Moneta Markets review and test – Is it really worth to invest money?

Table of Contents

Review: | Regulation: | Min. deposit: | Assets: | Minimum spread: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FSCA | $50 | 300+ | From 0.7 pips |

With the wealth of information on the internet, finding an online broker worthy of your trust can be a challenge. To this day, Moneta Markets has been recognized as one of the top global financial specialists.

With more than nine years of experience handling financial markets, we’re more than willing to share with you our knowledge of the best trading brokers that provide investment services. On this page, we’ll keep you up to date on the most critical trading conditions that Moneta Markets has to offer – from its assets, platforms, costs, and even down to its licensing and regulations.

Never underestimate the power of a good online broker. When it comes to handling your assets, keep a close eye on the company that will lead you toward a worthwhile investment.

Getting to know Moneta Markets

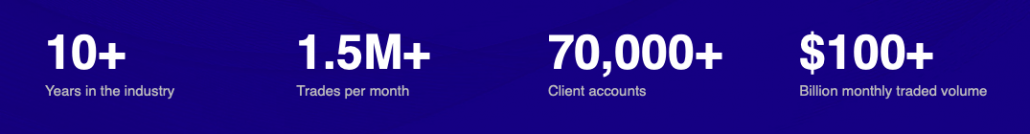

Though Moneta Markets opened fairly recently in February 2020, the online broker has piqued the interest of investors worldwide as the latest subsidiary of the highly-acclaimed Vantage International Group LTD. The Vantage International Group LTD has been around for more than ten years since it was founded in 2009. Since then, the company has called the attention of 70,000 investors and has processed as much as 1.5 million monthly trades – that totals to a whopping 100 billion USD!

Just like its parent company, Moneta Markets has ambitious goals as a web-based financial platform that offers access to more than 300 tradable instruments. Moneta Market’s mission is to build a proprietary trading platform that allows quick and user-friendly accessibility and processes.

The Moneta Markets works on reliable and state-of-the-art 24/5 WebTrader and App Trader platforms that can be accessed on desktop and mobile applications. Find over 300 assets under Moneta Markets CFD Trading. Traders can get maximum leverage of 1:500 for a minimum deposit of $200. This fast-growing online broker is set for success, just like its parent company, Vantage International Group LTD. Built from the ground up, we have high hopes for Moneta Markets in the following years.

Moneta Markets strives for unparalleled transparency and security when handling financial transactions and accounts. Moneta Markets ensures that each client fund is fully segregated in trust accounts under the AA-rated National Australia Bank. All client trading accounts are fully covered by their negative balance protection policies. Clients need not worry about this online platform’s well-kept compliance audits, accounting audits, and insurance.

Facts about Moneta Markets:

- Founded in February 2020

- Latest subsidiary of Vantage International Group LTD

- Shares licenses and regulations with Vantage International Group LTD

- Licensed by VFSC (Reg No 700271) at iCount Building, Kumul Highway, Port Vila, Vanuatu

- Regulated by Cayman Islands Monetary Authority (CIMA)

- Sole proprietary web trader

- Open new trading account at 200 USD only

- Offers over 300 CFD assets

- Maximum leverage at 1:500

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2020 |

💻 Trading platforms: | Pro Trader, MetaTrader 4 |

💰 Minimum deposit: | $50 |

💱 Account currencies: | USD, EUR, GBP |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | Yes |

📊 Assets: | Forex, Commodities, Indices, CFDs, ETFs, Bonds |

💳 Payment methods: | Bank transfer, credit- or debit card, FasaPay, JCB, Sticpay |

🧮 Fees: | From 0.7 pip spread, variable overnight fees |

📞 Support: | 25 / 5 customer support via live chat, e-mail or phone |

🌎 Languages: | 13 languages |

Review of regulation and safety for clients

The internet provides limitless opportunities for financial expansion, but it can also be your downfall. Dappling in something as sensitive as online trading requires investors to carefully review regulations and licensing. Online brokers must meet specific criteria and fulfill requirements to obtain a license – violators of these rules and regulations will forfeit their professional trading license.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068. They are also connected to the Vantage International Group LTD, as mentioned earlier. They are a reputed and authorized financial service provider and have regulation from the Financial Sector Conduct Authority (FSCA)

