The 8 best MetaTrader 4 demo accounts in comparison for traders

Table of Contents

Learning how to trade on the MetaTrader 4 platform can be difficult, especially if you are just starting out. No amount of YouTube tutorials, MetaTrader 4 guides, or webinars will teach you all you need to know before you start trading with this specific trading platform.

Before jumping in with both feet and trading with real-life cash, naturally, you would want to get the hang of using the platform. You would want to familiarize yourself with the necessary strategies and how to utilize the tools available on the trading software.

Good thing there are a lot of brokers out there who utilize the MetaTrader 4 platform and even offer demo accounts. This is perfect for newbie traders who want to learn how to trade. Demo platforms can be utilized by well-seasoned traders as well so they could try out new trading strategies on specific assets before investing their money in them.

In this review, you will read about the 8 best MetaTrader 4 demo accounts for trading online. You will find a few information about the broker, the available assets to trade, as well as the list of eligible countries for each company.

See the list of the best MetaTrader 4 demo accounts in comparison:

MetaTrader Broker: | Review: | Regulation: | Demo account: | Advantages: | Free Demo account: |

|---|---|---|---|---|---|

1. Vantage Markets | Regulated by the CIMA & ASIC | $ 10.000+ virtual money Unlimited and for free | # Regulated and safe # Real ECN trading # Fast order execution # No hidden fees # Free bonus available | Practice account: (Risk warning: Your capital can be at risk) | |

2. RoboForex | Regulated by the IFSC (Belize) | $ 100.000+ virtual money Unlimited and for free | # Leverage up to 1:2000 # Free demo account # Professional support # 12,000+ markets # Bonus program | Practice account: (Risk warning: Your capital can be at risk) | |

3. Moneta Markets | Regulated by the VFSC | $ 10.000+ virtual money Unlimited and for free | # Great for beginners # User-friendly interface # Sufficient educational tools # No deposit fees # Low spreads and commissions | Practice account: (Risk warning: Your capital can be at risk) | |

4. OctaFX | Regulated by the FSC (Maurituis) & CySEC (EU) | $ 10.000+ virtual money Unlimited and for free | # Spreads from 0.2 pips # Minimum deposit only $100 # Deposit bonus available # Leverage up to 1:500 # Free demo account | Practice account: (Risk warning: Your capital can be at risk) | |

5. FBS  | Regulated by the IFSC & CySEC | $ 10.000+ virtual money Unlimited and for free | # Bonus program & events # Leverage up to 1:3000 # Live account from $1 # 250+ markets available # Low spreads | Practice account: (Risk warning: Your capital can be at risk) | |

6. Libertex | Regulated by the CySEC | $ 10.000+ virtual money Unlimited and for free | # Low minimum deposit of $100 # 250+ trading assets # User-friendly platform # Excellent customer support # Competitive fees & spreads | Practice account: (Risk warning: 85% of retail investor accounts lose money when trading CFDs with this provider.) | |

7. Pepperstone | Regulated by the FCA, ASIC, DSFA & SCB | $ 10.000+ virtual money Unlimited and for free | # Award-winning broker # Excellent client support # Competitive spreads # Advanced tools # Free demo account for 30 days | Practice account: (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

8. FXCM | Regulated by the FCA, AFSL & FSCA | $ 10.000+ virtual money Unlimited and for free | # 100+ different markets # Competitive spreads # High security standards # Multi-regulated company # TradeStation, MT4, NinjaTrader, ZuluTrade available | Practice account: (Risk warning: 74% of CFD accounts lose money) |

List of the best MT4 demo account brokers:

- Vantage Markets – The best MetaTrader 4 broker with competitive conditions

- RoboForex – High leverage up to 1:2000

- Moneta Markets – Excellent execution speed broker

- OctaFX – Low-cost trading platform with high leverage

- FBS – The broker with a low minimum deposit

- Libertex – Popular choice from over 2.2 million clients worldwide

- Pepperstone – One of the leading CFD brokers

- FXCM – Ideal for forex trading

Now, let us take a closer look at all these brokers.

