5 best stock trading demo accounts in comparison for beginners

Table of Contents

With the number of tradeable stocks in the market, it is undoubtedly a difficult task to learn how to trade these efficiently. Of course, when it comes to any investment, we want to ensure we will benefit from it or know almost everything about the asset before taking cash out of our wallets.

This is where trading demo accounts come into play. In this review, you will read about the 5 best stock trading demo accounts to practice on. You will get some information on the broker and the products they offer.

See the list of the 5 best stock trading demo accounts here:

STOCK Broker: | Review: | Stock assets: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

2. Markets.com | 2,000+ | Starting 0.0 pips | 8,200+ | + Advanced trading tools + More than 8200 markets to trade + Only $250 minimum deposit + Accepts international traders + Over 25 languages supported | Free demo account(Risk warning: 67% of retail CFD accounts lose money) | |

3. XTB | 1,500+ | Starting 0.0 Pips | 3,000+ | + No hidden fees + Spreads from 0.1 pips + More than 3000 markets + No minimum deposit + Professional support team | Free demo account(Risk warning: 76% of retail CFD accounts lose money) | |

4. Admiral Markets | 2,000+ | Starting 0.0 pips | 4,000+ | + Many trading indicators + Great support with MT4/MT5 + Market news + Free demo account + Customizable platform | Free demo account(Risk warning: 76% of retail CFD accounts lose money) | |

5. Interactive Brokers  | 83+ stock exchanges | Starting 0.2 pips | 10,000+ | + Regulated in multiple countries + Four trading platforms with advanced trading tools. + Access to news stream and event calendars + Built-in analytics to judge trades + Workstation with a customizable interface | Free demo account(Risk warning: Your capital might be at risk) |

Our list of the 5 best stock trading demo accounts includes:

- Markets.com – Various markets to choose from

- XTB – Good allrounder for stock trading

- Admiral Markets – The “MetaTrader veteran”

- Interactive brokers – 43 years of experience in one platform

#2: Markets.com – Various markets to choose from

Markets.com was founded in 2008 and had been offering seamless trading and investments in different financial markets worldwide. With a wide range of assets and trading tools, this broker has won the award of Best Trading Platform 2020 and many more. Today, Markets.com is a part of a former TradeTech Group, Finalto Limited.

Markets.com offers more than 2200 market shares. Clients can trade stocks from the United States of America, Sweden, the United Kingdom, Italy, Spain, Denmark, Australia, Germany, Netherlands, Finland, France, Greece, Hong Kong, Poland, Portugal, the Czech Republic, Belgium, South Africa, Austria, and Norway.

The global markets are sorted into different categories. These categories are goods and services, technology, basic materials, financials, industrials, energy, healthcare, utilities, and telecom. Below is a list of their primary stocks.

- Tilray

- Amazon.com

- ITV

- Vodafone

- Rio Tinto

- Apple

- AMD

- Alphabet (Google)