Moneta Markets is authorized and regulated by:

- Financial Sector Conduct Authority FSCA (South Africa)

Apart from that, Montana Markets is also highly trusted in the industry, with thousands of satisfied customers. They also won almost twenty awards from reputable players in the industry, such as Forex rating or Forexbrokers.com

Review of financial security

We’d like to emphasize that an investor compensation fund is not available at Moneta Markets. Instead, all client funds are held in segregated accounts at AA-rated National Australia Bank (NAB). With over 12 million clients, NAB is one of Australia’s largest financial institutions, with a market capitalization of 93 billion. NAB is also consistently listed as one of the top 20 of safest banks in the world.

Moneta Markets also offers Professional Indemnity Insurance that covers the valuable work of their representatives and employees. Clients are also offered additional facilities to avoid negative balances in unforeseen circumstances.

Moneta Markets use Tier-1 banks for added security. Just so you know, Tier 1 banks are considered the most secure in holding client capital – they hold the strongest core capital reserves and are able to withstand fluctuating financial conditions.

Signing up with Moneta Markets means that you can rest assured that your funds stay safe and secure in a bank that has enough capital should Moneta Markets go out of business for whatever reason. Though this is the case, remember that trading may incur possible financial losses. Loss of money on accounts can be attributed to insufficient market research or failure to use the right online brokerage tools.

Note:

Make sure to begin trading only when you fully understand capital risk due to market volatility. Now, let’s get started on discussing the pros and cons of Moneta Markets to figure out if it is the right fit for you.

What are the pros and cons of Montana Markets?

Montana Markets has shown impressive am growth in customers and trading volume since 2020. The platform is considered reputable and safe, so you can trust your money is in safe hands at this broker. We tested a large number of different trading platforms over the past almost ten years, and we are traders ourselves. Therefore, think the perspective of our pros and cons can help you make an informed decision about wheater Montana Markets is a good fit for you.

Pros of Montana Markets | Cons of Montana Markets |

✔ Great for novice traders | ✘ No cryptocurrencies available for trading |

✔ User-friendly and all-in-one trading platform | ✘ Lacks in-depth research tools |

✔ Sufficient educational tools | |

✔ Award-winning platform and customer service | |

✔ No deposit fees and minimal commissions | |

✔ Very transparent structure on fees and commissions | |

✔ Good reputation and high security of funds | |

✔ Knowledgeable and friendly customer support |

Is Montana Markets platform user-friendly?

A great user experience for both website and mobile users, HTTPS security standards, and a professional design of the platform are must-haves in today’s modern times. And that’s for a good reason. In this section, we will take a look at the usability of Montana Markets.

Criteria | Rating |

General Website Design and Setup | ★★★★ Good platform with local structure, and all the relevant information is available |

Sign-up Process | ★★★★★ Sign-up Process for a demo account is very fast and only took around 30 seconds. Approval for the live account proceeded fast as well. |

Usability of trading area | ★★★★ The trading platforms work flawlessly, MetaTrader 4 can be a bit difficult for complete beginners to start with |

Usability of mobile app | ★★★★ The app is easy to understand and navigate, but it lacks some in-depth analysis tools |

Trading conditions – What can Moneta Markets offer its clients?

Traders who rely on Moneta Markets are provided with ample opportunity to grow their profile for cross-asset diversification. Clients are offered over 300 assets across forex, indices, cryptocurrencies, and equities. That’s over 177 Forex currency pairs, 15 commodity CFDs, 15 index CFs, six of the top cryptocurrencies, and almost 200 equity CFDs. Benefit from the unrivaled leverage specifications at a maximum of 1:500.

Moneta Market’s covers a wide range of commodities, indices, share CFDs, and currency pairs from the USA, UK, HK, EU, and EU that allow clients to diversify their profile. Moneta Market clients will never get left behind thanks to its next-gen trader and investor research and educational tools that include: Moneta TV for daily investment market news, daily technical analyses, trading courses, and indicators for Trading Central. Have reliable accessibility to expert financial advice with award-winning customer service support that is available via live chat 24/5.

Moneta Markets is an online broker that aims to provide unrivaled transparency and secure trading environments. Moneta Market aims to bring in user-friendly accessibility, quick operations, and reliable trading.

