The 3 best MetaTrader 4 alternatives in comparison

Table of Contents

MetaTrader is an intuitive and highly adaptive trading platform famous for its trade automation capacities. MT4 stands out in the area of foreign exchange (forex) trading. But traders can also get a different range of assets such as stocks, precious metals, and futures.

The platform offers exceptional tools for complete price estimation (technical and fundamental). You can also use automatic trading techniques (trading robots) and copy trading (trading signals).

Even if you don’t wish to use the MetaTrader 4, you can opt for the various other trading platforms. There are more than 50 substitutes for MetaTrader. The alternatives are available for iPhone, Windows, online / web-based, Android, and iPad.

Here, some of the best MetaTrader 4 alternatives will be available. All of these uphold a huge reputation. Also, you can get the best services from these platforms.

The list of the 3 best MetaTrader 4 alternatives includes:

TRADING SOFTWARE: | Review & RATING: | PRICING: | AVAILABLE FOR: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. TradingView  | • $14.95 per month (Pro plan) • $29.95 per month (Pro+ plan • $59.95 per month (Premium plan) | Web browser, Android, iOS | # Huge selection of technical indicators # Analytical tools # Alerts and notifications # Social platform to exchange with traders # Customizable # Add-ons available | Free TradingView plans available on Vantage Markets: (Risk warning: Your capital can be at risk) | |

2. cTrader  | Free plan available, commission depends on broker | Windows, Mac, Web browser, Android, iOS | # Advanced charting # Custom indicators # User-friendly interface # Fast order execution # Depth of market | Free cTrader account available on Pepperstone: (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

3. ATAS | • $69 (1 month) • $179 (3 months) • $299 (6 months) • $479 (1 year) • $1790 (for the unlimited plan) | Windows, Mac | # Fast order execution # News and market data services # Advanced automation possibilities # Wide range of indicators # Excellent risk management tools | Test ATAS for free: (Risk warning: Trading involves risks) |

Here is the list of the 3 best MetaTrader 4 alternatives for you:

- TradingView – Numerous indicators to choose from

- cTrader – Highly customizable

- ATAS – Professional trading at its best

Now let us take a closer look at each of this trading software.

#1 TradingView – Numerous indicators to choose from

TradingView is an excellent and versatile alternative to MetaTrader. It operates under Capital.com, which is one of the famous trading platforms and a trustworthy broker. Customers can get many features on TradingView.

These include:

- multiple timeframes,

- paper trading,

- evolved chart types,

- custom time intervals,

- fundamental data, and

- up-to-date market data.

Moreover, the TradingView platform is perfect for technical analysis and charting. Also, it upholds the most reasonable stock screeners. However, it only incorporates almost 30 brokers. And there is restrictive broker integration. That’s why some users prefer to trade outside the platform.

Good to know!

Like other trading platforms, TradingView also has market analysis tools and indicator builders for the amenity of the users. Customers can make use of them and gain momentum in the brokerage industry. In addition, TradingView is an extensive choice of diverse securities that traders can invest in. Therefore, you can obtain more than 6,000 markets all over the world.

If you want to practice on TradingView before you move on, traders have an option for it. TradingView provides you with a demo account. Users can open a TradingView demo account and practice trades over there. Once they feel they have boned up on trading strategies, they can look up to the real accounts.

Good to know!

There is a large social networking site along with a demo account. Hence people can get in touch with other traders and replicate their investments.

(Risk warning: Your capital can be at risk)