- Netflix

- Deutsche Bank

- Barclays

- Tesco

- Tesla

- GlaxoSmithKline

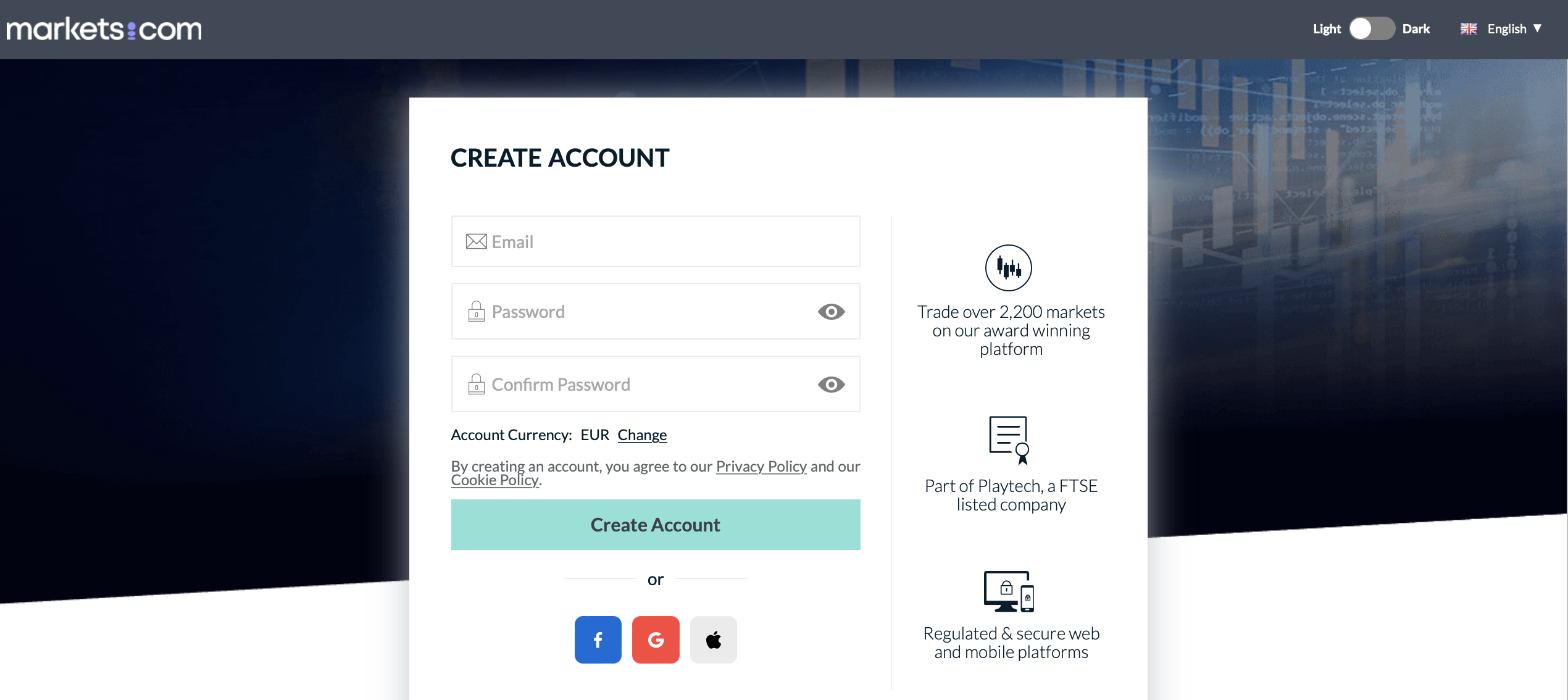

All these can be traded using their MetaTrader 4, MetaTrader 5, or their own proprietary trading platform, Marketsi or Marketsx. Signing up for a Markets.com demo account won’t take more than five minutes. You need to input your email and password, and you’re good to go.

Markets.com’s demo account comes with virtual funds that you can use to get the hang of their platform or devise your own trading strategy for the stocks you plan to invest in. You will be given the opportunity to practice trading with live market values and situations. It’s important to note that if your demo account has no new positions or is inactive for 90 days, Markets.com will automatically deactivate it.

This broker has a dedicated customer support team that can be contacted via telephone from Monday 12:00 midnight to Friday 11:55 PM GMT +2. They also have a live chat system that is available 24/5. They respond promptly and are sure to answer any of your questions.

Markets.com is not available for traders in India, Singapore, Puerto Rico, Hong Kong, Iran, Iraq, Syria, New Zealand, Turkey, Israel, Canada, Belgium, Japan, Brazil, the Russian Federation, and the United States of America.

(Risk warning: 67% of retail CFD accounts lose money)

#3: XTB – Good allrounder for stock trading

XTB is a Europe-based online asset trading broker. Founded in 2004, this broker is one of the leading European brokers in 13 countries like France, Germany, Poland, and the United Kingdom. With its 15 years of experience and award-winning innovative trading platform, XTB caters to more than 317,000 clients.

With XTB, you can trade stocks as CFDs with a leverage of up to 1:10. You can choose from 1875 shares from Belgium, Czechia, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States of America. Some famous companies you can find on XTB’s platform are Apple, Amazon, BMW, and Tesla.

