5 best CFD trading demo accounts for free & unlimited

Have you thought about becoming a successful trader, but don’t know where to start? Don’t worry you are not alone! There are seemingly endless opportunities to learn how to trade, but watching YouTube videos, attending webinars, or hiring a professional trader as a tutor won’t move the needle in my experience. Why? Because you will only truly learn trading, by practicing it yourself. Therefore,the best way to learn how to trade without risking your hard-earned cash is by practicing on CFD demo trading accounts.

In this review, you will read about the five best CFD trading demo accounts available on the market. You will also find useful information about the broker companies such as the products they offer, the leverage, as well as the conditions for their demo accounts.

See the list of the 5 best CFD trading demo accounts for beginners here:

CFD Broker: | Review: | Demo account: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. eToro  | Available and free | Starting 0.8 pips variable | 3,000+ | + Competitive spreads and commissions + Huge range of markets and assets + Best service + Personal service | Free demo account76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. **Please note that instruments restrictions may apply according to region | |

2. Plus 500  | Available and free | Variable Spreads from the Market Conditions | 2,800+ | + Best for 24/7 support + Social Trading + Cryptocurrencies + PayPal + No commissions + Copy portfolios | Free demo accountRisk warning: 82% of retail CFD accounts lose money. | |

3. XTB | Available and free | Variable spreads depending on market | 3,000+ | + Support 24/7 + PayPal + Cryptocurrency CFDs available + Guaranteed stops + Alarms | Free demo account(Risk warning: 72% of retail CFD accounts lose money) | |

4. Vantage Markets | Available and free | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + Supports MetaTrader 4/5 + Reliable support and service + No hidden fees | Free demo account(Risk warning: Your capital can be at risk) | |

5. IQ Option | Available and free | Starting 0.0 pips variable – only in main trading hours (no commission) | Over 300 | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Free demo account(Risk warning: Your capital might be at risk) |

What makes a demo account stand out?

Now, before I talk about the advantages of my five favorite demo accounts (and the respective trading companies) in more detail, I think it’s worth taking a minute and ask yourself, what makes a demo account especially good? After all, they are all free, right? While that’s true, (never pay money to use a demo account please, believe me, it’s a scam) there are also some differences.

- Some brokers try to limit the usage of the demo account and either restrict the access timewise (so you can only use the demo account for one month, for example) or limit the demo account balance. If that’s the case I highly recommend not letting you be put under pressure and only opening a live account when you feel confident enough.

- Usability and trading platform choices are another important factor. Different brokers offer access to different trading platforms, either in-house versions via a web trader or they give you access to external software. The best case scenario is of course if you can choose and try multiple different platforms so you can test which one is best in terms of usability for you.

- Lastly, the broker platform has a financial interest in turning your demo account into a live account once you sign up with them. I recommend testing the quality of their customer support, while you are still on a demo account. Consider factors like their availability and if they offer support in your native language if that isn’t English anyway. Most reliable broker care about the success of their clients and also offer educational resources such as blog articles, FAQs, video instructions, etc. for free.

Now, without further ado, let’s jump into the list of the best options for a demo account, currently available.

This is the list of the 5 best CFD trading demo accounts I have tested for you:

- eToro – One of the best platforms for copy trading

- Plus500 – Very fast demo account registration

- XTB – Professional service

- Vantage Markets – High leverage trading possible

- IQ Option – Easy to use

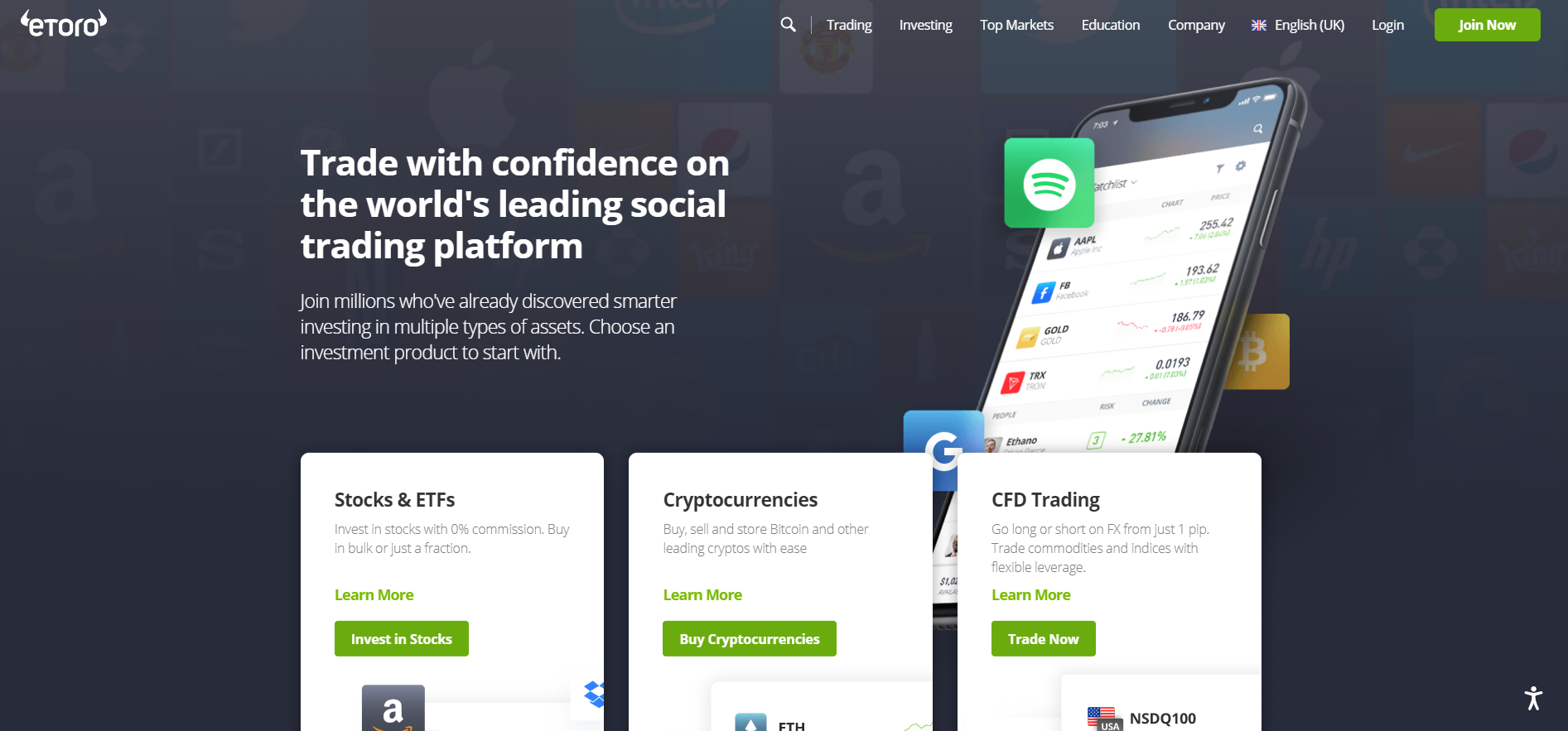

#1: eToro – One of the best platforms for copy trading

**Please note that instruments restrictions may apply according to region

eToro is the best CFD trading platform on the market when it comes to copytrading. It has an extensive global reach with over 20 million clients from over 100 countries. Originally known as RetailFX in 2007, they restructured their brokerage company to offer multi-asset products as well as social trading. They’ve become well known for their easy-to-use interface and platform, as well as their groundbreaking copy trading services.

