Can brokers manipulate the MetaTrader? – The hidden truth

Table of Contents

Most traders have to face the manipulation issue in the trading industry. When you are an investor, you must pay attention to several aspects. There are several dangers that you must not be aware of. Brokers make several changes according to their needs, stopping the trader from making a profit from the platform.

Some brokers influence prices, charts, spreads, and more. In addition, they make fake price boosts intending to influence traders to purchase certain currency pairings. Consequently, retail traders experience a sudden price change compared to the other platforms.

Let’s gather some more information about the manipulation in MetaTrader.

(Risk warning: Your capital can be at risk)

How reliable is the MetaTrader?

MetaTrader is one of the best and safest options when it comes to a trading platform. All of the data between the trader and server is encrypted. In addition, it hides your IP address while you opt for any investments and trades via the platform.

Good to know!

MetaTrader has an easy operating interface, which helps people to get along with the traders. That is why it becomes convenient for beginner traders. Developers have made this trading platform in a way that meets the requirements of every trader. So, it is a great platform for both advanced and new traders.

The platforms offer an array of top-notch customer services. Also, the withdrawal process of trading platforms is smooth, with a variety of payment methods. Consumers can choose a payment method with their trading platform at their convenience. With all these features, it becomes the best option to rely on with your funds and investments.

Can brokers manipulate the MetaTrader?

Yes, there is a possibility that a broker can manipulate the Metatrader execution. Thus, traders must be careful and keep an eye out while they opt for trading. Traders make use of spreading inaccurate information related to the services. ‘Can brokers manipulate the Metatrader?’ is a major industry concern.

Good to know!

For a beginner trader, it becomes more difficult to differentiate between honest and fake traders. So, MetaTrader users need to pay extra attention if they are new. Whenever you search for a broker, don’t rush with your decisions. Before you invest in any company, make sure to have details of its background and reputation.

Many companies claim to provide the best of the best services just to increase the crowd. They provide irrelevant data on the online channels that the investors often visit. When traders see a storm of bad information on display panels that seems fair, they tend to execute a given trade.

Here are some ways in which a broker can conduct a MetaTrader scam by manipulating it:

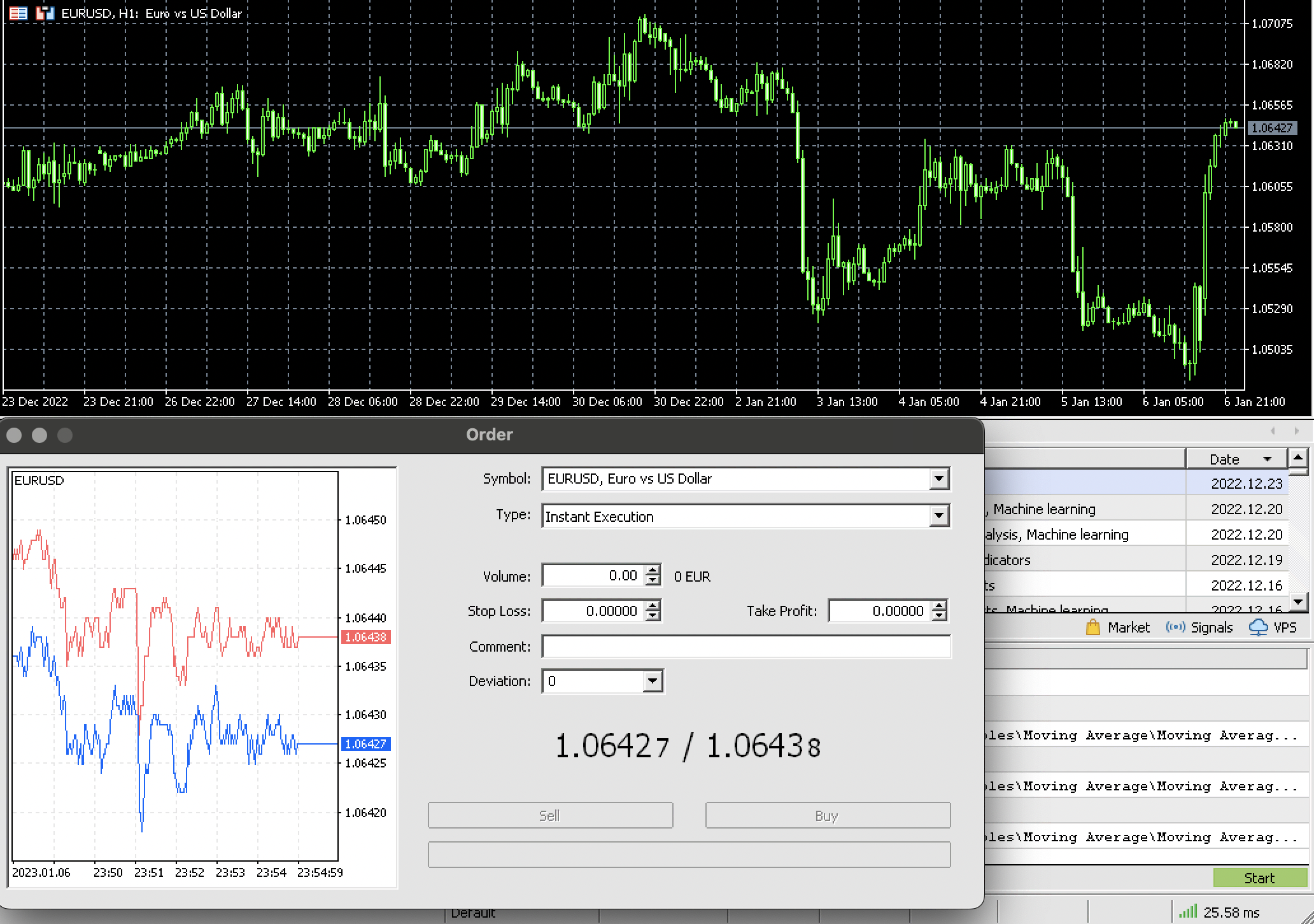

Execution time

Brokers can also manipulate the execution time. They make several changes that would benefit them but can have a great deal of loss for you. Every broker trades to make money, some of which can be against you. So, make certain that you never get along with the fraud brokers.

Price

Brokers manipulate the prices to yield to traders to stop losses from being triggered. Even though it is incorrect to say that every broker will cheat you with the funds. It is quite common in unregulated/offshore B-Book brokers. They are always up to scam traders, and these brokers are generally not regulated.

Good to know!

If you place take-profit or stop-loss orders, as the broker knows where they are, they can influence its “market price.” And it can result in the broker winning or avoiding a loss.

To avoid your prices/spreads being manipulated, trade with a regulated ECN/STP broker, as they cannot manipulate the pricing of currency pairs.

Spread

Brokers manipulate the spreads as well. With intent, they attempt to assemble a deceptive impression of the securities. The fraud brokers make false information reach out to the traders related to the price of securities and the market.

The brokers opt for this by spreading untruthful/false information. Or they will offer buy/sell orders purposefully. Also, it affects the price/turnover of an asset intending to create a promising prospect.

Our tip, sign up with the best MetaTrader brokers and start trading with low spreads & commissions:

MetaTrader Broker: | Review | Regulation: | SPREADS & ASSETS: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets  | Regulated by CIMA, ASIC | From 0.0 pips spread + $ 2 commission per 1 lot trade 800 markets+ | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips # Paypal & crypto payments | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

2. RoboForex  | Regulated by the IFSC | From 0.0 pips spread + $ 4 commission per 1 lot trade 16.000 Markets | # Multilingual 24/7 customer support # Leverage up to 1:2000 # Award-winning broker # Free bonuses # MT4/MT5 # Spreads from 0.0 | Live account from $ 10 (Risk warning: 72.87% of CFD accounts lose money) | |

3. IC Markets | Regulated by the ASIC, FSA & CySEC | From 0.0 pips spread + $ 3 commission per 1 lot trade 2,000 markets+ | # Free demo account # Spreads from 0.0 pips # Low commission # Real raw-spread trading # Big liquidity providers | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Can a broker manipulate MT4?

