Trade Republic review and test for new investors

Table of Contents

| Review: | Regulation: | Minimum deposit: | Assets: |

|---|---|---|---|

(4.2 / 5) (4.2 / 5) | BaFin (Germany) | 0€ | 50,000+ |

Securities trading is an attractive opportunity to invest your assets sensibly and ideally to increase them. This opinion is also held by more and more people, which is why, understandably, the market has grown enormously in recent decades. Not only banks but also online brokers and other companies are among the providers. One of them is Trade Republic.

If you have not heard of the online broker Traderepublic.com before, you will certainly ask yourself some questions now. What is Trade Republic? Is my money safe with Trade Republic? And who can we contact with questions? We asked ourselves these questions and took a closer look at the Online Broker. In the following, our Trade Republic experiences are reported in detail.

Introduction to Trade Republic:

Founded in 2015, Trade Republic Bank GmbH is considered Germany’s first mobile and commission-free broker and can boast a wide range of tradable products as well as several well-known and successful partners. The company’s history is as interesting as its founders themselves.

The origin of Trade Republic:

Two of the founders, namely Christian Hecker and Thomas Pischke, got to know each other during their studies in 2011 and stayed in touch afterward. While Christian became active in investment banking, Thomas worked for a company in the field of financial technology. Finally, they met Marco Cancellieri and during a discussion on the topic of investment the idea for Trade Republic was born and in 2015 the online broker was founded.

Only two years later in 2017, the founders could convince the financial service provider Sino AG of their concept, which joined the company as a strategic investor. Again two years later Trade Republic received its license as a securities trading bank, fulfilling the founders’ goal and making the idea of a mobile and commission-free broker come true.

A brief overview of the history:

- 2011 Getting to know Christian and Thomas

- 2015 Foundation of Trade Republic by Christian, Thomas, and Marco

- 2017 Sino AG joins as a strategic investor

- 2019 Trade Republic receives the license as a securities trading bank

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) Trade Republic’s security on the test benchIn addition to a valid regulation, there are also other categories in which a company must first prove itself in order to be considered truly safe. This area in particular weighs very heavily when deciding for or against a particular broker. On the one hand, the security and protection of the customer and his data also play an important role. On the other hand, the investor naturally also wants the protection of his assets – keyword deposit protection. Internet pages at Trade Republic are always transmitted encrypted. Thus, the trader’s data is safe from fraud and abuse. The SSL encryption can be recognized by two points. One is the “https://” at the beginning of the internet address and the other is the small lock icon next to the URL. Security at Trade RepublicIs my money safe with Trade Republic? This question is probably asked by many people. To answer briefly: Yes. Not only the regulation by the Bundesbank but also by the BaFin are an indication for this. In addition, all deposits of the clearing account are kept in a trust account with Solarisbank AG. There, they are legally secured up to an amount of 100,000 Euro per customer. Securities in the customer’s securities account, on the other hand, are the property of the investor and are therefore not covered by the deposit guarantee. Nevertheless, it cannot be denied that Trade Republic is a reputable and secure provider in the trading and investment sector. Trade Republic offers for traders and investorsA further important point, which prospective customers consider with the choice of a broker gladly is the variety of the offer as well as the valid conditions with the appropriate offerer. Finally, the customer would like to have the flexibility to decide between a multiplicity of products and enjoy the advantage of attractive conditions at the same time. Whether a user is well served by Trade Republic with regard to the offer as well as the conditions is shown in detail in the following. These markets can be traded at Trade RepublicWith the Broker Trade Republic, the client can expect not only a wide range of different products to trade in the market but also other advantages. These include a comprehensive custody account service, monitored stock market prices, and attractive and transparent conditions. The following markets can be traded at Trade Republic:

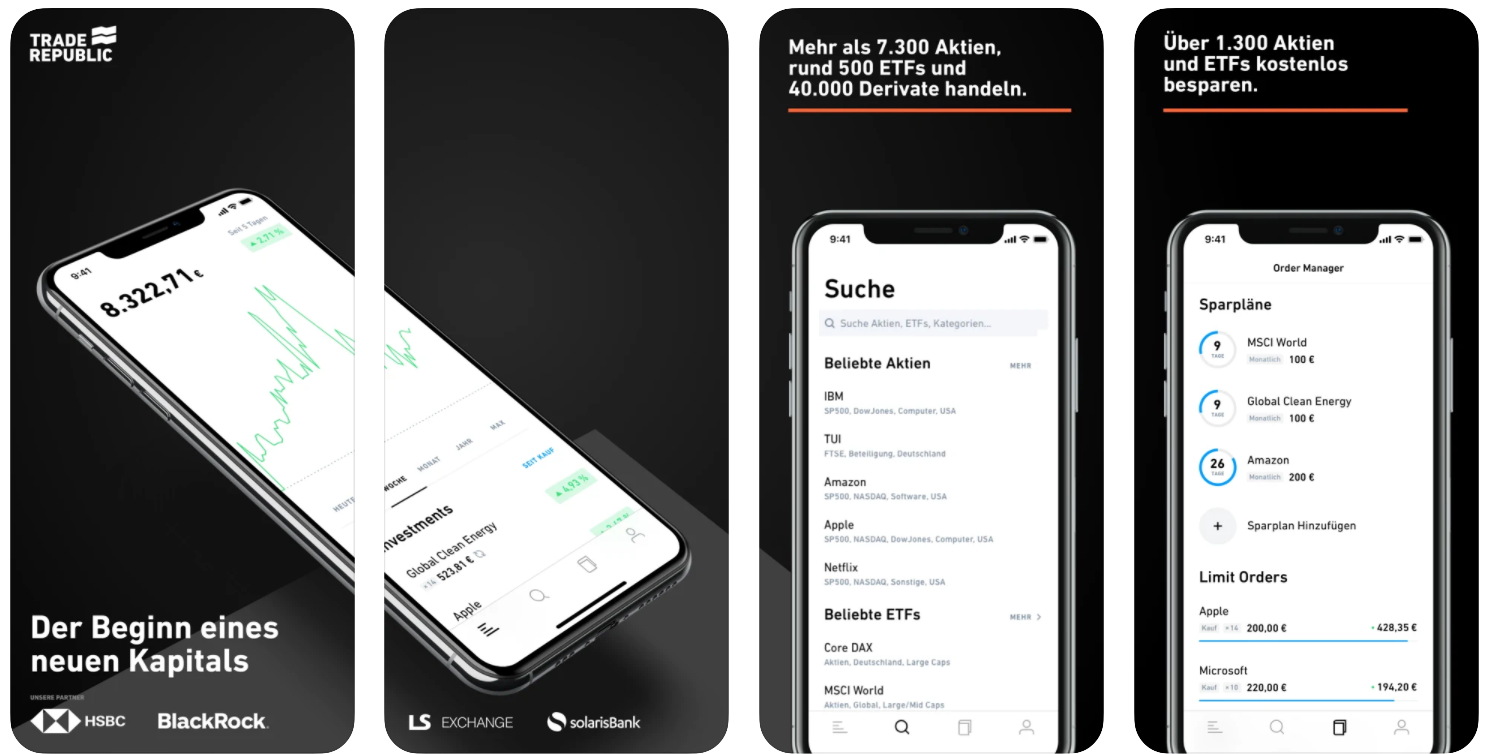

More than 7,500 different international stocks and ETFs are available to the customer. In addition, there are again 1,300 free share and ETF savings plans. And all this without commission costs and custody account fees. Shares are, so to speak, shares in the equity capital of a company. When you buy a share, you become a co-owner of the company to a certain extent and can look forward to dividend payments. The abbreviation ETF stands for Exchange Traded Funds. This is an investment fund that is continuously traded on an exchange. An advantage of ETFs over investment funds is that ETFs cost less due to passive management. In addition, Trade Republic can trade around 40,000 derivatives, including warrants, knock-out products, and factor certificates. Although this is a manageable range of markets overall, a large number of products are offered for trading in each area, which means that traders can certainly find what they are looking for. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Conditions of the Trade Republic at a glanceIn addition to a large selection of different products, customers usually also attach great importance to the corresponding conditions with the respective broker. Trade Republic also satisfies its investors and convinces them with long trading hours and comprehensive custody service. The trader profits with the purchase and/or trade of shares and ETFs with comparatively long trading hours from 7:30 o’clock to 23:00 o’clock. For derivatives, trading hours are from 8:00 am to 10:00 pm. Thus the investor has almost the whole day time to deal with his investments and trades and thus make the best out of his money. To ensure that securities trading is also successful and the customer can make sensible investment decisions, Trade Republic also offers a comprehensive securities account service. These services include, among others, the automatic payment of taxes that arise during trading. This also includes the annual tax certificate. In addition, Trade Republic allows the user to participate in corporate actions as well as general meetings.  