The 10 best MetaTrader 5 (MT5) brokers in comparison – Reviews:

Table of Contents

With the prevalence of the internet in the past decades, Forex trading has become exponentially easier and more beneficial for even those new to the scene—the daily trading volume of Forex rivals even that of the stock market. Twenty-four hours a day, five days a week, any regular person would gain some liquidity just from participating in the trade.

There are now tons of sites one can do their trading. However, not all of them are secure. Some platforms have even been touted as scams. Thankfully, MetaTrader 5 is a trusted and secure platform where you can easily trade Forex with a tap of your finger.

See the list of the 10 best MetaTrader 5 brokers here:

MetaTrader Broker: | Review: | REGULATION: | Advantages: | SPREADS & ASSETS: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets | Regulated by the CIMA & ASIC | # Regulated and safe # Real ECN trading # Fast order execution # No hidden fees # Free bonus available | From 0.0 pips spread + $ 2 commission per 1 lot trade 1,000 markets+ | Live account from $ 50 (Risk warning: Your capital can be at risk) | |

2. RoboForex | Regulated by the IFSC (Belize) | # Leverage up to 1:2000 # Free demo account # Professional support # 12,000+ markets # Bonus program | From 0.0 pips spread + $ 4 commission per 1 lot trade 16,000 markets+ | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. BlackBull Markets  | Regulated by the FSPR, FSCL | # 24-hour support # No hidden fees # Free demo account # 100+ different markets # Excellent liquidity | From 0.0 pips spread + $ 4 commission per 1 lot trade 26,000 markets+ | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

4. Moneta Markets | Regulated by the VFSC | # Great for beginners # User-friendly interface # Sufficient educational tools # No deposit fees # Low spreads and commissions | From 0.0 pips spread + $ 3 commission per 1 lot trade 800 markets+ | Live account from $ 50 (Risk warning: Your capital can be at risk) | |

5. IC Markets | Regulated by the ASIC, FSA & CySEC | # Free demo account # Spreads from 0.0 pips # Low commission # Real raw-spread trading # Big liquidity providers | From 0.0 pips spread + $ 3 commission per 1 lot trade 1,200 markets+ | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

6. AvaTrade | Regulated by 6 different regulators | # Highly regulated # Excellent security of customer funds # Free demo account # MetaTrader 4 & 5 # Fast execution speed | From 0.8 pips spread + $ 0 commission per 1 lot trade 1,250 markets+ | Live account from $ 100 (Risk warning: 71% of retail CFD accounts lose money) | |

7. OctaFX | Regulated by the FSC (Maurituis) & CySEC (EU) | # Spreads from 0.2 pips # Minimum deposit only $100 # Deposit bonus available # Leverage up to 1:500 # Free demo account | From 0.0 pips spread + $ 3 commission per 1 lot trade 800 markets+ | Live account from $ 100 (Risk warning: Your capital can be at risk) | |

8. FBS  | Regulated by the IFSC & CySEC | # Bonus program & events # Leverage up to 1:3000 # Live account from $1 # 250+ markets available # Low spreads | From 0.0 pips spread + $ 5 commission per 1 lot trade 250 markets+ | Live account from $ 1 (Risk warning: Your capital can be at risk) | |

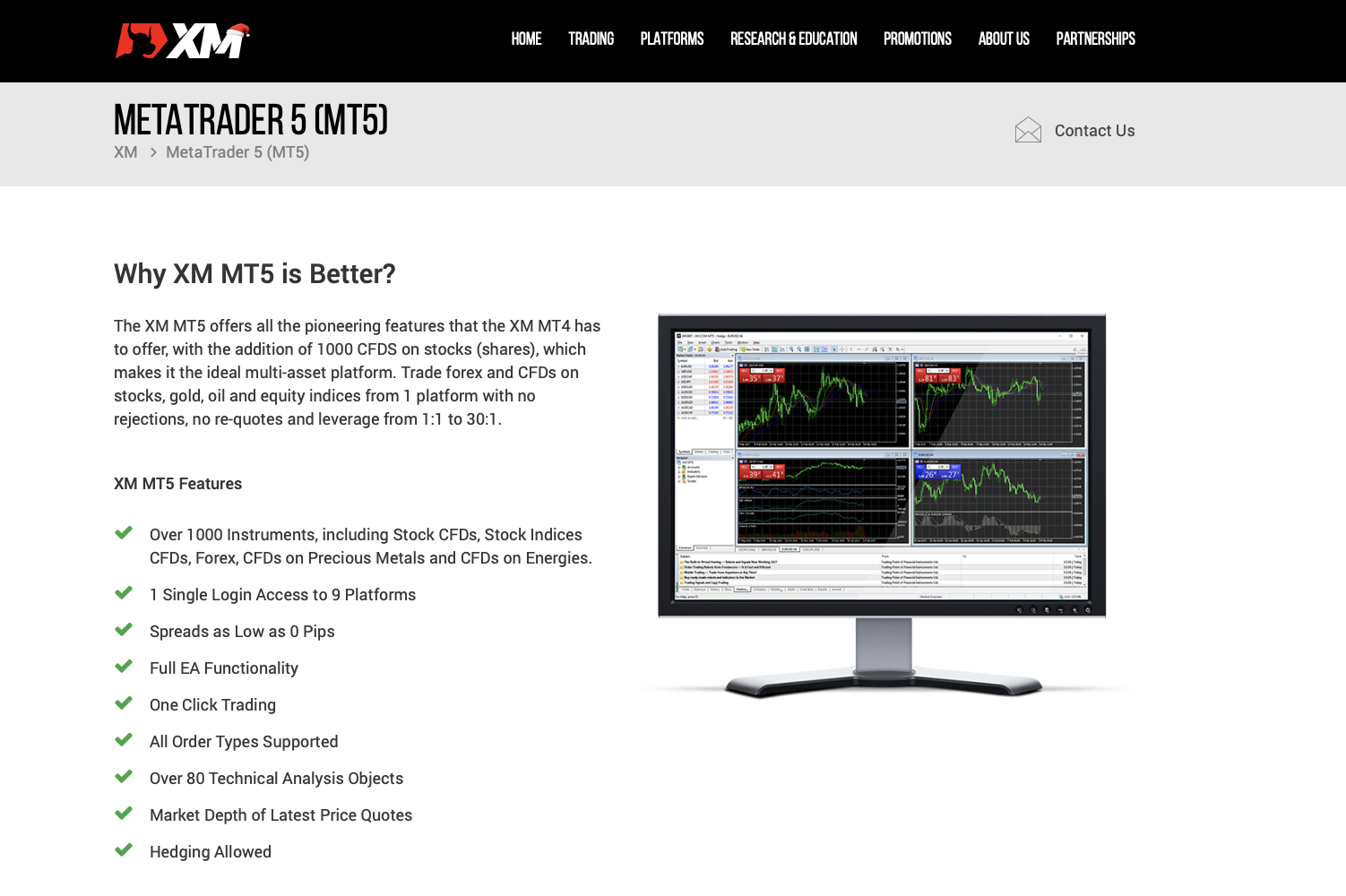

9. XM  | Regulated by the IFSC, CySEC, ASIC | # 1000+ assets # No hidden fees # Professional support # 3 account types # Regulated and safe | From 0.0 pips spread + $ 3.5 commission per 1 lot trade 1,000 markets+ | Live account from $ 5 (Risk warning: 75.59% of retail CFD accounts lose) | |

10. Admiral Markets | Regulated by the ASIC, CySEC, EFSA & FCA | # Competitive spreads # Regulated broker # Wide range of markets # High security # User-friendly platforms | From 0.0 pips spread + $ 4 commission per 1 lot trade 3,000 markets+ | Live account from $ 1 (Risk warning: 76% of retail CFD accounts lose money) |

Who is the best broker for the MetaTrader 5? – List

Still, on this great platform itself, you’ll encounter the problem of brokers. There are so many to choose from! And just like platforms, not all of them are trustworthy. That’s why we’ve put together this brief and handy list to show you which ten brokers on MetaTrader 5 are the best for you. We’ll be evaluating them according to user-friendliness, reliability, fees, tools and features, and how fast they can execute your trade. Let’s begin.

List of the top 10 MetaTrader 5 brokers:

- Vantage Markets – Well-regulated broker with excellent conditions of 0.0 pips raw spreads

- RoboForex – One of the best for forex trading

- BlackBull Markets – User-friendly interface

- Moneta Markets – Spreads from 0.0 pips and low commissions

- IC Markets – Perfect broker for beginners

- AvaTrade – Multi-regulated and highly secure broker

- OctaFx – Numerous awards and high customer satisfaction

- FBS – Leverage up to 1:3000 for risk-aware traders

- XM – Solid offers and many markets to choose from

- Admiral Markets – The “MetaTrader 5 veteran”

