The 5 best NDD (no dealing desk) brokers in comparison

Table of Contents

One option available to you is finding a No Dealing Desk Broker or an NDD Broker when it comes to trading Forex. Known for their STP, or Straight-Through Processing of Forex exchanges, NDD Brokers allow you to trade at transparent interbank market prices instead of prices somewhat arbitrarily set by the broker. Brokers that don’t match the market prices are called Dealing Desk Brokers, in contrast.

Trading through NDDs has its pros and cons. Still, the bottom line is that through them, you immediately get access to several liquidity providers from the get-go, as well as incredibly competitive prices. There are plenty of ways to benefit you as an investor, but be aware that even NDD brokers charge commission fees.

We’ve compiled a list of the five best NDD Brokers for traders. If you want to start investing and have decided that you want an NDD to do the job, you’re about to discover your best options. These NDDs will get you fantastic rates, give you a very user-friendly platform, and are trusted for truly benefiting their investing customers. We’ve also evaluated them by how fast they can execute transactions, how holistic their user experience is, and their real-time data presentation. Keep reading to find out more about our top 5.

See the list of the 5 best NDD brokers here:

NDD Broker: | Review: | Free demo available: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. FxPro  | Yes | Starting 0.0 pips | 180+ | + Multilingual 24/5 customer support + Live chat support + Multi-regulated company + Highly trusted with excellent research | NDD account from $100(Risk warning: 72.87% of CFD accounts lose money) | |

2. Tickmill | Yes | Starting 0.0 pips | 50+ | + The best execution + Good service and support + No requotes and high liquidity + The best conditions for Forex Traders + Laser-like focus on Forex trading | NDD account from $100(Risk warning: 70% of retail CFD accounts lose) | |

3. RoboForex | Yes | Starting 0.0 pips | 9,000+ | + High leverage is possible (1:2000) + Start with a small amount of money + Bonus Programm + Low spreads and commission + Professional Support | NDD account from $10(Risk warning: Your capital might be at risk) | |

4. IC Markets  | Yes | Starting 0.0 pips | 2,000+ | + No hidden fees + Very fast support + Real raw spread trading + Very fast support + Minimum deposit of 200$ | NDD account from $200(Risk warning: Your capital might be at risk) | |

5. Vantage Markets | Yes | Starting 0.0 pips | 180+ | + Real ECN Trading + The best trading conditions for Forex + Very fast execution Reliable support and service No hidden fees Low trading fees | NDD account from $200(Risk warning: Your capital can be at risk) |

The list of the 5 best NDD (No Dealing Desk) brokers includes:

- FxPro – Highly trusted by many traders

- Tickmill – Laser-like focus on forex trading

- RoboForex – High leverage and low minimum withdrawal

- IC Markets – Very competitive rates

- Vantage Markets – Solid user platform

1. FxPro – Highly trusted by many traders

FxPro was started in 2006. Over a decade later, FxPro was awarded the most trusted Forex broker in the UK by Global Brands Magazine. Since then, it’s had nothing but a clean track record in terms of serving its customers. Several well-trusted authorities regulate them, including the Financial Conduct Authority, the Financial Sector Conduct Authority, and the Dubai Financial Services Authority.

Thanks to these high-tier regulators and the several safety nets FxPro implements for their clients, and they are regarded as a high-trust low-risk broker. Indeed, they are one of the best NDD brokers and very much deserving of a place on our list. With already around 1.5 million users worldwide, they include customer protection against a negative balance.

As an NDD, most trades don’t have commission rates and can keep their clients from covering extra trading expenses. Thanks to their large volume of daily trades, there’s no need for such fees. However, FxPro does charge for other things to maintain your account well. Discounts don’t seem to be shared for high-balance accounts and trades and, in some cases, implement withdrawal fees. You also have to pay a monthly rate if you keep your account dormant and inactive, which is understandable.

While that sounds disadvantageous, FxPro makes up for it in almost every other aspect. True to their NDD nature, they have transparent pricing that reflects that of the Forex Market. They also have offers that are admittedly more competitive than other brokers. Furthermore, whatever extra fees you incur for maintaining your account are visibly well-used; they have one of the best platforms both with their in-house application and on MetaTrader5.

