How to trade Bitcoin: An all-inclusive guide to Bitcoin trading

Table of Contents

The volume of traders engaged in trading Bitcoin has increased recently. The bitcoin market makes a great market for trading because of the massive volumes of trades that occur on a day-to-day basis. This article covers an extensive guide about bitcoin trading. By the end of this article you will learn more about bitcoin trading, trading strategies, and tips, and explain why profit-seeking traders need to delve deeper into the world of bitcoin. Let’s begin with the trading platform and company to use.

How to choose the best Bitcoin brokers

The Bitcoin trading platform is one of the most important decisions to make if you want to trade bitcoin. There are a few things you need to know about Bitcoin Brokers o enable you to choose appropriately.

Some brokers specialize in bitcoin trading and other altcoins, while others allow less bitcoin trading. There are equally brokers that offer specific products. IQ Option, for instance, not only offers standard bitcoin trading through Forex pairs or CFDs, but it also offers bitcoin for trading through multipliers. This type of Bitcoin Broker offers more leverage, so their risks and rewards are equally higher. These advanced bitcoin financial products are a useful part of bitcoin day trading.

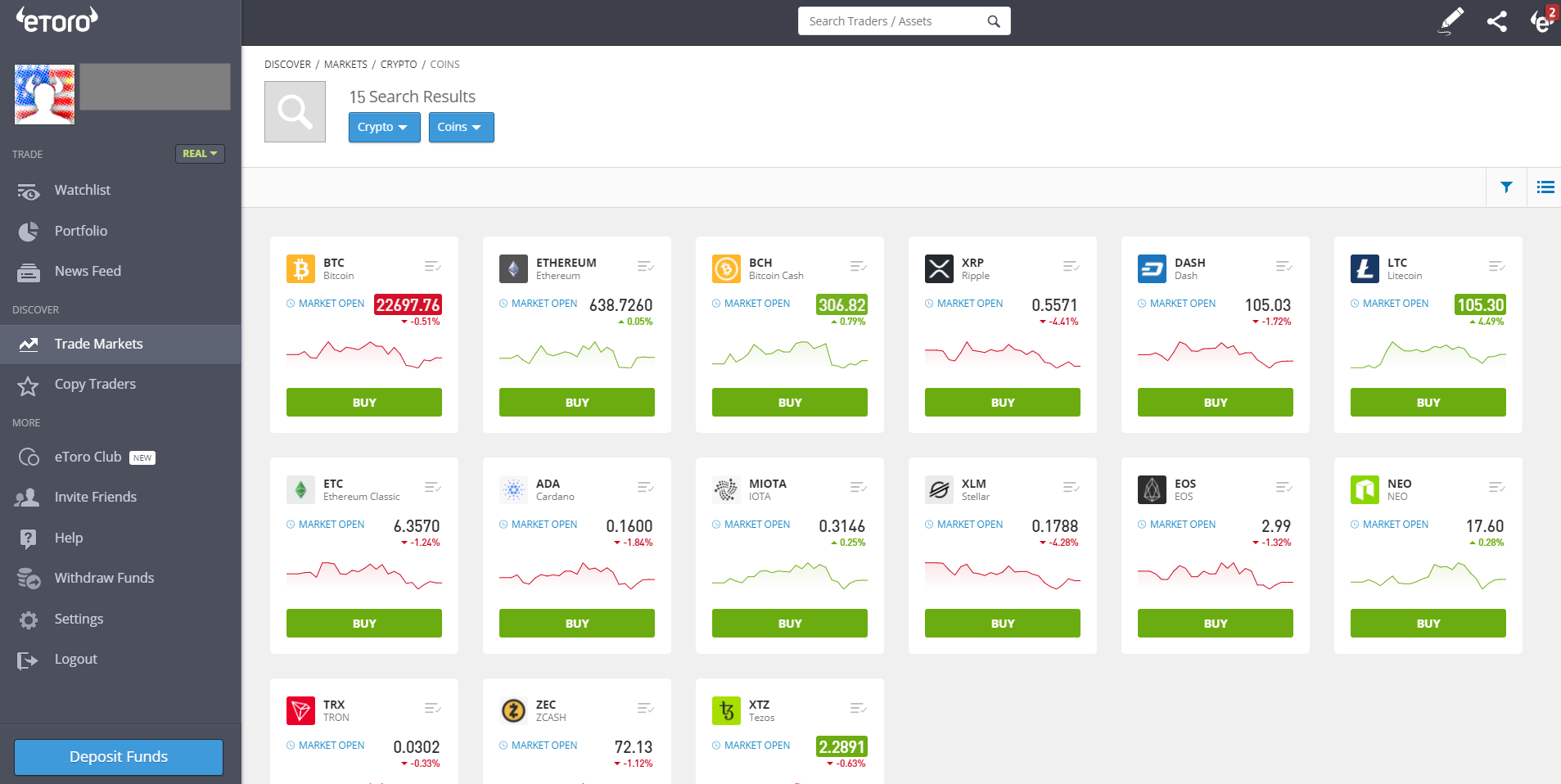

In the table you will see the best Bitcoin Brokers list:

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

Some of the features you need to search for in a bitcoin broker include the following:

1. Trading Apps & Software

Day traders should regularly watch their open position or the market because not responding to important news events in realtime can greatly affect their profit and loss. Many bitcoin brokers, therefore, offer convenient and user-friendly mobile apps to traders to make responding to market situations on the fly possible. With a mobile trading app, you can trade anywhere you are, and at any time of the day.

The bitcoin trading company you subscribe to will determine to a great extent your success because you will spend a lot of time on their platform every day. Therefore, search for a platform that suits your trading style and needs. Bitcoin exchanges such as Coinbase provide users with comprehensive platforms like the company’s Global Digital Asset Exchange (GDAX). We recommend creating a demo account first to ensure you have the necessary equipment and technical resources for trading bitcoin before opening a live account.

2. Fees when doing Bitcoin trading

Different bitcoin exchanges offer differing trade commissions and fees. Trading requires placing high volumes of trades. Therefore, only a small price difference can significantly reduce your profits. You can compare 3 key types of fee structures:

- Exchange fee: The amount you pay to use the bitcoin software. The crypto coins you trade can affect the exchange rate.

- Transaction fees: The amount you pay for transactions that involve the conversion of bitcoin to other cryptos and back. The maker charge is a charge you pay for offering to sell a bitcoin. The taker fee is the charge you pay for receiving an offer from someone.

- Deposit and Withdrawal Fees: The fee you pay for depositing and withdrawing bitcoin from the exchange. You will frequently discover that the deposit fee is less than the withdrawal fees. Another important fact to bear in mind is that some exchanges do not accept payments from credit cards. By standard, if you decide to pay with a debit/credit card, you will be charged a fee of say 3.99% while a 1.5% fee will be debited from your bank account.

In conclusion, choosing a bitcoin broker is not an easy decision to make. Do your research well before opening an account, read reviews, and try the exchange or trading software first. Some of the best exchanges to start your bitcoin trading include Coinbase, CEX.IO, Coinmama, Kraken, and Bitstamp.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

What is Bitcoin?

Bitcoin is the first crypto and a fragment of the growing crypto market. While liquid money comes in coins and paper, bitcoin is mostly an accumulation of data. By eliminating the need for banks or government intermediaries for your funds, Bitcoin trading requires the use of secure blockchain technology to move funds from one person to the other.

Bitcoin transactions make use of the blockchain secure ledger. Bitcoin mining occurs through complex mathematical algorithms processing. The blockchain system keeps records of every trade while at the same time ensuring that the process is secure. It equally helps to increase the transaction speed. Fees are charged for each trade.

Bitcoin was the first crypto coin to use blockchain technology, and a “fork” was over time created in the system as a result of growth challenges. The challenges led to the advent of Bitcoin Cash. Subsequently, other crypto networks evolved to enhance the speed, cost, and energy requirement of the system. This led to the development of crypto coins like Ripple, Ethereum, and Litecoin that all claim to outperform Bitcoin.

With a huge amount of bitcoin under the control of a handful of traders, bitcoin is currently trading only in a one hundredth million fraction which presently is smaller than a tenth of a cent. This makes it easy for everyone interested to enjoy and experience the daily boom in bitcoin trading volume.

The bitcoin market and the market of other altcoins were estimated at roughly 148 billion dollars in the last couple of years, but financial experts’ valuations will continue to grow even higher. For this reason, Bitcoin trading has become attractive.

Bitcoin accounts for roughly 50 percent of the crypto market, and Bitcoin CEO, Roger Ver, thinks that his project is the beginning of a better and freer world. While time will tell whether or not the statement is true, there are a few properties that attract those who want to make money on Bitcoin Day trading.

See here the Bitcoin price/chart at the moment:

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Why you should engage in Bitcoin trading?

- Wild swings: With more than 10% volatility in just a few hours, this market volatility should allow experienced bitcoin day traders to discover easy to trace price action and earning potential. In short, it’s an interesting marketplace for everyday trading. Therefore, except you make use of a day trading bot, it’s fun to watch bitcoin action on the screen.

- A great alternative for forex traders: It is not compulsory to understand the composite technological world of altcoins and bitcoin. Essentially, it’s a currency that allows you to apply the same trading strategies that you use in Forex trading.

- Possibility of leveraged trading: Some bitcoin exchanges offer leveraged trading. This means you may be exposed to more risk and also have the potential to make more profit than your trading budget regularly permits.