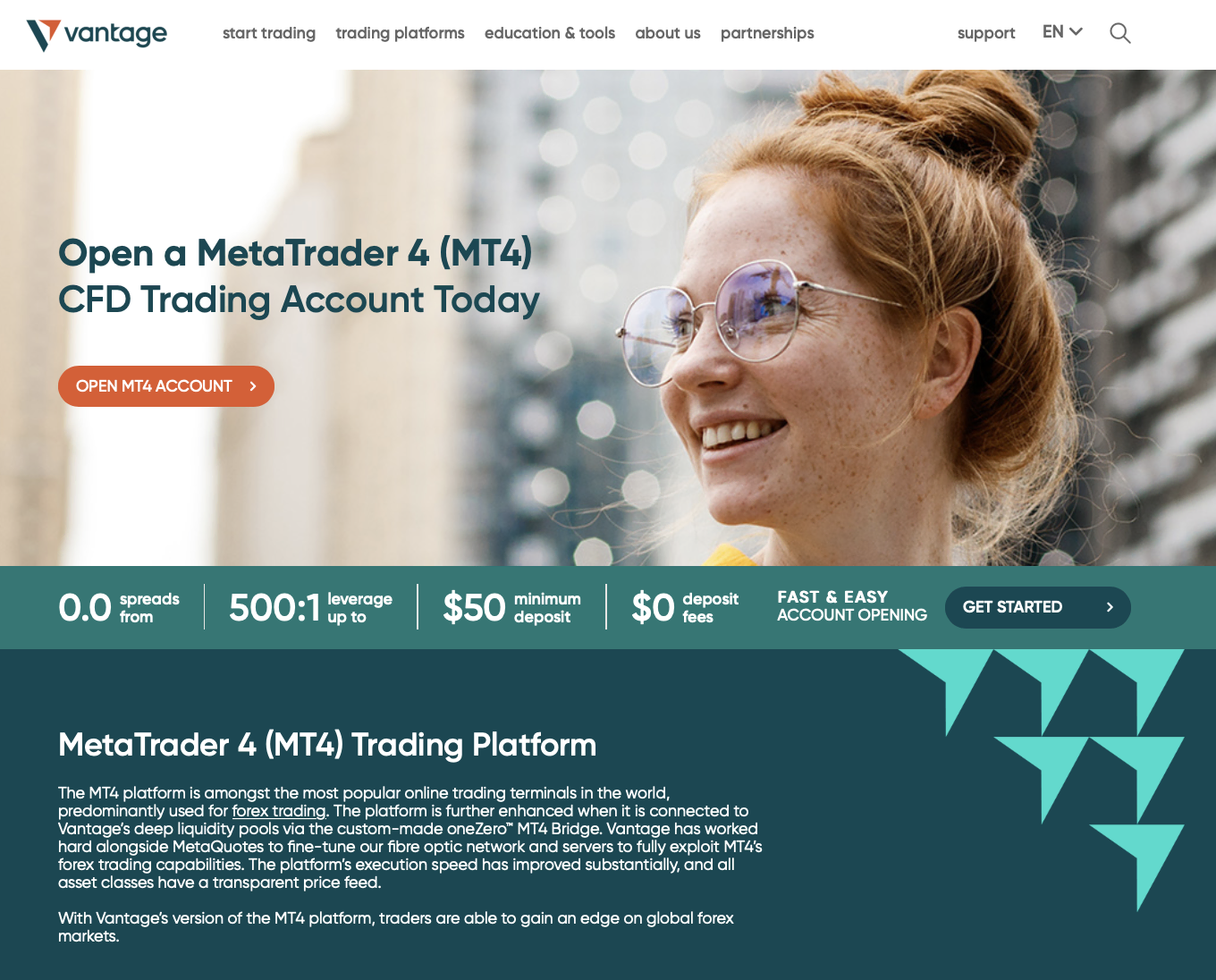

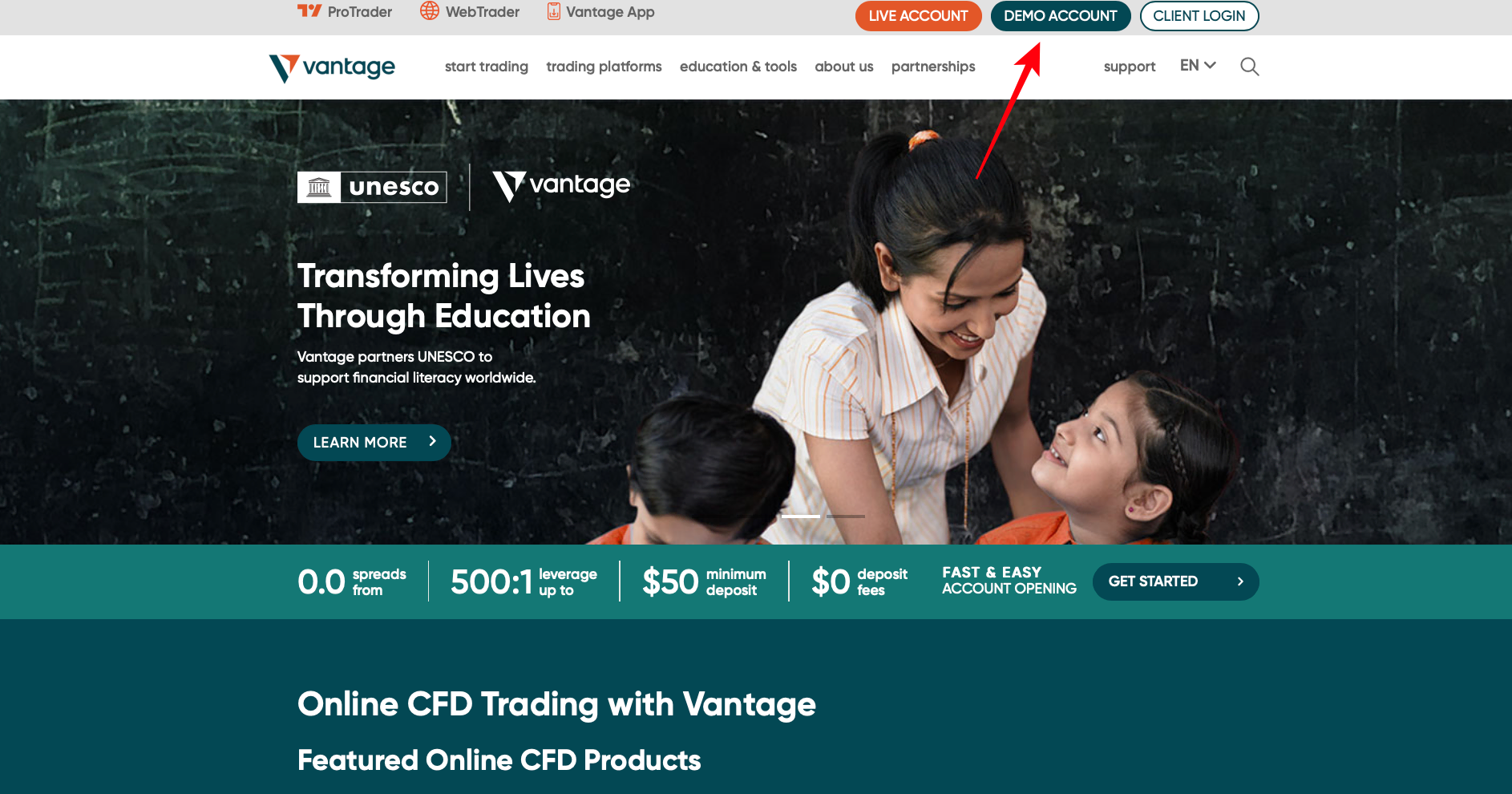

#1 Vantage Markets – The best MetaTrader 4 broker with competitive conditions

It is a great platform that allows traders to experience the best trading facilities. Traders can trust Vantage Markets because it is a reliable online platform. Besides, the MetaTrader 4 trading account that Vantage Markets offers is also great.

Good to know!

Vantage Markets offers one of the best MetaTrader 4 demo accounts. This demo account proves beneficial for new traders using the MetaTrader 4 trading platform.

The features of the Vantage Markets MetaTrader 4 demo account are as below.

- Traders can enjoy the virtual currency of about 10,000 USD on the Vantage Markets MetaTrader 4 demo account.

- Using a demo account on this trading platform is easy.

- The signup process for MetaTrader 4 demo accounts is simple on Vantage Markets. A trader can get started within a few clicks.

- This trading platform has a good clientele, so it is safe to opt for its demo account.

- Vantage Markets does not differentiate much between the live and demo trading account. Thus, if a trader is keen to learn the operation of a live MetaTrader 4 account, he can still choose a demo account.

So, traders can signup for Vantage Markets MetaTrader 4 demo accounts. This feature-rich trading platform offers traders just what they need. Besides, traders can enjoy almost 10,000 USD in their MT4 demo account. They can use these funds to learn to use the trading platform and place trades on it.

Good to know!

Vantage Markets also has great customer support. If a trader encounters any trouble with the demo account, he can look forward to seeking help from efficient customer support.

In addition, as soon as a trader learns to operate MT4 on the Vantage Markets MetaTrader 4 demo account, they can switch to a live account.

(Risk warning: Your capital can be at risk)

