5 best DMA Forex brokers & platforms – Direct market access execution in comparison

Table of Contents

See the list of the 5 best DMA Forex brokers:

Broker: | Review: | Offers direct Market access: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | Yes | IFSC | 9,000+ (40+ currency pairs) | + Many awards + Huge diversity + Many account types + Leverage up to 1:2000 + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Capital.com  | Yes | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (138+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 76% of retail CFD accounts lose money) | |

3. Vantage Markets  | Yes | CIMA, ASIC | 180+ | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

4. IC Markets  | Yes | ASIC, FSA, CySEC | 232+ | + Supports MT4 & MT5 + No hidden fees + Spreads from 0.0 pips + Multi-regulated + Fast support team + Secure forex broker | Live account from $200(Risk warning: Your capital can be at risk) | |

5. XM Forex  | Yes | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Cheap trading fees + No hidden costs + Regulated and safe + International trading + 1000+ assets | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) |

The search for the best direct market access (DMA) forex brokers can be a challenge in that there is a variety of forex brokers to choose from. One of the reasons traders scout for DMA brokers is the opportunity to trade deep liquidity and avoid market makers or brokerage firms altogether.

In most cases, Forex brokers make DMA accounts only accessible to VIP clients, professional traders, and institutional traders. This is because these traders can afford the cost of the sophisticated technology used in direct market access. Also, experienced traders execute large order trades, and the DMA facility fast and accurately executes trades, with minimal trading errors and reduced costs.

The evolution in the forex market from how orders were placed traditionally to screen-based trading and technological improvements has made room for even more investors in the market. However, the advent of direct market access has been a game-changer in recent times.

Direct Market Access uses APIs (Application Programming Interfaces) to view prices directly from liquidity providers, access current and historical data, evaluate trading performance and execute trades without the help or interference of a broker or market maker.

Direct market access works ideally with algorithmic trading to help buy-side and sell-side traders to achieve fast execution of institutional-sized orders. Direct market access is targeted at highly active traders seeking precision execution and quick access to liquidity.

DMA brokers are not the same as regular or conventional brokers who work with traders. Traditional traders mainly cater to retail traders, whereas DMA brokers tend to have a higher concentration on institutional and VIP traders. Moreover, indirect market access focuses on execution rather than research and fundamental analysis function.

Choosing a good DMA broker is one of the most important decisions to make as a trader or investor in the modern trading structure.

This guide will give you a comprehensive insight into direct access trading, features to look out for before choosing a DMA broker, and a list of brokers who offer direct market access.

(Risk warning: 76% of retail CFD accounts lose money)

What is direct market access (DMA)?

The direct market, also known as DMA, is an electronic trade execution system where trades are performed directly by traders and investors on order books. An order book is an electronic list of orders, including buy and sell orders, used by an exchange to record market interest or market depth for a specific financial instrument. It is organized by price list.

Before now, to place orders in an order book, traders had to rely on brokerage firms as an intermediary. However, with direct market access, individual investors and traders can bypass forex brokers and trade directly with large investment banks, market makers, and liquidity providers.

Although direct market access involves using advanced technology infrastructure owned by sell-side firms, trading with a DMA account provides the best possible prices on the market with the aid of intermediaries.

Traders also have more control to trade on the best bids and offers sourced directly from market makers or liquidity providers. They are also exposed to multiple levels of transparency.

Electronic trading and liquidity are requirements for direct market access. This is why the foreign exchange market uses this trading method, as it offers individual investors direct access to the financial market exchanges.

Direct market access gained popularity in the 1990s, and it is recommended for advanced traders in the forex market. Some of the entities that own and operate direct access markets include broker-dealers and market makers, also known as sell-side firms, and sell-side investment banks also have direct access markets.

Although individual investors can execute trades directly by interacting with an electronic order book, orders are still sent in the broker’s name and not in the trader’s name. The brokerage firm acts as your agent, giving you the unrestricted access you need. However, the liquidity provider is trading with a broker and not a retail trader.

Besides private traders, sell-side firms offer sponsored access to buy-side firms. Sponsored access is the process by which sell-side firms give out their technology infrastructure and direct market access trading platforms to buy-side firms who seek to control the DMA trading activities for their investment portfolios. Buy-side firms are firms that purchase investment securities. They include hedge funds, insurance firms, pension funds, and mutual funds. In addition, the buy-side may go ahead to offer direct access to market services to individual investors or traders.