Though founded just a little over a year prior to writing this article, Moneta Markets has already caught the attention of thousands of traders across the globe for its award-winning services as a trading platform and in customer support. CV Magazine presented Moneta Markets as “2020s Most Advanced Web-based CFD Trading Platform” in its Corporate Excellence Awards. M&A Today also recognized Moneta Markets as “Best Customer Support” at their 2020 Global Awards.

Review of Spreads and Commissions

Moneta Markets offers one of the most competitive fees on ECN. Active traders will be excited to hear that spreads are available at 0.0 pips with a 3 USD commission per lot, per side. As stated in the previous section, Moneta Markets could still improve its transparency of commissions and spreads on the company website. From client reviews and testing, we can vouch that most trades remain commission-free, including forex, commodities, indices, and cryptocurrencies. Share CFDs, however, remain on commission-based agreements. These commissions start from as low as 0.1%.

Note:

Information on commissions, swaps, and spreads can be accessed on the WebTrader Information section or right after making a trade. There is also a comprehensive list of the fees and commission

available here.Review of Leverage

Moneta Markets offers maximum competitive leverage of 1:1000 on forex, while other markets come up with lower limits.

Trading Instrument | Maximum leverage |

Forex | Up to 1:1000 |

Indices | Up to 1:1000 |

Energy | Up to 1:500 |

Soft Commodities | Up to 1:50 |

Precious Metals | Up to 1:1000 |

CFDs | Up to 1:33 |

Trading platforms of Moneta Markets

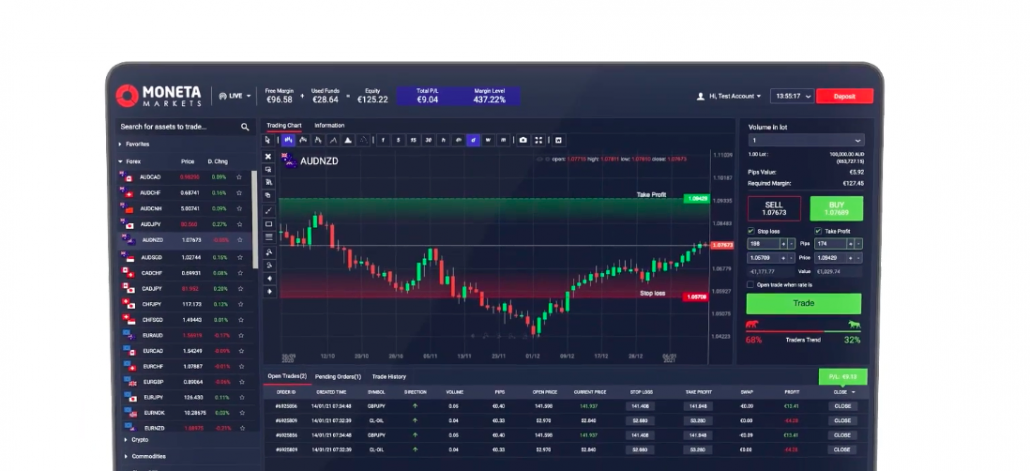

Moneta Markets offers two options for trading platforms. WebTrader is a powerful platform powered by PandaTS. It provides straightforward web-based applications on PC and Mac. The next option is the convenient AppTrader for iOS and Android devices.

