4 best Forex Brokers & platforms with guaranteed stop loss in comparison

Table of Contents

See the 4 best Forex Brokers with guaranteed stop loss:

Broker: | Review: | Stop Loss: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Plus500  | Guaranteed | CySEC, FCA, ASIC | 2,000+ CFDs (71+ currency CFD pairs) | + Competitive spreads + 24/7 support + Many markets + No hidden fees + PayPal-compatible | Live account from 100$ Risk warning: 82% of retail CFD accounts lose money. | |

2. IG  | Guaranteed | FCA (UK), NFA (US), AFSL (AU) | 17000+ (80+ currency pairs) | + Over 17.000+ assets + No hidden fees + Education for traders + Broker since 1974 + Fully regulated | Live account from 250$ (Risk warning: Your capital can be at risk) | |

3. CMC Markets  | Guaranteed | FCA, ASIC, FMA, MAS | 10,000+ (300+ currency pairs) | + No deposit-limitation + Several awards + Trustworthy broker + Multi-regulated + 10.000+ assets + 300+ currency pairs + Learning academy + Competitive spreads + Low fees | Free trading account(Risk warning: Your capital can be at risk) | |

4. EasyMarkets  | Guaranteed | CySEC, ASIC | 200+ (11+ currency pairs) | Live account from 100$ (Risk warning: Your capital can be at risk) |

When forex trading, traders expect that the market can move against your predictions. Most of the time, traders predict wrong and that is why forex brokers have risk management tools such as stop-loss and take-profit. At times the stop loss might not work due to slippage where the order price is different from the execution price. It can lead to positive slippage, but often traders suffer losses from negative slippage. It is why forex brokers offer the guaranteed stop loss at a cost. Likewise, it is effective when trading in a volatile market and can limit losses. Furthermore, it is imperative to apply it if you have a chance.

What is a guaranteed stop-loss?

A guaranteed stop loss is a price that you set such that once the market prices fall at this point, the broker will close your position regardless of the market conditions. The guaranteed stop loss is similar to other stop-loss orders.

The main difference is while the regular stop loss allows you to exit at a set price, it is susceptible to the effects of slippage. The Guaranteed stop loss is an order in which the forex broker closes the position at the set price and takes the slippage cost.

Few forex brokers offer this stop loss, but those who do, charge to access it. The charges cover the cost of the slippage that the broker might get exposed to if slippage happens.

What are the fees charged on a guaranteed stop-loss?

It is often used on volatile markets like CFDs, forex, and spread betting. Most forex brokers offer different rates for guaranteed stop losses. Some offer the guaranteed stop loss as a premium feature such as GSLO premium, which traders pay after a period, like yearly or monthly.

Other forex brokers offer charges that traders pay if they use it. The rates can be a percentage of the total volume sold example 0.25%. The rates vary with the type of forex broker and the volatility of the asset traded.

Traders who intend to use a guaranteed stop loss should check the costs before choosing a forex broker as the charges could become costly.

How do you use the guaranteed stop-loss?

For example, if you open a trading position with a standard lot of EUR/USD at 1.1563/65, it means you are buying 100,000 Euros. The asking price is 1.1565, and you are going long in this position. Let us also take the example of trading on a Friday.

On the weekend, many things can happen, including a financial release that could affect the value of the EUR/USD. Many forex traders worry about it, which is why apart from the stop-loss order, you also place a guaranteed stop loss.

So you can set a guaranteed stop loss at 1.1543 if a financial release occurs and a consequent gap-down throwing the prices at 1.1520, a guaranteed stop loss will ensure to close your position at 1.1543. It saves you from making further losses.

Advantages of a guaranteed stop loss:

1. It reduces losses

A guaranteed stop-loss allows traders to limit their losses when they trade on risky financial markets. It is also a great way to mitigate losses in case of financial news that can influence prices and causes volatility.

2. It protects investor funds against market gaps

When the financial markets open from a previous day lower or high price or when it opens after a weekend, there could be market gap ups or gap down. It is when prices open at a higher or lower price, that could lead to losses or profits for those having an open position.

Forex traders apply the guaranteed stop loss to prevent a gap down if they have open positions overnight or over the weekend.

3. It is effective against slippage

Slippage is when you place an order at a price, but the order gets executed at a different price due to volatility. When the market moves too fast, the chances of slippage are higher. If you make a buy order at a price and negative slippage occurs, you buy the asset at a higher price than anticipated.

