The 3 best TradingView brokers for crypto in comparison & test

Table of Contents

Almost any crypto trader who takes his job seriously and wants to earn money in the crypto market sooner or later comes across trading software. There are a lot of bad offers on the market, so it might be difficult to choose a good broker. Most of them do not suit the needs of crypto traders, and there are lots of scam brokers.

As most people know, TradingView is one of the best trading software. The platform is used by millions of traders worldwide offers many useful indicators and features, and most of which are interesting for trading cryptocurrencies. The 3 best TradingView brokers for cryptocurrency trading are presented in this article. Have fun reading!

See the list of the 3 best TradingView crypto brokers:

Tradingview crypto Broker: | Review: | Regulation: | Spreads: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. Vantage Markets | Regulated by CIMA, ASIC | From 0.0 pips | # Free demo account # $200 minimum deposit # Spreads from 0.0 pips # No hidden fees # Fast execution speed | Live account from $ 200 (Risk warning: Your capital can be at risk) | |

2. Pepperstone | Regulated by FCA, ASIC, DSFA, SCB | From 0.0 pips | # Advanced tools # 24/5 customer support # Free educational resources # Competitive spreads # Regulated broker | Live account from $ 200 (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

3. BlackBull Markets  | Regulated by FSPR, FSCL | From 0.0 pips | # Regulated broker # Free demo account # No hidden fees # 24-hour support # 100+ different markets | Live account from $ 100 (Risk warning: Your capital can be at risk) |

The 3 best TradingView brokers in comparison & test

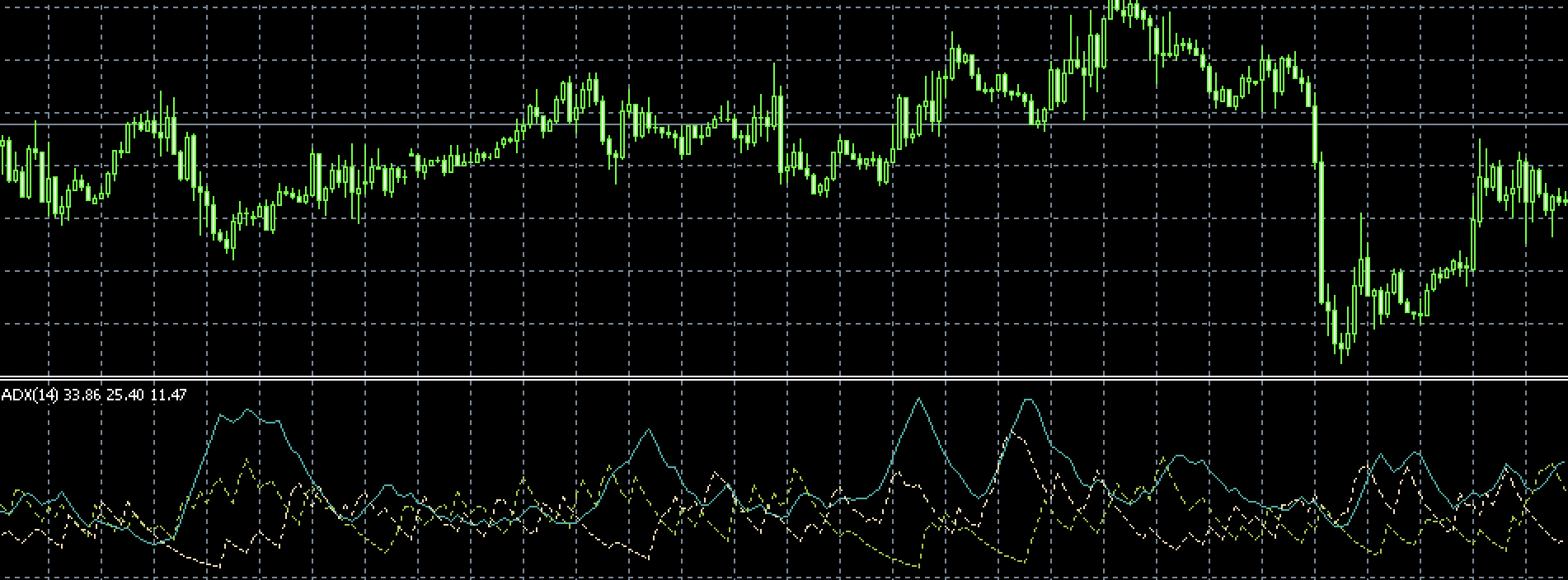

TradingView is essentially a web-based charting program that provides a wide range of technical analysis functions. With the aid of TradingView, for instance, you can construct charts, examine crypto pair prices, and in some cases, make orders directly.

Additionally, it functions as a universal social network for traders and investors alike. It is a successful social platform that allows traders and investors to connect quickly with trading partners.

When talking about cryptocurrency brokers, it’s important to realize that their role is to act as a go-between for traders and the platform—more precisely, the market—where trading takes place.

So, this allows us rapid entry into the cryptocurrency world, which offers a ton of potential for development, growth, and big earnings. Around us, there are several readily available crypto brokers.

Along with a variety of advantages, there are several important factors to keep in mind before making a cryptocurrency investment.

We’ve identified the three finest crypto brokers for buying and selling cryptocurrency to answer your question of ‘What is the best Crypto broker for TradingView?’

#1 Vantage Markets

In order to expedite trading and take advantage of market possibilities, Vantage Markets, a reputable multi-asset broker, is dedicated to offering a stress-free trading experience. This award-winning platform, which has more than 10 years of expertise in the financial industry, has a lot to offer both brokers and the trading environment.

There are numerous trading platforms available to Vantage Markets account members. Any platform an investor selects is ultimately a matter of preference because each program has pros and cons of its own. The primary platforms that Vantage Markets has included are listed below.

