Axi review and test – How good is the broker?

Table of Contents

REVIEW: | REGULATION: | MINIMUM DEPOSIT: | ASSETS: | MINIMUM SPREAD: |

|---|---|---|---|---|

(4.7 / 5) (4.7 / 5) | FCA, ASIC, IFC | $0 | 5 classes, 130+ products | Variable 0.0 Pips |

Each trader wants to trade with a Forex Broker who truly understands their needs. Axi is a company founded by traders for traders. The brand claims to be the best online broker choice for traders. In this review, we will tackle the company itself (AxiTrader), its platforms, services it offers and etc. We will know whether the firm is a scam or a legit broker. Can we trust Axi as our FX Broker? – Let’s find out.

What is Axitrader? – The company presented

Axi was founded in the year 2007 and was rebranded from AxiTrader to Axi in 2020, with a goal to be the online broker that traders would like to trade with. Since then, the company has risen and has grown to be one of the largest and leading Forex brokers in the world. Axi offers its clients the ability to trade Indices, Commodities, Forex Cryptocurrencies, and Shares.

The firm is founded by traders for traders. Since the brokers are traders themselves, they understand the need to have a great 24-hour service, tight spreads, and fast execution with minimal slippage. With that said, Axi commits to delivering its best to its clients to reach these factors that are very important to any aspiring trader in the online trading industry. Axi strives to provide any kind of help needed by any type of trader.

AxiTrader focuses always on integrity, service, and execution. It offers a trading platform that gives traders access to the latest market data, and the company strives to deliver exceptional client support. Traders trading with this broker will enjoy direct access to multiple destinations of liquidity in forex markets. The vision of Axi is to keep delivering remarkable trading support and become the world’s leading provider of online foreign exchange trading services.

Facts about AxiTrader:

⭐ Rating: | 4.7 / 5 |

🏛 Founded: | 2007 |

💻 Trading platforms: | MetaTrader 4 |

💰 Minimum deposit: | No |

💱 Account currencies: | AUD, EUR, GBP, USD, CHF, PLNX |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading amount / 0.01 lot |

⌨️ Demo account: | Yes, $50,000 limit |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Shares, Indices, Commodities, Cryptocurrencies |

💳 Payment methods: | Bank transfer, online banking, Credit- Debit Card, POLi, Cryptocurrencies, Neteller, FasaPay, Skrill, Boleto |

🧮 Fees: | Starting at 0.4 pip spread / variable commissions and overnight fees |

📞 Support: | 24 / 5 support via chat, e-mail, and phone in six languages |

🌎 Languages: | Website available in 14 languages |

Is Axi regulated? – Regulation and safety for customers

A broker that is regulated greatly affects the choices of traders. Regulation is very important because it is proof that a company has passed certain criteria in order to attain an official license to operate in the trading industry. It is also one key ingredient of having known that the broker that you are trading with is secure, safe, and legit. Axitrader is regulated by some of the known regulators in the trading industry. The company is registered as AxiCorp Financial Services Pty Ltd (AxiCorp). AxiTrader is regulated by the following: Financial Conduct Authority (FCA) in the UK, the Australian Securities & Investments Commission (ASIC) in Australia, and AxiTrader Limited is a member of the Financial Commission.

AxiTrader is regulated by the following:

- Financial Conduct Authority (FCA)

- Australian Securities & Investments Commission (ASIC)

- Financial Commission

Financial security

Axi takes the security and trust of its clients seriously. With this said, AxiTrader holds client funds in segregated accounts (with top-tier banks) and has amazing programs to secure its clients. The company has complied with the Financial Conduct Authority (FCA) and gained its regulation.

The company is a member of the Financial Services Compensation Scheme (FSCS). As a member of FSCS, the firm has a client protection program that is offered by FSCS that (only applies when) in the unlikely event that AxiTrader becomes insolvent, on behalf of retail clients, they will have up to £50,000 coverage.

Summary of the regulation and financial security:

- Authorized and regulated by FCA, ASIC, and The Financial Commission

- Financial Services Compensation Scheme £585,000

- Segregated customer funds

What are the pros and cons of Axi?

Before you make any decision, make sure you do your research and read the experiences of other users. After all, you only want to invest your hard-earned money with trusted, reputable companies which offer dedicated customer support. After testing Axi extensively and with our own money, we can give you an overview of the most important pros and cons we observed.

Pros of AxiTrader | Cons of AxiTrader |

✔ Company was founded by traders for traders, so they understand your need well | ✘ No negative balance protection |

✔ No deposit-, withdrawal- or inactivity fee and no minimum deposit | ✘ Response time from support times is slow at times |

✔ Possibility to fund your account with cryptocurrencies | ✘ MetaTrader 4 is the only trading platform available |

✔ Fast execution of orders with no slippage | |

✔ Dedicated account manager, even for a demo account | |

✔ High security of investments and multiple regulations | |

✔ Spread betting is possible |

Is AxiTrader easy to use for beginners?