- Global Access: Day trading bitcoin is possible from anywhere you are in the world. You can equally trade 24/7. All you require is an internet connection. Also, because you trade every day, there is no need to worry about the long-term bitcoin market success. While the stock market can be expensive for standard investors, with some stocks as high as about 110 pounds, with one dollar or pound, you can easily trade the bitcoin market.

- Low Fees and Taxes for Bitcoin Day Trading: In comparison with many traditional exchanges, Bitcoin-centred exchanges charge lower fees and have minimum account opening requirements.

- Long or short trade: Because every trading day is unique, you can go long or short in any one week.

Bitcoin wallet: what is a bitcoin wallet?

A bitcoin wallet is a program that stores bitcoins. Strictly speaking, you don’t store bitcoins anywhere. If you have a bitcoin in your wallet, you’ll have a private key (password) and this private key is equivalent to your bitcoin wallet address. Therefore, the wallet contains a private key for security purposes. The key matches the direction of the wallet. A bitcoin wallet is not an object you can see or touch. It’s a program that stores and trades bitcoins.

Bitcoin wallets make sending and receiving bitcoins easier and this makes it easier for traders to buy and sell bitcoin. Bitcoin wallets come in 4 different forms and these include desktop, mobile, web, and hardware wallets.

Four types of Bitcoin wallets

Bitcoin wallets are equally known as digital wallets. You must sign up for a digital wallet before you can trade bitcoin. Bitcoin wallets are similar to real wallets. Nonetheless, in place of physical money, the wallet stores essential information, like a secure private key for accessing your Bitcoin address and conducting transactions. The 4 types of Bitcoin wallets are desktop wallets, mobile wallets, web wallet, and hardware wallet.

1. Desktop Wallets

The desktop wallet is compatible with a desktop but you have to download and install it on your PC. It gives the user full control over the bitcoin wallet. The desktop wallet acts as an address through which users can send and receive bitcoins. It also allows users to save their private keys. Notable desktop wallets include Electrum, MultiBit, Armory, Hive OS X, and Bitcoin Core.

2. Mobile wallet

Mobile wallets have the same features as desktop wallets. With a mobile wallet, you can scan a QR code to perform “touch to pay” and near field communication (NFC) to pay in offline stores. Bitcoin Wallets are one type of mobile wallet. It is generally compatible with iOS or Android systems. There is a lot of malware that mimics your Bitcoin wallet; therefore, it’s a good idea to research your options before settling down with one.

3. Web wallet

With a web wallet, you can easily access bitcoins from any part of the globe. It is equally available from any browser or mobile device. Web wallets store private keys online, so you need to be cautious when you make a choice. Coinbase is a widely utilized web wallet service.

4. Hardware wallet

A hardware wallet is the type of bitcoin wallet that comes with the highest security. This is because they store bitcoins on physical hardware that is normally connected to a computer through a USB port. They are normally difficult to attack a virus. However, a small amount of Bitcoin theft incidents has been reported for these wallets. This USB wallet is the only type of bitcoin wallet that is not free. They are frequently sold for 100 or 200 dollars.

A few security tips for your bitcoin wallets

Since bitcoin wallets are important targets for hackers, keeping your bitcoin wallet safe is very important. Some security measures you can observe include encrypting your wallet using a hard-to-guess password and selecting a cold storage option. This means storing your key offline. Also, it’s a good idea to back up your desktop and mobile wallets often because any issues with the wallet app on your PC or mobile device can lead to a loss of money.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

What you’ll need to start Bitcoin trading

Now, we have explained why you should trade bitcoin and you know what you are doing. Follow this step by step guide to start day trading bitcoin:

1. Review the current Bitcoin price

One of the first things you’ll need to know is what the price is. To do that you’ll need to head over to an index or broker to see the latest traded value. You can also use orders – open orders or limit orders – to enter the market at the point you want to.

Bitcoin trading regularly involves speculation about the price. It doesn’t involve real coin ownership. Because of this, brokers that offer Forex and CFDs are usually the best place to start if you are just beginning. As a beginner, it is best to avoid purchasing the real coin through an exchange.

Therefore, your best place to start is to find out is to know the price. You ought to go to a bitcoin index or brokerage platform to find out the current trading value. You can equally utilize orders (open or limit) to trade the bitcoin market when you wish.

See the Bitcoin price below:

2. Choose a Bitcoin broker

The primary thing you need to do after checking the bitcoin price is to decide on which exchange you will use to trade bitcoin because you will be entrusting your fund to the company. Below are a few popular choices that are utilized by traders today:

In addition to trading on exchanges directly, other brokers allow traders to trade native bitcoin assets without owning the real coins. For instance, some of these brokers allow you to trade bitcoin against the USD. A few brokers like IQ Option equally permit traders to trade bitcoin through CFD or spread betting.

