FX Blue review and test: How good is the forex platform?

Table of Contents

Successful trading on the stock market is characterized by a strategy behind the trading. For this, however, suitable information is needed that allows analysis and, at best, simplifies it. One analysis platform that could be valuable for one’s own strategic stock market trading is FX Blue. We introduce you to our experiences with the free offers.

FXBlue Website

FX Blue at a glance – What is behind the website?

The offer of FX Blue is characterized by quality, reliability, and suitable analysis tools, and this since the foundation in 2009. Traders who specialize in Forex trading can benefit from the free offers of FX Blue and shape their own strategy with the content. Analysis and tracking tools are part of the company’s core offering.

What is particularly exciting is that the tools can be used free of charge by end-users. At the same time, FX Blue also offers services for developers and brokers that complement the software provider’s offering.

By addressing all stakeholders involved in trading, FX Blue can bring added value to one’s own trading, both independently of other tools or by means of a link to trading platforms such as Meta Trader or one’s own broker account.

Integrate FX Blue into your own trading platform

Of course, using a platform like FX Blue standing on its own already has advantages. But if the tools can be integrated directly into existing trading platforms that you own, it makes trading even easier, as trading can be done directly through a tool.

This possibility also exists with FX Blue, albeit with only a few cooperation partners. Considering the free usage, however, it is already great that the possibility exists at all.

In terms of trading partners, FX Blue has aligned itself with the crème de la crème of software providers in trading and therefore offers integration of its own tools in well-known platforms such as Meta Trader 4 and Meta Trader 5. The trading platforms enjoy worldwide popularity. But other trading platforms are also available for trading. These specialize mainly in forex trading – perfect for using FX Blue’s analysis capabilities.

Compatible are the offers of FX Blue thus with the following platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- xOpenHub

- Vertex FX

- FXCM TS2

Integration of FX Blue: Step-by-step guide

In order to be able to use the FX Blue tools to their full extent, it is worthwhile to integrate the tools into your own trading platform at your trusted broker. To do this, you need to proceed as follows:

- Register for a FX Blue Live Account

- Register the broker of your choice under the menu item FX Blue Live Account

- Enter and confirm the registration data

Offers to brokers and developers

Before we talk about the offers for investors, we would like to briefly point out the tools that FX Blue provides for developers and brokers. By the way, developers include both institutional developers and private investors who like to program their own trading signals. So that brokers also participate in a cooperation, there are of course also supporting tools for them.

A special feature of FX Blue’s tools is that many of them can be used as an app. Instead of an app for brokers, an app for developers and an app for private investors, FX Blue offers over 36 apps. Each app is limited to a specific need that could be met through different trading platforms. However, the main part of the apps is focused on MetaTrader offers. A total of 7 apps are available for developers.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) When choosing a broker, the following contents are usually particularly important:

FX Blue therefore compares brokers based on four evaluation pillars:

Training opportunities as well as regulation by a reputable institution such as BAFIN, ASIC or CySEC are important criteria for choosing your own broker. FX Blue compares a total of 13 brokers with each other:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Further training options offered by FX BlueFxBlue Broker Blog FX Blue also knows that further education and information gathering are important in trading and therefore offers suitable news for traders, which are published by brokers. The news section is located on the FX Blue website under the Broker menu item. There you can find direct news about the brokers and their offers, promotions, and training in the form of press releases as well as a news center. The blog posts are certainly much more interesting for traders than the updates about the broker content. Market news, exciting content that could influence trading and more can be read there. This helps with trading itself. Brokers like Pepperstone regularly publish articles there. Trading Mirror: Copying other traders has never been so easyTrading is always associated with emotions. Panic, fear of missing out or the eagerly awaited return can have a direct impact on trading behavior. However, it is not always good to rely on your gut feeling. For trading you need a cool head and at best an objective view from the outside. Of course, this is often difficult to achieve, but there are indeed ways to trade without emotions. One of these chances is Copy Trading and with the Trading Mirror of FX Blue this is possible for every trader. The copy trading works like this: You decide that a strategy should be traded by another trader. You can then have the Trading Mirror send you signals for the respective trades of the other exchange trader. The signals themselves, can be adjusted to your own risk profile. This offers the advantage of trading according to data and actions of other traders and not according to your own emotions. By adapting to one’s own trading profile, there is also no reason to question the signals. It is important to mention that Trading Mirror is only available for MetaTrader 4 and MetaTrader 5. However, the setup is very simple. All that is required is to create an FX Blue Live account, which will then link to the MetaTrader account. You can start copy trading right away. Short summaryFX Blue thus offers a range of options for trading that go far beyond the core offering – the tools. In particular, the available apps enable user-defined trading and thus exciting possibilities to optimize one’s own trading. Furthermore, the copy trading possibilities from the trading mirror are gigantic and have a positive effect on an emotionless trading behavior and that without taking increased risks that go beyond one’s own risk affinity. At first glance, the FX Blue offers seem very promising. However, let’s take a look at the core offer in the following. TRADING TOOLS IN AN OVERVIEW: WHAT DOES FX BLUE REALLY HAVE TO OFFER?The core of FX Blue’s offer are the tools that are offered for trading and there are really many of them. Therefore, you should not miss out on the free offers. How positive is our experience with the FX Blue tools? VERY POSITIVE. The most diverse tools enable an optimal, strategic orientation in stock market trading. So that you also know which tools optimize the forex trade, we present to you all tools of FX Blue. Calculators:Calculation tools are always helpful to quickly put currency pairs into direct comparison, calculate costs or look at currency conversion units. In fact, trading has a lot to do with numbers. The pip has to be calculated, the perfect time to set a stop loss has to be considered and many other numbers play a central role in trading. 7 calculation tools are therefore available at FX Blue, which you can use directly from the website. These are:

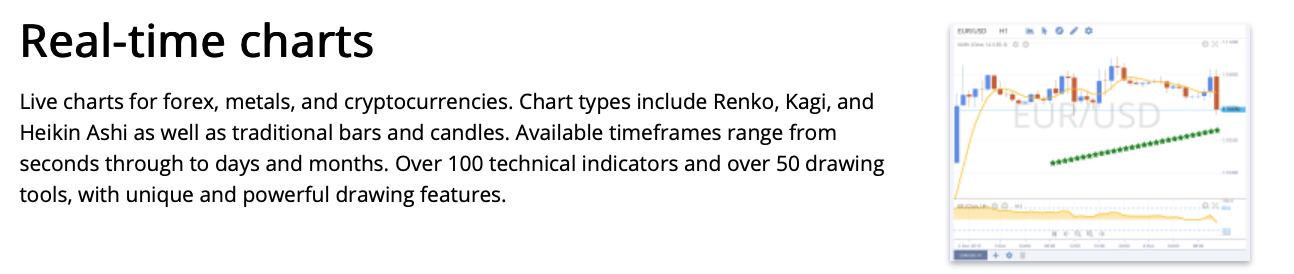

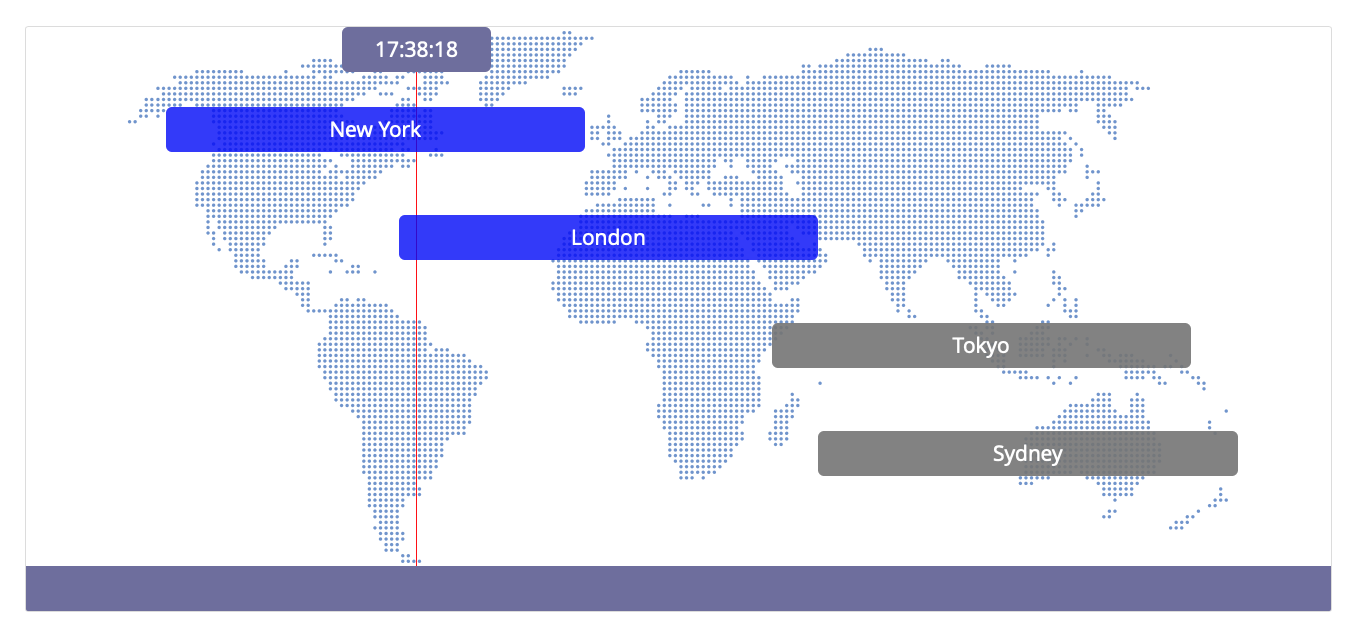

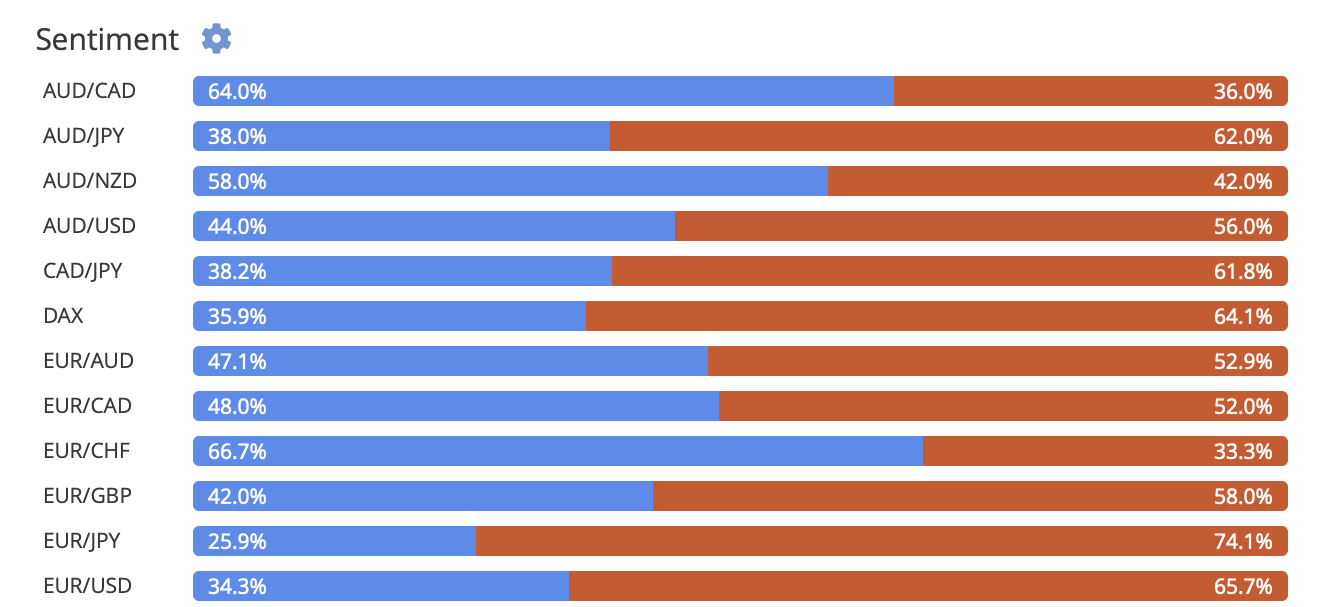

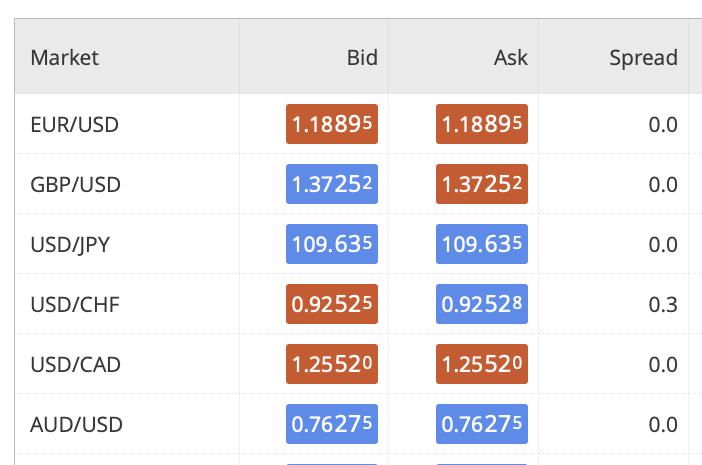

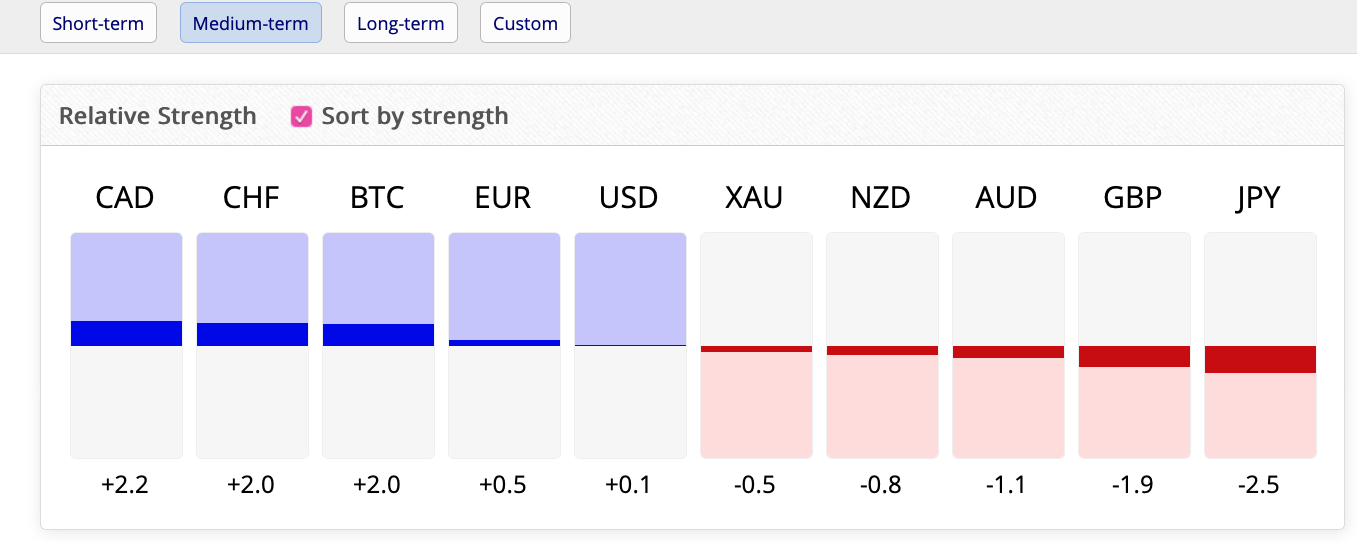

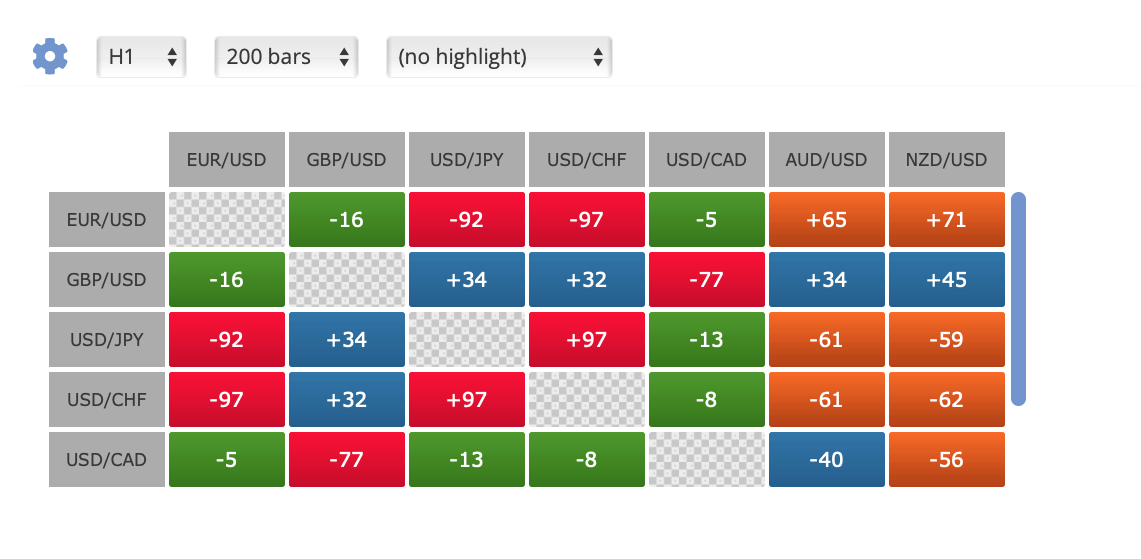

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Real-time-Charts for direct tradingFxBlue Real-Time Charts The chart technique in combination with real-time data is probably one of the most important trading analyses there is. FX Blue’s real-time charts offer over 100 indicators and 50 drawing tools that optimize charting and enable even better analysis. The variety of charts is also gigantic. Both classics and exotics of chart types like Renko are available. The charts themselves map forex, metal and cryptocurrencies for trading, the time frame of which can be determined individually. Session Map: Who is trading right now?FxBlue Session Map Market supply and demand also matter in trading. After all, the battle between bulls and bears is not a well-known stock market image for nothing. With FX Blue’s Session Map, investors can see directly how many traders are currently active in Tokyo, Sydney, London, and New York. This enables a better assessment of the current market situation and whether it is worth entering a market or not. Trader Sentiment: Are we going short or long?FxBlue Trader Sentiment From the behavior of other traders we can derive strategies and adapt to the current trends. This is also possible with the Trading Sentiment tool. It shows whether traders are going net-long or net-short. In this way, you can also better weigh up what is currently the better strategy. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Market Overviews: How volatile is the market?Not only the traders, but also the actual impact on the market should pay attention. In this regard, the trading tool Market Overviews can be useful. It shows, based on different time frames, how much fluctuation is present in the market and whether an upward or downward trend can be identified from what is happening in the market. Tick Chart: Market speed at a glanceTrends and fluctuations in a market go hand in hand now and then, which is why you need more tools to really help Tick charts are perfect for this. Ticks map candles on a candlestick chart and directly show how quickly changes are occurring in the market. The more ticks there are, the more the market changes in all directions as well. Technical Analysis: High importance for placing ordersTechnical analysis is basic for every trader. So it’s no wonder that FX Blue also offers a suitable tool. With the technical analysis tool, investors can make decisions based on various indicators. Pivot points are identified as well as an overriding buy and sell value in percent. Currency Heatmap: What are the exchange rates?The Currency Heatmap shows how a currency pair is currently performing. Is the exchange rate between the currencies falling or rising? Heatmaps can intuitively show how strong the differences in valuation between currency pairs are by using different colors. Quote Board: Let’s take a look at the pricesFxBlue QuoteBoard Not only the differences in the valuation levels of currency pairs but also the prices themselves represent important benchmarks for forex trading. Spreads, as well as matching prices, can be taken from the FX Blue Quote Board. Currency Strength: Which currency is stronger?FxBlue Currency Strength Tool Of