1. Vantage Markets – Winner with spreads from 0.0 pips

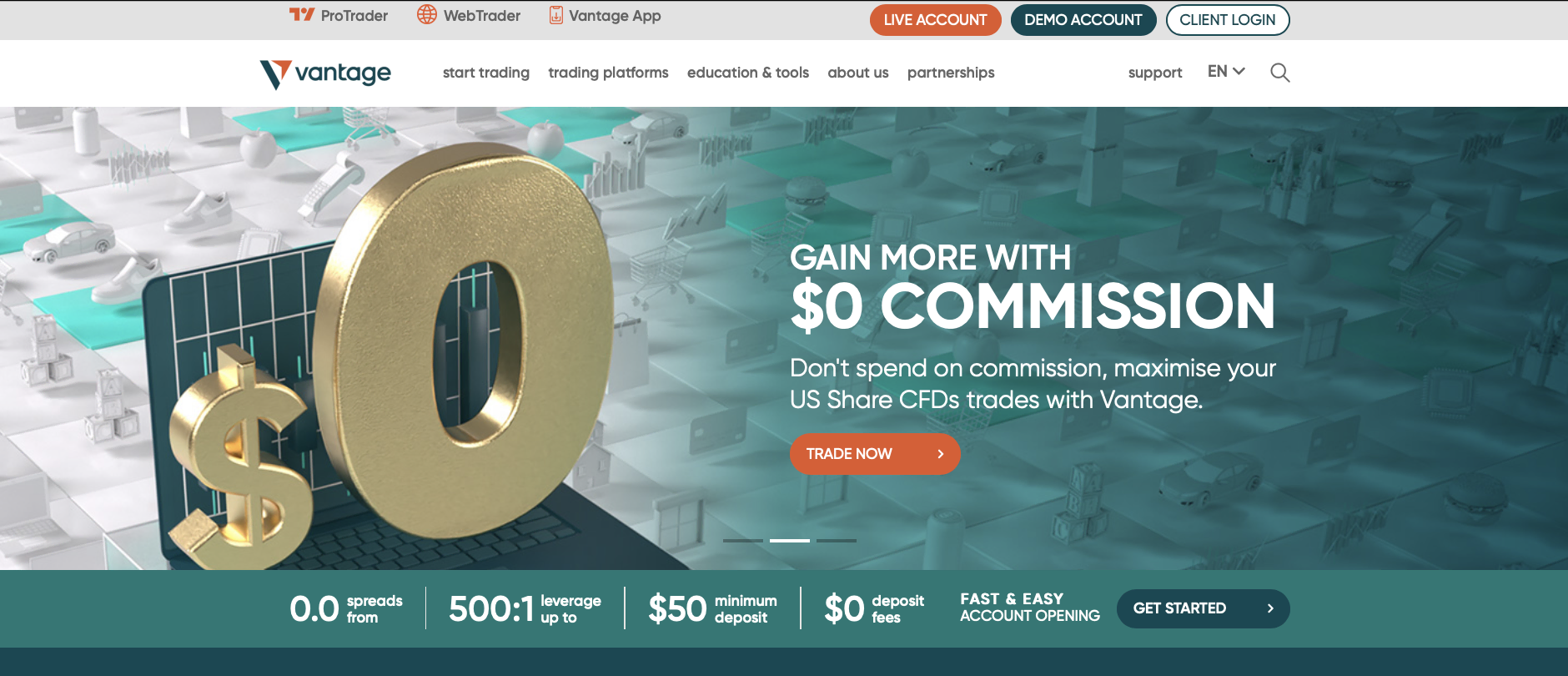

Vantage Markets, as a trading platform, is our winner and one of the best in terms of its market research, educational tools, and app usability. It’s considered average-risk and well-trusted since it is regulated by the Australian Securities and Investments Commission and the Financial Conduct Authority. Having been founded in 2009, it has built itself a good reputation among ordinary customers and experts alike.

Vantage Markets offers three different account types that you can open. They vary from commission-free to Pro commission-based accounts. Their spreads and number of tradable assets are around average for the platforms like it, but where Vantage shines is in its tools, features, and platforms.

As one of the brokers on MetaTrader5, you get the full variety of desktop, mobile, and web platforms. You also get headlines streaming from Forex websites and news and several copy-trading social platforms. Another key feature is how well Vantage Markets does its research. Aside from its client data and an economic calendar, Vantage Markets has in-house content of the research they perform to benefit its customers.

Benefits of Vantage Markets:

- Has direct streaming access to Forex News and Trading Central

- Provides an economic calendar and social data on currency pairings

- Has excellent mobile applications for Android and iOS

- The mobile app comes with a watch list available

- Average-risk

- Well-regulated by recognized authorities

(Risk warning: Your capital can be at risk)

2. RoboForex – Highest maximum leverage

Beginning in 2009, they served as BMW M Motorsport’s official trading partner. Due to its oversight by Belize’s International Financial Services Commission, it safeguards against negative balances. RoboForex not only lets you trade Forex assets but also stocks, commodities, cryptocurrencies, and four other kinds of assets.

RoboForex provides five different kinds of accounts as a platform. These are identified by the names Pro-Standard, Pro-Cent, R Trader, ECN, and Prime. To pick the account that best suits you, you can try out the demo versions of these accounts. The highest leverage provided is 2000:1, which, while uncommon, is an excellent alternative for those who want it. Commissions and leverage vary depending on the kind of account.

The RoboForex customer support is open 24/7. They have a variety of tools, such as their analytics application, for even greater user-friendliness. You can even find some helpful educational guides for when you start your Forex Trading endeavors.

Although it’s not as highly rated for its response time as Vantage markets, RoboForex customer service is available all seven days of the week, round the clock. For even more user-friendliness, they have multiple tools, including their own analytics application. You’ll even find some handy educational tutorials for when you begin your endeavors in Forex Trading.

Benefits of RoboForex

- Demo accounts are provided to new clients.

- Has access to a wide range of marketable assets

- Offers 24/7 customer service.

- Allows for a 2000:1 maximum leverage.

- Publishes instructive video guides on currency trading.

Besides, RoboForex protects you against negative balances thanks to its regulation by the International Financial Services Commission of Belize.

Benefits of RoboForex:

- Offers demo accounts to new customers

- Has a wide variety of tradable assets available

- Offers round-the-clock customer service all week long

- Allows a maximum leverage of 2000:1

- Posts educational video tutorials about currency trading

(Risk warning: Your capital can be at risk)

3. BlackBull Markets – Offers access to 23000+ markets

2014 saw the establishment of BlackBull Markets in New Zealand. BlackBull Markets, an ECN broker with raw spreads and commissions, is one of many antipodean Forex brokers. The Financial Services Providers Register (FSPR), which oversees them in New Zealand, limits the maximum leverage on several Forex currency pairs to 500 to 1. In addition to their worldwide offices in New Zealand, BlackBull Markets maintains branch offices in Malaysia and New York.

Even with its standard account offering, Blackbull Markets provides traders with a maximum forex leverage limit of 1:500. There is no fee to pay for the same account, and the spread begins at 0.8 pips.

Additionally, a prime account is available with a spread that begins at 0.1 pip; however, in this case, the charge is $6 per lot. Also available from Blackbull Markets are institutional Islamic forex accounts.

This MT5 trading platform offers over 23,000 markets to trade on. This comprises more than 64 forex pairs. Several social trading platforms have partnerships with Blackbull Markets. This includes MyFXbook and ZuluTrade.

Credit/debit cards and e-wallets like ChinaUnion, Neteller, Skrill, and FasaPay are among the methods of deposit.

Benefits of Black Bull Markets

- 23,000+ listed tradable instruments.

- Up to 1:500, high leverage.

- Standard account for new users with 0% commission.

- Deep liquidity ECN/NDD execution model.

- Pricing at institutional levels for retail traders using a proprietary price aggregating system.

- Social trading sites like ZuluTrade and Myfxbook.

(Risk warning: Your capital can be at risk)

4. Moneta Markets – Raw spreads from 0.0 pips

Moneta Markets is an online FX and CFD trading platform. ASIC, SVGFSA, and FSCA all regulate this relatively new trading site, which is registered in Vanuatu. Through the regulated brokers’ unique trading platform, Moneta Markets offers access to more than 1016 different financial instruments.

Averaging more than $100 billion in monthly trading volume, the group’s trading accounts total more than 35,000. Through the regulated brokers’ unique trading platform, Moneta Markets offers access to over 300 financial instruments.

CFDs from Moneta Markets are sophisticated instruments with a high potential for financial loss. Trading CFDs results in losses for 72% of retail investor accounts.

Consider financial dealer investment recommendations and your financial status to comprehend how forex and CFDs function, how they are traded publicly, and if you are able to afford to face the high likelihood of losing your invested funds.

Negative balance protection is available for Moneta Markets trading accounts. Through the proprietary Web Trader platform, as well as the widely used MT4 and MT5 trading platforms, users can trade 1016 financial instruments, including forex, CFDs, shares, commodities, and indices.

Benefits of Moneta Markets

- Account opening is quick and simple.

- From 0.0 Pips, ECN Spreads.

- Excellent selection of research tools, educational resources, and investment goals.

- Access that is clear and streamlined in terms of both funding and onboarding.

- Bonuses and promotions —the platform currently gives 50% deposit bonuses for deposits of at least $500. Users can also distribute referral links and receive bonuses for doing so.

(Risk warning: Your capital can be at risk)

5. IC Markets – Very flexible features and tools

Everyone, including beginner and experienced traders, is encouraged to use IC Markets. Advanced traders as well as institutional investors seeking exceptional trading circumstances, like ultra-fast order execution.

The broker makes sure that customers can benefit from price changes and have orders filled quickly. Because of the broker’s low average latency times (under 40 ms), traders can expect lightning-fast order execution. Additionally, all strategies, such as scalping, hedging, as well as high-frequency algorithms, are acceptable on the site.

Currently, three entities oversee the broker:

- The Australian Securities and Investments Commission

- The Cyprus Securities and Exchange Commission (CySEC)

- The St. Vincent & the Grenadines Financial Services Authority

Some of the market’s tightest spreads are available through IC Markets. Spreads begin at 0.0 pips on the broker’s platform. The Standard Account spreads begin at 1.0 pip. The broker further levies commissions based on the kind of account. The Standard Account carries no commission fees.

Users of IC Markets have access to three main trading platforms. These consist of MetaTrader 4, MetaTrader 5, and cTrader. Desktop computers, web browsers, and mobile devices that have access to the internet can all access all three platforms. The broker also provides mobile applications for iOS and Android.

Assets offered by IC markets include:

- Forex

- Bonds

- Stocks

- Futures

- CFDs on Commodities

- Indices

Benefits of IC Markets

- A wide variety of assets.

- Low spreads and fees on IC Markets (starting at 0 pips).

- Fast order execution.

- There are numerous analytical training resources available.

- Ability to trade using a mobile device.

(Risk warning: Your capital can be at risk)

6. AvaTrade – Multi-regulated broker

AvaTrade is regarded as one of the most secure MT5 forex brokers. Strict compliance guidelines must be followed in all aspects of client asset management, money security, and regular financial reporting.

ASIC, FSCA, FSA, and other agencies control it. Leverage up to 1:400 is available to eligible clients while trading. As a result, the trader can increase their profits by a factor of 400 if they are successful in speculating on price changes in a pair.

High-leverage forex brokers are fantastic, but losses are amplified on losing trades; therefore, newbies should proceed cautiously. Customers in the UK, Australia, and Europe are permitted maximum leverage of 1:30. AvaTrade offers more than 1,250 different instruments. This comprises more than 60 currency pairings.

When trading currency pairs, there is no commission due. The spread is the only thing left to pay. Traders have access to a demo account where they can practice.

Benefits of AvaTrade

- There are about a thousand instruments accessible, including trading in cryptocurrencies, indices, stocks, commodities, and foreign exchange (forex).

