Top 11 Future trading strategies for novice traders

Table of Contents

Futures markets are vast and versatile — you can trade everything from corn to cotton to crude oil with futures. But that’s not the only advantage of trading these derivatives. Traders that trade futures are not tied down to one sector of the economy, and their portfolios are relatively safer during periods of strong economic movement.

That said, futures are also known to be volatile, and the broad price swings put traders at greater risk of losses. Getting into futures trading without having a strategy in place is akin to gambling away money. The stakes are high when trading futures, and losses are inevitable if you go at it without a well-reasoned strategy.

Besides using technical analysis to study the potential movement of the price, learning tried-and-true strategies will give you the upper hand regardless of the market or futures you trade. We’ve outlined the 11 best futures trading strategies you can apply to improve your chances of trading success.

A quick refresher: What are Futures? How do they work?

Futures are contracts that obligate two parties – a buyer and a seller – to transact, that is, pay for and deliver an asset for a stipulated price at an agreed-upon date. These contracts are different from options, in which neither the buyer nor the seller is obligated to transact with the other party.

If you trade futures, you must oblige by the terms of the contract when it expires. Factors like the current market price of the contract or the underlying asset do not affect your contract. The price of futures contracts depends on the price of the underlying asset. The price of a futures contract is also influenced by the expiration date. Gold, crude oil, natural gas, and financial instruments like stocks and currencies are the most popular underlying assets for futures trading.

You must also note that futures contracts are standardized, and the quantity of the underlying asset to be bought and sold is always stated in the agreement. If you’re trading a contract on British Pounds, the size of the contract will always be GBP 62,500.

A crude oil contract always has a size of 1,000 barrels, and a corn futures contract will always have a size of 5,000 bushels.

How Futures work:

A futures contract can be used for hedging or speculating. Hedging means protecting from loss. Let’s say a farmer growing coffee wants to protect himself from a potential drop in price in the future. The farmer can buy a futures contract, and since the agreement mentions the amount he will be paid and the date he must deliver the coffee, even if the price of coffee goes down in the future, the farmer will not incur any losses.

However, most traders use futures for speculating. A trader can make a profit by analyzing trends and leveraging the fall or rise in the price of an asset. Traders rarely hold a contract till expiration, since they’re not interested in taking physical delivery of the goods. If a contract makes them money, they sell it off much before expiration.

11 Best Futures Trading Strategies:

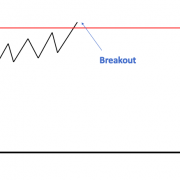

#1 Breakout Trading

A lot of traders counting on the breakout trading approach to make them money, and for good reason. As the name of the strategy suggests, the breakout trading approach makes traders money by leveraging the market’s volatility. In other words, when an asset’s price is “breaking out” of its usual chart patterns, trend lines, channels, and other indicators, this strategy is applied.

To use this strategy, you must learn to recognize chart patterns that signal the continuation of the trend – upward or downward. Chart patterns to look for include:

- Triangle pattern

- Pennant pattern

- Rectangle pattern

- Double tops and bottoms

- Head and shoulders pattern

After a breakout, the price of an asset becomes exceedingly volatile. Traders prepare for breakouts beforehand, setting up pending orders such as buy and sell stops to automatically make money when the asset’s price reaches the specified level. The idea is to make good use of the volatility and take positions in the direction of the price movement.

Stop-losses are also used to execute this strategy. If you’re going short, you must place a stop loss a little above the technical level when the breakout began. For a long position, the stop-loss must be placed just below the technical level.

The take-profit targets you must set depends on the type of breakout. If you see a head and shoulders pattern, the profit target is equal to the pattern’s height. On the other hand, if you see a triangle or rectangle pattern, your profit target must be set to the height of the pattern measured from the base.

You could also set profit targets by analyzing recent swing highs (or lows). Short-term support and resistance levels are also excellent indicators of profit targets you can expect.

#2 Fundamental Trading

While most strategies require you to carry out technical analysis, you must remember that most asset volatility is catalyzed by a change in an assets’ fundamentals.