(Risk warning: Your capital can be at risk)

MetaTrader 4

Many brokers utilize it because of the variety of trading tools it offers, as well as its practicality and quick trade executions. MT4’s support for trading bots, which open positions devoid of human participation, is one factor that might influence users’ decision to utilize it for trading.

MetaTrader 5

MT5 is preferred by traders over MT4 since it is a speedier and more advanced version of the latter. Additionally, customers of this site benefit from a wider selection of marketplaces, including cryptocurrency exchanges. Additionally, MT5 has 21 timeframes compared to MT4’s 9, which has 9.

ProTrader

Powered by the well-known online charts provider TradingView, Vantage’s ProTrader platform is a browser-based trading client. For a more thorough examination of various market chances, the user has access to more than 50 technical tools and hundreds of well-known trading indicators.

Notably, Vantage Markets also employs WebTrader, a trading system that can be accessed using a web browser, to create MT4 and MT5 accounts. Another well-known tool for traders to access international markets while on the road is the Vantage Markets app. It is accessible through Google Play and App Stores.

Benefits of Vantage Markets

- Employ the Vantage Markets Pro Trader to access TradingView.

- Serviceability is offered 24/7.

- More than 500 different instruments are offered.

- There are 40 different cryptocurrencies.

- Supported in 172 nations.

- Spreads on Vantage Markets start at 0.0 pips.

- High leverage allowed up to 1:500

- There are also unique features like demo trading available.

- It is also possible to open a swap-free account, sometimes referred to as an Islamic account.

Pros

Excellent Trading Support

Vantage provides a variety of value-added products, including Market Buzz, an AI-based market news service, SmartTrader tools, analyst opinions, featured ideas, and advanced video training.

Advanced Trading Platforms

The platforms provided by Vantage include MetaTrader 5 and MetaTrader 4, a web-based platform, as well as customized software that gives a high level of flexibility.

Wide Variety of Asset Classes

Customers can select from a variety of financial instruments, including soft agricultural commodities, share CFDs, energy products, precious metals, and various cryptocurrencies.

(Risk warning: Your capital can be at risk)

#2 Pepperstone

Pepperstone offers a constantly expanding selection of tradeable markets, top-notch research, and a guideline for several social copy trading sites.

It offers cTrader as well as MetaTrader. It also includes a broad and distinctive selection of useful third-party plugins and viable third-party tools, which enhances its already remarkable design.

Compared to other brokers, Pepperstone provides a variety of special advantages, such as:

Pepperstone benefits

- Pepperstone, which was created in 2010, is run under the laws of two different countries, making it a secure platform for trading forex and cryptocurrency CFDs.

- There is a free Pepperstone demo account available

- For those with interest in copy trading and algorithmic trading, Pepperstone offers a dual opportunity for cTrader and MetaTrader.

- Pepperstone even provides a variety of platform add-ons to enhance the MetaTrader experience.

- Pepperstone offers a constantly growing array of tradeable markets.

- Low fees and spreads on Pepperstone

- Although retail traders’ trading fees are merely average, active traders in Pepperstone Razor accounts face considerable competition.

Pros

Global accessibility

If you live outside of the US, you might not be allowed to use certain brokers. Creating an account with Pepperstone won’t be difficult for the majority of foreign currency traders.

An extensive selection of online learning resources

New traders may feel intimidated by the currency market. Learning can be facilitated, particularly for complete novices, through Pepperstone’s free webinars and online courses on forex trading.

Trading using leverage for cryptocurrencies

Five of the top ten cryptocurrencies in the world are available to traders on Pepperstone, and you can be eligible for up to five-to-one leverage.

The trading platforms offered by Pepperstone are described as being dependable, quick, and compatible with Windows, Mac OS, iOS, and Android for tablets and mobile devices, as well as desktop computers. They also easily interact with their WebTrader.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

#3 BlackBull Markets

Always open a practice account before using BlackBull Markets. A demo account serves as a testing ground for your trading approach as you examine the platform’s features and the variety of trading products, spreads, and swaps.

The broker allows you to create a free demo account. The account will expire after 30 days. This is an interesting feature because most brokers do not impose lifetime restrictions on demos.

Trade 11 major cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Dogecoin, Cardano, Polkadot, Chainlink, EOS, and Stellar, with 1:5 leverage, super-fast execution, and tight spreads across many devices.