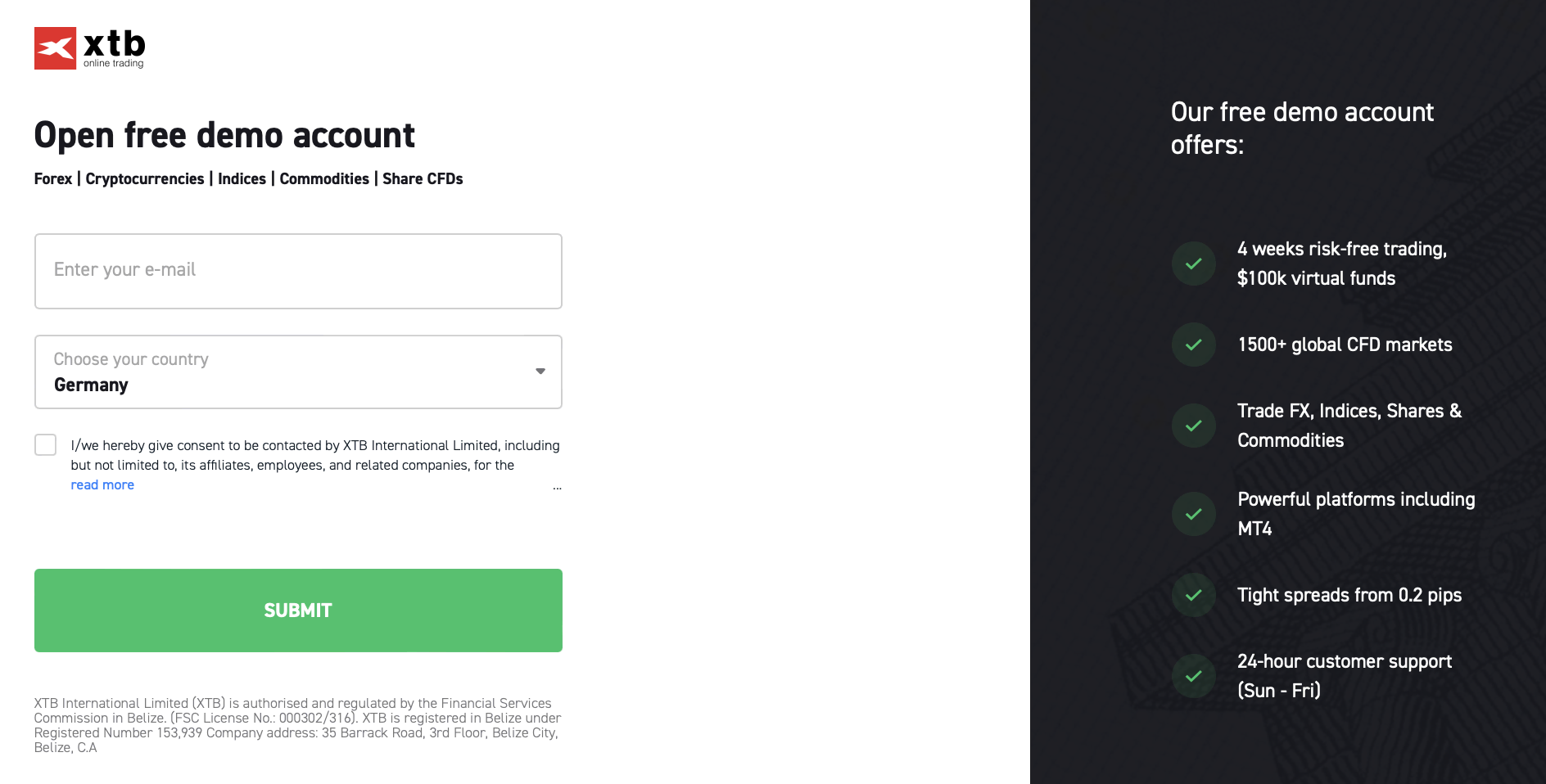

XTB has its own proprietary trading platform, xStation 5. This award-winning platform features fast execution speeds and a user-friendly interface. Availing of their free XTB demo account is very easy. Just enter your email address and your country of residence.

Once you have finished registering, you will be given a virtual fund of $100,000 and access to all their tools and features on the platform. You will have four weeks of risk-free trading to practice or familiarize yourself with trading stocks.

XTB’s customer service is available 24 hours every Sunday to Friday via live chat or email. Below is a list of telephone numbers and their corresponding supported country.