Most companies that offer direct access to markets merge it as a service provided in combination with access to complex trading strategies like algorithmic trading. This is one of the reasons why the direct access market is more suitable for experienced traders and investors seeking to place large volumes of transactions.

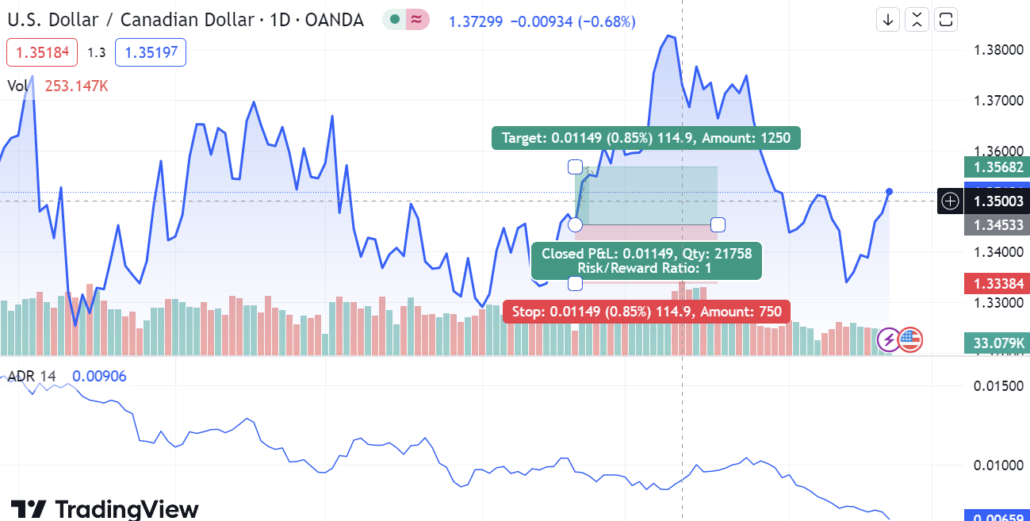

Leveraging direct market access, investors can take advantage of rapid price opportunities in the forex market. The main focus of direct market access is on speed. A fraction of a second can make all the difference in the foreign exchange market. Moreover, DMA allows traders to become market makers rather than price takers.

Direct market access also requires no human intervention between the client and the exchange, as the processes are electronic and automated.

(Risk warning: 76% of retail CFD accounts lose money)

How does DMA work?

Direct market access requires sophisticated technology and infrastructure, which sell-side firms usually own. These technologies and infrastructure are generally expensive to buy or build. Their maintenance cost is also on the high side.

DMA brokers work in direct contact with the banking institutions trading on the interbank market. An interbank market is a global network used to trade currencies directly between themselves. Financial institutions use them.

These banking institutions provide liquidity and deal in large volumes of foreign currencies. In addition, private traders can access actual market prices because brokers aggregate bid-ask prices from liquidity providers and transfer them to their clients.

In the time past, brokers act as market makers. This means they are on the other side of the trade, trading against the client. They offer a buy-and-sell quote and profit from the difference in price – spread or commission charged. This operation structure is referred to as a Dealing Desk.

The brokers in the Dealing Desk operation structure work as agents. The goal is to facilitate trades of financial instruments such as forex on behalf of their clients (the private traders)

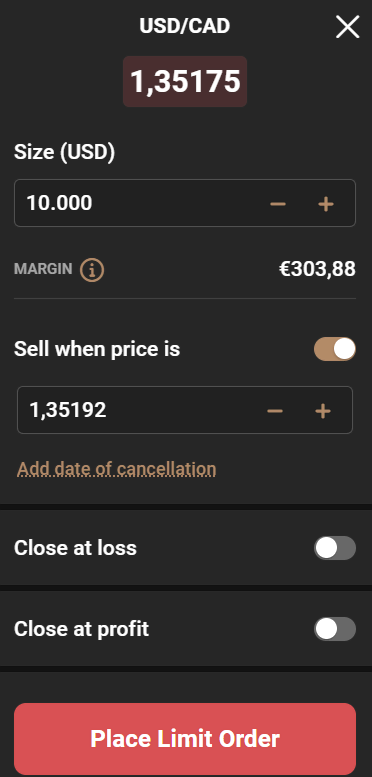

On the flip side, with a DMA broker, the operation structure is known as a No Dealing Desk (NDD), and the brokers that work in the direct market access industry are known as NDD brokers. This is because DMA affords traders the flexibility to control their operations. For example, they can submit their price proposals independently and manage their transactions instead of taking quotes from brokers.