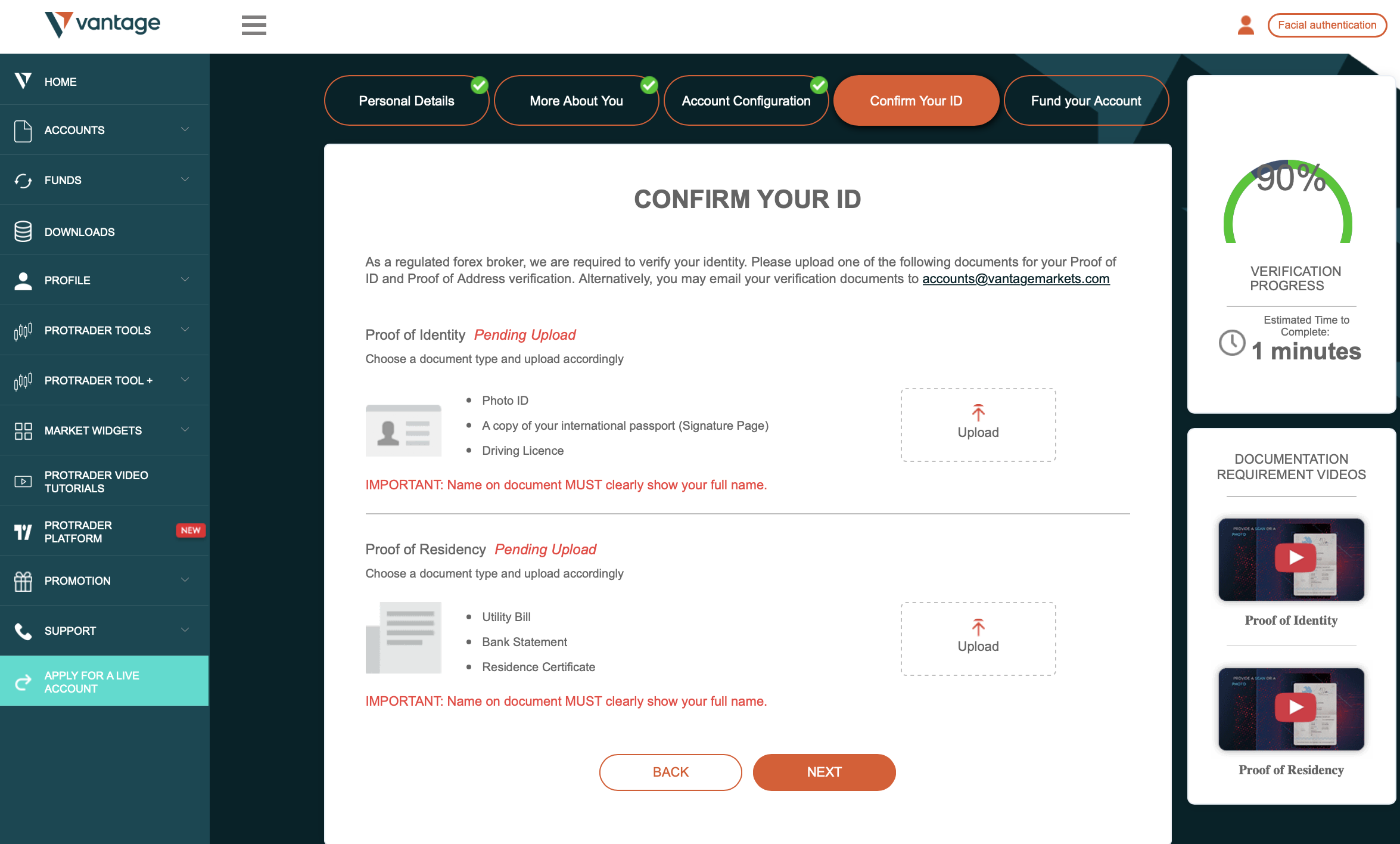

Keep in mind that you must have your passport or other photo ID, as well as a document proving your residency, on hand when signing up for a Live Account.

Their capacity to keep it secure is what matters. The benefit of doing business with this company is their familiarity with the privacy regulations they are expected to abide by.

BlackBull Markets provides a selection of funding options. The business provides Skrill, Neteller, China Union Pay, and FasaPay in addition to conventional bank transfers and credit/debit card transactions.

An ANZ Bank segregated account is used to hold customer funds. Additionally, money can be deposited into RHB and Maybank account holders’ accounts. CAD, JPY, USD, EUR, GBP, NZD, AUD, SGD, and ZAR are all acceptable deposit currencies for the business.

Not all payment options accept all of the deposit currencies that are available.

Remember, when adding money to your account that there will be a conversion fee of 3% if you decide to start a new account later in a different currency.

Benefits of BlackBull Markets

- Low forex and CFD trading costs.

- Account opening that is quick and simple.

- Superb educational resources.

- Offers the entire MetaTrader package (MT4 and MT5).

- Several third-party copy trading platforms are supported.

- Maximum 1:500 leverage.

Pros

24/7 dedicated support

BlackBull Markets values customer satisfaction. They offer multilingual help around-the-clock via live chat, phone, email, and specialized account managers.

Trading conditions that are superior

Take advantage of spreads starting at 0.0 pips, lightning-fast execution, leverage 500:1, and 26,000+ traded assets, including Forex, equities, and indices.

There are no costs for deposits

All approved payment methods, including bank transfers, Skrill, credit cards, and Neteller, are covered by their No-Fee Funding model. The above list has the best TradingView broker for crypto.

(Risk warning: Your capital can be at risk)

How to connect the Crypto broker with TradingView?

Let’s say you work with one of the brokerage companies mentioned above for your brokerage account. Then stick with us because we will provide you with all of the necessary information, which you can simply follow step by step and link to a broker using TradingView.

Suppose you don’t have a trading account. You must first register for an account, for which you must submit an application. Afterward, you can log in to trading view after obtaining an account.

Here, we’ll outline a few easy steps you can follow to connect with a broker:

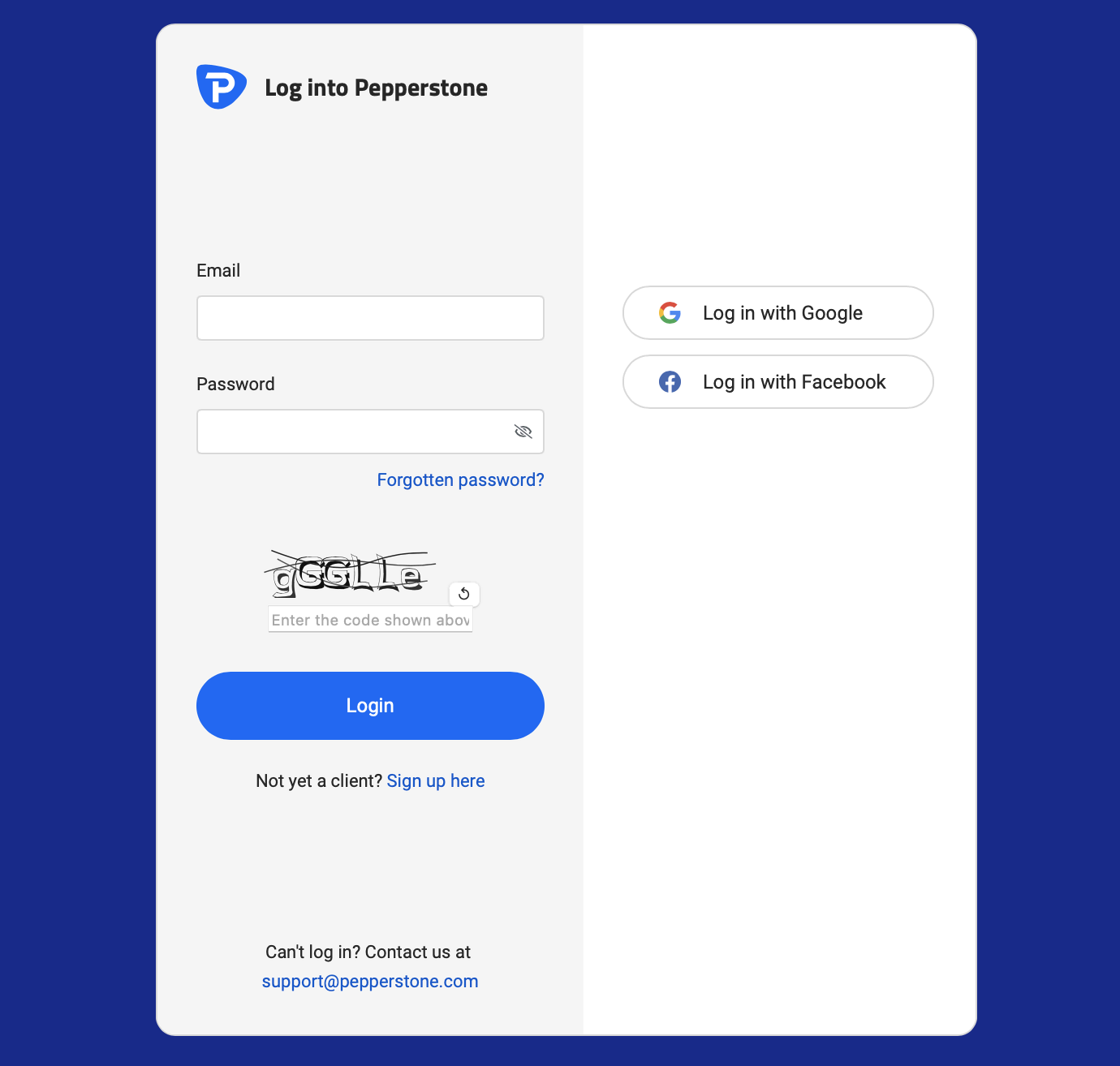

Step #1

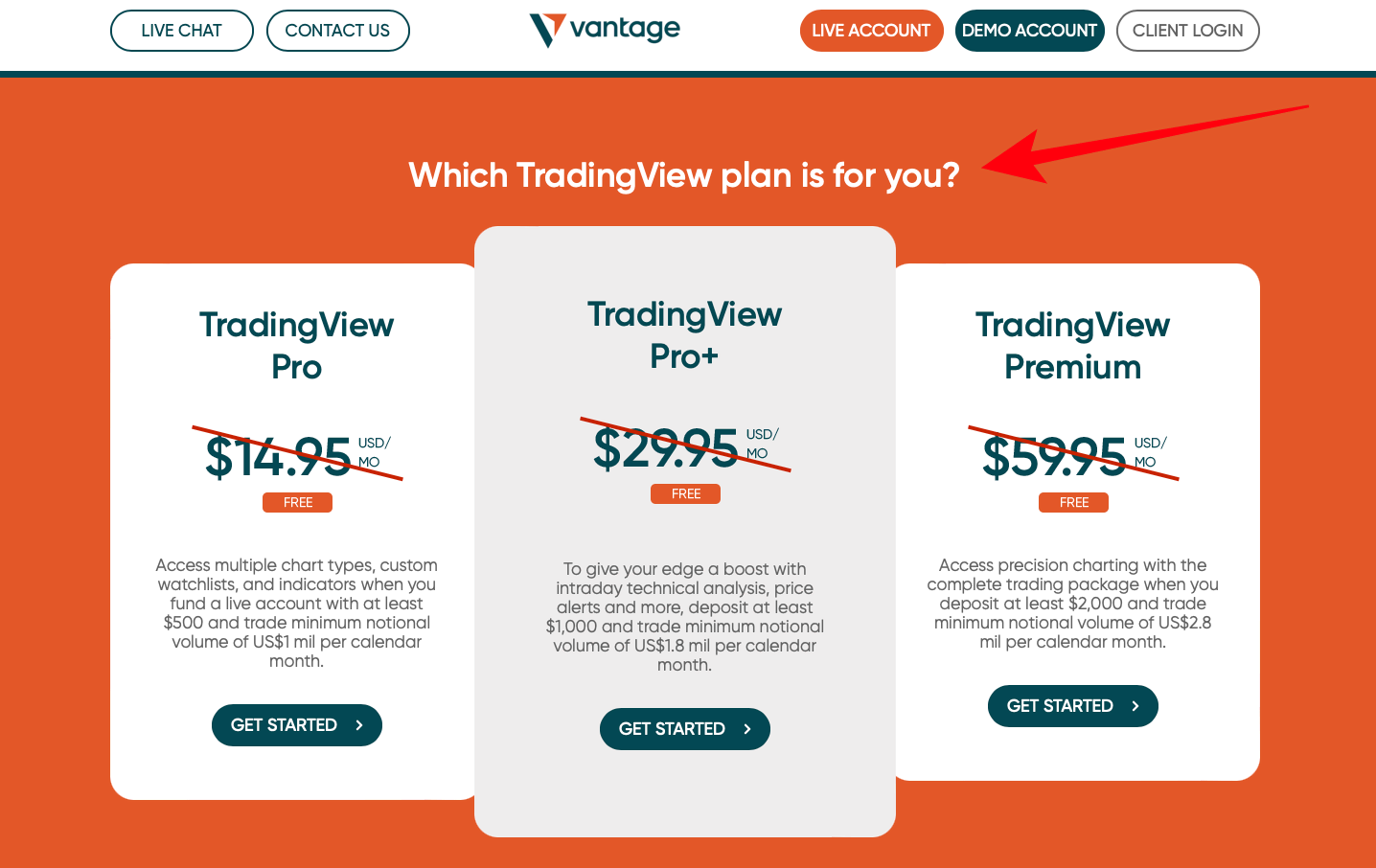

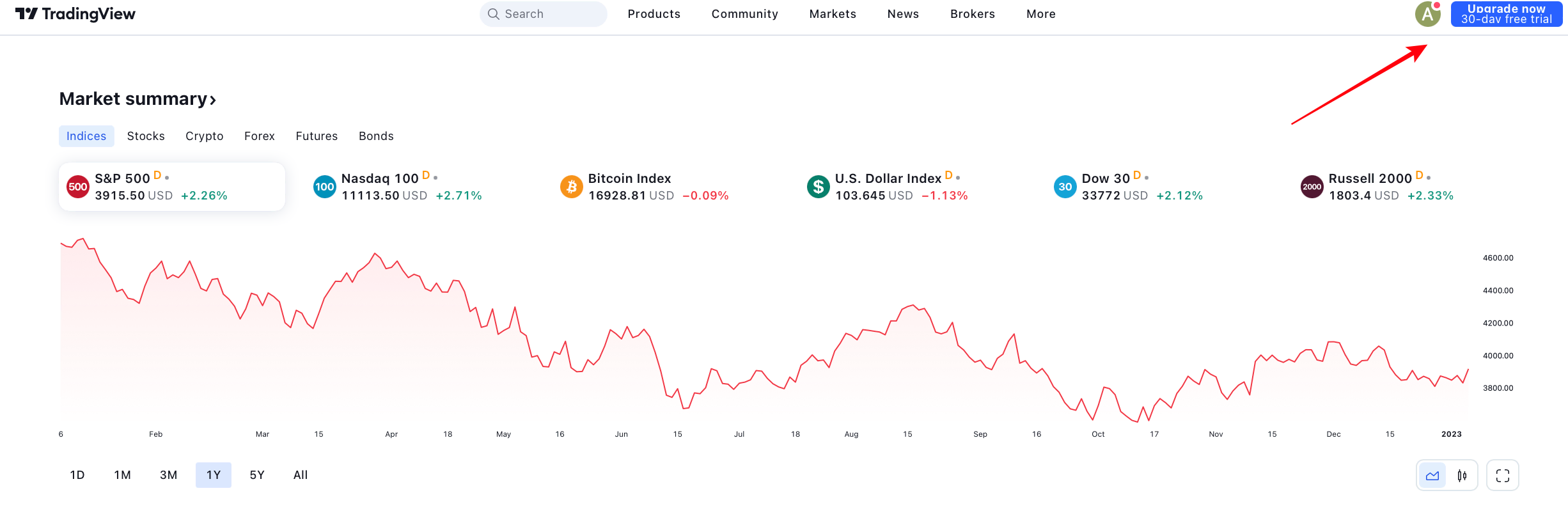

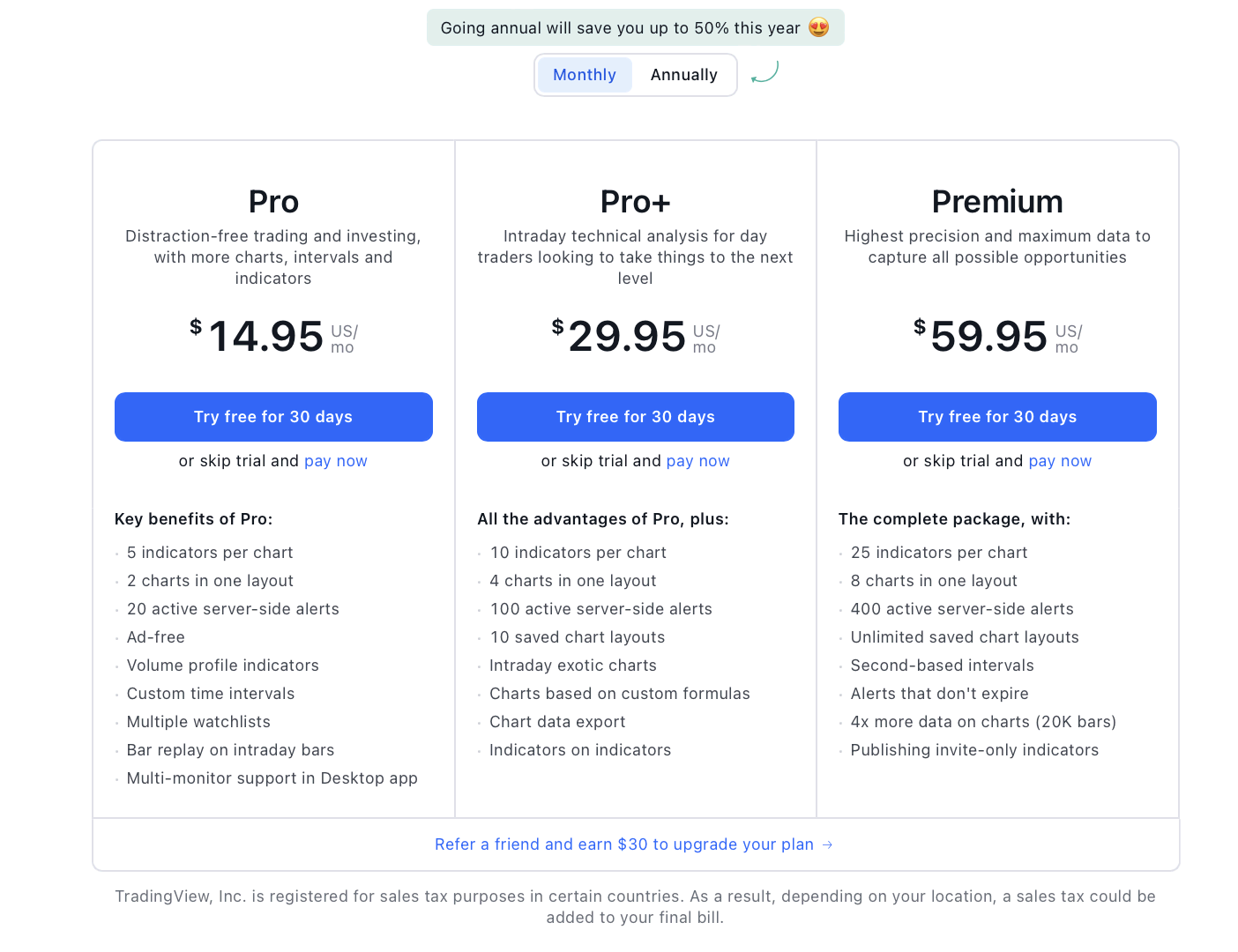