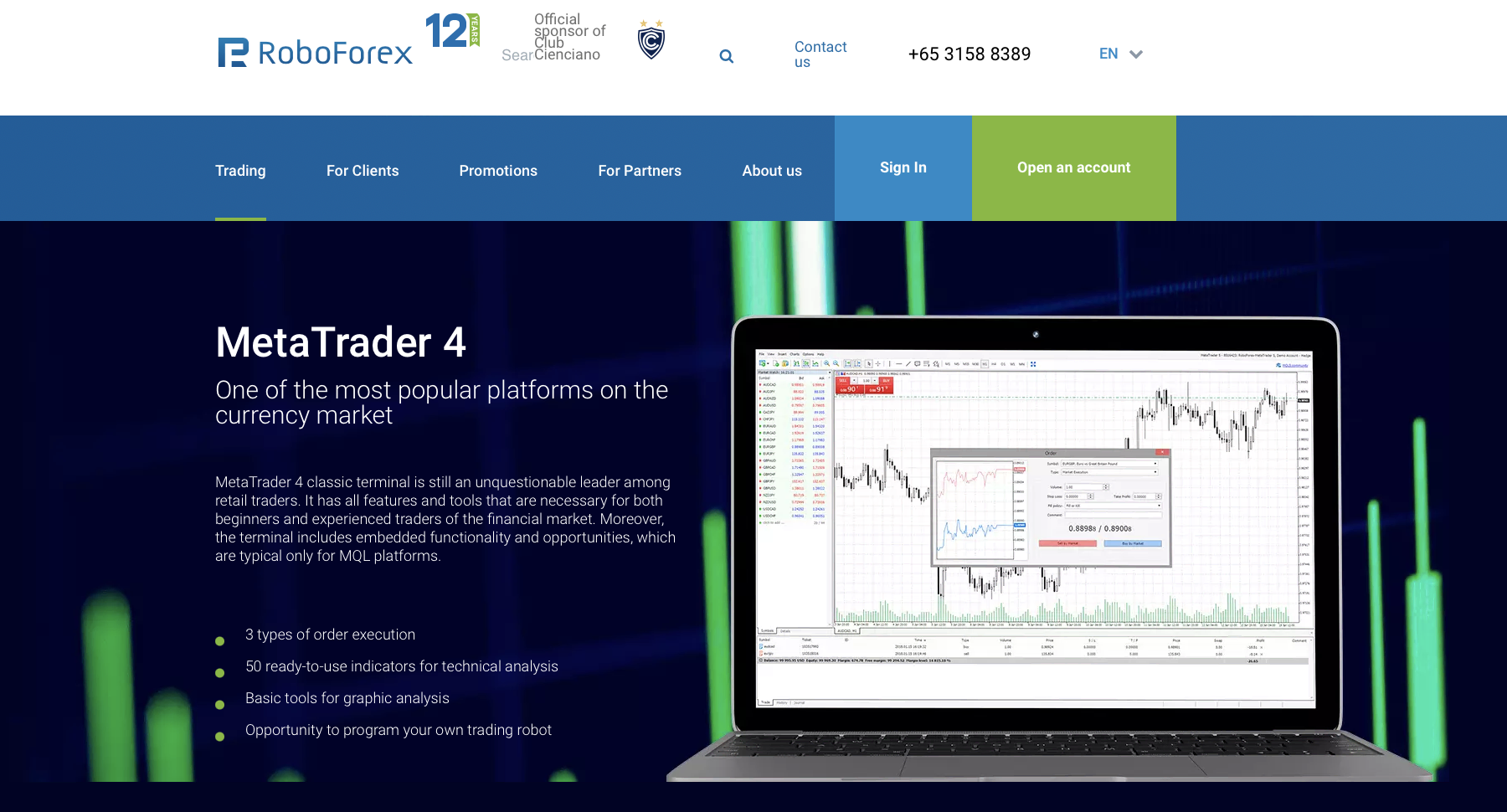

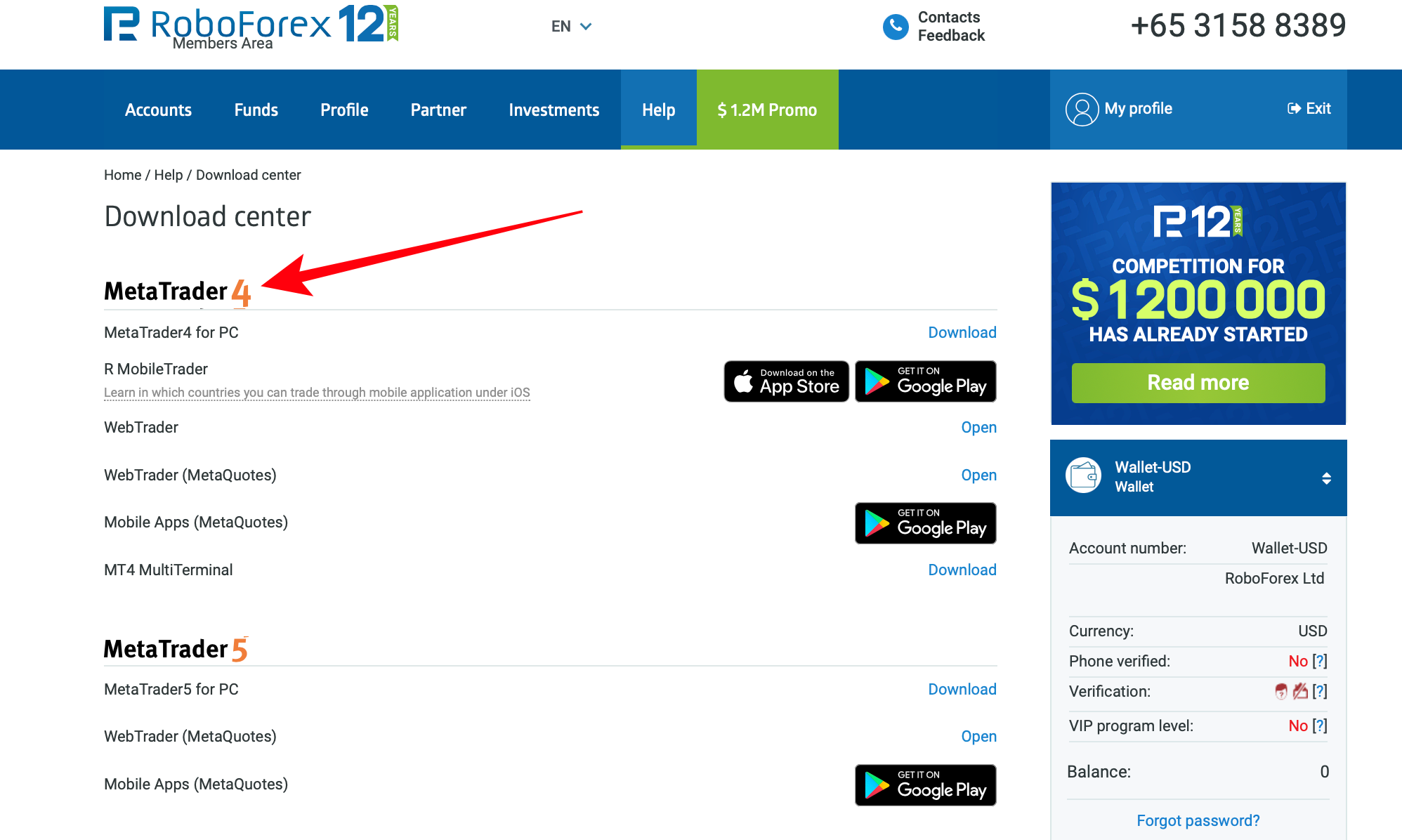

#2 RoboForex – High leverage up to 1:2000

RoboForex is well-known among brokers offering traders the best trading services. Most traders look forward to trading on RoboForex because of its simple user interface.

In addition, RoboForex offers all leading trading platforms to traders. So, you can enjoy using MT4 on RoboForex.

Good to know!

Traders can directly signup for a MetaTrader 4 live account on RoboForex. However, if they wish to test the platform before, they can choose MetaTrader 4 demo accounts on this trading platform.

The RoboForex MT4 demo account features include the following:

- The forex broker has all the necessary tools and indicators on the RoboForex demo account.

- Traders can get started on MetaTrader 4 demo accounts on RoboForex within a few minutes.

- Using the MT4 trading platforms is as simple on RoboForex as on other platforms.

- RoboForex also offers great services to traders.

- You can even find educational content on this trading platform. So, if you have trouble using the MetaTrader 4 demo accounts on RoboForex, you can seek help.

- Traders can find sufficient funds in their RoboForex demo accounts. It allows traders to trade on MT4 without any real money.

So, traders can perform two tasks using RoboForex MetaTrader 4 demo accounts. First, they can easily learn to use it. Secondly, a trader can know more about the functioning and services offered by RoboForex.

Thus, if you find MetaTrader 4 demo accounts that rank the best, we recommend RoboForex.

This online multi-asset, New Zealand-based broker has over ten years of experience and has forged partnerships with popular brands like BMW. With 800,000 registered accounts from 169 countries, they boast of winning more than ten prestigious awards.

RoboForex‘s MetaTrader 4 platform offers indices and commodities on their platform. See the list below for all the assets offered.

Indices:

- US 500 Index Cash (.US500Cash)

- US Nasdaq Index Cash (.USTECHCash)

- US Dow Jones Index Cash (.US30Cash)

- DE 30 Index Cash (.DE30Cash)

- JP 225Cash Index CFD (.JP225Cash)

Soft Commodities:

- Teucrium Wheat

- Teucrium Soybean

- Sugar Pure Beta ETN Ipath

- Teucrium Corn

Energy Commodities:

- Spot WTI Light Crude Oil (WTI)

- Spot Brent Crude Oil (BRENT)

Metals:

- Gold

- Silver

You can also trade over 40 currency pairs like EUR/USD, GBP/USD/, EUR/GBP, USD/JPY, and many more. There are also 53 stocks to choose from, including some well-known names like Tesla, Netflix, Google, Facebook, Apple, and Amazon.

