EuropeFX review – Is it a scam or not? – Honest test

Table of Contents

| Review: | Regulation: | Min. deposit: | Assets: | Minimum Spread: |

|---|---|---|---|---|

(4.5 / 5) (4.5 / 5) | CySEC | 1000€ | 300+ | From 0.1 pips |

There are plenty of online brokers online, and EuropeFX is one of them. An online broker uses designated platforms to support trades and usually requires you to do the trading manually instead of relying on an automated service.

EuropeFX offers a lot of products, commodities, stocks, CFDs, Forex, and indices, as well as different platforms to accommodate the strategies of every user.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What is EuropeFX? – Introduction of the broker

EuropeFX is a Forex broker regulated by Cyprus that has been operating since 2013. It is a CFD broker that offers a great selection of various assets and currency pairs. Created by Maxiflex Ltd, EuropeFX is officially registered at 46 Ayiou Athanasiou Ave, Cyprus.

Their main offices are located in Cyprus and in Germany, but it also encompasses multiple jurisdictions such as Austria, Denmark, Finland, Germany, Netherlands, Norway, Sweden, and Switzerland. Among the assets it offers are indices, stocks, crypto coins, and commodities. These also come with six different account types and three trading platforms.

One of these trading platforms is MetaTrader4. There are more than 40 forex pairs available on EuropeFX’s trading platform. The following is a list of exotic currencies:

- Singapore Dollar

- Turkish Lira

- Norwegian Krone

- Mexican Peso

- Hungarian Forint

- Hong Kong Dollar

- Russian Ruble

- South African Rand

- Danish Krone

- Swedish Krona

CFDs are available for the following:

- Gold

- Nickel

- Silver

- Aluminum

- Copper

- Stocks

- Orange juice

- Corn

- Coffee

- Cotton

- Natural gas

- Oil

- Cocoa

- 13 indices

- Other commodities

Traders using EuropeFX gain access to 15 commodities, 50 currency pairs, and 6 cryptocurrency pairs. It also maintains 13 index CFDs, and 111 equity CFDs, bringing up a total of 195 assets across 5 classes.EuropeFX has singled out two equity sectors: cannabis and pharmaceuticals. Most retail traders trying out EuropeFX for the first time will find their selection of assets just right.

As for their trading conditions, clients can start trading with as little as €200, but Europe FX recommends depositing at least €1,000 to open a Bronze account. The spread of a EUR/USD benchmark was found to fluctuate at 0,2 pips. But since EuropeFX takes a commission of $30 for every lot traded, this would bring up the fluctuation to 0,3 pips if the second currency within the pair is USD.

This means a EUR/USD spread has a competitive spread of 0,5 pips. The new European Securities and Markets Authority regulates the maximum leverage of EuropeFX. Leverage is capped at 1:30 for forex trading, but EuropeFX can offer leverage up to 1:200 for a professional trading account.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Is EuropeFX regulated? – Regulation and safety

EuropeFX holds an STP trade execution license. It uses a straight-through processing (STP) order execution model and is licensed by The Cyprus Investment Firm (CIF). Maxiflex Global Investments Corp Limited is EuropeFX’s brand, and the Cyprus Securities and Exchange Commission (CySEC) regulates the trade broker.

It is also partnered up with the Investor Compensation Fund (ICF), and EuropeFX has compliance with The Markets in Financial Instruments Directive (MiFID II).

Among the supervisory bodies that help regulate EuropeFX are:

- FSA of Denmark

- FSA of Finland

- REGAFI of France

- AFM of Netherland

- FCA of Britain

- FSA of Sweden

- BaFin of Germany

- FMA of Australia

- CNMV of Spain

- CONSOB of Italy

Furthermore, EuropeFX EU’s 5th Anti-Money Laundering Directive. Deposits made by clients are segregated, and they offer negative balance protection.

Thanks to the ICF, deposits of up to €20,000 are protected. There is also a cross-border regulation across countries that are part of the European Union, such as Germany, France, Italy, Poland, Ireland, Sweden, Spain, Netherlands, Romania, etc.

However, this regulation of European countries comes with account conditions like leverage and bonuses. These may not be as enticing compared to what other brokers have to offer. Despite all that, EuropeFX offers a secure environment fit for trading so that traders feel safe while using it.