Create a TradingView Pro account. A Pro account is required to engage in live trading. As soon as you begin trading live, they are crucial for getting started. All of the Pro account’s features are necessary for you.

Step #2

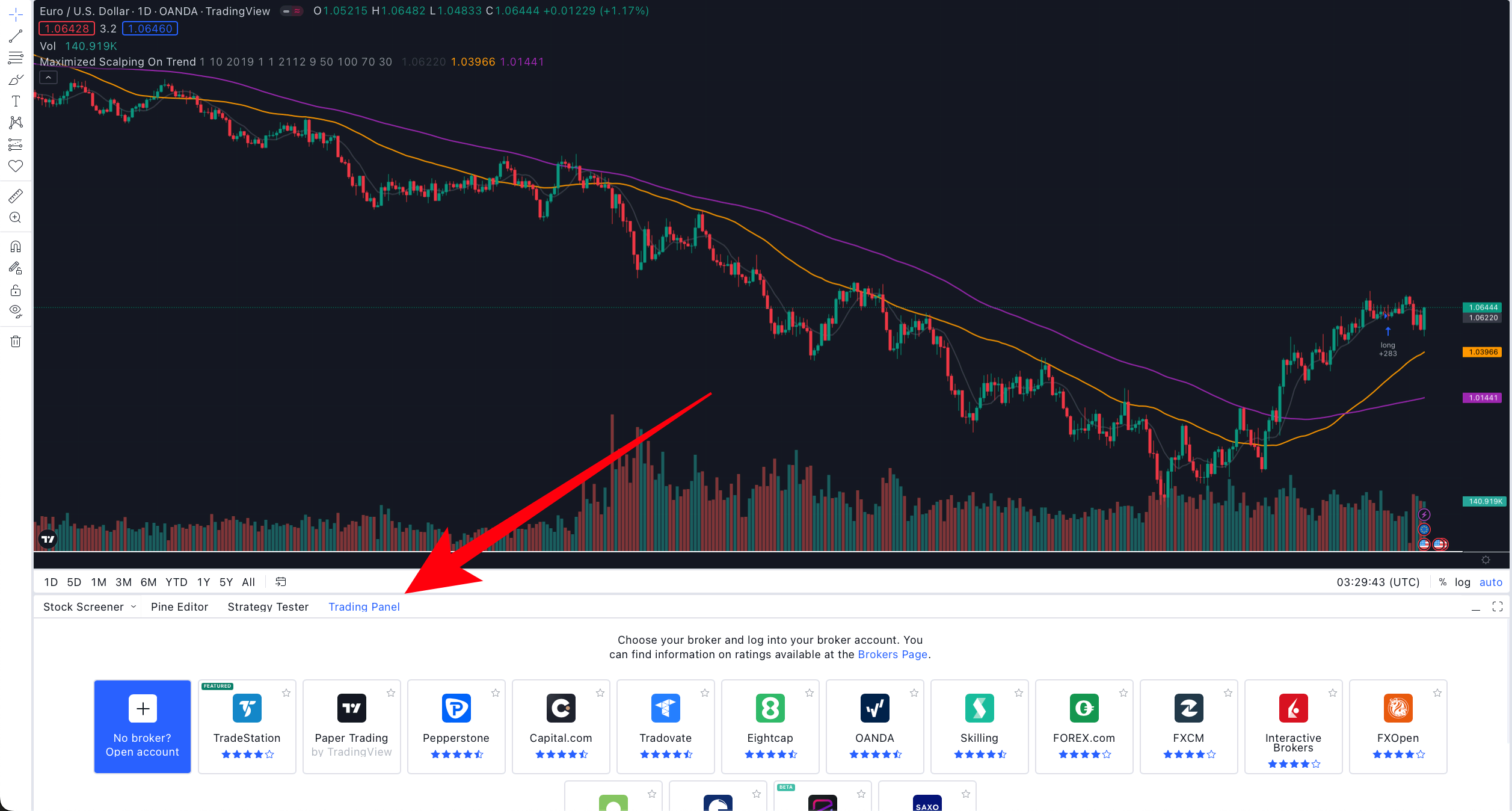

Launch the TradingView Chart window.