- MetaTrader 4, MetaTrader 5, their WebTrader, AvaOptions, and the highly regarded AvaTradeGO are available for desktop, tablet, mobile, and web-based trading.

- EA compatibility and a variety of automated trading platforms.

- Offering fair spread and leverage.

- Segregated accounts are used to hold client funds in order to increase security.

- Regulated in South Africa, the United Arab Emirates, Australia, the British Virgin Islands, and Japan.

- Trading platforms available in almost 20 languages.

(Risk warning: 71% of retail CFD accounts lose money)

7. OctaFX – Award-winning broker

From 2011 to the present, the OctaFX Broker has offered Forex services. It offers advantageous terms for Forex traders and operates under a CySEC license. Currently, more than 6.6 million customers worldwide have selected OctaFX as their middleman to the financial markets; however, the broker is concentrated in the nations of the Asia-Pacific area.

Indonesia, Malaysia, Pakistan, and other nations all have a high level of interest in OctaFX. Both active and passive investors who like to mimic the profitable trading tactics of other market participants employ its services. OctaFX won the Capital Finance International award for Best CFD Broker in the Asia-Pacific area in 2020 and Global Banking and Finance Review’s Best Forex Broker in Asia award in 2021. There are many instruments traders can access.

OctaFX provides social trading, forex trading, CFD trading, 52 trading symbols, 28 forex pairs, and cryptocurrency (CFD) trading.

The underlying asset cannot be traded directly; however, CFDs let you trade cryptocurrencies (like buying Bitcoin). It should be noted that neither UK residents nor UK businesses are permitted to trade cryptocurrency CFDs as retail customers with any broker.

The MT4 and MT5 platforms from MetaQuotes Software Corporation are available through OctaFX, a MetaTrader broker. Additionally, there is the cTrader, which also has the cAlgo platform.

Benefits of OctaFX

- Offers tested trading systems like MetaTrader 4, MetaTrader 5, and cTrader.

- Wide trading opportunities, including access to a service for duplicating trades and tight spreads starting at 0.6 pips.

- No non-trading broker commissions for money deposits or withdrawals.

- The minimum deposit is $100.

- It has a CySEC license from Cyprus to conduct brokerage business.

(Risk warning: Your capital can be at risk)

8. FBS – High leverage up to 1:3000

FBS forex broker is a global MT5 broker that provides services to the bulk of Europe, Asia, the United Arab Emirates, and South Africa. An important feature of this MT5 broker is that it enables leveraged currency trading up to 1:3000.

Visa, Skrill, Neteller, PerfectMoney, and STICPAY are examples of instant deposit options. The latter entails a 2.5% fee in addition to a $0.03 commission.

Over 25 forex pairs are available. According to the platform, the spread on a regular account begins at 0.5 pip. Other accounts are available, including zero-spread, cent, micro, ECN, and others.

Daily, weekly, and analytical videos are all accessible through FBS. A small collection of instructional resources is also available.

The IFSC oversees FBS activities (International Financial Services Commission). The Commission’s goal is to assess efficient management to safeguard the security and safety of market participants. IFSC helps the market expand quickly and healthily.

The Commission keeps an eye on how investment businesses are operating to make sure they are following the rules outlined in the legal and regulatory framework. The actions and operations of the stock market are under the direction of this public authority.

It implies that doing business with them is secure and dependable. International financial laws will protect you and ensure that you are never in conflict with the law. The rule of law is important to FBS, and the company is keen to resolve any disputes amicably.

Benefits of FBS

- There are many accounts to pick from.

- Maximum leverage of 1:3000.

- Spread starting at 0.0 pips.

- A group of highly skilled professionals.

- Thousands of profitable orders are filled every day.

- A trustworthy broker who is always improving.

(Risk warning: Your capital can be at risk)

9. XM – Good fee systems and transparency

XM Forex broker is a group of trusted brokers that started back in 2009. In 2017, they became known as XM Global and are currently being regulated by the International Financial Services Commission. Their platform is available for trading between 196 countries. Their vision and mission focus on helping millions of customers safely reach their investment goals.

XM has a lot of great features for new traders. Their demo account, for example, allows you to try their platform out with a virtual starting amount of $100,000 in the account. This way, you can learn the ropes of the platform before investing real money into the trade. They also make sure to steer clear of hidden fees, extra commissions, allow for autotrading, and they boast a 1-second transaction time for more than 99% of the trading that happens on their platform.

Aside from Forex, XM has over a thousand types of assets traded on its platform. Specifically with Forex, however, there are 55 currency pairs available to trade with. You also have the option of opening one of three types of accounts, which vary in spreads, and only one of the account types charges for commission. Since XM prides itself in being transparent with their fees, rest assured there is no catch.

Benefits of XM:

- The XM Demo account is excellent for beginners

- Over 1000 assets and 55 currency pairs available

- Well-regulated and trustworthy

- No hidden fees or commissions

- Excellent customer service and lightning-fast transaction times

- Available on all mobile devices and operating systems

Comes with bonus deals and features from time to time

(Risk warning: 75.59% of retail CFD accounts lose)

10. Admiral Markets – The MetaTrader 5 veteran

Compared to most of the trading platforms we’ve mentioned here, Admiral Markets is something of a veteran; it has been operating for almost 20 years. Besides being one of the top brokers on MetaTrader5, Admiral Markets is also regulated and reputed globally as an award-winning broker. The UK, Australia, the EU, Cyprus, and Estonia all regulate Admiral Markets, making it one of the most secure and trustworthy brokers around.

One of its most significant features is that you have to put down a $200 deposit when opening an account. That is a high amount for any ordinary trader, but it’s there for your benefit. This deposit is used to guard against negative balances. This deposit is also considered when considering the leverage of your account. Their available leverage goes up to 1:30.

Just like a few of our other brokers here, Admiral Markets allows you to open a Admirals demo account with virtual money so that you can get a feel of the trading practice. These demo accounts last for 30 days, after which you will need to verify it with official documents to either extend the demo or open an official account.

Benefits of Admiral Markets:

- Customer service support through chat and voice call

- Multi-awarded and globally regulated

- Guards against negative balances

- Offers plenty of educational resources

(Risk warning: 76% of retail CFD accounts lose money)

How to connect a broker with MetaTrader 5?

