assume that their trading strategy must always result in a profit. Creating such a strategy is simply not possible.

That being said, it is possible to tweak a strategy such that it achieves exceptional results. A strategy that reaps profits in six of every ten trades is an excellent strategy.

Things to look for in an automated Futures Trading Software

Every automated trading software offers some unique perks and has some distinctive drawbacks. There is no such thing as the ultimate automated trading system. That said, it is possible for you to find software that meets your needs. Here are things you should look for when you’re on the lookout for automated futures trading software:

- Easy-to-use interface: While the software will be doing most of the legwork, it still needs to be managed. The software you use must have an interface that you find easy to navigate, so you can make changes to your strategy on the fly.

- Detailed historical data for back testing: Performing back tests requires access to accurate historical data. The right software will give you access to charted data across multiple timeframes.

- Based on industry-standard programming language: If you want to be able to make custom indicators and truly hand-curated a strategy, you will need to program it yourself. Every trading bot is coded in a different language, so you must use one that is based on a well-recognized language.

Best automated Futures Trading platforms

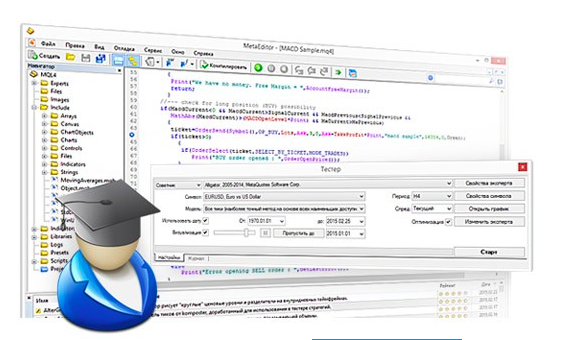

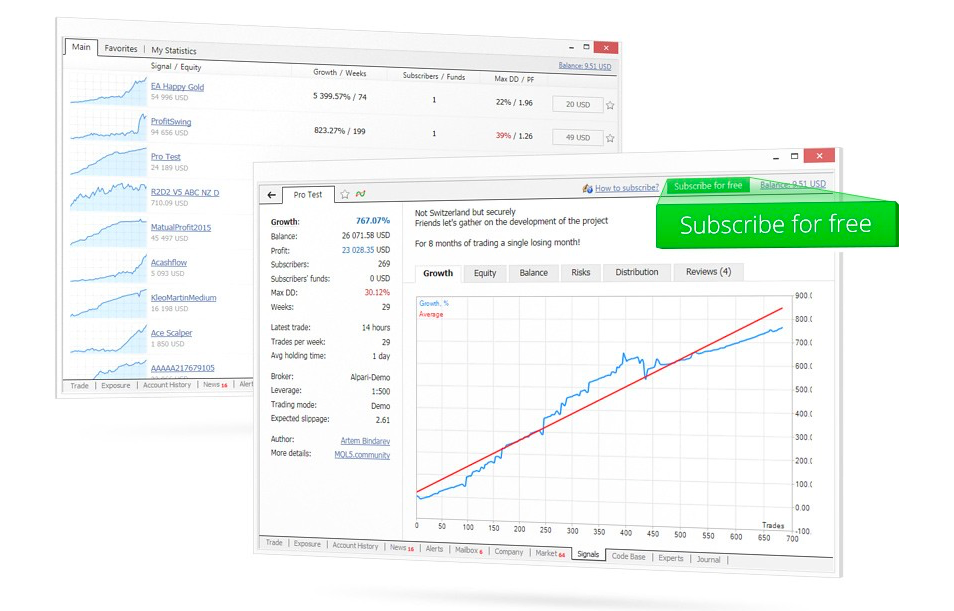

#1 MetaTrader 4

MetaTrader 4 is considered the top automated trading platform by traders of all skill levels. Besides enabling you to trade futures, you can also trade forex, CFDs, indices, commodities, and crypto with the software. To use it, you must connect to the brokers that allow you to link your trading account with the platform. Each of these brokers licenses the platform individually.

Note:

There is no shortage of brokers that link with MetaTrader. It is made available by 750+ brokers.

Features

You can set different types of orders, make an order using the chart with one click. MetaTrader 4 offers another excellent feature called the built-in tick, which aids traders in finding the right entry and exit points. The chart allows you to analyze price movement in nine different timeframes. The platform gives you access to dozens of technical indicators and graphic objects to make analysis easier.