- Czech Republic – +420 228 884 063

- Turkey – +90 (212) 705 1020

- Mexico – +52 5541708767

- Brasil – +55 1142103750

- Colombia – +57 15800534

- Chile – +56 232629600

- Argentina – +54 1152357099

- Peru – +51 17124709

- Cyprus – +357 25725352

- Belize – +48 222 739 976

- Germany – +49 (0) 69 9675 9232

- Romania – +40 31 425 54 93

- France – +33 1 53 89 63 30

- United Kingdom – +44 2036953086

- Thailand – +66 2 026 1622

- Hungary – +36 1 700 8349

- Italy – +39 02 94752633

- Poland – +48 22 2739960

- Slovakia – +421 233 006 951

- Spain – +34 915 706 705 Extensión 2

- China – +44 2036953086

- Vietnam – +84 287 300 3301

It’s important to note that traders from Romania, Kenya, Iran, Iraq, Syria, Cuba, Ethiopia, Uganda, Bosnia and Herzegovina, Pakistan, India, Israel, Turkey, Mauritius, Singapore, Slovakia, Australia, Japan, Canada, and the United States of America are not eligible to sign up for an account with XTB.

(Risk warning: 76% of retail CFD accounts lose money)

#4: Admiral Markets – The “MetaTrader veteran”

Admiral Markets has an extensive global reach, with main offices in Estonia, Tallinn, Germany, and India. This broker was founded in 2001 and had since been offering its services to traders around the globe. They hold multiple titles, including Best Education and Training 2020.

With Admiral Markets, you can trade stocks as it is or as CFDs. There are over 3300 shares to choose from. This ensures maximum exposure to the different types of stocks available on the market. You can either sort these by exchange and country or sort by industry. Below is a list of exchanges and their corresponding countries.

- Australia – ASX

- Austria – VIE

- Belgium – Euronext

- Denmark – CSE

- Finland – NASDAQ

- France – Euronext

- Germany – Xetra

- Japan TSE

- Netherlands – Euronext

- Norway – NASDAQ

- Portugal – Euronext

- Spain – BME

- Sweden – NASDAQ

- United Kingdom – LSE

- Unites States – AMEX, NASDAQ, and NYSE

Some of the most well-known companies, like Tesla, Amazon, Apple, Twitter, Facebook, Coca-Cola, and Disney, can be found here. All these can be traded on their MetaTrader 4 or MetaTrader 5 platform. These trading platforms are great for traders who are looking to practice using the most well-known platforms.

Admiral Markets’ demo accounts allow would-be traders to get used to the platform without risking real money. To open a demo account, you will need to register by filling up the form on their website. They will ask for your country of residence, full name, email address, password, and contact number.

Once you’ve successfully opened a practice account, you will be given full access to their trading platform along with $10,000 in virtual funds. You will be trading in real-time with a 15-minute delay. You can contact their customer service if you come across any problem on their platform. You can either send them an email or message them on WhatsApp. You may also call their telephone number (+442035041540) if you have any queries.

Admiral Markets’ website supports a wide range of languages. These are English, Dutch, Spanish, Estonian, Croatian, Vietnamese, Arabic, Chinese, Italian, Portuguese, Russian, Czech, Indonesian, Bangla, German, Romanian, Latvian, Hungarian, Hindi, Khmer, French, Lithuanian, Polish, Slovene, Thai, and Korean.

Traders from Singapore, Malaysia, Japan, Australia, Canada, and the United States of America are not permitted to use the Admiral Markets platform.

(Risk warning: 76% of retail CFD accounts lose money)