In this section, we test how easy it is to get started with AxiTrader as a beginner. Is the platform easy to understand and optimized for mobile devices? These are important factors to consider before you decide to open an account with any broker. To make things short, yes, Axi is a good broker for trading beginners, in our opinion. The set-up of the website is very intuitive, and there is a vast selection of educational materials to help you get started. With that being said, you will find our more comprehensive usability rating of Axi in the chart below.

Criteria | Rating |

General Website Design and Setup | ★★★★★ Highly intuitive set-up and design, logical structure, everything is easy to find |

Sign-up Process | ★★★★★ Very fast sign-up process for a demo account, which can easily be converted into a live account |

Usability of trading area | ★★★★ Good step-by-step tutorials on the platform, but MetaTrader 4 isn’t the most beginner-friendly trading platform, in our opinion |

Usability of mobile app | ★★★★ The app version of Aix hasn’t structured as well as the desktop version, but overall the app works flawlessly |

Review of the trading conditions for traders

AxiTrader offers traders the ability to trade indices, commodities, Forex, cryptocurrencies, and some CFDs with competitive spreads. The brand was built by traders for traders. Due to this, the company understands any type of trader and strives to deliver the best service, support, and as well as materials that they can. The firm does not require a minimum deposit, and any trader can start with any amount desired.

It offers free demo accounts where aspiring traders and as well as professional traders can practice their skills and trading strategy and be comfortable with the platform in trading with this Forex Broker. It has no hidden fees, no withdrawal, and a deposit fee as well. The company does not charge an inactivity fee and promotes simple and fast execution. The firm offers competitive spreads starting from 0.0 pips, and spread betting is possible. Also, there are Forex pairs that can be traded. Axitrader has developed the MetaTrader 4 (MT4) Platform for traders to enjoy the maximum capacity to trade using the more advanced version of the famous platform in the trading industry.

The brand also promotes the security of the funds of its clients, wherein the funds of the customers are segregated from their own company’s funds.

Trading Conditions:

- Free demo account

- Spreads starting 0.0 pips

- Advanced and developed MT4 Platforms

- Minimum deposit $0

- Able to trade indices, commodities, Forex, cryptocurrencies, and some CFDs

- Competitive Spreads

- Simple and fast execution

- No deposit and withdrawal fees

- No inactivity fee

- No hidden fees

- Spread Betting is possible

AxiTrader has won various awards throughout the years it has been operating. In the year 2012, it won ‘Best Spreds’ at China International Online Trading Expo (CIOT Expo). The following year 2013, the company won four awards: ‘Best IB and Affiliate Program Worldwide’ and ‘Best Forex Broker Asia’ at China International Online Trading Expo (CIOT Expo), ‘Most Recommended Fore Provider in Australia’ and number one for ‘Customer Service’ during Investment Trends Australia FX Report. In 2014, AxiTrader received awards as the winner of ‘Financial Institution Of The Year’ in the Asia-Pacific Financial Investment Association and was named ‘Strongest Brand Association With Being Trustworthy’ in Investment Trends Australia FX Report.

Also, in the year 2017, it won the ‘Most Reliable Broker in Forex Awards and ‘Highest Overall Client Satisfaction’ in the Investment Trends Australia FX Report. Only last year, 2018, AxiTrader gathered awards for being the winner of ‘Best MT4 Provider’ in compareforexbrokers.com.au and UK Forex Awards. It also won in the same year, ‘Most Trusted Forex Broker’, in UK Forex Awards.

We can say that these awards can serve as proof that trading with AXI is secure and that the company has excellent service. AXI is a legit and trusted broker that understands traders’ needs.

Test of the Axi trading platform

The Axi MetaTrader 4 platform is an advanced platform developed by professionals. The firm invested in co-located servers and fiber optics for faster, more accurate trading. It is not equal to any other MT4 platform since it is more advanced and has been developed by the company for better trading results. Since that AxiTrader promotes fast execution, this speed is possible on all platforms thanks to one-click trading. The firm has four types of trading platforms, namely: ‘AxiTrader MT4 in Desktop, Mac, and Mobile’, ‘AxiTrader MT4 NexGen’, ‘AxiTrader MT4 Forex Trading Signals’, and ‘AxiTrader MT4 Multi Account Manager’.

Axi MT4 for Desktop, Mac, and Mobile

AxiTrader MT4 Platform is available on desktop (as well as web), Mac, and mobile. The platform offers more than 100 currency pairs, automated trading (EAs), free setup, and download. It has full market coverage, which allows you to access the full range of trading options, from Forex and Commodities to CFDs and Indices. The platform is customizable, and you can manage your trading dashboard with its flexible charts and tools. MT4 is known to be the world’s number one trading platform for Forex trading.

As mentioned above, this platform is available on a desktop as well as a web browser. MT4 WebTrader Platform gives you access from your MT4 account to your web browser. It is abundant in features but optimized for lightweight web-based performance and gives comprehensive functionality with added flexibility to trade from any internet browser on any device. Also, you can definitely use it on your Mac devices, and its functionality is incredible, and it is user-friendly but has a kind of a learning curve for trading beginners. It does not require add-ons or plug-ins. You can simply download it completely free from a Mac-based solution.

