ATAS Order Flow trading software review and tutorial

Table of Contents

Are you looking for a detailed test and overview of the order flow software ATAS? – Then this page is the right place for you. With more than 9 years of experience in trading, we have been using this trading platform for more than 2 years. In the following sections, we will share our experiences with you and show you a detailed insight into the platform. Learn how to trade on the platform and what are the conditions for traders are.

| |

| REVIEW: |  (5 / 5) (5 / 5) |

| PRICE: | Lifetime or by month (69€) |

| FREE DEMO: | ✔ 14 Days |

| CHARTS: | More than 35 chart types + footprint |

| ORDER BOOK (DOM): | ✔ Smart DOM |

| MARKETS: | Futures (Commodities, Equities, Forex, and more) |

| DATA FEEDS: | All accepted |

| SPECIAL: | Professional indicators for better visualization |

What is ATAS? – The software presented

What is ATAS? – ATAS is a volume and order flow trading software that graphically processes market data directly from the stock exchange for you. Professional traders use the analysis of the volume and order book to identify the liquidity in the market and to open positions by themselves.

ATAS offers a complete set of tools for the analysis of futures, stock, and crypto markets. Via data feed, you get the data of the exchange directly sent your computer and ATAS evaluates it for you. Well-known tools, such as the volume profile, can be adapted and used in the software. Also, own tools (Smarttape, etc.) were developed and programmed especially for the trading software. The software surprises us at first sight with the simple configuration of the tools. Compared to other platforms, ATAS is very user-friendly.

Furthermore, it is to be noted positively that there is already a large community around the world, which trades with ATAS. The wishes of the traders are often met and new indicators or functions are programmed by a fast implementation. In summary, we can say that the software is very complex for many beginners. After a short familiarization phase, the software is very well mastered from our experience. For further information, we have published several videos with explanations about ATAS. Please have a look at this website to answer all your questions.

Facts about ATAS:

- Order Flow and volume trading software

- Supports any data feed and broker

- User-friendly and easy to use

- Customizable tools

- All that you need for professional analysis and trading

What markets can you trade with ATAS?

You can trade forward contracts (futures), stocks, and cryptocurrencies through this trading platform. ATAS supports numerous exchanges and there is a wide range of assets. However, it always depends on your broker or data feed. The broker is used to post the corresponding data for the various exchanges. ATAS is not the mediator of the data but only the executing software.

- Cryptocurrencies

- Russian Markets

- US and EU Futures

- US Stocks

Test the platform for free

For newcomers, ATAS offers a free trial version with a duration of 14 days. You get full access to all functions and can try the software. In addition, a data feed has to be added (more about this later). If you get a liking for ATAS afterward, you can book the license for one month or more. There is no automatic subscription, but the license must always be renewed by the trader himself.

What tools are offered for the trader?

The trading platform offers a very wide range of tools for analyzing the order flow. It doesn’t matter if you work with the candlestick chart, footprint chart, or only with the order book. ATAS has the right solution ready for you. From our experience, we have seen that some tools overlap a bit in the analysis and actually only have small differences. Therefore it is quite unnecessary to use all tools at once.

All in all, we could not test all tools completely, because we do not need them all for our own trading. Here you get a short overview:

- Charts: Footprint, Tick, Range, Volume, Trades, and more than 20 other chart types

- Smart DOM: Order book

- All Price: Calculate the volume for each price (BID/ASK)

- Smart Tape: Searching for big orders which is done as a lot of small orders

- Spread Chart: Analyse the order flow from other traders

- Indicators: Volume, Order Flow, Technical indicators for any chart type

The main menu provides access to the various tools via the upper bar. If, for example, a chart is to be opened, the appropriate futures contract or market must then be selected. Another advantage of ATAS is that the newest futures contract is always displayed (current chart). Optionally, you can also use other contracts.

Customize the chart easy as you want

In the picture below, we have opened several setting possibilities for you. The settings can be easily called up and configured via the chart window. ATAS offers a wide range of options to create your own trading style.

The chart views can be displayed in any color. In the settings, you can also highlight certain things (BID, ASK, etc.) in other colors. This makes it easy to identify the characteristics of a particular trading strategy. Another big advantage of ATAS is that you can move freely in the chart. Fast zooming and switching to another position of the chart is possible without any problems.

The settings can be saved in templates and retrieved and applied to other charts. Under “All Instruments” you will find a list of the different markets and stock exchanges. Optionally, you can switch to any futures contract. We recommend leaving the settings on “Continues” because then you don’t have to change the futures contract manually.

Trades can be settled via the chart trader or directly from the order book. Automatic exit strategies are also possible. The order execution and operation leave nothing to be desired from our experience.

Chart trading:

- Buy/Sell Market

- Buy/Sell ASK

- Buy/Sell BID

- Cancel BID/ASK/ALL (deletion of orders in the market)

- Reverse (Reverse positions)

- Close (Close active positions)

- Flat (Close all)

- Exit Strategies (Automatic Take Profit and Stop Loss)

- Trading from Chart (Trading directly from the chart)

In addition to the order book or the direct chart, trading can also be done with the chart trader. There is 1-click trading. An order is opened directly with only one click. The chart trader offers the trader good possibilities for risk management. For example, you can insert an automatic stop loss or take a profit. In summary, the chart interface of ATAS is very clear and all-around successful.

Professional Order Flow indicators for the chart

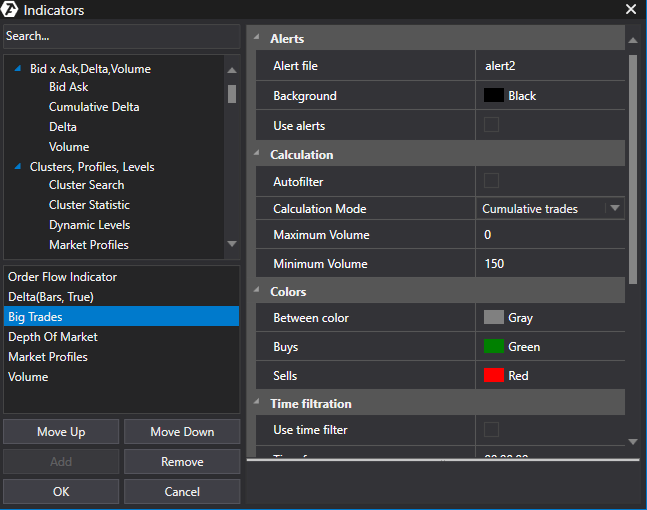

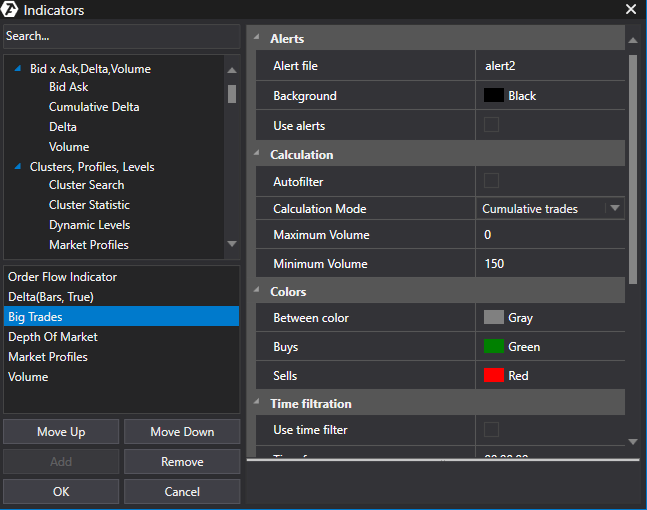

Overall, we have tested and applied many of the indicators of the trading software. There are more than 50 indicators available that can be applied to any chart. In the picture below you can see a section of the button for indicators.

In the following, we will introduce you to the best indicators of the platform. Every trader has his own preferences:

- Volume Profile: It indicates the vertically traded volume. You can adjust the indicator precisely. The value area can be displayed as desired. The Volume Profile is not only applicable to volume, but also to the delta, trades, etc.

- Market Profile: In addition, the Market Profile is very popular too. Based on the 30-minute chart it shows you important trade areas.

- Big Trades: This indicator shows you big order trades and volume on the chart automatically.

- Cluster Search: This is one of the most interesting indicators in our opinion. It doesn’t matter which data you want to highlight from the market. With Cluster Search, you can display any traded transactions you want.

- Order Flow indicator: This indicator shows you directly the Order Flow of the order book on the chart.

In the picture above you can see the section of the typical indicators. Simply select an indicator via the left search window and insert it into any chart. The indicators can be set in the right window. There are many ways to design your analysis. For example, analyze only the delta or the volume with an indicator. The setting options are really very varied and you should create an overview for yourself.

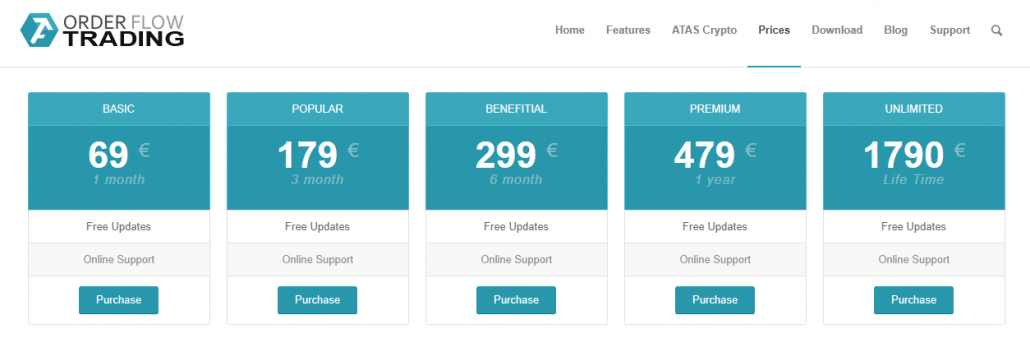

Review of the ATAS prices

The software is always paid in dollars or euros. Beginners can start with a monthly subscription of $74. The more months you book, the more money you will save. For example, if you book for 6 months, you will save $114. A lifetime license is available for $1,990.

In our opinion, the prices are fair, because ATAS offers several advantages (mentioned above) compared to other platforms.

There is no automatic subscription behind the different prices. You have to renew the license by yourself after the expiration. In the dashboard (login on the main page) you can see your current status and the duration of the license. Various methods can be used for the purchase (PayPal, bank transfer, and credit card). Sales to companies are also possible.

How to connect ATAS with the data feed and your brokerage account:

As mentioned above, you have to connect ATAS to the data of a stock exchange. There are different providers (CQG, Rithmic, CTS, etc.). These data cost a certain amount per month, which depends on the exchange. European stock exchanges are usually more expensive than American ones. For the trial version, you can create a free demo account with a data feed provider and there are no costs.

However, if you want to start live trading, the data feed must be booked through a broker of your choice. The fees are then automatically debited from the broker account. We recommend that you recharge your broker account with money and book a data feed after the data feed test period has expired. In the following section, we will describe exactly how to set up the data feed at ATAS.

1. Register for a free data feed or use your broker

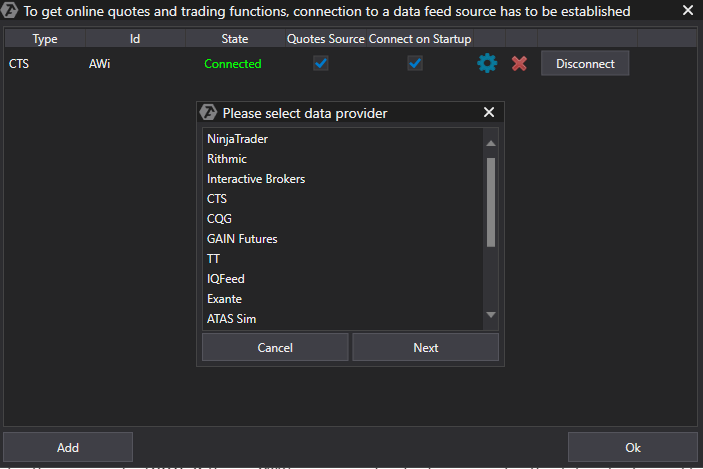

Either you create a demo data feed with any provider (CQG, Rithmic, CTS) or you create a broker account with a futures broker and book the data feed via the service of the broker.

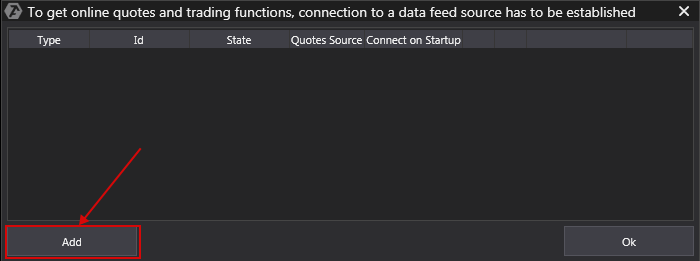

2. Add your data feed

Now simply click on “ADD” and select your data feed provider. Then you have to enter your access data. In the end, you have to confirm it and the connection will be entered into the software.

3. Get the connection

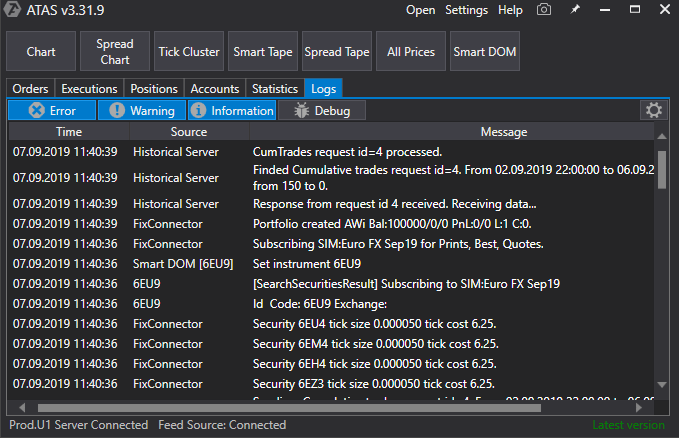

Now click on “Connect” and ATAS connects to the data feed. Optionally you can check “Connect on Startup” (we recommend) otherwise the data feed must always be connected manually when starting the software. The software is now completely ready for use.

Which broker you can use with ATAS?

For trading with ATAS, you need a real stock exchange future broker which is officially regulated and got licenses for trading. We recommend the broker Dorman Trading which is based in the USA. You will get very low fees and the fastest execution.

For trading futures, you need a lot of capital so many trades are asking if they can use a CFD or Forex Broker for using ATAS. It is possible but you can not trade directly from the platform. The solution is that you make your analysis with ATAS and open the orders on the CFD and Forex Broker platforms.

In addition, it is not possible to get data for CFDs or Forex because they are traded on the spot market or OTC (over the counter). You can only get the right data from the stock exchange for futures. Futures will move the market price of CFDs and Forex. Read our article on how to trade Forex with Order Flow.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Dorman Trading Broker for trading futures with ATAS

To trade directly with ATAS we recommend the Online Broker “Dorman Trading”. It is a US-based company that accepts international clients. You can trade with low fees and fast execution. Just connect the brokerage account with ATAS and you will be fine. The minimum account deposit is $2,500 and there are no additional fees.

Facts about brokers and Dorman Trading:

- Choose a reliable broker. We recommend “Dorman Trading”.

- You need a broker which got access to the real Stock Exchange

- To connect ATAS with Forex and CFDs is not possible

- For trading Forex and CFDs you have to use 2 different platforms

- Dorman Trading offers account opening with $2,500

- No hidden or additional fees with Dorman Trading

Review conclusion: ATAS is a very good and professional Order Flow Software

The ATAS Trading Platform is a recommendable software for every Order Flow and volume trader. The trading platform gives you all the tools you need to trade successfully.

The great advantage of the trading platform is that it is very easy to use and can be adjusted in many ways. Beginners should have settled in well after a short training period. With our videos on the platform, the operation should not be a problem anyway.

For a small price per month or a larger price for the annual license, ATAS is one of the leading order flow trading platforms worldwide. So far ATAS has not disappointed me and has always lived up to my expectations. Further information can also be found in our “Order Flow article“.

Become a professional elite trader thanks to volume trading. With this software, you are one step ahead of the crowd.

Trading without Order Flow is like driving without wheels. ATAS will give you a huge advantage for future trading.  (5 / 5)

(5 / 5)

Trusted Broker Reviews

Experienced traders since 2013FAQs- The most asked questions about ATAS:

What guarantees does ATAS offer?

The company makes it clear on its website that they aim to maintain 100% customer satisfaction. For this reason, they offer a 14-day free trial to help prospects decide if the software is worth purchasing. Additionally, if a customer is unsatisfied with the software for any reason in the first 14 days of purchase, ATAS offers a 100% refund.

Can I freeze an ATAS license?

Customers with the Premium package, the one-year license, can freeze their account for a maximum of 31 days (in total). However, customers who choose this option must freeze the account for a minimum of 10 days. The company will freeze the license the day the customer makes their request. Contact the company on Telegram or their support email address to freeze a license. Remember that the license will get unfrozen if you log in.

Do bulk buyers get any additional discounts?

Traders interested in buying five or more licenses can get a discount. The size of the discount depends on the number of licenses they purchase, and the validity of the licenses is calculated individually. You can discuss group discounts by contacting them on Telegram or emailing them at [email protected].

See other articles about trading tools:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)