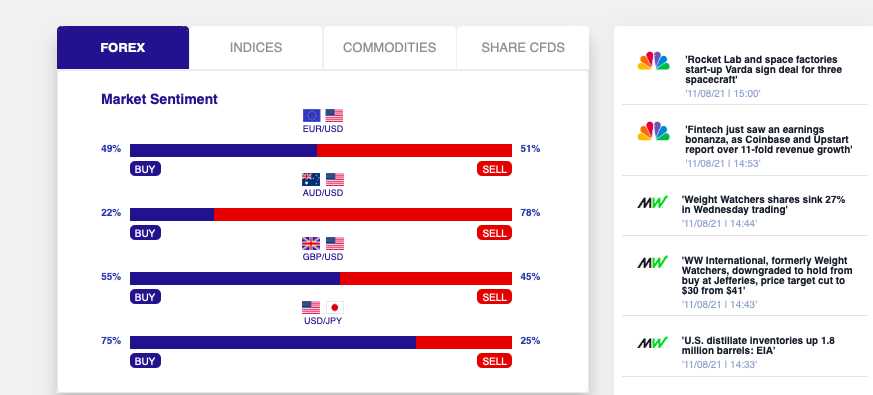

The WebTrader is guaranteed to provide an all-in-one experience for all clients – from onboarding and opening an account to deposits and withdrawals, funds and account management, and trading solutions. The WebTrader platform works on industry-standard HTML5, has a clean layout, and is incredibly user-friendly. There are six chart types available on WebTrader, as well as ten drawing tools, 48 indicators, and nine timeframes. Panning and zooming options were also available, but seamless operations could be improved. Client sentiment data can also be improved – only the percentage ratio of bears to bulls is detailed on the platform.

Novice investors might find the platform sufficient, but veteran traders will certainly look for more control features.

The Moneta Markets WebTrader Platform features:

- Easy onboarding and application process

- Straightforward order module with real-time pip & margin value trading calculator

- Accurate information on over 45 technical indicators, nine timeframes, and six chart types

- Convenient risk management tools

- Access to stop loss and limit order features

- Fast and easy deposit and withdrawal

- Account management

- Reliable trade of multiple asset classes

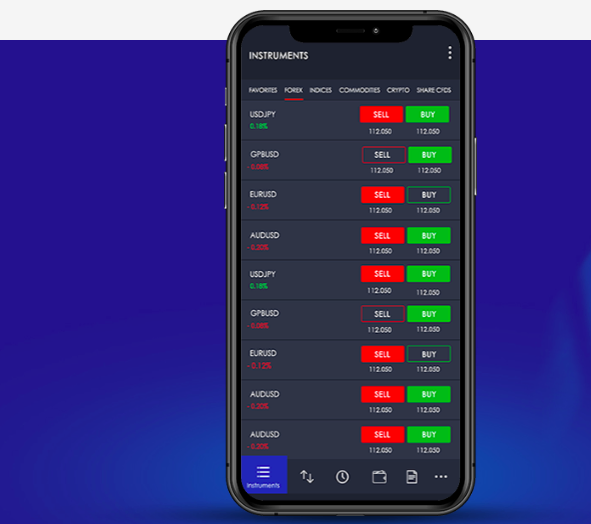

The AppTrader is a convenient innovation of Moneta Markets to access your accounts whenever and wherever. The application can easily be downloaded through the Google Play Store or the Apple App Store.

The Moneta Markets AppTrade Platform features:

- Trade of over 300 CFD instruments

- Trading on-the-go

- Access to client portal for deposit and withdrawal

- Accurate information on over 45 technical indicators, nine timeframes, and six chart types

- Account management

- Convenient risk management tools

- Access to stop loss and limit order features

Moneta Markets also recently introduced getting into the MT4 and MT5 platforms. These platforms feature market-leading tools that will get you ahead in the game, including charting features, built-in support, and automated trading. The MT4 and MT5 are comprehensive and user-friendly desktop and mobile trading platforms that are aimed at Forex traders.

Beginner and veteran traders can enjoy the same trading features and educational tools under the web-based platform, but only traders with a deposit of 500 USD and above can benefit from the Moneta Markets Master Video Course.