The fundamentals of an asset both initiate and reverse trends, which is why an intelligent trader bases 80% of their trading decisions on fundamentals. The technical analysis must account for no more than 20% of your trading decisions for a maximum chance of success. Staying in the loop about the changes in fundamentals requires continual study of reports and tracking major announcements that will affect the asset’s price.

If you’re buying and selling stock futures, company announcements, reports of raw material shortage, and bleak quarterly reports may cause a rapid rise or fall in prices that you can coattail on to make money. But there are some drawbacks to relying on fundamental analysis for futures trading. You will never know how high or low the price of an asset will rise or fall. You will need to couple your findings from fundamental analysis with the results of technical analysis to determine whether you should go long or short.

Furthermore, technical analysis is the only reliable tool you have to set well-grounded profit targets and stop-loss levels.

Trend checks:

One of the most effective ways of using fundamental analysis is to check the last three trend reports of the asset.

Let’s say you’re trading currency futures. You can check the economic growth reports and gather information from inflation and labor market reports since central banks use these same reports to rework their policies. If growth is down, inflation is slow, and labor markets are weak, you can expect banks to cut rates to stimulate economic activity. On the other hand, if economic activity is flourishing, unemployment rates are low, and the inflation reports correspond with the targets set by the central bank, you can expect interest rates to go up and subsequently expect the currency to appreciate in value.

Note:

You can apply trend checks to any market, including stock markets, commodity markets, and metal markets, and find profit opportunities.

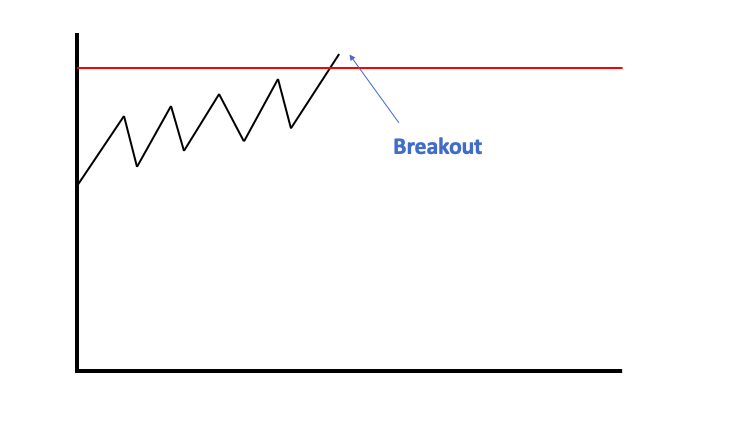

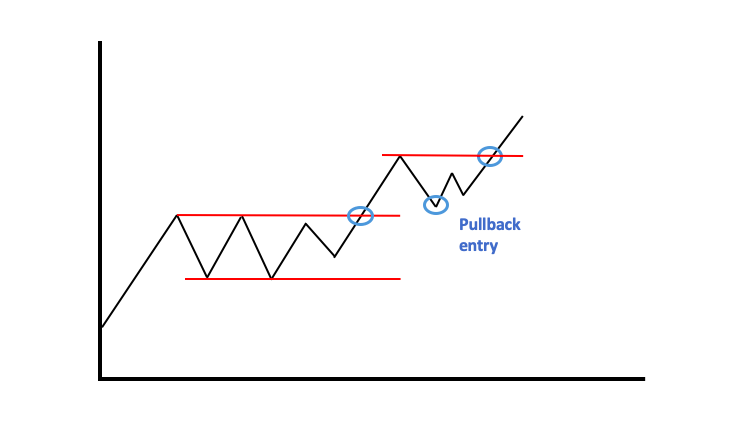

#3 The Pullback Strategy

As the name suggests, the pullback strategy makes use of price pullbacks to make a trader money.