When private traders work with DMA brokers, they get access to the market depth and receive numerous quotes, after which they can pick an ideal bid-ask price from one of the liquidity providers. The transaction is instant as the direct market access broker sends the order directly to the interbank market for execution.

Direct market access depends on fast internet connection or direct P2P connectivity in terms of technology. This can be executed using APIs (Application Program Interfaces). In addition, API-based DMA solutions are designed for automated trading. This way, there is minimal latency and maximum performance.

High-frequency trading and algorithmic trading would be non-existent without Direct market access (DMA). This is why API-based DMA solutions have become prevalent in the forex market.

The DMA brokers do not charge any commission, so how do they make their money? They earn profits by adding little mark-ups across all the spreads they send to traders from liquidity providers.

Also, some DMA brokers charge volume and inactivity fees monthly. These fees are charged to large-order traders who do not trade often. They have to pay for using the direct market access benefits at their convenience.

Direct market access is becoming a high demand in the foreign exchange market because it is a highly liquid market with over $5 trillion in daily transactions. Regardless, the profits garnered from direct market access are relatively small. This is why it is better recommended for advanced traders or more active traders.

(Risk warning: 76% of retail CFD accounts lose money)

Advantages of direct market access:

1. Direct access to price rates from liquidity providers

With the direct market access operation structure, investors or traders can see price rates straight from liquidity providers who have their standard ask-bid offer. They are afforded absolute transparency of an exchange order book and the orders contained therein. This eliminates the obstacles of partial order fills, rate rejections, and re-quotes.

The anonymity provided by the direct access market structure is especially beneficial to institutional traders who do not want anyone to find out what currencies they buy or sell.

2. Fast order execution

The elimination of an intermediary – a broker in the direct market access structure, facilitates quicker execution of orders. Traders no longer have to wait for their orders to move from broker to liquidity providers. Instead, they are carried out directly and immediately.

A short trading process increases the speed at which transactions are performed. Traders who perform large financial transactions benefit more from this as they can execute numerous trades within a day.

3. Greater efficiency and cost-saving

Another benefit of DMA trading is its effectiveness, mainly because it is technology-driven. Traders are also not required to pay any commission fee to their brokers, as brokers can profit little from mark-ups to their spreads. In addition, these spreads are usually fixed.

Traditionally, traders or investors were required to pay broker fees for using their services. The fees are for investment advice or to execute orders on the sale or purchase of currencies. These fees are no longer needed to leverage direct market access and the no human intervention structure.

4. The investor’s confidential information remains confidential.

One of the challenges traders faced in time past was the fact that there were cases when their confidential details, such as name, address, and bank account number, were leaked. However, direct market access lowers the risk to the barest minimum, as there is no third-party involvement.

Private traders or individual investors use the DMA provider’s identity instead of theirs in the trading process. This level of security also protects traders from cyber crimes, which are increasing daily.

5. Access to premarket and postmarket auctions

Auction participation is also an advantage of the direct market access platform. Traders and individual investors can participate in the opening and closing auctions where the prices are the highest or lowest.

This implies that traders can access even more profitable opportunities as the liquidity is higher during auctions. As a result, traders can take advantage and trade better, making more profits. However, there can also be cases of losses.

(Risk warning: 76% of retail CFD accounts lose money)

Disadvantages of direct market access:

While DMA trading is beaming with opportunities and advantages predominantly for advanced and large order traders, there are also disadvantages and risks to look out for to have a balanced and better trading experience. Let’s learn about some of these disadvantages.

1. Use of complex technology

Direct market access requires complex technology and infrastructure to enable automated trading and produce the kind of results seen. However, this infrastructure is quite expensive to purchase, build or maintain. It is, therefore, not accessible to many firms.

This is why companies that offer direct access markets provide it as a combined service. They merge DMA with access to advanced trading strategies like algorithmic trading and High-frequency trading.

2. Penalty tees for inactivity

Although one of the benefits of direct market access is that it is cost-effective because of the elimination of broker involvement, traders who do not trade actively are charged with inactivity. This implies that traders who use DMA providers have to trade actively to avoid such penalty fees.

Therefore, it is more profitable for professional traders and institutional traders who frequently trade large orders daily. In addition, the minimum deposit levied on traders who want to register a DMA account is relatively high because of the functions and benefits. This is why it is ideal for advanced traders and large firms who can afford these inadequacies.