The mobile trading platform of AxiTrader lets you enjoy trading wherever you want, whenever you want. You can simply download it from GooglePlay (for Android) or AppStore (for iOS) and start trading.

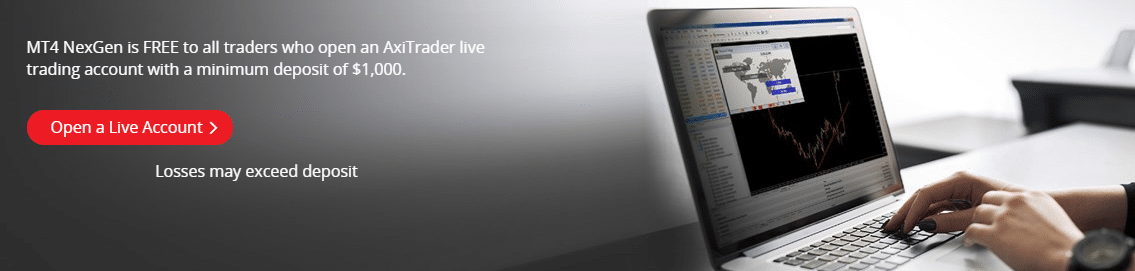

Axi MT4 NexGen

The Next Generation of MT4, or what Axi calls ‘Axi MT4 NexGen’, is an advanced MT4 platform that embodies advanced management tools. It has enhanced ordering and sentiment trading. This platform is more developed, with more features to enjoy for professional traders. With this platform, you can gain insights into live market trends by viewing how others are trading using its sentiment indicator.

It allows you to spot new opportunities and cut down money management errors by the use of its correlation trader feature. Also, it has an economic calendar that alerts you to huge events that enable you to stay on top of the market action. You can get better analysis and reporting by the use of an automated trade journal that automatically records your trading activity. This platform allows you to enter and exit trades faster and apply complex order types with speed. It has as well as a session map that shows the world’s market opening and closing times.

Please note that MT4 NexGen is free to all traders who open an AxiTrader live trading account with a minimum deposit of $1,000, and be aware that losses may exceed the deposit.

Axi MT4 forex trading signals

Axi MT4 Forex Trading Signals enables you to access thousands of ready-made trading strategies. This platform places trades automatically and has simple execution. By the use of trading signals, traders can copy trading strategies from thousands of traders from across the world straight into the MT4 platform. It has a 24-hour trading feature that lets trades continue to be placed, even when you’re away from your trading terminal. You can set your own tolerance to risk with stop loss contingencies with the use of flexible risk parameters.

Axi MT4 Multi Account Manager

AxiTrader’s Multi-Account Manager (MAM) is an integrated software tool that lets a single trader execute block trades on all accounts operating under a master account. It lets you place a number of orders in bulk, with speed, into an unlimited number of accounts or multiple accounts. It allows you to control an unlimited number of managed accounts from one trade terminal. AxiTrader has invested greatly with these MT4 platforms to MT4 servers to ensure that the MAM solution provides the fast and reliable service account managers need to service their clients.

Which includes all the features of a standard account, such as the use of EAs. This platform offers convenience, increased automation, and broadened functionality. Please note that this is only available to approve and regulate operators of discretionary accounts or managed investment schemes.

Axi MT4 platforms are well-developed and advanced. In fact, it won ‘Best MT4 Provider’ in compareforexbrokers.com.au and UK Forex Awards in the year 2018.

Facts about the platforms:

- Advanced and developed MT4 platforms

- Secure

- Fast execution

- Simple and user-friendly

- Can be used in any form of device (desktop, web, Mac, mobile)

- Reliable

- Convenient

- Multiple features

- Customizable

Professional charting and analysis is possible

Technical analysis and charting are very significant tools for having better trades in online trading. Every trader has their own skills and their own style. These tools can be said as the main ingredients for having better or good results. Charting helps traders track and watch asset price movement and market volatility in making their trades.

Technical analysis, on the other hand, is a discipline that helps traders evaluate investments and identify trading opportunities. It gives traders the power to analyze statistical trends gathered from trading activity, such as volume and price movement. When combined together, this can be a powerful edge to get better trades in trading. AxiTrader offers free educational material such as ebooks, blogs, webinars, seminars, and articles that can help you to learn and know about how charting and technical analysis are used in trading.