Review of account types

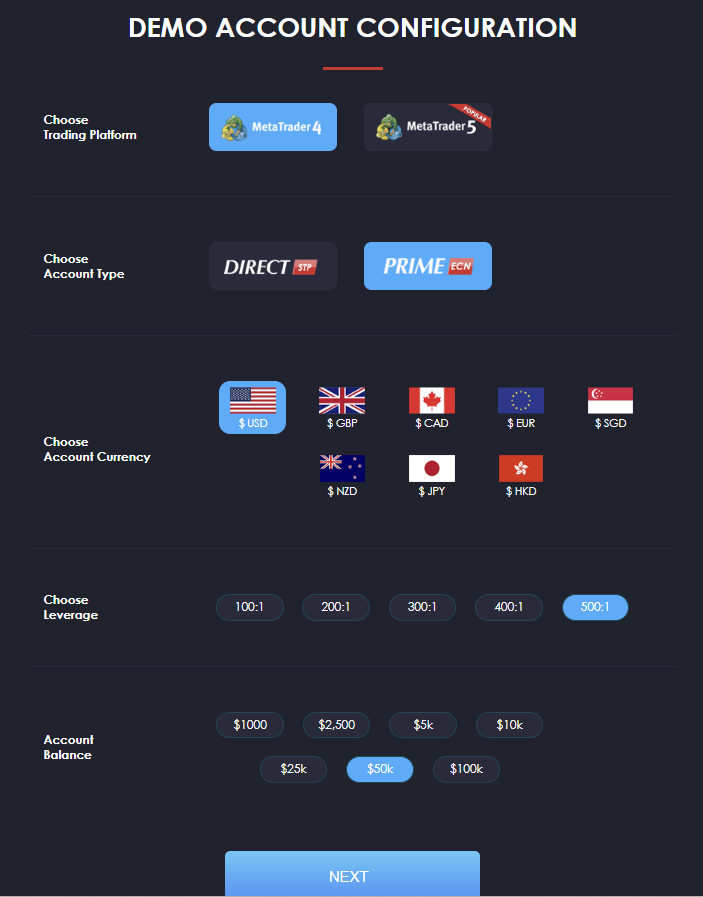

Opening an account with Moneta Markets is straightforward and quick, even for new traders. The Moneta Markets WebTrader provides the complete package for users – onboarding can be completed within the platform. Apart from the demo account, there are three account types for live accounts, Direct STP, Prime ECN, and Ultra ECN. If you are just starting out, we recommend starting with a Direct STP account.

Direct STP | Prime ECN | Ultra ECN | |

Execution Type | STP | ECN | ECN |

Minimum deposit | $50 | $200 | $20,000 |

Minimum volume | 0.01 lot | 0.01 lot | 0.01 lot |

Spreads from | 1.2 pip | 0.0 pip | 0.0 pip |

Commission | $0 | $3 per lot per side | $1 per lot per side |

Stop out | 50% | 50% | 50% |

Hedging | Yes | Yes | Yes |

Islamic account | Yes | Yes | Yes |

Suitable for | Beginners | Scalpers & EAs | Professional traders and money managers |

Certain countries are eligible for ID3 verification, which means that clients have the opportunity to quickly open an account without needing to provide additional documentation. Otherwise, uploading verification documents on the WebTrader platform is fast and easy. With Moneta Markets, all traders can only open a single CFD account. This is great news for individuals looking to democratize the brokerage industry.

All traders will be subject to the same trading conditions, regardless of their assets and connections. Up-selling of services and marketing tricks to increase deposits from retail traders will not be tolerated.

Opening a live account

Novice traders will be happy to know that opening an account with Moneta Markets is fast and simple. Since the broker is regulated by CIMA, new clients must complete standard compliance checks to ensure that they completely understand the risks of trading in the financial market. The quick application form will require you to provide your name, email address, contact number, and account password. From there, Moneta Markets will require verification of your identity and residence. This may take less than five minutes of your time.

Take note that you won’t be able to make trades right away – Moneta Markets will have to review your documents until you pass compliance. This may take up to several days, depending on your case. Do prepare a scanned copy of a government-issued identification card as well as a bank statement or utility bill showing your residence address. Make sure that these documents were issued in the past three months.

Opening a demo account:

If this information on Moneta Markets has piqued your interest, don’t hesitate to try their services. Opening a demo account with Moneta Markets is as easy as clicking a button! New clients can familiarize themselves with the Moneta Markets WebTrader and AppTrader platforms before opening a live account. Hone your trading skills until your demo account expires after 30 days.

Review of bonuses and promotions

As regulated by CIMA, there are no bonus or promotion restrictions in place for Moneta Markets. To encourage more substantial deposits, the online broker gives traders the opportunity to receive up to a 50% bonus for deposits 1000 USD and above. Remember that terms and conditions will apply, so take caution when withdrawing your initial deposit, as the cancellation of your bonus might follow.

Since the incentive only applies to deposits of 1000 USD and up, traders might be enticed to take on more than they could chew. A word of caution for new investors, try to assess your risk level – you might need to overlook this marketing tactic if it is beyond your comfort zone.