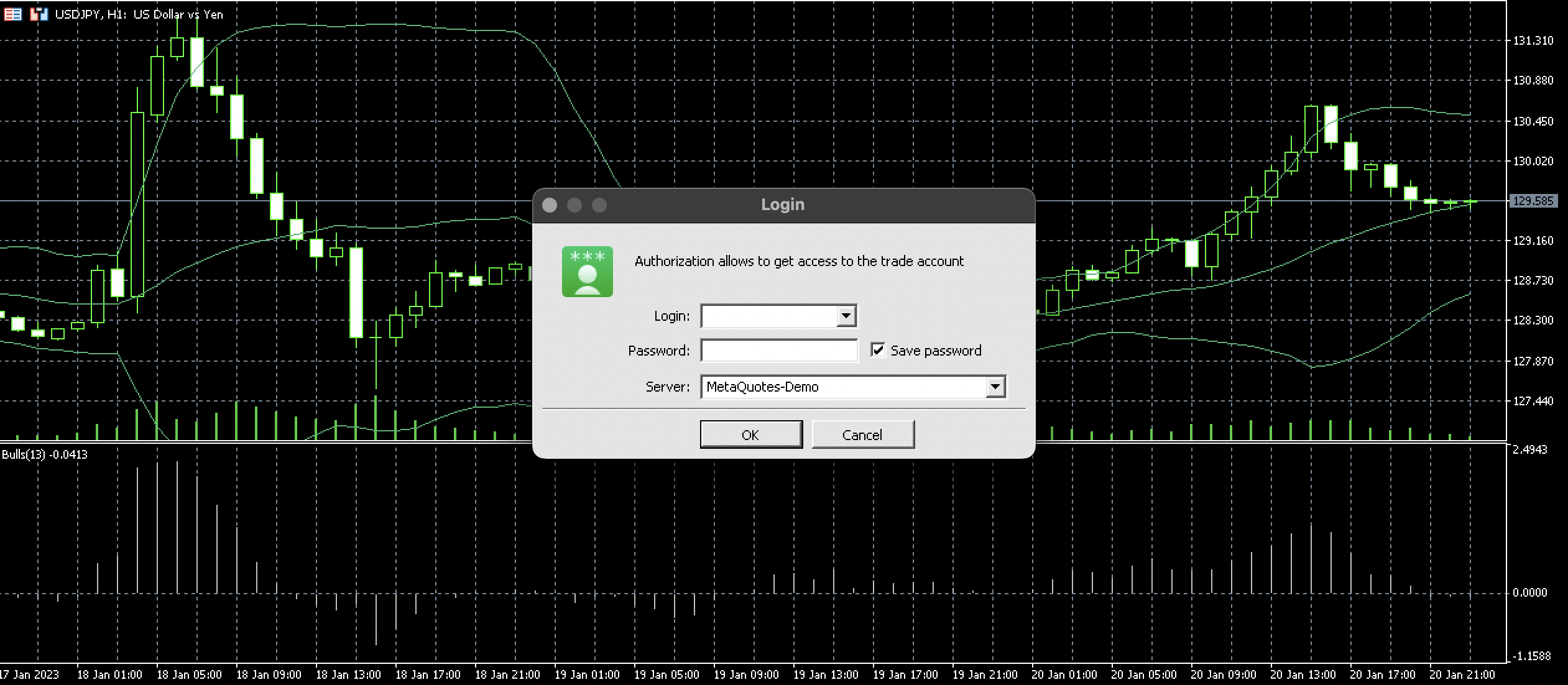

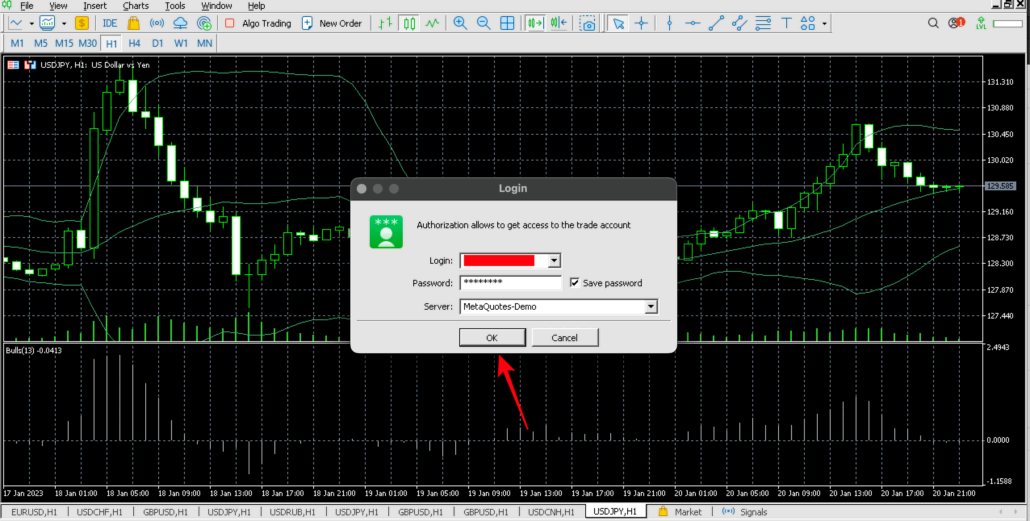

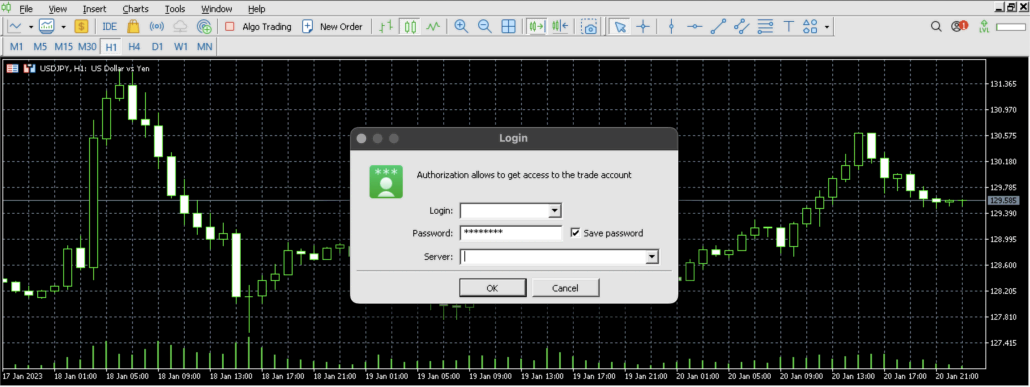

A login (account number) and password are required to access a trading account in order to begin working with it. In the trading platform, there are two different types of account access: investor and master. Full access to the account can be used by logging in with the master password.

You can only trade with investor authorization; you can view the account status, examine prices, and interact with your Expert Advisors. A useful tool for outlining the account’s trading procedure is Investor access.

Good to know!

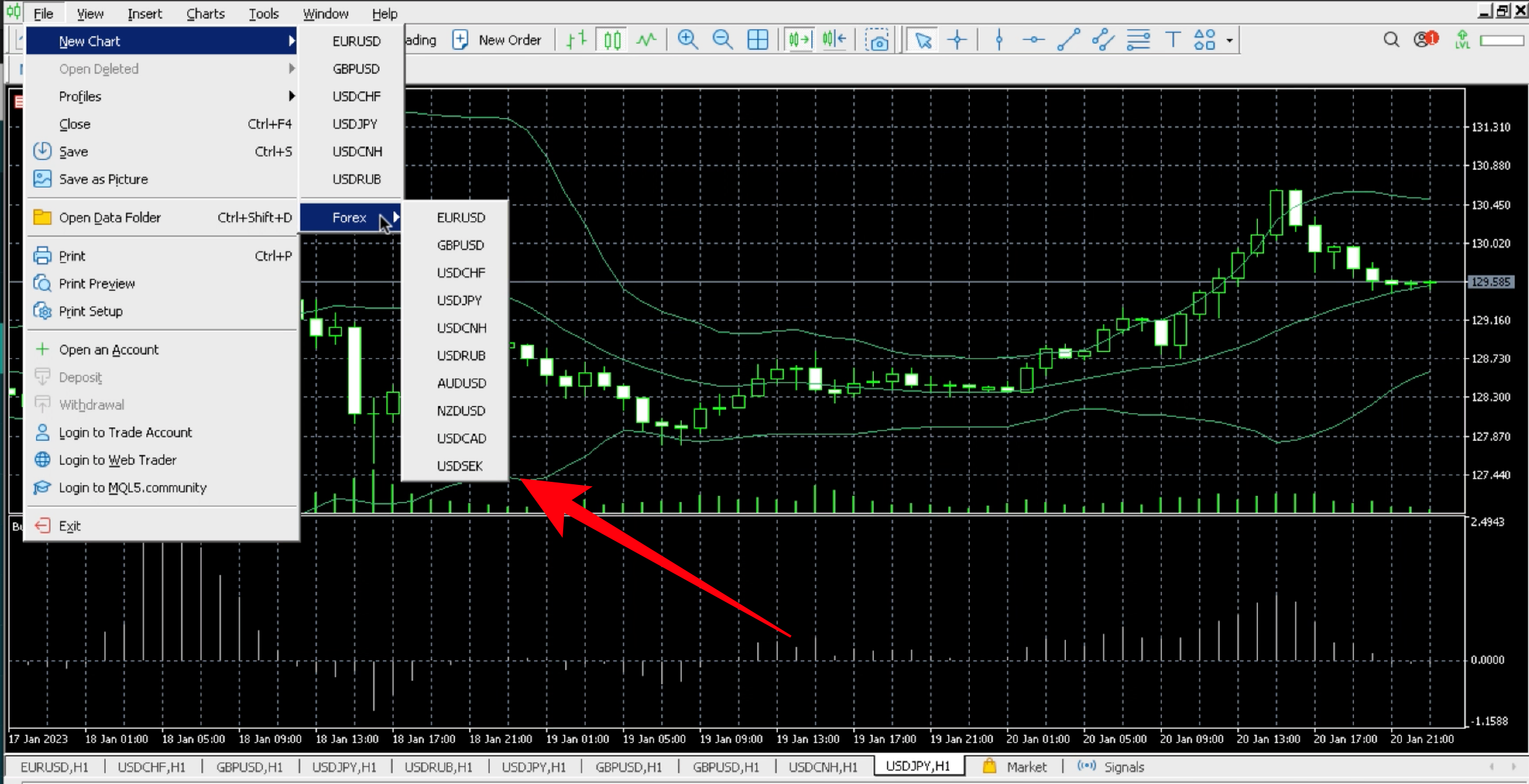

#1 In the Navigator or the File menu, select the “Login to Trade Account” option.

#2 Enter the following information in this window:

- Login — the account number used to make the connection.

- Password — the account password, either investor or master.

- Server — server to establish a connection to.

Another option is to select a server manually.

Good to know!

#3 Click “OK” to connect after filling out all the information.

Forced Change of Password

Upon authorization, you could be asked to modify the account’s master password. The administrator of the trade server may enable forced password changes. Safety is increased by the required master password change method, either when you first log in or on a routine basis.

To confirm, type in the new password a second time. The password must adhere to certain standards. Most standards include:

- It can’t be any shorter than what the password change dialog specifies.

- Minimum of two of the following character kinds are required: upper case, lower case, and digits.

- Cannot be the same password as the one you previously used.

Good to know!

Sign up for a trading account

How should I choose a broker for MetaTrader?

Here are a few essential criteria to consider while picking a good MetaTrader forex broker:

- Regulation is always crucial. To trade losses, keep your money safe, maintain segregated accounts, and use fair trading procedures, you need to know what regulations the broker is subject to.

- You must take data security into account. You need to be aware of their security procedures and track record for keeping all the crucial information they need from you secure.

- Costs and specifics of transactions matter. You want to know if you should keep spreads low or pay commissions.

- The broker should offer a simple, trouble-free method for making deposits and withdrawals.

- The quickest possible trade execution is crucial. You must be able to have the orders filled at or near the price you engage on.

- Of course, providing great customer service is crucial. When issues develop, you want them to be handled quickly and competently.