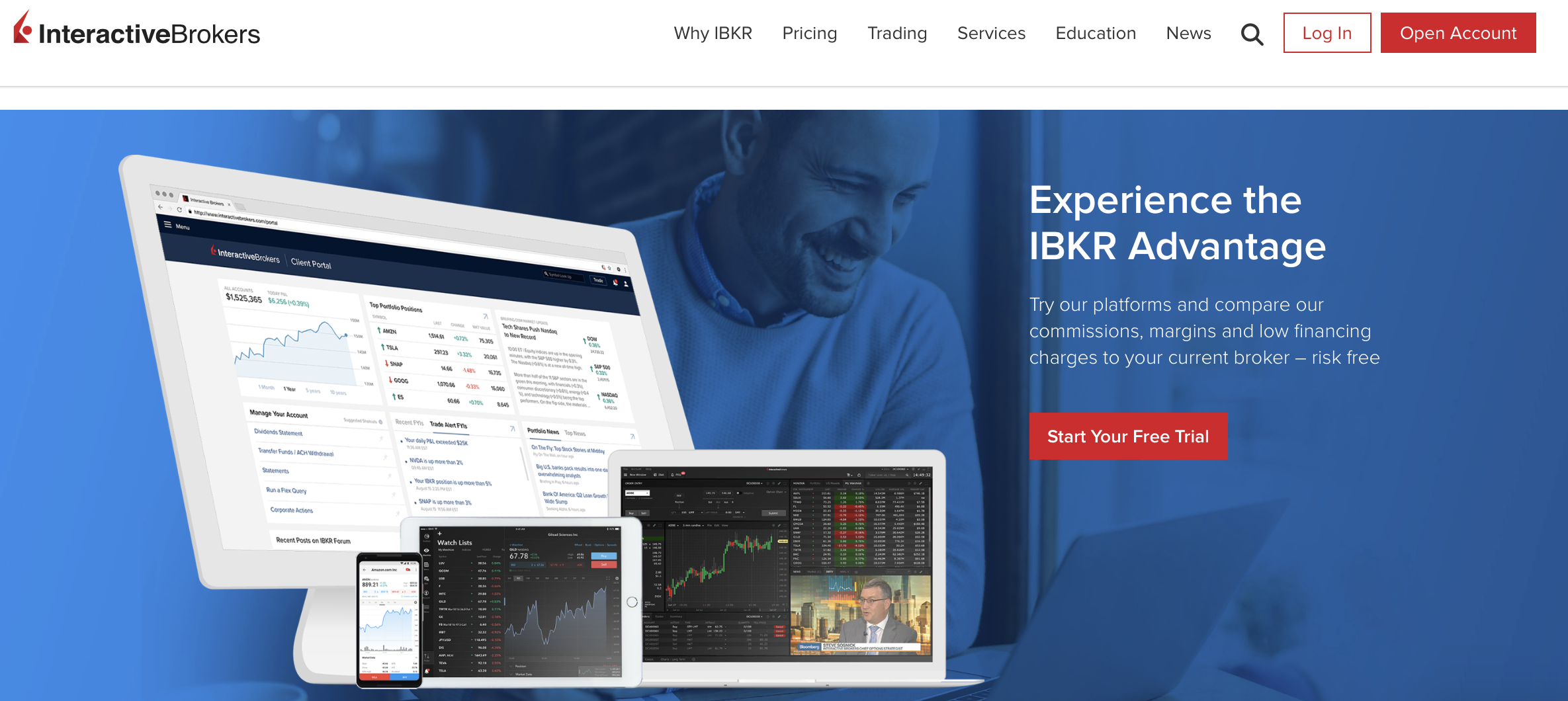

#5: Interactive Brokers – 43 years of experience in one platform

Interactive Brokers is one of the oldest online stock brokers on the market. With 43 years of experience, this company has an equity capital of more than $9 billion and executes more than three million daily trades. They have a global presence and headquarters in the United States, Switzerland, Canada, the United Kingdom, Hong Kong, Russia, Hungary, Australia, China, India, Japan, Singapore, Estonia, Ireland, and Luxembourg.

There are over 80 market centers to trade from on their cutting-edge and professional trading platform. Here is a list of the available regions and their corresponding market centers.

Asia Pacific:

- Australian Stock Exchange (ASX)

- Chi-X Australia

- Hong Kong Stock Exchange (SEHK)

- Shanghai-Hong Kong Stock Connect (SEHKNTL)

- Shenzhen-Hong Kong Stock Connect (SEHKSZSE)

- National Stock Exchange of India (NSE)

- CHI-X Japan (CHIXJ)

- JAPANNEXT

- Tokyo Stock Exchange (TSEJ)

- Singapore Exchange (SGX)

Europe:

- Vienna Stock Exchange (VSE)

- ENEXT.BE

- Nasdaq Baltic (N.TALLINN)

- Bats Europe (BATEEN)

- CHI-X Europe Ltd Clearnet (CHIXEN)

- Euronext France (SBF)

- Turquoise (TRQXEN)

- CBOE EU

- CHI-X Europe Ltd Clearstream (CHIXDE)

- Frankfurt Stock Exchange (FWB)

- GETTEX

- Stuttgart Stock Exchange (SWB)

- Tradegate Exchange (TRADEGATE)

- XETRA (IBIS)

- Budapest Stock Exchange

- Borsa Italiana (BVME)

- Nasdaq Baltic (N.RIGA)

- Nasdaq Baltic (N.VILNIUS)

- Euronext NL Stocks (AEB)

- OMXNO

- Warsaw Stock Exchange

- BVL

- Moscow Exchange

- Bolsa de Madrid (BM)

- Swedish Stock Exchange (SFB)

