5 best Forex brokers & platforms which allow hedging in comparison

Table of Contents

See the list of the 5 best Forex brokers which allow hedging in comparison:

Broker: | Review: | Hedging: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | Allowed | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (138+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 76% of retail CFD accounts lose money) | |

2. Vantage Markets  | Allowed | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

3. IC Markets  | Allowed | ASIC, FSA, CySEC | 232+ (65+ currency pairs) | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

4. FxPro  | Allowed | FCA, CySEC, FSCA, SCB | 250+ (70+ currency pairs) | + Multi-regulated + User-friendly + Mobile trading + Competitive spreads + Free demo account | Live account from $100(Risk warning: 72.87% of CFD accounts lose money) | |

5. Pepperstone  | Allowed | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Online forex trading has been around for quite a long time now. But it seems to have gained so much attention in the past couple of years. Although it may seem like a simple task, you need a lot of knowledge, patience, and discipline when dealing with online trading.

However, the first thing you have to do is find a credible broker that suits your trading needs. More importantly, if you are just starting out or simply want to lessen your risk, look for a broker that allows hedging when trading.

When looking for an online forex broker, you have to really look into the company and get all the information you need before signing up.

Here are just some things you should look for in a broker:

- The broker has been operating for at least two years.

- It is regulated by credible companies.

- The trading platform is user-friendly.

- The commission and fees make sense.

- It has the asset you want to trade.

- It is available in your country.

There are a lot of online forex brokers to choose from. But keep in mind that not all the brokers available can be trusted. This article will help you narrow down your choices. Keep reading to know more about the five best forex brokers which allow hedging.

List of the 5 best forex brokers that allow hedging:

1. Capital.com

Capital.com is a well-known online forex broker that was founded in 2016. Its main offices can be found in Australia, Cyprus, and the United Kingdom. This company has won multiple awards, including Best Mobile Platform, Most Innovative Broker, Most Transparent Brokerage Service Provider, Best Trading Features, and many more. You can check out the full list of awards on the website.

This broker holds licenses to operate issued by the SCB of Bahamas, the Australian Securities and Investments Commission, the Financial Conduct Authority, the SCA in the Bahamas, and the Cyprus Securities and Exchange Commission.

Pros:

- The Capital.com minimum deposit is only $20 for deposits with a credit card.

- You can open a live account within a few minutes.

- The demo account is free to use, and it comes equipped with all the tools and virtual currency.

- Learn about the dos and don’ts of trading with the Learn to Trade tab on the website.

- Enjoy low forex fees and commission.

Cons:

- US Dollar, Euro, Great British Pound, and Polish Złoty are the only currencies available.

- You can’t fully customize your workspace or charts.

- Touch login and Face ID are only available on IOS devices.

(Risk warning: 76% of retail CFD accounts lose money)

2. Vantage Markets

Back when it was established in 2009, Vantage Markets was known as Vantage FX. It is a part of the Vantage Global Prime Pty Ltd. Vantage Markets is based in Australia and holds an AFSL or Australian Financial Services License. This license was issued by ASIC or the Australian Securities and Investment Commission.

However, its operations are not limited to Australia only. Vantage Markets is permitted to operate in the United Kingdom by the FCA’s Financial Conduct Authority. It is also regulated by the Cayman Islands Monetary Authority or CIMA and the Vanuatu Financial Services Commission VFSC. To date, it has over 25 offices located around the world, and it is licensed to operate in upwards of 160 countries.

Pros:

- You can open an account within a couple of minutes.

- You can choose to trade on either the MetaTrader 4 or MetaTrader 5 platform.

- These two platforms are also available on the Vantage Market’s mobile application.

- The forex calendar on the website helps you stay updated on the forex market.

- More than 35 forex pairs are available to trade.

- A free demo account is available for 30 days, and it comes with virtual funds.

- The educational tab on the website features a lot of video tutorials, instructional tools, and e-books.

Cons:

- The minimum deposit required by Vantage Markets is $200.

- To gain access to all the Pro Trader Tools, you need at least $1,000 in your live trading account.

- To enjoy the perks of the Pro account, you need to deposit $20,000 in your account.

You can contact Vantage Markets customer support representatives via email, phone, or live chat. They are available 24/7 and support English, Chinese, Vietnamese, Indonesian, Malay, Hindu, and Thai.