Is there a negative balance protection?

Negative balance protection ensures that you don’t lose more than what you had initially deposited in the first place. This means you don’t end up owing any money in a losing trade. In case markets move rapidly against your trades and you end up in a losing position, negative balance protection is there so that the minimum balance possible in your account is zero. Luckily, EuropeFX does offer negative balance protection, thus ensuring the security of its customers.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

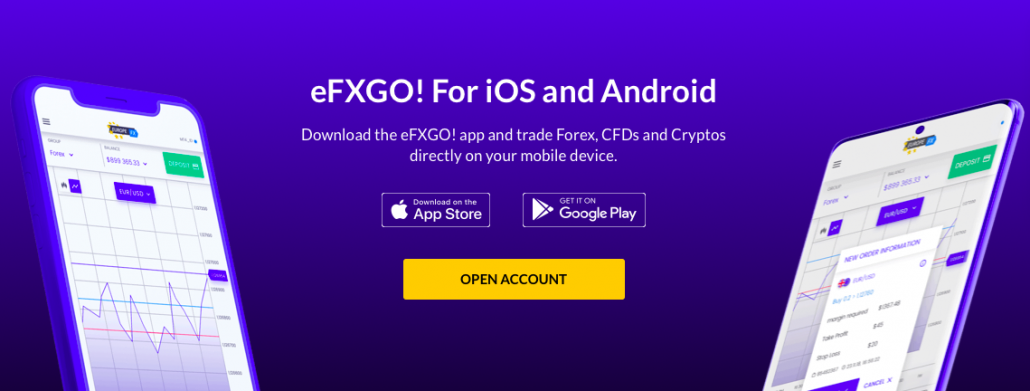

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) Test of the EuropeFX trading platformsEuroTrader 2.0EuroTrader 2.0 is an alternative to MT4. It is a recent addition to EuropeFX’s lineup. It uses resources lightly and comes packed with features all traders want in their CFD and forex trading platforms. Its features include the following:

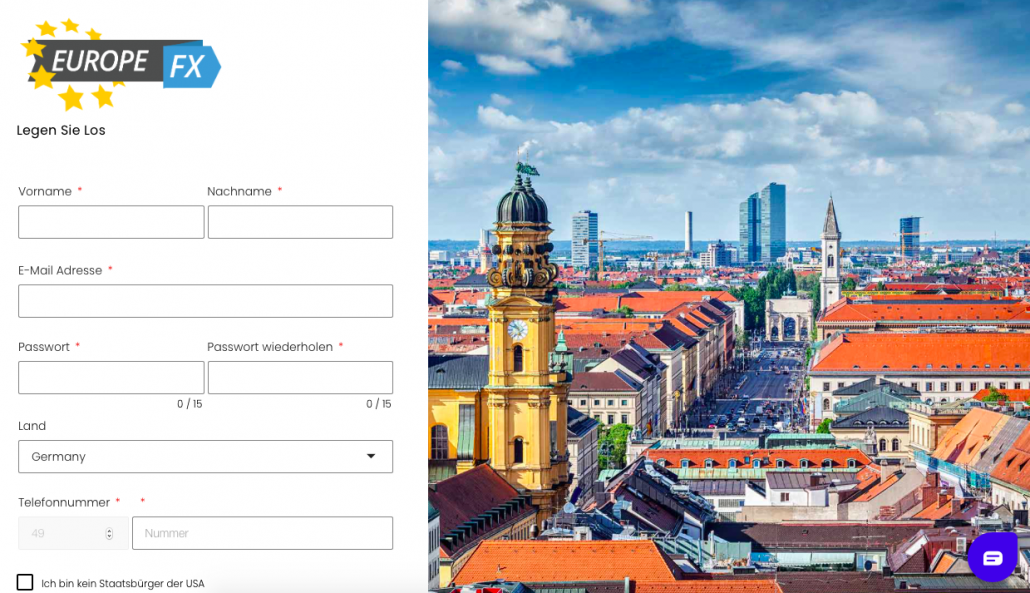

MetaTrader 4Also known as MT4, MetaTrader 4 is one of the best and most popular forex and CFD trading platforms worldwide. MT4 has a lot of advanced trading features that are placed in a user-friendly interface.  The programming language MT4 is built on is the powerful MQL4. The community of traders and developers using MT4 is highly active. There are a lot of analytical tools that come with MetaTrader 4. They offer up to nine time-frames for each of the assets supported on the platform. It has a built-in library of more than 50 technical indicators and access to sophisticated analytical tools. Traders have all the tools they need to identify their trends, and entry and exit points are well-defined for all traders tanks to the use of advanced order types. The MT4 platform allows traders to apply mechanical strategies in the market through the use of incorporated algorithmic trading. Since MT4 has multiple liquidity providers, EuropeFX is able to ensure that all of its platform’s streams live interbank prices in real-time. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Charting and AnalysisMetaTrader 4 is best known for its use of charts as well as its trading from charts feature. It uses trade alerts to accurately track the market conditions of any assets you may be focusing on. It uses signals configured to suit your trading style in order to gather this information. Custom indicators are the technical indicators of MetaTrader 4. You can create additional indicators on top of those that have already been integrated into the platform. These indicators are not meant for automatic trade. Rather, they are for technical analysis. Mobile TradingEuropeFX has an app available for mobile traders. It’s called FXGO! and is available for use on both iOS and Android systems. The app synchronizes with EuropeFX accounts and comes with a standalone trading suite with a client area that is user-friendly. Real-time market data is accessed by the app, and it also contains advanced charting tools and access to the EuropeFX analysis portal.  There are also apps for some of the MetaTrader platforms. For MT4 platform users, there is an MT4 app for tablet users and mobile users. All order types are offered within the app, as well as execution modes, custom indicators, interactive charts, and full trade history. Since it is an app, push notifications are available, and you can use the mobile chat forum to ensure you don’t miss anything. The app has received mostly good reviews online, but there are some minor complaints about technical issues. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) How to trade with EuropeFXBefore you start trading on EuropeFX, you need to learn the basics in order to develop a balanced understanding of how the stock market works. You can take online courses, or you can also try stock trading classes and attend them in person. Choose an option that is fit for you. The good thing about EuropeFX is that its interface is user-friendly for both experienced and beginner traders. It also provides plenty of resources and materials you can train with before you start trading. In order to start trading, you need to select different asset classes. Venture into commodities and Forex instead of just trading stock. Implement different strategies in trading stock so that you can figure out which strategy brings in more benefits for you. Once you want to start trading on EuropeFX, you will want to register on their website or use crypto trading robots like CryptoSoft. It is very easy to trade on the platform. Most beginners will be able to use it within a few minutes, while more experienced traders can use the complex functions MT4 has to offer. Users are able to access features such as their trading charts, asset list, trading history, etc. You will be able to see the list of products that are available for trade on the left side of the page. On the right side, you will see the chartings, and at the bottom, your trading history. Through the interface, you can also click on an asset, which will lead you to a pop-up screen showing its details. After you see its details, you can then decide whether or not you want to