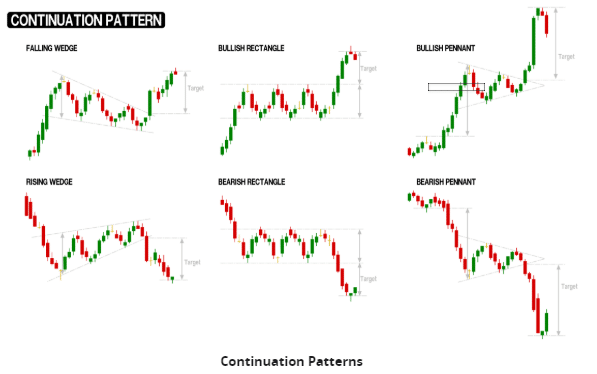

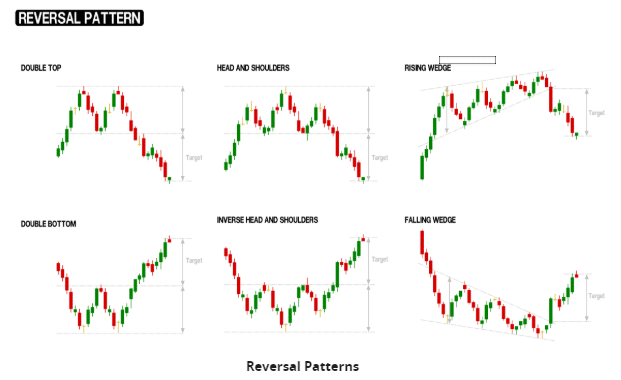

Price patterns and charting is known to most traders that use technical analysis as tools in their trades. Generally, it can be divided into patterns: continuation and reversal patterns. With this said, patterns help traders read the movements of the markets.

Continuation patterns are price patterns that show an existing trend with a temporary interruption. This type of pattern helps traders determine the decision to take on their next move, whether they are selling or buying an asset, for better trading results.

On the other hand, reversal patterns are signal trends when the direction changes. These signals can be used to trigger new trades because the reversal may cause a new trend to start. With that said, this can be used as a technical pattern that can serve as an advanced warning to identify potential changes in the market direction.

Please be aware that these patterns are only tools. It is not recommended to use as a basis for an offer to buy or sell or the solicitation of an offer to buy or sell any kind of product, whether security, financial, or any type of instrument. Traders have their own styles and strategies. Every trader is unique, and you should know by yourself which works for you.

Review of the Mobile Trading (App) by AxiTrader

Any type of trader would want to be able to trade anywhere and whenever they want. AxiTrader lets you enjoy trading wherever you are whenever you want with its mobile trading. It is quick and easy to install, full of functions like charts, alerts, and analysis to help you keep pace with the market in real-time. AxiTrader mobile trading app connects your main MT4 trading terminal to give you trading flexibility to the maximum. You can follow all the ups and downs with real-time updates by viewing live pricing. You will be able to modify your trades by just swiping your screen, and you can view your past trading activity fast and easily with the help of the Past Orders feature that pulls up your historical data.

With this app, you can keep a close eye on the action by monitoring live orders. It has a real-time charting feature that allows you to choose how you would like to view data. It is also customizable and gives you updates on the latest market development news. You can download the MT4 mobile trading app for iPhone, iPad, Android, or tablet.

Features of App:

- Customizable

- Fast Execution

- Display Charts

- Allows you to use all types of orders

- On-the-go trading insights

- Read Market News

- Free Demo Account

- Search and select instruments

- Advanced and Developed Trading Tools

- Customer Support

How to trade with Axi? – Step-by-step tutorial

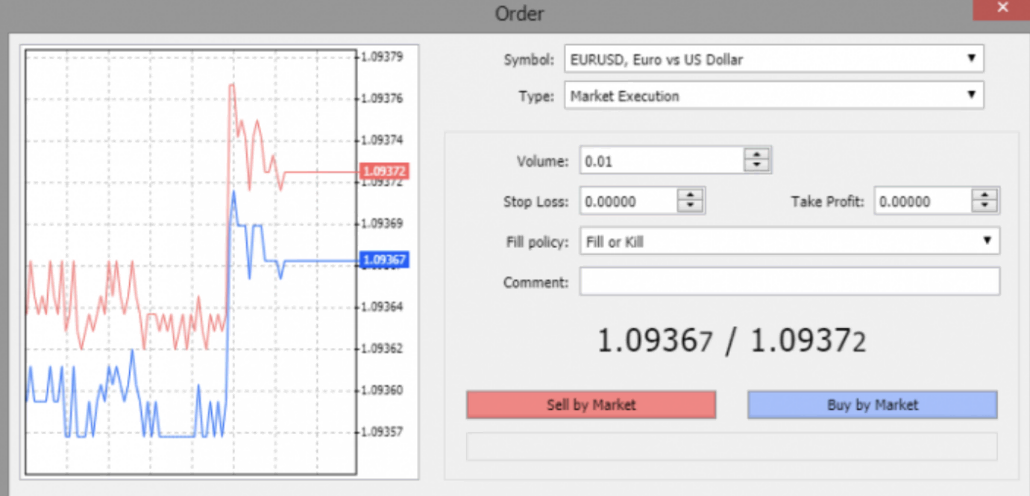

In trading, we invest because we want to profit. Most traders make decisions on whether a market is rising or falling when looking to place a profitable trade. As a trader, you need to know the volatility and trend of the market you want to trade in. When the market value falls, you can ‘sell’ the asset, and when the price increases in value, you can ‘buy’ the asset you choose. In order to have better trading results, you need to keep on track of the markets as well as your position.

Once you choose a market, you can decide on what asset you want to analyze. After analyzing the asset, make sure to make a forecast of the price movement. Then, open the order mask and customize your position. You have to choose the order volume, and then you can decide whether you buy or sell the asset you want or chose.