As CFD products, you can practice trading more than 3,000 assets, either long or short, with leverage that ranges from 1:1 up to 1:30 for select products with a demo account. This allows you to practice under normal conditions where you can develop your strategies for technical analysis, portfolio management, and risk management.

With eToro, you can trade currencies, commodities, indices, and cryptocurrencies as CFDs. Below is a list of the offered assets as CFDs on eToro’s account.

There are also tons of CFD stocks available on their platform. These include famous companies like Disney, Microsoft, Apple, Google, eBay, Amazon, Alibaba, and many more. You can access the complete list on their website or their platform.

Etoro offers the most assets to trade in this comparison.

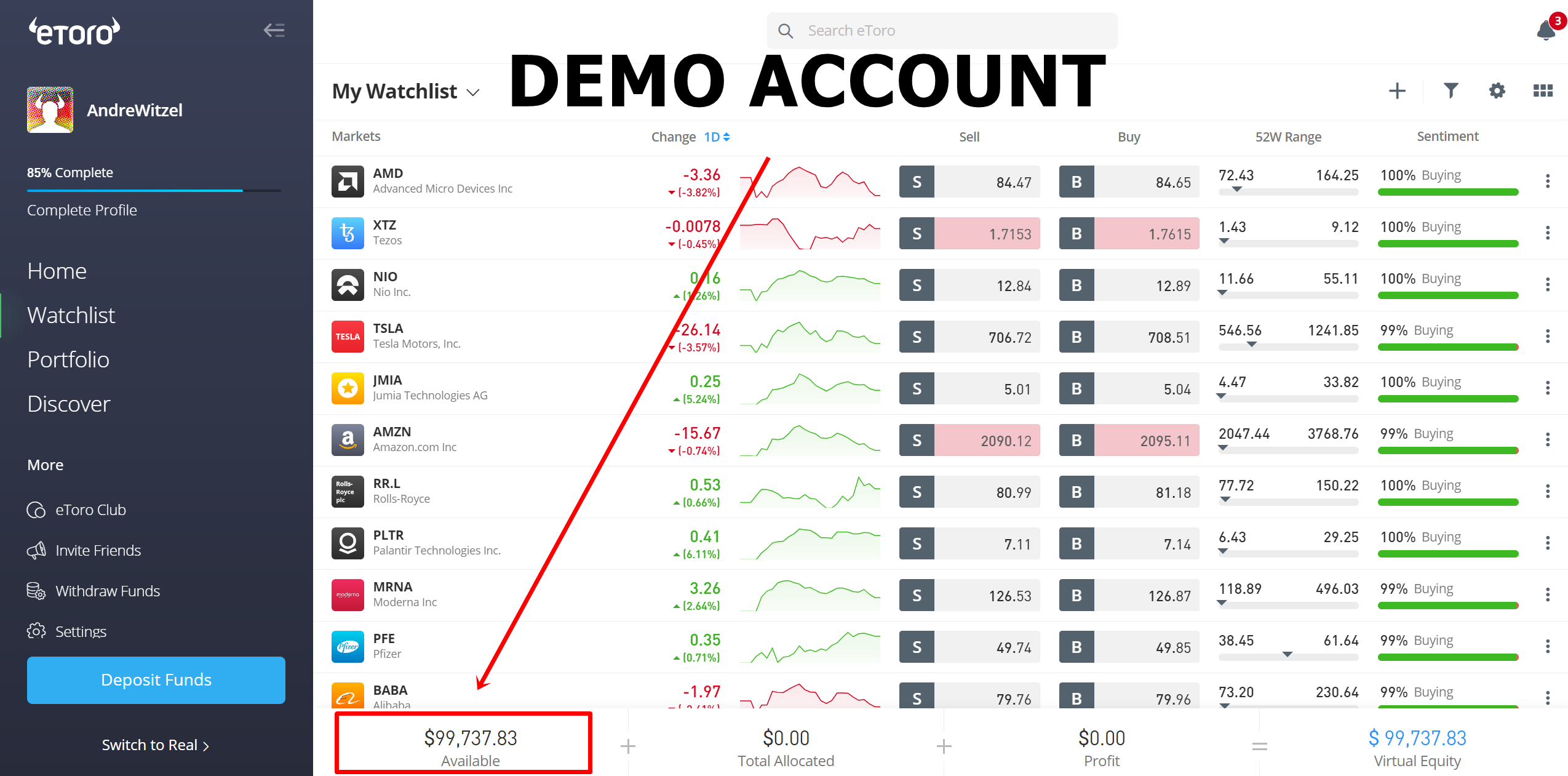

How to sign up for a demo account

To sign up with eToro, you need to input your chosen username, your personal email, and a password. You can also sign up by linking your Facebook account or Gmail account. After that, you will be given access to your account, which is both a live and demo account.

Practicing on eToro’s demo account or virtual portfolio is entirely risk-free. You will be given a virtual value of $100,000, which you can use to trade any of the available assets on the platform.

Since the demo account gives full access to all of eToro’s features, you can even communicate with the community that is trading CFDs you’re interested in directly on their platform. This means you can get a second opinion or additional insight on your desired asset.

eToro’s customer service is available on their trading platform via their help center. Here you will find frequently asked questions. You also have the option to open a ticket detailing your concern, and a customer service representative will get back to you within one business day.

advantages of Etoro demo account | Disadvantages of eToro demo account |

|---|---|

✔ Free and unlimited demo account with $100,000 | ✘ No access to the live chat support on a demo account |