Customer support and service

Most online traders won’t give much attention to setting up a customer support system, but as a relatively new online broker, this step is necessary for Moneta Markets.

We salute Moneta Markets for receiving an award for their exceptional customer service the same year that the online broker was founded! CV Magazine acknowledged Moneta Markets as the “2020 Best Customer Award” for its 24-hour, five days-a-week reliable customer support via telephone, live chat, and email. Clients are promptly directed to an accommodating agent who will diligently address all their inquiries. The customer service team can accommodate as many as 15 languages!

Live chat support at Moneta Markets is available through their website and application. Responses can arrive in as fast as 10 to 20 minutes. Email support is also exceptional, with an average response time of about four to five hours. Telephone services are also efficient – support teams successfully and adequately address all queries. We love that the team is diverse enough to include multiple language options!

A convenient FAQ section is also available should you have any pertinent questions. Clients looking for immediate assistance can find solace in the friendly support team at Moneta Markets.

What are the deposit and withdrawal options at Moneta Markets?

In this section, we will take a look at the Moneta Markets deposit and withdrawal options. The broker offers a good selection of deposit and withdrawal methods overall. For first-time deposits, it is important to notice there is a limitation via credit cards for deposits of more than $1,000 or equivalent. Also, the maximum deposit amount per day is $10,000 per day.

Now, let’s look at the processing times, fees, and base currencies available for account founding at Moneta Markets.

Method | Processing time | Fees | Available Currencies |

Bank transfer | 2-5 business days | $0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

Credit- and debit card | Instant | $0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

FasaPay | Instant | $0 | USD |

JCB | Instant | $0 | JPY |

Sticpay | Instant | $0 | USD, GBP, EUR, SGD, JPY, NZD, CAD |

For withdrawals, on the other side, the broker usually promises to handle withdrawal requests within 24 hours. Only for bank transfers, the processing time might be slightly longer and take between 3-5 business days. There are also various anti-money procedures and regulations in place, which may delay the withdrawal process further, especially if you are trying to withdraw large sums of money. But, generally, we can confirm the withdrawal process is reliable and professional overall.

Does Moneta Markets over negative balance protection?

Yes, Moenta Market’s policy it to protect their clients from negative balance protection; you will never risk more money than the funding in your trading account. This means even if the markets move against you and the liquidity of your positions becomes insufficient, you will never need to reinvest large sums of money at short notice. It is a feature many brokers offer, so that isn’t unique to Moneta Markets, but it adds a well-needed additional security layer, especially for trading novices.

How does Moneta Markets make money from you?

It is good to know how Moneta Markets and other brokers are generating revenue. If, such as in this particular case, the brokers are transparent and open about it, it is generally a very good sign. On the page’s main menu, you can easily read the commission and fee structure of Moneta Markets.

But, how is the revenue structure for Moneta Markets in particular? Like many other brokers, they also make the majority of their income with added spreads or commissions per trade, depending on your account type. While the Direct STP account type is a spread-based account type, and Prime ECN and Ultra ECN, the revenue comes from commissions. Which system is better for you depends on various factors, such as your trading strategies and personal preferences.

In addition to spreads and commissions, Moneta Markets does also make revenue from overnight swap fees for positions opened outside the market opening hours and currency exchange fees.

Moneta Markets education and training tools

Moneta Markets provide sufficient opportunity for new traders to begin their investment journey. At just 50 USD, traders can open an account and enter the financial market. Moreover, training tools are provided for novice investors. Though the online brokerage platform aims to improve client education with its tools, current segments for training and research are lacking. As a relatively new online broker, Moneta Markets understandably has a few points to improve on in terms of research and training.

Moneta Markets provides available research tools such as a Trading central add-on, technical analyses, an economic calendar, a client sentiment indicator, and branded Moneta TV daily content. The platform provides over 100 videos as part of its Moneta Markets Masters Course, covering day trading, risk management, chart readings, and market strategies.

Though this is the case, we find a lack of comprehensive and in-depth quality market research. To entice new traders and to aid in the growth of its traders, Moneta Markets must improve its educational program. We have high hopes for Moneta Markets to successfully improve the implementation and execution of its research and education section.