invest in it. How to open your trading account You can register for a EuropeFX account by preparing the necessary personal details and documents to verify your identity. You just have to go to their website and fill out all the necessary information. All you need is about 36 seconds to complete your new account application. Connecting it to your Google or Facebook account makes the process go faster. You need to verify your account in order to comply with stipulations mandated by the AML/KYC. Usually, you will need to provide a copy of your trader’s ID and a document that proves your residency. Since EuropeFX complies with its regulators, then it can be trusted with these kinds of sensitive information. EuropeFX offers five different account options for its clients. Each account option has a unique feature and a different deposit amount: Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) BronzeThis is the most basic and simplest account offered by EuropeFX. The Bronze account requires account holders to pay a minimum deposit of €1,000. Through this account, clients are assigned a relationship manager for a temporary trial period as well as access to a Trading Central Daily Newsletter. Premium signals that come from the Trading Centre are also accessible through the trial period. On top of this, they also receive individual private sessions with the Trading Academy of EuropeFX. Unfortunately, Bronze account members do not receive the following features: private trading sessions, SMS trading alerts, Event Room access, and VIP services. Copy-trading tools such as RoboX and Mirror Trader will also be unavailable for Bronze account members. Any trading commissions using this kind of account are only standard. SilverA definite step up from the Bronze account, the Silver account requires account holders to pay a minimum deposit of €2,500. More features can be accessed by choosing this account. Clients will still receive the same features from the Bronze account, such as a relationship manager for a temporary trial period and the Trading Central Daily Newsletter. Premium signals that come from the Trading Centre are also accessible through the trial period. But unlike Bronze account holders, Silver account members get three individual private meetings per month from the Trading Academy of Europe FX as well as access to Mirror Trading. Similar to the Bronze account holders, Silver account members do not have access to private trading sessions, SMS trading alerts, Event Room access, and VIP services.  GoldThe Gold account requires account holders to pay a minimum deposit of €10,000. Unlike Bronze and Silver account holders, Gold account members are no longer limited to trial periods. They are assigned a relationship manager and the Trading Central Newsletter. On top of that, they will also receive premium signals from the Trading Centre. On top of that, clients who choose this type of account have four individual private sessions with the Trading Academy of EuropeFX and two private trading sessions each month. They now have access to SMS trading alerts, RoboX, and Mirror Trader. Any trading commissions from this type of account receive up to a 10% discount. PlatinumThe Platinum account requires account holders to pay a minimum deposit of €25,000. Clients receive all features that are accessed by Gold account holders like a relationship manager, Trading Central Newsletter, and premium signals from the Trading Centre. Instead of only receiving four individual private sessions at the Trading Academy of EuropeFX, platinum clients receive eight of these sessions. And they have access to four private trading sessions each month. Additionally, platinum account holders can access a maximum of two events in the event room per month. They also receive SMS trading alerts, RoboX, and Mirror Trader. Any trading commissions from this type of account receive up to a 25% discount. Unfortunately, the platinum account does not offer any VIP services. PremiumThe Premium account requires account holders to pay a minimum deposit of €50,000. Since they are a step up from the platinum account, premium account members have access to everything the previous account types did not have:

Any trading commissions from the platinum account receive up to a 25% discount. VIP services are also available, but it is still on its trial period. Since this is a premium account, users can personalize depending on their personal goals. But all premium accounts have the following primary features:

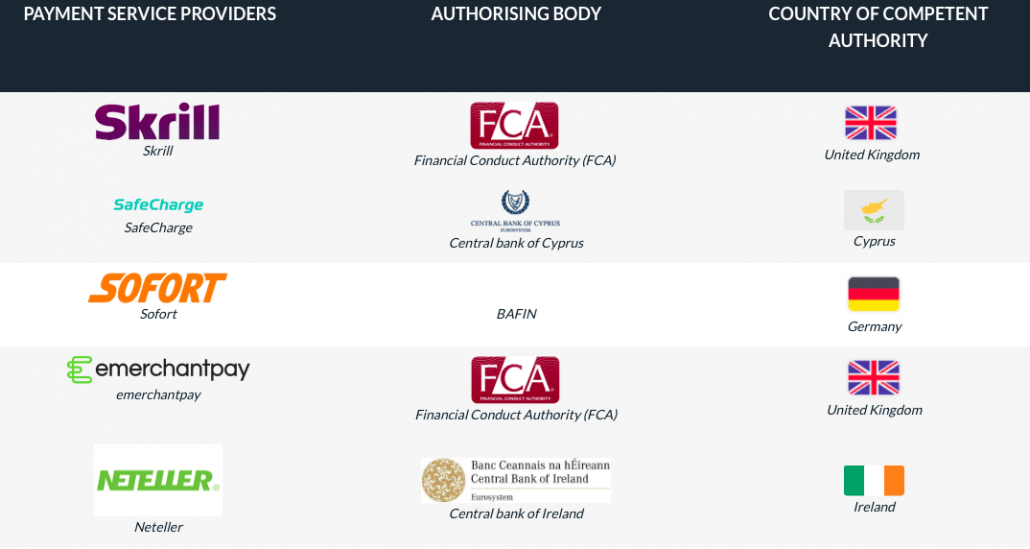

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Demo accountIt is risky to pin all your money immediately without knowing the layout of EuropeFX’s trading platforms. You can test out all the trading platforms offered by EuropeFX by creating a demo account for free. Through a demo account, you will be able to learn the ins and outs of the broker’s trading platforms. Most users choose not to invest until they’re done with the demo account. EuropeFX’s offered demo account is completely free to use and poses no risks at all. You receive virtual money (€100,000) when you try out this feature so that you can familiarize yourself with the platform. It is advised that you use demo accounts before you initiate a live trade that uses your own real money. EuropeFX’s demo account lasts for 30 days from the date of registration.  Deposits and withdrawals with EuropeFXThere are multiple ways to deposit and withdraw money using EuropeFX. All methods are regulated and authorized by European standards such as the FCA and BaFIN. Meanwhile, the minimum amount required for withdrawal is 1 GBP/USD/EUR, while the maximum amount you can withdraw is the available equity in your account.  EuropeFX does not charge any deposit fees, but it does charge withdrawal fees that are worth 25 GBP/USD/EUR and may take 24 hours to 5 days to process. In order to have a smooth transaction for both depositing and withdrawing, AML guidelines must be complied with, and the name found on the trading account must match the name indicated in the payment option. EuropeFX prides itself on transparency and follows the guiding principle of Client Fund Security. All payments are managed through the Level 1 PCI international payment service, and all transactions are processed through EuropeFX’s platforms. This ensures that all transactions go through the advanced 128 SSL encryption so that the client’s data remains confidential. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) Support and service for clientsThe opening hours of EuropeFX’s platforms are 24 hours every day except Sundays. However, these timings can often differ depending on the market.  You can find this information on the trading platforms or a website’s asset index. All times indicated are GMT+2/GMT+3 DST. EuropeFX also offers multiple platforms for customer support. They offer a live chat service, which you can access through their website. Just click on the logo located in the bottom corner. Other than their live chat service, you can also try messaging apps such as Telegram, Viber, and Whatsapp. Although, these apps are usually only used to submit any necessary documents. You can also try contacting them through the following methods:

Their support team can help answer all your queries, from opening and closing an account to Bitcoin rush trading. Conclusion of the EuropeFX reviewUsing an online broker such as EuropeFX does not guarantee you an immediate profit. Investment products depend on the cycles and trends ongoing in the market. It may take a few weeks before you are able to see potential returns on your account. Despite claims that EuropeFX is a scam, it is actually a legitimate online broker and not a scam. It is well-regulated and very transparent with the price quotes. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 75% of retail CFD accounts lose money) FAQ – The most asked questions about EuropeFX :What are the most popular Forex pairs?The most well-known and most liquid forex available on the market is usually paired. In no particular order, these pairs are USDCHF, USDCAD, USDJPY, AUDUSD, GBPUSD, NZDUSD, EURJPY, EURUSD, and EURGBP. Can you trade stocks in EuropeFX?Stocks is one of the most popular markets out there and you can trade stocks in NAGA. Can I share my account with a business partner or anyone else?No, you can’t share an account. How does EuropeFX make money?Spreads and commissions are applied in every transaction made through EuropeFX. Through these commissions, the company earns. Additionally, the company also charges a $25 fee for all withdrawals and a $50 inactivity fee every three months. By adding all these surplus amounts, EuropeFX manages to earn quite a good deal. What countries does EuropeFX not accept?There are many restricted jurisdictions from where EuropeFX does not allow customers, like Israel, North Korea, the USA, Australia, the United Kingdom, etc. Apart from these, EuropeFX has a very wide network and serves almost all the countries of the world. It is very popular in all the countries in which it is legal. Where is EuropeFX based?EuropeFX has many offices, some of which are in Cyprus, Berlin, Limassol, Malta, and Germany. However, EuropeFX accepts clients all over the world. Does EuropeFX charge fees?There is a lack of pricing transparency at EuropeFX. However, as per the information available, it levies a 7% trade commission. The trading costs include swap rates on leveraged overnight positions. Most probably, it is the most important trade fee of EuropeFX. Those who wish to trade on EuropeFX must evaluate the total costs before starting their trades. Check out our similar blog posts: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Europe-FX-Logo.png 69 173 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2021-02-28 15:44:492023-01-27 20:02:54EuropeFX |