- VIRT-X (VIRTX)

- London Stock Exchange (LSE)

- LSE International Order Book (LSEIOB1)

- Tel Aviv Stock Exchange

North America:

- ArcaEdge (ARCAEDGE)

- Bats BYX (BYX)

- Bats Global Markets (BATS)

- Chicago Stock Exchange (CHX)

- Direct Edge (DRCTEDGE)

- Direct Edge (EDGEA)

- IB VWAP Dealing Network (VWAP)

- IEX

- Knight Securities

- Long-Term Stock Exchange (LTSE)

- Members Exchange (MEMX)

- MIAX PEARL

- NASDAQ (NASDAQ)

- NASDAQ OMX BX (BEX)

- NASDAQ OMX PSX (PSX)

- New York Stock Exchange (NYSE)

- NYSE American (AMEX)

- OTC Markets Pink (PINK)

- Alpha ATS (ALPHA)

- Chi-X Canada

- Omega ATS (OMEGA)

- Toronto Stock Exchange (TSE)

- TSX Venture (VENTURE)

- Mexican Stock Exchange (MEXI)

Interactive Brokers’ trading platform is fully customizable and relatively user-friendly. They offer prospective clients the opportunity to test their platform without risk. This allows you to trade in a simulated environment whenever you want.

It’s common to have questions or concerns. You can contact Interactive Brokers’ customer support via email or telephone. However, their website features a help desk with FAQs. This should be enough to address most concerns.

This particular broker is very strict when it comes to their clients. They only accept traders from the United States, Canada, and the United Kingdom.

(Risk warning: Your capital can be at risk)

What is a stock trading demo account?

A stock trading demo account, as the name suggests, allows you to trade stocks or CFDs for stocks. Although you do not become a part-owner of a company by buying the underlying stock, you get to experience what it feels like to buy and trade stocks and shares through your designated broker.

You’ll be given virtual funds to trade whatever company you wish with realistic trading conditions such as margin, leverage, and spread. Other conditions, such as added commissions or receiving dividends through your demo account, depending on the broker you choose. However, most of the features offered by your chosen broker may most likely be accessed by you. This includes research for technical and fundamental analysis, tutorials and guides on trading and their platform, and access to charts and watchlists.

Depending on the broker you choose, the virtual funds credited to your demo account may vary but is usually more than 10,000 USD. Trading with leverage and margin trading allowed will also vary per broker, so check that. Some brokers will also limit your use of demo accounts by only letting their clients use them for a month. However, since demo accounts are free, you can create another if your previous one expires.

Why should you use a stock trading demo account?

The best thing about demo accounts is that they are risk-free and hassle-free to create. Usually, you only need to put in your email address and name to create an account. With unhindered access to most of the features on the platform your broker offers, you can freely explore what they offer and their trading conditions. Some brokers only offer the more popular indices, while others expand their range of products to include smaller markets, bringing about more trade opportunities. Knowing what your broker offers will assist you in deciding your desired trading partner.

Being a risk-free way to learn, you get to experiment with your own trading styles or perhaps even use trading bots. You can even discover or create a new trading strategy by mixing and matching different indicators. Depending on the platform, you can create your own trading bots or modify an existing one.

Notice:

Some new demo account users may encounter CFDs and options for the first time when trading using a stock trading demo account. This is an excellent way for them to learn more about these, as they can significantly affect your trading.

Since options trading has more risks and more complicated terms, having a demo account enables you to practice and create multiple strings of options trades without the fear of losing money.

Generally, having a demo account prepares you for actual live trading. You experience competitive or wide spreads depending on the asset you choose to trade. You also learn which stocks are worth trading by observing trends related to demand or their fundamental factors.

For veteran traders, it is never wrong to hone acquired skills or test new ones. Some may even use this opportunity to gain back their confidence in the event of a losing streak.

Additionally, some brokers offer perks to their clients in the form of a contest. Whichever demo account tops the leaderboards in terms of gain will win a cash prize credited to their live account.

Advantages and disadvantages of a stock trading demo account

Although most stock trading demo accounts also offer the opportunity to practice trading other asset classes, some do not. This hinders the chance to transition to learning more, especially if the stock trading is not your forte which could be in forex or in options trading.

Depending on your broker, you might not have access to CFDs or Contracts for the difference, allowing you to go either long or short, depending on your chosen trade direction. Also, some won’t allow you to use margin or leverage until you meet set conditions and criteria directly linked to your account.