It is crucial to have a guaranteed stop-loss that will limit loss especially if you are trading a higher volume.

4. It is a tool when creating a trading strategy

It is a crucial tool if you are a volume trader using leverage. Forex traders can implement it as part of a trading strategy and reduce losses.

Disadvantages of guaranteed stop loss:

1. Many forex brokers charge fees for the GSLO

Many forex brokers charge a cost when you use the guaranteed stop loss. It helps protect the forex brokers from the losses they get exposed to in case of a gap down or slippage. For some forex brokers, the guaranteed stop loss is a premium feature.

At times forex traders can pay for the premium guaranteed stop-loss, and take a long time to use it. It means that the financial market goes on normally, and the traders don’t need to place a guaranteed stop loss. With time it causes an extra expense for forex traders, even though the costs are small.

2. You could get stopped out too soon

If you set a guaranteed stop-loss too soon and the market makes a flutter before resuming a profitable course, you can get stopped out. It means that the broker closes your position, and you lose potential profits.

It is crucial to learn how to use risk management tools strategically. They can lead to losses when used inappropriately.

List of the 4 best Forex brokers with guaranteed stop loss:

1. Plus 500

It is a forex broker founded in 2008 and based in Israel and offices in the UK, Australia, Singapore, and Cyprus. It offers a wide range of trading instruments such as CFDs on cryptocurrencies, indices, shares, options, commodities, ETFs, and forex.

Regulation

- CySEC (Cyprus) and more alternatives

Account types of Plus 500

Plus 500 has two types of trading accounts,

The Standard account is a retail account most forex traders open. According to regulations, it has a minimum deposit of $100, and traders can access maximum leverage of 1:30 for forex brokers.

Another account is the Plus500 professional account, for expert traders and volume traders. It has an initial deposit of 500,000 euros and requires you to be an active volume trader to access this account.

Risk warning: 82% of retail CFD accounts lose money.

Trading costs

Plus500 has competitive fixed or variable spreads and has no commissions for its fees. It has an inactivity fee of $10 when your trading account is dormant for more than three months. It also has overnight fees for positions open overnight.

There is a conversion fee for deposits in any other currency, apart from the base currency. It has guaranteed stop-loss order costs, but the withdrawals and deposits are free. It accepts various payment methods such as credit/debit cards, Skrill, B pay, Trustly, Ideal, Giropay, and PayPal.