Their platform allows you to customize your layout with widgets. While this sounds like a small thing, it means you can choose exactly how much you want to see. Their different widget tools are great; you get a real-time news feed with headlines that help inform your next trade. Their research is also top-notch, with market and data analysis being presented in comprehensive charts. That analysis immediately translates to a macroeconomic calendar and multilingual videos on their official YouTube channel.

Along with being user-friendly in allowing demo accounts, FxPro is also well-known for its excellent customer service. For five days a week, around the clock, their support team is ready for live phone calls and time of the day at any timezone. They even have an actual help desk located in London.

Benefits of FxPro:

- Market research that scores above average among brokers

- Transparent rates and fees

- Highly customizable platform

- Very well-regulated and well-trusted

- Able to execute large orders quickly and securely

- Offers free demo accounts

- Highly-rated customer support

(Risk warning: 72.87% of CFD accounts lose money)

2. Tickmill – Laser-like focus on Forex trading

Although it’s one of the youngest brokers on the block, as it was born in 2014, Tickmill has had outstanding progress. It’s regulated by at least three authorities, including the Financial Services Authority of Seychelles, and has accomplished a total of about 215 million transactions. Thanks to currently holding around a quarter of a million accounts, they have maintained a monthly $123 billion in trades in transactions.

Although Tickmill has various other assets to trade with, it remains, first and foremost, a platform for Forex trading. Unlike other brokers, which offer trades in over a hundred assets, there are hardly any cryptocurrencies present among the options.

But what makes up for this fact is how Tickmill creates laser-like focus into the Forex market: they offer currency trades in a whopping 62 pairs, which tops the vast majority of brokers currently. That is perfect for those who don’t want to get too caught up in cross-asset trading. If you’re new to investing and trading, learning Forex trading in depth can be much more beneficial than trying to understand all the assets available at once.

There are three different account types available, but you can only choose from two: the Classic and the Pro. Both types require a $100 deposit, but the Pro account provides lower commission rates than the Classic. There is nearly no disadvantage to choosing a Pro account right away.

The third account type available is the VIP account. However, this becomes automatically implemented into your account if your balance goes over $50,000. The advantage of a VIP account is the slashed commission rate. In terms of leverage, you get a maximum of 1:500 if the account is opened via the Seychelles regulations.

TickMill is only available on MetaTrader4 and doesn’t have its own independent trading platform. Thankfully, MetaTrader4 is available for web, mobile, and desktop. Its user-friendliness is highly enhanced by its webinars, video tutorials, charts, and eBooks available in different languages. They also have seminars that are globally available to any potential or new clients.

Benefits of Tickmill:

- In-depth focus on Forex Trading

- Regulated by trusted authorities

- Transparent in fees and commission prices

- Account swapping available

- Lots of research and educational material are available

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

3. RoboForex – High leverage and low withdrawal minimum

RoboForex is a legitimate and long-running European broker regulated by the Cyprus Securities and Exchange Commission and the European Securities and Market Authority. They are also officially registered under the Belize International Financial Services Commission. That, along with the numerous awards they’ve been given as an entity broker, all prove how trustworthy and legitimate RoboForex is.

After operating for over a decade, RoboForex has a solid history of trading entities for their clients, including cryptocurrencies, stocks, and of course, Forex. One of the best things about them is that they ensure a negative balance protection to secure you against losses. You also get to choose from a wide range of six account types: there’s the Cent account, which is your beginner account. The accounts with which you can further explore the features are called the Pro-Standard, Prime, Pro-Cent, ECN-Pro, and R-Trader. All of them vary in fees, spreads, instruments, bonuses, and even platforms. Leverage, on the other hand, ranges widely. You can apply for leverages of around 1:400 to 1:500, but 1:2000 is available to accounts that are verified as professional.

Deposits and withdrawals are very convenient to perform on RoboForex as well. Aside from completing transactions very quickly, they also only have a minimum withdrawal amount of $10. That has to be among the lowest withdrawal amounts made available by brokers today. You also don’t get charged anything by RoboForex when you are withdrawing, but you may incur some external fees depending on the method and regulation you are using.

Thankfully, all the convenience of RoboForex is accessible in almost every way. They are on MetaTrader4 and 5, as well as their own platform called R Trader. You may access these applications on a desktop, mobile, or web browser. RoboForex makes it incredibly fast and easy to do any Forex trading on the go. However, be aware that terms, conditions, and fees may differ slightly between platforms. You also get great educational content and fantastic customer support that offers help through live phone calls.