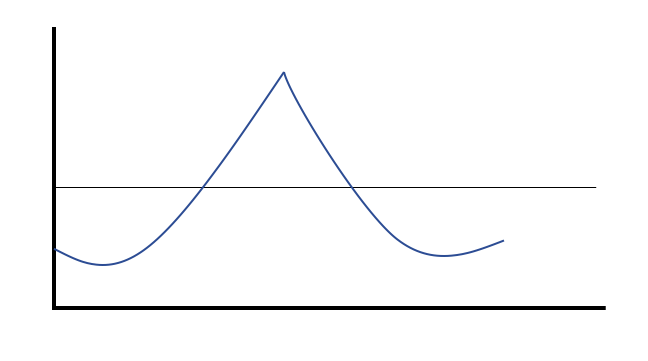

A “pullback” happens after a price breakout. In the breakout stage, the price of a trending asset rises past or dips below a support/resistance level, and in the pullback stage, the price movement is reversed. The price will rise past a well-founded resistance level in an uptrend, reverse, and then retest the level again. After retesting, the trader must enter a long position aligned with the upward trend.

In contrast, during a downtrend, the price will dip below a well-founded resistance level, reverse, and then retest the level again. In this pullback, the trader must enter a short position aligned with the downward trend, then wait to see the profits roll in.

How Pullbacks are work:

When traders start cashing out their profits, the asset’s price is driven in the opposite direction of the breakout, causing a “pullback.”

At this point, the traders that missed out on the initial trend wait for the price to drop back and normalize to the support/resistance level. These traders intend to enter at a lower price and wait for the price to be driven back up again. When a critical support or resistance level breaks, its nature changes, and it turns into a resistance or support level, respectively. Pullbacks take full advantage of this phenomenon. While you can observe this phenomenon on larger timeframes such as the daily timeframe, they are sometimes observed in shorter timeframes such as 30-minute and 1-hour timeframes.

When applying this strategy, place your stop-loss orders below the support level (previously the resistance level) during an uptrend. Set a recent high as your profit target, and wait for the position to work out.

In a downtrend, you must place your stop-loss orders below the resistance level (previously the support level). Set a recent low as your profit target, and wait for the position to make you money.

#4 Trading the bounce

Some markets have a higher tendency to follow a specific trend. Stock markets are an excellent example of these markets. But there are other markets, like the currencies market, where assets typically trade in a range. To use this strategy, you must understand the fundamental meaning of a resistance level. If an asset is having difficulties rising above a certain price, that price level is called the resistance level.

The market includes traders holding all types of positions. However, when the price reaches the resistance level, some traders will close existing positions and take their profits, while others will open short positions in hopes of making a profit. Both of these actions put pressure on the asset’s price, driving the price back down. Traders who read the market right and open short positions at the right time make profits.

Consider an alternate scenario: an asset’s price is struggling to fall below a certain level and reaches the resistance level. Some traders will close their short positions and leave the market with profits, while others will buy at lower prices to sell high later. Both of these actions will increase the buying pressure on the asset and drive the price up.

While the strategy sounds simple, you must be careful with it. Before you place any orders, ensure that the asset is actually trading in a sideways range. To do this, look for the absence of higher highs or lower lows when studying the asset since these indicate that you’re in a ranging market and can use this strategy. You could also use indicators such as the ADX indicator. The ADX indicator follows trends and will show you if you’re in a ranging market at a glance. If the ADX value is below 25, the market is not in a trend.

Stay sharp since you don’t want to stay in the trade if the support or resistance level breaks. If you’re buying, place your stop-loss below a critical support level, and if you’re shorting, place it above a resistance level. However, remember to account for fake breakouts and market noise and leave some room for volatility when setting your stop-loss level. Set your profit target close to recent highs/lows or other critical technical levels.

#5 Buyer and Seller Interest Strategy

Studying the buyer and seller interest data is one of the smartest ways to decide whether you should be buying or shorting a futures contract. The reasoning behind this is that the data is derived from the Depth of Market window, which shows the volume of open buy and sell orders for futures contracts at all price levels.

Depth of Market data, or Order Book data, reveals the liquidity of the asset. A lower number of orders at a price means lower volatility, and vice versa. The data is updated in real-time and reflects the trading activity in the market.

Stocks and most other instruments tend to move towards the price that has the most number of orders. Let’s say a stock is trading at $100, and the Order Book reveals that there are 100 buy orders at $110, 200 at $111, and 400 at $112. There are 40 sell orders at $99, 60 at $98, and 150 at $97.