(Risk warning: Your capital can be at risk)

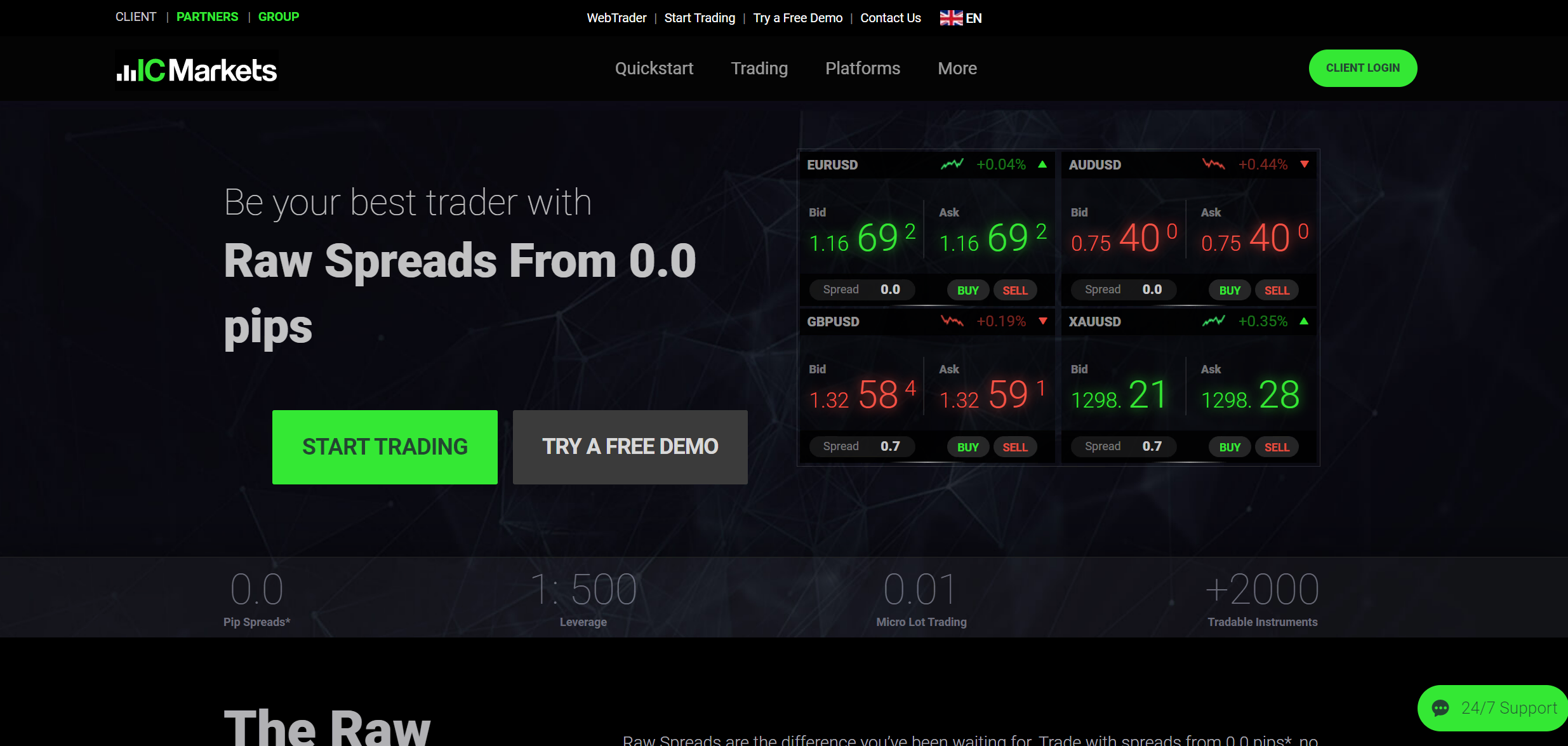

3. IC Markets

A group of experts in Sydney, Australia, founded IC Markets in 2007. They have expanded their reach throughout the European region over the years, and the firm now has offices all around the world.

The Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the Financial Supervisory Authority all regulate this forex broker. These firms assure that IC Markets is secure and trustworthy.

Pros:

- Trading costs and commissions are minimal.

- There are no withdrawal or deposit fees at IC Markets.

- You will not be charged an inactivity fee if your account is dormant for six months.

- It simply takes a few minutes to set up an account.

- The offered trading platforms include MetaTrader 5, MetaTrader 4, and cTrader.

- This broker’s mobile application includes access to all three trading platforms.

- Make advantage of the website’s free instructional tools and content.

- On IC Market’s demo account, you may practice trading for free.

Cons:

- To create a live trading account, you’ll need $200.

- There is no option to enable price alert notifications on the desktop trading platform.