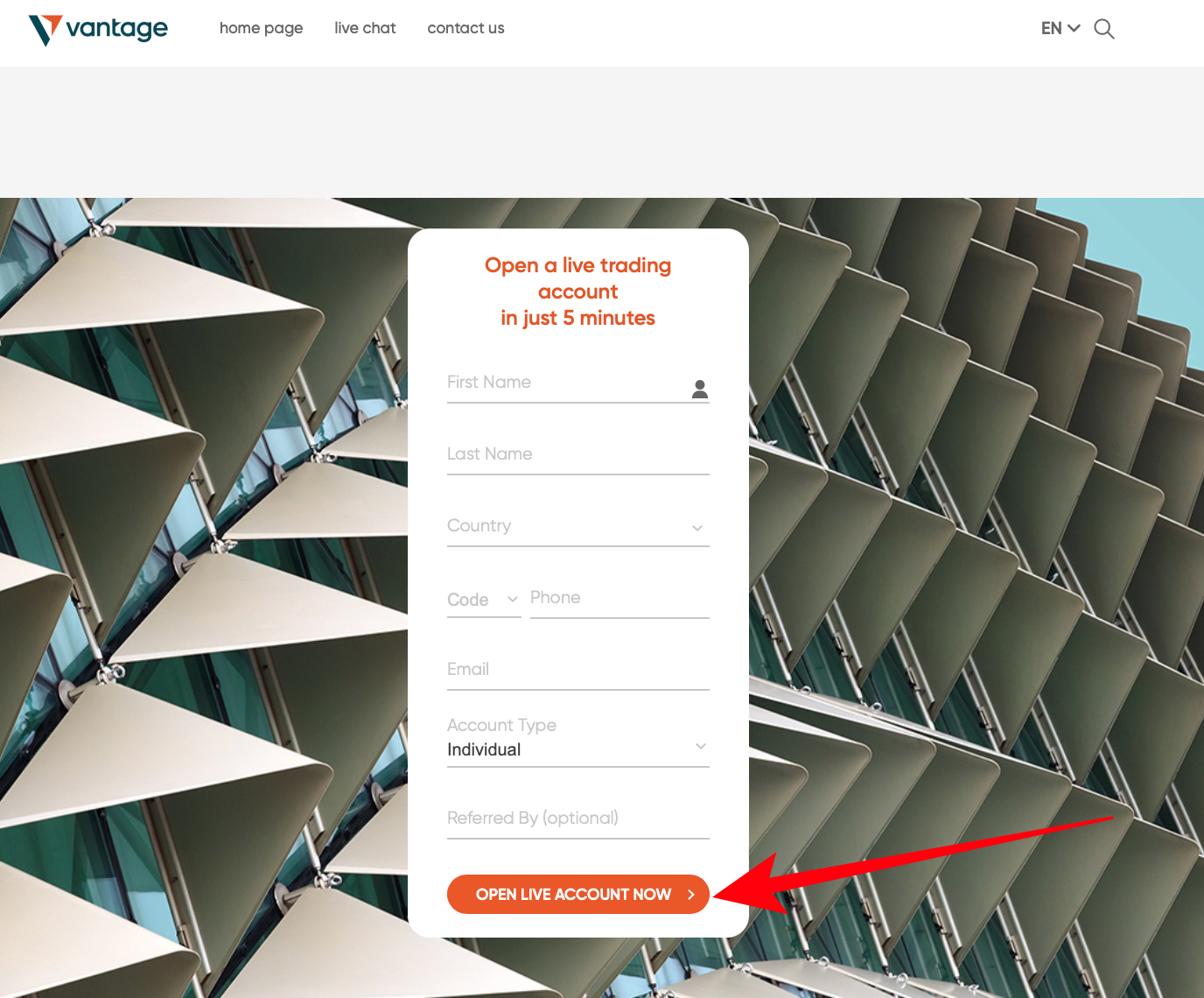

- You must open an account with the broker you choose after making your choice among the several that are offered. You must fulfill all account conditions before owning an account with a broker.

- You must also include information such as your name, country of residence, preferred payment method, email address, and other details.

- A few brokerages will additionally want your phone number. It can be used to verify your identification, for two-factor authentication, or to call you if you need assistance.

(Risk warning: Your capital can be at risk)

Here is a summary of how to open a trading account:

1. Complete the form.

(Risk warning: Your capital can be at risk)

2. Enter your information and choose the platform you want to trade on.

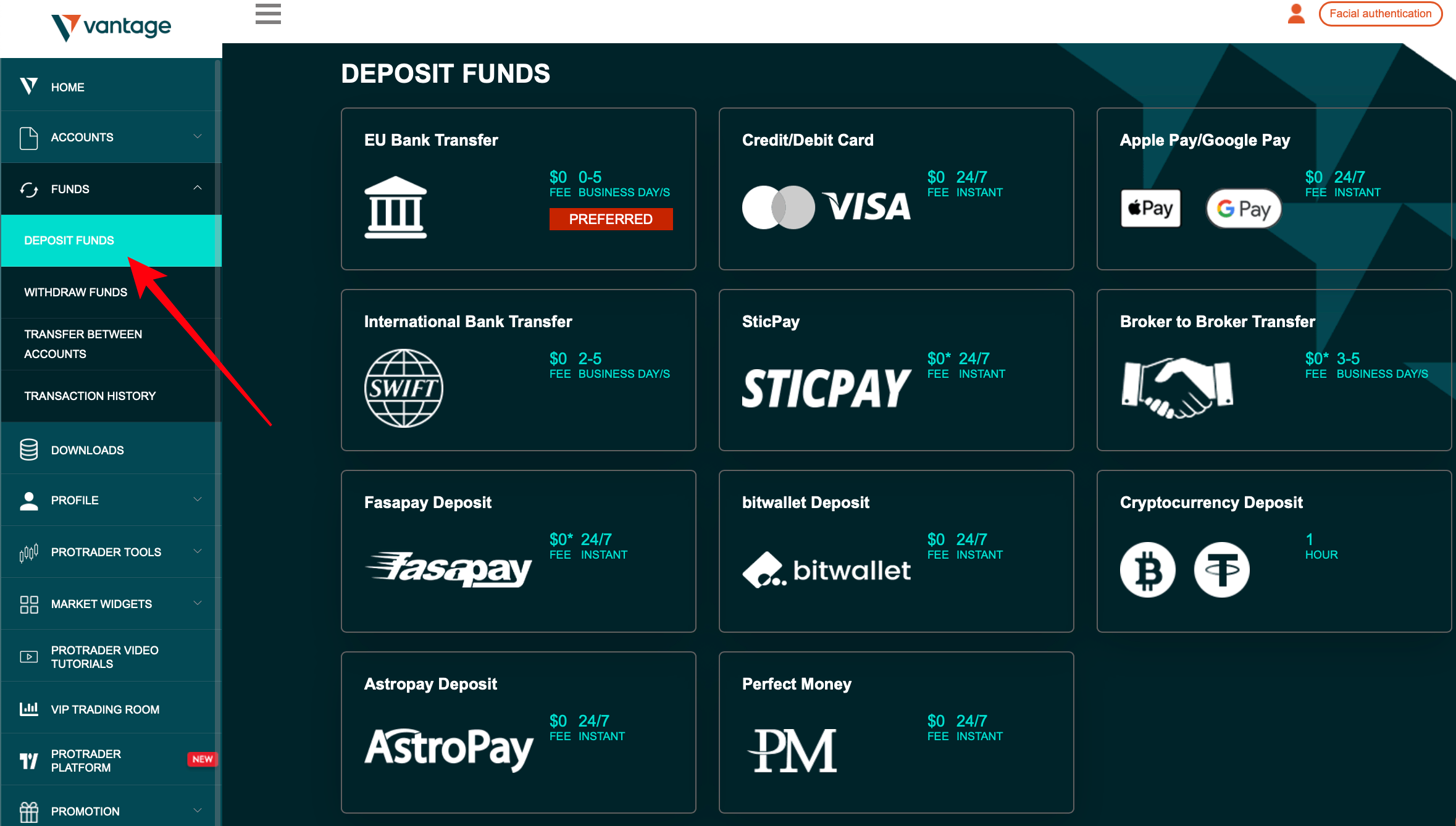

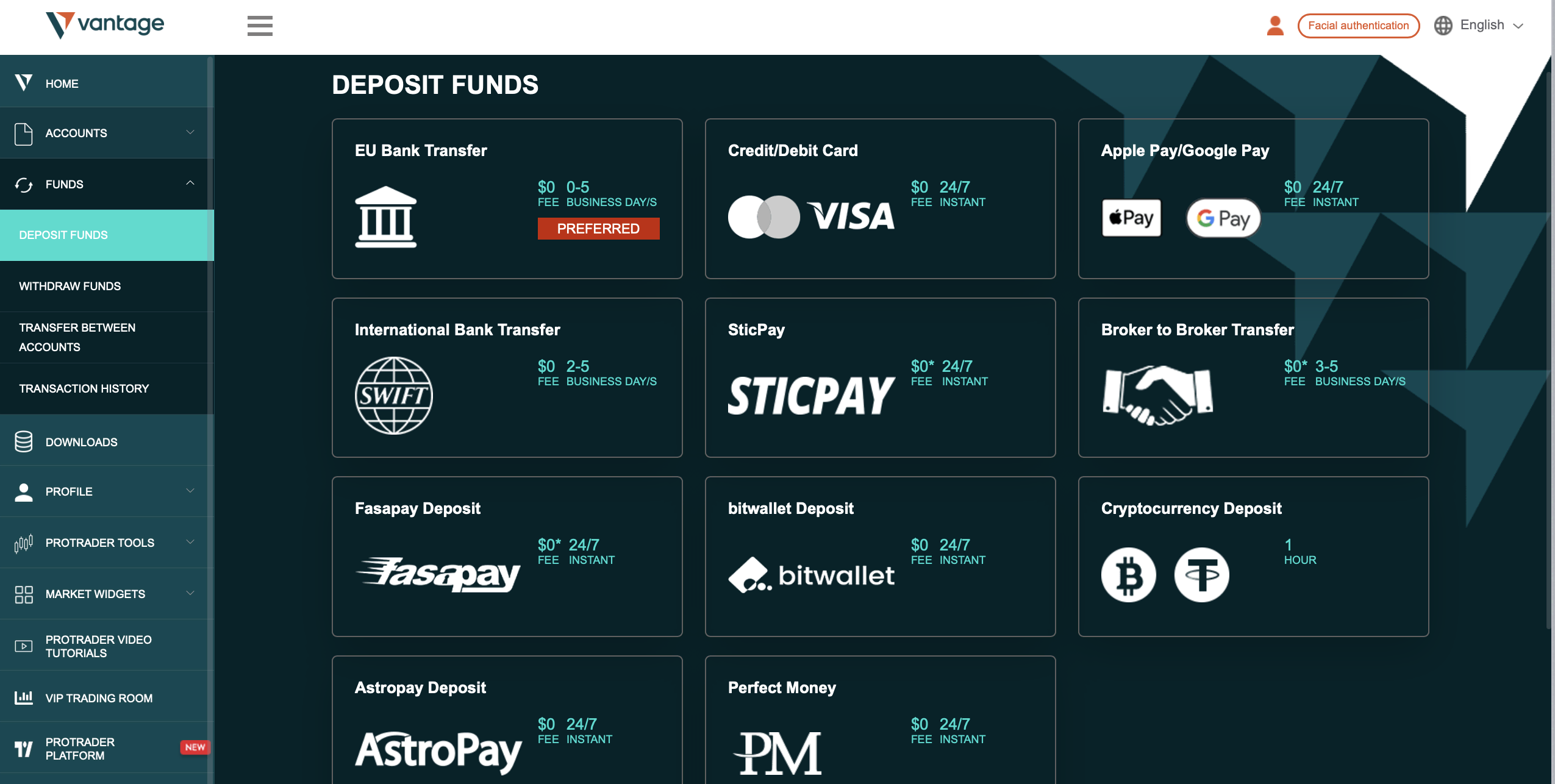

3. Make a deposit into your account.

4. Select a comfortable payment method from a list of options.

5. Log in to the trading site and begin trading

6. Select an asset to trade.

(Risk warning: Your capital can be at risk)

How to trade on the MetaTrader 5 with a broker?

So how do you create an account on MetaTrader 5 (MT5) and begin trading? The next sections of the article will examine each of the five major steps in turn:

#1 Select an MT5 Broker

Is MetaTrader 5 a Forex broker? MetaTrader is a prominent forex and CFD trading software suite, although it is not a broker. This implies that the level of security when trading forex will be determined by your forex broker rather than the MetaTrader software.