Step-by-step trading tutorial:

- Choose an asset you want to analyze

- Analyze the asset and make a forecast of the price movement

- Open the order mask and customize your position

- Choose the order volume

- Buy or sell the asset you want

Since Axi gives traders the ability to trade Forex and some CFDs, you must know the difference between these two in order to have better trading results. CFDs are complex instruments and come with a high risk of losing money or investments rapidly due to leverage. About 74 – 89% of retail investor accounts lose money when trading CFDs with this provider. You should know if you are willing to take the risk of losing money by trading CFDs before making a decision.

Register your live account with Axi

Opening a live account with Axi takes only three simple steps. First, you need to complete the application by filling up the form. Second, in order to help protect your account, Axitrader requires verification in the form of sending an ID to confirm your identity. Third and last, fund your account with any amount you want, as Axi does not require any minimum deposit, and you can go ahead and start trading.

You should not worry about your personal details as the website of Axi is encrypted to secure your personal information. Also, with regard to sending your ID, this may be done electronically. Axi takes the data protection of its clients seriously.

Open your free demo account

Demo accounts are very important in a trader’s trading experience. This serves as a practice, too, where you can execute your skills, practice your strategies and be comfortable with the trading platform without using real money or funds. Axi offers real-time execution speeds and spreads. It’s free for 30 days and has virtual funds of $ 50,000. The account can be set to the following currencies: EUR, USD, GBP, CHF, or PLN. It is designed to reflect the same live market environment when trading on an AxiTrader live account.

It is easy to register a demo account with Axitrader. You just need to fill in the form, download and install the platform (MetaTrader 4 / MT4) and start practice trading with $ 50,000 virtual cash in the account. We highly recommend getting a demo account before going live in trading because it is important to practice your skills and strategies as well as be comfortable with the platform. Trading itself requires high risks, and as traders, we need to be aware of that.

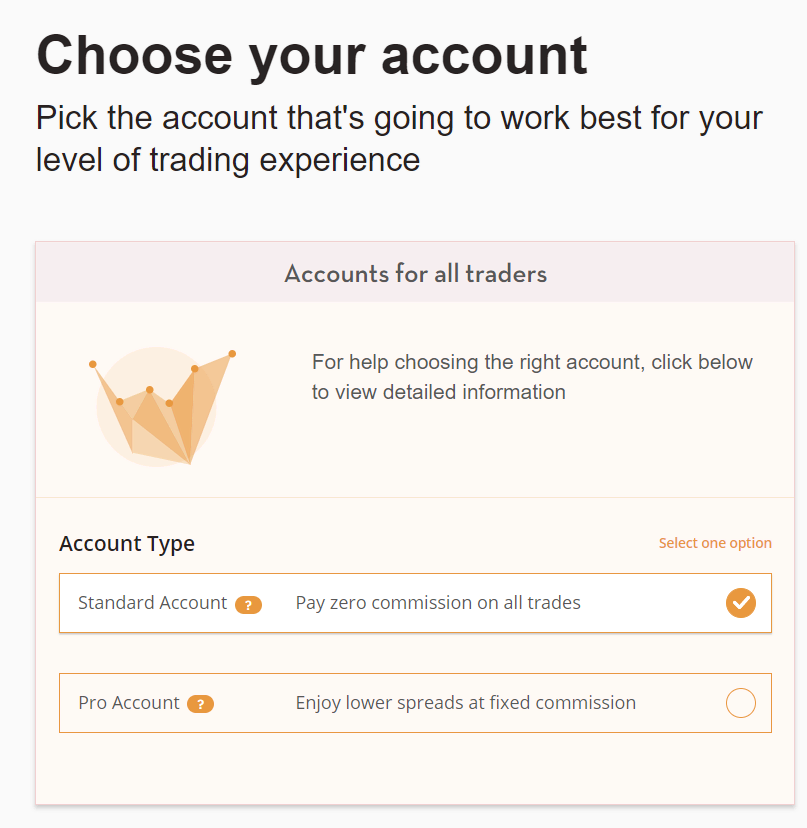

Account types with Axi

| MT4 Standard Account: | MT4 PRO ACCOUNT: | MT 4 Elite account: | |

|---|---|---|---|

| SETUP COST: | Free | Free | Free |

| SPREADS: | From 0.4 pips | From 0.0 pips | From 0.0 pips |

| COMMISSION: | $0 | $7 round turn (USD) | $3.50 round turn (USD) |

| MINIMUM TRADE SIZE: | 0.01 lots | 0.01 lots | 0.01 lots |

| MINIMUM DEPOSIT: | $0 | $0 | $25,000 |

| LEVERAGE: | 1:30 (EU – retail), 1:500 (international) | 1:30 (EU – retail), 1:500 (international) | 1:30 (EU – retail), 1:500 (international) |

| AUTOCHARTIST: | Yes | Yes | Yes |

| MOBILE TRADING: | Yes | Yes | Yes |

MT4 Standard Account:

MT4 Standard Account offers 80 currency pairs, no commission, no minimum deposit, free setup, and download. It has flexible charts and tools. You can customize your trading dashboard by dragging and dropping your favorite charts and analysis tools. Spreads are starting from 0.4 pips without commission. It is very easy to use and offers access to the full range of instruments, from Forex and Commodities to CFD Indices. It is designed for fast and simple execution with the use of MT4’s one-click trading. With this account, you can track your progress with comprehensive trade history and analysis. AxiTrader has invested in co-located servers and fiber optics for faster, more accurate trading with its advanced technology.