3. Price differences

When compared to prices offered on the over-the-counter market, the variation isn’t exactly huge. That is, the prices are not necessarily better in comparison. In addition, as a result of the regulations that ensure traders are executed seamlessly, trading activities are not as flexible as over-the-counter methods.

OTC trading methods offer more flexibility for traders. In fact, because of the absence of spreads in direct market access, traders are usually charged more for dynamic spreads.

Choosing the right DMA forex broker isn’t a walk around the park. Every financial investment requires deliberate research, good decision, caution, and mindfulness. This is why it is essential to ensure your DMA forex broker has the right features. Some critical features to look out for ina. DMX broker includes

- Provides highly specialized trading platforms

- Pricing

- Routes

- Excellent customer service

That being said, here are 5 top direct market access brokers in comparison.

List of 5 top direct market access brokers in comparison:

1. RoboForex

RoboForex is a trusted online brokerage company founded in 2009, and its headquarters is situated in Belize. It is regulated by the International Financial Service Commission (IFSC)

RoboForex offers traders five different types of accounts: Standard account, Micro account, Islamic account, VIP account, and ECN account. Their customer service is available 24 hours a day. In addition, they provide email and phone support. Unfortunately, RoboForex doesn’t provide LiveChat Support.

Besides PayPal and Skrill, traders can choose from four other funding and withdrawal facilities: Bank transfer, Credit Card, Neteller, and Payoneer. Traders are required to pay withdrawal fees but not deposit fees or inactivity fees. In addition, RoboForex offers 35 forex pairs, including major and minor forex pairs.

RoboForex offers direct market access. This technology provides zero delays in order execution in STP mode, no dealers, and no re-quotes.

(Risk Warning: Your capital can be at risk)

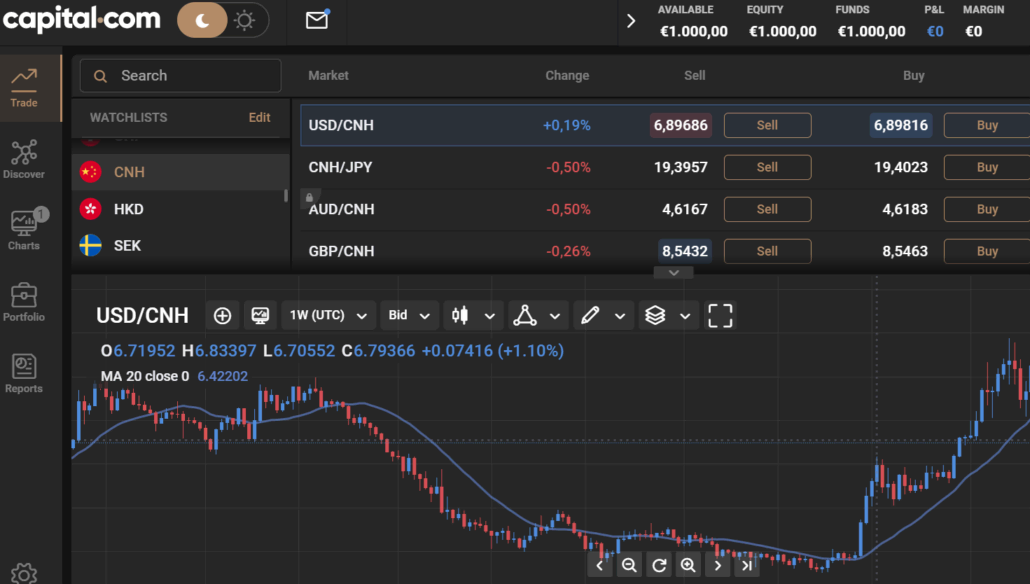

2. Capital.com

Capital.com is an online brokerage firm that started in 2016. The company accepts traders from more than 183 countries around the world. Capital.com is regulated by several jurisdictions like the United Kingdom and Cyprus.

Traders have access to over 3,000 assets, including 125 currency pairs. Capital.com ranks top in terms of instruments offered to customers. In addition, traders can receive live updates and price notifications for over 3,000 markets.

There are no hidden fees, and traders are not required to pay any commission. In addition, Capital.com offers traders fast order execution, low minimum deposit, a wide array of training material, online courses, and training guides. This is particularly beneficial to beginner traders.

It is a good choice for traders seeking technologically advanced platforms offering direct market access and other algorithms trading strategies. The payment types accepted include Wire transfer, debit card, credit card, Skrill, Webmoney, Neteller, Asian online banking, and others.