MetaTrader 4 is also available on mobile and gives you full control over your account. The built-in chat option enables you to connect with other traders, and the integrated EAs analyze quotes and execute trades for you without much hassle.

Research Tools

While there are no third-party research offerings, movement alerts and other tools come built-in to keep you in the loop about market events. It is also possible for you to use a plugin to get access to news providers. Feeds from providers such as Bloomberg, Reuters, and many more come integrated into the software. All you have to do is select which ones you want to get your news from.

You can also create a personalized feed for yourself using the API.

Fees

You can get your hands on MetaTrader 4 for free. When you first launch the application, you will be asked to create a free demo account to test the platform’s features. When you access MT4 via a broker, you may get access to additional features that are made available in the Pro account.

Support

The software’s official website has a dedicated page for helping users with getting started. It also has guides to help you learn to alter terminal settings, customize the UI, use the charts, analytics, auto-trading features, and a lot more. If you want to purchase the software, you can get in touch with MetaQuote’s customer support team. You can also get the software through brokers that have licenses for it.

#2 NinjaTrader

NinjaTrader is known for offering a vast array of technical analysis features that come in very handy for new traders. The demo trading features set it apart from the competition. There is a catch, though. The software is only officially available on Windows-based computers. However, you can get access to the software on other platforms on requesting customer support.

Note:

If you have a Mac, you will need to run NinjaTrader using Boot Camp.

Features

All of your orders will be routed through CQG by default. But you have the option of executing your orders via Rithmic and Kinetick. Traders can get their hands on NinjaTrader for free with any funded brokerage account. You will get access to top-notch charting features, market analysis features, and a demo account, so you can test your strategies before investing real capital.

Some of the advanced capabilities of the software are locked behind a paywall. You will need to either lease it quarterly or buy a lifetime license to get access to them.

Research Tools

One of the best features of NinjaTrader is that it gives you access to a high-performance backtesting engine. The engine enables you to test out their trading plans on historical data, so they can gauge its viability. Furthermore, the vast array of educational material available makes it easy for you to learn to use all the platform’s features and enhance your trading skills.

Fees

NinjaTrader is one of the most economical automated trading platforms you can use. The minimum deposit is $1000, and the commissions go as low as $.09 per contract. The margins for day trading are also very low, starting at $500. The platform is available for free, and you can check out all the features, even the advanced features, for free in the demo account.

However, if you want to use the advanced features in live markets, you will need to get a paid license. The company also offers a lifetime license, which gives you access to a suite of advanced features. The automated trading features are only available to the users that get the lifetime license.

Support

You can reach out to the NinjaTrader customer support team via email and phone. Alternatively, you can also fill out the online support form to get the team to address your issue.

Support is offered to international clients in their native language, which is an indicator of excellence.

#3 AlgoTrader

AlgoTrader is versatile, allowing you to trade in futures, forex, options, commodities, and stock markets.

It is the first platform that enables traders to automate cryptocurrency trading. What makes it impressive is that a trader can develop, automate, and execute several trading plans simultaneously.

Features

One of the best things about AlgoTrader is that it offers some seemingly basic features that make trading easier. The platform supports multiple currencies, and you can set it up to convert your currency automatically.

You don’t have to download and install anything to use AlgoTrader. You can access it on the web from anywhere. As soon as you log in, you will see an overview of your account on the screen and get right to managing your trades.

Research Tools

The TradingView chart gives you access to several indicators that make studying patterns and finding trends easier.

You also get access to numerous chart types, all of which allow you to analyze price movements from different perspectives. The charts are customizable, and the drawing tools made available make a trader’s job a tad bit easier.

Fees

There is no free version of the software available. You will need to get a yearly license to get access to AlgoTrader. To request a quote, visit www.algotrader.com/about-us/contact/.

Support

Transitioning to trading with a bot can be challenging. But you don’t have anything to worry about since the comprehensive documentation will help you learn to use the tool quickly.

You can also request remote or on-site training to learn using the platform faster.

#4 The Honest Robot Trader

The Honest Robot Trader (THRT, for short) makes it very easy for you to automate trading. But besides that, it offers a lot of features that make life easier for traders.

What makes it stand out is that the company is willing to guarantee a 5% increase in portfolio value every year, which counts for a lot in a market full of unreliable software.