MT4 Pro Account:

MT4 Pro Account is the account that most professional traders prefer. It offers low commissions, from $3.50 per side. It also offers raw spreads as low as 0.0, no minimum deposit, no requotes, and instant execution. This account covers the full market and allows you to trade Forex, Commodities, and CFD Indices from a single trading terminal. It is easy to use and has fast execution with the feature of MT4’s one-click trading. It enables you to track your progress with comprehensive trade history and improve with analysis too. It gives you access to the same depth of pricing as institutional businesses like banks, financial institutions, and hedge funds. With this account, you can run your strategy across multiple currency pairs by taking advantage of low spreads across both major and minor currencies. It has a positive slippage where you’ll receive the benefits of positive slippage and better trade prices with the help of AxiTrader’s price improvement technology.

MT 4 Elite Account:

If you are a highly experienced and professional trader, the MT 4 Elite account is perfect for you. Some of the advantages you get as an Elite Account client are access to exclusive market analysis & indicators, regular webinars for highly advanced traders, and a complementary MT4 Forex VPS Hosting Service. Thanks to their partnership with Manchester City, you can also win exclusive prizes such as VIP pitch-side experiences and behind-the-scenes tours.

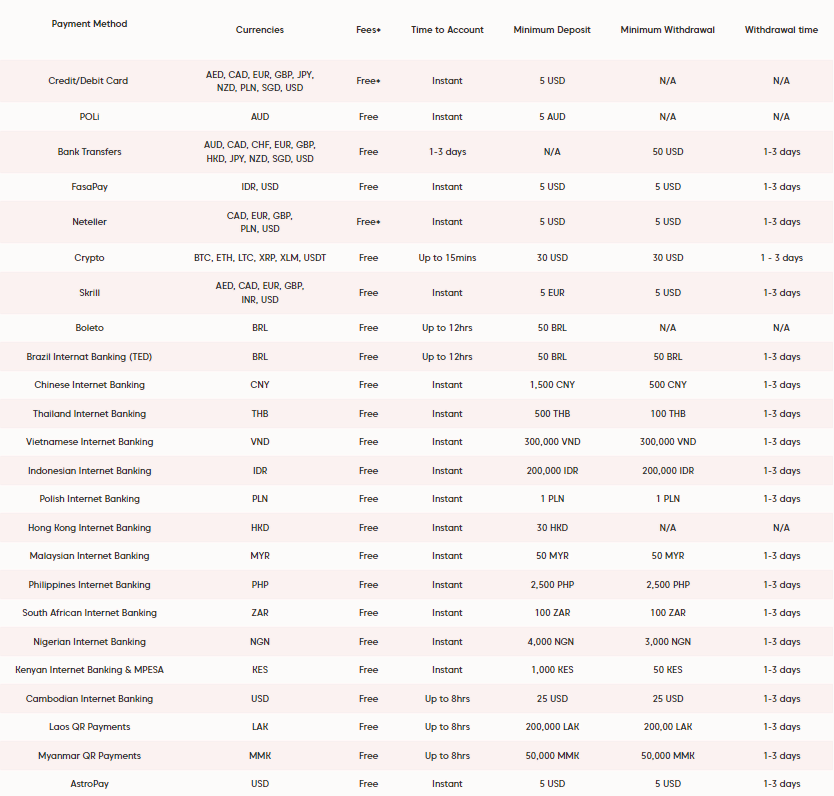

Review of the deposit and withdrawal

The funding account process is also significant in a trader’s trading journey. As traders themselves, AxiTrader understands how important the funding process is. For this reason, the firm has made it easier for its clients where traders can fund their accounts online anytime. The company has several funding options, and the process is fast, simple, and secure. Axi allows its customers to have accounts in the following currencies: GBP, USD, EUR, CHF, or PLN.

The company accepts a vast variety of funding options such as Moneybookers/Skrill, Neteller, Wire Transfer, Credit Card, and BPAY, to name just a few. Also, Axi allows you to deposit your funds with crypto. As it promotes fast processing of funds, it means that processing should take no longer than 10 minutes to reach your account, with a few exceptions. You will find an overview of the funding methods and the respective process time below. If funds have not arrived after the indicated time, you can contact their 24-hour support team which is available 24 hours a day, Monday to Friday.

Payment Methods that can be used:

- Moneybookers/Skrill

- Neteller

- Wire Transfer

- Credit Cards

- BPAY

- Cryptocurrencies (for example, Bitcoin)

AXI does not charge any fees on deposits and withdrawals.

Is negative balance protection included at AxiTrader?