With this data, you can make out that there is a higher interest in buying than selling and position yourself in the market accordingly.

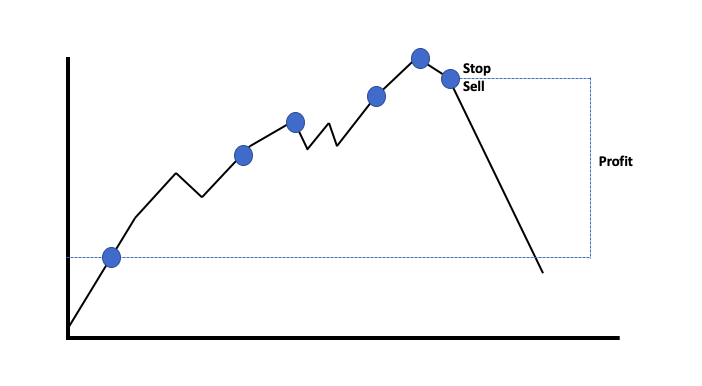

#6 Trend Trailing

Trend trailing is one of the best strategies a novice trader can use. There’s a proven history of it working, and executing it is quite easy. The strategy is easy to understand. If you see the price rising, go long, and if the price is falling, look for a suitable short position. But trend trailing gets frustrating because many traders don’t know when to close the trade, regardless of if they’re going long or short.

To understand when the right time to close the position is, you must understand how to spot trends.

When the price of an asset goes up, you will see that the price hits higher highs and higher lows. The downtick in the price, which is the higher low, results from counter-trend moves such as traders selling off and taking their profit. It is sensible to buy in on the trend when the price is hovering around the higher low since it is the exact point where the trend should resume going up. You can apply the same blueprint for a downtrend – if you see the top of a lower high, it’s the right time to open a sell position.

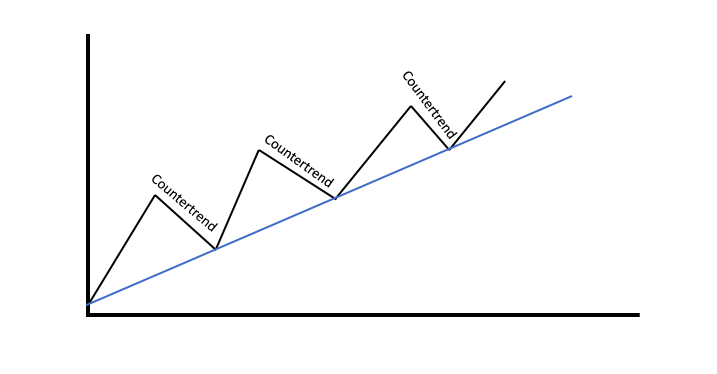

#7 Trend Countering

The idea behind this strategy is to take positions in the opposite direction of a trend. When using this strategy, a trader must set their mindset to look for sale opportunities when the price is rising and buy opportunities when the price is falling. The strategy is not baseless. Every time there is an impulse move on the market, a price correction follows it.

Traders using this strategy must place targets at the 50% mark of the impulse move. Alternatively, traders can also set the target at an important Fibonacci level. Bear in mind, though, using the counter-trend strategy is a lot riskier than most other strategies.

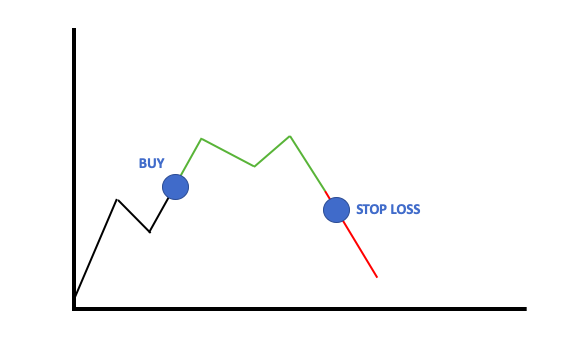

#8 Long Trading

The long trading strategy is perhaps the most basic futures trading strategy. It simply means buying a futures contract expecting its value to rise before the contract expires.