While most brokers offer significant exchanges in their list of available products, some do not offer markets in Asia, where many trends and opportunities can be found. Not only this, but if they offer other exchanges, not all listed stocks will be available. It is best to double-check what assets are being offered for each broker to maximize your potential.

Remember that your selected broker might not offer the stock you want, given that it might be in another market or probably because it was just listed recently. It is always best to test out the limits of what your broker can offer in terms of market coverage.

How to trade stocks – Quick tutorial for aspiring traders

Stocks are one of the most accessible asset classes to trade because they usually only trade in a single direction, and you only have to either buy a stock that you want or sell it if you want to exit your position.

Upon creating your account and logging in to your demo account, depending on your trading platform, you’ll see charts, a watchlist, and your own personal portfolio, which you’ll be filling up with stocks you have purchased.

The first thing you need to do is to select a stock that you want to trade. If you have difficulty choosing one, you can use market screeners that will filter out favorable trades that follow your trading rules and conditions. A third-party screener is readily available online if your broker doesn’t have a built-in screener.

Once you have selected the stock that you want, be sure also to check its chart to familiarize yourself with its trend and possible risk if it ever goes down or if it doesn’t go in your favor. You can do this through the identification of supports and resistances.

You must also set up your trade by inputting your desired trading volume at a specific price. If you want your trade to be filled or executed immediately, you can select “market price” or choose a high bid price.

Depending on your broker and if the product offered is a stock CFD, there might be an option to adjust the leverage on your trade. You can do that while entering your trade.

To close a position, you need to navigate your way to your portfolio and select the stock you wish to sell. If available, you can click on the X mark on your portfolio, or you can manually sell a position by doing the same steps above when you first bought the stock but changing the desired trade to “Sell” instead of “Buy.”

Tips and tricks for stock trading

One of the best things about stock trading is the diversification of industries and companies available for trading. To find the best stock to trade, you must first find the industry trending the most. For example: During the 2020 rally of stocks, the Electric Vehicle sector was one of the biggest winners. Within this sector, you can filter out each stock based on volatility and trend. You would find out that Tesla was the fastest mover in the first few months, but in the later months, Chinese EV companies and smaller EV companies took the lead.

To assist you in finding out the fastest industry, an indicator called Relative Strength is applied, which would find the top sectors that are the strongest and rank them on a percentile basis. This indicator shouldn’t be confused with a stock’s RSI (Relative strength index), which measures the strength of each stock based on its past movement, whereas its counterpart compares a stock or industry with other assets.

Notice:

One key factor in success in stock trading is the ability to discern your appropriate risk per trade. If a trade goes wrong, you should be able to limit your losses while maximizing your gain if you are right. Practice and backtesting are critical, so be sure to utilize the demo account as much as possible.

One of the best strategies a stock trader could also use is trading stocks that have recently reached their all-time high. There is a tip in the trading world in that whatever goes up will continue to go up until the trend is broken.

Conclusion – The best stock trading demo accounts are listed above

Our list of the 5 best demo accounts for stock trading offers a wide range of platforms for beginners and experienced traders. From Markets.com as a simple and user-friendly platform to Interactive Brokers, which has over 43 years of trading experience. When choosing a demo account for stock trading, you should look at the trading conditions and costs, as well as the available features and markets. We recommend opening a free demo account with Markets.com to practice and test stock trading.

FAQ – The most asked questions about stock trading demo account:

What is a stock trading demo account?

A stock trading demo account is a practice account that helps novice traders get an idea of actual trading strategies and methods. If you are a new stock trader, the demo account can help you know what to search for while trading in the stocks.

What is the focus of the stock trading demo account?

The stock trading demo account focuses chiefly on helping new traders know trading practices in the stock markets and exchanges. The demo account prepares novices for their future transactions in real-world stock trading. The demo account aims to make the stock trading journey of potential traders smoother. It also helps professional traders try new trading strategies in real-world stock trading before implementing them.

How can I open a stock trading demo account?

Opening a stock trading demo account with a forex broker is a breeze and quick. You can open the account online, by SMS, phone, or email. You can also open the demo account by visiting the broker’s office in person. While opening the demo account online, visit the broker’s website, select the “Open Account” option, complete the registration form, and press the “Submit” key.

Last Updated on September 30, 2024 by Andre Witzel

(5 / 5)

(5 / 5)