✔ Access to all features of the live account | |

✔ User-friendly trading platform | |

✔ Free analysis tools even on the demo account | |

✔ Competitive fees and spreads | |

✔ Social trading makes it easy to get started |

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

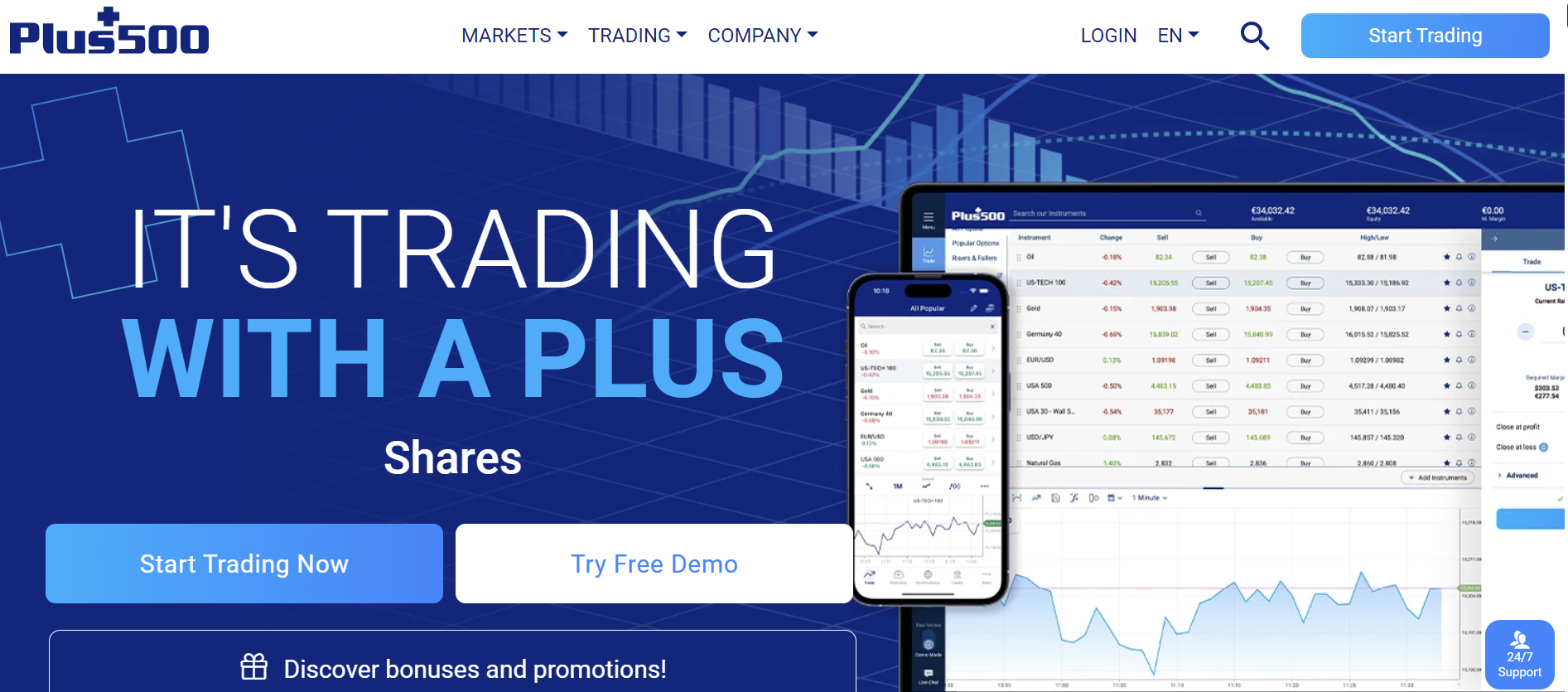

#2: Plus500 – Very fast demo account registration

Plus500 specializes in CFD trading for all the asset classes they offer. With 13 years of experience, this Israel-based broker caters to clients from more than 50 countries, and their company is also publicly listed on the LSE or the London Stock Exchange. As the leader in CFD trading, they were the first to introduce Bitcoin CFD to the market.

For forex CFDs, you have over 60 pairs to choose from. Some examples of these currency pairs are EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. These are also known as the major currency pairs, and they could be traded with a leverage of 1:30.

Plus500’s indices offer more than 15 assets. They also have a cryptocurrency index that includes the top ten cryptocurrencies. You will also have the option to trade an index comprising the FANG+ stocks, which include Facebook, Amazon, Netflix, Google, and more.

The shares and options offered on Plus500’s platform are over 1000. This gives you flexibility and diversity when it comes to trading these particular asset classes.

With a maximum leverage of 1:5, you could trade up to 30 ETFs like ARK Innovation ETF, iShares Core DAX ETF, S&P/ASX 50 Fund ETF, and SPDR S&P Aerospace & Defense ETF. Below, you will find a list of the tradeable cryptocurrencies and commodities on Plus500’s platform.

Obviously, the demo accounts you use are closely connected to the broker with the best trading conditions and you should consider that as well. However, for me, Plus500 offers the best demo account features overall. It is primarily a very user-friendly platform, with an absolutely unlimited demo account and great resources for trading beginners, that make the difference.

How to sign up for a demo account

What makes the demo account so great in my opinion, is the extremely simple sign-up procedure for a demo account. You can open it in literally 30 seconds and after you create an account you will even get a quick tutorial on how to navigate around on the platform. All you need to enter is your e-mail address and password. Plus500 doesn’t require you to provide your phone number and therefore won’t bother you with marketing calls, which is very refreshing and something that really makes them unique.