Going long is best to do when you’re expecting a clear upward movement in the price of the underlying asset. Fundamental analysis and technical analysis can help you estimate the right time to buy-in. Using the strategy to trade futures contracts offers you an uncapped advantage – as long as the price rises, you will make a lot of money.

However, long trading isn’t without its risks. If the price goes down, you stand to lose a lot more than you initially invested, since futures contracts involve a lot of leverage.

#9 Short Trading

Short trading is the opposite of the strategy mentioned above. A trader sells a contract at its current price, expecting the price of the futures contract to fall so they can repurchase it and pocket the difference.

It is a straightforward strategy, but it’s a lot riskier than long trading. In long trading, the worse that can happen is that the underlying asset’s price could hit zero, meaning there is a limit to how much money you could lose.

However, since there is no limit to how much the price of the underlying asset could rise, the potential risk is unlimited. You must be very careful when trading futures contracts short since it is discernibly one of the riskiest strategies you could apply.

#10 Spread Strategy

Buying a futures contract and selling another one later is all that entails the spread strategy. The idea behind the strategy is that you’re going to profit from the unanticipated change in the relation between the two contracts. You will be trading the difference between two contracts.

Using this strategy will lower the risk of losses since each spread is a hedge limiting the amount of money you can use. The best thing about this strategy is that its effectiveness isn’t reduced even when markets are highly volatile.

#11 Calendar Spreads

Calendar spread strategies involve trading contracts on the same asset, but every contract has a different expiration date.

Bull Calendar Spreads

The bull calendar spread strategy requires you to buy a short-term contract and short a longer contract. Positioning yourself this way in the market reduces the risk of loss by getting rid of the driver of the contract’s value, which is the underlying asset. The goal with bull calendar spreads is that the spread must widen in favor of the short-term contract.

The advantage of this strategy is that there are multiple ways for you to profit since the spread can widen in a few different ways. The prices of both can go up or down, but as long as the spread widens, you will make money.

Note:

The strategy is best used when a trader expects the long contract to rise in price more than the short contract does. While the approach is more conservative than the others, the risk it reduces makes it worth applying to sensitive trades.

Furthermore, you don’t need as much money to use this strategy as you do for buying a one-leg futures position. The lower margin requirement allows you to make a bigger return from the trade.

Bear Calendar Spreads

The bear calendar spread strategy involves shorting a short-term contract and going long on a long-term contract. However, the aim of this trade is the same as the bull calendar spread strategy – the spread must widen in favor of the short-term contract.

Since the two contracts can move in many ways, like in the bull calendar spread strategy, there are several ways to win with a bear calendar spread. As long as the spread widens over time, you will make money. You must use this strategy when you expect the contract you’re shorting to increase more than the contract you’re going long-on. In this scenario, the spread between the two will be the widest, reaping you maximum profits.

Another similarity this strategy shares with the bull calendar spread strategy is that it requires less capital to set up than a one-leg futures contract. The position is less volatile, and similar to its bullish counterpart, is considered a conservative move.

However, you also enjoy higher returns as a result of the lower capital invested.

Picking the right Futures Trading Strategy

A smart trader always plans out how they will make decisions during the trade before they actually open any trade. The first step to take is to study the market before opening any positions thoroughly. Some of the questions you must ask yourself before you begin trading are:

- What is my goal with this trade?

- How much risk can I tolerate? Does my risk tolerance tally with the risk involved in this trade?

- If things go wrong and the trade doesn’t go my way, when and how will I pull out of the trade?

- What types of orders will help me make money in this trade?

- How will I keep track of market developments and price movements?

Answering these questions and reflecting on the consequences of every move you make will create a mental guide that will help you navigate the trade.

Common Futures Trading mistakes to avoid

You can apply many trading strategies to make money, but there are some you should avoid using when trading futures.

Using Scalping Strategies

We recommend that you steer clear of using scalping strategies. These are strategies that make you money, leveraging the smallest of movements in the price in extremely short timeframes. Traders, especially novice traders, find its fast pace appealing and often end up losing a lot of money because they didn’t understand what they were doing. Making profits using scalping techniques is difficult. Besides having the discipline and learning the ability to stay calm, a trader must have experience, so they know how to operate in all types of circumstances.