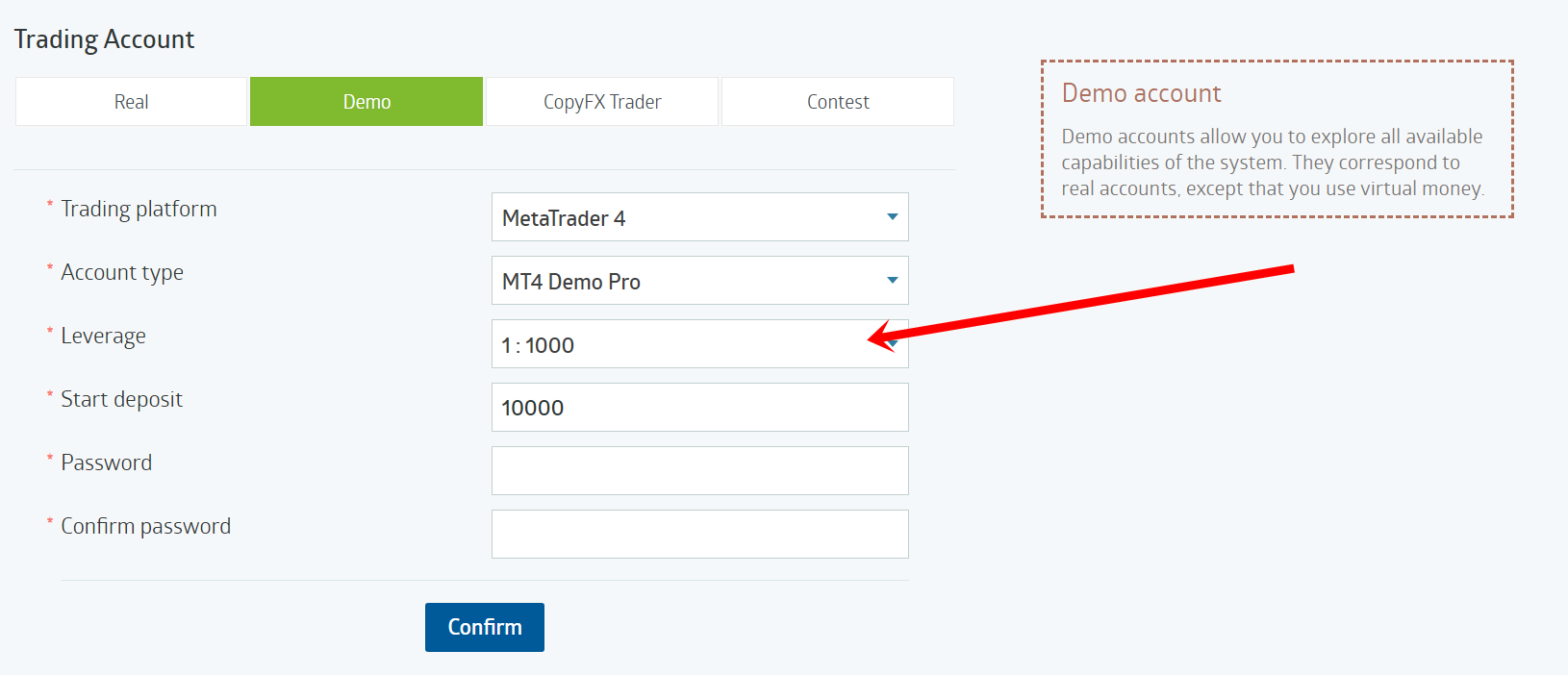

RoboForex’s MetaTrader 4 platform comes equipped with 12,000 trading instruments that will help you familiarize yourself with how the market works and how these tools can assist you. Opening a demo account requires you to fill up a form with your email, full name, and mobile number. After that, you will get to choose between a Demo Pro account, a demo account, and a demo R Trader account.

The Demo Pro account is the ideal demo account type because it replicates live market trading conditions with a maximum leverage of 1:2000. You can freely hone your skills on their MetaTrader 4 platform for 90 days.

You can contact their customer service 24/7 via email and live chat using Telegram, Skype, Viber, WhatsApp, and Facebook Messenger. You can also contact them via telephone.

Traders from the Russian Federation, Australia, Canada, Japan, and the United States of America are not eligible to sign up for an account with RoboForex.

(Risk warning: Your capital can be at risk)

#3 Moneta Markets – Excellent execution speed broker

Moneta Markets is next on the list if your exploration of the MetaTrader 4 demo accounts does not end with Vantage Markets or RoboForex. This trading platform serves the needs of hundreds of MT4 users. Apart from offering MT4, traders can also use other leading trading software on Moneta Markets.

Good to know!

The best-in-class service Moneta Markets offers helps traders stay connected to this platform. The features of MetaTrader 4 demo accounts offered by this platform are the best.

Many traders join Moneta Markets for the great benefits that it offers. Some advantages of using the MetaTrader 4 demo accounts on Moneta Markets are below.

- You can trade all the leading cryptocurrencies with MetaTrader 4 demo accounts on Moneta Markets. Besides, forex, indices, and CFDs are also available to trade.

- You can plan and strategize how to use MetaTrader 4 platform by using the demo accounts offered by this trading platform.

- Like other trading platforms, you can access virtual funds on Moneta Markets MetaTrader 4 demo accounts. If a trader runs out of funds on this trading platform, he can always top it up.

- The features a trader gets in Moneta Markets live trading accounts are easily available on the MetaTrader 4 demo accounts.

Thus, traders can experience first-hand trading on the demo accounts. This trading platform can satisfy any trader’s needs so that he can switch to live trading accounts without second thoughts.

(Risk warning: Your capital can be at risk)

#4 OctaFX – Low-cost trading platform with high leverage

OctaFX is a broker that successfully makes it to the list of brokers that offer the best MetaTrader 4 demo accounts. OctaFX is already known for its best services. Besides, it is popular for the MetaTrader 4 suite it offers traders.

Good to know!

OctaFX has a seamless user interface. So, any trader desirous of using this platform can signup for a trading account. But first, you can use the MetaTrader 4 demo accounts that OctaFX offers.

This trading platform allows traders to download the MetaTrader 4 platform. Finally, after signing up for the demo account on OctaFX, traders can log into their MT4 trading accounts.

Here are some advantages of using MetaTrader 4 demo accounts on OctaFX:

- OctaFX MetaTrader 4 demo accounts are easy to use. The trading platform has a very simple process to allow traders to use the demo account.

- The demo account on OctaFX has approximately 10,000 USD. MetaTrader 4 demo accounts with OctaFX are available for 30 days.

- Once the trading account balance finishes, traders can ask the broker to top them up.

- OctaFX demo accounts have features similar to live trading accounts. So, trading on OctaFX is the best trading platform.

Traders interested in using the best MetaTrader 4 demo accounts can use OctaFX. This trading platform’s services are remarkable. Like other platforms, OctaFX excels in offering traders the best educational resources.

(Risk warning: Your capital can be at risk)

#5 FBS – The broker with a low minimum deposit

Finally, traders can rely on FBS for the best MetaTrader 4 demo accounts. FBS simplifies trading on MetaTrader 4 for traders. It allows traders to use its demo account to learn operating the MetaTrader 4 trading platform.

So, before placing any real trades, a trader can consider placing trades on MetaTrader 4 demo accounts. It will help them check the relevance of their trading strategies.

Besides, it will also help traders learn how to customize their trading tools. Thus, traders get nothing but the best trading experience on the FBS MetaTrader 4 demo accounts.

Here are some features of MetaTrader 4 demo accounts on FBS:

- FBS offers traders with demo account trading on MT4. The features are unmatched. Besides, the customer service of FBS makes it a lucrative trading platform.

- Traders can use the amount in their FBS demo account to initiate trades. The demo account trades on this platform do not cost anything to traders.

- Traders can use the FBS demo account for free for thirty days. After thirty days, traders might need to pay a fee to use the FBS MetaTrader 4 demo accounts.

(Risk warning: Your capital can be at risk)

#6: Libertex – Popular choice from over 2.2 million clients worldwide

With over 20 years in the trading scene, Libertex has more than 2.2 million clients from 11 countries and has won over 30 awards. This Cyprus-based broker has over 200 assets to trade with a leverage of up to 1:600 depending on the product you are trading.

On their MetaTrader 4 platform, there are over 50 currencies available. These include the seven major pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, NZD/USD, and USD/CHF. Exotic pairs like EUR/RUB, USD/RUB, USD/SGD, GBP/SEK, and many more can be traded on their platform.

Compared to other brokers, who only offer the popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, Libertex has these and some of the lesser-known cryptos like Dogecoin, Polkadot, Ontology, Cosmos, and many more.

You will also find 18 commodities divided into three groups. These groups are Metals, Agriculture, and Oil and gas. Below is a list of all the commodities found on their platform.

Metals:

- Gold

- Silver

- Copper

- Platinum

- Palladium

Agriculture:

- Coffee Robusta Cash

- Coffee Robusta

- Sugar

- Corn

- Wheat

- Soybean

- Cocoa

- Coffee

Oil and Gas:

- Light Sweet Crude Oil

- Heating Oil

- Henry Hub Natural Gas

- WTI Crude Oil

- Brent Crude Oil

Good to know!

The indices offered here come from North America, Europe, Asia, the Middle East (Israel 35), and South America (Chile Index).

North America:

- Volatility Index

- MEX BOLSA Index

- US Dollar Index Future

- RUSSELL 2000

- S&P 500

- NASDAQ 100

- Dow Jones

Europe:

- CAC 40

- AEX

- Russia50 Index

- FTSE 100

- Italy 40

- Spain 35

- EURO STOXX 50

- DAX

Asia:

- Vietnam Index

- Nikkei 225

- Hang Seng Index

- China A50

There are over 50 stocks to choose from in Libertex’s platform. You will find some well-known companies like Canopy Growth Corp, McDonald’s, Nintendo US and Japan, Starbucks, Walt Disney, and many more.

A Libertex MetaTrader 4 demo account comes equipped with €50,000 in virtual funds that you can use to trade any of these assets with zero risks. You will also have the option to start trading on a live account without having to register again.

You can get in touch with their customer service representatives via email and telephone (+35722 025100). Keep in mind, though, that it may take one business day before they tend to your query or concern. Libertex’s services are available to traders from the European Economic Area or EEA.

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

#7: Pepperstone – Ideal for forex trading

Pepperstone is one of the leading CFD and forex brokers based in Australia. They have been operating for over ten years and have more than 70,000 registered clients from all over the world.

Using Pepperstone’s MetaTrader 4 platform, you have the option to trade 180 forex pairs. This includes the seven major currency pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD, EUR/GBP, USD/CHF, and USD/CAD. You will also find minor pairs like GBP/JPY, GBP/CHF, GBP/CAD, EUR/JPY, EUR/CHF, EUR/CAD, CHF/JPY, CAD/JPY, and CAD/CHF.

Forex pairs are not the only thing you can trade in Pepperstone’s platform, though. Below is a list of all the indices, commodities, and cryptocurrencies available on their platform.

Indices:

- US Wall Street 30 Index

- US 500 Index

- US Tech 100 Index

- US 2000 Index

- US Volatility Index

- Canada 60 Index

- Australian 200 Index

- Japan 225 Index

- Hong Kong 50 Index

- China 50 Index

- Singapore 25 Index

- South Africa 40 Index

- Hong Kong China H-shares Index

- Germany 30 Index

- UK 100 Index

- France 40 Index

- Spain 35 Index

- EU Stocks 50 Index

- Germany Tech 30 Index

- Germany Mid 60 Index

- Netherlands 25 Index

- Norway 25 Index

- Switzerland 20 Index

Commodities:

- Gold

- Silver

- Platinum

- Palladium

- Crude Oil

- Brent Oil

- Natural Gas

- Cocoa

- Coffee

- Copper

- Cotton

- London Sugar

- Orange Juice

- Soybean

- Sugar

- Wheat

Cryptocurrencies:

- Bitcoin

- Bitcoin Cash

- Dash

- Ethereum

- Litecoin

- Crypto10

- Crypto20

- Crypto30

There is also a wide range of UK, US, AU, and German shares available. Some well-known companies like Alibaba, Facebook, MasterCard, and Nike can be traded with Pepperstone.

All the assets mentioned above are great for practicing your different trading strategies using their demo account. Signing up is a straightforward process. You will be given 30 days to access all their tools and assets with a virtual fund of £50,000.

If you have any questions or you encounter any problems, you can check out their help center. You’ll find frequently asked questions or common problems that clients encounter and how to resolve these. You can also send them an email with your concern or call them via their telephone number: +44 (800) 0465473

Their website supports English, Chinese, Spanish, Vietnamese, and Thai. Their services are available to traders from all over the world except Saudi Arabia, Canada, Brazil, New Zealand, the United States of America, and India.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

#8: FXCM

This London-based broker boasts of more than 20 years of experience and numerous awards. They are also proud to be known as one of the companies that offer the most liquid markets. FXCM has offices located in South Africa, Israel, Canada, Hong Kong, Australia, Cyprus, and the United Kingdom.

With over 40 forex pairs, including the major and minor pairs, and stocks from the US, UK, EU, and HK, you can train yourself and devise new trading strategies that would suit your market of choice. Indices, as well as commodities and cryptocurrencies, are tradeable on FXCM’s MetaTrader 4 platform. You will find a list of these products below.

Indices and corresponding futures:

- VOLX (Mini VIX Future)

- US30 (E-Mini Dow Future)

- GER30 (DAX Index)

- CHN50 (SGX FTSE China A50 Future)

- NAS100 (E-Mini Nasdaq 100 Future)

- INDIA50 (SGX NIFTY 50 Future)

- AUS200 (ASX SPI 200 Future)

- US2000 (E-Mini Russell 2000 Future)

- HKG33 (Hang Seng Future)

- JPN225 (Nikkei 225 Dollar Future)

- FRA40 (CAC40 Index Future)

- ESP35 (IBEX35 Index Future)

- UK100 (FTSE 100 Index Future)

- EUSTX50 (Euro Stoxx 50 Future)

Commodities:

- Gold

- Silver

- Wheat

- Brent Crude Oil

- Copper

- Soybean

- Corn

- West Texas Intermediate

- Crude Oil

Cryptocurrencies:

- Bitcoin

- Ethereum

- Litecoin

- Stellar

- Bitcoin Cash

- EOS

FXCM‘s MetaTrader 4 platform allows you to set levels for stop loss while opening a new trade. Micro-lots also allow you to trade more precise lot sizes. There are a ton of other features and tools that clients can utilize on their MetaTrader 4 platform. Using a demo account gives you access to all of these, along with $50,000. The currency can be changed to Euros or Pounds if you prefer one of these.

To sign up, you need to input your full name, email, country of residence, phone number, and preferred currency. If you need assistance, they have a built-in live chat system on their website. You can also contact them via WhatsApp, email, or telephone.

Good to know!

Contacting them via telephone is convenient because they have different numbers for over 40 countries.

Traders from Iceland, Ukraine, the United Arab Emirates, the United States of America, Trinidad and Tobago, Thailand, Turkey, Saudi Arabia, Singapore, Russia, Philippines, Qatar, Pakistan, New Zealand, Norway, Malaysia, Mexico, Kenya, Japan, Iran, India, Israel, Hong Kong, Egypt, Greece, Costa Rica, Switzerland, Colombia, Canada, Belgium, Brazil, Saint Barthelemy, Argentina, and Bahrain are not eligible to sign up with FXCM.

(Risk warning: 74% of CFD accounts lose money)

What is a MetaTrader 4 Trading demo account?

The MT4 demo account allows you, as the client, to use MT4 as a platform to trade the broker’s offered assets without putting any of your capital at risk. You’ll be given a certain virtual amount to trade with for you to use as much as you wish. All features available for live accounts can be used for demo accounts as well. This includes tutorials, guides, entering orders, and accessing charts.

Most brokers allow you to create multiple demo accounts, but some offer these accounts with a time limit of one month. With that in mind, explore the possible options you have with numerous brokers and compare their assets, spreads, and types of accounts to know which demo account suits you the best.

Why you should use the demo account

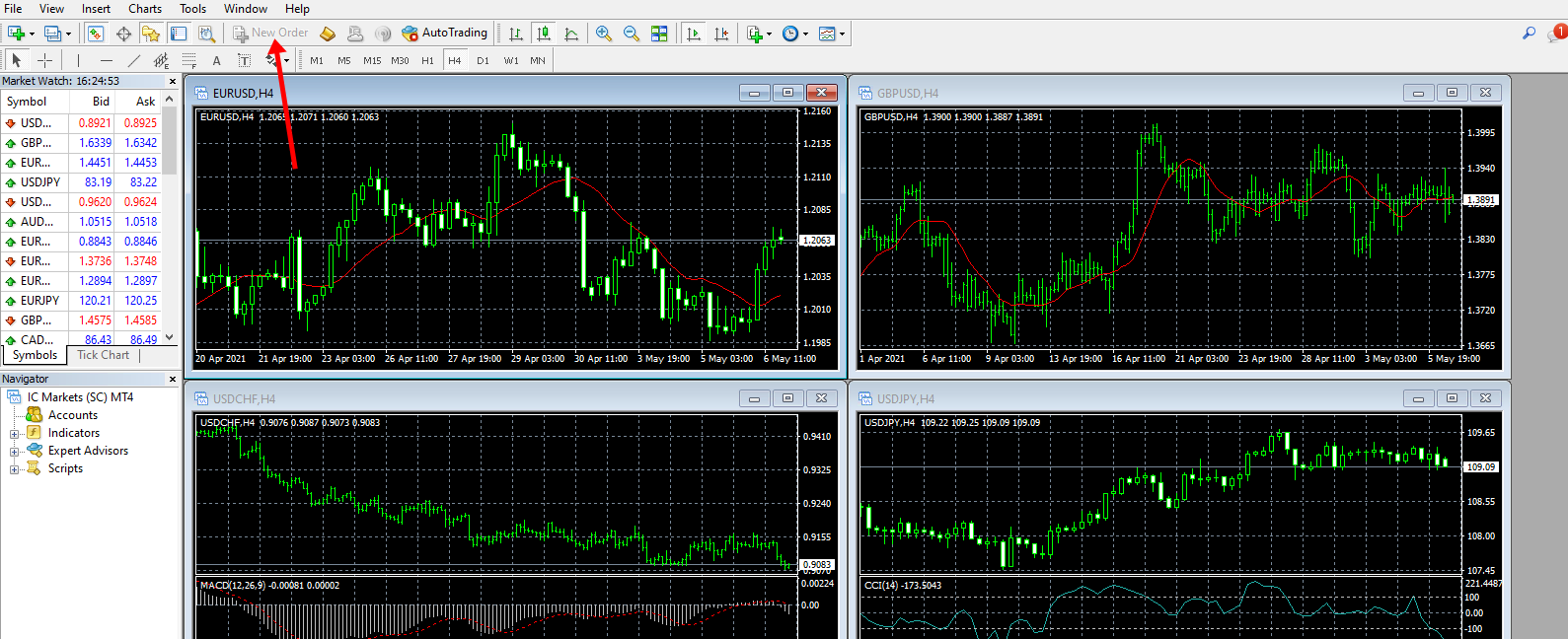

Creating a demo account with MT4 ensures that you get one of the best platforms that the trading world has to offer. With its user-friendly interface, you can set trades, allocation percentages, and leverage levels, and put up your charts like what a live account can do.

MT4’s demo account gives you the ability to trade forex, stocks, indices, commodities, options, and a lot more. It’s only limited by what your broker can provide but using MT4 gives you the upper hand over most platforms because of its reliability and speed of execution.

With 30 technical indicators available by default, you can trade using their built-in chart. You can avoid the hassle of having to access a third-party website. You can even craft your own indicators and screeners to find the trade that’s right for you. With nine time frames available, you can trade either in the short term to scalp or even in the long term for a portfolio built to grow.

A strategy tester is also available on the platform for you to gauge the strength of a certain asset and could act as a second opinion for your existing strategies.

Demo accounts give you the freedom to use up all the capital in your account to try out new techniques without any limitations. If you blow up your account for whatever reason, you can always start again, either by refreshing your account balance or asking your brokers.

Advantages and disadvantages:

The MetaTrader4, being the predecessor of the MetaTrader5, has the basic features that enable you to already trade at a high level but lacks some advanced tools that are already available on more modern brokers. Despite having just the basic features, MT4 is relatively simpler and easier to use compared to its upgraded counterpart. The interface can be customized as well for you to have all you need on one screen.

Since MT4 is popular, most brokers will offer this as a platform. This is a benefit to MT4 users as they don’t need to get used to a new platform, and they could keep all of their desired settings.

With MT4’s features, you can even utilize hedging strategies that can protect you from losses. With the availability of options and other complex assets, one could even have more opportunities to gain.

Good to know!

The MT4 has three order execution types, whereas the MT5 has four. Both have Instant Execution, Execution on Request, and Execution by Market, but the advanced platform has an Execution by Exchange order type.

For the number of Pending Order Types, the MT4 only has four. These are Buy Limit, Buy Stop, Sell Limit and Sell Stop. Advanced traders would notice that the MT4 does not have Buy Stop Limit and Sell Stop Limit. The usage for the missing two pending order types is detrimental to traders that would want to automate their trade even further, especially when they have found a good asset to trade.

The MT4 also has the disadvantage of not being able to view market depth. Not being able to know the volume per price of the stock would sometimes increase your average entry price for more illiquid assets such as exotic pairs or perhaps stocks that are not popular.

An economic calendar also is not available for the MT4, and the client would need to access a third-party website for that. Reports for your trades and portfolio activities are only available in a table format, whereas more advanced platforms have charts so you can easily visualize your performance.

The MetaTrader5 also offers more technical indicators and timeframes than its predecessor. The MT4 only offers 30 Technical indicators and nine-time frames. Even though this is enough for some traders, having more options to choose from will greatly assist in seeking out favorable opportunities in the market.

Other features that MT4 does not offer include partial order filling, netting, exchange trading, and fund transfer between accounts. Their strategy tester only offers the most basic of results as well, unlike the MT5, which can customize based on currency and assets traded.

(Risk warning: Your capital can be at risk)

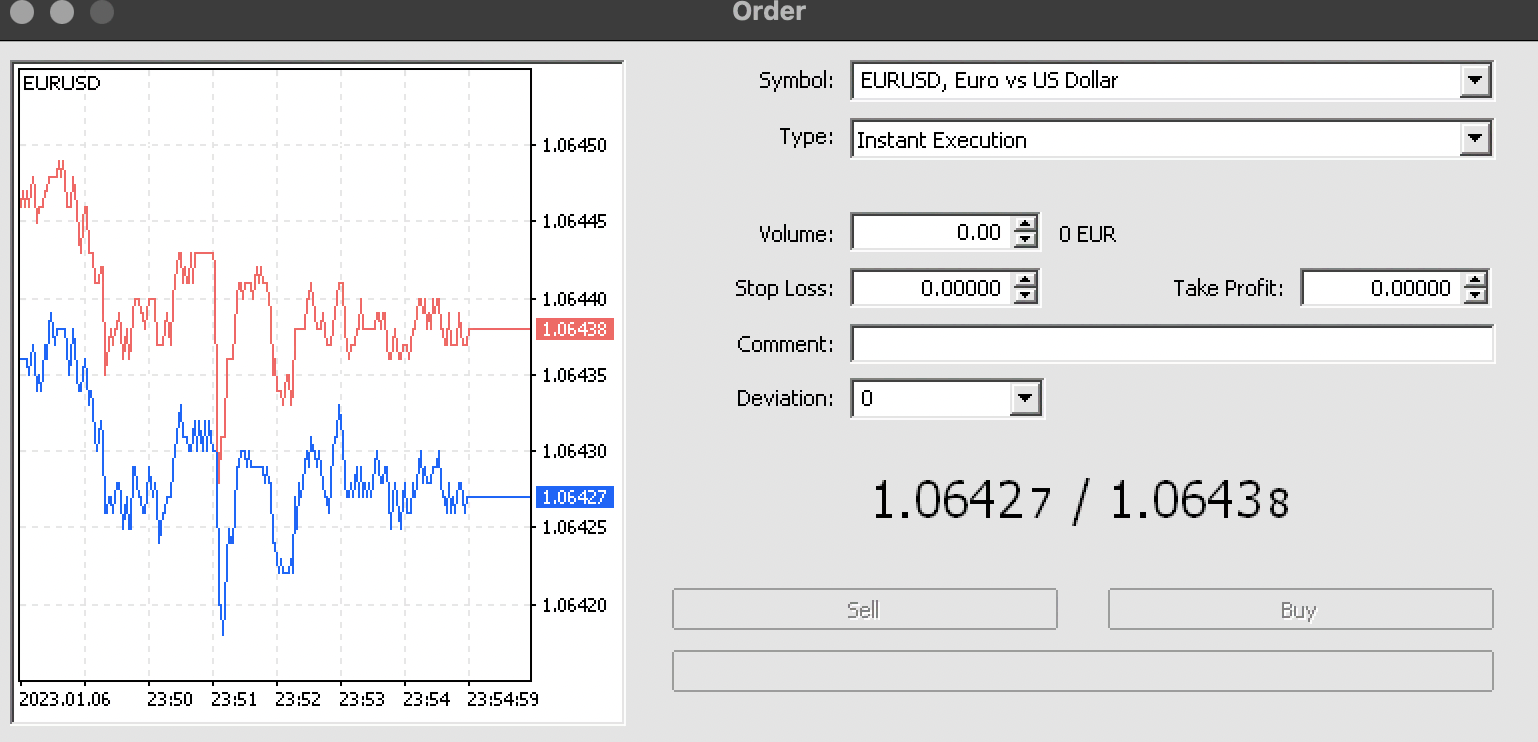

How to trade using MetaTrader 4 demo account:

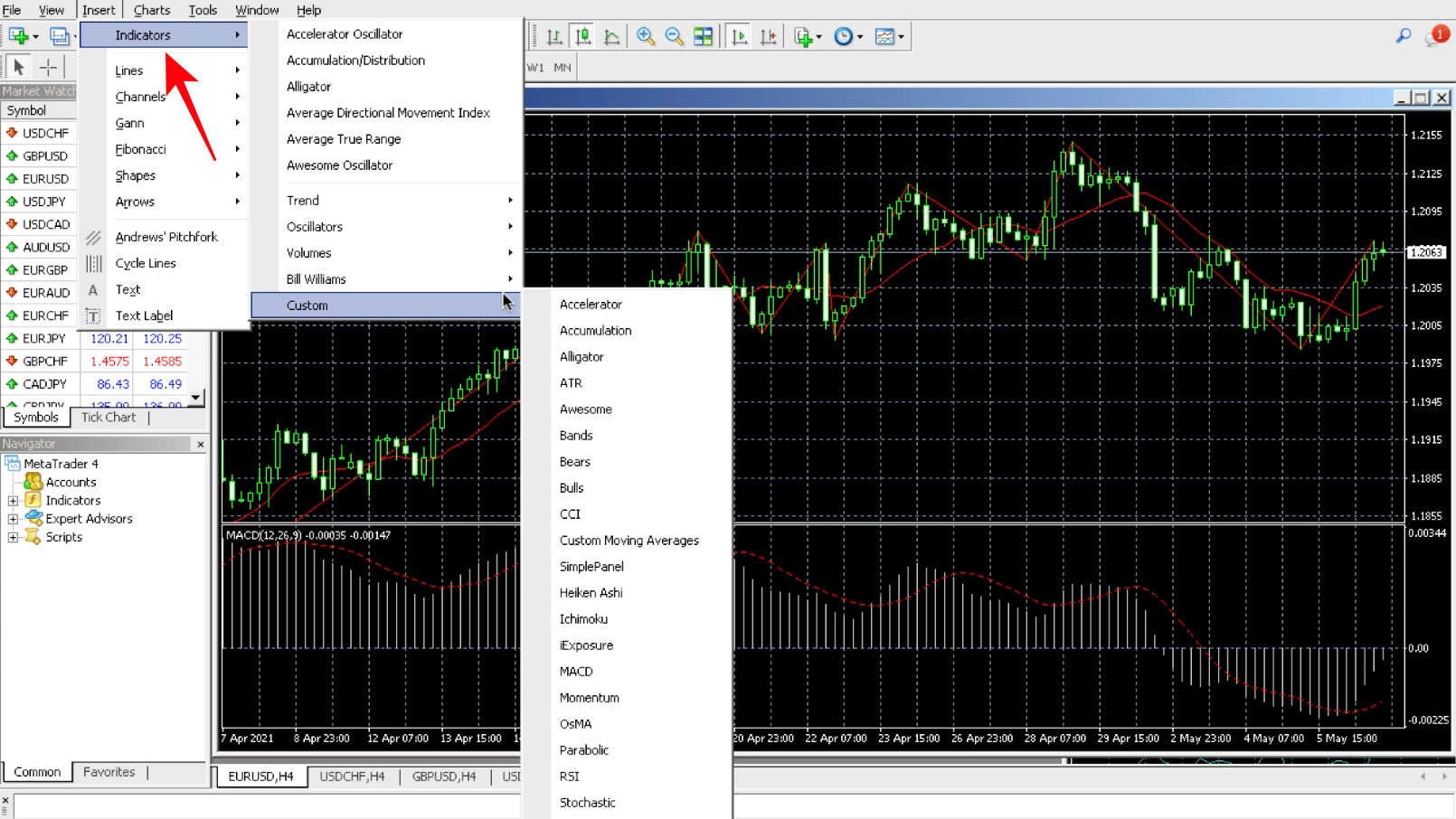

First, make sure everything is customized to your liking. Set up your watchlist for better organization of your trade ideas for assets.

Next, your chart should be customized to your liking. This includes changing your chart with its technical indicators and choosing the preferred color scheme.

Templates are also available so that you don’t have to repeat the same customization process for every chart. You need to familiarize yourself with everything the chart has to offer. The volume bars below should be seen, prices should be easily identifiable, and the bar style on the chart should be changed to candlesticks or bars, depending on which you want.

Within the quick bar near the top of the interface, you’ll also see different drawing tools. Here, you’ll find the tools to make horizontal, vertical, and diagonal lines for you to take note of important price points in the chart.

To enter a trade, click “New Order” near the top of the screen. A new pop-up box will open, asking for more details on your desired trade. Information needed includes the symbol or the ticker code, your desired trading volume, stop loss level, take profit level, and what kind of market execution you would prefer for this trade. There is also an option to sell or buy, which is synonymous with going short and long, respectively.

Pending trades and open trades are seen at the bottom of the platform. To close or cancel a trade, click the x button on the bottom far right of the interface.

Tips and tricks for trading with the MetaTrader 4

It is mentioned countless times in guides and tutorials that MT4 and MT5 are easy to use, but this depends on your level of understanding of trading as a whole. Be sure to read guides and also practice using a demo account to avoid the chance of carelessly losing all your money with a few clicks of a button.

The few disadvantages that MT4 has against the MT5 are far too few for it to hinder you from trading at your max potential. For features not found in the MT4, you can make up for these using third-party platforms and websites found for free online.

With your demo account, navigate through the software and set everything up before opening up your live account. Be sure that charts, the news feed, watchlists, and the order tab are within a few clicks of the main interface. It’s even better if these are found in the main interface for easier access.

Don’t be afraid to waste numerous accounts to demo trading. These exist at your disposal and for your benefit. Finding your specialty and strategy should always be your priority.

You can even experiment with creating your own bots. You can even probably sell these bots when you’ve made a profitable one.

The order types found in MT4 are already enough for you to set up your trades for efficiency. You can set buy stops, buy limits, sell limits and sell stops to either protect your profits or limit your losses through various combinations.

MT4 allows hedging, so be sure to look up guides on that. Given that MT4 brokers have a lot of products offered, there are multiple assets that can be used to hedge, such as commodities and indices.

Overall, MT4 has lesser features compared to MT5, but this is actually a benefit for beginners since they have to study a bit less and even use an interface that is simpler to understand and use.