3. Start capital

You need capital to start bitcoin day trading. Since you are just starting and trying out the market, we advise you to start small. Just like with any risky investment, never at any time invest an amount that is much more than you can afford to lose. Strictly determine your risk tolerance. If you stick within this limit, you’ll never worry about losing your money in the bitcoin market.

Useful advice: If you decide to pay with a credit card, you may be charged roughly 1.00%. Therefore, be cautious and look for credit cards that will give you 3% cashback to cover some of your expenses.

4. Bitcoin strategy

You need a good trading strategy if you want to day trade bitcoin. A few traders depend on their trading bot for assistance, while others depend on their technical analysis skills and discretion. Almost all bitcoin trading guides suggest using price charts and having an efficient risk management strategy. When you do this, you can minimize losses and increase your profit potential.

5. Learn to read charts

Although you can come across a lot of lines and bar charts, you should not depend on them. Candlestick charts provide traders with more detailed information in a minimal amount of time. You can get some important clues from them.

- What are the opening and closing prices on the chart?

- How high and how low the price has been during a given period.

- When the candlestick is green, it means that the closing price is higher than the opening price.

- Red candles mean that the closing price is lower than the opening price.

- Green candles that are rising, show a market potentially trending upward.

- When the chart is mainly red, it’s an indication of a downtrend.

When trading with the chart, make sure you have the correct set of timeframes. For bitcoin trading, you’ll need a chart that’s one to thirty minutes long.

When you are starting to do bitcoin day trading, you need to familiarize yourself with candlestick indicators. Bitcoin often shows repeating monthly trends in a row. When three of the last four candles are red, they will continue to move in that direction except the RSI implies that they have reached an oversold position.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Balance volume indicator

An onboard volume indicator (OBV) is an essential tool for day-trading bitcoin. It comes with a reasonable combination of price and volume actions to inform you of the total amount presently entering and leaving the market.

If bitcoin trading goes up while OBV trading goes down, it cues traders to sell, but the uptrend will not happen. You can use the same for buying in the opposite direction.

Trading News Events

An additional bitcoin trading tip is to use news from many news sources. Bitcoin’s worth is highly dependent on public opinion. Therefore, news events can activate price actions. The best place to start for your bitcoin news includes:

- Bitcoin Magazine

- Coindesk

- CryptoCoinsNews

- Brave New Coin

- CNBC

- Coin Telegraph

- Business Insider

- The Street

Bitcoin trading risks – Be careful

- Regulatory risks: A concern about whether regulation will lead to total market disruption?

- Volatility risk: Bitcoin is a very volatile asset and is more volatile compared to trading stock and gold markets. While volatility makes bitcoin day trading a viable option for profit, it also makes the market unpredictable.

- Currency risk: While Bitcoin technology would always be there, any transaction made will not be reversed except the receiver decides to do so. Therefore, you should only deal with people you know, trust, or who are reputable.

Trading fees/ charges: When doing direct trading of bitcoins, trading costs can vary significantly.

- Margin trading: The derivative of bitcoin is often offered on a margin account.

Although it increases the profit potential, it equally boosts your risk potential.

Our conclusion on Bitcoin trading

The Bitcoin market is a great trading opportunity for traders. With this all-inclusive bitcoin day trading guide, you can now start trading bitcoin profitably. It will equally help you to avoid the common mistakes that starters of bitcoin trading make. You can now take advantage of the volatility of the market to start making money day trading bitcoin in the comfort of your home.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

FAQ – The most asked questions about Bitcoin Trading :

Is there any transaction fee for trading bitcoin?

Transaction fees are charged if you wish to convert bitcoin to any other currency and vice-versa. There are two types of charge- the maker charge and the taker charge. The maker charge is charged when you offer to sell a bitcoin to a trader, and the taker charge is deducted from your account when you buy a bitcoin from someone else.

What are the Withdrawal and deposit fees for bitcoin trading?

Generally, the deposit fees are less than the withdrawal fees. Moreover, if you wish to use credit or debit cards to make the payment while bitcoin trading, you may be charged an extra 3.99%, and in addition to that, a 1.5% fee will also be charged to your account. This happens when some exchanges do not allow cards as a payment method.

Are the fees for Bitcoin trading high?

You will definitely have to pay some amount for bitcoin trading, but the fees are comparatively lower than other traditional exchanges. Bitcoin also takes a minimum account opening charge.

Does the platform we are using for Bitcoin trading matter?

Yes, the platform you are choosing for bitcoin trading is very important as you will spend most of your time there, and it should fit your trading style and needs. It is best to use a demo account first to understand their equipment and tools and then officially sign up for one.

See other articles about crypto trading:

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)