- Customer service agents take a long time to answer.

- There are no recordings or videos on the website’s instructional area.

The customer support representatives are available 24/7 and can be contacted via email, phone, and live chat on the website. They support English, Vietnamese, Chinese, Indonesian, Korean, German, French, Portuguese, Spanish, Malay, Italian, Croatian, and Bulgarian.

(Risk Warning: Your capital can be at risk)

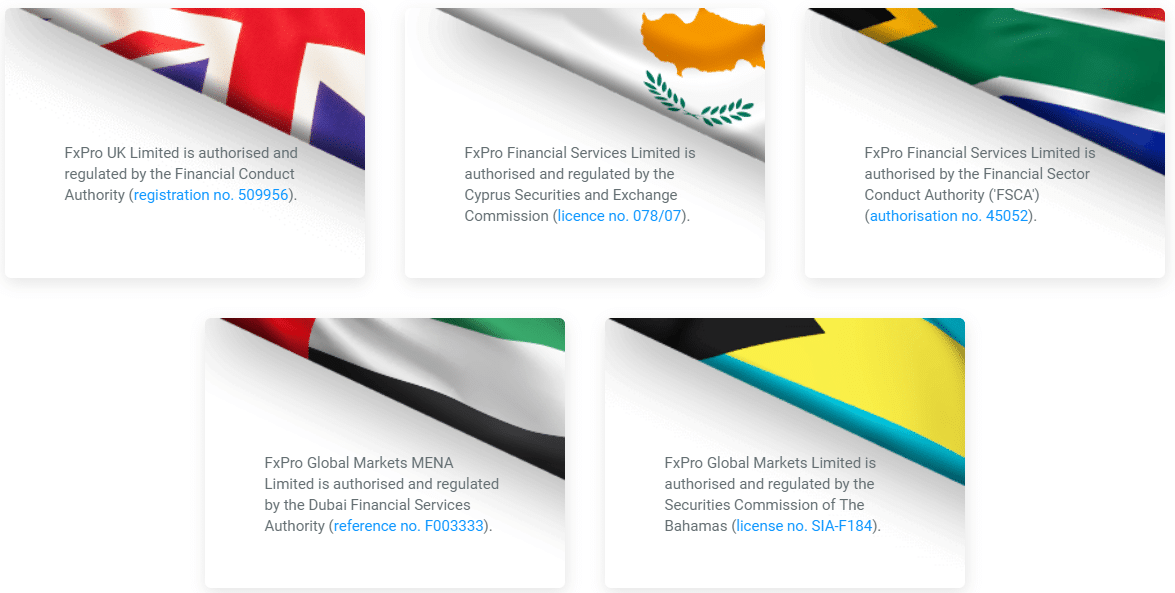

4. FxPro

FxPro is a forex brokerage that was founded in 2006. FxPro Group Limited, a well-known broker, located in Cyprus, owns it. It now serves over 1,700,000 dealers from over 165 countries. This broker has received various honors, including the title of “Most Trusted Forex Brand.”

FxPro’s operations are overseen by four regulatory authorities in total. The Cyprus Securities and Exchange Commission, the Financial Conduct Authority, the Bahamas Securities Commission, and the Financial Sector Conduct Authority are the four organizations.

Pros:

- With the real-time market news tool, you can keep track of the market’s movement.

- There is a free demo account accessible.

- Take advantage of minimal commissions and trading expenses.

- It simply takes a few minutes to open an account.

- The charts and workspace may be customized to your liking.

- You can choose to get notifications or price alerts on the trading platform.

- To open a live trading account, you only need to deposit at least $100.

- Learn how to trade using all the instructional tools available on FxPro’s website.

- You can deposit and withdraw funds without paying a charge.

Cons:

- You will be charged an inactivity fee if your account is dormant for six months.

- You can only contact FxPro’s customer support experts 24 hours a day, seven days a week.

- While this broker accepts major currencies, it only supports a few smaller currencies.

Customer support is available 24 hours a day, seven days a week, and you can contact them through email, chat, or phone. The Help Center on the website has the answers to some questions and provides basic information on a number of topics.

The website supports 31 languages. These languages include English, Malay, Chinese, Korean, Finnish, Bulgarian, Polish, Spanish, French, Italian, German, Vietnamese, Lithuanian, Croatian, and many more.

(Risk warning: 72.87% of CFD accounts lose money)

5. Pepperstone

Pepperstone was founded in 2010 in Melbourne, Australia, by a group of financial specialists. They founded Pepperstone with the intention of revolutionizing online FX trading. This broker opened offices in London, Dallas, Melbourne, and Bangkok in 2016.