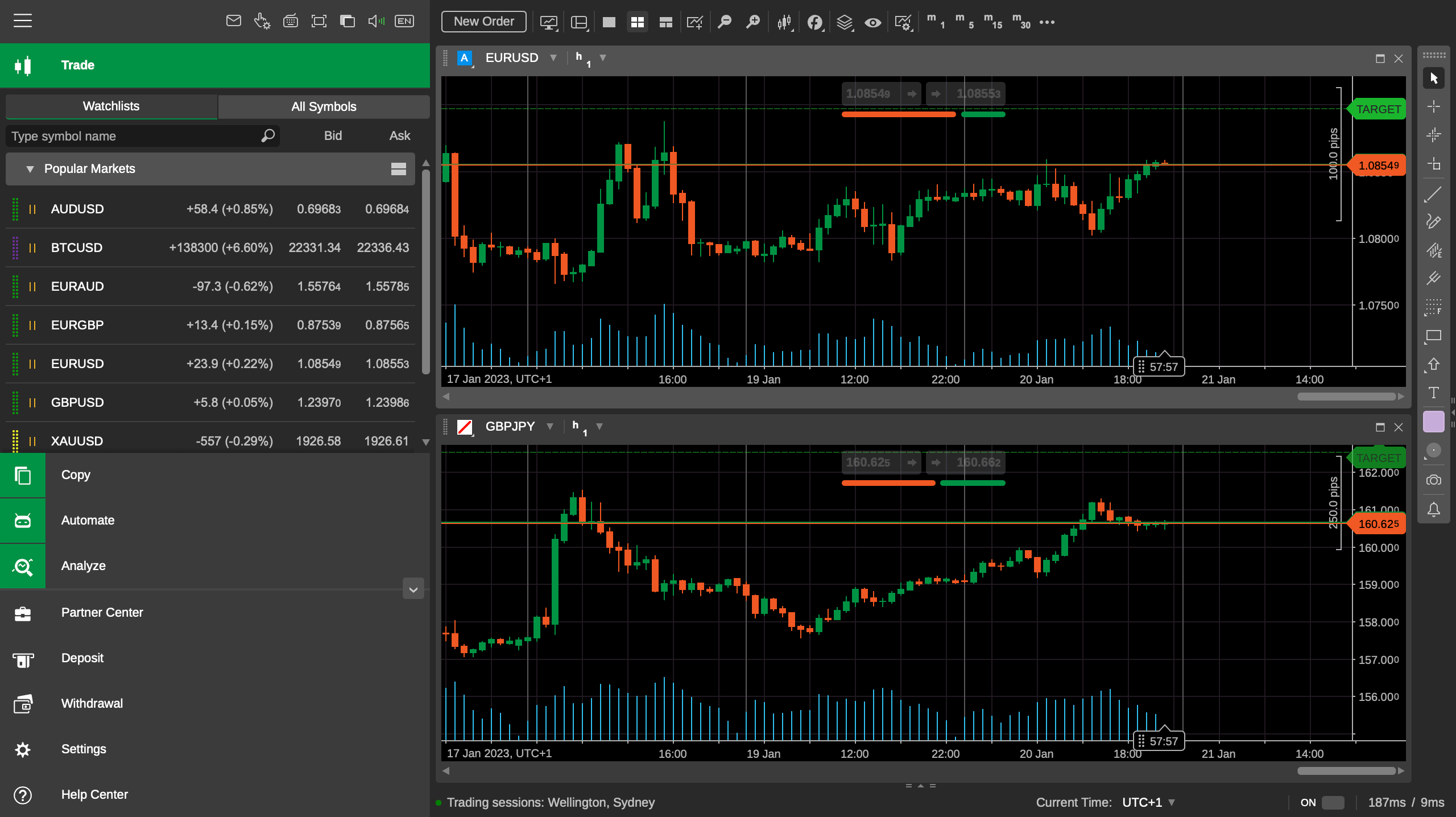

#2 cTrader – Highly customizable

cTrader is a full-blown suite contract for difference (CFD) and forex trading platforms. With a wide range of assets, it has become a great alternative for MetaTrader. Users on cTrader can get access to forex, stock indices, commodities, stocks, shares, etc.

Additionally, you can use different layouts, which adds up to the customizability of the software. With comprehensive charting tools, you can specify multi- or single-chart layouts. Also, you can change their time limit and transform the color schemes of your charts. So, it is one of the best MT4 alternatives for advanced traders and beginners.

Apart from that, traders using cTrader can get more features, such as:

- level II pricing,

- quick trade execution,

- cutting-edge charting tools, and

- numerous order types.

A “cTrader automate” service aids in building algorithmic trading robots that automate your trading. The Open API feature of cTrader authorizes designers to write codes for apps. And it can connect to and trade with any cTrader account. But there is an issue with cTrader that traders can find problematic. It has a distinct programming language compared to MT4. So, if you are an MT4 user, you might have trouble starting on cTrader.