Another advantage of the attractive conditions offered by the online broker is that the price-quality is monitored by the stock exchange. The spreads are linked to the reference market XETRA, which is an exchange-based trading place of the Frankfurt Stock Exchange. The abbreviation XETRA stands for “Exchange Electronic Trading”. The advantage, which probably interests most traders, is trading completely without commission. As already mentioned Trade Republic is the first mobile and commission-free broker in Germany. This gives you the opportunity to invest in shares, ETFs, and derivatives without paying a commission. Although an external cost flat rate of 1 Euro per trade must be paid nevertheless, can be invested in shares as well as ETF savings plans permanently free of charge. Short intermediate conclusionMy experience with the Trade Republic offers as well as the applicable conditions could hardly be better. Apart from the interesting founding history and the sympathetic founders as well as employees, the broker has managed to convince four very well-known and large partners of his idea and concept and is now working successfully with them. Furthermore, Trade Republic also scores very well in the area of regulation. On the one hand, the broker is regulated by the BaFin (Federal Financial Supervisory Authority), on the other hand additionally by the Bundesbank. Added to this is the great importance of security, which is not only evident from the SSL encryption of the website, but also from the deposit protection of up to 100,000 euros per customer. Although Trade Republic offers only a few markets for trading, the customer has a wide range of products to choose from. These include a selection of shares, ETFs, and derivatives. The company also offers attractive conditions, including long trading hours, commission-free trading, and comprehensive custody service. Review of the Trade Republic trading platformWhen it comes to choosing the right provider in the field of securities trading, one or the other has a hard time. Of course, it is an important decision that can only be reversed with effort. Therefore it is definitely worthwhile to inform oneself in advance and to compare different providers so that the trader can find the right broker for his individual needs and wishes. Criteria like valid regulation, high security, attractive conditions as well as a wide range of products understandably play an important role. However, the available trading platform of the broker should not be forgotten. This should have some characteristics in order to allow investors to trade as stress-free as possible. These characteristics are of high relevance:

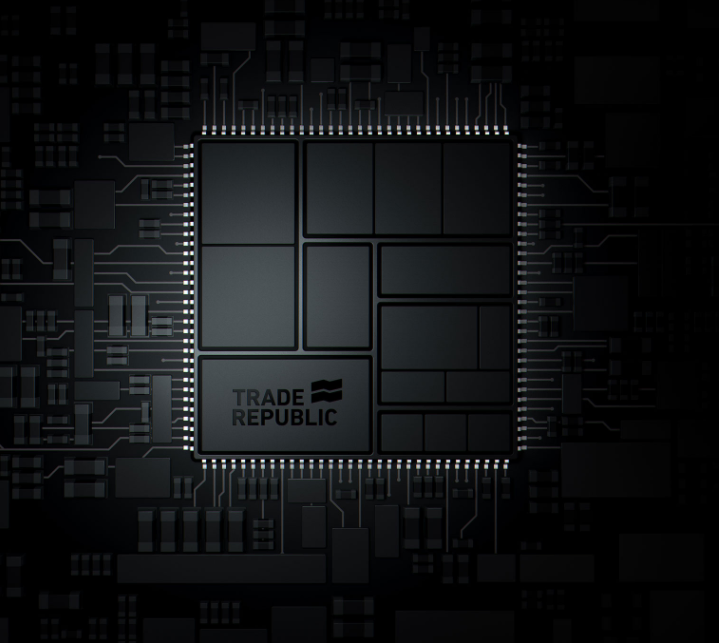

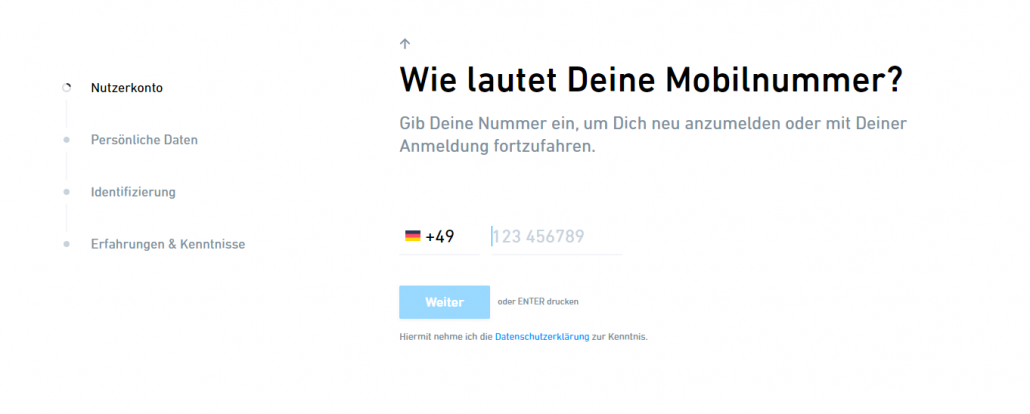

Many companies offer software or program that the customer must install on their computer in order to be able to trade. Therefore there is no desktop version of the Broker. Trade Republic – as the first mobile and commission-free broker in Germany – offers its trading platform as a mobile version or app.  The mobile app is available free of charge for both iOS and Android devices from the respective App Store and Google Play Store. With this smartphone app, customers can keep track of their assets and investments while on the move and manage them at any time. This gives the trader full flexibility in securities trading.  You have the option to search for shares, ETFs, or derivatives and filter them according to individual criteria. In addition, useful functions such as price alerts, push messages and real-time data allow the customer to react quickly to any changes and make flexible decisions. All orders, dividends, account movements, and corresponding settlements are archived in the personal timeline. Mobile trading with Trade Republic proves that successful securities trading is possible without the need for numerous different programs and software. Trade Republic offers investors a clear platform where they can keep track of their own investments, access real-time quotes, and react quickly to changes – all on their smartphones. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Opening of an account with the Trade RepublicIf the prospective customer finally decided on a broker, it goes to the depot opening. So that nothing more stands in the way of the opening of the depot and the customer does not regret it already with the registration for this offerer to have decided, the registration process should go as fast and simply as possible from places. Opening a securities account with Trade Republic is very simple and starts in four steps. Since the Trade Republic trading platform is an app, the customer must first enter the mobile number of the smartphone on which he wants to use the Trade Republic app. Then they are asked for personal data such as name and address.  The next step is to identify the trader. This is done by the investor confirming his identity in a short video chat with a Trade Republic employee using a valid identification document and then answering a few questions for a few minutes. An SMS is then sent to the specified mobile number. The code contained in the SMS only needs to be entered. Finally, the trader is asked about his experience and knowledge in securities trading. The process should take no longer than 15 minutes and the Trade Republic Depot is already set up and trading can begin.  However, there are some requirements that must be met to open a Trade Republic account. On the one hand, the customer must have a smartphone with an iOS or Android operating system. On the other hand, a European cell phone number, as well as a SEPA bank account, must be available. In addition, the investor must be of legal age and must have permanent residence in Germany as well as be taxable in Germany. If these characteristics can be proven, nothing more stands in the way of securities trading. Another thing that investors can benefit from is a premium for attracting new customers. As soon as the recruited new customer carries out his first trade, one is rewarded with a premium of 15 euros. Portfolio transfer to Trade RepublicFrom time to time it happens that a client chooses a certain broker and after a certain time the satisfaction decreases. Often one then comes to the conclusion that the decision was not the right one and decides to change. But in some cases, this is not as easy as expected. With Trade Republic, on the other hand, the portfolio transfer is quick, easy, and even free of charge. To do this, the customer must first decide whether a complete transfer or a transfer of individual positions should take place. In the app, he then has to go to the personal area and there to the settings. If the customer now selects the option “Depotübertrag” under “Service” and confirms this with “Continue”, he receives the transfer form, which he prints out, fills in, and finally sends signed to the previous custodian bank. Usually, a transfer of a securities account is processed and executed within a few days. However, the duration depends on the previous custodian bank and can be up to six weeks in exceptional cases. Such delays can be explained, among other things, by technical reasons when transferring positions from foreign credit institutions. Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Types of securities accounts with the Trade RepublicNot only the process of opening a securities account but also the range of different securities account models on offer is an important criterion for a large number of people, according to which they decide either for or against a particular broker. After all, every customer is individual, just like his investment plans and his corresponding wishes and needs. A tailor-made depot model can therefore be found best when the provider has several depots to choose from. Unfortunately, this is not the case with Trade Republic. Here there is only one type of depot: the securities depot. Trade Republic does not offer a special version for young investors, for communities – such as married couples or life partners – or for business customers. This is not to say that the company’s securities account is not a good offer nevertheless and that the trader can successfully invest and invest in securities. Here it is worthwhile to balance his individual interests and goals in securities trading with the functions and advantages of the Trade Republic securities account and possibly the offer is sufficient for this. These order types are available at Trade RepublicWith Trade Republic, a customer can use three different order types. These include the following:

While with the market order, the purchase is made at the next best market price, so to speak, the trader sets values in advance with the limit order. For example, he sets a value below the current market price at which he wants to make a purchase or a value above the current price at which he wants to make a sale. The stop order is practically the counterpart of the limit order. It sets a value above the current price at which to make a purchase or again a value below the current price at which to sell. However, order types such as Stop Loss or Stop Buy are not available. Placing an order with Trade Republic: How it worksAs mentioned above, it is very easy and fast to open a Trade Republic Depot. But this is not the only thing, because placing an order – and thus buying and selling securities – is also quite simple and is described in detail below. To place an order, first, open the Trade Republic app and search for the security you want to invest in. In order for the order to be executed, there should be enough funds in the clearing account. If the trader now clicks on the corresponding security, he will be taken to a detailed view where information on the security and the historical price development is displayed. If the customer now selects the “Buy” button, he or she will be forwarded to the order entry. There he determines the number of pieces of the security that are to be bought. The respective price per share is also displayed. Furthermore, the customer can determine the desired order type. Here he can choose between a market order, stop order, or limit order. Other ways of placing the order, such as stop-loss or stop-buy are not offered here. If “Next” is clicked now, the trader receives a summary of the order, which he can confirm after checking the data. And thus the order is placed. The message “Order successfully created” makes this clear once again. The current status of the order can be tracked on the user’s profile at any time Trade Republic fees and costs at a glanceFor most traders, securities trading is not only about investing their assets sensibly but also about increasing them in the best case. High costs and fees are usually not welcome. Nevertheless, these are incurred by a large number of providers. In many cases, the reasons for this are low automation and outdated IT. But not with the Trade Republic. This powerful digital broker frees its customers from high costs so that everyone has the chance to invest easily and free of charge in the capital market. Thus Trade Republic has developed the next generation broker and revolutionized securities trading with this simple idea. And the company also deals with its customers in a completely transparent manner in terms of costs and fees. An order commission does not accrue in principle. Neither for shares nor for ETFs or derivatives. Only for the processing an external cost lump sum of 1 Euro is charged. In addition, there is a selection of more than 1,300 shares and ETFs, in which you can invest permanently free of charge. If you want to have all information about costs and fees in one place, you can use the Trade Republic’s list of prices and services as a guide. This is only one page long, which is an indication of the few and low fees that are incurred. As already mentioned, there is no order commission, but an external cost flat rate of only 1 Euro per trade. There are also no costs when buying a share or ETF savings plan if the order volume is at least 10 Euro and at most 5,000 Euro per order. Postal order placement is subject to a cost of 25 euros. It is therefore advisable to place orders via the app. In addition, the management of the securities account, as well as the clearing account and transfers to the reference account, are free of charge. The transfer order by letter is again 25 Euro. The following services are still free of charge:

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) Deposit and withdrawal with Trade RepublicA large number of brokers and banks offer their customers various payment methods that they can use to deposit or withdraw money into or from their securities account. Many traders also insist on having the choice between different payment methods and thus certain flexibility. Do you think Trade Republic also offers several options for deposit and withdrawal? To keep the answer short: No. With Trade Republic, payments can only be made from a German bank account. This means that the customer cannot use alternatives such as payment by credit card, PayPal, or other e-money institutions. How long does it take to deposit at Trade Republic?How long it takes to transfer money from your bank account to the clearing account depends on the bank and its processes. In general, however, it can be said that in most cases deposits are credited to the clearing account within one or two bank working days. Customer service and support put to the test Customer Service Trade RepublicIn this area, Trade Republic makes an extraordinarily good impression. Not only an extremely extensive “Questions and Answers” area convinces and provides the trader with answers to numerous questions. In the Trade Republic App, the user can also go directly to the live chat via “Settings” and “Service”, where he can get help from an employee. In addition, a service number is also stored to reach the service by phone or alternatively an e-mail address for contacting the service by e-mail.

Conclusion on our Trade Republic experience and review:After this detailed field report, all aspects are considered and summarized in a conclusion. First of all, the history of the company is remarkable, as are its founders and what they have achieved. The Trade Republic Bank GmbH is the first mobile and commission-free broker in Germany and convinces with two regulations at once – from the BaFin on the one hand and the Bundesbank on the other. Trade Republic can also score points in terms of security. Both SSL encryption and deposit protection of up to 100,000 euros per customer make a positive impression. The fact that the founders managed to win four large and well-known companies as partners speak for the concept and idea of Trade Republic. The range of tradable markets includes shares, derivatives, and ETFs and is therefore comparatively small. On the other hand, the selection of products is very large and the conditions are also extremely attractive. For example, there is no order commission and, like many other services, custody account management is free. There is only a flat fee for external costs of 1 Euro per trade. Since Trade Republic is a mobile broker, the trading platform is a smartphone app. A desktop version is not available. This is a matter of taste and can be declared as an advantage or disadvantage. The opening and transfer of securities accounts, as well as the placing of orders, is quite simple. The customer has the choice of three different order types:

Other types such as stop-loss or stop-buy are not offered. For deposits and withdrawals, a trader of the Trade Republic is strongly limited in his possibilities. Payment options like a credit card, PayPal, or other methods are not offered here. Instead, a German SEPA bank account is required, through which payments must be processed. The selection of charts and other analysis tools also leaves something to be desired. However, the online broker again convinces with its outstanding customer service and support, which can be reached via various contact channels and around the clock. Trade Republic is a new fintech broker from Germany with a user-friendly platform for investing but some features for professional trading are missing. Trusted Broker ReviewsTrade from 0.0 pips over 3,000 markets without commissions and professional platforms: (Risk warning: 67% of retail CFD accounts lose money) FAQ – The most asked questions about Trade Republic :Can we trust Trade Republic?If you are a beginner in trade and are looking for a platform that is easy to use and has basic features, Trade Republic is the best choice for you. Trading stocks and EFTs has never been this easy. But make sure to keep a mentor since trade republic customer care takes a significant amount of time to respond to problems. What is the main work of the Trade republic?Trade republic is exclusively made only for mobile phones and provides a trading platform to the traders of Australia, Germany, and France. By installing the mobile app and signing up with trade republic, you can trade shares, bonds, EFTs, and other commodities. How to withdraw money from Trade Republic?Unlike other platforms, trade republic only allows money withdrawal and account funding to a limit. However, if you wish to withdraw money, it generally takes 3-5 business days to reach your account. How to invest in the Trade Republic?You will only have to follow a few steps to start investing in trade republic. First, click on the stock you are interested in buying. Then, decide on an amount you want to invest. Make sure not to invest a huge chunk in one go, especially if you are a newbie. Start from as small as $1. After this, confirm your order. See other articles about online brokers: Last Updated on January 27, 2023 by Arkady Müller https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2020-12-09 22:45:452023-01-27 19:18:25Trade Republic |