Features

With The Honest Robot Trader, you can trade E-Mini S&P futures and also NASDAQ futures. The platform also allows you to automate the trading of micro contracts.

One of its best features is that all the bots are set to day-trade – no position is held overnight. The bots will begin trading automatically every morning (eastern time), and positions will be closed when the trading day ends. You don’t ever have to worry about dealing with overnight risk.

Research Tools

All of the bots supplied by THRT can be accessed from anywhere in the world. The bots run on NinjaTrader 8 and TradeStation, and the entire portfolio comprises assets from the most liquid markets worldwide.

With THRT, you don’t have to worry about doing any research. The pre-configured bots evolve with time and make you money on autopilot.

Fees

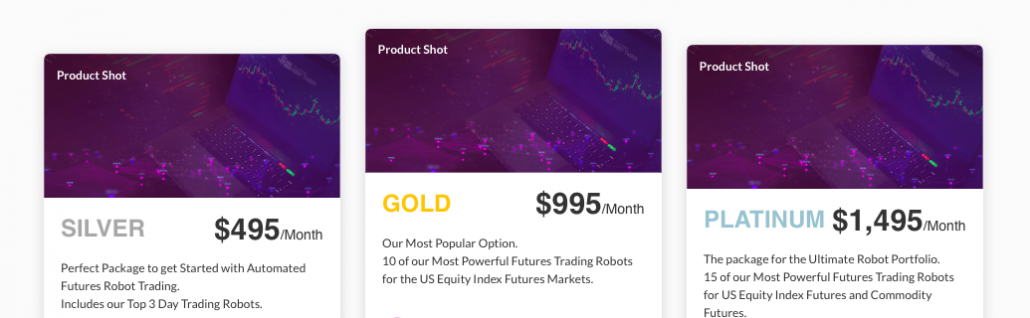

While there is no free plan, the four plans made available come at reasonable prices for what’s offered. The Silver plan gives you access to three bots for $495 a month. The Gold plan costs $995 monthly but gives you access to 10 bots trained to reap high profits. The plan also gives you access to portfolio compounding features.

The Platinum plan is the most expensive plan, coming in at $1495 a month. It gives you access to 15 of the most powerful futures trading bots and dedicated support.

For a limited period, the company is offering Futures Project X, its most feature-loaded product, for a special price.

You will get access to every bot and feature for a small one-time fee of $499. To continue having access to the platform, you must pay $299 every subsequent month. To add to that, THRT couples $2,300 worth of bonuses in the plan at no additional charge during this limited-time offer.

Support

With Futures Project X, you will get access to unlimited VIP email support. The team will respond to your queries in a matter of minutes, so you have nothing to worry about, even if you encounter an issue.

Conclusion: Automated tradings offers high flexibility from different providers

While automated trading is appealing, you should never think of it as a substitute for carefully executed trades. Technology fails from time to time, and you will need to monitor the system, so it doesn’t accidentally lose your money.

That being said, EAs can monitor hundreds of markets and find great profit opportunities for you every second. As long as you have some trading experience and a knack for operating software well, you can find a lot of success using automated trading systems.

FAQ – The most asked questions about Automated Future Trading:

Can automated future trading generate profit?

Automated trading is a stock market trading technique whereby you can get many orders quickly. However, the number of quality orders you will get is not guaranteed. And through this technique, you can acquire huge profits. Using automated trading, you can execute stock market orders at a very high rate and earn better profits with higher volume.

Can server-based trade platforms be used to utilize automated future trading systems?

Yes, traders have the choice to use server-based trade platforms to operate their automated trading systems. Through these platforms, a trader needs to learn the commercial strategies that will help them in sales, and the trader will be able to design their own systems. Using this, they will also be able to host their existing systems on the server-based platform.

What are some best-automated future trading platforms?

Some of the top-ranked automated trading platforms are NFT profit which is best for trading NFTs: Meta Profit which helps in auto trading crypto with a claimed 99.4% success rate; eToro Copy Trading for auto trade crypto, stocks, Forex, and more; TeslaCoin for top new automated trading system and Bitcoin Prime that is best known for automated crypto trading software.

Learn more about future trading:

Last Updated on January 27, 2023 by Arkady Müller

pexels.com/Pavel Danilyuk

pexels.com/Pavel Danilyuk