Finding and choosing a forex broker that supports the MetaTrader 5 trading platform is the first process in opening an MT5 trading account.

Because there are so many options available, selecting a reliable broker can be challenging. Do your research thoroughly, and if you’re unsure, use one of the brokers listed above.

(Risk warning: Your capital can be at risk)

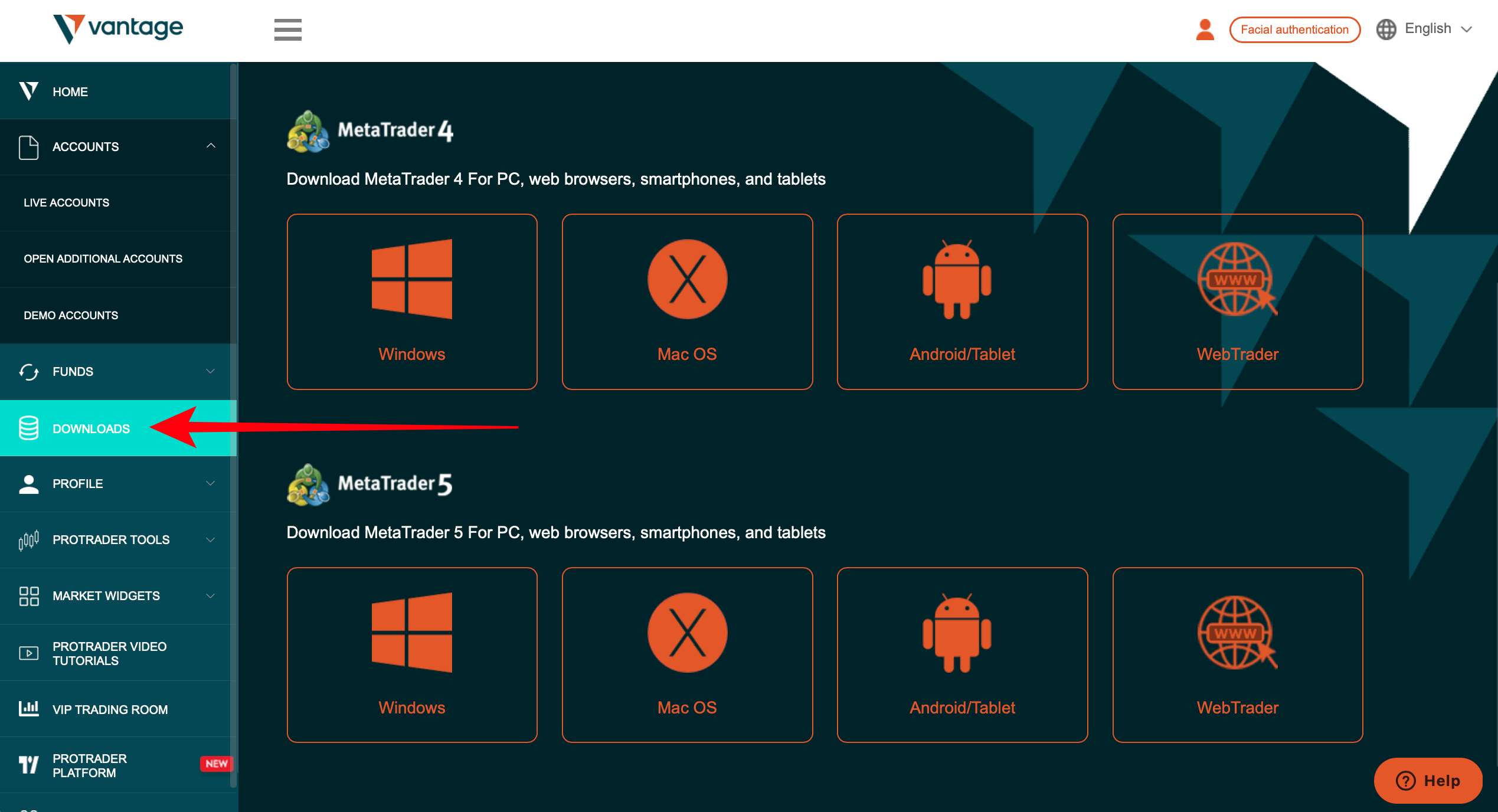

#2 Download the MetaTrader 5

Downloading MetaTrader 5 is the next step. You must download the same program for both MT5 demo accounts and live accounts if you plan to open either.

The file can easily be downloaded. To begin the installation process, launch the file you just downloaded. You must have a demo or live MT5 trading account to log in, both of which we will walk you through opening later on.

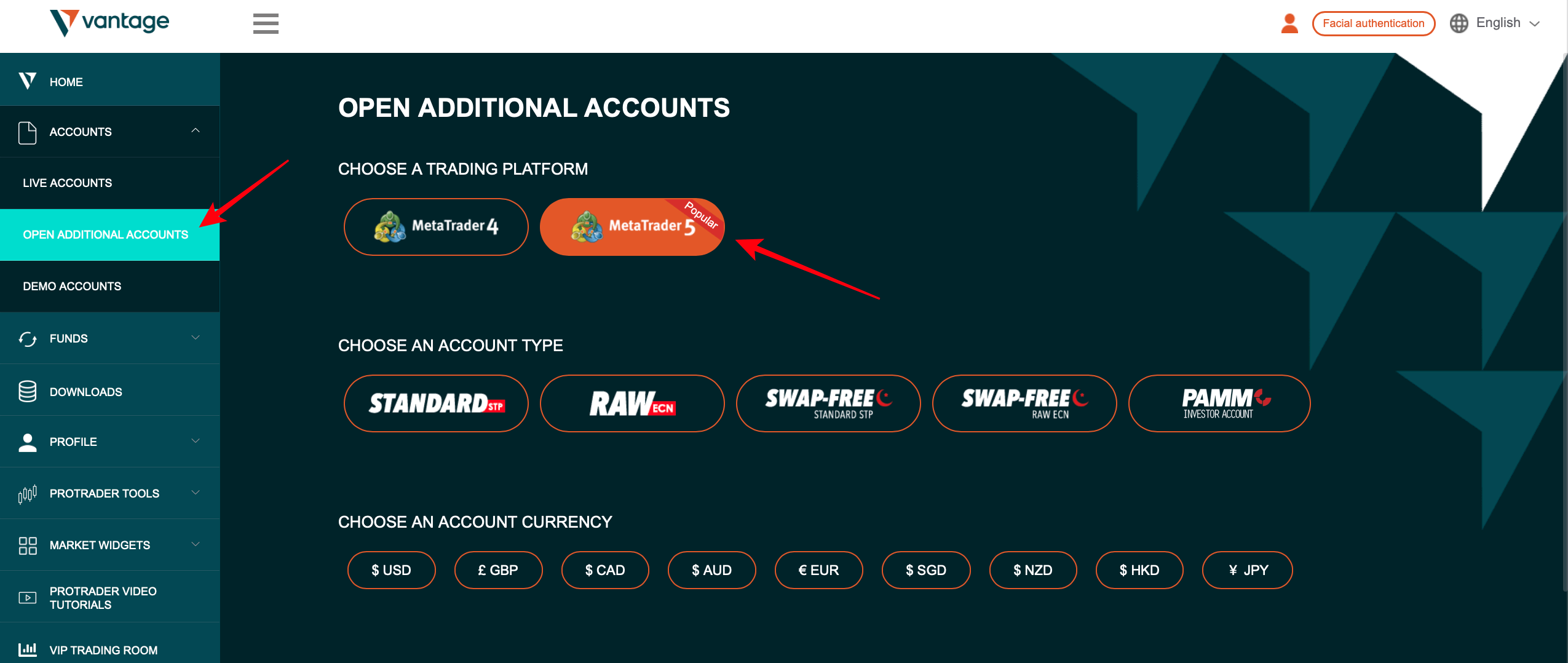

#3 Create an account on the MetaTrader 5

You must open either a real or demo MetaTrader 5 account after completing the MT5 trading platform download.

We advise new traders to get some practice on an MT5 Demo account before moving on to the live markets.

How to sign up for a demo account that supports the MetaTrader 5?

You can practice trading in actual market conditions on a variety of different products with a demo trading account in MetaTrader 5 without risking any of your own money.

Visit the demo account page on their website, fill out the form, and you’ll be able to open a free MT5 demo account. Your MetaTrader 5 demo account information will be sent to you via email once you’ve completed this, and you can use those credentials to access the trading platform.

Any of the aforementioned brokers allow you to open a live MT5 account if you’re prepared to trade on active markets.

First, you must enter the trader’s room using your signed email address and password; if you possess a demo account, this is the email you used during the registration procedure. In case you don’t possess one already, you must create a trader’s room account.

Just follow these procedures after logging into your trader’s room:

- Click the open live account button.

- Add and validate your phone number.

- Add the requested details throughout the subsequent pages. These specifics will include your name, address, passport number, and tax identification information.

- Read the confirmation notice, then confirm your agreement.

- By uploading the required papers, you can confirm your identity.

- After your broker has reviewed your application, they will email you to let you know how it has turned out. If it’s approved, the necessary details will be emailed to you.

(Risk warning: Your capital can be at risk)

1. Log into your MT5 account

Launch the MT5 trading platform once you have set up your MT5 trading account. Log in to the trading account.

Your screen will then display a dialog box that asks you to enter the MT5 account information in order to log in. Make sure the server information listed in the “Server” section corresponds with what the MetaTrader 5 broker has provided.

In this field, if necessary, you may overtype. The “Login” area should be filled out with your account ID, and the “Password” field should be filled out with your primary password.