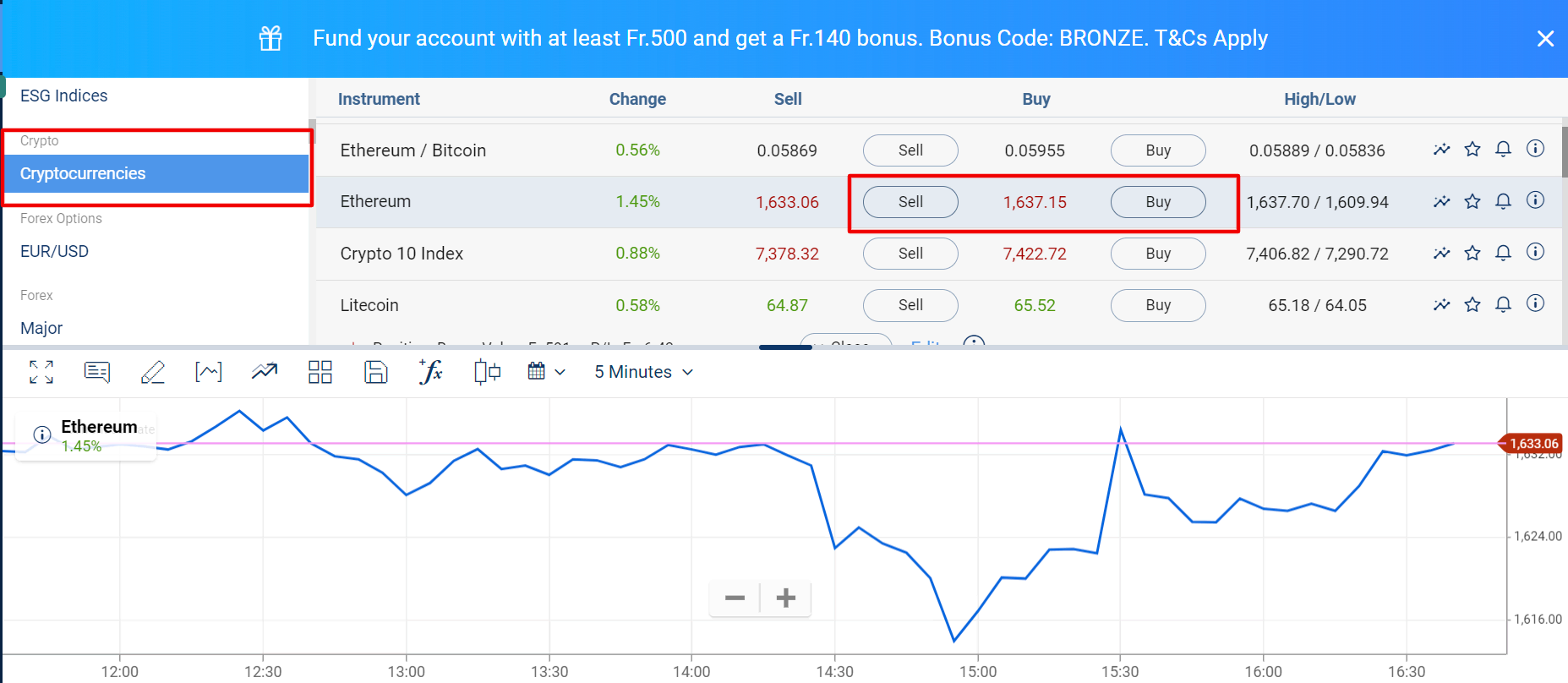

Their demo account comes equipped with €20,000 in virtual funds and access to their WebTrader platform along with all its tools and functions. And their web trading platform is highly self-explanatory. For example, to open a virtual buy position on Ethereum, all you need to do is select the asset on the left-hand side, hit buy, and determine the order size.

The Plus500’s website supports 32 languages. These are English, Estonian, Croatian, Lithuanian, Norwegian, Romanian, Swedish, Arabic, Czech, Spanish, Icelandic, Hungarian, Polish, Slovak, Turkish, Chinese, Danish, Greek, Italian, Maltese, Portuguese, Slovenian, Bulgarian, Traditional Chinese, Dutch, French, Latvian, Russian, German, Finnish, and Hebrew. If you are able to set the language to your native one, that’s an advantage you should not underestimate.

advantages of the plus500 demo account | disadvantages of the plus500 demo account |

|---|---|

✔ Fast demo account registration | ✘ No access to MetaTrader 4/5 on the demo account |

✔ The Web platform is very straight-forward to understand | |

✔ Trading platform and support available in 32 languages | |

✔ No time limitation on the demo account | |

✔ support is available 24 hours per day | |

✔ Good selection of tradable assets on the demo account |

Risk warning: 82% of retail CFD accounts lose money.

#3: XTB – Professional service

Since 2004, XTB has been growing and is now known as one of the most prominent stock exchange-listed brokers that offers its service to 13 countries, including Germany, France, and the United Kingdom.

With XTB, you can practice trading their CFD assets with a leverage of up to 1:10 on the demo account. Beside that, the variety of tradable assets on demo accounts is one of the best in the market. You can choose to trade any of the 1876 stock CFDs or 140 ETF CFDs. Among the stock CFDs, you will find famous names like Apple, Facebook, Tesla, Amazon, Google, and many more. For ETFs, some of the available funds are Ark Fintech Innovation ETF, Ark Autonomous Technology and Robotics ETF, Ishares Core US Aggregate, and Vanguard Total International Bond. The complete list of stock CFDs and ETF CFDs can be found on their website.

If stock and ETF CFDs are not enough for you, they also offer 25 cryptocurrencies and cryptocurrency pairs as CFDs. Below is a list of the available assets related to crypto on their platform.

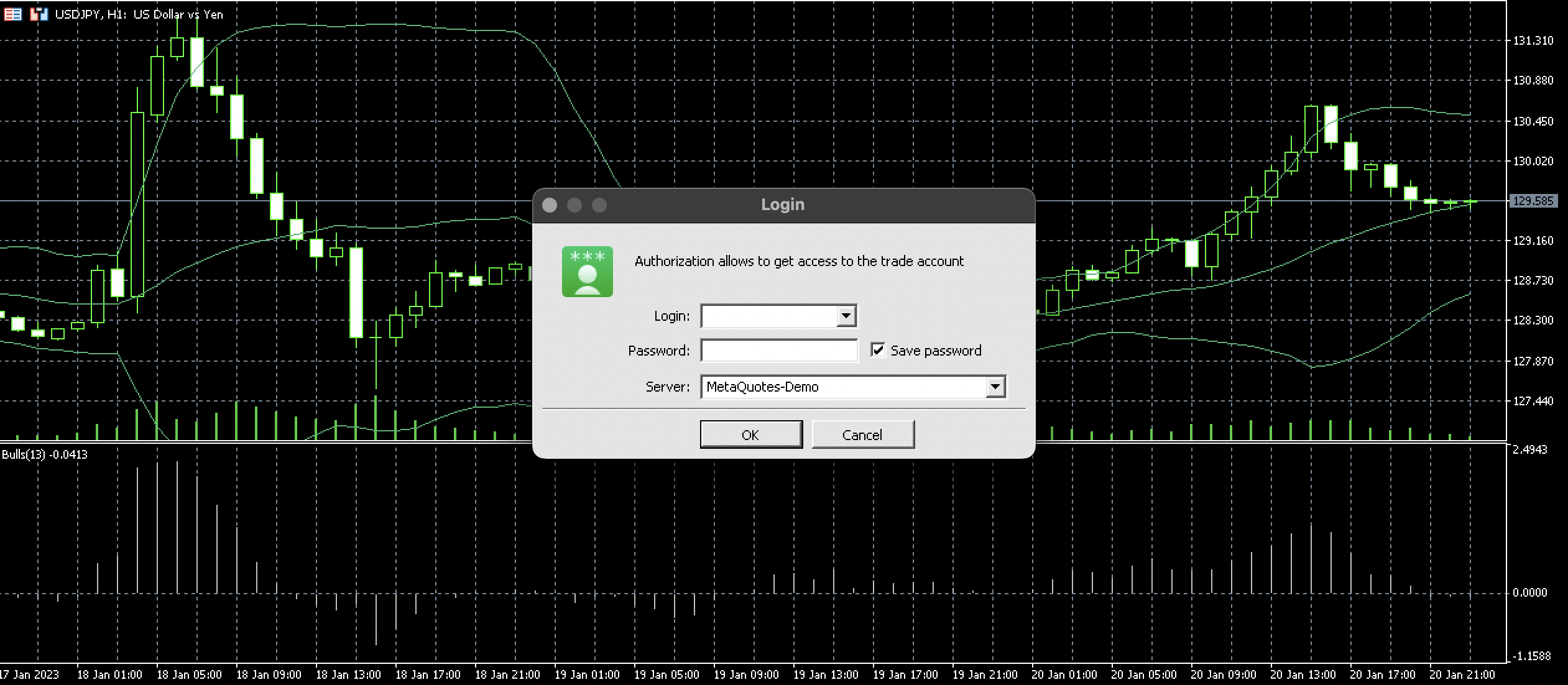

With the choice to use their award-winning proprietary trading platform, xStation 5, or the well-known MetaTrader 4, you can easily practice with your demo account with high execution speeds on a user-friendly interface. This gives you four weeks of access to the platform with $100,000 in virtual funds.

Even when using the demo version of the xStation 5, you can utilize all features that live accounts can access. This includes having a built-in chart, a watchlist, market analysis, and price alerts. Aside from this, their education tab and news updates will be available for you as well. XTB also has an excellent CFD trading app for mobile trading from anywhere.

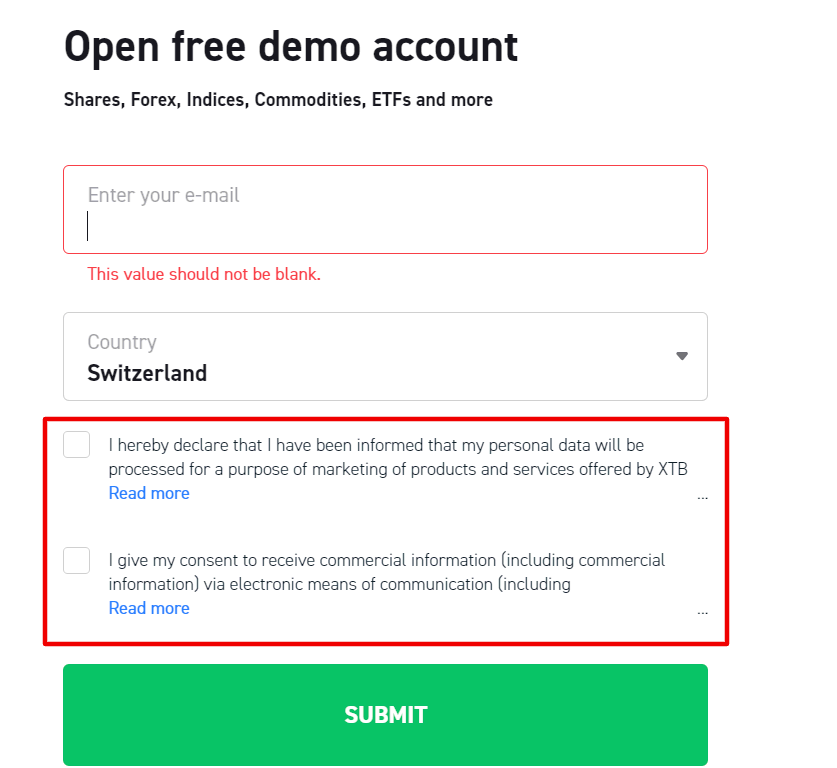

How to open a demo account

To open a demo account, all you have to do is input your email and country of residence. Afterward, you will be asked to put in your full name and mobile number. Once you’re done, you will be able to practice trading on their platform. It should take you less than a minute to open a free demo account.

On the demo account, you can either use MetaTrader or their award-winning trading software xStation. Both options are very suitable for beginners and you will find it easy to navigate around.

advantages of xtb demo account | disadvantages of xtb demo account |

|---|---|

✔ Sign-up for a demo account is quick and uncomplicated | ✘ Usage of demo account is limited to four weeks |

✔ Great broker to practice trading with leverage | |

✔ Full access to xStation or MetaTrader software with a demo account | |

✔ Plenty of professional analysis tools available with a demo account | |

✔ Selection of more than 1,500 tradable assets | |

✔ $100,000 in virtual funds is more generous than with most other brokers |

A

(Risk warning: 72% of retail CFD accounts lose money)

#4: Vantage Markets – High leverage trading possible

Vantage Markets is an excellent trading platform that lives up to its name as one of the best brokers. The company has been around since 2009 and is one of the few trustworthy ECN brokers. Major liquidity providers such as HSBC, Bank of America, Credit Suisse, JP Morgan, and others are among the liquidity providers for Vantage Markets.

CIMA and ASIC regulate the platform. In addition, traders will find attractive terms and conditions on live accounts. Spreads start at 0.0 pips, there are over 180 assets, and the minimum deposit for a live account is only $200. Commissions are generally meager.

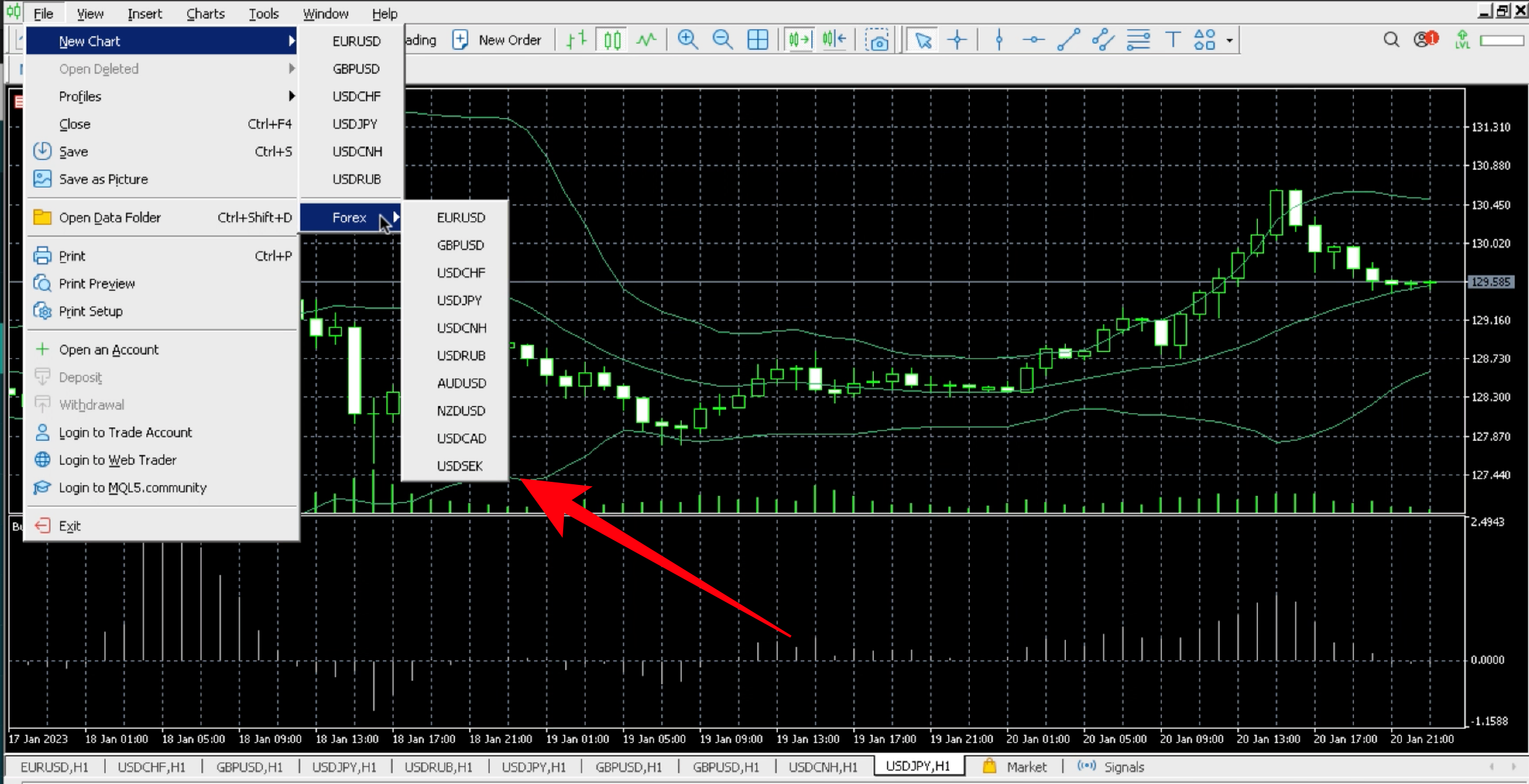

How to sign up for a demo account

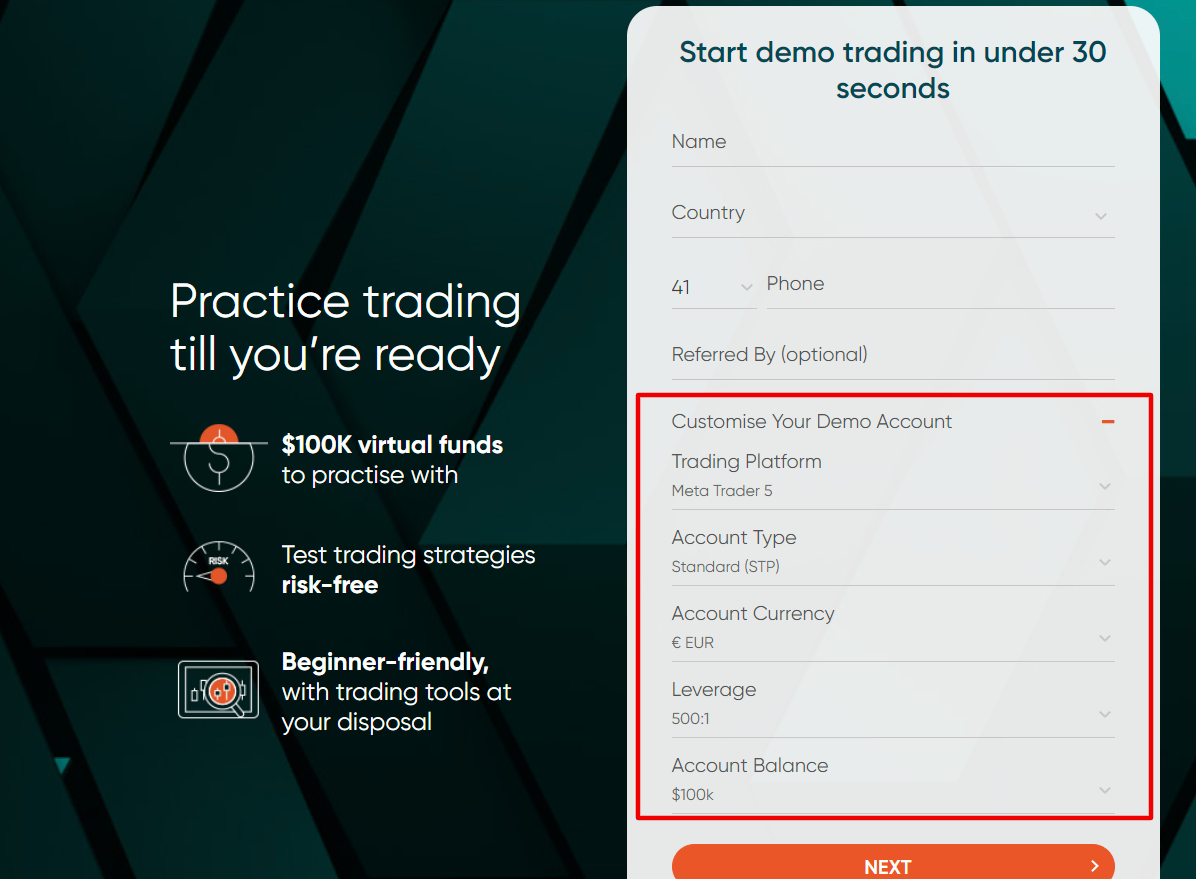

Like most brokers, Vantage Markets tries to make the sign-up process for a demo account as easy as possible. You will need to enter your name, country of residence, and phone number. What’s really cool is the option to customize your demo account. You can choose your base currency, the account balance, leverage level, and trading software for example

Even with a free demo account, you can use Vantage Markets’ excellent trading platforms, including MetaTrader 4 and MetaTrader 5. Traders can benefit from high leverage of up to 1:500. There is also a choice of lower leverage levels for those with a lower risk appetite.

B

Advantages of vantage demo account | disadvantages of vantage demo account |

|---|---|

✔ Vantage markets offer the best trading conditions for Forex trading | ✘ Limited range of assets |

✔ Very fast order execution on both, demo and live account | |

✔ Access to MetaTrader 4/5 with demo account | |

✔ The demo account is highly customizable | |

✔ Possibility to practice with a real ECN broker | |

✔ Great support and access to educational material | |

✔ 100k in virtual funds on a demo account |

(Risk warning: Your capital can be at risk)

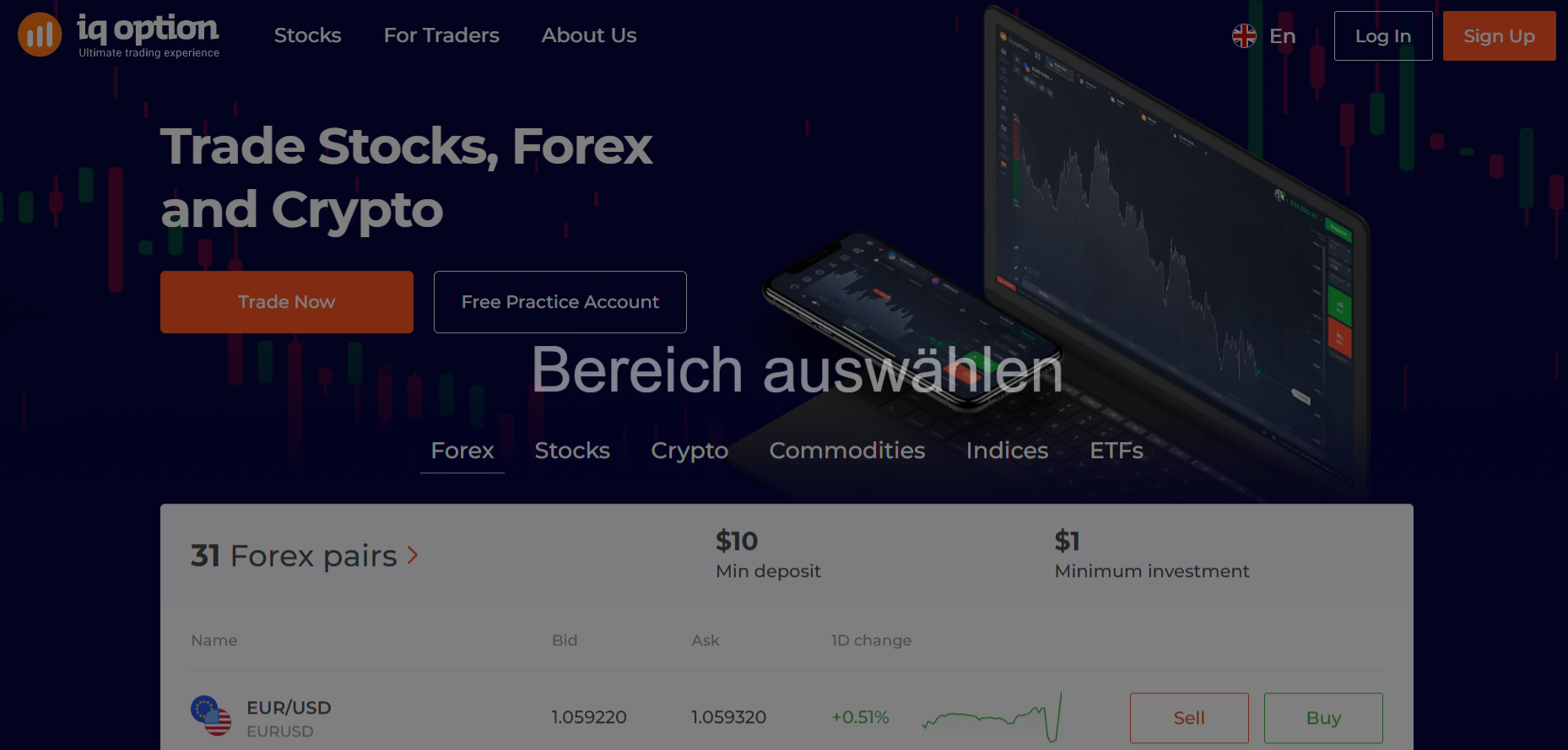

#5: IQ Option – Easy to use

Despite the fact that IQ Option specializes in binary options trading, they also offer forex, crypto, stocks, commodities, ETFs, and CFDs. Established in 2013, this particular broker has won multiple awards and has over 48 million registered users from around the globe.

Here is a list of all the available forex, crypto, commodities, and ETFs on IQ Option’s platform. You can trade all these with a leverage of up to 1:1000.

As for their stocks, you can choose from over 190 companies. You will find well-known names here, like Apple, Amazon, Tesla, Netflix, Nike, Visa, Disney, McDonald’s, Walmart, and Pfizer.

Availing of their demo account entitles you to $10,000 in virtual funds and access to their online investing platform, which is available for both Windows and Mac. You can also download the mobile version from their website or on Google Play or the Apple App Store.

How to sign up for a demo account

Signing up is very easy. Just provide your full name, country of residence, phone number or email address, and your customized password. You can even register using your Facebook or Gmail account.

One of the advantages of an IQ option demo account is that is truly unlimited. You can reset the virtual account as many times as you need. Also, they offer 24/7 customer support should you have any questions. IQ options mainly focus on binary options trading, so if that’s something you are interested in, I definitely recommend signing up for a risk-free demo account.

(Risk warning: Your capital might be at risk)

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

Advantages of IQ options demo account | disadvantages of IQ options demo account |

|---|---|

✔ Easy sign-up process via E-mail or Gmail account | ✘ No access to external trading software |

✔ The demo account is very beginner-friendly | ✘ Clients from the United States and some other countries can’t open a demo account |

✔ They offer unlimited demo accounts with 24/7 customer support if needed | |

✔ You can use leverage of up to 1:1000 with a demo account | |

✔ The trading app is one of the best in class |

What is a CFD trading demo account?

A CFD trading demo account is a type of account that allows you to trade Contracts for Difference on a risk-free and virtual trading account provided by your desired broker. Your capital will never be at risk, but you will be able to simulate natural trading conditions provided by your broker and with the volatility of the market.

CFDs come from a wide variety of assets like forex, cryptocurrencies, ETFs, indices, stocks, and commodities. By trading a demo account that has access to CFDs, you have the chance to experience trading all these assets depending on your selected broker.

Demo accounts exist to provide assistance for new traders and veteran traders alike. These accounts are used for practicing and testing out strategies and techniques to know how well you perform in the market. These accounts are always free but keep in mind that some brokers limit your use of their broker accounts. Contact your broker for more information on these.

In the event that you blow up your demo account, don’t worry because you can easily create a new one in a few steps, or you can contact customer service to replenish your virtual account balance.

Why you should use the demo account

Trading using a CFD demo account gives you the experience of being a client of your chosen broker without risking any of your capital. Mostly all of the features available for that particular broker can also be accessed by you. This includes the platform, research, and educational materials, as well as the assets that the broker offers for all its clients.

You will be able to simulate real-time trading conditions, such as trading fees for swaps, commissions, and spreads. This allows you to practice in the world of trading, where each trade always incurs a certain amount of risk.

With all of the features available, you’ll be given a chance to use leverage, trading bots, and perhaps interact with other clients depending on your chosen broker.

One of the best things about demo accounts is the ease of creating one. Assuming that you want to have a clean account with all your funds back, you can either contact customer service or create a new account since registration for this is easy and hassle-free. Whether you blow up your account or make millions, you have the advantage of experience and newfound knowledge that you can use in your next trades, whether they be in your demo or live account.

Some brokers also offer contests to encourage you to practice and be the best trader you can be. Top traders are usually awarded credits for their live accounts.