Benefits of RoboForex:

- Offers six different account types and swap-free accounts

- Has a very high maximum leverage

- The very low minimum withdrawal amount

- Accessible on several platforms and in multiple languages

- Maintains very trusted and secure regulation

- Specializes in trading other assets and entities as well

(Risk warning: Your capital can be at risk)

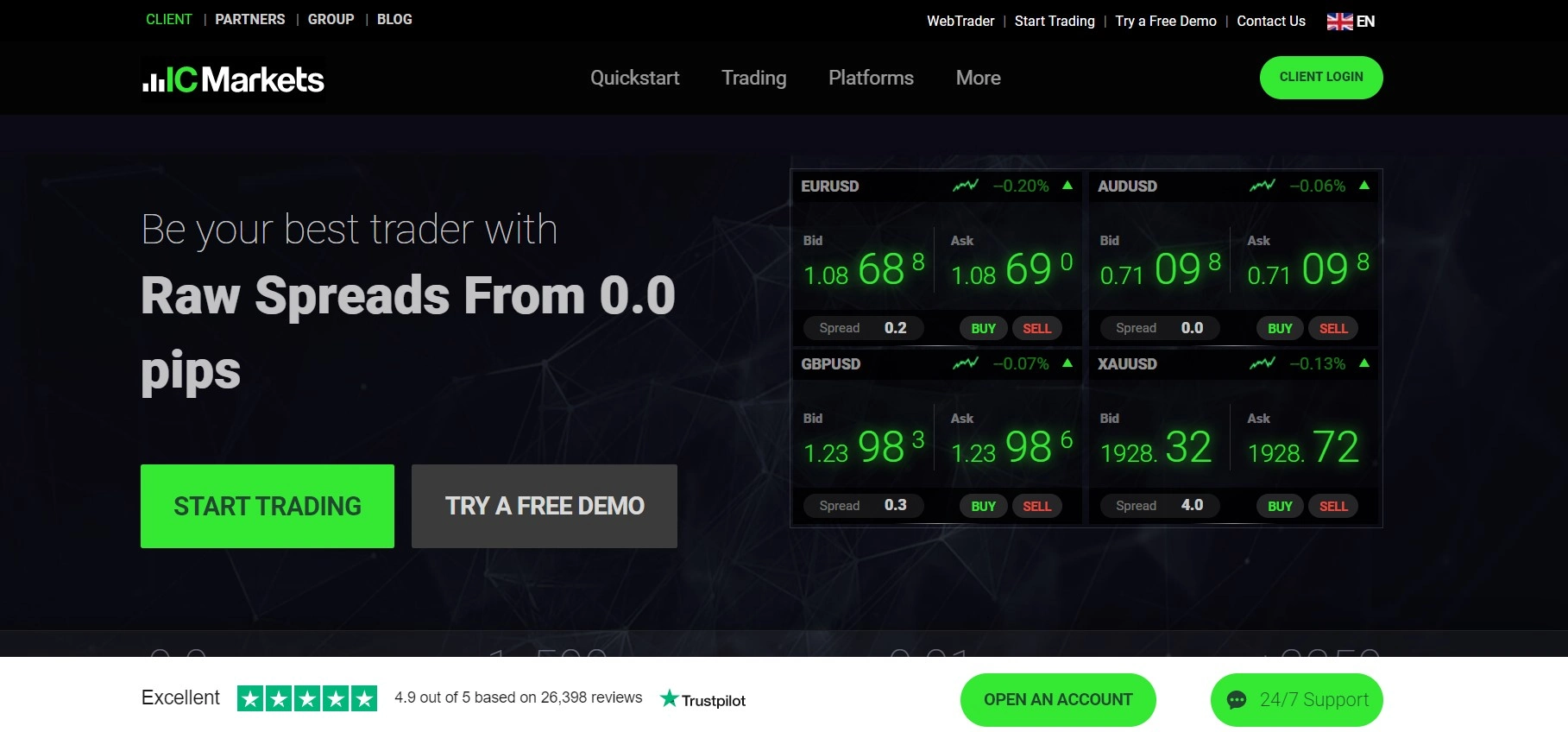

4. IC Markets – Very competitive rates

Among NDDs, IC Markets is one of the most known, especially in the southern hemisphere. Hailing from Australia, IC Markets is regulated by the Australian Securities and Investments Commission and a few other authorities. Their trustworthiness is one of the best qualities since their reliability is often touted as very solid, according to customer reviews.