Good to know!

cTrader has a simple configuration that helps people to get along with the platform without any trouble. The well-designed user interface is easy to understand. Thus, it’s a good option for beginners as well.

cTrader offers a demo trading account as well. Traders on cTrader who want to opt for risk-free practice can consider a cTrader demo account. There is no use of real money; you can start trading without worrying about your real funds. The cTrader is available on brokers such as Pepperstone.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

#3 ATAS – Professional trading at its best

ATAS is the top analytical and trading platform for order flow and volume trading. It consists of all the functions that you need for order flow and volume trading. Clients using ATAS can benefit from a wide range of exclusive tools and indicators. It caters to the needs of each of the traders.

Good to know!

Moreover, traders can view market events from the outside and inside with the help of ATAS. They can look out through the root of markets. The ATAS trading platform is in demand among prop shops, hedge funds, and professional traders. But it is less famous among the (retail) traders.

ATAS provides you with a broad range of qualities for fast and fortunate market calculations. It consists of Level II data (market depth), current and historical volume levels, and time & sales. With its analytical instruments, it improves the knowledge value of market data.

Apart from them, you can get a few more features with the platform. These are:

- Tick cluster: to get a clear view of transaction volumes

- Smart tape: to show the actual market trade.

- All price: to evaluate the volume traded at any price levels

- Spread tape: to catch a glimpse of the volume of trades

- Brilliant DOM with spoofing, HFT algorithm tracking, etc.

- Peculiarly designed indicators, such as the Big Trades and Cluster Search

- More than 25 footprint types, 70 indicators, and 14 distinct charts

- Masterpiece charting with special time divisions such as range, reversal, delta, etc.

- DOM with willingly configurable design and operations

Good to know!

ATAS trading platform offers you prudent technical support. If you face any issue with using ATAS, you can contact ATAS customer care for their perfect services.

Disadvantages of the MT4:

Traders might avoid the MT4 trading platform because of its cons.

Hedging

Hedging is not available in MT4. It is a crucial risk management practice that is missing when traders trade on MT4. Besides, you can consider it the worst problem of the platform.

Loss of Connection

Many users of MT4 have faced this problem. Traders might suffer a loss of connection if they have plunged into the subway or outside the coverage area. However, make sure not to open your deals while you are in a subway or elevator. It can result in a deficit of funds.

Mobile Operations

Customers can find the MetaTrader 4 trading platform difficult to use when they use the platform on their phones. The functionality of the platform is designed according to the standards of a PC. Although there is no issue with the functionality of MT4, you can find a problem with the capacity.

Bugs

Users can find the platform full of bugs as it is coded from scratch. But you can get rid of these bugs from MetaTrader 5. All traders can do is debug most of the bugs at the time of beta testing.

Conclusion – There are many great MetaTrader 4 alternatives!

Despite the growth of more recent and better-off trading platforms, MetaTrader 4 is still one of the prominent trading platforms. Though, it is not a broker but a third-party software that brokers suggest to their customers.

Most retail investors and forex brokers like to consider MetaTrader 4. Although if you want to try out other trading platforms, you can look for the best MetaTrader 4 alternatives.

Above mentioned are some of the best alternatives for MetaTrader 4. If you want to switch to other platforms, you can consider any of them. They have a wide range of robust trading tools and functional investment products. Every trader can find something of their need.

(Risk warning: Your capital can be at risk)

Frequently asked questions about MetaTrader alternatives:

Which is better, MT5 or MT4?

Without any doubt, MT5 is exceptional and more efficient than MT4. Both of them are most frequently used. Most users prefer MT4 because it is simpler to understand. People are familiar with the platform and can use it with ease.

On the other hand, MT5 could be easier to use. It has a complex interface, making it tough to get along with the platform. You can choose any of these according to your necessities.

Is TradingView a better MT4 alternative?

Although both offer various indicators and features, TradingView provides many indicators and functionality. Users have the option to fund and withdraw money from their accounts. But with MT4, you can get more safety for your account. And the platform is more reliable than TradingView.

Do the best MetaTrader 4 alternatives offer better services?

Every trader’s trading needs can vary. Thus, the best trading platform for one broker might not be great for another. However, if we consider TradingView, ATAS, or cTrader, they are known to be the best MT4 alternatives.

Is it possible to use MetaTrader 4 without a broker?

Be mindful that MetaTrader 4 is not a broker, as mentioned earlier. Brokers offer this third-party software and operate all the trades. MetaTrader 4 is a viewing platform that permits you to handle and view trades. But you have to place the trades with the broker in real. They buy the privileges to the software. So, you have to look out for a trustworthy and reputed broker.

Last Updated on February 17, 2023 by Andre Witzel

(4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)