Pepperstone is regulated by the BaFIN, CySEC, FCA, ASIC, SCB, DFSA, and CMA. It is also renowned as one of the world’s largest forex brokers. The firm has received several important accolades, including Best Trading Platform, Best Australian Broker, and others.

Pros:

- Pepperstone does not have a minimum deposit requirement.

- Customer service staff are quite easy to reach.

- There are no fees for inactivity, deposits, or withdrawals at Pepperstone.

- An account may be set up in minutes.

- You can trade on the cTrader, MetaTrader 4, or MetaTrader 5 platforms.

- A mobile application is available for download from the Apple App Store and the Google Play Store.

- With Pepperstone’s demo account, you may try out the platform for free.

Cons:

- Pepperstone charges an overnight or rollover fee, which varies according to the deal.

- Customer service is only available 24 hours a day on weekdays.

- Clients residing outside of Australia or the European Union will be charged a withdrawal fee.

If you have any questions or problems, you can contact their customer support via email and phone. The live chat feature is available on both the website and the trading platform. The languages available are English, Chinese, Vietnamese, Spanish, and Thai.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What does hedging mean in forex trading?

Hedging is known as a popular strategy that a lot of newbies and well-seasoned forex traders use. This is because it helps lessen the risk, and it also protects the trader’s position from an unfavorable movement.

An investor who is long a forex pair or anticipates to be in the upcoming minutes, hours, or days via a transaction can be safeguarded from downside risk by implementing a forex hedge correctly. Put it another way, a user or client who is short a foreign currency pair might use a forex hedge to safeguard against upside risk.

Advantages of hedging

The hedging strategy comes with many advantages. First of all, it minimizes your losses by a lot because you stand to gain whether the market goes up or down. Second, hedging does not require a high margin. This means prices are more flexible compared to other trading strategies.

Many hedging tools are also available, which help lock in your profits. It is also preferred by a lot of traders because it helps them get through volatile market periods. The hedging strategy does not require a lot of time either. So you don’t have to be glued to your computer or device screen for hours each day.

How to use hedging in forex trading?

It is quite simple to set up your trade using the hedging strategy. Simply log into your online forex trading account and look for the asset or forex pair that you wish to invest in. Once you’ve chosen the forex pair, decide on the size of the position. Lastly, execute the trade and simply check the market and charts from time to time.

However, you have to do a bit of research before you open or execute a trade. Study the forex market and how it moves. If you can, get information from professional traders or go to a social trading platform and discuss your thoughts with fellow investors.

How to open your account

The account opening process is almost the same for each broker. They will collect basic information like your complete name, email address, contact number, and country. Next, they will need to verify your email address or phone number by either giving you a call or sending you an email with a link that you have to click on.

Once you successfully verify your account, the broker will require you to deposit funds before you can start trading on your live forex trading account. You will find the various deposit methods supported by each broker mentioned in this article below.

Deposit

- Capital.com

Capital.com, like Vantage Markets, accepts bank or wire transfers, Visa, Maestro, or MasterCard debit or credit cards, and numerous online wallets. You may utilize well-known e-wallets such as Sofort, PayPal, and Apple Pay.

You may be confident that any funds you deposit using a debit or credit card will immediately be credited to your account. The same is true with online wallets. However, you should allow at least 24 hours. Deposits made by wire or bank transfer typically take three business days.

- Vantage Markets

Vantage Markets allows you to top up your profile using a wire or bank transfer, a MasterCard or Visa debit or credit card, or an electronic wallet. It is crucial to remember that depositing funds through wire or bank transfer will take at least 2-3 working days. However, if you’re using a debit or credit card or an online wallet, it typically just takes a few minutes. Sometimes the money may appear in your account right away.

As online wallets, vantage Markets accept Skrill, Neteller, AstroPay, JCB, UnionPay, and FasaPay. Deposits may be made with any of the nine main currencies accepted by this broker. They do not, however, support any of the small or exotic currencies. Finally, take in mind that this broker’s minimum deposit is $200.

- IC Markets

IC Markets accepts bank or wire transfer deposits, MasterCard or Visa debit or credit card deposits, and e-wallets. The main distinction is that the accessible e-wallets include PayPal, UnionPay, Neteller, Skrill, Rapidpay, Bpay, FasaPay, and Klarna.

The amounts you deposit will appear in your account immediately or within a few minutes. However, take in mind that this is dependent on the operations of the bank, card, or e-wallet you use. You may always contact their customer care if it is taking too long.