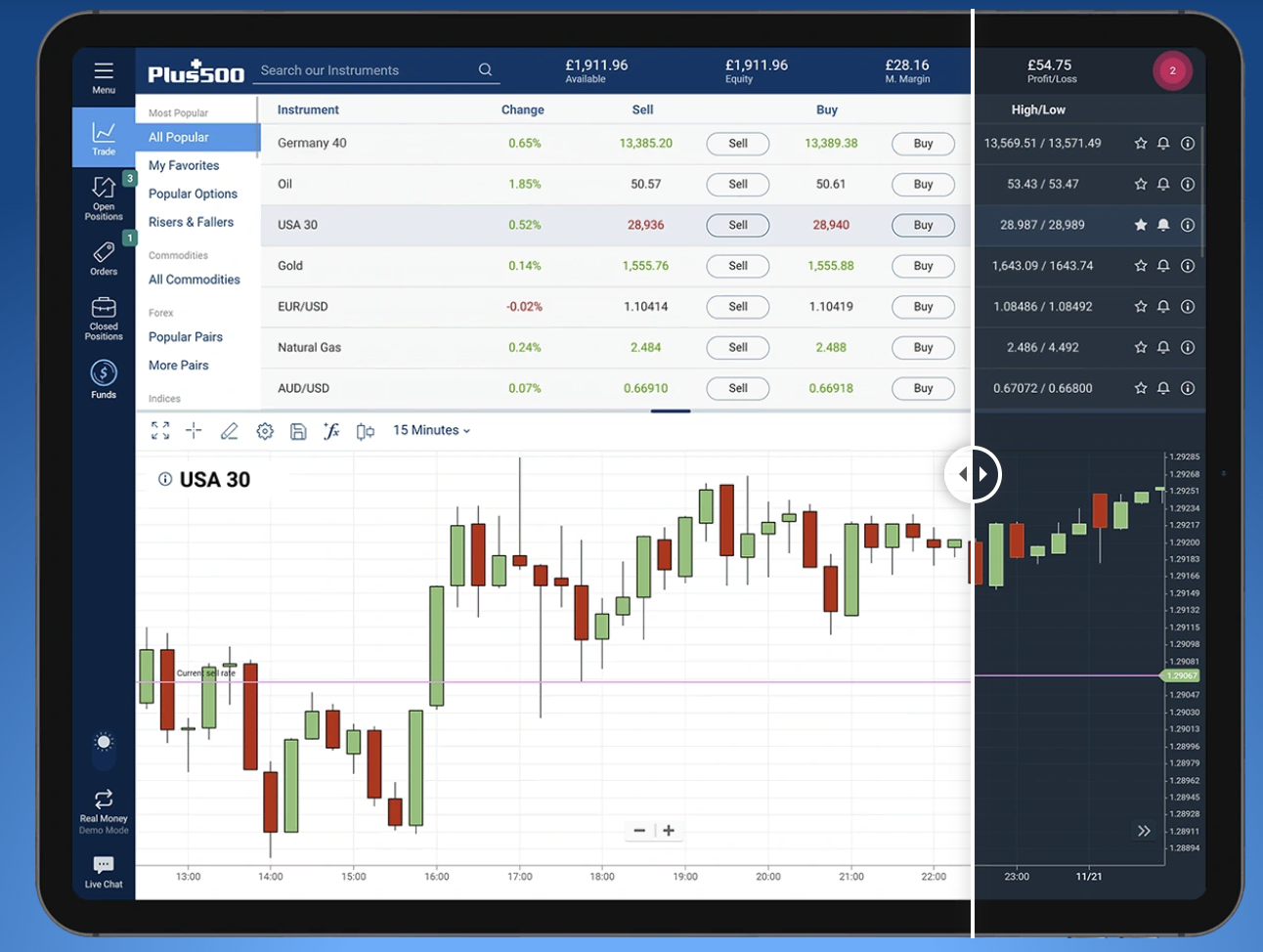

Features

- It has a free demo account for traders to test its account features.

- It has security measures like SSL data encryption. A separate account for client funds ensures that client funds are not mixed with company funds.

- It uses its proprietary trading platform Plus500 trading platform, which offers various trading tools such as charts, technical indicators, and drawing tools.

- It has risk management tools integrated such as stop loss, take profits, stop limits, and the guaranteed stop loss.

- The guaranteed stop loss enables traders to find how much loss to anticipate, limits risk, and has wider spreads.

- There are market news and analysis available on their trading platform such as articles about changes that affect the financial markets.

- Traders can get research tools such as trader sentiments, notifications on any market changes, and price alerts through emails or SMS on a mobile phone.

- Traders can access their trading accounts wherever they are through the mobile app, desktop, and website versions.

- Educational materials on Plus 500 include informative trading videos and articles about various trading instruments such as CFDs, options, and trading strategies.

- Traders can also find their eBook having lessons about the assets offered and how to navigate their trading platform.

- Their customer support is available 24/7 through emails, live chat.

Pros

- It has fast execution rates

- It has a guaranteed stop-loss feature

- Quality trading tools

- Userfriendly platform

- Regulation from tier-one regulators

Cons

- Limited research materials

- Limited trading instruments

Risk warning: 82% of retail CFD accounts lose money.

2. IG

It is a forex broker founded in 1974 and has 150,000 clients from 17 countries on five continents. It offers more than 17000 financial markets such as indices, currencies, shares, bonds, commodities, forex, ETFs, and cryptocurrencies.

Regulation

- Commodities Futures Trading Commission in the US

- Australian Securities and Investment Commission

- Japanese Financial Services Authority

- Monetary Authority of Singapore

- National Futures Association in the US

- Financial Conduct Authority in the UK

- Swiss Financial Market Supervisory Authority

Account types on IG

IG has trading accounts to suit diverse traders and offers seven various accounts. The trading account, Professional, Turbo 24, share dealing, Exchange accounts, Limited risk, and Options trading account.

The account availability depends on the country, as some are not available in other countries based on the regulations of that country. Their initial deposits also vary with the country, but for US clients, they have a minimum deposit of $250.

(Risk warning: 75% of retail CFD accounts lose money)

Trading costs

IG has spread as low as 0.6 pips for its retail accounts, and the commissions depend on the asset you are trading. It also has a maximum leverage of 1:30 for EU clients as per ESMA regulation, but for other traders outside the EU, they can get up to 1:200.