course, the currencies do not arm wrestle with each other. However, it is useful for traders to know which currency is currently rated as strong. The visual representation allows a quick overview. Correlation Check of currenciesFxBlue Correlation Matrix The tool shows how strongly currency pairs are currently correlated with each other. The stronger the correlation is, the riskier is the entry into forex trading of the currency pairs. Therefore, this tool is a good indicator for risk decisions. Always make yourself aware of your own risk profile here. If you are risk-averse, should be invested in currencies that have little potential for conflict. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Future Events Scanner: Identify important events on the marketFxBlue Future Event Scanner Events such as company financial statements, press releases, trade alliances, and more can have a direct impact on a market’s prices. This is also true for forex trading. The Future Event Scanner identifies exactly such events that will take place in the future. This allows you to better react to changes as well as identify trends. Tops and flops, the setting of a time frame as well as historical price data can be filtered and viewed with the screener. Summing up: FX Blue is a great tool for online tradingIn summary, we can say that the tools offered by FX Blue leave hardly anything to be desired for Forex trading. The tools are free to use and can be used both independently and in conjunction with a trading platform. This offers maximum flexibility. In addition, calculators and sentiment charts that are mapped in tools provide a quick overview of markets, the behavior of other traders and the current currency fluctuations. Based on one’s own risk profile, appropriate conclusions can then be drawn that fit one’s own trading strategy. Thus, FX Blue’s tools do not really go into depth but are perfect overviews. For the fact that they are free, they are comprehensive and highly recommended. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about FX Blue :What is FX Blue?FX Blue is a service provider that helps you in analyzing and publish the results of your trade. You can review your trades from platforms like MT4, MT5, xOpenHub, FXCM TS2, cTrader, or Vertex FX. How to integrate FX Blue into your trading platform?You can integrate FX Blue into your own trading platform at your trusted broker to reap the full benefits of the tools offered by FX Blue. To do the same, you just need to see a few steps. Firstly, you must website the official website and get register for your very own FX Blue Live Account. After that, you need to choose from the list of brokers under the menu item of the FX Blue live account and get registered with one. Finally, to complete the integration process, you should feed in the necessary details and get confirmed. What additional features does FX Blue offer?FX Blue gives major importance to education, information, and news for making all necessary decisions during the time of trading. Due to this reason, they also provide broker-published news to all the traders on their platform, which is placed under the Broker menu item on the official website of FX Blue. There, all the news is available directly about the brokers, their promotions and offers, and press-released pieces of training. See our other similar blog posts: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-04-20 12:05:062023-01-27 20:15:30FX Blue |