Yes, a broker can manipulate MT4. MT4 is exposed to manipulation as the other things in the trading market. Many brokers want to reach their dreams by hook or crook. And because of achieving their goals, they opt for manipulating. Therefore, MetaTrader users must watch each step.

Types of manipulation

We have mentioned that manipulating MT4 is possible. Brokers make use of these methods to rob people and get an advantage. Let’s look at the methods by which brokers opt to manipulate MT4.

Slippage

Market conditions are explosive, and that’s why the price of the currency can vary. Slippage means the gap between currency pairs, often occurring to many traders. Be cautious of this because sometimes brokers tend to blame the reason for the price gap on slippage.

Spoofing

Spoofing is prohibited and illegal, referring to placing phony orders in a typical currency and creating fake interest. As a result, spoofing can make traders lose a lot of money. However, the increased demand has made it go through artificial inflation.

In consequence, it attracts a crowd of investors. It has legal consequences because it breaks the law. The government might take legal action against MetaTrader scams such as these when investors indulge in illegal practices.

False Spikes

Some unscrupulous brokers take advantage of this process and fake price waves. And it attracts unsuspecting traders. When a trader places an order, they will see the price fluctuating.

You can avoid it by comparing your account with other people. Furthermore, you can also use charts that third-party Forex vendors offer.

Can MT5 be manipulated by brokers?

Yes, MT5 can be manipulated by dishonest brokers. Some brokers might cheat people and rob their money. When you look for brokers, you better watch out. What you choose will show up your future trading future.

Given below are the few methods that corrupt brokers use to fraud people. You must be careful of these factors to have a satisfying trading experience.

Stop Hunting

Brokers swindle people by making specific decisions in their favor. When the traders move on to stop hunting, brokers suggest winding up a particular trade so they don’t get into any kind of loss.

And when the traders do so, they drive the prices in another direction. It occurs in the market often, so keep an eye on it.

Front Running

Dishonest brokers make use of front running. Put another way; if a broker thinks of placing an order, the other will automatically seize it before them. When a trader grabs the deal of the other trader, it outrages an individual’s situation and exploits their charts. Thus, it can hurt the involved broker.

What to look for when choosing your MetaTrader broker?

To have a successful online trading experience, you need to find a suitable MetaTrader broker. It seems tough, as dozens of online brokers pretend to offer you an amazing trading experience. We have mentioned a few things you must consider while looking for a broker.

Regulatory Compliance

A license from a regulatory body is a necessary certification, so you must check for it first. Make sure your MetaTrader broker is under the regulation of the National Futures Association. If you’re looking for the NFA member number of the company, you can see it in the “About Us” option on its website.

Margin call and leverage

Before you move on to make any trade, have a sight of their margin call conditions. At any point, if the margin in your trading account becomes insufficient, the forex broker will allocate a margin call to help you out. Although, the rules can differ for different traders. Sometimes brokers ask to increase the margin and close the investor’s deals.

(Risk warning: Your capital can be at risk)