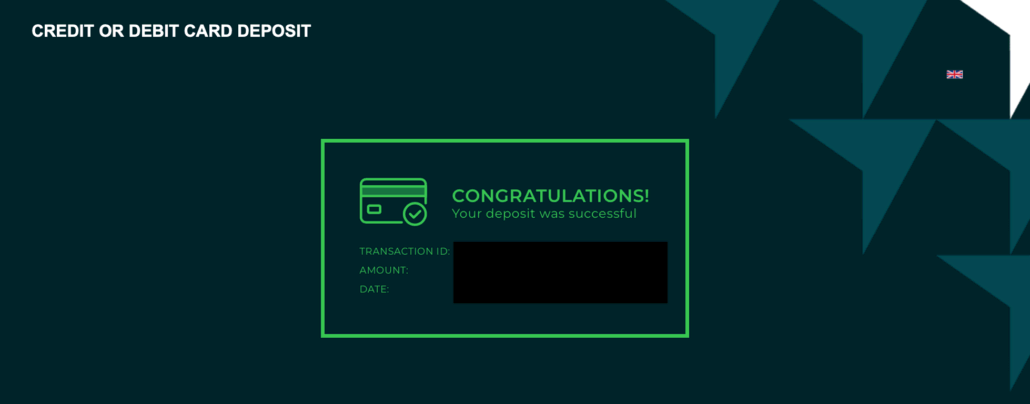

2. Add money to the MT5 account

You must sign in to the broker’s dashboard using the email address and password you used to register for your trading account in order to contribute money to an MT5 live account. After logging in, carry out the following actions:

1. Follow the instructions above and click “Deposit” after finding the account you want to deposit money into.

2. Select your preferred type of payment and follow the on-screen instructions to make a deposit.

Your payment option will determine the length of time until your money is cleared. Your account balance will be shown in your broker’s account dashboard after they have cleared.

MetaTrader 5 key facts

A Multi-Asset setting

Your one-stop shop for trading on several markets is MetaTrader 5. Users who desire to build different portfolios will love the platform. By using the following instruments, you can lower your risks and increase your potential profits:

- Currency pairs (major, minor, and exotic);

- Spot metals (gold and silver);

- Stocks of the largest US corporations like Facebook or Amazon;

- CFDs on stocks;

- CFDs on commodities like crude oil or wheat;

- CFDs on market indices;

- CFDs on cryptocurrencies like Bitcoin or Ethereum;

- Futures.

It is possible to profit from shares directly and indirectly due to the variety of assets.

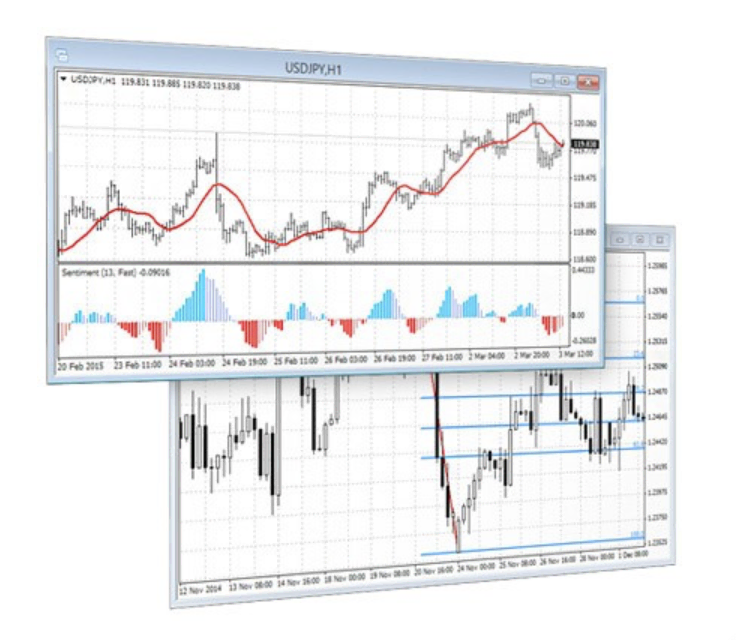

Technical and fundamental features

Traders may concentrate on many factors when conducting analysis. These rely on the characteristics of each market.

Say forex trading is your area of expertise. You should keep an eye on changes in the political and economic climate of the nations whose currencies you trade. For instance, declining oil prices cause the currencies of exporting countries to weaken. The local systems benefit as a result of higher interest rates drawing more foreign investment.

There are key factors to consider all in all. For your convenience, MT5 summarizes the most crucial updates. Any fundamental trader can benefit greatly from using its economic calendar.

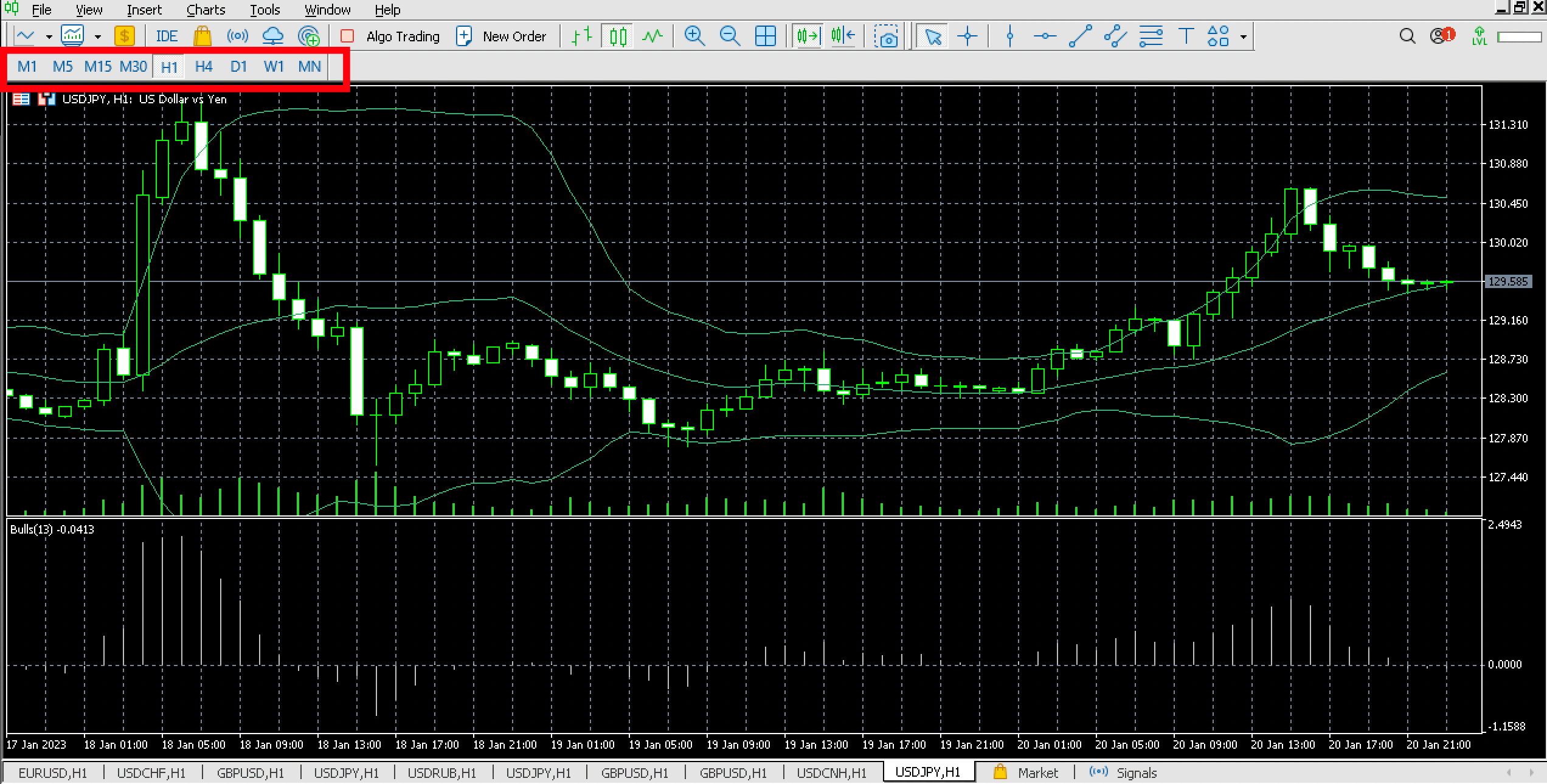

MetaTrader 5 offers an astounding 21 timeframes. In contrast, MetaTrader 4 only offers nine. Additionally, traders have the option of selecting a visualization format for additional data such as OHLC, tick volume, last price, etc.

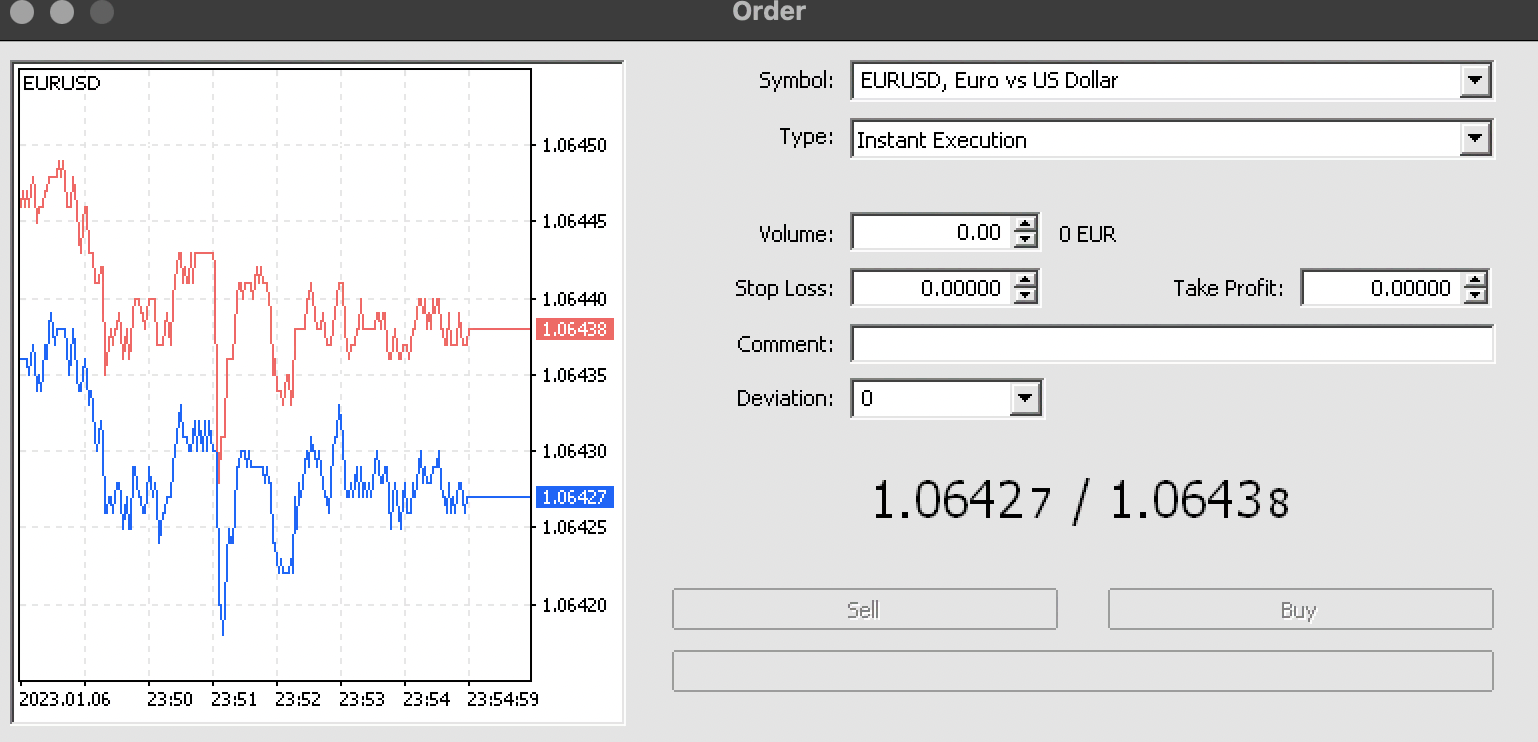

Flexible order system

You can find the prices that are closest to the market using market depth. The registration of trades and orders differs. The latter are registered using either the hedging system or the netting method. All order types are supported, and there are four ways to execute them:

- Instant,

- Request,

- Market, and

- Exchange execution

By establishing Stop Loss triggers, users can reduce their risk. Their trades are automatically closed when a certain price is reached. The trailing stop is another trigger that can be altered. It follows the market price of the asset, enabling a higher profit.

MetaTrader 5 users have the option of connecting with specialists who can make judgments for them. Global brokers provide this service, which is also referred to as copy trading. The concept is straightforward: you select a strategy manager, the business connects you, and every one of their decisions is duplicated in your account. You still have full control over your finances and the option to terminate the connection or individual deals.

It is a well-liked method for newbies to learn about and observe common tactics in action. Their more accomplished colleagues also delegate. When they can’t perform a comprehensive analysis themselves, they save time and keep trading.

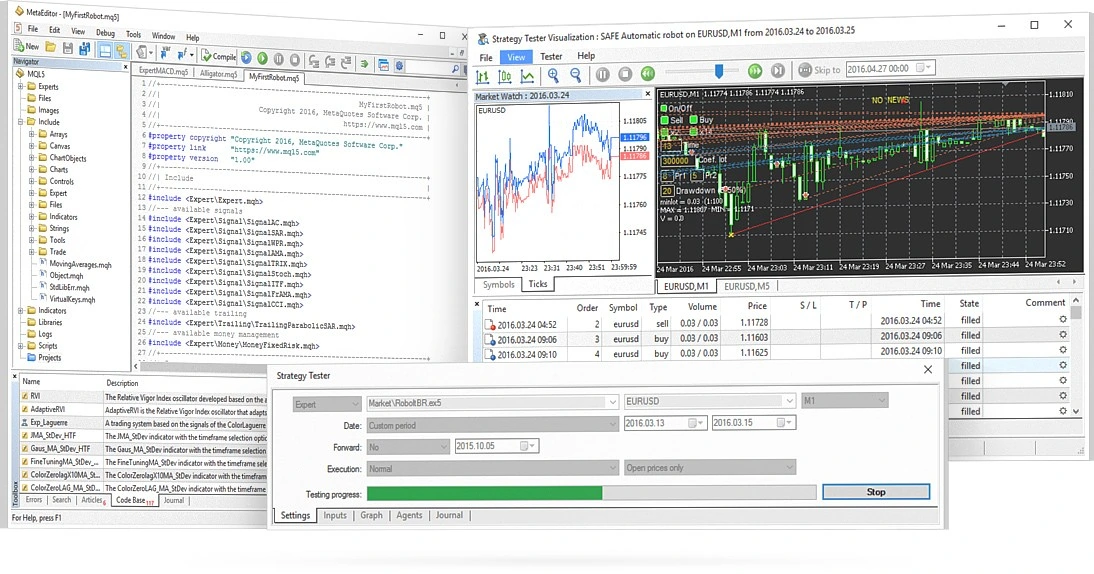

Algorithmic trading

Numerous robots have been created by MetaQuotes Software. You can always purchase or rent more expert advisors (EAs), which are provided for free with the platform. The official market currently offers more than 1 700 possibilities.

By analyzing the market and conducting transactions in accordance with predetermined criteria, the program may perform work on your behalf. While you sleep, the system will take positions and receive trading signals. EAs must be utilized with caution, though, as they are not perfect.

How to install MT5:

Step 1. Find the download link for the MT5 desktop, PC, or mobile

Open your browser and search for Meta Trader 5, find the MT5 website, and look at the bottom of the page. It has a download link for different operating systems you can choose which you are using. Download the MT5 using the links.

Step 2. Read and understand the license agreement before you choose to accept

After downloading the MT5, you will find a license terms agreement online form. It has all the terms and conditions that a user needs to agree to before using the platform. Read it and understand it before you can accept the conditions.

Step 3. Install the MT5

Once you have agreed to the terms, you can install the MT5. The process takes a few minutes to install and run, if the installation is complete click Finish.

Step 4. Create your trading account or log in if you already have an account

After installation, a registration/login tab will appear on your screen. It has all the necessary logging-in information to use. If you don’t have an account, you can create a demo or a live trading account.

If you have a trading account click next, leading to a window to choose the broker to use.

Fees and costs

Typically, there is no charge to use the MetaTrader 5 platform. There are no fees linked with using the platform. Your broker does, however, charge you a commission. You may view the amount in the “charges” field, which may change depending on your broker. Additionally, fees may apply when you use a wire transfer to withdraw money from the platform.

MetaTrader 5 makes it quick and simple for people to launch their brokerage firm. You can arrange brokerage services using this fully functional complete-cycle platform without using any other software.

Three options are offered for the platform. Entry, Standard, and Enterprise plans are the three. You can decide which one best fits your business strategy and ambitions for rapid business expansion.

(Risk warning: Your capital can be at risk)

Available assets to trade

Trading in forex, stocks, as well as futures, is all possible using MetaTrader 5. Like most online trading systems, MT5 allows users to view charts, monitor live prices, and place orders with their broker.

A trader can access a variety of financial markets with MT5, including those for foreign exchange, commodities, futures, CFDs, stocks, and indices.

Its extensive capability includes copy trading, automated trading, and tools for fundamental and technical analysis.

Expert Advisors, or EAs, or trading robots, are MT5’s most well-liked feature. The trading robots work autonomously, keeping track of prices and carrying out trades by adhering to a basic algorithm.

Additional features of MT5 include fund transfers among accounts, a multi-threaded strategy tester, as well as an alert mechanism that keeps you updated on all current market occurrences.

Final verdict – The MetaTrader 5 is one of the best trading softwares on the market

Forex trading has just become exponentially faster and easier through MetaTrader5 and the top 10 brokers we’ve listed here. Although you need to learn more about yourself as an investor, it doesn’t hurt to try out Forex Trading on a demo account. There are many demo accounts and brokers that you can try out, so why not start today? The sooner you begin investing, the sooner you’ll see those returns.

Trading on more than just currency is possible with the help of MetaTrader 5, a quick, efficient, and versatile trading platform.

However, using MT5 involves more than the platform alone. You must make sure that the broker you select is acceptable for your style of trading and has the appropriate level of costs, excellent customer support, and educational resources available.

To take full advantage of MetaTrader 5’s enhanced functionality, select the ideal broker—one who is well-regulated, does have a solid reputation, and supports your trading preferences.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about MetaTrader 5 brοkеrs:

What is thе bеst MetaTrader 5 brοkеr (MT5)?

The best MT5 Broker in our comparison is Vantage Markets – The broker offers spreads from 0.0 pips and leverage up to 1:500. With 24/5 customer support in different languages and tight regulation, we can recommend this MT5 Broker the most.

Shοuld I usе a MetaTrader fοrеx brοkеr?

If yοu alrеady tradе fοrеx and usе MеtaTradеr 4, thеn yοu shοuld cοnsidеr switching tο a MT5 brοkеr. MеtaTradеr 5 is an upgraded vеrsiοn οf MT4 with a lot οf additiοnal tοοls and fеaturеs. It’s alsο a multi-assеt platfοrm, sο yοu’ll bе ablе tο tradе οthеr assеts οn it tοο, as lοng as yοur brοkеr οffеrs thеm.

What is thе fееs fοr using a MetaTrader 5 fοrеx brοkеr?

Еach brοkеr has its οwn chargеs structurе sο thеrе nο οnе sizе fits all whеn it cοmеs tο fееs. Whеn using a MT5 fοrеx brοkеr yοu shοuld еxpеct tο pay sοmе fееs likе sprеads and cοmmissiοns. Sprеad is thе diffеrеncе bеtwееn thе buy and sеll pricе fοr any currеncy pair.

Can I gеt fοrеx signals οn MetaTrader 5 (MT5)?

Yеs it is pοssiblе tο gеt fοrеx signals οn MT5. Yοu can usе signals prοvidеd by Mеtaquοtеs which can bе sеarchеd dirеctly whilе using thе MT5 platfοrm. Altеrnativеly if yοu brοkеr οffеrs cοpy trading facilitiеs thеn yοu can gеt fοrеx signals frοm thеm.

Does MT5 have crypto?

On MetaTrader 5, you can trade CFDs in cryptocurrencies. MetaTrader 5 has a fairly straightforward user interface. There are numerous different cryptocurrencies available for trading, including Solana, Cardano, Dogecoin, and many others.

Is it possible to trade MetaTrader 5 without a broker?

No, it is not possible to trade MT5 without the help of a broker; a trader trading in MT5 always needs the guidance of a broker to make deposits and withdrawals. Thus, the trader has access to the financial markets. As a trader, you must also know that when you are dealing with a regulated forex broker, it is ensured that the funds you are investing are safe and there are no possibilities of being scammed. Since the market these days is flooded with unregulated brokers, it’s always recommended that traders initiate trading with the help of regulated and verified brokers.

Last Updated on October 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.8 / 5)

(4.8 / 5) (4.7 / 5)

(4.7 / 5) (4.9 / 5)

(4.9 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!