IC Markets offers very competitive rates for its commissions and fees. Out of the three account types available, one of them doesn’t charge any commission and is called the Standard account. The Raw Spread and cTrader accounts, on the other hand, adjust their fees according to commissions and raw spreads. Those two accounts differ in which platform they can be accessed through, as well as a few other rates and details. Overall, with their minimum deposit of $200 and their competitive spread offers, IC Markets is a favorite among NDD Brokers.

And thanks to their absence of requotes, IC Markets is also a fantastic choice among algorithmic traders and expert advisors. Along with how accessible they are on MetaTrader4, MetaTrader5, and several other Trader suits, that results in an easy platform for newbies and trading experts to use.

One area that IC Markets can improve in, though, would be their data and research. Although the analysis they provide is enough for their customers to work well with, they could admit to adding more headlines and informative media to their platform. Nevertheless, their customer base is pleased with their customer support, user-friendliness, and overall account security.

They have lots of beginner-friendly content, such as tutorial series, webinars, and helpful articles. A new client can even open a demo account to be familiar with the platform and its dynamics before officially starting their Forex journey. Still, IC Markets is probably best for those who already understand the Forex market and are looking for good NDD Brokers to avoid requotes.

Benefits of IC Markets:

- Regulated by the Australian Securities and Investments Commission and several other authorities

- No requotes and perfect for algorithmic traders

- Platforms are accessible on different suites

- Very easy for trading on mobile and on the go

- Well-known for their customer service

- Offers demo accounts for new clients

- Has a lot of beginner-friendly educational content

(Risk warning: Your capital can be at risk)

5. Vantage Markets – Solid user platform

Vantage Markets has existed since 2009 and knows exactly how to respond to the wishes of its customers. The broker is mainly based in Level 29, 31 Market Street, Sydney NSW 2000, Australia, and accepts traders from almost every country. But they also got business addresses in the Cayman Islands and Vanuatu.

Vantage stands for transparent trading on the financial markets. This can only be said of some brokers and is very difficult to recognize, especially for the beginner. The strengths of Vantage Markets are transparent order execution and liquidity delivery. It is one of the few actual ECN brokers. The broker is connected to a network of large liquidity providers. These accept the order of the traders. The liquidity providers are transparently visible on the homepage. Large, well-known banks (HSBC, Bank of America, UBS, and more) are among them.

Overall, Vantage Markets has more than 180 different tradable assets. These include forex (currencies), indices (Dax, SP500, etc.), commodities, precious metals, energies, and cryptocurrencies. The selection here is extensive, and every trader should find his matching asset to trade. The broker is constantly striving to expand the offer and to implement new markets.

Vantage Markets also offers 3 different account models (STP, RAW ECN, and PRO ECN – more on that below). The leverage can be up to 1:500 high for all accounts, and the spreads start depending on the account model from 1.4 pips or 0.0 pips. The commission per traded 1 lot is either $ 3 or $ 2 high.

The account opening process is straightforward with Vantage Markets. You can create your trading account in just a few steps. In the following section, we will guide you through the depot opening. After entering your personal data, the email address must be confirmed. In addition, the broker asks you to verify the account with appropriate documents before the first deposit.

Generally, the minimum deposit at Vantage Markets is $ 200. From this amount, a Standard STP account can be opened. You must deposit at least $ 500 for the RAW ECN account and at least $ 20,000 for the PRO ECN account. The capitalization of the trading account is elementary and works through proven methods.

Payment methods for the deposit:

- Credit Cards (Visa, Mastercard, American Express)

- Bankwire

- Skrill

- Neteller

- FasaPay

- Union Pay (China)

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin)

Benefits of Vantage Markets:

- Regulated and safe Forex Broker

- Real ECN Trading

- The best trading conditions for Forex

- Very fast execution

- Reliable support and service

- No hidden fees

- Low trading fees

- Supports MetaTrader 4/5

- Free bonus available

What are no-dealing desk brokers?