It has overnight and an inactivity fee of $18 for trading accounts that remain inactive for more than two years. Deposits and withdrawals are free except for credit cards that attract a deposit fee of 0.5%. it also has guaranteed stop-loss fees charged if you use this feature. IG accepts various payment methods such as bank transfers, debit/ credit cards, and electronic wallets.

Features of IG:

- It has a free demo account for new traders to start trading.

- It has four trading platforms, ProRealTime, DMA, MT4, and the Web Trader trading platforms.

- The IG and MT4 platforms offer premium trading features such as multiple charts with nine different time frames, 50+ indicators, a market manager, and a correlation tool.

- Pro real-time trading platform also offers trading tools such as 100+technical indicators, advanced charting software, filter tool, and the Depth of market.

- Traders can use one-click trading to access and manage different trading accounts at a time.

- The risk management strategies like stop loss, take profit, limit loss, and the guaranteed stop-loss order.

- The guaranteed stop-loss order is effective in CFDs, and spread betting, is available on the drop-down of the deal stop loss option.

- Traders can get research materials through the news feeds, daily blogs and videos, and the economic calendar available on their website.

- Its users can monitor their open position even without using the website since IG also has a desktop and a mobile application.

- Educational resources covering various financial instruments and topics are available through blogs, videos, and live webinars. It also has a mobile app with educational content for trading.

- Their customer care team is available 24/5 through live chat emails and phone calls.

Pros:

- Fast account registration

- Quality educational resources

- Industry-leading trading tools

- Guaranteed stop loss

- Registration from multiple jurisdictions

- Negative balance protection

Cons:

- Customer care is only available 24/5

(Risk warning: 75% of retail CFD accounts lose money)

3. CMC Markets

CMC Markets is a publicly-traded UK forex broker founded in 1989 and has grown to serve numerous trading brokers. Forex traders can access forex pairs, indices, cryptocurrencies, commodities, shares, ETFs, and treasuries on CMC markets.

Regulation

- Financial Conduct Authority

(Risk warning: 73% of retail CFD accounts lose money)

Trading accounts at CMC Markets

It offers three types of trading accounts, spread betting, CFD trading account, and corporate trading account. Forex traders can access more than 11500 trading instruments, and these accounts have zero initial deposits.

Trading costs

Spreads start at 0.3 pips with no commissions on the Spread betting account. The Corporate and CFD trading account has commissions when you trade shares from $10 per round turn. It also has rollover rates displayed when you open a trading position overnight.

It charges inactivity for accounts dormant for over a year and a guarantee stop loss fee (GSLO). Withdrawals and deposits are free, and traders use Bank transfers, credit/debit cards, and electronic wallets such as PayPal.

Features of CMC Markets:

- A free demo account for practices strategies using virtual funds.

- It has integrated two trading platforms, the next generation, and the MT4.

- The next-generation trading platform offers a variety of 12 charts, 35+ drawing tools, 80+technical indicators, custom and interval charts, price history of up to 20 years.

- Meta trader 4 also has one-click trading, a price ladder, three order types, Guaranteed stop loss, risk management strategies, and price alerts.

- It offers advanced charting software with full-screen mode and allows traders to look at four different charts at a time.

- It offers guaranteed stop-loss orders (GSLO) at a premium charge and has a 100% refund if unutilized.

- CMC markets have made it possible to access trading accounts through a phone with its mobile app, and a desktop version that compliments the website version.

- Traders can access automated trading on the MT4 trading platform thanks to the MQL4 programming language and the Expert Advisor to develop a trading robot.

- Research materials include trading insights, reports, Reuters news, CMC TV, its economic calendar, financial blogs on various topics, and current news on the market.

- It offers educational resources such as video courses and articles with detailed information about different markets.

- It also has webinars and events and analyses of events in the markets, strategies employed during trading, and video courses on how to use the risk management strategies like the GSLO.

- Their customer support is present 24/7 through live chat, email, and phone calls.

Pros:

- The fast account registration process

- Registered by tier-one jurisdiction

- Excellent customer support

- Wide range of educational materials

- Low trading fees

- Low initial deposits

- Numerous trading instruments

Cons:

- High initial deposit on the professional account

(Risk warning: 73% of retail CFD accounts lose money)

4. Easy Markets

Easy Markets is a forex broker that has served for more than two decades since its launch in 2001. It offers various trading instruments such as metals, commodities, options, indices, forex, and cryptocurrencies.