(Risk warning: 76% of retail CFD accounts lose money)

3. Vantage Markets

Vantage marketers, formerly known as Vantage FX, have been reliable, affordable trading for over 13+ years, with over 400,000 traders actively using this broker and 300+ CFD assets, including forex. In addition, traders have access to trading platforms such as MetaTrader 4, MetaTrader 5, Marker Trader, Web Trader, Mobile trading apps, Autotrader, Zulu Trading, MyFXBookand Trading view.

They are regulated by the Australian Securities and Investments Commission (ASIC, Financial Conduct Authority in the United Kingdom, and the Cayman Islands Monetary Authority in the Cayman Islands.

Vantage Markets is one of the DMA forex brokers that focus on algorithmic and automated trades where trades are executed within predetermined parameters. They also have an active customer support team that can be accessed 24 hours a day.

Traders also have access to a free demo account. This is an excellent opportunity for new traders to learn the ropes of the forex market before using their real accounts for trading activities.

Deposit and withdrawal facilities include Bank transfer, Skrill, Swift, BPay, Neteller, and Poli. Funds deposited via Bank transfer become visible in the account one day after the deposit is made, while funds deposited using credit or debit card show up in the account after 60 seconds,

Traders are permitted to withdraw manually or online. Most withdrawals are processed within a 12-24-hour interval. After a withdrawal is made, Australian traders can access funds the next day, while international traders have to wait several days for the money to reflect in their accounts.

(Risk warning: Your capital can be at risk)

4. IC Markets

IC Markets is a well-known Australian-based broker. They are regulated by the Australian Securities and Investments Commission (ASIC), one of the strictest regulatory bodies in the financial world.

The IC Markets platform provides various trading terminals, including MetaTrader 4, MetaTrader 5, and cTrader. It is especially popular among traders who execute trades using algorithmic and automated trading strategies.

Some of the benefits of choosing IC Markets are access to research and educational resources, deep forex liquidity, immediate order execution, excellent service for algorithmic traders, the spread of 0 pips, and competitive prices. It’s also ideal for scalpers, high-volume traders, and algo traders.

Traders also have the advantage of the low latency VPS service available at IC Markets. This is particularly beneficial to Expert Advisors. In addition, traders have access to a free demo account. This is a good idea for beginner traders who want to gain knowledge of forex trading. However, the demo account will be closed after 30 days of inactivity.

Although traders might be required to pay conversion fees, there is no charge for a minimum deposit.

One of the disadvantages of trading with IC Markets is the long wait period before the withdrawal. Traders are required to wait for about two weeks to process withdrawals via bank wires.

(Risk Warning: Your capital can be at risk)

5. XM

XM Group is an online brokerage company regulated by the Cyprus Securities and Exchange Commission (CySEC). The company has traders in about 156 countries around the world. XM brokers offer a personalized approach to individual clients and boast excellent customer service in multiple languages.

XM is a direct market access (DMA) broker. Traders can also access analysis and unparalleled tracking tools. The trading platforms available on XM include MetaTrader 4, MetaTrader 5, and cTrader. There are also multiple local payment options available.

(Risk warning: 75.59% of retail CFD accounts lose)

Conclusion – Choosing a DMA-forex-broker is useful in many cases

Direct market access is ideal for block trades. This is because the direct market access software can place a large number of traders all at once with high speed and immediate execution. This, in turn, empowers professional and private traders to have more control of their trading activities.

When choosing the ideal DMA Forex Broker to suit your trading strategies, it is essential to consider both the advantages and disadvantages of the broker’s offers and find how well it satisfies your trading needs.

FAQ – The most asked questions about DMA Forex Brokers:

What do you mean by DMA in forex?

DMA is an FX execution that provides traders access to the physical market without mediators. In general, FX trading gets carried out through a forex broker. They seek quotations from exchanges and market makers before presenting their users with the most competitive price. Traders can benefit from this feature on the trading platform.

What is the master mode in DMA?

DMA’s master mode is an operational low bi-directional tri-state line. It can be used by traders to import the data of peripheral assets during the DMA memory read loop. Those who are on forex trading platforms can get along with these features. It will make their trading journey smoother. Besides, traders will be able to mint more money with such innovative features.

What does 200 DMA forex mean?

The 200 DMA forex refers to the 200-day moving average. It is portrayed as a line on charts and depicts the average price over 40 weeks. It helps traders to understand if the trend is up or down. Furthermore, it also recognizes possible support or resistance areas. This feature is of great help to traders to get aware of the trend.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5)