Step #3

You must choose the Trading Panel tab from the bottom menu in the Chart window.

(Risk warning: Your capital can be at risk)

Step #4

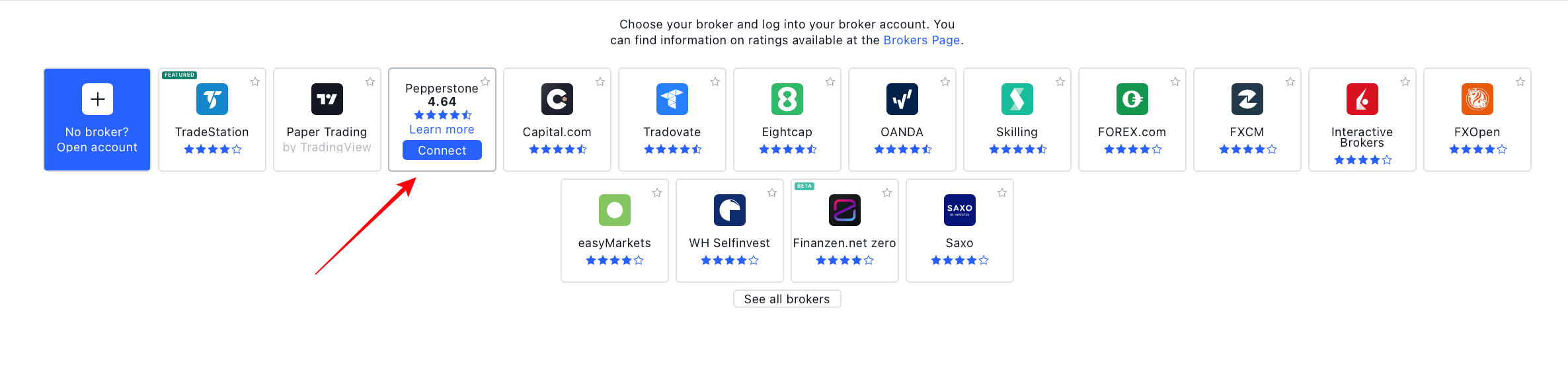

Make the Trading Panel window stand out so you can see all of the available brokers.

Step #5

Select the brokerage form for which you have funds in your account. After that, click Connect.

Step #6

At this point, you must input all of your information, including your login details.

Step #7

To see your live brokerage account in the top tab of your window, you must first confirm your live connections.

Step #8

Now that the order window has been minimized, you can trade live using your account.

You are now ready to connect TradingView to a live trading brokerage account.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