If you want to apply scalping strategies, make sure you’ve gotten enough practice with long-term strategies like swing trading and are able to make profits consistently.

Risk warning:

Futures are incredibly volatile, and diving straight into trading with scalping strategies can leave you in a devastating financial position.

Trading in Illiquid Markets

The number of buyers and sellers in the market determines the liquidity of the market. Some assets never face shortages of traders to make deals with. Stocks of tech firms like Apple and instruments like the EUR/USD pair have numerous market participants. Large trading volumes are an indicator of low volatility and other trading risks. However, you will come across assets that seem lucrative to trade but have low market volumes.

Low market volume translates to high volatility, and trading assets with this characteristic will lose you money.

Holding positions over the weekend

Your position may be exposed to unfavorable market events overnight, making your strategy worthless. Avoid holding positions overnight and especially over the weekend.

Importance of Sticking to a Trading Strategy

Choosing a strategy and sticking to it is important for several reasons. The most important of which is that sticking to strategies keeps you disciplined. Future contracts involve leverage and allow you to operate in even the most volatile of markets.

Not having a blueprint to guide you when you need to make a decision will leave you directionless. Fear and greed may get the best of you, leading to simple mistakes that make a big dent in your finances. You must also remember that a strategy that works well for someone else may not work for you. The fundamental reason behind this is that your objectives with trading are different, and so is your trading style.

While simulating your plan will help you when it’s game time, it is ultimately the combination of discipline and good strategy that leads to trading success.

Other Mistakes To Avoid

- Forgetting to protect yourself: Trading futures is risky, and forgetting to protect yourself can set you back thousands of dollars. Remember to use features like buy and sell stops to good use every time you want to enter a position. Alternatively, use a hedging strategy such as buying puts to limit losses.

- Getting distracted: Futures trading requires you to be involved throughout the trade. The only way to succeed with these trades is to constantly evaluate the market and continuously figure out your next move. While distractions are inevitable, you must do your best to limit getting distracted when you’re trading.

- Not trying out new ideas: Markets are constantly changing, and even if you think you’re a highly-skilled trader, there’s always a thing you can learn and improve your results with. Getting caught up in the “I know enough” mindset is a mistake many traders make. If you’re not willing to keep learning, you will be left behind with losses when the market changes drastically. To change with the market and consistently make profits, you must keep learning, no matter how good you think you’ve gotten.

Conclusion: Enter future markets with a good strategy

If you’ve been trading for some time and think you’re ready to go big with your traders, entering futures markets is the right step to take. Futures markets are fast-paced, and besides giving you the leverage you need to make more money, they also give you a platform to test your discipline and skill. However, getting started or finding direction when you feel lost can get difficult. We’ve helped you with both of those problems in this post.

Making money trading futures contracts is challenging, and now that you know the key strategies, you have a solid foundation to work with. As long as you avoid making the mistakes highlighted above, too, you’ll find success with trading futures.

FAQ – The most asked questions about Futures trading strategies :

What is the best futures trading strategy?

The first thing you should know is how to establish a trading plan. Make sure to plan your trades properly before starting with the actual trading. Next, once you have started trading, know your position and protect it at any cost because, without it, you can lose a huge amount of assets. Make sure to narrow your focus, but do not overdo it. Think both long and short-term and learn to trade risk-free. The last and most important tip is to learn from margin calls and be patient at every step.

Is future trading strategy profitable?

Yes, Future trading can be profitable if used wisely. If you are a trader with good judgment, you can make quick money with futures trading. It is because it has ten times more exposure than normal stocks. In fact, the prices in future trading also increase faster than in the spot or cash markets.

Which future trading strategy is the most profitable?

You can try scalping if you want to gain a good amount of profit. It involves selling the assets immediately after a trade to gain huge profit. Through this strategy, you can make money on trade no matter what the price target is.

Learn more about trading Futures:

Last Updated on January 27, 2023 by Arkady Müller