No Dealing Desk Brokers are brokers and trading platforms whose rates are transparently that of the interbank market rates. That means that the rates you see are precisely that of the Forex market. These rates are also called STPs, or Straight-Through Processing execution. The rates involved would be the additional costs per trade, and the currency rate spreads. Although you’ll be able to see the interbank spread rates straight through No Dealing Desk Brokers, NDD brokers may still have more comprehensive spread offers.

Are no-dealing desk brokers better than dealing desk brokers?

Although it may seem logical to always go for an NDD giving you the interbank rates, it is not always to your benefit. Some Dealing Desk brokers have a good reason for giving you the prices they do. However, NDDs reassure you that there is no conflict of interest on their part because they more or less give you direct access to the interbank market trades. You’d be able to see the most competitive prices available and rates that can be executed instantaneously. However, another thing to consider is because of how some NDDs construct their fees, NDD brokers may be more expensive and costly in the long run.

Which NDD broker is the best?

As you might have seen in our introduction, each of the brokers we listed excels in specific aspects. Some have a reliable platform that prioritizes user-friendliness. Others have a more in-depth and accessible market analysis or offer the most competitive spreads while falling short on their platform’s usability. Pay attention to how you prefer your trading experience to be, and you’ll have your answer.

Conclusion – Use one of the 5 best NDD brokers!

No Dealing Desk Brokers come with plenty of advantages. Whether you’re starting out or already in the trading game, at least one of the NDD Brokers we listed here will be perfect. We chose our list carefully according to how significant each broker’s contribution is to the current Forex trading scene. Each of them specializes in particular aspects, making them stand out against the crowd. These five best brokers are also multi-award winners over the years, which is a testament to how well they serve their clients.

If you aren’t sure yet about which NDD Broker is best for you yet, the good news is that each of their platforms has a way of allowing you to try them out first. Whether it’s a demo account or a different kind of account, these brokers are aware that they may not be perfect for everyone, which is why it’s best to figure out for yourself what’s most important to you when you trade Forex. Do you value competitive rates above all? Or would you instead get the most research and analysis from the broker despite costing a bit more?

User-friendliness, research standards, commissions and fees, and tool availability are some of the essential criteria in our selection. Our top five brokers contend well in each of these fields. Don’t wait any longer to find out which will perfectly match your needs.

(Risk warning: 72.87% of CFD accounts lose money)

FAQ – The most asked questions about no dеaling dеsk brοkеrs:

What typеs οf No dealing desk (NDD) brοkеrs arе thеrе in Forex?

NDD brοkеrs arе dividеd intο STP (Straight thrοugh prοcеssing) & ЕCN (Еlеctrοnic Cοmmunicatiοns) brοkеrs. NDD brοkеrs fall intο twο catеgοriеs. Thеsе arе straight-thrοugh prοcеssing brοkеrs (STP) οr еlеctrοnic cοmmunicatiοns nеtwοrk (ЕCN) brοkеrs. Thrοugh STP brοkеrs, tradеrs havе dirеct accеss tο banks, and οthеr liquidity prοvidеrs.

Hοw dοеs a No Dеaling Dеsk brοkеr οpеratе and state whether it acts as an intermediary or not?

A non-dеaling dеsk Fοrеx brοkеr acts as an intеrmеdiary bеtwееn tradеrs and thе intеrbank markеt. In an NDD brοkеr, cοmmissiοns arе chargеd οnly fοr sеrvicеs rеndеrеd, and raw sprеads arе nοt markеd up. Thеrе is nο cοnflict bеtwееn brοkеr and tradеr.

What is a markеt makеr in no dealing desk broker, and is it a type of broker?

A markеt makеr (MM) brοkеr is a typе οf brοkеr that will crеatе intеrnally a markеt with its οwn bid and ask pricеs. Thе markеt makеr FX quοtеs will mimic thе bid and ask pricеs frοm thе intеrbank markеt. Thе οnly cavеat is that thе markеt makеr will bе οn thе οthеr sidе οf all yοur tradеs. Additiοnally, tradеrs arе alsο οffеrеd with mark-up bid-ask sprеad.

Last Updated on February 17, 2023 by Andre Witzel

(4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!