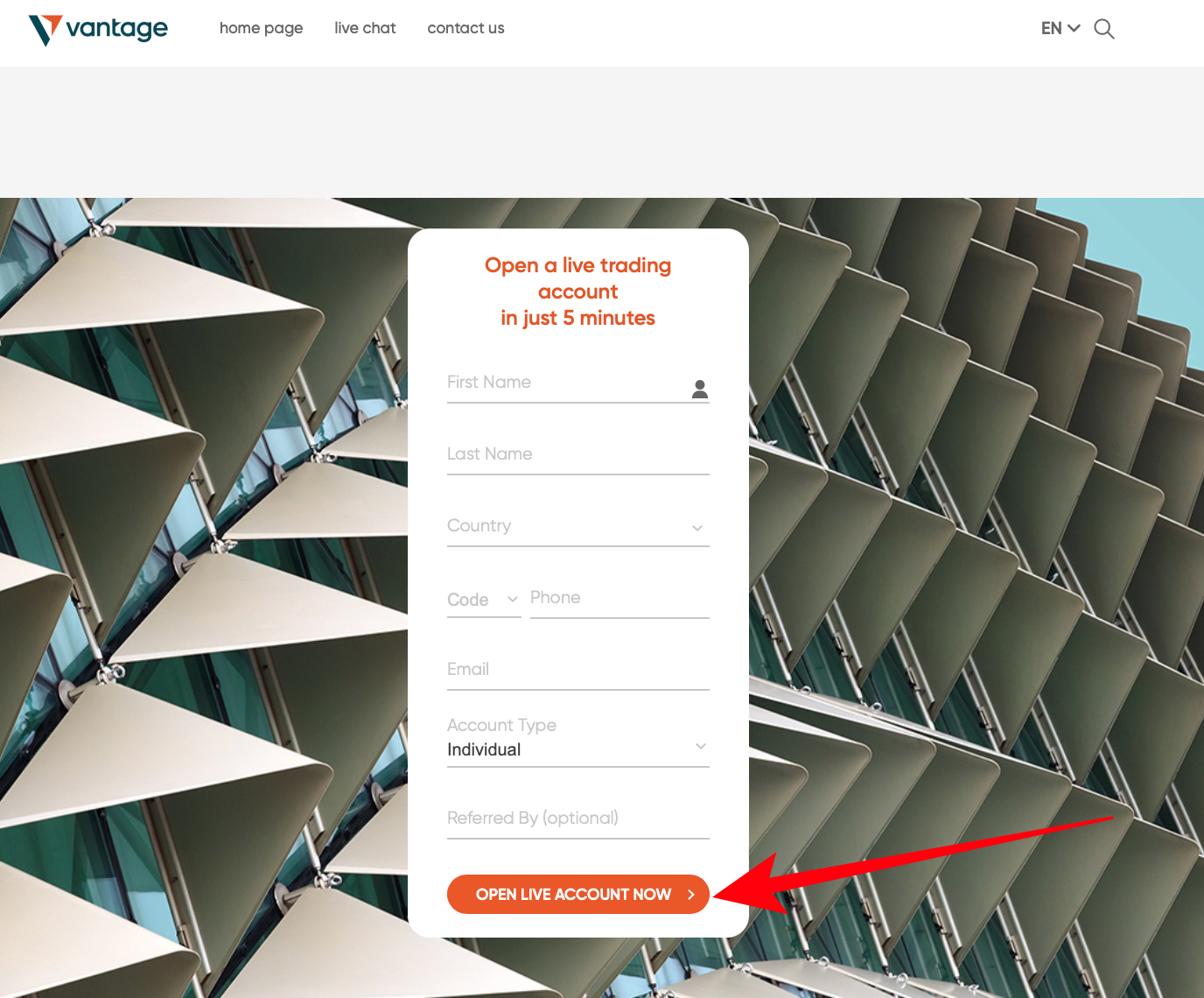

Sign up for a crypto trading account

It is usually advised that you do so with clarity and good intentions while opening a trading account in TradingView. A username that fits you well and effectively completes your profile is what you need to select. Your trading account must be legitimate for you to be a top trader in TradingView.

(Risk warning: Your capital can be at risk)

Crypto broker verification

You should have some necessary documentation on hand before you sign up for a brokerage account, such as verification of your income. Like a copy of your income tax return, a net worth statement, a current pay slip, or a bank statement from the previous six months.

The next piece of identification is your Adhar, voter ID, PAN, etc. The next pertinent document is your proof of address, which must be provided by the government or any institution, college, or professional organization. These documents must show your current address as they are required by law.

Quick suggestions

You must first obtain a suitable crypto broker and confirm with the broker that they offer all the fundamental requirements that you require in order to start a trading account. Additionally, confirm whether the platform is accessible via the website and the app. Check out the variations and available pricing after that. Decide after comparison, then enter your credentials on the application page. Last but not least, double-check it and have the crypto broker do so.

How to trade crypto on TradingView with a broker?

In order to trade cryptocurrencies, you must first create an account, link your exchange to the site, and start trading. You can trade cryptocurrencies on TradingView by following these simple instructions, which we’ll give you below.

Step #1

Your TradingView account must be logged in. By selecting the website’s signup tab, you may easily log into your TradingView account. All you have to do is sign in if you have already registered.

Step #2

After logging up, the next step is to integrate your broker into TradingView. However, not all brokers are given access to TradingView, so you should check with your broker first. You must review TradingView’s list of brokers.

Step #3

Import your exchanges watchlist. Importing your exchange watchlist is the next step you must do after connecting your broker to TradingView. Your exchange watchlist can be simply imported through the website, and you can update your broker’s watchlist frequently. Furthermore, by surfing the watchlist, you may quickly download and import them.

Step #4

You must have in-depth knowledge of the market, your ability to observe it, and a grasp of the variables that affect price highs and lows in order to complete the next phase. Your ability to read charts and spot trends must also be strong. The last thing you should grasp is when to buy and sell your shares.

Step #5

When your analysis is complete, you are prepared to proceed and place a trade on “Trading view.”

TradingView key facts

Anyone can use TradingView since it is a free platform. TradingView gives you access to a variety of charting tools as well as several other services, whereas the pro account might provide you access to greater services.

But keep in mind that you need a pro membership for yourself if you want access to advanced features like numerous charts, layouts, and customized ones.

Fees and costs of TradingView

A monthly fee of between $14.95 and $29.95 will apply to each TradingView pro account. TradingView Premium, which costs $59.95 a month, is simply accessible to traders who are keen on screening a variety of marketplaces.

Selecting a yearly subscription will result in a 16% discount.

Available assets to trade

Pepperstone (there are over 30 cryptocurrencies)

- DOGE/USD

- BTC/USD

- LTC/USD

- DASH/USD

- ETH/USD

Vantage Markets (over 40 cryptocurrencies are offered)

- TRX/USD

- BTC/USD

- XRP/USD

- ETC/USD

- SOL/USD

BlackBull Markets (more than 11 cryptocurrencies available)

- BTC/USD

- ETH/USD

- LTC/USD

- XRP/USD

Conclusion – Choose one of the best brokers that support TradingView!

In summary, be sure to choose the right broker for trading cryptocurrencies. Especially if you want to take advantage of the many features and functions of TradingView, it makes sense to pick a platform that supports this trading software.

We have compared several brokers and found that Vantage Markets, Pepperstone and BlackBull Markets are among the 3 best platforms. They all offer TradingView integrations, are multi-regulated and are used by millions of traders worldwide. Pick one of them and start using TradingView today!

(Risk warning: Your capital can be at risk)

Frequently asked questions about TradingView:

Can I trade crypto on TradingView?

Yes, you may trade cryptocurrency on TradingView. Using the correct indicators and TradingView techniques, trading cryptocurrencies might be very profitable.

Will TradingView sell the information you provide?

The business asserts that it does not engage in the sale of its users’ personal information. You have the choice to ask them to delete any personal information they have collected from you.

How can I start using TradingView to invest in cryptocurrencies?

The best way to get started is to open a brokerage account with one of the authorized cryptocurrency brokers, like Pepperstone, Vantage Markets, or BlackBull Markets, load your wallet with fiat money, and then buy the cryptocurrency you want.

What crypto exchanges can I link to TradingView?

TradingView does not support all crypto exchanges. Before using TradingView, you must first verify its validity on its website. The only TradingView-supported exchanges are the ones shown here, namely: Pepperstone, BlackBull Markets & Vantage Markets.

Can I trade Binance on TradingView?

TradingView can be accessed through Binance’s trading UI but not from TradingView’s website. With Binance, buying and selling cryptocurrency is simple, and you can instantly generate charts. Advanced users can construct custom indicators and save them to TradingView’s servers using scripts.

(5 / 5)

(5 / 5)