Regulation

- Financial Services Authority of Seychelles

- Financial Services Commission from the British Virgin Islands

- Australian Securities and Investments Commission

- Cyprus Securities and Exchange Commission

(Risk Warning: Your capital can be at risk)

Account types at Easy Markets:

Easy markets have three types of trading accounts VIP, Premium, and Standard accounts.

The Standard account has a minimum deposit of $20, and forex spreads from 1.7 to 2.4 pips. The Premium account has a minimum deposit of $2000, and forex spreads from 1.2 to 1.9 pips.

The VIP account for professional volume traders has an initial deposit of $10,000, and forex spreads from 0.7 to 1.4 pips. Traders can open position sizes from 0.01 lots.

Trading fees

It is commissions free on most of the trades, but there are overnight fees for open accounts overnight. It also has no inactivity fee and leverage from 1:200 to 1:400. Deposit and withdrawal are free, and it also has no account maintenance fee.

It accepts various payment methods such as credit and debit cards such as Visa/Maestro and bank transfers. It also has digital wallets like Skrill, Neteller, Fasa pay, Perfect money and Stic pay.

Features of Easy Markets:

- It has a demo account that traders can test its trading platform.

- It uses two trading platforms, its proprietary Easy markets platform, and the MT4.

- Features on the Easy Markets include one-click trading, technical indicators, charts, and the inside viewer.

- The Easy Markets MT4 platform features include one-click trading, built-in indicators, Historical data covering more than 20 years, and fixed spreads.

- With fast market execution rates from the two trading platforms, traders can cancel a losing trade for a small fee.

- It has a freeze trade tool that traders use to trade at a price for a short time and take advantage of that period in a volatile market.

- Traders can access risk management tools such as a free guaranteed stop-loss to assist traders limit losses in a volatile market.

- It offers negative balance protection, a tool that protects investor funds from complete depletion if the market goes against them.

- It has an Islamic account offering the same trading features as other trading accounts, including the guaranteed stop loss and negative balance protection.

- Research resources are in the market analysis section with deep market insight, live charts, currency rates, and current market news articles.

- The education section has the Easy Markets academy, with a free trading course for new traders. The course covers basic trading knowledge on how to implement trading strategies.

- It also has video courses that teach negative balance protection and guaranteed stop loss.

- Other educational resources include guides, e-books, videos, and the trading glossary.

- Customer care is available 24/5 on emails, phone calls, live chat, and social media platforms.

Pros

- Fast order procession speeds

- Negative balance protection

- Registration from tier-one jurisdiction

- Quality trading tools

- Extensive educational content

Cons

- Limited research materials

(Risk Warning: Your capital can be at risk)

Conclusion – Knowing that the stop loss is guaranteed provides peace of mind

Traders should invest in understanding what a guaranteed stop loss is and how it works. It is a trading tool that can help a trader in a volatile market. It is also a tool that traders can implement in their trading strategies.

Few forex brokers offer the guaranteed stop loss. It is why traders should do their research well if they want a forex trader with risk management tools.

FAQ – The most asked questions about Forex brokers guaranteed stop loss:

Can I pay for a guaranteed stop-loss?

Some forex brokers offer guaranteed stop loss as a premium service that you pay after a month. Some charge you once triggered, while forex brokers also have a free guaranteed stop loss.

What is the difference between a stop loss and a guaranteed stop loss?

The regular stop loss can be affected by factors like slippage and closing your trade at a different price than what you order. A guaranteed stop-loss ensures that the position closes at the price you indicate at whatever market conditions.

What does forex guaranteed stop-loss mean?

Guaranteed stop losses ensure that your open trades are closed if the market declines below a certain level. This means that you wouldn’t suffer an unanticipated loss despite any major volatility and gapping.

Do good brokers provide guaranteed stop loss orders?

Yes, they do. Price fluctuations can occur more quickly than platforms can keep up with, making guaranteed stop losses useful in turbulent market conditions. A guaranteed stop loss ensures that you’ll never lose more money than was originally projected when the position was initiated.

Who should utilize guaranteed stop loss orders?

For new traders with minimal expertise in forex trading, guaranteed stop-loss orders are indeed a great risk management tool because the premium order type enables you to control losses if markets go against you.

Do guaranteed stop loss brokers require payment from me?

Only if the market declines to or below that level will you be responsible for paying for the guaranteed stop loss. You won’t pay to utilize the guaranteed stop loss if you close the transaction before that occurs or if the market doesn’t decline.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5)