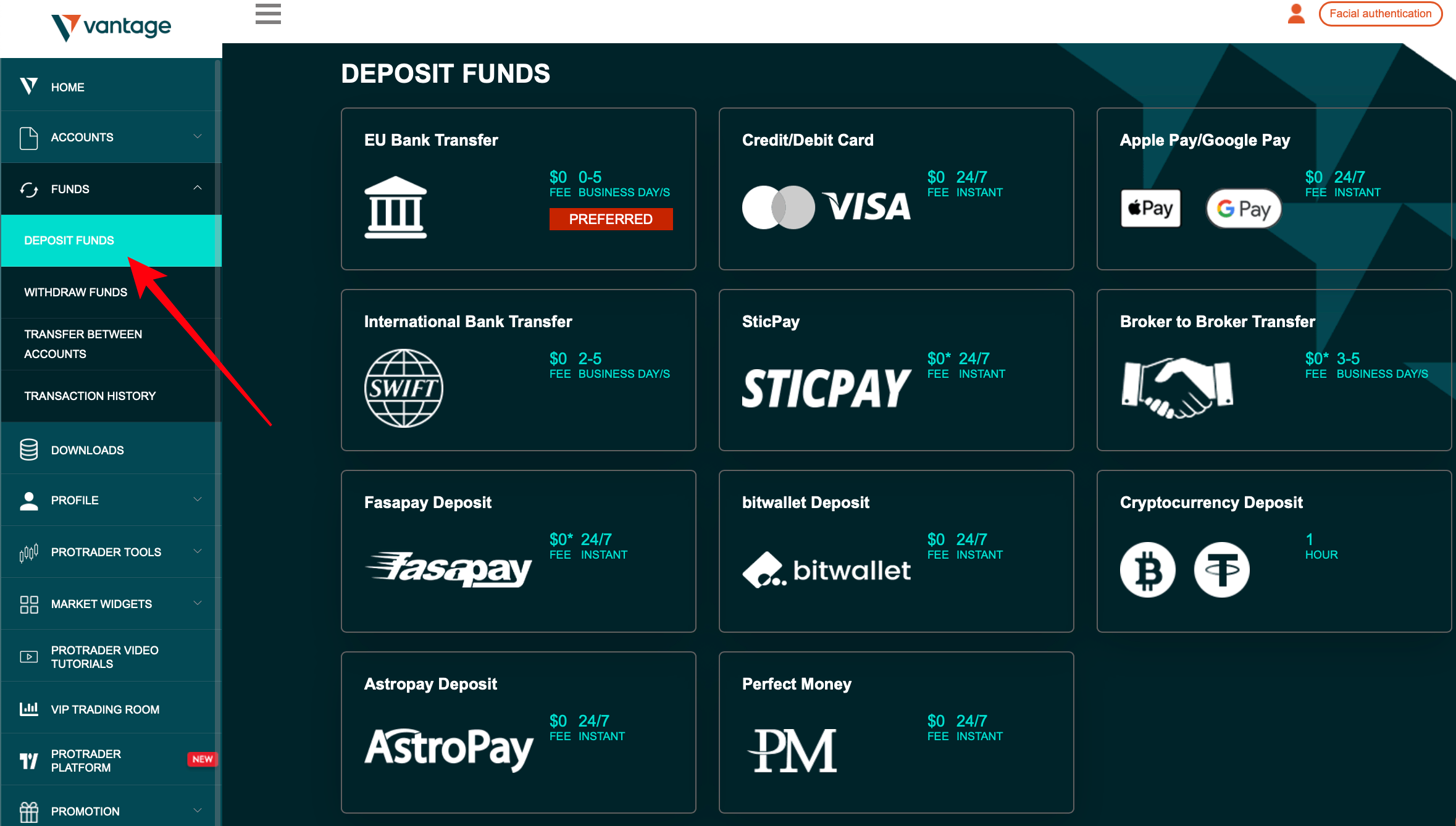

Deposit and withdrawal methods

Another major thing for traders to consider is funding and withdrawing money to your MetaTrader 4 or MetaTrader 5 account. Make certain to find out the available funding methods of the broker. All brokers generally offer payment methods such as Bank Wire transfers, Credit/Debit cards, PayPal, and Skrill (Moneybookers). Also, check out the minimum MetaTrader 4 deposit and withdrawal needs.

Good to know!

You must select a leverage that meets all your trading needs and abilities. Some brokers provide you with a 200:1 leverage. It works in favor of the traders with winning positions. As long as the possibility for losses is magnified, leverage can quickly ruin a trader’s account.

Bonuses

Look for forex brokers who offer bonuses. It can be a great factor in enhancing your trading capital. Many brokers allow a 30% or 50% bonus on the first deposit you make. Traders can get these bonuses in their trading accounts without more ado.

When you accomplish a specific trading volume, you can draw back the bonus amount. Moreover, be aware of reading out the terms of service related to the bonus. Thus, you will know if there are any restrictions on that bonus.

Conclusion – Shield yourself from unethical brokers

When you’re in this industry, you are prone to witness them. It is very common to encounter these issues and scams. Yet, you’re ready to get rid of them with some of the methods we have suggested. You can use these tactics and shield yourself from unethical brokers and fraud.

(Risk warning: Your capital can be at risk)

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.8 / 5)

(4.8 / 5)