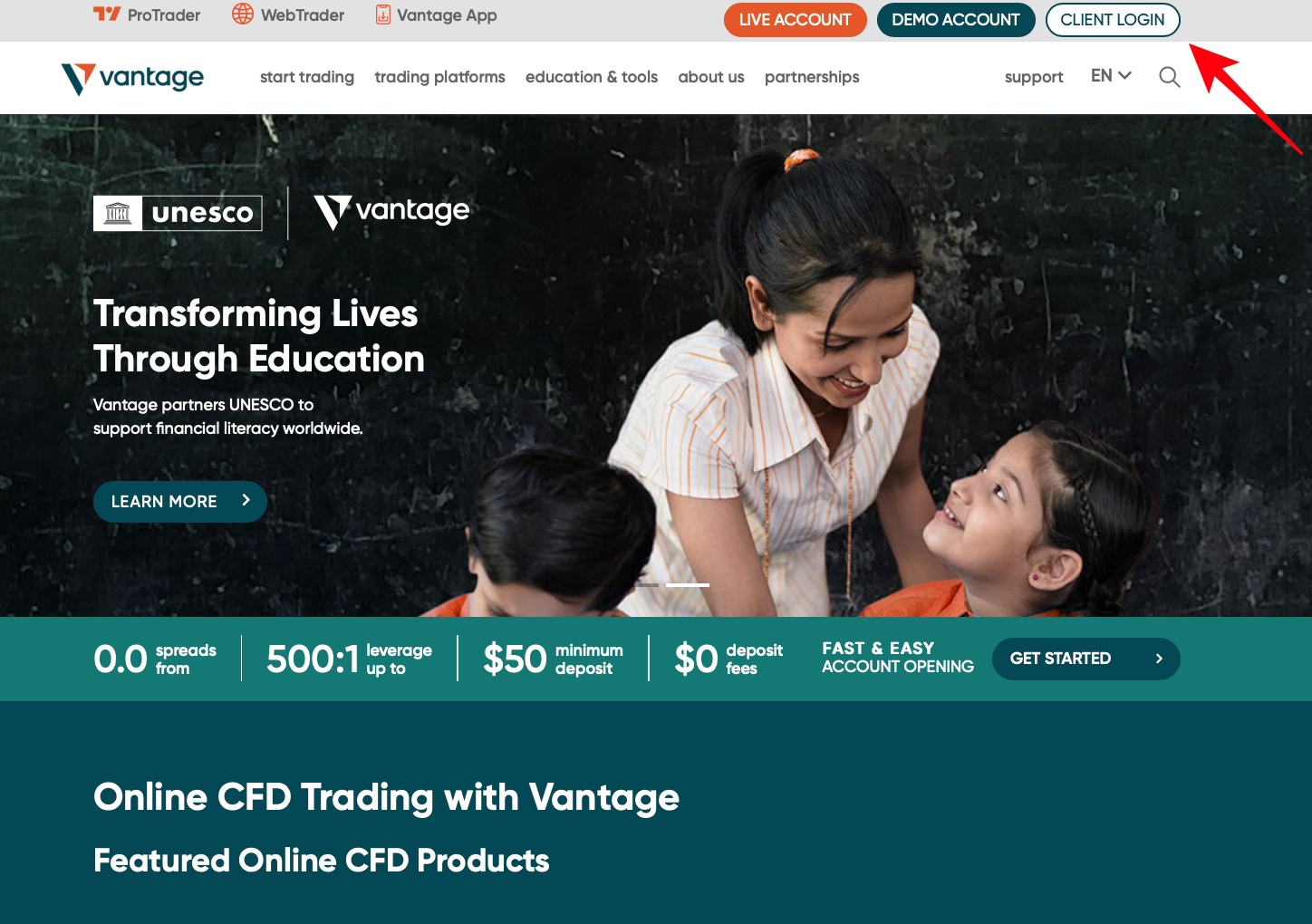

How to sign up for a MetaTrader 4 demo account?

Once you have chosen a MetaTrader 4 demo account, you can signup to use it. A trader can use the following steps to sign up for a trading account for demo usage.

- Visit the broker’s website and signup for a trading account.

- The broker will offer an option saying ‘try demo or ‘signup for a demo account.’

- Clicking on this option will require a trader to enter his details.

- Traders can then choose the type of demo account they wish to use. For instance, most brokers offer you an option to choose the type of trading platform you wish to access. Here, you can select MetaTrader 4. Then, you can submit your preference for using the MT4 demo account.

- After submitting, the trader’s demo account will start functioning. You will have virtual funds in your MetaTrader 4 demo account. You can use these funds to place trades and learn how to use the MT4 trading platform.

(Risk warning: Your capital can be at risk)

How to login into the MT4 demo account?

(Risk warning: Your capital can be at risk)

Once your MetaTrader 4 demo account is ready, a trader must log in. Of course, you can use the web version on your phone or computer.

After installing the MT4 trading platform on your device, a trader only needs to enter the login credentials. These login credentials are the same as when you signup with a broker.

Good to know!

A trader does not need to signup for a MetaTrader 4 demo account separately. Logging into MetaTrader 4 demo account will require you to enter the login information of your brokerage account.

Tutorial: How to use the MetaTrader 4 demo account?

This tutorial would help traders to use the MetaTrader 4 demo account.

#1 Login to your MT4 demo trading account

The first step to using the MetaTrader 4 demo account is to log into it. As mentioned, your login credentials are sufficient to log in.

#2 Pick an underlying asset to trade

Since virtual funds are in your MT4 demo account, you don’t need to add more. So, you can directly proceed to choose an underlying asset.

#3 Use the technical indicators and conduct a technical analysis

Traders can use all the available tools on MT4. Once you connect your broker with MetaTrader 4, you can enjoy trading with all the platform’s features.

So, here you can learn how to customize the trading tools and technical indicators. It will help you conduct technical analysis. Then, finally, you can place a trade.

#4 Place your trade

Once you have made your perfect technical analysis, you can place your trade on the MetaTrader 4 demo account. After the trade closes, you will know whether you made a profit. Thus, a MetaTrader 4 demo account is perfect for testing and improvising your trading skills.

You can even opt for the automated trading feature on the MT4 demo account. It will help you trade without putting in much effort.

Pros and Cons of an MT4 demo account:

Of course, a MetaTrader 4 demo account has several advantages and disadvantages. Let’s discuss some.

Pros

- Learning to use the MetaTrader 4 trading platform is more accessible with a demo account.

- The MetaTrader 4 demo account has virtual funds. So, traders can learn using the MT4 platform without funding it with their own money.

- There are no real profits and losses on the MT4 demo account.

- Traders can always ask their broker to top up funds in their MetaTrader 4 demo account.

- Most brokers offer free demo trading accounts for MT4.

Cons

- The use of a MetaTrader 4 demo account is limited. Traders can use it for 30 days. After that, traders must pay their brokers.

- Withdrawing funds from the MetaTrader 4 demo account is not possible.

- The demo account will help a trader strategize, but more is needed to guarantee success when placing trades on a live trading account.

Conclusion – Practice makes you a better MT4 trader!

So, a MetaTrader 4 demo account can greatly help any trader. This trading platform lets traders in on the basics of trading on MT4. However, choosing the best MetaTrader demo account is crucial. For that, traders can select one of the five MT4 demo accounts.

These brokers are perfect for fulfilling any trader’s needs. Their trading services are inexplicably well.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about MetaTrader4 demo accounts:

What is the use of opening the Metatrader4 demo account?

The Metatrader4 demo account helps you explore everything associated with trading. You can try new trading strategies and ensure you are confident before you trade with real money on the MT4 platform.

What does the account Metatrader4 demo stimulate?

The Metatrader4 demo account inspires live trading situations on the MT4 platform but without real money in the account balance.

Should I deposit money in my Metatrader4 demo account?

No, you do not need to deposit real money in your Metatrader4 demo account, as it is free to open. You can trade with $10,000 as virtual money to test your trading techniques.

How am I benefited from the Metatrader4 demo account?

The Metatrader4 demo account allows you to trade with a Forex broker online. You can access popular and thriving trading platforms. You can use your MT4 demo account until you feel confident that you are accustomed to trading methodologies.

For whom is the Metatrader4 demo account suitable?

The Metatrader4 demo account is appropriate for novice traders starting their trading voyage. The demo account is also appropriate for professional traders due to its flexibility, speed, precision, and innovative features.

What is the use of the MetaTrader 4 demo accounts?

MetaTrader 4 demo accounts help traders understand the trading basics of the platform. It allows traders to access trading tools and technical indicators for a personalized trading experience. Besides, traders don’t need to use their money to use an MT4 demo account for placing trades.

What are some best MetaTrader 4 demo accounts?

Some great MetaTrader 4 demo accounts are available at:

Vantage Markets

RoboForex

FBS

Moneta Markets

OctaFX

What is the duration of availability of MetaTrader 4 demo accounts?

MetaTrader 4 demo accounts are usually available for free for 30 days. After that, the broker might require a trader to pay. However, the duration of availability highly depends on the broker.

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)