Advantages and disadvantages of CFD trading demo accounts

Let’s talk briefly about the advantages and disadvantages of demo accounts CFD trading. In my experience, there is absolutely no reason not to open a demo account. It’s free, quick, and most importantly will help you to determine, whether CFD trading is for you or not, without risking any of your hard-earned money.

$Plus, you can test and improve your trading and analytical skills in real-world market situations. On the other hand, please never forget, that CFDs are very volatile and complex financial products, therefore profits aren’t guaranteed even after practicing on a demo account. Trading with real money is still different, especially if psychological aspects come into play.

You can learn more about the most important advantages and disadvantages of CFD demo accounts in the table below:

advantages of demo accounts | disadvantages of demo accounts |

|---|---|

✔ Good environment to test the platform risk-free | ✘ Demo accounts could potentially lead to overconfidence |

✔ Possibility to test and improve analytical skills in a real-world environment | ✘ The mental stress and pressure can’t be simulated with a demo account |

✔ Option to practice the use of margin and leverage without financial risks | |

✔ A demo account is great for error identification and correction | |

✔ Easy to learn how to best use indicators and what settings to use | |

✔ A demo account is a simple way to keep track of your trading decisions |

Note:

Another advantage of trading CFDs is the fact that you do not have to own an asset like gold physically. Contracts for difference give you the right to profit from the increase or decrease of price by just going long or short this asset.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to trade CFDs with a demo account – Step-by-step tutorial

Step 1 – Log into your demo account

Upon logging in to your demo account, double-check if the asset you want to trade is offered as a CFD product. Check its chart and fundamental values, if applicable, to know if your trading has a good chance of going in your favor.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Step 2 – Select a CFD product you would like to trade and set the leverage correctly

When you’ve selected your ideal CFD product to trade, you need to decide whether you want your trade executed at market price or at your desired price point using the different types of orders provided by your broker. Input your desired trade size or lot size afterward.

A tab to choose your desired leverage may also pop up depending on your broker. Sometimes, leverage or margin is already set by default in your account’s settings.

You may also set cut loss levels and take profit levels to your liking. Most importantly, double-check if the trade you have set is in the right direction. Many newbie traders accidentally go short when they actually want to go long, and vice versa.

CFD trading demo accounts without registration

If you are looking for a CFD demo account without a registration I have two great options for you. The advantage is obviously the very low entry barrier. You also don’t need to worry about the safety of your data and you won’t be bothered by marketing calls. The goal of the trading companies is obviously that you open a live account with them, and some brokers have pushy methods to achieve that.

ActiveTrades

You can test the demo account on Activetrades without registration, although it is limited to 72 hours. If you want to extend the trial period after, for a 30-day period by sign-up. ActiveTrades’ demo account is a valuable tool for both novice and experienced traders with a very beginner-friendly interface. The balance is limited to $10,000 but you have unlimited access to all tools functions and indicators.

(Risk warning: 66 - 79% of retail CFD accounts lose money)

Pocket Option

The second option, is Pocket Option, a broker with a focus on binary option trading. Without registration, they offer access to a demo account with $50,000 in virtual funds. They have currencies, cryptocurrencies, stocks, indices, and commodities with a payout ratio of up to 92% if your prediction is correct.

Still I should mention that binary options aren’t for everybody and come with a high risk. Unlike with other forms of trading, the broker makes money when the market moves against you in this scenario. But, if you want to try it, the broker has a good reputation and has been on the market for more than 10 years.

(Risk warning: Your capital can be at risk)

How useful is a demo account for trading CFDs?

The usage of a demo account is highly useful in my experience. I would not recommend signing up for a live account with any broker without testing their demo account. It helps you familiarize yourself with the new platform, allows you to test your strategies, and gives you an impression of customer support.

Some brokers have no time limits on demo accounts, while others only allow you to use them for a certain number of days (often 30 days). Talking to your broker about the demo account’s features and functionality is crucial. In conclusion, I recommend, that if you’re just starting out as a trader, you should spend as much time as possible on a demo account.

If you are an experienced trader who wants to try out a new strategy, you may just need a few days or weeks on a demo account to get a feel for the market. They are available so that you can practice trading and try out different strategies without really spending any money.

Are CFD demo accounts unlimited?

Whether there is a limit or not entirely depends on the respective policies of the trading companies. In my experience, you will find both, providers who limit the usage of their demo accounts and those who won’t. If there is a limit, in most cases the demo account will expire after four weeks. If you run out of virtual funds, very often there is an option to reset the account and continue practicing. My advice for you as a trading beginner is to spend as much time as possible on the demo account. If you need more time to practice, you could even open a second account with a different E-mail address.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion: Which is the best CFD practice account?

Before I finish the article I would like to give you my take on which CFD demo account is best. At the end of the day, it all comes down to your personal preferences, and you can easily open multiple demo accounts. You should also consider the live trading conditions (spreads and commissions, customer support, fees, etc.) because after all this will have a huge influence on the success of your trading career. Therefore, again, don’t hesitate to compare and test multiple options.

Again to conclude this article, personally I like the Plus500 demo account the most, mainly thanks to the extremely clean interface, the absolutely unlimited demo account, and the great educational resources for trading beginners. Whatever choice you are making, the strategy, your willingness to learn, and the right mindset are just as important as the best CFD trading platform.

FAQ – The most asked questions about the CFD demo account:

What is a demo CFD trading account?

The CFD trial trading account simulates our platform without risk. Even after you’ve registered a genuine account, you may use it to test tactics and get a feel for the features. More virtual coins can be added at any moment using the ‘Payments’ tab. This platform also allows you to learn about the Next Generation platform’s capabilities.

Which demo account is the best for trading cryptocurrency CFDs?

Some of the best tradings account for 2023 based on research, survey, and testing are: HFM, which is best for the MT4 Demo account, IG has the best customer support, Pepperstone has the best ECN Demo account; XM also has one of the best MT5 demo accounts, AvaTrade is the best Mobile demo account, etc.

Is a minimum deposit required for CFD demo trading account?

No, the advantage of a demo account is that you can test the platform and risk-free without investing your own money. Instead, you will find a virtual balance in your demo account and you can practice with these virtual funds. No regulated broker will ever ask you to pay money to open a demo account.

What’s the difference between CFD demo and CFD real accounts?

The main difference is that you will trade with virtual funds on a demo account and with your personal capital on a live account. What makes demo accounts so helpful is that you can practice your trading skills in real-live market conditions. Also, obviously, it isn’t possible to withdraw the funds in your demo account, but you should have access to the capital in your CFD account at all times.

See our similar blog posts:

The information displayed herein about Plus500CY Ltd. and its services is merely generic and derived from publicly available reliable sources or received from Plus500CY Ltd. (entity authorized to operate in Spain through the passporting regime, reg no. 3848).

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5)