No, AxiTrader accounts are not automatically protected by negative balance protection, and if your account balance goes negative due to fast market movements, you will first need to cover the negative balance. This is definitely something to have an eye on, as particularly newer traders may not be familiar with how rapidly markets move.

Axi support and service for customers

Customer support of AxiTrader operates 24 hours a day, five days a week. The operating hours start at 22:00 (00.00 server time) Sunday night GMT and ends at 22:00 on Friday Night (GMT). As traders themselves, AxiTrader completely understands the need of traders, especially when it comes to customer support and services. The firm, inspired by its goals to become the broker that all types of traders want to trade with, drives them to deliver the best service they can.

Axi has support in 6 languages in around 12 countries that are trading with the firm. You can reach support via phone call, email, and live chat. The live chat has an instant response, which ‘instant’ means that you will receive a response within 10 minutes.

There are dedicated account managers whenever you need a direct point of contact for more personalized service. AxiTrader agents are professional and helpful. You can also request a callback by filling up the ‘Request A Call Back,’ and an agent from AxiTrader will get in touch with you and assist you with your needs.

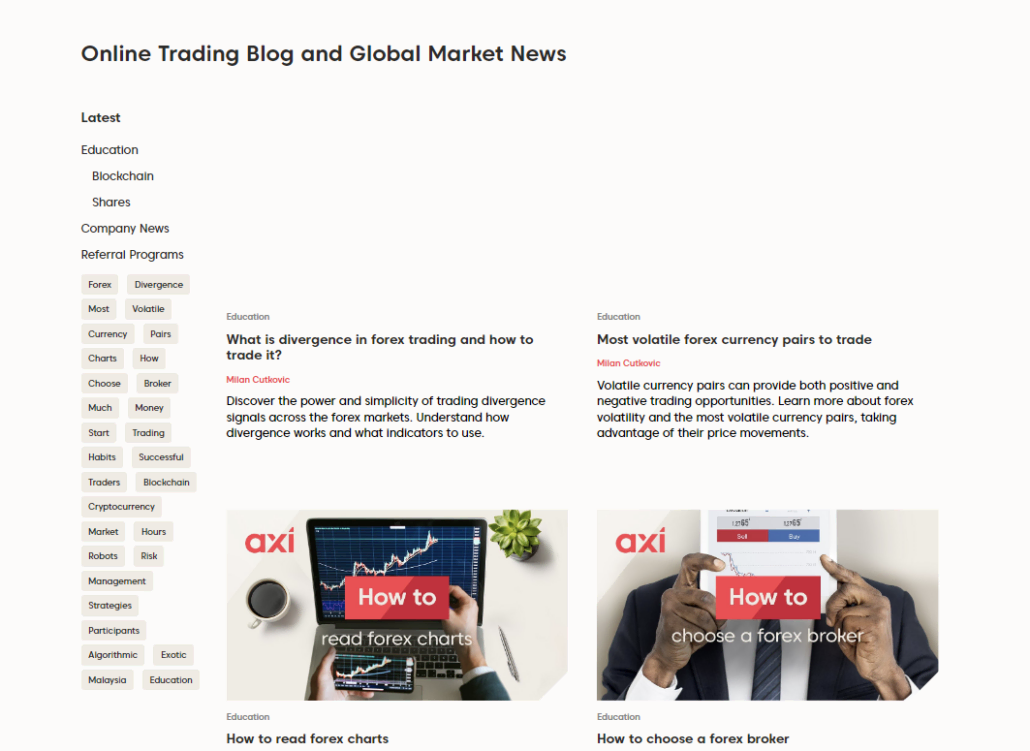

Also, AxiTrader offers training and free educational materials every trader needs. The company has online education programs, tutorial videos, and free webinars. You can learn a lot about trading. It has also blogs written by experienced traders that will surely inspire you while trading with this broker. The firm has video tutorials as well as and glossary. We can say that these are very helpful materials for aspiring traders as well as professionals.

What’s best as well about the service and assistance being offered by Axi is that the firm offers free eBooks. This material is very helpful in any trader’s journey in trading. This is also something to look forward to when trading with AxiTrader.

Axi’s customer support and service are good and award-winning. It won an award for being number one for Customer Service in investment Trends year 2013 during Australia FX Report. Also, in the year 2017, it won ‘Highest Overall Client Satisfaction’ in the Investment Trends Australia FX Report.

Facts about the support:

- 24-hour Customer Support (Monday to Friday)

- Supports 12 Countries and 6 Languages

- Offers Free Online Education, Webinars, Online Tutorials, and e-Books

- Email Support

- Live Chat Support

- Phone Support

- Offers Callback

- Won Award as Number 1 for ‘Customer Service’

SUPPORT: | PHONE (UK): | PHONE (INT): | ADDRESS: |

|---|---|---|---|

24/5 | 0800 612 7070 | +61 2 9965 5830 | 36 – 38 Leadenhall Street London EC3A 1AT United Kingdom |

Fees and costs

Since Axi was founded by traders for traders, the firm understands the importance of costs and fees in trading. With that said, Axis does not charge an inactivity fee or withdrawal fee. The company also offers trading fees at the lowest price. What’s best about trading with Axi is that it has no minimum deposit requirements, you are free to deposit any amount. Also, the firm does not charge a deposit fee. We can say that the fees and costs of Axi are favorable for traders.