The Trading Central includes:

- Moneta Markets WebTV: live trading news from the New York Stock Exchange

- Economic Calendar: access to up-to-date market news and announcements

- Market Buzz: access to the latest news and price events for 3,0000 assets

- Features Ideas: Technical and trade ideas

- DupliTrade: automatic duplication of portfolio trades of proprietary investors

What are the best Moneta Markets alternatives?

As always, let’s take a look at the most recommended broker alternatives before we conclude the article. Each and every broker come with some different and unique features that are most helpful for certain trading groups. Some of them shine when it comes to usability, customer support, regulations, or other factors. Therefore, the decision of which broker is best for you ultimately depends on your requirements and needs. The three options below are excellent alternatives for Moneta Markets.

Capital.com

If you are looking for a trusted, beginner-friendly trading platform with more than 3,000 assets to choose from, capital.com is definitely among the best options. The low minimum deposit of $20 is also a great advantage for trading beginners just starting out and looking to get a first glimpse at the trading universe. The availability of online classes, webinars, and their own educational app called Investmate is great for trading newbies and intermediate traders alike. Read the detailed test of our experience with capital.com here.

RoboForex

For intermediate to advanced traders, RoboForex is a highly interesting alternative mainly due to its large variety of more than 12,000 assets to trade and the industry-leading leverage of up to 1:2000. With RoboForex, you can not only trade less popular currencies and assets with very attractive spreads, you can also choose from five flexible and adjustable trading platforms. In our review, some of the broker’s highlights were a very fast execution of orders as well as the above-average civil liability insurance program.

XTB

Last but certainly not least on the list of potential alternatives to consider, XTB, as one of the world’s largest Forex brokers, can’t be ignored. This European broker was founded back in 2002 and is traded on the Polish stock market since 2016. Interestingly enough, the company gained 4% in value on the first day after doing so and currently has offices in 12 countries. The main advantages of the broker are they provide access to one of the best trading platforms currently available (Station 5) and the are very transparent with their fees and commissions.

Conclusion of the review: Should I invest with Moneta Markets? – We think yes!

Though relatively new to the industry, Moneta Markets provides clients with superior leverage and trading tools for CFD trading, as well as award-winning customer service and web-based platforms. More advanced traders can also engage in MT4 and MT5 platforms to access more advanced tools.

Advantages:

- Great for novice traders

- User-friendly and all-in-one trading platform

- Sufficient educational tools

- Award-winning platform and customer service

- No deposit fees and minimal commissions

Disadvantages:

- Lacks in-depth research tools

FAQ – The most asked questions about Moneta Markets :

Is Moneta Markets legit and safe?

Yes, Moneta Markets is regulated by the Cayman Islands Monetary Authority (CIMA), and it holds client funds at the National Australia Bank.

What can I trade at Moneta Markets?

Clients can trade over 300 instruments. This includes forex, indices, shares, commodities, and cryptocurrencies.

How do I withdraw from Moneta Markets?

Easily withdraw your funds by submitting a withdrawal request form. Processing may take up to 24 hours before the money appears in your bank account.

Is Moneta Markets a regularized platform?

Moneta Markets was originally the brand name of Vantage Group. This is regulated globally by many authorities like the FSCA. Launched in 2020, it is a global CFD and FX broker.

How do you use Moneta Markets?

You can start using Moneta Markets in just three simple steps. First, create an account, which will allow you to begin trading instantly. Next, with the help of various funding methods convenient to you, fund your account. Lastly, start trading by getting access to more than a thousand instruments across all asset classes.

Is Moneta market safe?

In a survey, Moneta Markets has been given 71 out of 99 in the trust score. So, it has average risk. It is not publically traded, and it does not operate as a bank. Additionally, it is authorized by one tier-3 regulator and two tier-1 regulators. There is no tier-2 regulation in Moneta Markets.

What is the minimum amount we must deposit in Moneta Markets?

The minimum deposit amount at Moneta Markets is USD 50. However, you can only deposit the amount using Bank Wire and Credit or Debit Cards. But opening a live CFD account and keeping it live doesn’t need any money.

Check out our similar blog posts:

Last Updated on June 28, 2023 by Res Marty