Capital.com accepts the following currencies: NZD, AUD, JPY, USD, CHF, HKD, CAD, SGD, EUR, and GBP.

- FxPro

Debit or credit card deposits made using Maestro, Visa, or MasterCard normally take a few minutes to complete. This deposit method accepts the following currencies: GBP, USD, CHF, USD, EUR, AUD, PLN, and JPY. It takes at least a day to add funds through bank or wire transfer, and it only accepts ZAR, JPY, AUD, GBP, EUR, CHF, PLN, and USD.

Finally, you may deposit funds into your online forex trading account via Neteller, Skrill, and UnionPay. The currencies accessible are USD, CHF, JPY, PLN, USD, and EUR.

- Pepperstone

Deposits may be made with MasterCard or Visa debit or credit cards at this online forex broker. Bank and wire transfers are also possible, with up to three business days processing times. If you prefer to use online wallets, this broker accepts PayPal, and the cash will be deposited into your account immediately.

This broker accepts only nine of the main currencies. EUR, CHF, USD, AUD, SGD, GBP, JPY, NZD, and HKD are the currencies that can be deposited into your Pepperstone account.

Withdrawal

If you want to withdraw your earnings, you can do so using the same method you used to fund your live trading account. This expedites and simplifies the procedure. The trading platform makes it simple to fill out a withdrawal request form. Keep in mind that you may be asked for certain personal information, such as your home address, contact information, and full name, in order to withdraw your cash. This is for your own safety.

Each broker accepts the same withdrawal methods mentioned above. Read the terms and conditions to verify if the broker asks for a withdrawal fee. If it takes a while for your money to be withdrawn, please feel free to contact the broker’s customer care through chat, email, or telephone, so they can assist you through the withdrawal process.

Conclusion – Make sure to choose a broker that allows hedging before using this method

When looking for a trustworthy and dependable forex broker who provides hedging, you must pay close attention to detail. It’s all well and good to read articles, customer reviews, and even blog entries regarding those forex brokers. You get all the information you need to get to know the firm. However, this is often not enough.

It is also critical for you to understand the commission costs that each of these brokers charges. Also, find out if there are any other additional fees.

The forex broker you pick should ideally offer a customer support service that is available 24 hours a day, seven days a week. After all, the forex market is open 24 hours a day, seven days a week, and you need all the aid you can get when you’re out there trading.

When a broker’s customer service staff responds quickly, you know they are reliable. It would be a plus if the service was available in many languages too. However, you cannot rely just on the broker’s help desk. You must conduct your own study and educate yourself on the dos and don’ts of online FX trading.

Also, you should always use the free demo account provided by online forex brokers. Not only will you be able to test the platform to see whether it is right for you, but you will also be able to practice or develop new trading methods without investing any money.

These demo accounts come with virtual funds that may be traded in a simulated environment that mimics live market movements. Experiment with all of the trading tools. Check to see whether you can personalize your charts too. Use these sample accounts to hone your trading abilities before moving on to the real deal.

It’s also important that you keep this in mind: Hedging is not a strategy that will guarantee it again. It is simply a strategy that will help minimize or reduce your risk of loss. However, trading is a very risky thing to do. So do what you can to lessen your losses and make sure to discipline yourself when it comes to investing your hard-earned cash.

Should you put all your funds in forex just because you think hedging is a strategy that eliminates 100% risk? Absolutely not. That’s one way to go bankrupt. Do not deposit every single penny that you own. Most importantly, before executing any trade, make sure you have adequate knowledge of the forex pair you are trading.

FAQ – The most asked questions about Forex brokers which allow hedging :

Is hedging legal? Do forex brokers allow hedging?

You must already be aware that hedging in forex trading is not legal in any of the areas. It is often observed that there are many individual brokers who don’t permit hedging based on their own policy. Hedging is often practiced by a lot of traders who are trying to sort out the risk effectively. There are also some mentionable regulatory bodies that practice the use of FIFO (First in First Out) executions, which equally make the practice of hedging almost impossible.

How to choose a broker for hedging?

When you are concerned about the process through which you should choose a broker for hedging, then there are a few fats that are worth mentioning. All because of the nature of hedging, the allotted fees and the spreads become vital when you are trying to choose a broker. Since you are initiating two different positions in the market at the same time and on the same asset, you need to pay double the commission, if at all there are any.

Other than that, you also need to pay for the spread and the overnight fees and the trading fees, and other allotted charges, if any.

And the final object to observe is any form of slippage that may occur.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)