Facts about fees of Axi:

- The minimum deposit of $ 0

- Does not charge a deposit fee

- Does not charge a withdrawal fee

- Does not charge an inactivity fee

- Low trading fees

How does this broker make money from you?

As explained in the section above, AxiTrader has many advantages for traders, such as no deposit, withdrawal, or inactivity fee. Nevertheless, like every other broker, Axi also makes a profit from each of your trades. They do it in the form of added spreads and commissions per trade. The exact spread depends, and the instruments you trade, and the commission will mostly depend on your account type.

What are the best AxiTrader alternatives?

Before we conclude, we will give you our free best alternatives in case you are not sure if the broker is a good fit for you. All these alternatives are highly reputed and regulated brokers, but they all come with pros and cons.

Captial.com

Capital.com is a trusted Forex and CFD trader platform and was founded in 2016. The platform has more than 280,000 users from around the world thanks to its excellent reputation and beginner-friendly platform. Multiple authorities regulate the broker and, overall, a perfect choice, no matter if you are experienced with trading or just starting out. Read our detailed review of capital.com here.

RoboForex

Next on our list of the best IC Markets alternatives is RoboForex. With this broker, you can trade a wide variety of assets, and their main advantage is the low minimum deposit of just $10. Additionally, your funds are very safe as the IFSC Belize officially licenses the broker. Also, the broker is owned by a big company group with headquarters in Europe. Finally, Roboforex also offers many account types to choose from, which gives you a lot of flexibility. All of these make the broker one of the best Axi alternatives. Read our in-depth RoboFores-review here.

XTB

XTB is currently among the best-known broker platforms in the world. XTB was founded back in 2006 in Poland and has seen steep growth ever since. More than 3,000 different assets in six asset categories are available to trade for you with this broker. But don’t just take our word; customers awarded XTB with multiple awards, and it is well known for its outstanding customer service. For example, every customer has access to dedicated 1 to 1 support for every client and a learning center with tons of resources.

Is Axi legit or a scam? – Conclusion of the review

Axi is a broker founded by traders for traders. The company gives its dedication to delivering the needs of aspiring traders as well as professionals in online trading. It offers its clients the ability to trade indices, commodities, Forex cryptocurrencies, and some CFDs. It has competitive spreads from 0.0 pips and fast execution with minimal slippage. The firm offers as well Forex pairs to trade and spread betting as possible. AxiTrader has the lowest trading fees and doesn’t have any minimum deposit required.

Since the company is managed by traders themselves, they understand the need to have a great 24-hour service and give their best to deliver it to their clients. Axi focuses always on integrity, service, and execution. It offers an advanced and developed MetaTrader 4 (MT4) platform that allows traders to enjoy the maximum capacity to trade. The brand also promotes the security of the funds of its clients, wherein the funds of the customers are segregated from their own company’s funds. It has gathered various awards, including as the most trusted Forex broker.

We can say that AxiTrader is secure and a trusted, legit Forex Broker. Axi is a broker that truly understands traders’ needs.

Advantages:

- Regulated company

- Offers simple and fast execution

- Transparent trading experience

- High security of investments

- 24-hour customer support (Monday to Friday)

- Free training and educational materials

- Doesn’t charge an inactivity fee and withdrawal fee

- Advanced and highly-functional software

- Advanced and developed MT4 platforms

- Offers mobile trading

- Offers free demo account

- Spread Betting is possible

- Reliable and competitive spreads

Axi provides fast execution and tight spreads for the forex market. We can recommend this broker to invest with because of the good service and conditions.

Trusted Broker Reviews

Experienced and professional traders since 2013Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs-The most asked questions about Axi:

Is AxiTrader a trustworthy broker?

Axitrader is not a fraud but has been recognized repeatedly for its dependability, offering low-risk Forex trading. AxiTrader is authorized and supervised by the 2 key regulatory bodies, the Financial Conduct Authority (UK) and the ASIC.

Is AxiTrader protected against negative balances?

Individual users receive Negative Balance Protection, which guarantees they will not lose more than what they’ve invested with AxiTrader. To minimize confusion, customers have a single brokerage account with AxiTrader but can have many subsidiary profiles in the shape of trading software logins.

Can you hedge with AXI?

Yes. When using the same asset, Axitrader permits two trades in opposing ways. This is classified as a Hedged Trade. When you have open Buy and Sell trades in the same asset, you’ll be required to pay half of the usual margin amount.

Is Axi suitable for newbies?

Axi offers a comprehensive instructional program, which makes it a great alternative for new traders. The third-party PsyQuation trade statistics program is also a useful resource for growing traders.

What is Axi’s withdrawal process?

Sign in to the Customer Account to transfer your cash. Once you’re on the Customer Portal, select Withdraw Earnings (on the left-hand corner), select the appropriate withdrawal mode for your account, and then follow the instructions.

See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty